Behind the Scenes of Lemonade's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Lemonade LMND.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with LMND, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Lemonade.

This isn’t normal.

The overall sentiment of these big-money traders is split between 58% bullish and 33%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $774,292, and 6 are calls, for a total amount of $243,940.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $31.0 to $60.0 for Lemonade over the recent three months.

Analyzing Volume & Open Interest

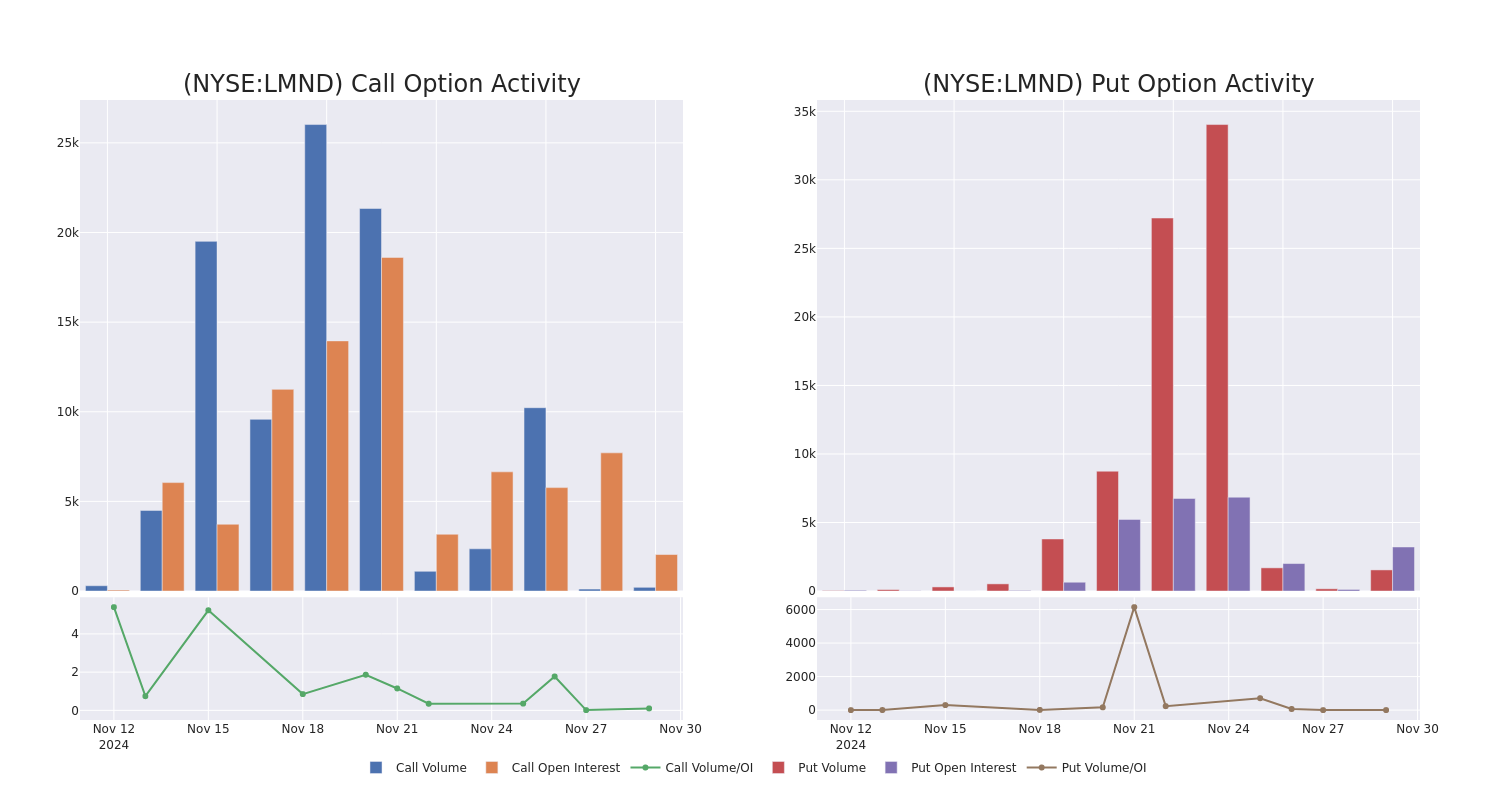

In today’s trading context, the average open interest for options of Lemonade stands at 525.2, with a total volume reaching 1,749.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lemonade, situated within the strike price corridor from $31.0 to $60.0, throughout the last 30 days.

Lemonade 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMND | PUT | TRADE | BEARISH | 12/06/24 | $2.5 | $2.05 | $2.4 | $51.50 | $452.4K | 2.6K | 616 |

| LMND | PUT | SWEEP | BULLISH | 12/06/24 | $2.4 | $2.15 | $2.4 | $51.50 | $106.8K | 2.6K | 445 |

| LMND | CALL | TRADE | BULLISH | 12/20/24 | $18.6 | $17.7 | $18.42 | $33.00 | $73.6K | 101 | 40 |

| LMND | PUT | SWEEP | BULLISH | 12/06/24 | $2.7 | $2.4 | $2.4 | $49.00 | $72.9K | 320 | 300 |

| LMND | PUT | SWEEP | BULLISH | 01/17/25 | $6.3 | $6.1 | $6.1 | $50.00 | $54.2K | 48 | 98 |

About Lemonade

Lemonade Inc operates in the insurance industry. The company offers digital and artificial intelligence based platform for various insurances and for settling claims and paying premiums. The platform ensures transparency in issuing policies and settling disputes. The company is using technology, data, artificial intelligence, contemporary design, and social impact to deliver delightful and affordable insurances. Geographically, it operates in California, Texas, New York, New Jersey, Illinois, Georgia, Washington, Colorado, Pennsylvania, Oregon and others.

In light of the recent options history for Lemonade, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Lemonade

- Currently trading with a volume of 982,313, the LMND’s price is down by -0.83%, now at $48.75.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 88 days.

Professional Analyst Ratings for Lemonade

5 market experts have recently issued ratings for this stock, with a consensus target price of $33.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from BMO Capital persists with their Underperform rating on Lemonade, maintaining a target price of $15.

* An analyst from JMP Securities has decided to maintain their Market Outperform rating on Lemonade, which currently sits at a price target of $60.

* An analyst from Morgan Stanley has elevated its stance to Equal-Weight, setting a new price target at $42.

* An analyst from Morgan Stanley has decided to maintain their Underweight rating on Lemonade, which currently sits at a price target of $23.

* An analyst from Piper Sandler has decided to maintain their Neutral rating on Lemonade, which currently sits at a price target of $25.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lemonade with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply