Check Out What Whales Are Doing With LMT

Financial giants have made a conspicuous bullish move on Lockheed Martin. Our analysis of options history for Lockheed Martin LMT revealed 8 unusual trades.

Delving into the details, we found 75% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $209,249, and 3 were calls, valued at $135,800.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $580.0 for Lockheed Martin over the last 3 months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Lockheed Martin options trades today is 163.29 with a total volume of 514.00.

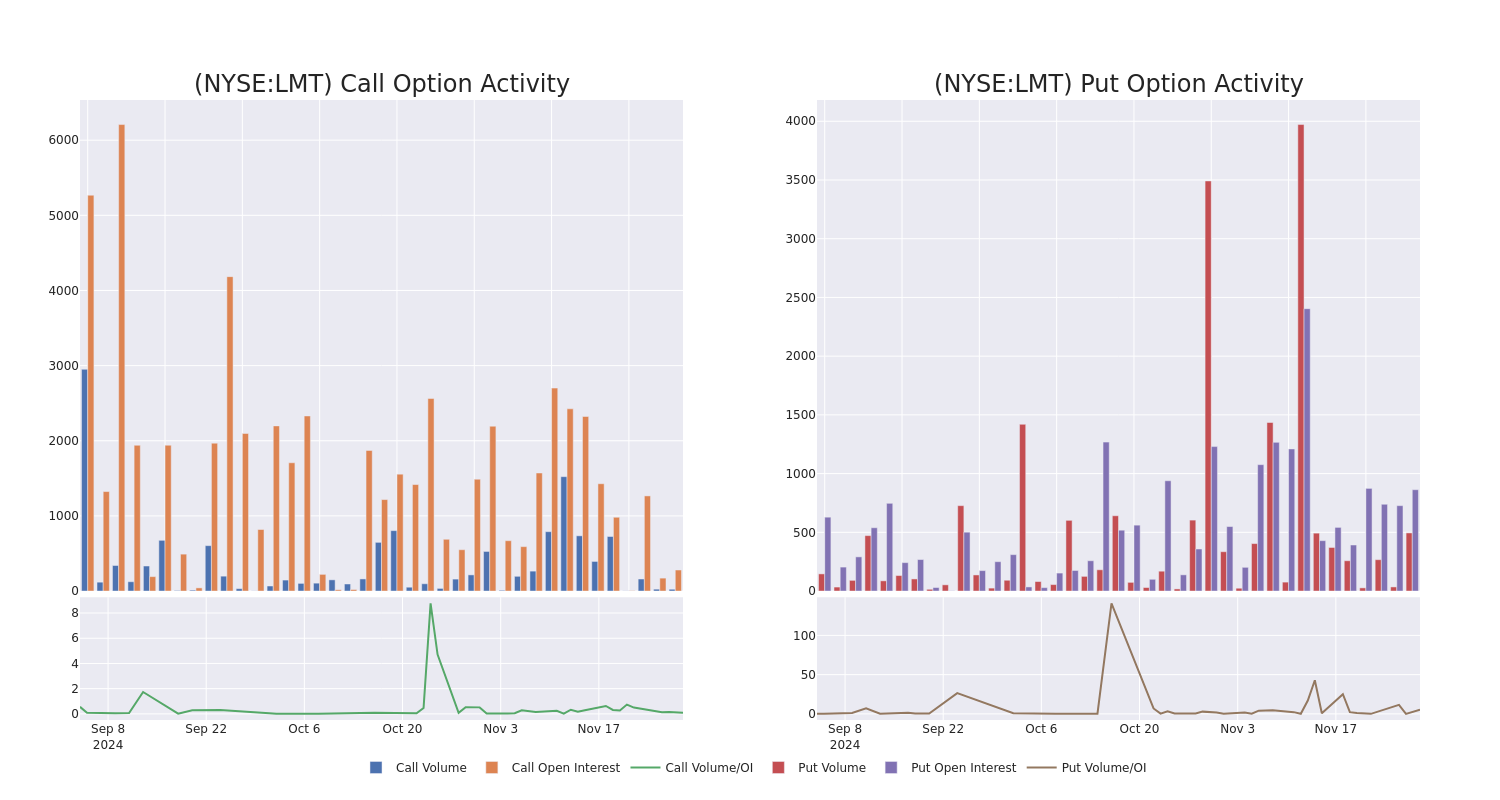

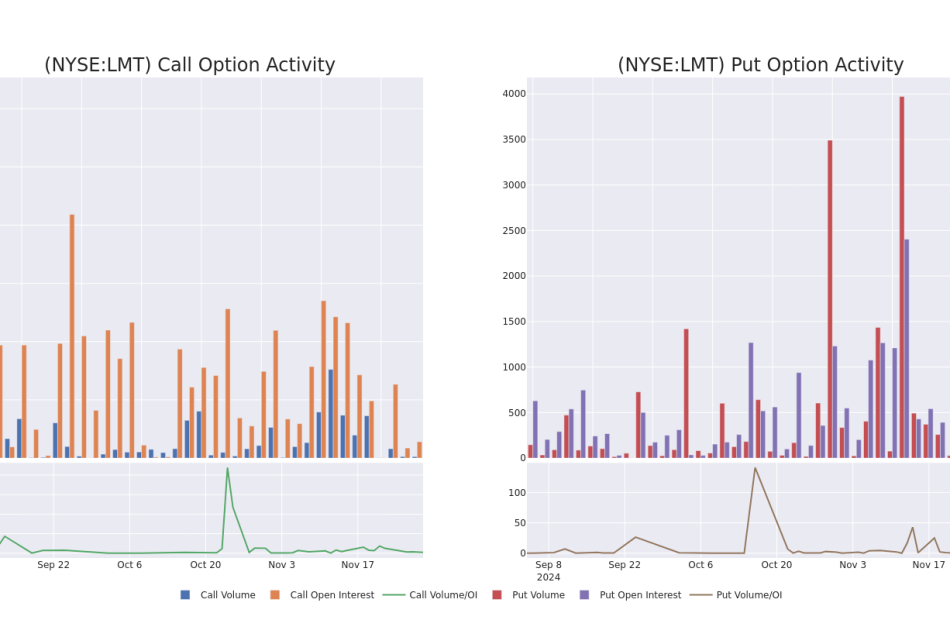

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lockheed Martin’s big money trades within a strike price range of $250.0 to $580.0 over the last 30 days.

Lockheed Martin Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | TRADE | BULLISH | 01/17/25 | $281.2 | $274.8 | $279.2 | $250.00 | $83.7K | 3 | 3 |

| LMT | PUT | TRADE | BULLISH | 06/20/25 | $31.0 | $29.4 | $29.9 | $525.00 | $71.7K | 40 | 24 |

| LMT | PUT | TRADE | BULLISH | 06/20/25 | $31.0 | $29.3 | $29.9 | $525.00 | $53.8K | 40 | 42 |

| LMT | PUT | SWEEP | BULLISH | 12/06/24 | $1.2 | $0.65 | $0.85 | $510.00 | $29.4K | 129 | 402 |

| LMT | PUT | TRADE | BEARISH | 12/06/24 | $55.3 | $55.3 | $55.3 | $580.00 | $27.6K | 11 | 5 |

About Lockheed Martin

Lockheed Martin is the world’s largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed’s largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed’s remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

In light of the recent options history for Lockheed Martin, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Lockheed Martin Standing Right Now?

- Trading volume stands at 657,680, with LMT’s price up by 0.65%, positioned at $529.15.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 53 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lockheed Martin options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply