What the Options Market Tells Us About MongoDB

Financial giants have made a conspicuous bullish move on MongoDB. Our analysis of options history for MongoDB MDB revealed 13 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $656,351, and 9 were calls, valued at $469,456.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $360.0 for MongoDB over the last 3 months.

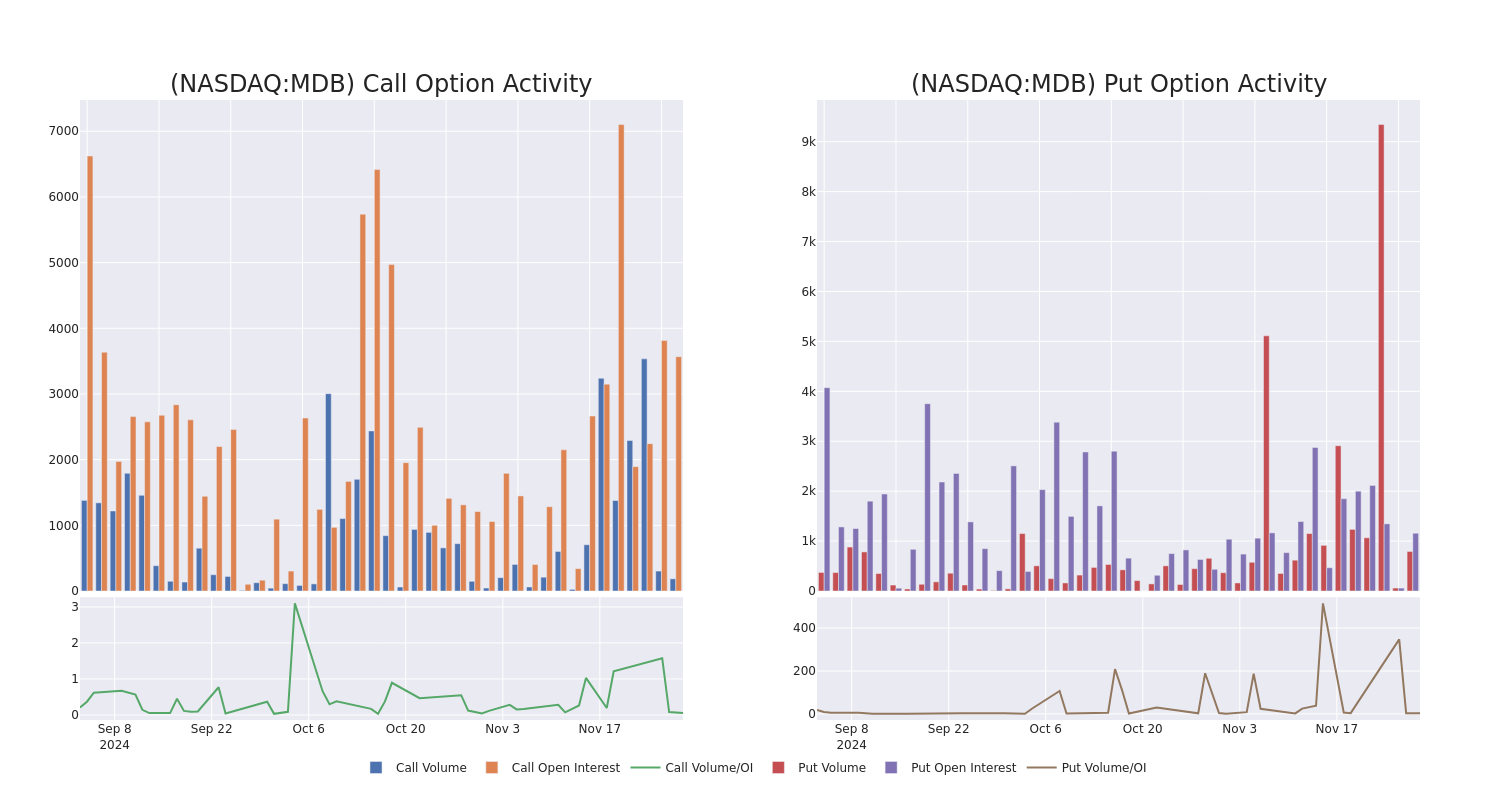

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for MongoDB’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across MongoDB’s significant trades, within a strike price range of $250.0 to $360.0, over the past month.

MongoDB Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MDB | PUT | TRADE | BEARISH | 03/21/25 | $16.65 | $15.9 | $16.35 | $270.00 | $490.5K | 240 | 318 |

| MDB | CALL | SWEEP | BULLISH | 12/20/24 | $14.95 | $13.35 | $14.54 | $360.00 | $144.9K | 1.1K | 100 |

| MDB | CALL | SWEEP | BULLISH | 12/20/24 | $54.65 | $53.4 | $54.65 | $280.00 | $76.5K | 466 | 14 |

| MDB | PUT | TRADE | BULLISH | 01/17/25 | $4.15 | $3.8 | $3.8 | $250.00 | $63.0K | 911 | 166 |

| MDB | PUT | TRADE | BEARISH | 01/17/25 | $3.9 | $3.8 | $3.9 | $250.00 | $51.8K | 911 | 300 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB’s database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

After a thorough review of the options trading surrounding MongoDB, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

MongoDB’s Current Market Status

- Currently trading with a volume of 298,644, the MDB’s price is up by 0.09%, now at $324.89.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 10 days.

Professional Analyst Ratings for MongoDB

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $385.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for MongoDB, targeting a price of $345.

* An analyst from Piper Sandler persists with their Overweight rating on MongoDB, maintaining a target price of $425.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MongoDB with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply