Tesla Bull Gary Black Says Cybercab Won't See An Early Roll Out, Expects A Cheaper Compact Car Under $30K To Launch In First Half Of 2025

The Future Fund managing partner Gary Black thinks that Tesla Inc. TSLA will not roll out the Cybercab earlier than its scheduled release in 2026.

What Happened: Black said in a post on X on Friday that those who believe Tesla won’t launch a more affordable compact model priced between $25,000 and $30,000 with four seats, a steering wheel, and pedals in the first half of 2025 are overlooking key details.

He referenced the EV giant’s third-quarter earnings call transcript where Elon Musk tied the topic of a cheaper Tesla EV to a forecast of 20-30% YoY volume growth for 2025.

He went on to add that the Cybercab won’t be available until 2026, underscoring that Tesla will not disclose any details about the new cheaper model until right before its launch to avoid impacting Model 3 or Model Y sales in the fourth quarter.

In a separate tweet, Wedbush analyst Dan Ives highlighted that the next major milestone investors are waiting for is a formal federal framework for Full Self-Driving (FSD).

He believes it will provide a significant boost to Tesla’s autonomous and AI ambitions in 2025 and 2026.

Why It Matters: Earlier this week, Cybercab was spotted undergoing tests at the Giga Texas facility.

The vehicle, priced below $30,000, is a key element of the company’s plan to transform urban transportation through self-driving vehicles.

However, the autonomous vehicle industry faces skepticism, as Lucid Group Inc. LCID CEO Peter Rawlinson previously said that self-driving cars won’t be a reality until the 2030s.

In October, Tesla reported its third-quarter revenue which reached $25.18 billion, marking an 8% increase compared to the previous year. However, the figure fell short of the Street’s consensus estimate of $25.37 billion, according to the data from Benzinga Pro.

Price Action: Tesla’s stock finished at $345.16 on Friday, rising 3.69% for the day. In after-hours trading, it saw a slight uptick of 0.081%. Year-to-date, Tesla’s stock has surged by 38.94%.

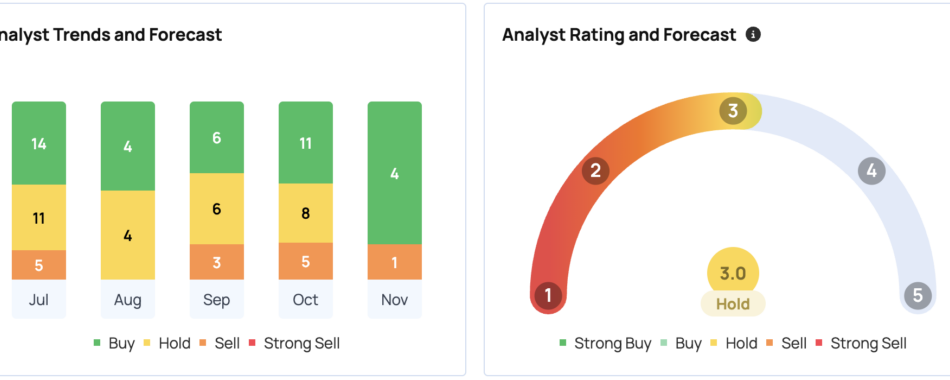

The consensus rating for Tesla stock is “Neutral,” according to data from Benzinga Pro. The highest price target is $400, while the consensus target stands at $232.20, suggesting a 33% downside from current prices.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Pexels

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MicroStrategy's Michael Saylor Calls Bitcoin The 'Manhattan In Cyberspace,' Says It's An Asset You Could Expect To 'Last 1,000 Years'

Michael Saylor, executive chairman and co-founder of MicroStrategy MSTR, likened Bitcoin to “Manhattan in cyberspace,” describing it as a long-lasting asset in an interview on Wednesday.

What Happened: Saylor emphasized the unique nature of Bitcoin, highlighting its capped supply and its status as a global, digital commodity, in an interview with Barron’s.

“Bitcoin is actually a way to store value without a trusted intermediary. I’m putting my money in cyberspace, and I want to transform the capital from financial and physical to digital,” Saylor said.

“It is indestructible, immortal, invisible, and you don’t have all the things that drag down the value of a building. So think of it as Manhattan in cyberspace.”

Saylor called the flow of money into Bitcoin to a flow of money from the 20th century to the 21st.

MicroStrategy’s strategy of leveraging Bitcoin has significantly impacted its stock performance. The company’s shares have surged 465% year-to-date, vastly outperforming the S&P 500’s 27% gain.

Over the past two years, MicroStrategy’s stock has climbed an astonishing 1,773%, compared to the index’s 48% rise, according to Barron’s.

Saylor also discussed MicroStrategy’s capital-raising plan, which includes issuing stock to purchase Bitcoin. He stated that this approach allows the company to benefit from Bitcoin’s growth, which he believes yields more than the S&P 500.

As for MicroStrategy’s primary product, Saylor said it’s now actually a “Bitcoin treasury company,” with its treasury operations significantly outpacing its software business in terms of earnings.

Why It Matters: Saylor has been a prominent advocate for Bitcoin, consistently promoting its potential as a valuable asset. In a recent interview, he revealed that MicroStrategy is generating $500 million daily from Bitcoin as its value nears $100,000.

Saylor has also been vocal about the opportunity cost of not investing in Bitcoin. He criticized Warren Buffett for not utilizing Berkshire Hathaway’s cash reserves to invest in Bitcoin, suggesting that it has resulted in significant capital destruction.

Moreover, Saylor’s approach to Bitcoin has positioned MicroStrategy as a key player in the Bitcoin space, branding it as the “public equity play on Bitcoin maximalism.”

Price Action: MicroStrategy’s stock closed at $387.47 on Friday, falling slightly by 0.35%. Year-to-date, the stock has gained 465%, according to Benzinga Pro data.

The MicroStrategy stock has a consensus rating of “Buy.” The highest price target is $690, while the consensus price target is $449.50, implying a 16% upside.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Michael Saylor / MicroStrategy

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Costliest Snack Ever? Crypto Investor And Tron Founder Justin Sun Eats $6.2M Duct-Taped Banana: 'The Real Value Is The Concept Itself'

Cryptocurrency investor and Tron TRX/USD founder Justin Sun has eaten a $6.2 million duct-taped banana artwork, asserting its conceptual value and drawing parallels to digital assets like NFTs.

What Happened: Sun, who outbid six others at a Sotheby’s auction in New York on Nov. 20, consumed the pricey fruit at a news conference in Hong Kong on Friday.

The artwork, named “Comedian,” was initially presented by Italian visual artist Maurizio Cattelan at the Art Basel Fair Miami in 2019.

“To be honest, for a banana with such a back story, the taste is naturally different from an ordinary one,” Sun posted on X, formerly Twitter.

The banana showcased at Sotheby’s was procured for 35 cents from a New York City fruit vendor. Sun has expressed his intention to buy 100,000 more bananas from the original vendor. He ate a replacement banana bought in Hong Kong at the event.

“The real value is the concept itself,” he said, equating “Comedian” to digital assets such as NFTs.

“This conceptual artwork can be assembled and disassembled anywhere and at any time conveniently and in any place in the world,” he further elaborated.

Why It Matters: This event mirrors previous performances by artist David Datuna in 2019 and a South Korean university student in 2023.

Earlier this year in October, Sun was appointed as the Prime Minister of Liberland, a self-proclaimed micronation that operates on a cryptocurrency and blockchain-based economy.

This appointment came after a notable career setback for him. In April 2023, Sun was removed from his position as Grenada’s Ambassador to the World Trade Organization (WTO) due to an SEC lawsuit filed against him.

He held the ambassadorial role since November 2021 and represented Grenada at the WTO’s 12th Ministerial Conference. Despite this, he still refers to himself with the title H.E. (“His Excellency”) on his official X account.

Price Action: At the time of writing, TRX, the native cryptocurrency of Tron, was trading at $0.2041, reflecting a 1.23% increase over the past 24 hours, according to data from Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'More Freedom': Why Joe Rogan Left L.A. For A $14.4 Million Mansion On Lake Austin

Joe Rogan’s move from Southern California to a Lake Austin estate in 2020 marked more than just a change of scenery for the controversial podcaster.

The $14.4 million property, which has 300 feet of lake frontage and custom-built podcast studios, has become central to his expanding media empire – particularly since he signed a $250 million Spotify deal earlier this year, allowing broader platform distribution.

Don’t Miss:

According to a Realtor.com report, the 11,000-square-foot waterfront mansion sits on four acres of parkland overlooking undeveloped preserve land. Built in 2008, the estate has eight bedrooms, 10 bathrooms and extensive amenities, including three docks, a pool and multiple terraces. Instagram posts seen by the Realtor show Rogan’s additions, including a sauna, cold plunge tub and professional recording facilities.

The move coincided with Rogan’s initial $100 million exclusive Spotify agreement, though his motivation extended beyond business. “Everything’s shut down, everything’s staying shut down,” Rogan recalled of pandemic-era California. A restaurant visit to Austin with his children proved the reason why. “We don’t have to wear a mask? We could eat at a restaurant?” he remembered them asking. “Two months later, I lived here.”

See Also: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — you can become an investor for $0.80 per share today.

Rogan’s custom podcast studio within the mansion has hosted many high-profile guests, from tech mogul Elon Musk to former President Donald Trump, whose recent three-hour interview drew massive audiences.

Despite slipping to third place in Apple’s podcast rankings behind “The Daily” and “Crime Junkie,” Rogan still holds Spotify’s top position.

The property’s location, while close to downtown Austin, offers celebrity-level privacy – sharing the neighborhood with stars like Sandra Bullock, according to the report. Interior features include a formal dining room with built-ins, a dual-island kitchen, living areas with floor-to-ceiling windows and a dedicated office space.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, with minimum investments as low as $100 for properties like the Byer House from Stranger Things.

By 2022, Rogan had fully embraced the Texas lifestyle, citing the state’s “more freedom” compared to the West Coast. His February 2024 contract renewal with Spotify, expanding distribution to YouTube and Apple, suggests the Austin move has paid professional dividends alongside personal satisfaction.

The former comedian and UFC commentator’s rise in podcasting, from his 2009 launch to becoming one of the medium’s most influential voices, has been marked by both success and controversy.

Recent headlines Realtor noted highlight ongoing disputes over his political commentary, including criticism from Ukrainian boxer Wladimir Klitschko regarding Russia-Ukraine war discussions.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Unstoppable Growth Stock to Buy and Hold for Years

Putting money into a promising growth stock and just letting it sit there can potentially lead to some fantastic returns for investors. However, having patience in a growing business is crucial. It can sometimes take a while for a stock’s value to reflect any impressive earnings and revenue growth the company may experience over the years and the potential it may possess.

One stock that looks impressive and downright unstoppable right now is e.l.f. Beauty (NYSE: ELF), which has been continuously generating solid growth numbers. With the stock still trading at a modest $7.3 billion market cap, it’s not hard to see how this popular cosmetics company could become much more valuable in the future.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

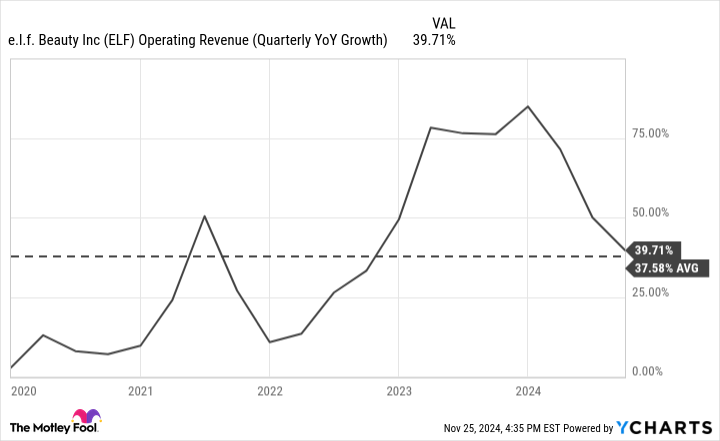

When a company grows its business for 23 consecutive quarters, “unstoppable” is the one word that definitely comes to mind. And according to e.l.f., its business hasn’t only been growing its sales for 23 straight quarters, but it also achieved market-share gains. The company’s competitively priced cosmetics are appealing options for consumers, now more than ever due to continued inflation and challenging economic conditions.

While the company’s growth rate has been slowing down in recent years, it’s still above its five-year average. And although 40% may be a slowdown for e.l.f.’s business, many companies would love to be achieving those types of numbers.

Unfortunately, the slowing growth rate has been enough of a reason to lead to a sell-off in e.l.f.’s share price in recent months. But the good news for patient investors is that there can be a lot more growth when looking at the long term, as e.l.f. is winning over young customers.

A reason I’m optimistic about the company’s future prospects isn’t just tied to its recent results, but also what consumers are saying about the business. According to Piper Sandler‘s most recent Taking Stock With Teens Survey, e.l.f. is far and away the top cosmetics brand with teens in the U.S. It was rated as the top brand for 35% of teens in the cosmetics category, with the next most popular brand having just a 10% share.

E.l.f. is winning over young consumers by offering an appealing mix of both quality and price. As those teens grow up with the brand, they have the potential to continue using e.l.f. products as they get older.

Shares of e.l.f. have fallen by more than 30% in the past six months as the company’s cooling growth rate is raising concerns for investors. But achieving more than 40% growth is hard for any business, especially in an economic environment where consumers have less purchasing power due to inflation.

Notice of Delisting and Re-Compliance of Nasdaq Listing Rule

HONG KONG, Nov. 30, 2024 (GLOBE NEWSWIRE) — On November 21, 2024, Primega Group Holdings Limited PGHL (the “Company“), was notified by Nasdaq Listing Qualifications Staff of the Nasdaq Stock Market LLC (“Nasdaq“) that the Company has not paid a sum of certain fees as required under Nasdaq Listing Rule 5900 Series (“Delisting Notice“). Nasdaq Listing Rule 5250(f) states that “the Company is required to pay all applicable fees as described in the Rule 5900 Series.” Nasdaq notified the Company that the failure to comply with this requirement served as a basis for delisting the Company’s securities from the Nasdaq Capital Market. The notification from Nasdaq further outlined that if the Company does not elect to appeal, the Company will face delisting from the Nasdaq Capital Market and the Company’s shares will be suspended on December 3, 2024.

The Company has made a full and complete repayment of the outstanding fees on November 26, 2024. On November 27, 2024, the Company received notification from Nasdaq that subject to certain disclosure obligations, which this press release forms a part of, the matter regarding Outstanding Fees is closed.

The Company is now in compliance with Nasdaq Listing Rule 5250(f).

Trading of the Company’s shares is unaffected and continues as usual.

The Delisting Notice does not impact the Company’s business operations or financial position, and we remain focused on maintaining business growth. Neither the Company nor any of its subsidiaries are subject to any further disciplinary action by Nasdaq.

PRIMEGA GROUP HOLDINGS LIMITED

About Primega Group Holdings Limited

Primega Group Holdings Limited is a provider of transportation services that employs environmentally friendly practices with the aim of facilitating reuse of construction and demolition materials and reduction of construction waste. Through an operating subsidiary in Hong Kong, the Company operates in the construction industry, mainly handling transportation of materials excavated from construction sites. The services principally comprise of (i) soil and rock transportation services; (ii) diesel oil trading; and (iii) construction works, which mainly include excavation and lateral support works and bored piling. The Company generally provides its services as a subcontractor to other construction contractors in Hong Kong.

Forward-Looking Statements

Certain statements in this press release are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s filings with the SEC.

For investor and media inquiries, please contact:

Company Info

Primega Group Holdings Limited

Man Siu Ming, Director and Chairman of the Board

msm@primegagroup.com

+852 3997 3682

Investor Relationship

HBK Strategy Limited

Katy Chan, Director

ir@hbkstrategy.com

+852 2498 3681

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan, Tesla Settle 3-Year-Old Dispute Over Stock Warrants

JPMorgan Chase & Co. JPM has decided to withdraw its lawsuit against Tesla Inc. TSLA, which was centered around a breach of contract involving stock warrants from 2014.

What Happened: This resolution was revealed through a court filing in Manhattan, indicating that both parties have agreed to drop their claims against each other, reported Reuters.

The lawsuit, initiated by JPMorgan in November 2021, sought $162.2 million. The bank alleged that Tesla breached the contract following a 2018 post by CEO Elon Musk, which suggested taking Tesla private at $420 per share.

This post, according to JPMorgan, led to significant stock price volatility, necessitating adjustments to the strike price of the warrants.

JPMorgan argued that the post required them to reprice the warrants, and Tesla’s failure to compensate for the subsequent stock price increase led to the lawsuit.

Tesla countersued in January 2023, accusing JPMorgan of attempting to gain a “windfall” through the repricing. The settlement terms remain undisclosed.

Why It Matters: The roots of this legal battle trace back to Elon Musk’s post in August 2018, where he mentioned considering taking Tesla private at $420 per share, claiming to have secured funding.

This caused a spike in Tesla’s stock price and led to a series of events, including a fraud charge by the SEC against Musk.

The lawsuit by JPMorgan, filed in November 2021, was a direct result of the financial implications of Musk’s post. The settlement marks the end of a prolonged legal dispute that has been closely watched by investors and industry observers.

Price Action: Tesla stock closed at $345.16 on Friday, up 3.7%. The stock is up nearly 39% year-to-date, according to Benzinga Pro data.

The Tesla stock has a consensus rating of “Neutral.” The highest price target is $400, while the consensus price target is $232.20, implying a 33% downside.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image made via photos on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum, Dogecoin Climb, But Ripple Rockets: Analyst Calls It 'An Insane Period'

Cryptocurrency markets are closing Friday strong, with Bitcoin’s performance paving the way for altcoin gains.

| Cryptocurrency | Price | Gains +/- |

| Bitcoin BTC/USD | $97,590 | +2.8% |

| Ethereum ETH/USD | $3,600 | +1.0% |

| Solana SOL/USD | $242.66 | +2.8% |

| Dogecoin DOGE/USD | $0.4355 | +9.6% |

| Shiba Inu SHIB/USD | $0.00002621 | +4.0% |

Notable Statistics:

- IntoTheBlock data shows large transaction volume decreasing by 22.6% and daily active addresses falling by 8%. Exchanges netflows are up by 188%.

- Coinglass data reports 86,529 traders were liquidated in the past 24 hours for $242 million, with $150 million being liquidated short positions.

Notable Developments:

Top Gainers:

| Cryptocurrency | Price | Gains +/- |

| Algorand ALGO/USD | $0.4318 | +42.3% |

| Hedera HBAR/USD | $0.17 | +18.9% |

| XRP XRP/USD | $1.74 | +17.7% |

Trader Notes: Daniel Cheung, co-founder of Syncracy Capital, speculates that altcoins will “rip 50% in a day” once Bitcoin breaks $100,000.

Trader Bluntz highlights a bullish chart pattern for Dogecoin playing out, saying, “things are about to get fun again.”

Popular crypto analyst Michaёl van de Poppe sees this as the “institutional and governmental cycle,” flagging discussions around Bitcoin as a strategic reserve in the U.S. and Brazil, while Russia recognizes Bitcoin as property.

“It’s actually an insane period,” the analyst concludes.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mortgage Applications Hit 30-Year Low – Buyers Still 'Out,' Says Reventure CEO: Here's Why

Homebuyer sentiment has plunged to multi-decade lows, with 82% of Americans seeing late 2024 as a poor time to purchase a home, according to Reventure Consulting. The pessimism edges out even the early 1980s housing market when mortgage rates reached 18%.

Don’t Miss:

Mortgage applications reflect the negative outlook, falling 50% below pre-pandemic levels and marking their sixth consecutive weekly decline, according to the Mortgage Bankers Association (MBA). The latest weekly survey shows a 10.8% decrease in overall application volume, with purchase activity dropping to its lowest point since mid-August.

“Buyers are out. And have been out the last 18 months,” said Reventure CEO Nick Gerli, pointing to a “massive standoff” between buyers and sellers. “But sellers don’t care. They are still pricing their houses very high, leading to the worst market for transactions in decades.”

Rising interest rates continue driving the decline.

See Also: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — you can become an investor for $0.80 per share today.

The average 30-year fixed mortgage rate climbed to 6.81% last week, its highest since July. Jumbo loans saw even steeper increases, reaching 6.98% from 6.77% the previous week.

“Ten-year Treasury rates remain volatile and continue to put upward pressure on mortgage rates,” Joel Kan, MBA’s Vice President and Deputy Chief Economist, said in a press release. The impact goes beyond purchases, with refinancing activity falling to its lowest since May.

Gerli identified a psychological barrier in home prices as a key factor suppressing demand. “People don’t really care about marginal swings in mortgage rates. They also don’t really care that their income has grown the last five years,” he said on X, formerly Twitter.

“They are still stuck on the fact that a house that looks like it should be $400k is priced at $600k. And they can’t get over it,” he noted.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

However, according to Gerli, the market may be approaching a turning point as inventory levels near pre-pandemic norms. National active listings now sit just 21% below pre-pandemic figures, with some markets exceeding their previous benchmarks.

That inventory growth could pressure sellers to adjust prices, particularly as buyer sentiment remains at historic lows.

Recent data shows affordability concerns outweigh traditional market dynamics. Even with rising incomes and rate fluctuations, the negative sentiment has exceeded levels historically associated with similar affordability metrics, suggesting a shift in buyer psychology regarding home valuations.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.