Deere Q4 Earnings: Beats Expectations, Steep Sales Drop, Margins Squeeze & More

Deere & Co DE reported a fourth-quarter net sales and revenue decline of 28% year-over-year to $11.143 billion, beating the consensus of $9.335 billion.

Deere clocked an EPS of $4.55, down from $8.26 YoY, beating the consensus of $3.90.

Production & Precision Agriculture net sales declined 38% YoY to $4.305 billion, Small Agriculture & Turf net sales fell 25% to $2.306 billion, and Construction & Forestry revenue declined 29% to $2.664 billion due to lower shipment volumes.

Financial services revenues grew 13% year over year to $1.522 billion. Net income declined to $173 million from $190 million a year ago due to higher credit loss provisions, partially offset by portfolio income, lower SA&G expenses, and valuation gains.

Operating profit fell 52.1% YoY to $1.45 billion, and margin contracted by 661 bps to 13%. Segment operating margins: Production & Precision Agriculture 15.3%, down YoY from 26.4%; Small Agriculture & Turf 10.1%, down YoY from 14.4%; Construction & Forestry 12.3%, down YoY from 13.8%.

As of October 27, Deere held $8.5 billion in cash and equivalents. DE’s net cash provided by operating activities for the fiscal was $9.231 billion, compared to $8.589 billion a year ago.

In the third quarter, the company launched employee-separation programs across the U.S., Europe, Asia, and Latin America to align with strategic priorities and reduce redundancies. These largely involuntary programs incurred $157 million pretax ($124 million after-tax) in 2024, with $130 million paid.

“Amid significant market challenges this year, we proactively adjusted our business operations to better align with the current environment. Together with the structural improvements made over the past several years, these adjustments enable us to serve our customers more effectively and achieve strong results across the business cycle,” commented John May, chairman and CEO of Deere.

Guidance: Deere projects fiscal 2025 net income to be between $5.0 billion and $5.5 billion. For fiscal-year 2024, net income attributable to Deere was $7.100 billion.

The company said it remains committed to making investments that enhance customer productivity and profitability.

Price Action: DE shares traded higher by 1.49% at $411.00 premarket at the last check Thursday.

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: JOHN FISHER Sells $323K Worth Of Federated Hermes Shares

JOHN FISHER, Vice President at Federated Hermes FHI, reported an insider sell on November 20, according to a new SEC filing.

What Happened: FISHER opted to sell 7,817 shares of Federated Hermes, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $323,336.

In the Thursday’s morning session, Federated Hermes‘s shares are currently trading at $41.42, experiencing a down of 0.0%.

Discovering Federated Hermes: A Closer Look

Federated Hermes provides asset-management services for institutional and individual investors. The firm had $782.7 billion in managed assets at the end of June 2024, composed of equity (10%), multi-asset (less than 1%), fixed-income (12%), alternative (3%), and money market (75%) funds. The firm’s cash-management operations are expected to generate around 50% of Federated’s revenue this year, compared with 28%, 12%, and 10%, respectively, for the equity, fixed-income, and alternatives/multi-asset operations. The company’s products are distributed via trust banks, wealth managers, and retail broker/dealers (64% of AUM), institutional investors (27%), and international clients (9%).

Federated Hermes’s Financial Performance

Revenue Growth: Federated Hermes’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 1.44%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Key Insights into Profitability Metrics:

-

Gross Margin: With a high gross margin of 66.7%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Federated Hermes’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 1.06.

Debt Management: Federated Hermes’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.41.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 13.11, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 2.08, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 7.75, Federated Hermes could be considered undervalued.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Transaction Codes Worth Your Attention

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Federated Hermes’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inquiry Into Amazon.com's Competitor Dynamics In Broadline Retail Industry

In the ever-evolving and intensely competitive business landscape, conducting a thorough company analysis is of utmost importance for investors and industry followers. In this article, we will carry out an in-depth industry comparison, assessing Amazon.com AMZN alongside its primary competitors in the Broadline Retail industry. By meticulously examining key financial metrics, market positioning, and growth prospects, we aim to offer valuable insights to investors and shed light on company’s performance within the industry.

Amazon.com Background

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services’ cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon’s non-AWS sales, led by Germany, the United Kingdom, and Japan.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Amazon.com Inc | 43.35 | 8.23 | 3.49 | 6.19% | $32.08 | $31.0 | 11.04% |

| Alibaba Group Holding Ltd | 17.85 | 1.57 | 1.62 | 4.64% | $54.02 | $92.47 | 5.21% |

| PDD Holdings Inc | 12.55 | 4.61 | 3.63 | 13.54% | $37.97 | $63.36 | 85.65% |

| MercadoLibre Inc | 68.51 | 24.47 | 5.35 | 10.37% | $0.72 | $2.44 | 35.27% |

| JD.com Inc | 11.31 | 1.61 | 0.35 | 5.22% | $15.92 | $45.04 | 5.12% |

| Coupang Inc | 42.14 | 10.29 | 1.49 | 1.74% | $0.28 | $2.27 | 27.2% |

| eBay Inc | 15.32 | 5.38 | 3.02 | 11.59% | $0.95 | $1.85 | 3.04% |

| Vipshop Holdings Ltd | 6.45 | 1.34 | 0.48 | 2.76% | $1.47 | $4.96 | -9.18% |

| Dillard’s Inc | 10.81 | 3.39 | 1.01 | 6.37% | $0.15 | $0.58 | -4.19% |

| MINISO Group Holding Ltd | 17.80 | 4.13 | 2.90 | 6.26% | $0.79 | $1.77 | 24.08% |

| Ollie’s Bargain Outlet Holdings Inc | 26.70 | 3.38 | 2.44 | 3.14% | $0.08 | $0.22 | 12.41% |

| Macy’s Inc | 22.40 | 0.94 | 0.17 | 3.53% | $0.44 | $2.16 | -3.48% |

| Nordstrom Inc | 12.86 | 3.85 | 0.25 | 13.68% | $0.4 | $1.49 | 3.23% |

| Kohl’s Corp | 6.40 | 0.47 | 0.11 | 1.73% | $0.35 | $1.6 | -4.18% |

| Savers Value Village Inc | 18.67 | 3.17 | 0.94 | 5.09% | $0.07 | $0.22 | 0.53% |

| Groupon Inc | 12.32 | 8.45 | 0.63 | 34.72% | $0.03 | $0.1 | -9.48% |

| Average | 20.14 | 5.14 | 1.63 | 8.29% | $7.58 | $14.7 | 11.42% |

Through a thorough examination of Amazon.com, we can discern the following trends:

-

The current Price to Earnings ratio of 43.35 is 2.15x higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

The elevated Price to Book ratio of 8.23 relative to the industry average by 1.6x suggests company might be overvalued based on its book value.

-

With a relatively high Price to Sales ratio of 3.49, which is 2.14x the industry average, the stock might be considered overvalued based on sales performance.

-

With a Return on Equity (ROE) of 6.19% that is 2.1% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

-

With higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $32.08 Billion, which is 4.23x above the industry average, the company demonstrates stronger profitability and robust cash flow generation.

-

The gross profit of $31.0 Billion is 2.11x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 11.04% is significantly lower compared to the industry average of 11.42%. This indicates a potential fall in the company’s sales performance.

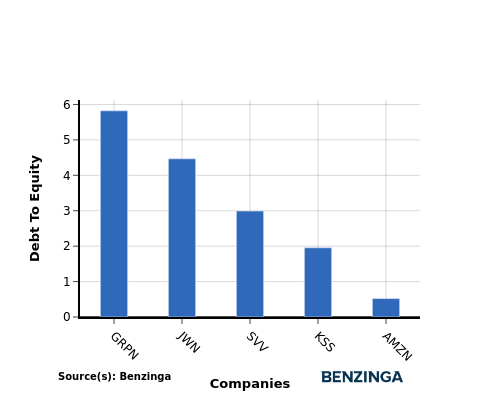

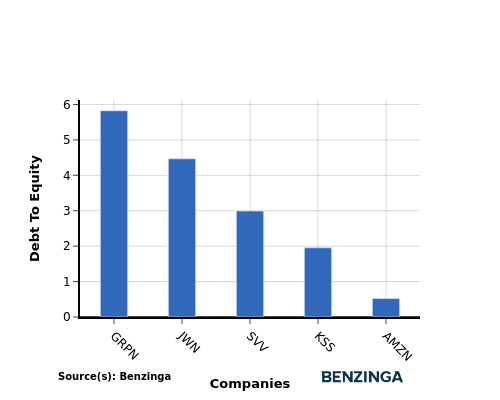

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Amazon.com can be assessed by comparing it to its top 4 peers, resulting in the following observations:

-

Among its top 4 peers, Amazon.com has a stronger financial position with a lower debt-to-equity ratio of 0.52.

-

This indicates that the company relies less on debt financing and maintains a more favorable balance between debt and equity, which can be viewed positively by investors.

Key Takeaways

For Amazon.com, the PE, PB, and PS ratios are all high compared to its peers in the Broadline Retail industry, indicating that the stock may be overvalued. The low ROE suggests that Amazon.com is not generating significant returns on shareholder equity. However, the high EBITDA and gross profit margins show strong operational performance. The low revenue growth rate may be a concern for Amazon.com compared to its industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BJ’s stock rises on first membership-fee increase in 7 years

Last Updated:

First Published:

BJ’s Wholesale Club Holdings Inc. announced an increase in its membership fees Thursday, marking the first hike in seven years. The company’s stock surged in premarket trading and is up 0.4% at 9:36 a.m. Eastern time.

Effective Jan. 1, 2025, BJ’s

BJ Club membership fee will increase by $5, going up to $60 a year, and its Club+ membership fee will increase by $10, to $120 a year, the company said when announcing third-quarter earnings results. Earlier this year, rival Costco Wholesale Corp. COST hiked its membership fees for the first time since 2017.

How To Earn $500 A Month From Intuit Stock Ahead Of Q1 Earnings

Intuit Inc. INTU will release earnings results for the first quarter, after the closing bell, on Thursday, Nov. 21.

Analysts expect the Mountain View, California-based company to report quarterly earnings at $2.36 per share, down from $2.47 per share in the year-ago period. Intuit projects to report quarterly revenue of $3.14 billion, compared to $2.98 billion a year earlier, according to data from Benzinga Pro.

With the recent buzz around Intuit ahead of quarterly earnings, investors may be eyeing potential gains from the company’s dividends. As of now, Intuit offers an annual dividend yield of 0.64%. That’s a quarterly dividend amount of $1.04 per share ($4.16 a year).

To figure out how to earn $500 monthly from Intuit, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Intuit’s $4.16 dividend: $6,000 / $4.16 = 1,442 shares.

So, an investor would need to own approximately $938,165 worth of Intuit, or 1,442 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $4.16 = 288 shares, or $187,373 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis (the dividend payment and the stock price fluctuate over time).

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

INTU Price Action: Shares of Intuit gained by 1% to close at $650.60 on Wednesday.

On Nov. 18, Scotiabank analyst Allan Verkhovski initiated coverage on Intuit with a Sector Perform rating and announced a price target of $700.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Price Hits All-Time High – How You Can Trade The Cryptocurrency's Growth Trajectory

In a relatively short time frame, society’s sentiment towards cryptocurrencies seems to be shifting from skeptical to almost celebratory as the versatility of digital currencies has become more apparent, which is reflected in the fact that the price for Bitcoin hit an all-time high recently after the U.S. elections. Furthermore, the recent securitization of Bitcoin and Ethereum has helped legitimize and expand the value proposition of these currencies, turning them into regulated investable assets that individuals and institutions can trade or allocate to within their portfolios. While this rising popularity has gathered the interest of many individuals, it has also made them aware of the price volatility present within the asset class, leading some to wonder about the underlying dynamics of cryptocurrencies and if it is right for them. But others say there is no need to worry – for example, with Plus500’s Crypto offerings, CFD Crypto assets are available to trade with a leverage of 1:2 while Future Crypto assets are available for U.S. traders.

Factors That Influence Cryptocurrency Prices

Though Bitcoin, Ethereum and other cryptocurrencies are digitally native, supply and demand factors still influence their price. Given that Bitcoin’s underlying protocol/coding limits its supply to 21 million coins, fluctuations in demand can lead to price volatility. Mining new Bitcoin is an energy-intensive process that requires the collaboration of various stakeholders within the blockchain ecosystem. Additionally, investor interest, adoption rates and macroeconomic conditions also affect demand.

A seminal factor influencing Bitcoin’s price is ‘Bitcoin Halving,’ which occurs every four years. The last one occurred on April 14th, 2024. In simple terms, Bitcoin Halving reduces the rate at which new coins are created. Thus, it is self-induced scarcity written into Bitcoin’s code. The rationale for these quadrennial halving events is to reduce the supply of Bitcoin entering circulation, thus allowing existing coins to keep their value (i.e., avoid inflation).

Similarly, supply and demand dynamics also influence Ethereum’s pricing; however, the cryptocurrency’s underlying protocols also influence its value. In 2021, Ethereum developers enacted Ethereum Improvement Proposal 1559 (EIP1559), which overhauled Ethereum’s transaction fee mechanism in a way that impacts users, miners and holders of Ethereum. One of the results stemming from this change relates to how users would transact on Ethereum. More specifically, the change required that users destroy an algorithmically determined amount of the cryptocurrency, thus limiting its oversupply on the network and the possibility of inflation.

Finally, Bitcoin and Ethereum’s mass adoption and securitization are also influential pricing factors. After rejecting Bitcoin for almost a decade, the U.S. Securities and Exchange Commission approved spot Bitcoin ETFs in January this year, which resulted in several ETF makers launching these solutions. The approval of Ethereum ETFs soon followed. Outside the U.S., some markets, such as Hong Kong, are also launching cryptocurrency ETFs, as there is growing investor demand for these asset types. The securitization of these cryptocurrencies and the usage of these instruments by retail and institutional investors is a growing factor influencing their price.

Overall, it’s important for traders to exercise caution and adapt their strategies as new information and market trends emerge, striking a balance between risk and reward. For example, with Plus500 you can learn the basics of risk management with their trading academy tools.

How To Trade Cryptocurrencies

The price volatility present in cryptocurrencies, specifically Bitcoin and Ethereum, is indicative of an active market. As with most asset classes, be it stocks, bonds, commodities or other such instruments, there will be periods of upswings and drawdowns. This cyclicality in price creates opportunities for individuals to enter at a reasonable price point and benefit from potential appreciation. Alternatively, they can take a short position if they believe the current valuation is too high and a correction will occur.

Individuals who want to gain exposure to cryptocurrencies can achieve this in multiple ways. As mentioned previously, Bitcoin and Ethereum ETFs are now available to the broad market. These ETFs allow individuals to have turnkey access to the respective cryptocurrencies in a unitized solution. ETFs are possibly the most accessible avenue for individuals looking to invest or trade cryptocurrencies.

Cryptocurrency futures are contracts between two investors who speculate on a cryptocurrency’s future price, giving them exposure to cryptocurrencies without purchasing them. Crypto futures resemble standard futures contracts because they allow traders to speculate on the price trajectory of an underlying asset. For traders or speculators, using cryptocurrency futures enables them to capitalize on the dynamic shifts that occur with these currencies.

Finally, individuals can buy the specific cryptocurrency they desire through a cryptocurrency trading service or exchange. Doing so would provide them with direct ownership of their chosen cryptocurrency.

Why Consider Cryptocurrencies Now?

Against the backdrop of an uncertain macroeconomic and geopolitical landscape, the decentralized nature of Bitcoin, Ethereum and other cryptocurrencies has risen in appeal as investors seek to diversify their portfolios. Simply put, cryptocurrencies broaden the risk and return spectrum available to investors. In other words, for investors willing to take more risk, the cryptocurrency asset class may have the potential to deliver higher total returns in the form of tradable instruments widely available on exchanges.

How To Trade Cryptocurrencies With Plus500

Plus500 PLSQF is a multi-asset fintech group operating trading platforms globally. Established in 2008, the firm has grown its importance as a player in the financial trading sector, being listed on the London Stock Exchange under the ticker symbol PLUS and included in the FTSE 250 Index.

Given the group’s global operations, it is regulated by several entities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Israel Securities Authority (ISA) and others in Europe and Asia-Pacific jurisdictions.

Regarding service offerings, Plus500 is expanding and currently offers three platforms: Plus500 Contract For Differences (CFD) with more than 2800 CFD instruments, Plus500 Invest with more than 2700 shares (available in certain countries) and Plus500 Futures, which is a futures platform available in the U.S. only.

As a trading platform, Plus500 is designed to be straightforward and accessible for beginners while offering advanced features for experienced traders. Beginner traders should use the demo account and all the resources in the Trading Academy. Traders can start with as little as $100, and Plus500 Futures (U.S.) offers a deposit bonus of up to $200.

For traders interested in cryptocurrency CFDs, Plus500 can provide up to 1:2 leverage on such transactions. Plus 500 also provides educational resources to upskill one’s trading ability and ongoing 24/7 professional support as needed.

Ready to begin your cryptocurrency trading journey? Click here to check out the Plus500 platform! *82% of retail CFD accounts lose money.

Trading in futures and options carries substantial risk of loss is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments.

Featured photo by Traxer on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Natural Gas Prices Spike To Over 1-Year Highs, Oil Surges To $70 As Ukraine Says Intercontinental Ballistic Missile Fired By Russia

Geopolitical tensions between Russia and Ukraine are once again roiling global energy markets, with rising prices raising concerns over the potential economic impact on U.S. consumer bills.

On Thursday, Russia launched an intercontinental ballistic missile (ICBM) from the Astrakhan region during an overnight strike on Dnipro, Ukraine, Reuters reported, citing the Ukrainian air force.

As reported by Reuters, security experts said this marks the first use of an ICBM in a military conflict. The missiles are designed for nuclear warhead delivery. There is no indication the missile was nuclear-armed, Reuters said.

Western officials disagree with Ukraine’s assessment, The New York Times said in a report, and say the missile was likely of intermediate range. The Times said the officials spoke anonymously in order to discuss a private Western intelligence assessment.

The Ukrainian air force said the missile was fired from over 435 miles away, targeting the central-eastern city of Dnipro.

While the attack caused injuries to two people, the extent of the damage remains unclear. Ukrainian president Volodymyr Zelenskyy condemned the move, commenting on X: “Our insane neighbour has once again revealed its true nature.”

The move adds to escalating tensions, coming on the heels of Ukraine firing two Western-made missiles at Russia on Tuesday and Wednesday, after receiving approval from the White House to target Russian territory.

US Natural Gas Prices Spike, Eye Best Monthly Performance Since July 2022

In the wake of these heightened external geopolitical risks, U.S. natural gas prices surged.

Futures tied to the Henry Hub benchmark – as tracked by the United States Natural Gas Fund LP UNG – jumped more than 6% on Thursday, reaching $3.40 per million British thermal units — the highest level since early November 2023.

The commodity is now up 50% for November, positioning itself for its strongest monthly rally since July 2022.

Natural gas demand in the U.S. has been driven by plummeting temperatures, intensifying the need for heating.

The National Oceanic and Atmospheric Administration warned on Thursday of the season’s first significant snowfall in the central and northern Appalachians, with heavy accumulation expected through Friday.

“Higher elevations will have the best chance of significant accumulations, however even the lower elevations of central and northern Pennsylvania and south central New York will likely see some accumulation of snow,” the NOAA wrote in a post on X.

The U.S. Energy Information Administration is set to release weekly natural gas inventory change later Thursday.

Europe’s natural gas market is grappling with fresh supply concerns as winter approaches after Austria’s OMV Group disclosed over the weekend that it will no longer receive volumes from its long-term contract with Russia’s Gazprom.

WTI Oil Prices Climb, Gold Eyes 4th Straight Positive Day

The ripple effects of escalating geopolitical tensions also extended to crude oil markets.

West Texas Intermediate crude futures, tracked by the United States Oil Fund USO, climbed 2.2% on Thursday morning, trading at $70 per barrel — the highest level since Nov. 11.

Gold continued to attract demand for safe-haven assets, with the precious metal rising 0.6% to $2,665 per ounce, eyeing the fourth straight session of gains.

Bitcoin rose 3%, hitting a new peak of $98,367.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock jumps following earnings beat, strong outlook as 'age of AI is in full steam'

Nvidia (NVDA) reported third quarter earnings after the bell on Wednesday that topped expectations on the strength of sales of its high-powered AI chips fueling what its CEO Jensen Huang called the “age of AI.”

The world’s largest publicly traded company by market cap, Nvidia reported earnings per share (EPS) of $0.81 on revenue of $35.1 billion. Analysts were anticipating EPS of $0.74 on revenue of $33.2 billion.

Nvidia also said it anticipates revenue of $37.5 billion, plus or minus 2%, for the fourth quarter. That’s just ahead of Wall Street expectations of $37 billion.

Nvidia’s stock price seesawed Thursday morning, popping to an intraday record before moseying around the flatline, as investors weighed the forecast.

“The age of AI is in full steam, propelling a global shift to Nvidia computing,” Huang said in a statement. “Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training, and inference.”

The chip giant’s Data Center business, which makes up the vast majority of its revenue, brought in $30.8 billion in the quarter, beating out analysts’ expectations of $29 billion and jumping 112% versus the $14.5 billion the segment made in Q3 last year.

Nvidia’s gaming revenue came in at $3.3 billion, up from the $2.8 billion the division brought in last year. Analysts were looking for $3 billion.

Nvidia’s stock has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond.

Read more: Nvidia nearly triples in value over 11 months: Is it time to invest?

Nvidia also appeared to assuage concerns about potential slowdowns in the availability of its next-generation Blackwell chip, with CFO Colette Kress saying that the AI GPU will begin shipping in the current quarter and ramp into the year ahead.

“Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026,” she added.

Read more: How does Nvidia make money?

Shares of Nvidia were up 192% year to date as of Wednesday, easily outpacing any of the company’s chipmaker rivals. AMD (AMD), the closest competitor, has seen its stock price sink over 5% year to date, while Intel (INTC), which is contending with a difficult turnaround, has seen its stock plunge nearly 52%.

Nvidia is facing an uncertain future, given that Donald Trump has threatened to put blanket tariffs on products from around the world.

Earnings Preview: Global Blue Gr Holding

Global Blue Gr Holding GB is set to give its latest quarterly earnings report on Friday, 2024-11-22. Here’s what investors need to know before the announcement.

Analysts estimate that Global Blue Gr Holding will report an earnings per share (EPS) of $0.03.

Investors in Global Blue Gr Holding are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.06, leading to a 1.42% increase in the share price on the subsequent day.

Here’s a look at Global Blue Gr Holding’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.08 | 0.07 | 0.06 | |

| EPS Actual | 0.02 | 0.01 | 0.06 | 0 |

| Price Change % | 1.0% | -1.0% | -0.0% | 14.000000000000002% |

Market Performance of Global Blue Gr Holding’s Stock

Shares of Global Blue Gr Holding were trading at $5.57 as of November 19. Over the last 52-week period, shares are up 24.89%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Global Blue Gr Holding visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow, S&P 500, Nasdaq rise as Nvidia pops, bitcoin jumps to record high

US stocks climbed on Thursday as investors dug into Nvidia’s (NVDA) earnings and revenue forecast for insights into the prospects for AI-fueled growth, while bitcoin (BTC-USD) hit yet another record high.

The Dow Jones Industrial Average (^DJI) rose 0.3%, while the S&P 500 (^GSPC) added 0.4%. The tech-heavy Nasdaq Composite (^IXIC) led the gains with an increase of 0.6%, coming off a muted day for the major gauges.

Nvidia beat on profit in the third quarter, but the chipmaker forecast its slowest revenue growth in seven quarters as it noted supply chain issues. Those constraints will limit deliveries of the new flagship Blackwell chip, the company said — but will also lead to demand outstripping supply into 2026.

That suggests a revenue boost is just being pushed down the road until the issues ease, some analysts suggested, given the dearth of sizable competitors in AI chip making.

Still, Nvidia shares recovered from pre-market losses to open up over 4%, as investors debated the future of the AI boom.

Elsewhere in tech, Alphabet (GOOG, GOOGL) shares edged lower after the DOJ asked a judge to force its Google unit to sell off its Chrome browser. But its antitrust team held off on Android, laying out a choice between divesting the mobile operating system business or adopting stringent remedies.

Weekly jobless claims released on Thursday morning came in at 213,000, a decline from the prior week’s upwardly revised 219,000. Investors used the labor market data to weigh the Federal Reserve’s appetite for interest-rate cuts. Traders are now pricing in a 44% chance of the Fed holding pat at its December meeting, up from about 28% a week ago, per the CME FedWatch tool.

Investors are also on alert for Donald Trump to end the drawn-out wait for his Treasury Secretary pick, as they assess the likely impact of the president-elect’s cabinet choices on prospects for the economy.

Meanwhile, bitcoin briefly climbed to a fresh all-time high just above $98,000. The biggest cryptocurrency is closing in on the key $100,000 milestone amid reports that Trump’s team is debating whether to appoint a White House crypto policy chief.

LIVE 6 updates