CUBI BREAKING NEWS: Customers Bancorp, Inc. Investors that Suffered Losses Are Encouraged to Contact Rosen Law About Ongoing Investigation into the Company (NYSE: CUBI)

NEW YORK, Nov. 08, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Rosen Law Firm, a global investor rights law firm, continues to investigate Customers Bancorp, Inc. CUBI for potential violations of the federal securities laws.

If you invested in Customers Bancorp, you are encouraged to obtain additional information by visiting https://rosenlegal.com/case/customers-bancorp-inc/.

Why Did Customers Bancorp’s Stock Drop?

On August 8, 2024, during market hours, the Federal Reserve Board of Governors issued an announcement entitled “Federal Reserve Board issues enforcement action with Customers Bancorp, Inc. and Customers Bank.” Attached to the announcement was a written agreement between the Federal Reserve Bank of Philadelphia, Customers Bancorp, Inc., and Customers Bank. The agreement stated “the most recent examinations and inspection of [Customers Bancorp and Customers Bank] conducted by the Federal Reserve Bank of Philadelphia [. . .] identified significant deficiencies related to the Bank’s risk management practices and compliance with the applicable laws, rules, and regulations relating to anti-money laundering (“AML”), including the Bank Secrecy Act [. . .], including the rules and regulations issued thereunder by the U.S. Department of the Treasury [. . .], and the AML requirements of Regulation H of the Board of Governors [of the Federal Reserve System] [. . .]; and the regulations issued by the Office of Foreign Assets Control of the United States Department of the Treasury[.]”

On this news, Customers Bancorp’s stock fell $7.22 per share, or 13.3%, to close at $47.01 per share on August 8, 2024.

Click here for more information: https://rosenlegal.com/case/customers-bancorp-inc/.

What Can You Do?

If you invested in Customers Bancorp you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://rosenlegal.com/submit-form/?case_id=28067 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

Why Rosen Law Firm?

We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

For more information about RLF and its attorneys, please visit https://rosenlegal.com/.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

_______________________

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Official opening of 90 social and affordable housing units in Granby

GRANBY, QC, Nov. 8, 2024 /CNW/ – Today, the governments of Quebec and Canada and the City of Granby are proud to open Simonds, a building with 90 social and affordable housing units for individuals over 50 and people living with an intellectual disability or with autism spectrum disorder. The building cost over $22 million to construct and is an initiative of the Office d’habitation de la Haute-Yamaska-Rouville.

The event was attended by France-Élaine Duranceau, Quebec Minister Responsible for Housing; the Honourable Marie-Claude Bibeau, Minister of National Revenue and Member of Parliament for Compton–Stanstead; François Bonnardel, Quebec Minister of Public Security, Quebec Minister Responsible for the Estrie Region and Member of the National Assembly for Granby; Julie Bourdon, Mayor of Granby; and Robert Riel, Municipal Councillor and Chair of the Board of Directors of the Office d’habitation de la Haute-Yamaska-Rouville.

The Government of Quebec contributed more than $10.8 million through the Société d’habitation du Québec’s (SHQ’s) Programme d’habitation abordable Québec. The SHQ also secured the mortgage loan taken out by the Office d’habitation de la Haute-Yamaska-Rouville through the SHQ’s Programme de financement en habitation.

The Government of Canada contributed nearly $6 million to the project through the third Canada-Quebec Rapid Housing Initiative Agreement.

The City of Granby contributed more than $1.8 million to the Office d’habitation de la Haute-Yamaska-Rouville, in addition to donating the land, worth $2.5 million.

Quotes:

“I am very proud to highlight our government’s contribution to the construction of this building with 90 social and affordable housing units through the Programme d’habitation abordable Québec. I applaud this initiative by the Office d’habitation de la Haute-Yamaska-Rouville and its partners, which will help low-income individuals benefit from affordable housing. We will continue to work on all fronts and on all solutions to ensure that every Quebecer has a home that meets their needs.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“The federal government will continue to work hard toward ensuring that everyone in Quebec and across Canada has a safe and stable place to call home. We’re quickly providing new affordable housing to those who need it most across the country, thanks to the third Canada-Quebec Rapid Housing Initiative Agreement and collaboration from all levels of government.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“This social and affordable housing project shows our desire to find solutions that provide more living spaces in the Granby area. This is a beautiful example of a social mix that meets a great need in the area and helps improve citizens’ quality of life.”

François Bonnardel, Quebec Minister of Public Security, Quebec Minister Responsible for the Estrie Region, and Member of the National Assembly for Granby

“In Granby, as elsewhere in Canada, access to affordable housing is crucial to the stability of many people. Today’s announcement is a real example of the positive impact of federal investments in Quebec’s housing sector.”

The Honourable Marie-Claude Bibeau, Minister of National Revenue and Member of Parliament for Compton–Stanstead

“The official opening of the Simonds building is an important step in our commitment to ensuring access to affordable housing adapted to the needs of the most vulnerable members of our community. This project will meet Granby’s housing needs. Thanks to the collaboration between the various levels of government and our local partners, whom I want to thank, we’re building an inclusive and supportive living environment together.”

Julie Bourdon, Mayor of Granby

“This project is more than just a building. It embodies our collective commitment to the right to housing for all. At a time when the need for affordable housing has never been greater, this building symbolizes hope and inclusion. It addresses a fundamental issue in our society: ensuring that every individual has a home.”

Robert Riel, Chair of the Board, Office d’habitation de la Haute-Yamaska-Rouville

Highlights:

- Up to 45 of the 90 households in the building could be eligible for the Société d’habitation du Québec’s (SHQ) Rent Supplement Program, ensuring that they spend no more than 25% of their income on housing. This additional assistance is covered by the SHQ (90%) and the City of Granby (10%).

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

Facebook: SocietehabitationQuebec

Twitter: HabitationSHQ

LinkedIn

About Canada Mortgage and Housing Corporation

Visit canada.ca/housing for the most requested Government of Canada housing information.

As Canada’s authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/08/c9872.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/08/c9872.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

V BREAKING NEWS: Visa Inc. Investors that Suffered Losses are Encouraged to Contact Rosen Law about Ongoing Investigation into the Company – V

NEW YORK, Nov. 08, 2024 (GLOBE NEWSWIRE) — Rosen Law Firm, a global investor rights law firm, continues to investigate Visa Inc. V for potential violations of the federal securities laws.

If you invested in Visa, you are encouraged to obtain additional information by visiting https://rosenlegal.com/case/visa-inc/.

Why did Visa’s Stock Drop?

On September 24, 2024, during market hours, the United States Department of Justice issued a release entitled “Justice Department Sues Visa for Monopolizing Debit Markets.” In this release, the DOJ announced that it had “filed a civil antitrust lawsuit today against Visa for monopolization and other unlawful conduct in debit network markets[.]” The release further stated the “complaint alleges that Visa illegally maintains a monopoly over debit network markets by using its dominance to thwart the growth of its existing competitors and prevent others from developing new and innovative alternatives.”

The release quoted Attorney General Merrick Garland as stating “[w]e allege that Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market[.] Merchants and banks pass along those costs to consumers, either by raising prices or reducing quality or service. As a result, Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.”

On this news, Visa’s stock fell 5.4% on September 24, 2024.

Click here for more information: https://rosenlegal.com/case/visa-inc/.

What Can You Do?

If you invested in Visa you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://rosenlegal.com/submit-form/?case_id=29131 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

Why Rosen Law Firm?

We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

For more information about RLF and its attorneys, please visit https://rosenlegal.com/.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Desjardins Affordable Housing Initiative – 60 affordable housing units for families to be built in Trois Rivières through an innovative partnership

TROIS-RIVIÈRES, QC, Nov. 8, 2024 /CNW/ – The governments of Quebec and Canada, together with Desjardins, the City of Trois-Rivières and Accès Logement Mauricie, have announced the construction of 60 affordable housing units in five buildings, for families or people living alone. The housing project, called the Ste-Madeleine residences, will be located on Sainte-Madeleine Boulevard and on Du Sanctuaire Street, in Trois-Rivières.

The project is part of the Desjardins Affordable Housing Initiative, an innovative partnership between the Government of Quebec and Desjardins for the rapid creation of 1,750 affordable housing units, as well as the Government of Canada’s Affordable Housing Innovation Fund.

Sonia Lebel, Quebec Minister Responsible for Government Administration and Chair of the Conseil du trésor, made the announcement on behalf of France-Élaine Duranceau, Quebec Minister Responsible for Housing. She was joined by the Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry and Member of Parliament for Saint-Maurice–Champlain, Jean Lamarche, Mayor of the City of Trois-Rivières, Jean-Yves Bourgeois, Executive Vice-President of Desjardins’ Business Services Group, and many community partners.

The financial package of just over $20 million includes investments of $10.5 million from the Government of Quebec, $600,000 from the Government of Canada and $1.4 million from the City of Trois-Rivières. Desjardins is adding close to $6.9 million in mortgage funding and $931,000 in patient capital. Accès Logement Mauricie will eventually take over management and maintenance of the project.

In collaboration with Habitations Populaires du Québec and Accès Logement Mauricie, the Ste-Madeleine residences will welcome its first tenants in winter 2025. The project will include 30 one-bedroom units and 30 two-bedroom units. The monthly rent will be set at $719 for a one-bedroom unit and $920 for a two-bedroom unit.

About the Desjardins Affordable Housing Initiative

In 2022, the Government of Quebec entrusted Desjardins with $175 million for the creation of 1,000 new social and affordable housing units. Projects would be spread over 14 Quebec regions and be delivered by the end of 2025. Desjardins would then make available $150 million in financing and patient capital to project developers with the support of Capital régional et coopératif Desjardins. Project developers committed to keeping the units affordable for up to 35 years.

With its dedicated team and extensive network of caisses, as well as the expertise of the Caisse d’économie solidaire, Desjardins quickly exceeded its targets. It brought in non-profit organizations, housing co-operatives and municipalities. Now it’s on track to make over 1,500 affordable housing units available by the end of 2025.

In view of these results, in December 2023, Quebec added $43.75 million to the amount originally awarded to Desjardins, to create 250 additional affordable housing units. In all, Desjardins will make more than 1,750 affordable housing units available in three years.

Quotes:

“I’ve often said that we need to innovate to build more and better housing, especially given the current housing crisis. This collaboration with Desjardins is further proof that our government is taking concrete action alongside municipalities and housing organizations, to better house Quebecers with low or moderate incomes. I’m excited about this partnership with Desjardins, which mobilizes stakeholder expertise to very quickly build quality affordable housing. We’re determined to deliver results with this partnership, and the success of the Ste-Madeleine residences is a great example of that!”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“We’re determined to ensure that everyone has a safe place to call home. I’m proud that we could support this project through the Affordable Housing Innovation Fund, in collaboration with the Government of Quebec, the City of Trois-Rivières and Desjardins. This demonstrates our unwavering commitment to ensuring that no one is left behind.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Getting funding for the Ste-Madeleine residences housing project means we can continue working to keep housing affordable in my home region of Mauricie. This initiative by Habitations populaires du Québec and Accès Logement Mauricie also shows the value of staying agile and joining forces to deliver solutions for our community. Congratulations to all the partners!”

Sonia Lebel, Quebec Minister Responsible for Government Administration, Chair of the Conseil du trésor and Member of the National Assembly for Champlain

“Everyone deserves a safe and affordable place to call home. Through the Affordable Housing Innovation Fund, we’re building affordable housing, quickly, for those who need it most throughout the country. Thanks to the project announced today, 60 affordable housing units will soon be available to the people of Trois-Rivières.”

The Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry and Member of Parliament for Saint-Maurice–Champlain

“In addition to offering a 20-year tax credit, the City of Trois-Rivières is supporting the first phase of this project by investing $1.4 million through its Program to Support the Development of Affordable Housing. The Ste-Madeleine residences will play a key role in the revitalization of the Bas-du-Cap sector, providing a healthy living environment, accessible housing and a stronger sense of belonging within our Trois-Rivières community. I would like to underline the excellent collaboration of the partners involved in this project, which will enable the former site of the Sainte-Madeleine church to regain a significant social vocation.”

Jean Lamarche, Mayor of Trois-Rivières

“At Desjardins, we are deeply convinced that access to housing for all is a fundamental pillar in building strong, resilient communities. The Ste-Madeleine residences project is a perfect illustration of our ability to create innovative and sustainable solutions for our communities. By working closely with local governments and organizations, we bring not only financial resources, but also our expertise and commitment to collective well-being. This project is a testament to our ability to turn challenges into opportunities, offering quality housing to those who need it most.”

Guy Cormier, President and CEO, Desjardins Group

“We’re happy to do our bit to help house our local community. Once again, when all the players come together and work in concert, great things can be achieved. This project is a typical example of this concerted effort on the part of governments and the business community alike, since it has been completed in record time. We’re developing not just housing units, but a living environment that will serve our community for generations to come. Let’s breathe new life into a religious site through this partnership.”

Guy Gagnon, President, Accès Logement Mauricie

Highlights:

- Habitations Populaires du Québec is a non-profit organization (NPO) founded in 1978 thanks to the financial participation of five Desjardins caisses in the City of Trois-Rivières. This NPO acts as a community real estate owner, developer and manager. Its real estate portfolio includes 160 projects totalling more than 4,500 social and affordable housing units, and it has nearly 2,000 units under management. It owns more than 800 units through its affiliated NPO.

- Accès Logement Mauricie is an NPO affiliated with Habitations Populaires du Québec whose mission is to house low- and moderate-income households. A contract will be awarded to Habitations populaires Québec for management, maintenance and rental services.

- CMHC’s Affordable Housing Innovation Fund (AHIF) will promote innovation and growth in the affordable housing sector by encouraging the development of new funding models and construction techniques.

- The Fund’s objective is to support innovative funding models and unique designs to make housing more affordable and reduce the costs and risks associated with affordable housing projects.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

SocietehabitationQuebec

HabitationSHQ

LinkedIn

About Canada Mortgage and Housing Corporation

About Canada Mortgage and Housing Corporation

Visit canada.ca/housing for the most requested Government of Canada housing information.

As Canada’s authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/08/c1713.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/08/c1713.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Friday's Top 5 Trending Stocks: What's The Scoop On GameStop, SoFi, Tesla?

GameStop Corp. GME, SoFi Technologies, Inc. SOFI, Tesla, Inc. TSLA, Cassava Sciences, Inc. SAVA and Anavex Life Sciences Corp. AVXL are the top five trending tickers on Stocktwits Friday. Here’s a look at what grabbed retail investors’ attention.

GME GM-Meme: GameStop tops the list this week. The stock moved on heavy volume and zero fundamentals Friday, as the original meme-stock tends to do. Keith Gill, a.k.a. Roaring Kitty, dumped his Chewy, Inc. CHWY shares at the end of October and GameStop has climbed steadily since.

SOFI Surges: SoFi shares have climbed 17% this week as investors hope for deregulation under a second Trump presidency. The stock pumped on heavy volume and ended the day more than 9% higher.

Read Next: What Does Trump’s Victory Mean For EV Giant Tesla And The Big 3 Automakers?

TSLA For President: Tesla shares blasted higher after Donald Trump won the presidential election. Tesla CEO Elon Musk joined Trump several times on the campaign trail and may even be appointed to a position in the administration.

Investors may also consider Trump’s EV and tariff policy beneficial to Tesla, as both could potentially reduce competition for the U.S.-based EV giant. The stock has been up 30% since Tuesday, and its market cap has now reached more than $1 trillion.

SAVA: Cassava Sciences is a frequent flier on the Stocktwits trending list. HC Wainwright & Co. analyst Vernon Bernardino reiterated Cassava Sciences as a Buy and maintained an ambitious price target of $116 on Friday. The stock is currently trading at just under $27.

AVXL: Anavex Life Sciences rounds out the list as another heavily-shorted biotech stock that moved on heavy volume, despite a lack of news. According to data from Benzinga Pro, 21.78% of shares are being sold short, and the stock saw more than triple its average trading volume on Friday.

GME, SOFI, TSLA, SAVA, AVXL Price Action: According to data from Benzinga Pro, GameStop shares closed up 6.1% at $24.88, SoFi shares closed up 9.33% at $13.01, Tesla shares closed up 8.19% at $321.22, Cassava Sciences shares closed up 6.55% at $27.00 and Anavex Life Sciences shares ended the day up 21% at $9.24 on Friday.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

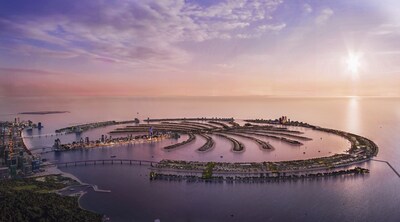

Palm Jebel Ali Project Surges Ahead in 2024: Milestones Achieved in Record Time for Dubai's Most Anticipated Development

DUBAI, UAE, Nov. 8, 2024 /PRNewswire/ — Nakheel, a member of Dubai Holding’s pioneering real estate arm Dubai Holding Real Estate, has marked significant progress in the development of Palm Jebel Ali in 2024, with the project progressing at pace to meet 2025 milestones.

The development masterplan was approved by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai in May 2023, who said at the time; “Palm Jebel Ali will further strengthen our urban infrastructure and consolidate the city’s emergence as one of the world’s leading metropolises. This new groundbreaking project reflects our strategic development plan centred on raising the quality of life and happiness of residents.”

The Palm Jebel Ali area received further recognition this year when His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Deputy Prime Minister, Minister of Defence, and Chairman of The Executive Council of Dubai, approved the master plan for the 6.6 kilometre development of Jebel Ali Beach. The project includes a five-kilometre sandy beach, to be developed by Nakheel, as well as a 1.6-kilometre-long Mangrove Beach, to be developed by Dubai Municipality.

Khalid Al Malik, Chief Executive Officer of Dubai Holding Real Estate, said; “At Nakheel we believe in developing dreams, inspired by the vision of our leaders and the hopes of our people. The rapid progress we are currently witnessing on ground at Palm Jebel Ali is testimony to the grand success of our key partnerships and our joint endeavours to ensure we deliver on our commitments.”

Several key contracts for the project were awarded throughout 2024, including the construction of a new 6-kilometre road, the contracts for the island’s marine works, dredging, land reclamation, beach profiling and sand placement, directly supporting the construction of villas. The first eight fronds of the project are expected to be site-ready for villa infrastructure and civil works by the first quarter of 2025.

Crucially, the contract for the construction of exclusive ultra-luxury villas on the first six fronds of the project has also been awarded and are scheduled for completion by late 2026. Nakheel recently announced their partnership with Dubai Electricity and Water Authority for the development of two substations on Palm Jebel Ali.

Video: Palm Jebel Ali

Photo – https://stockburger.news/wp-content/uploads/2024/11/Nakheel_1.jpg

Photo – https://stockburger.news/wp-content/uploads/2024/11/Nakheel_2.jpg

Photo – https://stockburger.news/wp-content/uploads/2024/11/Nakheel_3.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/palm-jebel-ali-project-surges-ahead-in-2024-milestones-achieved-in-record-time-for-dubais-most-anticipated-development-302300124.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/palm-jebel-ali-project-surges-ahead-in-2024-milestones-achieved-in-record-time-for-dubais-most-anticipated-development-302300124.html

SOURCE Nakheel

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hims & Hers Health Recent Insider Activity

Harrison Patrick Carroll, Chief Medical Officer at Hims & Hers Health HIMS, disclosed an insider sell on November 7, according to a recent SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Thursday outlined that Carroll executed a sale of 15,000 shares of Hims & Hers Health with a total value of $331,093.

Hims & Hers Health shares are trading up 0.17% at $23.46 at the time of this writing on Friday morning.

All You Need to Know About Hims & Hers Health

Hims & Hers Health Inc is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more.

A Deep Dive into Hims & Hers Health’s Financials

Revenue Growth: Hims & Hers Health’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 77.13%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Key Profitability Indicators:

-

Gross Margin: With a high gross margin of 79.16%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Hims & Hers Health’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.35.

Debt Management: Hims & Hers Health’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.03.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 53.68 is lower than the industry average, implying a discounted valuation for Hims & Hers Health’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.33, Hims & Hers Health’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Hims & Hers Health’s EV/EBITDA ratio stands at 86.9, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Navigating the World of Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Hims & Hers Health’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

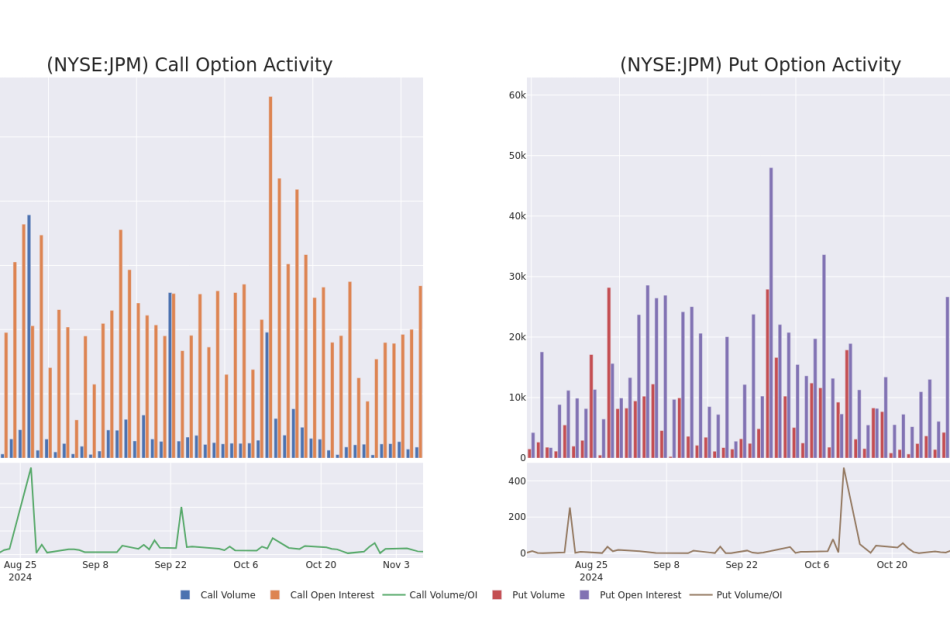

JPMorgan Chase's Options: A Look at What the Big Money is Thinking

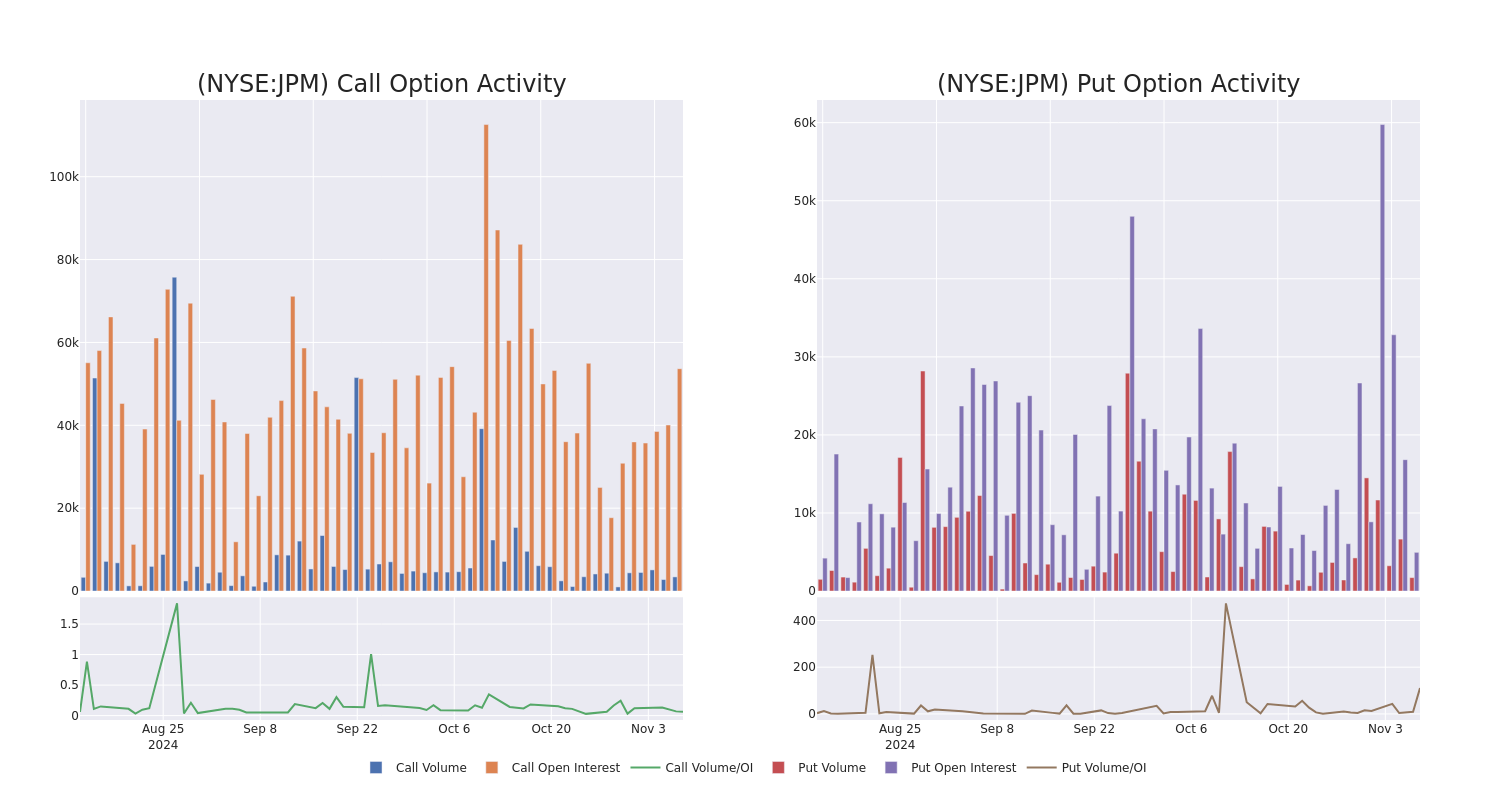

Financial giants have made a conspicuous bullish move on JPMorgan Chase. Our analysis of options history for JPMorgan Chase JPM revealed 34 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 29% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $534,186, and 25 were calls, valued at $1,699,384.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $140.0 to $255.0 for JPMorgan Chase over the last 3 months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for JPMorgan Chase options trades today is 1890.97 with a total volume of 5,138.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for JPMorgan Chase’s big money trades within a strike price range of $140.0 to $255.0 over the last 30 days.

JPMorgan Chase Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | TRADE | BULLISH | 01/17/25 | $40.85 | $40.45 | $40.71 | $200.00 | $407.1K | 4.0K | 100 |

| JPM | CALL | TRADE | BULLISH | 01/17/25 | $8.95 | $8.9 | $8.95 | $240.00 | $223.7K | 9.3K | 358 |

| JPM | CALL | SWEEP | BEARISH | 01/16/26 | $103.15 | $102.0 | $102.0 | $140.00 | $122.3K | 199 | 12 |

| JPM | PUT | TRADE | BULLISH | 01/15/27 | $29.05 | $26.6 | $27.4 | $240.00 | $109.6K | 6 | 40 |

| JPM | PUT | SWEEP | BEARISH | 11/15/24 | $1.54 | $1.51 | $1.53 | $235.00 | $92.2K | 3.4K | 843 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments–consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

After a thorough review of the options trading surrounding JPMorgan Chase, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is JPMorgan Chase Standing Right Now?

- Currently trading with a volume of 5,820,469, the JPM’s price is up by 0.88%, now at $238.47.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 68 days.

Professional Analyst Ratings for JPMorgan Chase

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $238.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Barclays has decided to maintain their Overweight rating on JPMorgan Chase, which currently sits at a price target of $257.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for JPMorgan Chase, targeting a price of $230.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on JPMorgan Chase with a target price of $241.

* An analyst from Evercore ISI Group persists with their Outperform rating on JPMorgan Chase, maintaining a target price of $230.

* An analyst from Oppenheimer persists with their Outperform rating on JPMorgan Chase, maintaining a target price of $232.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for JPMorgan Chase, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

John B Hess Takes Money Off The Table, Sells $77.84M In Hess Stock

John B Hess, Chief Executive Officer at Hess HES, executed a substantial insider sell on November 7, according to an SEC filing.

What Happened: Hess opted to sell 543,679 shares of Hess, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $77,835,860.

Tracking the Friday’s morning session, Hess shares are trading at $142.75, showing a down of 0.0%.

Get to Know Hess Better

Hess is an independent oil and gas producer with key assets in the Bakken Shale, Guyana, the Gulf of Mexico, and Southeast Asia. At the end of 2023, the company reported net proved reserves of 1.4 billion barrels of oil equivalent. Net production averaged 391 thousand barrels of oil equivalent per day in 2023, at a ratio of 74% oil and natural gas liquids and 26% natural gas.

Key Indicators: Hess’s Financial Health

Revenue Growth: Hess’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 13.96%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company sets a benchmark with a high gross margin of 78.09%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Hess’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.62.

Debt Management: Hess’s debt-to-equity ratio surpasses industry norms, standing at 0.88. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 16.64 is lower than the industry average, implying a discounted valuation for Hess’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 3.46, Hess’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 7.36, Hess demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Hess’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

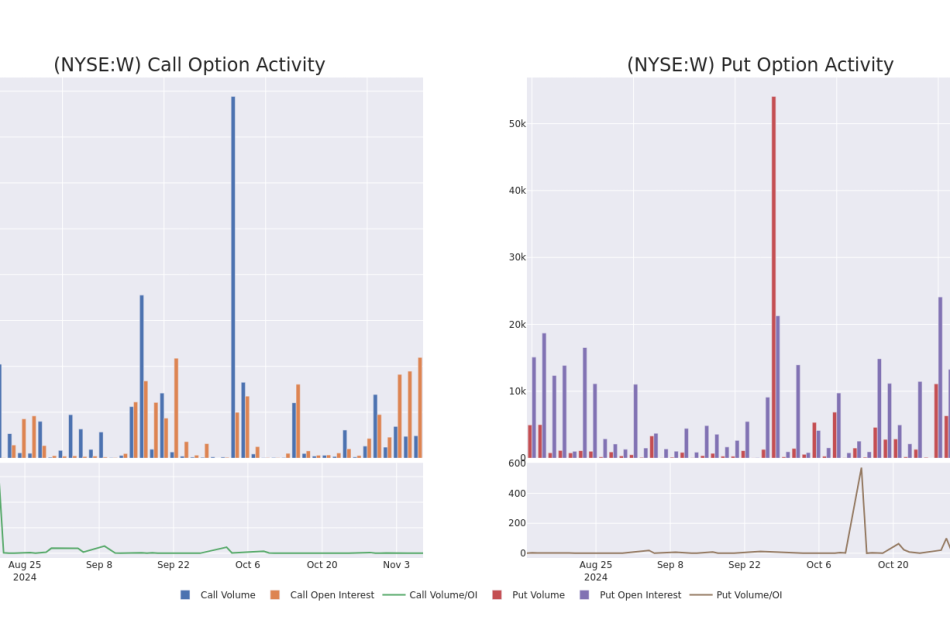

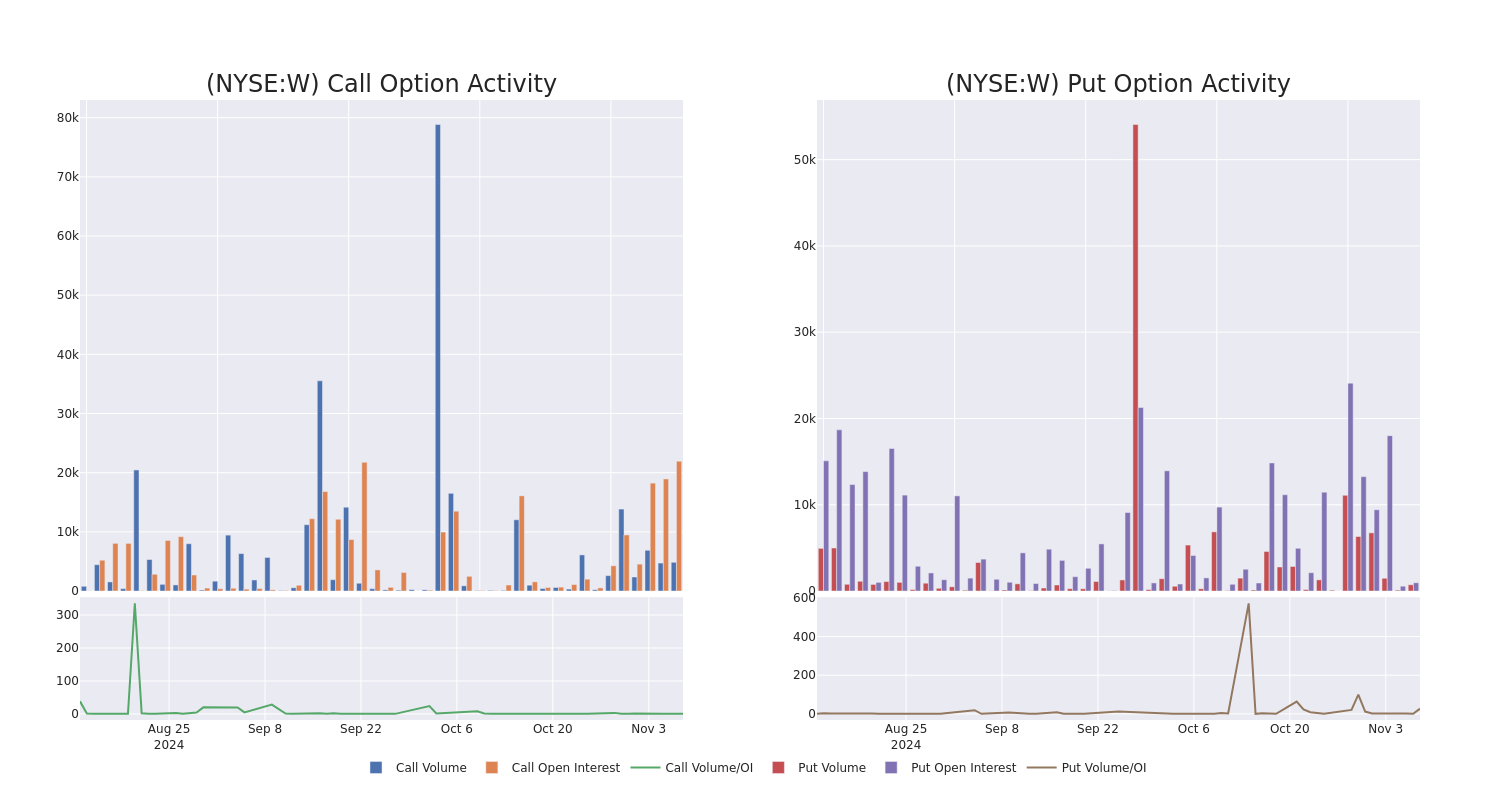

Looking At Wayfair's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Wayfair W, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in W usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 16 extraordinary options activities for Wayfair. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 68% leaning bullish and 25% bearish. Among these notable options, 5 are puts, totaling $324,922, and 11 are calls, amounting to $502,588.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $32.5 to $95.0 for Wayfair during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Wayfair’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wayfair’s whale activity within a strike price range from $32.5 to $95.0 in the last 30 days.

Wayfair 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| W | CALL | TRADE | BULLISH | 01/16/26 | $11.45 | $11.45 | $11.45 | $40.00 | $114.5K | 280 | 100 |

| W | PUT | TRADE | BULLISH | 01/15/27 | $10.65 | $10.35 | $10.47 | $35.00 | $104.7K | 4 | 100 |

| W | PUT | SWEEP | BULLISH | 06/20/25 | $4.15 | $4.05 | $4.05 | $32.50 | $75.3K | 192 | 187 |

| W | PUT | SWEEP | BULLISH | 06/20/25 | $7.15 | $7.0 | $7.0 | $37.50 | $72.1K | 489 | 373 |

| W | CALL | TRADE | BULLISH | 01/17/25 | $2.0 | $1.97 | $2.0 | $45.00 | $70.0K | 1.4K | 353 |

About Wayfair

Wayfair engages in e-commerce in the United States (87% of 2023 sales), Canada, the United Kingdom, Germany, and Ireland. It’s also embarked on expansion into the brick-and-mortar landscape, with a handful of stores between the AllModern, Birch Lane, Joss & Main, and Wayfair banners. At the end of 2023, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

In light of the recent options history for Wayfair, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Wayfair Standing Right Now?

- Currently trading with a volume of 4,770,975, the W’s price is down by -0.55%, now at $39.57.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 104 days.

What The Experts Say On Wayfair

In the last month, 5 experts released ratings on this stock with an average target price of $50.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wedbush has decided to maintain their Outperform rating on Wayfair, which currently sits at a price target of $45.

* An analyst from Needham downgraded its action to Buy with a price target of $60.

* An analyst from RBC Capital has decided to maintain their Sector Perform rating on Wayfair, which currently sits at a price target of $50.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Wayfair, targeting a price of $46.

* An analyst from Baird has decided to maintain their Neutral rating on Wayfair, which currently sits at a price target of $50.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Wayfair, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.