AirSculpt Technologies Reports Third Quarter Fiscal 2024 Results

MIAMI BEACH, Fla., Nov. 08, 2024 (GLOBE NEWSWIRE) — AirSculpt Technologies, Inc. AIRS(“AirSculpt” or the “Company”), a national provider of premium body contouring procedures, today announced results for the third quarter and nine months ended September 30, 2024.

“Our revenue and Adjusted EBITDA for the quarter were in line with our expectations with the period including progress on our strategy despite continued challenges in the consumer environment,” said Dennis Dean, Interim Chief Executive Officer and Chief Financial Officer of AirSculpt Technologies, Inc. “We are pleased with our four new center openings during the quarter and our 2023 de novo class continues to surpass our expectations. While our same center sales remain down, we are focused on improving the conversion of leads to consults and cases and believe this, combined with our new center openings and our cost reduction efforts, has us on the right track to return to positive revenue growth while also improving our margins over time.”

Third Quarter 2024 Results

- Case volume was 3,277 for the third quarter of 2024, representing a 4.3% decline from the fiscal year 2023 third quarter case volume of 3,426;

- Revenue declined 9.1% to $42.5 million from $46.8 million in the fiscal 2023 third quarter;

- Net loss for the quarter was $6.0 million compared to net loss of $1.7 million in the fiscal 2023 third quarter; and

- Adjusted EBITDA was $4.7 million compared to $9.1 million for the fiscal 2023 third quarter.

First Nine Months 2024 Results

- Case volume was 10,972, a decline of 2.5% from the first nine months of fiscal 2023 case volume of 11,252;

- Revenue declined 4.8% to $141.2 million from $148.3 million in the first nine months of fiscal 2023;

- Net loss was $3.2 million compared to net income of $0.1 million in the prior year period; and

- Adjusted EBITDA was $18.9 million compared to $33.1 million for the prior year period.

2024 Outlook

The Company affirms the guidance provided on October 24, 2024 for revenue in the range of $183 million to $189 million as compared to its previous guidance provided with second quarter fiscal 2024 earnings of revenue in the range of $180 million to $190 million. The Company is also maintaining its full year 2024 adjusted EBITDA guidance as follows:

- Adjusted EBITDA of approximately $23 to $28 million

- Adjusted EBITDA to cash flow from operations conversion ratio of approximately 50% (1)

- Five new centers to open in 2024

For additional information on forward-looking statements, see the section titled “Forward-Looking Statements” below.

(1) Calculated as cash flow from operating activities divided by Adjusted EBITDA.

Liquidity

As of September 30, 2024, the Company had $6.0 million in cash and cash equivalents and $5.0 million of borrowing capacity under its revolving credit facility. The Company generated $8.6 million in operating cash flow for the nine months ended September 30, 2024, compared to $19.1 million for the same period of 2023.

Conference Call Information

AirSculpt will hold a conference call today, November 8, 2024 at 8:00 am (Eastern Time). The conference call can be accessed by dialing 1-877-407-9716 (toll-free domestic) or 1-201-493-6779 (international) using the conference ID 13749064 or by visiting the link below to request a return call for instant telephone access to the event.

https://callme.viavid.com/viavid/?callme=true&passcode=13725116&h=true&info=company&r=true&B=6

The live webcast may be accessed via the investor relations section of the AirSculpt Technologies website at https://investors.airsculpt.com. A replay of the webcast will be available for approximately 90 days following the call.

To learn more about AirSculpt Technologies, please visit the Company’s website at https://investors.airsculpt.com. AirSculpt Technologies uses its website as a channel of distribution for material Company information. Financial and other material information regarding AirSculpt Technologies is routinely posted on the Company’s website and is readily accessible.

About AirSculpt

AirSculpt is a next-generation body contouring treatment designed to optimize both comfort and precision, available exclusively at AirSculpt offices. The minimally invasive procedure removes fat and tightens skin, while sculpting targeted areas of the body, allowing for quick healing with minimal bruising, tighter skin, and precise results.

Forward-Looking Statements

This press release contains forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements, which are subject to risks, uncertainties, and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies, and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. You are cautioned that there are important risks and uncertainties, many of which are beyond our control, that could cause our actual results, level of activity, performance, or achievements to differ materially from the projected results, level of activity, performance or achievements that are expressed or implied by such forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements, including those factors discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K.

Our future results could be affected by a variety of other factors, including, but not limited to, failure to open and operate new centers in a timely and cost-effective manner; inability to open new centers due to rising interest rates and increased operating expenses due to rising inflation; increased competition in the weight loss and obesity solutions market, including as a result of the recent regulatory approval, increased market acceptance, availability and customer awareness of weight-loss drugs; shortages or quality control issues with third-party manufacturers or suppliers; competition for surgeons; litigation or medical malpractice claims; inability to protect the confidentiality of our proprietary information; changes in the laws governing the corporate practice of medicine or fee-splitting; changes in the regulatory, macroeconomic conditions, including inflation and the threat of recession, economic and other conditions of the states and jurisdictions where our facilities are located; and business disruption or other losses from war, pandemic, terrorist acts or political unrest.

The risk factors discussed in “Item 1A. Risk Factors” in our Annual Report on Form 10-K and in other filings we make from time to time with the U.S. Securities and Exchange Commission could cause our results to differ materially from those expressed in the forward-looking statements made in this press release.

There also may be other risks and uncertainties that are currently unknown to us or that we are unable to predict at this time.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Forward-looking statements represent our estimates and assumptions only as of the date they were made, which are inherently subject to change, and we are under no duty and we assume no obligation to update any of these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated after the date of this press release to conform our prior statements to actual results or revised expectations, except as required by law. Given these uncertainties, investors should not place undue reliance on these forward-looking statements.

Use of Non-GAAP Financial Measures

The Company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), however, the Company believes the evaluation of ongoing operating results may be enhanced by a presentation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Net Income per Share, which are non-GAAP financial measures. Although the Company provides guidance for Adjusted EBITDA, it is not able to provide guidance for net income, the most directly comparable GAAP measure. Certain elements of the composition of net income, including equity-based compensation, are not predictable, making it impractical for us to provide guidance on net income or to reconcile our Adjusted EBITDA guidance to net income without unreasonable efforts. For the same reasons, the Company is unable to address the probable significance of the unavailable information regarding net income, which could be material to future results.

These non-GAAP financial measures are not intended to replace financial performance measures determined in accordance with GAAP. Rather, they are presented as supplemental measures of the Company’s performance that management believes may enhance the evaluation of the Company’s ongoing operating results. These non-GAAP financial measures are not presented in accordance with GAAP, and the Company’s computation of these non-GAAP financial measures may vary from similar measures used by other companies. These measures have limitations as an analytical tool and should not be considered in isolation or as a substitute or alternative to revenue, net income, operating income, cash flows from operating activities, total indebtedness or any other measures of operating performance, liquidity or indebtedness derived in accordance with GAAP.

| AirSculpt Technologies, Inc. and Subsidiaries Selected Consolidated Financial Data (Dollars in thousands, except shares and per share amounts) |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | $ | 42,548 | $ | 46,793 | $ | 141,172 | $ | 148,309 | |||||||

| Operating expenses: | |||||||||||||||

| Cost of service | 17,766 | 18,175 | 54,635 | 56,144 | |||||||||||

| Selling, general and administrative(1) | 25,495 | 25,030 | 75,525 | 76,805 | |||||||||||

| Depreciation and amortization | 3,003 | 2,629 | 8,693 | 7,479 | |||||||||||

| Loss/(gain) on disposal of long-lived assets | — | 4 | 4 | (198 | ) | ||||||||||

| Total operating expenses | 46,264 | 45,838 | 138,857 | 140,230 | |||||||||||

| (Loss)/income from operations | (3,716 | ) | 955 | 2,315 | 8,079 | ||||||||||

| Interest expense, net | 1,591 | 1,836 | 4,638 | 5,462 | |||||||||||

| Pre-tax net (loss)/income | (5,307 | ) | (881 | ) | (2,323 | ) | 2,617 | ||||||||

| Income tax expense | 733 | 786 | 894 | 2,522 | |||||||||||

| Net (loss)/income | $ | (6,040 | ) | $ | (1,667 | ) | $ | (3,217 | ) | $ | 95 | ||||

| (Loss)/income per share of common stock | |||||||||||||||

| Basic | $ | (0.10 | ) | $ | (0.03 | ) | $ | (0.06 | ) | $ | 0.00 | ||||

| Diluted | $ | (0.10 | ) | $ | (0.03 | ) | $ | (0.06 | ) | $ | 0.00 | ||||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 57,650,923 | 56,785,087 | 57,543,678 | 56,661,903 | |||||||||||

| Diluted | 57,650,923 | 56,785,087 | 57,543,678 | 58,329,685 | |||||||||||

| (1) | During the first quarter of fiscal year 2024, the Company recorded a cumulative reversal of stock compensation expense of $10.4 million related to reassessing the probability of achieving the performance target on certain of the Company’s performance-based stock units. For further discussion, see Note 6 to the condensed consolidated financial statements of the Company’s Quarterly Report on Form 10-Q for the Quarterly Period ended September 30, 2024. |

| AirSculpt Technologies, Inc. and Subsidiaries Selected Financial and Operating Data (Dollars in thousands, except per case amounts) |

|||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| Balance Sheet Data (at period end): | |||||||

| Cash and cash equivalents | $ | 5,972 | $ | 10,262 | |||

| Total current assets | 12,892 | 15,961 | |||||

| Total assets | $ | 208,245 | $ | 204,019 | |||

| Current portion of long-term debt | $ | 3,719 | $ | 2,125 | |||

| Deferred revenue and patient deposits | 2,343 | 1,463 | |||||

| Total current liabilities | 25,347 | 20,315 | |||||

| Long-term debt, net | 66,423 | 69,503 | |||||

| Total liabilities | $ | 125,708 | $ | 120,027 | |||

| Total stockholders’ equity | $ | 82,537 | $ | 83,992 | |||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Cash Flow Data: | |||||||||||||||

| Net cash provided by (used in): | |||||||||||||||

| Operating activities | $ | 1,830 | $ | 635 | $ | 8,637 | $ | 19,090 | |||||||

| Investing activities | (4,899 | ) | (2,116 | ) | (10,479 | ) | (8,092 | ) | |||||||

| Financing activities | (825 | ) | (10,638 | ) | (2,448 | ) | (11,954 | ) | |||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Other Data: | |||||||||||||||

| Number of facilities | 31 | 27 | 31 | 27 | |||||||||||

| Number of total procedure rooms | 65 | 57 | 65 | 57 | |||||||||||

| Cases | 3,277 | 3,426 | 10,972 | 11,252 | |||||||||||

| Revenue per case | $ | 12,984 | $ | 13,658 | $ | 12,867 | $ | 13,181 | |||||||

| Adjusted EBITDA (1) (3) | $ | 4,666 | $ | 9,075 | $ | 18,871 | $ | 33,143 | |||||||

| Adjusted EBITDA margin (2) | 11.0 | % | 19.4 | % | 13.4 | % | 22.3 | % | |||||||

| (1) A reconciliation of this non-GAAP financial measure appears below. |

| (2) Defined as Adjusted EBITDA as a percentage of revenue. |

| (3) For the three months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.7 million and $0.5 million, respectively. For the nine months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.8 million and $3.3 million, respectively. |

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Same-center Information(1): | |||||||||||||||

| Cases | 3,147 | 3,426 | 10,013 | 11,252 | |||||||||||

| Case growth | (8.1) % | N/A | (11.0) % | N/A | |||||||||||

| Revenue per case | $ | 12,949 | $ | 13,658 | $ | 12,805 | $ | 13,181 | |||||||

| Revenue per case growth | (5.2) % | N/A | (2.9) % | N/A | |||||||||||

| Number of facilities | 27 | 27 | 27 | 27 | |||||||||||

| Number of total procedure rooms | 57 | 57 | 57 | 57 | |||||||||||

| (1) | For the three months ended September 30, 2024 and 2023, we define same-center case and revenue growth as the growth in each of our cases and revenue at facilities that were owned and operated during the three month period ended September 30, 2024 and 2023, respectively. At facilities that were not owned or operated for the entirety of the prior year period, the current year period has been pro-rated to reflect only growth experienced during the portion of the three months ended September 30, 2024 in which such facilities were owned and operated during the three months ended September 30, 2023. We define same-center facilities and procedure rooms based on if a facility was owned or operated as of September 30, 2023. |

| For the nine months ended September 30, 2024 and 2023, we define same-center case and revenue growth as the growth in each of our cases and revenue at facilities that were owned and operated during the nine month period ended September 30, 2024 and 2023, respectively. At facilities that were not owned or operated for the entirety of the prior year period, the current year period has been pro-rated to reflect only growth experienced during the portion of the nine months ended September 30, 2024 in which such facilities were owned and operated during the nine months ended September 30, 2023. We define same-center facilities and procedure rooms based on if a facility was owned or operated as of September 30, 2023. |

AirSculpt Technologies, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

(Dollars in thousands)

We report our financial results in accordance with GAAP, however, management believes the evaluation of our ongoing operating results may be enhanced by a presentation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Net Income per Share, which are non-GAAP financial measures.

We define Adjusted EBITDA as net (loss)/income excluding depreciation and amortization, net interest expense, income tax expense, restructuring and related severance costs, loss/(gain) on disposal of long-lived assets, settlement costs for non-recurring litigation, and equity-based compensation.

We define Adjusted Net Income as net (loss)/income excluding restructuring and related severance costs, loss/(gain) on disposal of long-lived assets, settlement costs for non-recurring litigation, equity-based compensation and the tax effect of these adjustments.

We include Adjusted EBITDA and Adjusted Net Income because they are important measures on which our management assesses and believes investors should assess our operating performance. We consider Adjusted EBITDA and Adjusted Net Income each to be an important measure because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis. Adjusted EBITDA has limitations as an analytical tool including: (i) Adjusted EBITDA does not include results from equity-based compensation and (ii) Adjusted EBITDA does not reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments. Adjusted Net Income has limitations as an analytical tool because it does not include results from equity-based compensation.

We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue. We define Adjusted Net Income per Share as Adjusted Net Income divided by weighted average basic and diluted shares. We included Adjusted EBITDA Margin and Adjusted Net Income per Share because they are important measures on which our management assesses and believes investors should assess our operating performance. We consider Adjusted EBITDA Margin and Adjusted Net Income per Share to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

The following table reconciles Adjusted EBITDA and Adjusted EBITDA Margin to net (loss)/income, the most directly comparable GAAP financial measure:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net (loss)/income | $ | (6,040 | ) | $ | (1,667 | ) | $ | (3,217 | ) | $ | 95 | ||||

| Plus | | ||||||||||||||

| Equity-based compensation(1) | 3,430 | 4,492 | 1,522 | 13,483 | |||||||||||

| Restructuring and related severance costs | 1,099 | 995 | 5,487 | 4,300 | |||||||||||

| Depreciation and amortization | 3,003 | 2,629 | 8,693 | 7,479 | |||||||||||

| Loss/(gain) on disposal of long-lived assets | — | 4 | 4 | (198 | ) | ||||||||||

| Litigation settlements(2) | 850 | — | 850 | — | |||||||||||

| Interest expense, net | 1,591 | 1,836 | 4,638 | 5,462 | |||||||||||

| Income tax expense | 733 | 786 | 894 | 2,522 | |||||||||||

| Adjusted EBITDA | $ | 4,666 | $ | 9,075 | $ | 18,871 | $ | 33,143 | |||||||

| Adjusted EBITDA Margin | 11.0 | % | 19.4 | % | 13.4 | % | 22.3 | % | |||||||

| (1) | As of the nine months ended September 30, 2024, this amount contains a cumulative reversal of stock compensation expense of $10.4 million related to reassessing the probability of achieving the performance target on certain of the Company’s performance-based stock units. For further discussion, see Note 6 to the condensed consolidated financial statements of the Company’s Quarterly Report on Form 10-Q for the Quarterly Period ended September 30, 2024. |

| (2) | This amount relates to settlement costs for non-recurring litigation of $0.9 million for the three and nine months ended September 30, 2024. This amount is accrued in “Accrued and other current liabilities” as of September 30, 2024. See Note 9 to the condensed consolidated financial statements included in this Quarterly Report on Form 10-Q for further discussion. |

For the three months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.7 million and $0.5 million, respectively. For the six months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.8 million and $3.3 million, respectively.

The following table reconciles Adjusted Net Income and Adjusted Net Income per Share to net income/(loss), the most directly comparable GAAP financial measure:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net (loss)/income | $ | (6,040 | ) | $ | (1,667 | ) | $ | (3,217 | ) | $ | 95 | ||||

| Plus | |||||||||||||||

| Equity-based compensation(1) | 3,430 | 4,492 | 1,522 | 13,483 | |||||||||||

| Restructuring and related severance costs | 1,099 | 995 | 5,487 | 4,300 | |||||||||||

| Loss/(gain) on disposal of long-lived assets | — | 4 | 4 | (198 | ) | ||||||||||

| Litigation settlements(2) | 850 | — | 850 | — | |||||||||||

| Tax effect of adjustments | (717 | ) | (751 | ) | 996 | (2,079 | ) | ||||||||

| Adjusted net (loss)/income | $ | (1,378 | ) | $ | 3,073 | $ | 5,642 | $ | 15,601 | ||||||

| Adjusted net (loss)/income per share of common stock (3) | |||||||||||||||

| Basic | $ | (0.02 | ) | $ | 0.05 | $ | 0.10 | $ | 0.28 | ||||||

| Diluted | $ | (0.02 | ) | $ | 0.05 | $ | 0.10 | $ | 0.27 | ||||||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 57,650,923 | 56,785,087 | 57,543,678 | 56,661,903 | |||||||||||

| Diluted | 57,650,923 | 58,954,829 | 58,289,022 | 58,329,685 | |||||||||||

| (1) | During the first quarter of fiscal year 2024, the Company recorded a cumulative reversal of stock compensation expense of $10.4 million related to reassessing the probability of achieving the performance target on certain of the Company’s performance-based stock units. For further discussion, see Note 6 to the condensed consolidated financial statements of the Company’s Quarterly Report on Form 10-Q for the Quarterly Period ended September 30, 2024. |

| (2) | This amount relates to settlement costs for non-recurring litigation of $0.9 million for the three and nine months ended September 30, 2024. This amount is accrued in “Accrued and other current liabilities” as of September 30, 2024. See Note 9 to the condensed consolidated financial statements included in this Quarterly Report on Form 10-Q for further discussion. |

| (3) | Diluted Adjusted Net Income Per Share is computed by dividing adjusted net income by the weighted-average number of shares of common stock outstanding adjusted for the dilutive effect of all potential shares of common stock. |

Investor Contact

Allison Malkin

ICR, Inc.

airsculpt@icrinc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Power Play: QuantumScape's Bold Battery Vision and the Roadblocks Ahead

- In September 2020, QuantumScape set high expectations with claims about its solid-state batteries, including rapid charging and extended lifespans.

- By December 2021, these promises had driven its stock to an all-time high, fueled by strong investor excitement over the potential of this breakthrough technology.

- On January 4, 2021, an article titled “QuantumScape’s Solid State Batteries Have Significant Technical Hurdles To Overcome” highlighted that the company’s technology was still in the early stages, far from mass production — causing a 40% drop in stock price.

- In response, QuantumScape’s Chief Technology Officer Tim Holme acknowledged the challenges, stating, “We still have much work ahead.”

- In January 2021, shareholders sued the company, claiming it hid important technical risks related to its technology.

- QuantumScape has agreed to a $47.5 million settlement with shareholders to resolve the lawsuit. Affected investors can now file a claim to receive their payment.

Overview

QuantumScape Corp. QS went public in November 2020 through a merger with Kensington Capital Acquisition, aiming to transform the EV industry with its innovative solid-state battery technology. However, an article published on January 4, 2021, raised serious doubts about the company’s claims regarding charging speed, performance in cold conditions, and cost-effectiveness, which resulted in a 40% drop in stock price and a lawsuit from investors. Recently, QuantumScape ultimately reached a $47.5 million settlement with the affected shareholders to resolve this scandal.

Bold Promises: QuantumScape’s Ambition To Change The EV Landscape

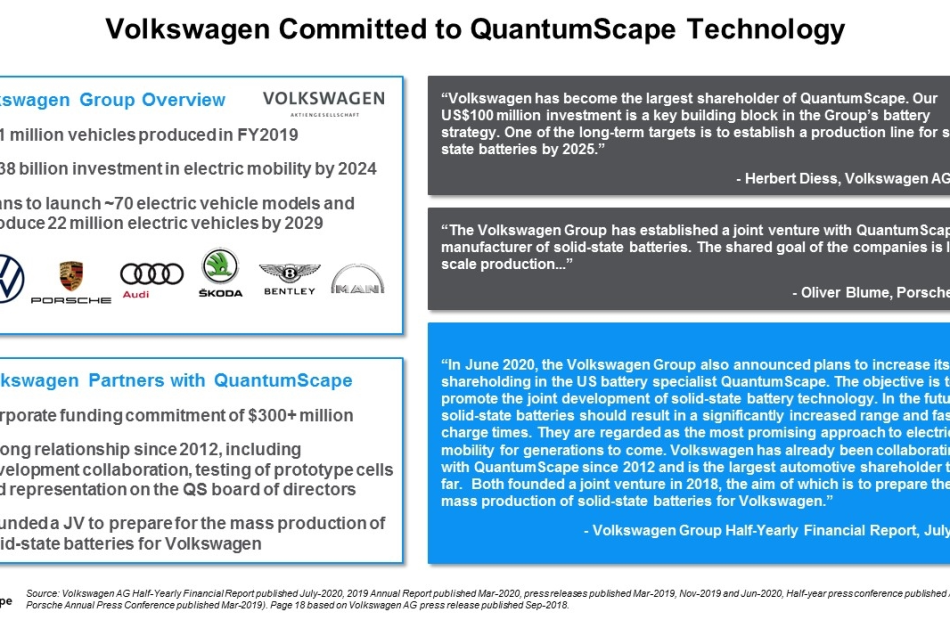

In 2020, QuantumScape caught the attention of prominent investors like Volkswagen, Bill Gates, and Fidelity.

Bill Gates highlighted the critical need for battery innovation, saying, “To replace all existing cars, we need batteries that charge quickly, take up less space, cost less, and match the range of gas-powered vehicles. QuantumScape has a promising battery that is part of the solution.”

That same year, Volkswagen reinforced its confidence in QuantumScape by investing an additional $200 million, further solidifying its support for the company’s technology.

In its September 2020 investor presentation, QuantumScape outlined a major global market opportunity, projecting $450 billion in battery sales fueled by the annual production of over 90 million vehicles.

Moreover, in January 2021 investor presentations, the company presented an ambitious vision for safer, faster-charging batteries that could redefine electric vehicle performance.

The presentation pointed out that previous attempts at EV commercialization had faltered due to technical challenges such as slow charging speeds, inadequate cathode loading, and unreliable separators, which limited battery life to under 800 cycles.

Additionally, these lithium batteries operated within a narrow temperature range, often requiring extra lithium, were costly, and had low energy density, all of which hindered their efficiency and prevented widespread adoption.

QuantumScape positioned itself as a compelling alternative by focusing on solid-state batteries instead of conventional lithium ones. Key benefits included faster charging — reaching 80% in just 15 minutes compared to lithium’s sub-50% in the same timeframe — longer lifespan, retaining 80% capacity after 1,000 charges, reliable performance in cold conditions (effective down to -30°C), and overall greater power output.

CEO Jagdeep Singh expressed optimism about the disruptive potential of this technology:

“We believe the performance data we’ve unveiled today shows that solid-state batteries have the potential to narrow the gap between electric vehicles and internal combustion vehicles, helping EVs become the world’s dominant form of transportation.”

Behind the Hype: Questions Arise Around QuantumScape’s Tech

On January 4, 2021, an article published on Seeking Alpha raised questions about QuantumScape’s battery technology, pointing out potential issues with capacity, range, and real-world performance.

The report suggested the battery might only last 260 charge cycles — far below the 800 cycles initially promised — and flagged high production costs due to complex materials.

Under low temperatures, specifically -10°C, the battery was said to reach just 5% charge in 15 minutes, falling short of the projected 80%.

The author highlighted these challenges, noting the hurdles QuantumScape faces in scaling its technology for the mass market.

In an interview, QuantumScape founder and CEO Jagdeep Singh defended the company, saying, “The Seeking Alpha story had no merit. It read like it was written by someone who didn’t know anything about batteries.”

After the article’s publication, QuantumScape clarified that its batteries were still in development, with test results based on small prototypes rather than full battery packs.

However, the article’s findings significantly affected investors, resulting in a 40% drop in share price and a lawsuit against QuantumScape and CEO Jagdeep Singh.

Resolving The Case

To resolve the lawsuit from investors, QuantumScape has agreed to a cash settlement of $47.5 million. If you invested in QuantumScape, you may be eligible to claim a portion of this settlement to recover your losses.

This year, QuantumScape made significant progress by delivering its new battery samples to automakers, achieving an important milestone for 2024 and moving closer to widespread use. The batteries promise faster charging and longer range, though mass production will take time. To accelerate this process, QuantumScape recently partnered with Volkswagen’s PowerCo, which plans to manufacture the batteries at facilities in Europe and Canada. With a focus on reducing costs and energy consumption, PowerCo aims to start production by 2026-2027, setting the stage for a new era in electric vehicle performance.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SANUWAVE Announces Record Quarterly Revenues: Q3 FY2024 Financial Results

Q3 2024 revenues were $9.4 million, up 89% from Q3 2023. This was an all-time quarterly record for the Company.

Q3 2024 gross margin was 75.5%, vs 71.5% in Q3 2023

GAAP Operating Income was $2.0 million

Company provides guidance for revenue growth of 40-50% for Q4 2024 versus Q4 2023

EDEN PRAIRIE, Minn., Nov. 08, 2024 (GLOBE NEWSWIRE) — SANUWAVE Health, Inc. (the “Company” or “SANUWAVE”) SNWV, a leading provider of next-generation FDA-approved wound care products, is pleased to provide its financial results for the three months ended September 30, 2024.

Q3 2024 ended September 30, 2024

- Revenue for the three months ended September 30, 2024, totaled $9.4 million, an increase of 89%, as compared to $5.0 million for the same period of 2023. This growth is greater than the previously provided guidance for a 65 – 75% increase.

- 124 UltraMist® systems were sold in Q3 2024 up from 55 in Q3 2023 and from 72 in Q2 2024.

- UltraMist® consumables revenue increased by 75% to $5.4 million (58% of revenues) in Q3 2024, versus $3.1 million for the same quarter last year. UltraMIST systems and consumables remained the primary revenue growth driver and continued to represent over 97% of SANUWAVE’s overall revenues in Q3 2024.

- Gross margin as a percentage of revenue amounted to 75.5% for the three months ended September 30, 2024, versus 71.5% for the same period last year.

- For the three months ended September 30, 2024, operating income totaled $2.0 million, an increase of $2.5 million compared to Q3 2023 as a result of the Company’s continued efforts to drive profitable growth and manage expenses.

- Net loss for the third quarter of 2024 was $20.7 million, driven predominantly by the change in the fair value of derivative liabilities. This compares to a net loss of $23.7 million in the third quarter of 2023. Net loss year to date was $18.6 million versus a net loss of $44.0 million in the nine months ended September 30, 2023.

- Adjusted EBITDA [1] for the three months ended September 30, 2024, was $2.1 million versus Adjusted EBITDA of $(0.3) million for the same period last year, an improvement of $2.4 million. Year to date Adjusted EBITDA was $3.5 million versus a loss of $1.8 million in the prior year period.

“The third quarter showed acceleration in revenue growth rate from the first half of the year with growth of 89% year on year (and 31% sequentially) leading the company to a growth rate of 68% for the first nine months of 2024 as compared to the same period in 2023,” said Morgan Frank, CEO. “Obviously, we’re very pleased with these results, especially to have achieved operating income and Adjusted EBITDA positivity again this quarter and, for the first time, became cash generative from operations even after cash interest expense. We have begun to gain traction with some larger customers and our sales funnel remains the most promising it has ever been. As we look to the fourth quarter, we will seek to build on this progress as we continue to hire additional sales and commercial staff. We expect to experience a bit of a ‘pigs through a python’ scenario for us over the coming months and quarters, as large orders move the needle on revenues in significant and variable fashion, but we anticipate finishing 2024 strongly as a breakout year for SANUWAVE.”

Financial Outlook

The Company forecasts Q4 2024 revenue of $9.7 to $10.5 million (40-50% increase from Q4 2023) and therefore for revenues for 2024 as a whole to be in excess of $32 million (an increase of 57% vs full year 2023). The Company forecasts Q4 gross margin as a percentage of revenue to remain in the mid-70s.

Subsequent to quarter end, the Company effected a 1-for-375 reverse stock split on October 18, 2024, completed its note and warrant exchange, and raised $10.3 million in a private placement, simplifying the Company’s capital structure and leaving it with approximately 8.5 million shares outstanding. Details of this transaction can be found on the SANUWAVE website https://sanuwave.com/investors/press-release-details?newsId=OxzYFl0t620enXp1VyUG or in its filings with the SEC.

As previously announced, a business update will occur via conference call on November 8, 2024 at 8:30 a.m. EST. Materials for the conference call are included on the Company’s website at http://www.sanuwave.com/investors

Telephone access to the call will be available by dialing the following numbers:

Toll Free: 1-800-267-6316

Toll/International: 1-203-518-9783

Conference ID: SANUWAVE

OR click the link for instant telephone access to the event.

https://viavid.webcasts.com/starthere.jsp?ei=1692398&tp_key=e3cff43c54

A replay will be made available through November 29, 2024:

Toll-Free: 1-844-512-2921

Toll/International: 1-412-317-6671

Replay Access ID: 11157276

[1] This is a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” and the reconciliations in this release for further information.

About SANUWAVE

SANUWAVE Health is focused on the research, development, and commercialization of its patented, non-invasive and biological response-activating medical systems for the repair and regeneration of skin, musculoskeletal tissue, and vascular structures.

SANUWAVE’s end-to-end wound care portfolio of regenerative medicine products and product candidates helps restore the body’s normal healing processes. SANUWAVE applies and researches its patented energy transfer technologies in wound healing, orthopedic/spine, aesthetic/cosmetic, and cardiac/endovascular conditions.

Non-GAAP Financial Measures

This press release includes certain financial measures that are not presented in our financial statements prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). These financial measures are considered “non-GAAP financial measures” and are intended to supplement, and should not be considered as superior to, or a replacement for, financial measures presented in accordance with U.S. GAAP.

The Company uses Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and Adjusted EBITDA to assess its operating performance. Adjusted EBITDA is Earnings before Interest, Taxes, Depreciation and Amortization adjusted for the change in fair value of derivatives and any significant non-cash or infrequent charges. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) as a measure of financial performance or any other performance measure derived in accordance with U.S. GAAP, and they should not be construed as an inference that the Company’s future results will be unaffected by unusual or infrequent items. These non-GAAP financial measures are presented in a consistent manner for each period, unless otherwise disclosed. The Company uses these measures for the purpose of evaluating its historical and prospective financial performance, as well as its performance relative to competitors. These measures also help the Company to make operational and strategic decisions. The Company believes that providing this information to investors, in addition to U.S. GAAP measures, allows them to see the Company’s results through the eyes of management, and to better understand its historical and future financial performance. These non-GAAP financial measures are also frequently used by analysts, investors, and other interested parties to evaluate companies in our industry, when considered alongside other U.S. GAAP measures.

EBITDA and Adjusted EBITDA have their limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under U.S. GAAP. Some of these limitations are that EBITDA and Adjusted EBITDA:

• Do not reflect every expenditure, future requirements for capital expenditures or contractual commitments.

• Do not reflect all changes in our working capital needs.

• Do not reflect interest expense, or the amount necessary to service our outstanding debt.

As presented in the U.S. GAAP to Non-GAAP Reconciliations section below, the Company’s non-GAAP financial measures exclude the impact of certain charges that contribute to our net income (loss).

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to future financial results, production expectations, and plans for future business development activities. Forward-looking statements include all statements that are not statements of historical fact regarding intent, belief or current expectations of the Company, its directors or its officers. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond the Company’s ability to control. Actual results may differ materially from those projected in the forward-looking statements. Among the key risks, assumptions and factors that may affect operating results, performance and financial condition are risks associated with regulatory oversight, the Company’s ability to manage its capital resources, competition and the other factors discussed in detail in the Company’s periodic filings with the Securities and Exchange Commission. The Company undertakes no obligation to update any forward-looking statement.

Contact: investors@sanuwave.com

SELECTED FINANCIAL DATA

FOR THE QUARTERS ENDED SEPTEMBER 30, 2024 AND 2023

| (in thousands) | 2024 | 2023 | |||||||

| Revenue | $ | 9,360 | $ | 4,953 | |||||

| Cost of Revenues | 2,293 | 1,412 | |||||||

| Gross Margin | 7,067 | 3,541 | |||||||

| Gross Margin % | 75.5 | % | 71.5 | % | |||||

| Total operating expenses | 5,114 | 4,072 | |||||||

| Operating Income (Loss) | $ | 1,953 | $ | (531 | ) | ||||

| Total other expense | (22,610 | ) | (23,169 | ) | |||||

| Net Income (Loss) | $ | (20,657 | ) | $ | (23,700 | ) | |||

NON-GAAP ADJUSTED EBITDA

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| (in thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net Income/(Loss) | $ | (20,657 | ) | $ | (23,700 | ) | $ | (18,624 | ) | $ | (44,042 | ) | |||

| Non-GAAP Adjustments: | |||||||||||||||

| Interest expense | 3,661 | 3,845 | 11,004 | 12,504 | |||||||||||

| Depreciation and amortization | 256 | 266 | 736 | 780 | |||||||||||

| EBITDA | (16,740 | ) | (19,589 | ) | (6,884 | ) | (30,758 | ) | |||||||

| Non-GAAP Adjustments for Adjusted EBITDA: | |||||||||||||||

| Change in fair value of derivative liabilities | 18,849 | 19,325 | 17,633 | 29,943 | |||||||||||

| Other non-cash or non-recurring charges: | |||||||||||||||

| Gain on extinguishment of debt | – | – | (5,205 | ) | – | ||||||||||

| Severance agreement and legal settlement | – | – | 585 | – | |||||||||||

| Release of historical accrued expenses | – | – | (579 | ) | (1,250 | ) | |||||||||

| Shares for services | – | – | – | 224 | |||||||||||

| License and option agreement | – | – | (2,500 | ) | – | ||||||||||

| Prepaid legal fees expensed from termination of Merger Agreement | – | – | 457 | – | |||||||||||

| Adjusted EBITDA | $ | 2,109 | $ | (264 | ) | $ | 3,507 | $ | (1,841 | ) | |||||

CONDENSED CONSOLIDATED BALANCE SHEETS

| (In thousands, except share data) | September 30, 2024 | December 31, 2023 | |||||

| ASSETS | |||||||

| Current Assets: | |||||||

| Cash and cash equivalent | $ | 3,259 | $ | 1,797 | |||

| Accounts receivable, net of allowance of $1,056 and $1,237, respectively | 2,836 | 3,314 | |||||

| Inventory | 3,431 | 2,951 | |||||

| Prepaid expenses and other current assets | 378 | 1,722 | |||||

| Total Current Assets | 9,904 | 9,784 | |||||

| Non-Current Assets: | |||||||

| Property, equipment and other, net | 774 | 938 | |||||

| Intangible assets, net | 3,906 | 4,434 | |||||

| Goodwill | 7,260 | 7,260 | |||||

| Total Non-current Assets | 11,940 | 12,632 | |||||

| Total Assets | $ | 21,844 | $ | 22,416 | |||

| LIABILITIES | |||||||

| Current Liabilities: | |||||||

| Senior secured debt, in default | $ | 24,426 | $ | 18,278 | |||

| Convertible promissory notes payable | 4,817 | 5,404 | |||||

| Convertible promissory notes payable, related parties | 2,838 | 1,705 | |||||

| Asset-backed secured promissory notes payable | — | 3,117 | |||||

| Asset-backed secured promissory notes, related parties | — | 1,458 | |||||

| Promissory note payable, related party | 500 | – | |||||

| Accounts payable | 4,137 | 5,705 | |||||

| Accrued expenses | 5,241 | 5,999 | |||||

| Factoring liabilities | 1,938 | 1,490 | |||||

| Warrant liability | 35,509 | 14,447 | |||||

| Accrued interest | 643 | 5,444 | |||||

| Accrued interest, related parties | 952 | 669 | |||||

| Current portion of contract liabilities | 137 | 92 | |||||

| Other | 375 | 947 | |||||

| Total Current Liabilities | 81,513 | 64,755 | |||||

| Non-current Liabilities | |||||||

| Lease liabilities, less current portion | 236 | 492 | |||||

| Contract liabilities, less current portion | 358 | 347 | |||||

| Total Non-current Liabilities | 594 | 839 | |||||

| Total Liabilities | $ | 82,107 | $ | 65,594 | |||

| STOCKHOLDERS’ DEFICIT | |||||||

| Preferred Stock, par value $0.001, 5,000,000 shares authorized; 6,175 shares Series A, 293 shares Series B, 90 shares Series C and 8 shares Series D authorized; no shares issued and outstanding at September 30, 2024 and December 31, 2023 | $ | – | $ | – | |||

| Common stock, par value $0.001, 2,500,000,000 shares authorized; 3,150,062 and 3,041,492 issued and outstanding at September 30, 2024 and December 31, 2023, respectively * | 3 | 3 | |||||

| Additional paid-in capital | 178,397 | 176,979 | |||||

| Accumulated deficit | (238,673 | ) | (220,049 | ) | |||

| Accumulated other comprehensive income (loss) | 10 | (111 | ) | ||||

| Total Stockholders’ Deficit | (60,263 | ) | (43,178 | ) | |||

| Total Liabilities and Stockholders’ Deficit | $ | 21,844 | $ | 22,416 | |||

* Reflects a one-for-three hundred seventy-five (1:375) reverse stock split of the outstanding shares of the Company’s common stock effected on October 18, 2024

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

| (In thousands, except share data) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | $ | 9,360 | $ | 4,953 | $ | 22,308 | $ | 13,404 | |||||||

| Cost of Revenues | 2,293 | 1,412 | 5,799 | 3,876 | |||||||||||

| Gross Margin | 7,067 | 3,541 | 16,509 | 9,528 | |||||||||||

| Operating Expenses: | |||||||||||||||

| General and administrative | 2,545 | 2,681 | 8,059 | 6,678 | |||||||||||

| Selling and marketing | 2,202 | 1,039 | 4,468 | 3,430 | |||||||||||

| Research and development | 161 | 165 | 519 | 436 | |||||||||||

| Depreciation and amortization | 206 | 187 | 568 | 563 | |||||||||||

| Total Operating Expenses | 5,114 | 4,072 | 13,614 | 11,107 | |||||||||||

| Operating Income (Loss) | 1,953 | (531 | ) | 2,895 | (1,579 | ) | |||||||||

| Other Income (Expense): | |||||||||||||||

| Interest expense | (3,315 | ) | (2,907 | ) | (9,948 | ) | (10,125 | ) | |||||||

| Interest expense, related party | (346 | ) | (938 | ) | (1,056 | ) | (2,379 | ) | |||||||

| Gain on extinguishment of debt | — | – | 5,205 | – | |||||||||||

| Change in fair value of derivative liabilities | (18,849 | ) | (19,325 | ) | (17,633 | ) | (29,943 | ) | |||||||

| Other expense | (106 | ) | – | (893 | ) | (16 | ) | ||||||||

| Other income | 6 | 1 | 2,806 | – | |||||||||||

| Total Other Expense | (22,610 | ) | (23,169 | ) | (21,519 | ) | (42,463 | ) | |||||||

| Net Loss | (20,657 | ) | (23,700 | ) | (18,624 | ) | (44,042 | ) | |||||||

| Other Comprehensive Loss | |||||||||||||||

| Foreign currency translation adjustments | — | 7 | 121 | (6 | ) | ||||||||||

| Total Comprehensive Loss | $ | (20,657 | ) | $ | (23,693 | ) | $ | (18,503 | ) | $ | (44,048 | ) | |||

| Net Loss per share: | |||||||||||||||

| Basic and Diluted * | $ | (6.49 | ) | $ | (9.95 | ) | $ | (5.92 | ) | $ | (24.15 | ) | |||

| Weighted average shares outstanding: | |||||||||||||||

| Basic and Diluted * | 3,185 | 2,381 | 3,146 | 1,823 | |||||||||||

* Reflects a one-for-three hundred seventy-five (1:375) reverse stock split of the outstanding shares of the Company’s common stock effected on October 18, 2024

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

| (In thousands, except share data) | |||||||||||||||||||

| Three Months Ended September 30, 2024 | |||||||||||||||||||

| Common Stock | |||||||||||||||||||

| Number of Shares Issued and Outstanding |

Par Value | Additional Paid- in Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Loss |

Total | ||||||||||||||

| Balances as of June 30, 2024 | 3,150,062 | $ | 3 | $ | 178,397 | $ | (218,016 | ) | $ | 10 | $ | (39,606 | ) | ||||||

| Net loss | – | – | – | (20,657 | ) | – | (20,657 | ) | |||||||||||

| Balances as of September 30, 2024 | 3,150,062 | $ | 3 | $ | 178,397 | $ | (238,673 | ) | $ | 10 | $ | (60,263 | ) | ||||||

| Three Months Ended September 30, 2023 | ||||||||||||||||||||

| Common Stock | ||||||||||||||||||||

| Number of Shares Issued and Outstanding |

Par Value | Additional Paid- in Capital |

Accumulated Deficit | Accumulated Other Comprehensive Loss |

Total | |||||||||||||||

| Balances as of June 30, 2023 | 1,497,700 | $ | 2 | $ | 153,824 | $ | (214,584 | ) | $ | (80 | ) | $ | (60,838 | ) | ||||||

| Shares issued for settlement of debt | 1,238,509 | 1 | 18,576 | – | – | $ | 18,577 | |||||||||||||

| Foreign currency translation adjustment | – | – | – | – | 7 | $ | 7 | |||||||||||||

| Net loss | – | – | – | (23,700 | ) | – | $ | (23,700 | ) | |||||||||||

| Balances as of September 30, 2023 | 2,736,209 | $ | 3 | $ | 172,400 | $ | (238,284 | ) | $ | (73 | ) | $ | (65,954 | ) | ||||||

* Reflects a one-for-three hundred seventy-five (1:375) reverse stock split of the outstanding shares of the Company’s common stock effected on October 18, 2024

| Nine Months Ended September 30, | ||||||||||||||||||||

| Common Stock | ||||||||||||||||||||

| Number of Shares Issued and Outstanding |

Par Value | Additional Paid- in Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||||

| Balances as of December 31, 2023 | 3,041,492 | $ | 3 | $ | 176,979 | $ | (220,049 | ) | $ | (111 | ) | $ | (43,178 | ) | ||||||

| Shares issued for settlement of warrants | 14,440 | – | 6 | – | – | 6 | ||||||||||||||

| Shares issued for settlement of debt | 94,130 | – | 1,412 | – | – | 1,412 | ||||||||||||||

| Foreign currency translation adjustment | – | – | – | – | 121 | 121 | ||||||||||||||

| Net loss | – | – | – | (18,624 | ) | – | (18,624 | ) | ||||||||||||

| Balances as of September 30, 2024 | 3,150,062 | $ | 3 | $ | 178,397 | $ | (238,673 | ) | $ | 10 | $ | (60,263 | ) | |||||||

| Nine Months Ended September 30, 2023 | ||||||||||||||||||||

| Common Stock | ||||||||||||||||||||

| Number of Shares Issued and Outstanding |

Par Value | Additional Paid- in Capital |

Accumulated Deficit | Accumulated Other Comprehensive Loss |

Total | |||||||||||||||

| Balances as of December 31, 2022 | 1,463,300 | $ | 1 | $ | 153,298 | $ | (194,242 | ) | $ | (67 | ) | $ | (41,010 | ) | ||||||

| Shares issued for services | 34,400 | 1 | 526 | – | – | 527 | ||||||||||||||

| Shares issued for settlement of debt | 1,238,509 | 1 | 18,576 | – | – | $ | 18,577 | |||||||||||||

| Foreign currency translation adjustment | – | – | – | – | (6 | ) | (6 | ) | ||||||||||||

| Net loss | – | – | – | (44,042 | ) | – | (44,042 | ) | ||||||||||||

| Balances as of September 30, 2023 | 2,736,209 | $ | 3 | $ | 172,400 | $ | (238,284 | ) | $ | (73 | ) | $ | (65,954 | ) | ||||||

* Reflects a one-for-three hundred seventy-five (1:375) reverse stock split of the outstanding shares of the Company’s common stock effected on October 18, 2024

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| (In thousands) | Nine Months Ended September 30, | ||||||

| 2024 | 2023 | ||||||

| Cash Flows – Operating Activities: | |||||||

| Net Loss | $ | (18,624 | ) | $ | (44,042 | ) | |

| Adjustments to reconcile net loss to net cash used by operating activities | |||||||

| Depreciation and amortization | 736 | 780 | |||||

| Bad debt expense | 16 | 547 | |||||

| Shares issued for services | – | 224 | |||||

| Gain on extinguishment of debt | (5,205 | ) | – | ||||

| Change in fair value of derivative liabilities | 17,633 | 29,943 | |||||

| Amortization of debt issuance costs and original issue discount | 4,792 | 5,656 | |||||

| Accrued interest | 2,749 | 5,529 | |||||

| Changes in operating assets and liabilities | |||||||

| Accounts receivable | 66 | 253 | |||||

| Inventory | (480 | ) | (844 | ) | |||

| Prepaid expenses and other assets | 225 | (487 | ) | ||||

| Accounts payable | (1,013 | ) | 464 | ||||

| Accrued expenses | 763 | (1,326 | ) | ||||

| Contract liabilities | 56 | 50 | |||||

| Net Cash Provided by (Used in) Operating Activities | 1,714 | (3,253 | ) | ||||

| Cash Flows – Investing Activities | |||||||

| Proceeds from sale of property and equipment | – | 13 | |||||

| Purchase of property and equipment | (254 | ) | (169 | ) | |||

| Net Cash Flows Used in Investing Activities | (254 | ) | (156 | ) | |||

| Cash Flows – Financing Activities | |||||||

| Proceeds from convertible promissory notes | – | 1,202 | |||||

| Payment of note payable | (2,175 | ) | – | ||||

| Proceeds from convertible notes payable | 1,300 | – | |||||

| Proceeds from promissory note payable, related party | 500 | – | |||||

| Proceeds from bridge notes advance | – | 2,994 | |||||

| Proceeds (Payments) from factoring, net | 449 | (710 | ) | ||||

| Payments of principal on finance leases | (193 | ) | (130 | ) | |||

| Net Cash Flow (Used in) Provided by Financing Activities | (119 | ) | 3,356 | ||||

| Effect of Exchange Rates on Cash | 121 | (5 | ) | ||||

| Net Change in Cash During Period | 1,462 | (58 | ) | ||||

| Cash at Beginning of Period | 1,797 | 1,153 | |||||

| Cash at End of Period | $ | 3,259 | $ | 1,095 | |||

| Supplemental Information: | |||||||

| Cash paid for interest | $ | 3,189 | $ | 984 | |||

| Non-cash Investing and Financing Activities: | |||||||

| Shares issued for settlement of debt | 1,412 | – | |||||

| Write off deferred merger costs | 1,226 | – | |||||

| Warrants issued in conjunction with convertible promissory notes | 3,633 | 570 | |||||

| Conversion of convertible notes payable to common stock | – | 18,577 | |||||

| Capitalize default interest into senior secured debt | 3,850 | – | |||||

| Conversion of asset-based secured promissory notes to convertible promissory notes | 4,584 | – | |||||

| Embedded conversion feature on convertible promissory notes payable | – | (520 | ) | ||||

| Common shares issued for advisory shares | – | 302 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toyota And Honda's Profits Drop Due To Challenges In China

On Wednesday, Toyota Motor Corporation TM issued its fiscal second quarter results, posting a weaker-than-expected profit due to production halts and macroeconomic events. Its smaller domestic rival, Honda Motor Co. Ltd. HMC reported a surprising decrease in operating profit that was dragged down by a significant sales drop in China.

Honda’s disappointing Q2 results reflect significant hit from unfavorable market conditions in China.

Honda reported that fiscal second quarter net profit contracted by 20% 494.68 billion yen, equivalent to $3.26 billion with operating profit dropping 15% to 257.9 billion yen.

For the fiscal year that will March 2025, Honda now expects an even bigger net profit drop, increasing its prior guidance of a 9.7% fall to a 14% drop. While it previously expected to sell 3.9 million units during the fiscal year, it now lowered its guidance to 3.8 million as first-half group car sales dropped 8% to 1.78 million. During the six months that ended on September 30th, revenue still grew 12% so despite falling short of estimates, Honda remains optimistic.

Toyota’s Fiscal Q2 Highlights

For the quarter that ended on September 30th, Toyota reported its operating income tumbled 20% to 1.16 trillion yen which amounts to $7.81 billion, coming short of Bloomberg’s estimate of 1.25 trillion yen. This was Toyota’s first profit decline in two years and it is owed to weaker sales in its main market, North America.

The world’s largest automaker by sales volume reported revenue of 11.44 trillion yen, topping LSEG’s consensus estimate of 11.41 trillion yen while net profit attributable to company more than halved compared to last year’s comparable quarter to 573.7 billion yen. Sales volume slipped to 2.3 million from 2023’s comparable quarter when it amounted to 2.42 million units.

One should note that sales were up against 2023’s record as Toyota benefited from pivoting towards hybrids over all-electric vehicles. Hybrid sales fell 35% YoY over the past six months, but Toyota still sold an impressive figure of 1.8 million units.

Toyota’s Trimmed Guidance

Toyota lowered its prior sales forecast of 10.95 million units to 10.85 million. However, it reaffirmed its annual sales revenue guidance of 46.00 trillion yen and a net income of 3.57 trillion yen.

Overall, Toyota posted stable sales in a challenging macroenvironment. Despite surface-level weakness in unit sales and profitability, Toyota’s latest report shows a relatively stable performance.

Historically, Toyota has a good track record when it comes to growth, but the EV era that is in the making brought its fair share of challenges which will undoubtedly continue to test Toyota’s strength.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lamar Advertising Company Announces Third Quarter Ended September 30, 2024 Operating Results

Three Month Results

• Net revenues was $564.1 million

• Net income was $147.8 million

• Adjusted EBITDA was $271.2 million

Nine Month Results

• Net revenues was $1.63 billion

• Net income was $363.9 million

• Adjusted EBITDA was $754.6 million

BATON ROUGE, La., Nov. 08, 2024 (GLOBE NEWSWIRE) — Lamar Advertising Company (the “Company” or “Lamar”) LAMR, a leading owner and operator of outdoor advertising and logo sign displays, announces the Company’s operating results for the third quarter ended September 30, 2024.

“Our third quarter results came in largely as expected, with particular strength in local and programmatic sales. Expenses were slightly elevated but as we move through Q4, we see that correcting and see full year consolidated EBITDA margins coming in right around 47%,” chief executive Sean Reilly said. “In addition, Q4 revenue growth is pacing ahead of Q3. Consequently, we are raising full year guidance for diluted AFFO to a range of $7.85 to $7.95 per share.”

Third Quarter Highlights

• Net revenues increased 4.0%

• Net income increased 5.3%

• Adjusted EBITDA increased 2.1%

• AFFO increased 5.7%

Third Quarter Results

Lamar reported net revenues of $564.1 million for the third quarter of 2024 versus $542.6 million for the third quarter of 2023, a 4.0% increase. Operating income for the third quarter of 2024 decreased $1.6 million to $186.6 million as compared to $188.1 million for the same period in 2023. Lamar recognized net income of $147.8 million for the third quarter of 2024 as compared to net income of $140.4 million for the same period in 2023, an increase of $7.4 million. Net income per diluted share was $1.44 and $1.37 for the three months ended September 30, 2024 and 2023, respectively.

Adjusted EBITDA for the third quarter of 2024 was $271.2 million versus $265.7 million for the third quarter of 2023, an increase of 2.1%.

Cash flow provided by operating activities was $227.4 million for the three months ended September 30, 2024 versus $222.5 million for the third quarter of 2023, an increase of $4.8 million. Free cash flow for the third quarter of 2024 was $198.1 million as compared to $181.0 million for the same period in 2023, a 9.4% increase.

For the third quarter of 2024, funds from operations, or FFO, was $214.0 million versus $210.0 million for the same period in 2023, an increase of 1.9%. Adjusted funds from operations, or AFFO, for the third quarter of 2024 was $220.7 million compared to $208.8 million for the same period in 2023, an increase of 5.7%. Diluted AFFO per share increased 5.4% to $2.15 for the three months ended September 30, 2024 as compared to $2.04 for the same period in 2023.

Acquisition-Adjusted Three Months Results

Acquisition-adjusted net revenue for the third quarter of 2024 increased 3.6% over acquisition-adjusted net revenue for the third quarter of 2023. Acquisition-adjusted EBITDA for the third quarter of 2024 increased 1.8% as compared to acquisition-adjusted EBITDA for the third quarter of 2023. Acquisition-adjusted net revenue and acquisition-adjusted EBITDA include adjustments to the 2023 period for acquisitions and divestitures for the same time frame as actually owned in the 2024 period. See “Reconciliation of Reported Basis to Acquisition-Adjusted Results”, which provides reconciliations to GAAP for acquisition-adjusted measures.

Nine Month Results

Lamar reported net revenues of $1.63 billion for the nine months ended September 30, 2024 versus $1.56 billion for the nine months ended September 30, 2023, a 4.7% increase. Operating income for the nine months ended September 30, 2024 increased $11.7 million to $495.4 million as compared to $483.7 million for the same period in 2023. Lamar recognized net income of $363.9 million for the nine months ended September 30, 2024 as compared to net income of $347.5 million for the same period in 2023, an increase of $16.4 million. Net income per diluted share was $3.54 and $3.39 for the nine months ended September 30, 2024 and 2023, respectively.

Adjusted EBITDA for the nine months ended September 30, 2024 was $754.6 million versus $717.6 million for the same period in 2023, an increase of 5.2%.

Cash flow provided by operating activities was $594.3 million for the nine months ended September 30, 2024, an increase of $64.9 million as compared to the same period in 2023. Free cash flow for the nine months ended September 30, 2024 was $540.3 million as compared to $453.5 million for the same period in 2023, a 19.1% increase.

For the nine months ended September 30, 2024, funds from operations, or FFO, was $571.7 million versus $554.2 million for the same period in 2023, an increase of 3.2%. Adjusted funds from operations, or AFFO, for the nine months ended September 30, 2024 was $592.5 million compared to $547.3 million for the same period in 2023, an increase of 8.3%. Diluted AFFO per share increased 7.8% to $5.78 for the nine months ended September 30, 2024 as compared to $5.36 for the same period in 2023.

Liquidity

As of September 30, 2024, Lamar had $450.7 million in total liquidity that consisted of $421.2 million available for borrowing under its revolving senior credit facility and $29.5 million in cash and cash equivalents. There were $320.0 million in borrowings outstanding under the Company’s revolving credit facility and $249.8 million outstanding under the Accounts Receivable Securitization Program as of the same date.

Recent Developments

On October 15, 2024, the Company amended its Accounts Receivable Securitization Program to extend the Program’s maturity date from July 21, 2025 to October 15, 2027, with a springing maturity date under certain conditions. All other significant terms and conditions were unchanged.

Revised Guidance

We are updating our 2024 guidance issued in May 2024. We now expect net income per diluted share for fiscal year 2024 to be between $4.97 and $4.99, with diluted AFFO per share between $7.85 and $7.95. See “Supplemental Schedules Unaudited REIT Measures and Reconciliations to GAAP Measures” for reconciliation to GAAP.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding sales trends. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected in these forward-looking statements. These risks and uncertainties include, among others: (1) our significant indebtedness; (2) the state of the economy and financial markets generally, and the effect of the broader economy on the demand for advertising; (3) the continued popularity of outdoor advertising as an advertising medium; (4) our need for and ability to obtain additional funding for operations, debt refinancing or acquisitions; (5) our ability to continue to qualify as a Real Estate Investment Trust (“REIT”) and maintain our status as a REIT; (6) the regulation of the outdoor advertising industry by federal, state and local governments; (7) the integration of companies and assets that we acquire and our ability to recognize cost savings or operating efficiencies as a result of these acquisitions; (8) changes in accounting principles, policies or guidelines; (9) changes in tax laws applicable to REITs or in the interpretation of those laws; (10) our ability to renew expiring contracts at favorable rates; (11) our ability to successfully implement our digital deployment strategy; and (12) the market for our Class A common stock. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023, as supplemented by any risk factors contained in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. We caution investors not to place undue reliance on the forward-looking statements contained in this document. These statements speak only as of the date of this document, and we undertake no obligation to update or revise the statements, except as may be required by law.

Use of Non-GAAP Financial Measures

The Company has presented the following measures that are not measures of performance under accounting principles generally accepted in the United States of America (“GAAP”): adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), free cash flow, funds from operations (“FFO”), adjusted funds from operations (“AFFO”), diluted AFFO per share, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense. Our management reviews our performance by focusing on these key performance indicators not prepared in conformity with GAAP. We believe these non-GAAP performance indicators are meaningful supplemental measures of our operating performance and should not be considered in isolation of, or as a substitute for their most directly comparable GAAP financial measures.

Our Non-GAAP financial measures are determined as follows:

- We define adjusted EBITDA as net income before income tax expense (benefit), interest expense (income), loss (gain) on extinguishment of debt and investments, equity in (earnings) loss of investee, stock-based compensation, depreciation and amortization, loss (gain) on disposition of assets and investments, transaction expenses and investments and capitalized contract fulfillment costs, net.

- Adjusted EBITDA margin is defined as adjusted EBITDA divided by net revenues.

- Free cash flow is defined as adjusted EBITDA less interest, net of interest income and amortization of deferred financing costs, current taxes, preferred stock dividends and total capital expenditures.

- We use the National Association of Real Estate Investment Trusts definition of FFO, which is defined as net income before (gain) loss from the sale or disposal of real estate assets and investments, net of tax, and real estate related depreciation and amortization and including adjustments to eliminate unconsolidated affiliates and non-controlling interest.

- We define AFFO as FFO before (i) straight-line income and expense; (ii) capitalized contract fulfillment costs, net; (iii) stock-based compensation expense; (iv) non-cash portion of tax expense (benefit); (v) non-real estate related depreciation and amortization; (vi) amortization of deferred financing costs; (vii) loss on extinguishment of debt; (viii) transaction expenses; (ix) non-recurring infrequent or unusual losses (gains); (x) less maintenance capital expenditures; and (xi) an adjustment for unconsolidated affiliates and non-controlling interest.

- Diluted AFFO per share is defined as AFFO divided by weighted average diluted common shares outstanding.

- Outdoor operating income is defined as operating income before corporate expenses, stock-based compensation, capitalized contract fulfillment costs, net, transaction expenses, depreciation and amortization and loss (gain) on disposition of assets.

- Acquisition-adjusted results adjusts our net revenue, direct and general and administrative expenses, outdoor operating income, corporate expense and EBITDA for the prior period by adding to, or subtracting from, the corresponding revenue or expense generated by the acquired or divested assets before our acquisition or divestiture of these assets for the same time frame that those assets were owned in the current period. In calculating acquisition-adjusted results, therefore, we include revenue and expenses generated by assets that we did not own in the prior period but acquired in the current period. We refer to the amount of pre-acquisition revenue and expense generated by or subtracted from the acquired assets during the prior period that corresponds with the current period in which we owned the assets (to the extent within the period to which this report relates) as “acquisition-adjusted results”.

- Acquisition-adjusted consolidated expense adjusts our total operating expense to remove the impact of stock-based compensation, depreciation and amortization, transaction expenses, capitalized contract fulfillment costs, net, and loss (gain) on disposition of assets and investments. The prior period is also adjusted to include the expense generated by the acquired or divested assets before our acquisition or divestiture of such assets for the same time frame that those assets were owned in the current period.

Adjusted EBITDA, FFO, AFFO, diluted AFFO per share, free cash flow, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense are not intended to replace other performance measures determined in accordance with GAAP. Free cash flow, FFO and AFFO do not represent cash flows from operating activities in accordance with GAAP and, therefore, these measures should not be considered indicative of cash flows from operating activities as a measure of liquidity or of funds available to fund our cash needs, including our ability to make cash distributions. Adjusted EBITDA, free cash flow, FFO, AFFO, diluted AFFO per share, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense are presented as we believe each is a useful indicator of our current operating performance. Specifically, we believe that these metrics are useful to an investor in evaluating our operating performance because (1) each is a key measure used by our management team for purposes of decision making and for evaluating our core operating results; (2) adjusted EBITDA is widely used in the industry to measure operating performance as it excludes the impact of depreciation and amortization, which may vary significantly among companies, depending upon accounting methods and useful lives, particularly where acquisitions and non-operating factors are involved; (3) adjusted EBITDA, FFO, AFFO, diluted AFFO per share and acquisition-adjusted consolidated expense each provides investors with a meaningful measure for evaluating our period-over-period operating performance by eliminating items that are not operational in nature and reflect the impact on operations from trends in occupancy rates, operating costs, general and administrative expenses and interest costs; (4) acquisition-adjusted results is a supplement to enable investors to compare period-over-period results on a more consistent basis without the effects of acquisitions and divestitures, which reflects our core performance and organic growth (if any) during the period in which the assets were owned and managed by us; (5) free cash flow is an indicator of our ability to service debt and generate cash for acquisitions and other strategic investments; (6) outdoor operating income provides investors a measurement of our core results without the impact of fluctuations in stock-based compensation, depreciation and amortization and corporate expenses; and (7) each of our Non-GAAP measures provides investors with a measure for comparing our results of operations to those of other companies.

Our measurement of adjusted EBITDA, FFO, AFFO, diluted AFFO per share, free cash flow, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense may not, however, be fully comparable to similarly titled measures used by other companies. Reconciliations of adjusted EBITDA, FFO, AFFO, diluted AFFO per share, free cash flow, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense to the most directly comparable GAAP measures have been included herein.

Conference Call Information

A conference call will be held to discuss the Company’s operating results on Friday, November 8, 2024 at 8:00 a.m. central time. Instructions for the conference call and Webcast are provided below:

Conference Call

General Information

Founded in 1902, Lamar Advertising LAMR is one of the largest outdoor advertising companies in North America, with over 360,000 displays across the United States and Canada. Lamar offers advertisers a variety of billboard, interstate logo, transit and airport advertising formats, helping both local businesses and national brands reach broad audiences every day. In addition to its more traditional out-of-home inventory, Lamar is proud to offer its customers the largest network of digital billboards in the United States with over 4,800 displays.

| LAMAR ADVERTISING COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA) |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net revenues | $ | 564,135 | $ | 542,609 | $ | 1,627,536 | $ | 1,555,078 | |||||||

| Operating expenses (income) | |||||||||||||||

| Direct advertising expenses | 182,717 | 175,305 | 542,001 | 515,606 | |||||||||||

| General and administrative expenses | 86,111 | 79,201 | 253,540 | 248,392 | |||||||||||

| Corporate expenses | 24,148 | 22,414 | 77,360 | 73,520 | |||||||||||

| Stock-based compensation | 12,097 | 3,916 | 37,713 | 16,362 | |||||||||||

| Capitalized contract fulfillment costs, net | (132 | ) | (117 | ) | (506 | ) | (203 | ) | |||||||

| Depreciation and amortization | 75,112 | 74,636 | 227,531 | 222,919 | |||||||||||

| Gain on disposition of assets | (2,474 | ) | (879 | ) | (5,486 | ) | (5,243 | ) | |||||||

| Total operating expense | 377,579 | 354,476 | 1,132,153 | 1,071,353 | |||||||||||

| Operating income | 186,556 | 188,133 | 495,383 | 483,725 | |||||||||||

| Other expense (income) | |||||||||||||||

| Loss on extinguishment of debt | 270 | 115 | 270 | 115 | |||||||||||

| Interest income | (662 | ) | (621 | ) | (1,701 | ) | (1,559 | ) | |||||||

| Interest expense | 42,937 | 45,070 | 131,761 | 130,163 | |||||||||||

| Equity in earnings of investee | (2,642 | ) | (699 | ) | (2,087 | ) | (1,326 | ) | |||||||

| 39,903 | 43,865 | 128,243 | 127,393 | ||||||||||||

| Income before income tax (benefit) expense | 146,653 | 144,268 | 367,140 | 356,332 | |||||||||||

| Income tax (benefit) expense | (1,169 | ) | 3,843 | 3,225 | 8,821 | ||||||||||

| Net income | 147,822 | 140,425 | 363,915 | 347,511 | |||||||||||

| Net income attributable to non-controlling interest | 346 | 408 | 849 | 833 | |||||||||||

| Net income attributable to controlling interest | 147,476 | 140,017 | 363,066 | 346,678 | |||||||||||

| Preferred stock dividends | 91 | 91 | 273 | 273 | |||||||||||

| Net income applicable to common stock | $ | 147,385 | $ | 139,926 | $ | 362,793 | $ | 346,405 | |||||||

| Earnings per share: | |||||||||||||||

| Basic earnings per share | $ | 1.44 | $ | 1.37 | $ | 3.55 | $ | 3.40 | |||||||

| Diluted earnings per share | $ | 1.44 | $ | 1.37 | $ | 3.54 | $ | 3.39 | |||||||

| Weighted average common shares outstanding: | |||||||||||||||

| Basic | 102,307,059 | 101,960,356 | 102,223,918 | 101,890,573 | |||||||||||

| Diluted | 102,617,515 | 102,130,614 | 102,547,490 | 102,085,016 | |||||||||||

| OTHER DATA | |||||||||||||||

| Free Cash Flow Computation: | |||||||||||||||

| Adjusted EBITDA | $ | 271,159 | $ | 265,689 | $ | 754,635 | $ | 717,560 | |||||||

| Interest, net | (40,716 | ) | (42,823 | ) | (125,230 | ) | (123,684 | ) | |||||||

| Current tax expense | (2,124 | ) | (2,588 | ) | (6,582 | ) | (7,911 | ) | |||||||

| Preferred stock dividends | (91 | ) | (91 | ) | (273 | ) | (273 | ) | |||||||

| Total capital expenditures | (30,140 | ) | (39,145 | ) | (82,270 | ) | (132,152 | ) | |||||||

| Free cash flow | $ | 198,088 | $ | 181,042 | $ | 540,280 | $ | 453,540 | |||||||

| SUPPLEMENTAL SCHEDULES SELECTED BALANCE SHEET AND CASH FLOW DATA (IN THOUSANDS) |

|||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| (Unaudited) | |||||||

| Selected Balance Sheet Data: | |||||||

| Cash and cash equivalents | $ | 29,510 | $ | 44,605 | |||

| Working capital deficit | $ | (326,410 | ) | $ | (340,711 | ) | |

| Total assets | $ | 6,520,068 | $ | 6,563,622 | |||

| Total debt, net of deferred financing costs (including current maturities) | $ | 3,245,706 | $ | 3,341,127 | |||

| Total stockholders’ equity | $ | 1,212,945 | $ | 1,216,788 | |||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (Unaudited) | |||||||||||

| Selected Cash Flow Data: | |||||||||||

| Cash flows provided by operating activities | $ | 227,393 | $ | 222,546 | $ | 594,297 | $ | 529,420 | |||

| Cash flows used in investing activities | $ | 31,385 | $ | 115,916 | $ | 108,046 | $ | 245,925 | |||