Rahul D Samant Takes Money Off The Table, Sells $585K In Delta Air Lines Stock

Disclosed on October 31, Rahul D Samant, EVP & Chief Info Officer at Delta Air Lines DAL, executed a substantial insider sell as per the latest SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Thursday outlined that Samant executed a sale of 10,000 shares of Delta Air Lines with a total value of $585,330.

Delta Air Lines‘s shares are actively trading at $58.49, experiencing a up of 0.05% during Friday’s morning session.

About Delta Air Lines

Atlanta-based Delta Air Lines is one of the world’s largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned most of its international revenue and profits from flying passengers over the Atlantic Ocean.

Delta Air Lines: A Financial Overview

Revenue Growth: Delta Air Lines’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 1.22%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Key Profitability Indicators:

-

Gross Margin: The company excels with a remarkable gross margin of 24.41%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Delta Air Lines’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.98.

Debt Management: Delta Air Lines’s debt-to-equity ratio is below the industry average at 1.79, reflecting a lower dependency on debt financing and a more conservative financial approach.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 7.94 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.61 is lower than the industry average, implying a discounted valuation for Delta Air Lines’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 8.81, Delta Air Lines could be considered undervalued.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Delta Air Lines’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Selling: HEIDI MILLER Unloads $6.03M Of Fiserv Stock

Disclosed on October 31, HEIDI MILLER, Board Member at Fiserv FI, executed a substantial insider sell as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that MILLER sold 30,000 shares of Fiserv. The total transaction amounted to $6,033,842.

During Friday’s morning session, Fiserv shares down by 0.0%, currently priced at $199.81.

About Fiserv

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for us banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company’s revenue is generated internationally.

Fiserv: Financial Performance Dissected

Positive Revenue Trend: Examining Fiserv’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.02% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Holistic Profitability Examination:

-

Gross Margin: The company excels with a remarkable gross margin of 61.51%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Fiserv exhibits below-average bottom-line performance with a current EPS of 0.98.

Debt Management: Fiserv’s debt-to-equity ratio is below the industry average. With a ratio of 0.92, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 38.2 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 5.8 is above industry norms, reflecting an elevated valuation for Fiserv’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 15.75, Fiserv demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Fiserv’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Andy Jassy Touts 'Deep Partnership' With Nvidia, But Amazon Is Doubling Down On In-House Custom Silicon For Price-Conscious Customers

During the third-quarter earnings call, Amazon.com, Inc. AMZN CEO Andy Jassy underscored the company’s dedication to its in-house silicon development, despite acknowledging a “deep partnership” with Nvidia Corporation NVDA.

What Happened: On Thursday, Jassy acknowledged that while Amazon has a strong partnership with Nvidia for GPUs, customers have expressed a need for better price performance for their AI workloads, especially as they scale up.

“While we have a deep partnership with Nvidia, we’ve also heard from customers that they want better price performance on their AI workloads,” he said during his opening comments.

This has led Amazon to invest in its own custom silicon: Trainium for training and Inferentia for inference.

“The second version of Trainium, Trainium2 is starting to ramp up in the next few weeks and will be very compelling for customers on price performance,” he stated.

See Also: OpenAI Rolls Out ChatGPT Search, Google Shares Slide

The Amazon CEO also highlighted that Amazon Web Services experienced a 19.1% year-over-year growth, reaching an annualized run rate of $110 billion.

He cited customer deals with ANZ Banking Group, Booking.com, Capital One, Fast Retailing, Itaú Unibanco, National Australia Bank, Sony, T-Mobile, and Toyota as evidence of AWS’s continued success.

“You can look at our partnership with Nvidia called Project Ceiba, where NVIDIA has chosen AWS’s infrastructure for its R&D supercomputer due in part to AWS’s leading operational performance and security,” Jassy said.

Later while responding to a question, Jassy noted AWS’s strong partnership with Nvidia saying, “We tend to be their lead partner on most of their new chips.”

He added, “We were the first to offer H200s in EC2 instances. And I expect us to have a partnership for a very long time that matters.”

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Last month, Amazon inked a five-year deal with data and AI startup Databricks, which centered around Amazon’s Trainium AI chips, offering a less expensive alternative to Nvidia Corp’s popular GPUs.

Meanwhile, Amazon announced third-quarter net sales of $158.9 billion, reflecting an 11% increase compared to the previous year. This total surpassed the consensus estimate of $157.2 billion from analysts, according to data from Benzinga Pro.

The company reported third-quarter earnings per share of $1.43, exceeding the Street consensus estimate of $1.14.

Price Action: At the time of writing, Amazon shares surged 6.07% to $197.50 in after-hours trading, recovering from a 3.39% drop to $186.19 during the regular trading session.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HILCO REAL ESTATE SALES CLOSES $27M BANKRUPTCY SALE OF TWENTYFOUR25 GALLERIA OFFICE IN HOUSTON, TEXAS

NORTHBROOK, Ill., Nov. 1 2024 /PRNewswire/ — Through a contentious bankruptcy process, Hilco Real Estate Sales (HRE) proudly announces the successful sale of an 11-story, 285,000± SF Class A office building for $27 million. HRE was engaged by Galleria 2425 Trustee, Jones Murray LLP, to manage the Chapter 11 Bankruptcy sale of this property located at 2425 West Loop South in Houston, Texas.

The HRE team served as advisors, establishing a comprehensive marketing and sale process that effectively maximized interest in the asset. During a focused one-month marketing period, HRE targeted the Southwest region and the local Houston area, generating nearly 31,000 views across its listing platforms. After a competitive virtual auction, the sale resulted in two offers with the final price significantly exceeding the court approved minimum bid by $7.25 million.

Ben Zaslav, director of business development at Hilco Real Estate Sales, stated, “Our team’s deep understanding of the bankruptcy process and the nuances of real estate sales allow us to help clients achieve the best possible outcomes. By providing targeted, actionable solutions and driving speed-to-value, we consistently help our bankruptcy clients maximize the value of their commercial real estate assets. This is what sets HRE apart in a competitive market.”

Steve Madura, senior vice president at Hilco Real Estate Sales, added, “Executing a successful sale within a tight 30-day window required rapid and strategic marketing efforts, along with efficient management of inquiries, showings and negotiations. This urgency often necessitates compromises, but in this case, we were able to maximize the property’s value while closing the deal quickly.”

The sale was completed within 30 days following the sale confirmation hearing, showcasing HRE’s ability to deliver exceptional results under tight deadlines.

For more information about this transaction or to inquire about other opportunities, please visit our website HilcoRealEstateSales.com or call (855) 755-2300.

About Hilco Real Estate Sales

Successfully positioning the real estate holdings within a company’s portfolio is a material component of establishing and maintaining a strong financial foundation for long-term success. At Hilco Real Estate Sales (HRE), a Hilco Global company (HilcoGlobal.com), we advise and execute strategies to assist clients seeking to optimize their real estate assets, improve cash flow, maximize asset value and minimize liabilities and portfolio risk. We help clients traverse complex transactions and transitions, coordinating with internal and external networks and constituents to navigate ever-challenging market environments.

The trusted, full-service HRE team has secured billions in value for hundreds of clients over 20+ years. We are deeply experienced in complex transactions including artful lease renegotiation, multi-faceted sales structures, strategic asset management and capital optimization. We understand the legal, financial, and real estate components of the process, all of which are vital to a successful outcome. HRE can help identify the most viable options and direction for a company and its real estate portfolio, delivering impressive results in every situation.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hilco-real-estate-sales-closes-27m-bankruptcy-sale-of-twentyfour25-galleria-office-in-houston-texas-302291303.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hilco-real-estate-sales-closes-27m-bankruptcy-sale-of-twentyfour25-galleria-office-in-houston-texas-302291303.html

SOURCE Hilco Real Estate

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

REX KENNETH QUERY Takes Money Off The Table, Sells $1.32M In Nucor Stock

Revealing a significant insider sell on October 31, REX KENNETH QUERY, Executive Vice President at Nucor NUE, as per the latest SEC filing.

What Happened: QUERY’s decision to sell 9,000 shares of Nucor was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $1,321,159.

During Friday’s morning session, Nucor shares up by 0.41%, currently priced at $143.28.

Unveiling the Story Behind Nucor

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are: steel mills, steel products, and raw materials, the steel mills segment derives maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural and plate; steel trading businesses; rebar distribution businesses; and Nucor’s equity method investments in NuMit and NJSM.

Financial Milestones: Nucor’s Journey

Revenue Challenges: Nucor’s revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -7.84%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 10.18%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Nucor’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.05.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.34.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 13.65 is lower than the industry average, implying a discounted valuation for Nucor’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 1.09, Nucor’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Nucor’s EV/EBITDA ratio, lower than industry averages at 6.84, indicates attractively priced shares.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Understanding Crucial Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Nucor’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Metal Organic Frameworks Market Estimated to Reach $22.1 billion by 2030 Globally, at a CAGR of 22.1%, says MarketsandMarkets™

Delray Beach, FL, Nov. 01, 2024 (GLOBE NEWSWIRE) — The Metal Organic Frameworks Market is projected to grow from USD 0.51 billion in 2024 to USD 1.70 billion by 2030, at a CAGR of 22.1% during the forecast period, as per the recent study by MarketsandMarkets. The growth of metal organic frameworks is driven by several factors. Rising demand for efficient gas storage solutions and increasing shift towards clean energy is driving the adoption of metal organic frameworks in several industries. Metal organic frameworks finds its uses in gas adsorption, gas separation, sensing & detection, catalysis, and water harvesting applications due to its unique properties such as high porosity, larger surface area, structural diversity, and tunable pore size. Emergence of artificial intelligence and machine learning for identifying and selecting perfect metal organic frameworks for various applications is likely to boost the demand for metal organic frameworks market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=67821376

Browse in-depth TOC on “Metal Organic Frameworks Market”

196 – Market Data Tables

51 – Figures

215 – Pages

List of Key Players in Metal Organic Frameworks Market:

- Nanorh (US)

- Framergy, Inc. (US)

- novoMOF (Switzerland)

- BASF SE (Germany)

- Numat Technologies, Inc. (US)

- MOFapps (Norway)

- Nuada (UK)

- ProfMOF (Norway)

- ACSYNAM (Canada)

- Promethean Particles Ltd. (UK), ACMOFS (China), GS Alliance Co., Ltd. (Japan), Physical Sciences Inc. (US), Majd Onsor Fartak (Iran), SyncMOF Inc. (Japan), Immaterial Ltd. (UK), Atomis Inc. (Japan), CD Bioparticles (US), Nanowiz Tech (India), Kerone Engineering Solutions Ltd. (India), Nanoshel LLC (US), Jiangsu Xianfeng Nanomaterial Technology Co., Ltd. (China), Decarbontek, Inc. (US), Svante Technologies Inc. (Canada), Nanochemazone (India)

Drivers, Restraints, Opportunities and Challenges in Metal Organic Frameworks Market:

- Driver: Growing demand for metal organic frameworks to curb down carbon emissions

- Restraint: High cost of metal organic frameworks

- Opportunity: Growing investments in green hydrogen projects to boost the market

- Challenge: Toxicity concerns in metal organic frameworks

Key Findings of the Study:

- Copper-based metal organic frameworks accounted for the largest market share, both in terms of value and volume.

- Mechanochemical synthesis method accounted for the second largest market share, both in terms of value and volume

- Gas storage application segment is estimated to account for the highest market share in 2023, in metal organic frameworks market.

- Europe to hold the largest market share during the forecast period.

Get Sample Pages: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=67821376

Based on type, Zinc-based segment is expected to have the second largest share of the metal organic frameworks market in 2023 by value. Zinc-based metal organic frameworks are majorly used in biomedical applications including drug delivery due to their versatility, lower toxicity, and being easily biodegradable. Key factors driving their use for gas adsorption and gas storage applications is due to their improved storage and control over reaction ability between gas molecules and components. Additionally, copper-based metal organic frameworks hold the largest share in the metal organic frameworks market due to their growing demand for gas adsorption, gas storage, catalysis, and sensing & detection applications.

Based on synthesis method, Mechanochemical segment is expected to have the second largest share of the metal organic frameworks market in 2023 by value. The mechanochemical synthesis method is widely used for the preparation of metal organic frameworks due to its shorter reaction time, cost effectiveness and environmentally friendly synthesis. It offers several advantages, including higher yields, product purity, and availability of reactants and products that are difficult to encounter in conventional solution-based synthesis. Metal organic frameworks prepared by mechanosynthesis are used for gas separation and carbon capture applications.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=67821376

Based on application, the metal organic frameworks market has been segmented into gas and liquid adsorption/separation, water harvesting, gas storage, sensing & detection, catalysis, and other applications. Metal organic frameworks is widely used for gas and liquid adsorption/separation application due to its larger surface area, highly porous structure, and high selectivity. Gas and liquid adsorption/separation holds the second largest share of the metal organic frameworks market in 2023 by value.

Based on Region, North America was the third largest market for the metal organic frameworks in 2023, with US being the largest market in the region. The North American metal organic frameworks market is experiencing significant growth and presents various opportunities for industry players. This growth is fuelled by the increasing demand for efficient gas storage solutions. Strong research and development initiatives and growing focus towards clean energy solutions is driving the demand for metal organic frameworks in this region.

Browse Adjacent Markets: Mining, Minerals and Metals Market Research Reports & Consulting

Related Reports:

- Wire & Cable Market – Global Forecast to 2029

- Ammonium Sulfate Market – Global Forecast to 2029

- Thermo Compression Forming Market – Global Forecast to 2029

- Tire Recycling Market – Global Forecast to 2029

- Ammonia Market – Global Forecast to 2029

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Likely To Open Higher After 'Mag 7' Wrap Up Busy Week, Apple, Amazon And Intel On Radar: Investors Eye Monthly Jobs Report, Economist Says Earnings Won't Trump Bonds

Investors on Wall Street could see some respite after major indices registered a downbeat session on Thursday. Index futures point to a positive start on Friday, ahead of the crucial monthly report on jobs data.

Thursday was a busy day as far as tech earnings are concerned, with Apple Inc. AAPL, Meta Platforms Inc. META, Amazon.com Inc. AMZN, and Intel Corp. INTC reported their September quarter results.

While Meta and Microsoft both fell in after-market hours, Amazon surged after the company handily beat Street consensus. The company expects its fourth-quarter sales to surge between 7% to 11%.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.47% |

| S&P 500 | 0.39% |

| Dow Jones | 0.35% |

| R2K | 0.12% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY rose 0.43% to $571.07 and the Invesco QQQ ETF QQQ gained 0.51% to $486.33, according to Benzinga Pro data.

Cues From Last Session:

All three major indices registered a downbeat Thursday, with S&P 500 and Nasdaq Composite posting their biggest single-day fall since Sept. 3.

The overall investor sentiment declined, with the Greed index entering the “Fear” territory.

Most sectors on the S&P 500 closed on a negative note, with information technology, consumer discretionary, and real estate stocks recording the biggest losses on Thursday. However, utilities and energy stocks bucked the overall market trend, closing the session higher.

Crude oil prices edged up, mostly recovering their losses over the previous weekend due to Israel’s missile strikes on Iran.

Treasury yields continued to climb amid fears of higher deficits due to a possible re-election of former President Donald Trump.

Besides, the International Monetary Fund has also warned about the long-term trajectory of U.S. national debt

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -2.76% | 18,095.15 |

| S&P 500 | -1.86% | 5,705.45 |

| Dow Jones | -0.90% | 41,763.46 |

| Russell 2000 | -1.63% | 2,196.55 |

Insights From Analysts:

Ryan Detrick, Chief Market Strategist at Carson Group, highlighted that November is the “best month of the year” as far as equity markets are concerned.

“The last time it fell more than 1% was in 2008, and it has been higher 11 of the past 12 years. Not to be outdone, it is the best month since 1950, in the past decade, and in election years, while it ranks as the second-best month the past 20 years (only July is better).”

Detrick added that the bull market is here to stay. After experiencing a bull run for the past three years, the expert highlighted that “the potential for many more years of gains is actually quite high.”

WisdomTree and Wharton School economist Jeremy Siegel, too, thinks earnings will beat interest rates, but there’s something more important to consider.

He added that there could be increased anxiety in the markets until the election is over, after which there could be a bounce back.

However, Siegel added that he now anticipates only three 25-basis point rate cuts between now and June next year.

“Earnings will trump interest rates for stocks, but certainly for bonds, they are not good,” Siegel told CNBC in an interview.

On the economic data front, U.S. initial jobless claims declined by 12,000 from the previous week to 216,000 in the week ending Oct. 26.

The personal consumption expenditure price index rose 0.2% month-over-month in September following a 0.1% increase in August.

See Also: Best Futures Trading Software

Upcoming Economic Data:

- The monthly jobs report is scheduled to be released at 8 a.m. ET.

- S&P’s final U.S. manufacturing PMI will be released at 9:30 a.m. ET.

- Construction spending data will be released at 10 a.m. ET.

- Auto sales data is expected to be released during the day.

Stocks In Focus:

- Apple Inc. AAPL shares fell 1.2% in premarket even as the company posted record quarterly revenue on the back of a rebound in iPhone sales.

- Amazon.com Inc. AMZN will be on investors’ radar after the company reported better-than-expected results during the September quarter. The stock is up 6.8% in premarket trading.

- Intel Corp. INTC is up nearly 6% in premarket trading even after the company posted a record loss of $16.6 billion during the September quarter.

- Exxon Mobil Corp. XOM shares surged 1.3% in premarket trading after the company beat earnings per share (EPS) estimates, even though it posted a slight miss on revenue.

- Trump Media & Technology Group Corp. DJT shares continued to fall amid increased volatility, falling 3.3% in premarket trading. The stock fell 11.7% on Thursday.

- Investors are awaiting earnings results from Chevron Corp. CVX and Cardinal Health Inc. CAH today.

Commodities, Bonds And Global Equity Markets:

Crude oil futures gained in the early New York session, rising 2.08% as Iran prepares for another attack on Israel.

The benchmark 10-year Treasury note yield rose marginally to 4.289%.

Most Asian markets closed in the red on Friday, while European stocks were mostly higher in early trading.

Read Next:

Photo courtesy: Wikimedia

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

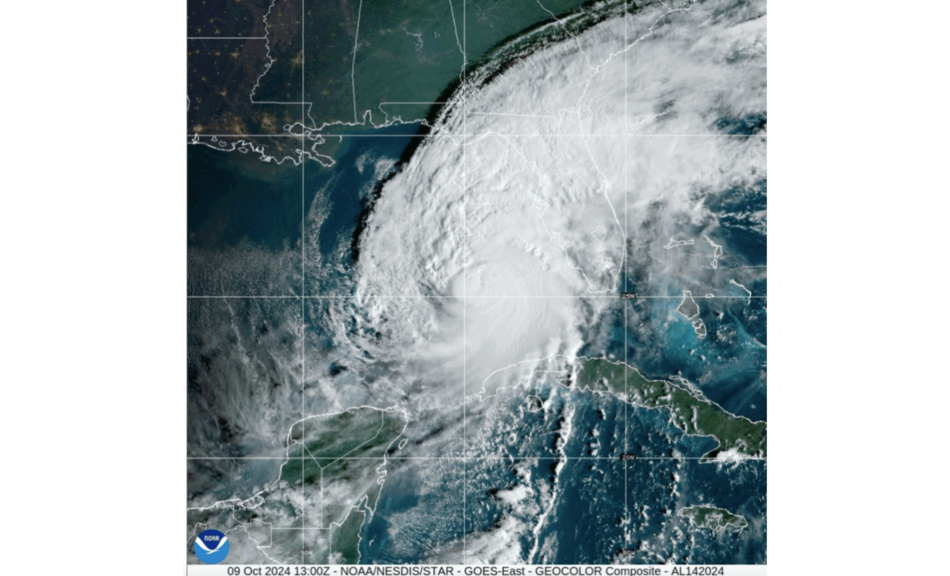

US Economy Adds Only 12,000 Jobs In October, Sharply Misses Estimates As Hurricanes, Strikes Pummel Hiring

The U.S. economy experienced almost no job growth in October as the pace of employment creation slowed to its lowest level since December 2020, according to the official jobs report released Friday.

This downturn likely reflects the impact of hurricane disruptions, strikes in manufacturing and election-related uncertainties, all of which affected hiring nationwide.

Total nonfarm payrolls grew by only 12,000 last month, a sharp decline from the average monthly gain of 194,000 over the previous year.

Despite the hiring freeze, the unemployment rate held steady at 4.1%, suggesting that businesses are retaining their existing workforce even as new job creation stalls.

October Employment Situation: Key Highlights

- Nonfarm payrolls rose by 12,000, sharply decelerating from the previous downwardly revised 223,000 and well below the expected 113,000 as per TradingEconomics estimates.

- “Employment continued to trend up in health care and government. Temporary help services lost jobs. Employment declined in manufacturing due to strike activity,” the Bureau of Labor Statistics wrote in the report.

- Private payrolls contracted by 28,000, weighed down by 46,000 layoffs in manufacturing.

- Government sector employment rose by 40,000 in October, close to the monthly average gain of 43,000 over the past year.

- Total nonfarm payroll employment was revised down by 81,000 for August, from an initial estimate of 159,000, and by 31,000 for September, from 254,000, totaling 112,000 fewer jobs than previously reported.

- The unemployment rate stood at 4.1%, as expected.

- Average hourly earnings advanced at a 0.4% monthly pace, accelerating from September’s downwardly revised 0.3% increase and surpassing expectations of 0.3%.

- On an annual basis, wages rose 4%, as predicted, up from September’s 3.9% rate.

Stocks Rally As Fed Rate-Cut Expectations Soar

Following the release of the October jobs report, futures on major U.S. equity indices rallied, driven by increased expectations of Federal Reserve rate cuts.

Contracts on the S&P 500 and Nasdaq 100 both rose by 0.5%, while Russell 2000 futures surged 0.8%. This rebound comes after the SPDR S&P 500 ETF Trust SPY closed 1.9% lower on Thursday, marking its steepest one-day decline since early September and ending a five-month winning streak.

The disappointing jobs data led markets to fully price in a 25-basis-point rate cut at the Fed’s upcoming meeting on November 7, according to the CME FedWatch Tool. Additionally, the probability of another quarter-point cut in December increased to 86%, up from 75% previously.

Read Next:

Photo: National Oceanic and Atmospheric Adminstration (NOAA).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Rebound After Selloff As October Hiring Slump Fuels Interest Rate Cut Bets: 10 ETFs To Watch Friday

A hiring freeze in October lifted market expectations for a Federal Reserve interest rate cuts, providing relief to U.S. stocks after Thursday’s decline.

The U.S. economy added only 12,000 jobs in October, 211,000 fewer than in September. This marked the lowest monthly pace since December 2020 and sharply missed estimates of 113,000.

Market pricing now reflects a full probability of a 25-basis-point rate cut at next week’s Federal Reserve meeting, with the likelihood of another cut in December surging to 85%, according to the CME FedWatch tool.

Hurricanes, Strikes Knock October Employment Down

Beyond the dismal October employment figures, which suggest a recession-like scenario, factors such as hurricanes and strikes have significantly disrupted hiring across the nation.

Hurricane Helene hit Florida’s Gulf Coast on Sept. 26, followed by Hurricane Milton on Oct. 9, prompting widespread evacuations and disrupting multiple economic sectors.

“It is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect on the over-the-month change in national employment, hours, or earnings estimates,” the Bureau of Labor Statistics (BLS) stated in its report.

Additionally, layoffs surged in manufacturing, rising to 46,000 — the highest since 2009, excluding the pandemic months of March and April 2020. “Manufacturing employment decreased by 46,000 in October, reflecting a decline of 44,000 in transportation equipment manufacturing largely due to strike activity,” the BLS added.

Despite stagnant job growth in October, the unemployment rate held steady at 4.1%, indicating that businesses remain committed to retaining their workforce.

Equity ETFs Rise On Rising Rate-Cut Bets

- The SPDR S&P 500 ETF Trust SPY, tracking the S&P 500 index, rebounded 0.7% after Thursday’s 1.9% slump.

- The tech-heavy Invesco QQQ Trust QQQ, replicating the Nasdaq 100, was 0.6% higher.

- Small caps outperformed, with the iShares Russell 2000 ETF IWM soaring 1.2%.

- The Roundhill Magnificent Seven ETF MAGS rose 1.4%. On Thursday, it tumbled 3.9%, marking the sharpest 1-day drop since late July.

- Sector-wise, the Consumer Discretionary Select Sector SPDR Fund XLY led gains, up over 2%, fueled by a 6% post-earnings rally from Amazon.com Inc. AMZN.

- The Direxion Daily AMZN Bull 2X Shares AMZU skyrocketed by 13%.

- Rising expectations for Fed rate cuts fueled gains in real estate industries, with the iShares U.S. Home Construction ETF ITB rising 1.8%.

- Semiconductors rebounded after tumbling by 3.9% on Thursday. The iShares Semiconductor ETF SOXX rose 1.6%. Intel Corp. INTC was among the best performers following better-than-expected results.

- The SPDR Gold Trust GLD – the biggest physically-backed gold ETF – also rose 0.5%, rebounding after Thursday’s 1.6% decline.

- The United States Oil Fund USO, which tracks West Texas Intermediate (WTI) crude performance, gained 1% amid rising geopolitical tensions in the Middle East following Iran’s retaliatory attack on Israel.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CPABC: Greater Victoria's workforce posts healthy growth in 2024

VICTORIA, British Columbia, Nov. 01, 2024 (GLOBE NEWSWIRE) — According to BC Check-Up: Work, an annual report by the Chartered Professional Accountants of British Columbia (CPABC) on labour market trends across the province, there were 243,200 Greater Victoria residents working in September 2024, up 6.2 per cent from one year earlier.

“We saw some of the strongest employment growth in the province over the past year,” said Simon Philp, FCPA, FCMA, Market Vice President at CIBC. “It’s good to see that resilience at the local level, especially when the B.C. labour market as a whole has shown some weakness.”

Greater Victoria’s unemployment rate fell slightly to 3.9 per cent in September 2024 and was the third lowest among all census metropolitan areas in Canada. The labour force participation rate—the proportion of the working-age population who were either working or looking for work—was 67.2 per cent, up 4.3 percentage points in the two years since September 2022.

“Unemployment and labour force participation have been trending in the right direction for two years now,” noted Philp. “It’s been challenging given the higher interest rate environment, but we are starting to get some relief on that front.”

Employment in the goods sector increased by 6,200 workers (+23.1 per cent) between September 2023 and September 2024. Meanwhile, the services sector also added workers during the year, led by the information, culture, and recreation industry, where employment increased by 6,100 workers (+79.2 per cent).

“This year’s growth was driven by industries not usually seen as major employers in Greater Victoria,” noted Philp. “It’s a great reminder of the diverse opportunities available, which contributes to economic stability in the area.”

To learn more, see www.bccheckup.com.

About CPA British Columbia

The Chartered Professional Accountants of British Columbia (CPABC) is the training, governing, and regulatory body for over 40,000 CPA members and 6,000 CPA candidates and students. CPABC carries out its primary mission to protect the public by enforcing the highest professional and ethical standards and contributing to the advancement of public policy.

CPABC Media Contact: Jack Blackwell, Economist 604.259.1143 news@bccpa.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.