Up 264%, Is MicroStrategy On Track to Become the First $1 Trillion Crypto Stock?

Right now, there are only a handful of companies with a market cap exceeding $1 trillion. With the exception of Warren Buffett’s Berkshire Hathaway, all of them are high-growth tech stocks. So the natural assumption is that the next great $1 trillion company will be yet another tech company.

But what if the next $1 trillion company is a crypto company instead? That’s the vision for MicroStrategy Inc. (NASDAQ: MSTR), which has absolutely soared in value as a result of its massive Bitcoin (CRYPTO: BTC) holdings. For the year, MicroStrategy is up a resounding 264%, and since 2020, it has outperformed every single S&P 500 stock. So is MicroStrategy really on track to become the first $1 trillion crypto stock?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The first thing you need to know about MicroStrategy is that it holds 252,220 Bitcoins on its balance sheet, worth a cumulative total of $17 billion at today’s prices. This makes MicroStrategy easily the largest corporate holder of Bitcoin in the world. In fact, MicroStrategy now holds over 1% of all Bitcoin in circulation today.

The company shows no signs of stopping anytime soon. MicroStrategy has been on a Bitcoin buying spree since 2020, and makes regular Bitcoin purchases nearly every month. If anything, MicroStrategy is now ramping up its purchases of Bitcoin. The company’s newest strategy is to issue convertible debt as a way to buy even more Bitcoin in the future.

The path to $1 trillion is actually remarkably simple: Buy as much Bitcoin as possible, and wait for it to appreciate in price. Given that Michael Saylor, founder and executive chairman of MicroStrategy, now thinks that Bitcoin can hit $13 million by the year 2045, a trillion-dollar valuation is certainly within the realm of possibility.

In October, Saylor outlined a brand-new strategy. The plan, quite simply, is to transform MicroStrategy from an enterprise software company into an investment bank. As Saylor notes: “The endgame is to be the leading Bitcoin bank, or merchant bank, or you could call it a Bitcoin finance company.”

As part of this strategic transformation, MicroStrategy will begin to create new Bitcoin capital market instruments. From a broad conceptual standpoint, think of MicroStrategy as a giant Wall Street investment bank doing everything that a Goldman Sachs or Morgan Stanley does, but with Bitcoin instead of dollars.

ROSEN, LEADING INVESTOR COUNSEL, Encourages AMMO, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – POWW

NEW YORK, Nov. 02, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of AMMO, Inc. POWW between August 19, 2020 and September 24, 2024, both dates inclusive (the “Class Period”), of the important November 29, 2024 lead plaintiff deadline.

SO WHAT: If you purchased AMMO securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the AMMO class action, go to https://rosenlegal.com/submit-form/?case_id=29426 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 29, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) AMMO lacked adequate internal controls over financial reporting; (2) there was a substantial likelihood AMMO failed to accurately disclose all executive officers, members of management, and potential related party transactions in fiscal years 2020 through 2023; (3) there was a substantial likelihood AMMO failed to properly characterize certain fees paid for investor relations and legal services as reductions of proceeds from capital raises rather than period expenses in fiscal years 2021 and 2022; (4) there was a substantial likelihood AMMO failed to appropriately value unrestricted stock awards to officers, directors, employees and others in fiscal years 2020 through 2022; and (5) as a result of the foregoing, defendants’ positive statements about AMMO’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the AMMO class action, go to https://rosenlegal.com/submit-form/?case_id=29426 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Stock Turned $10,000 Into $1.5 Million Over the Past 3 Decades. Here's Why It's a Smart Buy Today.

The stock market is one of the greatest wealth creators out there. Over the long run, the S&P 500 index has returned about 10% annually during the past century, rewarding patient investors who take a buy-and-hold approach to investing.

Some companies outperform the S&P 500 over extended periods. These companies have strong business models and capital and risk management, which allows them to produce stellar cash flows no matter what the economy does.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

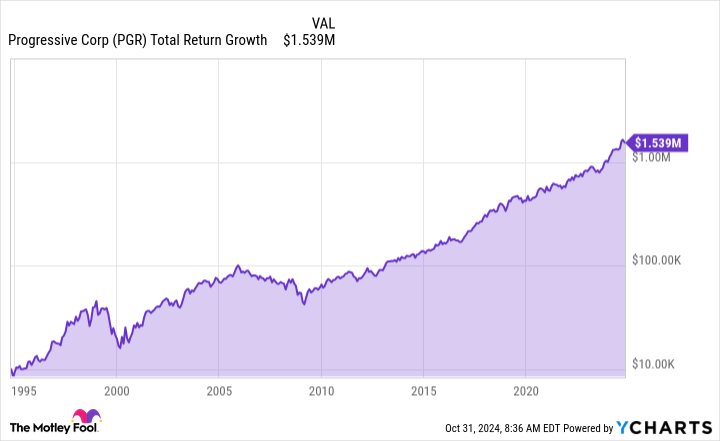

One excellent company that continues to show strength is Progressive (NYSE: PGR). The insurance company has delivered phenomenal returns of 18.3% compounded annually during the past three decades. Put differently, patient investors who invested $10,000 in the insurer three decades ago would be sitting on more than $1.5 million today. Here’s why Progressive can keep delivering.

Investing in insurance stocks isn’t as exciting as investing in next-generation technology, but they can be an important part of your diversified portfolio. That’s because insurance companies can provide steady cash flow thanks to consistent demand as people and businesses look to protect themselves from catastrophic losses. Even the legendary investor, Berkshire Hathaway Chief Executive Officer Warren Buffett, has said that insurance is a crucial part of Berkshire’s business.

However, investing in just any insurance company isn’t good enough. The industry is extremely competitive, and it can be difficult for companies to stand out. When you look at the industry, insurers, on average, barely break even. In other words, insurers collect just enough premiums to pay out claims and other expenses. This is where Progressive differentiates itself.

In 1965, Peter B. Lewis, the son of one of Progressive’s founders, took over as CEO of the insurance company. Lewis made a commitment that the company would grow by consistently underwriting profitable insurance policies. This differed from the commonly accepted practice that insurance companies should break even on policies and make their profit from their investment portfolios instead.

Progressive set a goal to make $4 in profit for every $100 in premiums it received, and it continues to strive for this goal today. In other words, the company aims to achieve a combined ratio of 96%, which measures the ratio of a company’s claims costs plus expenses divided by premiums collected.

Elon Musk's Mother Does Harris Impression During TV Appearance

Maye Musk, mother of Elon Musk, has sparked a flurry of reactions following her controversial imitation of Vice President Kamala Harris on Fox Business.

What Happened: Maye Musk, a South African former model and dietitian, was a guest on Fox Business on Thursday. During the show, she mimicked Vice President Harris, reflecting MAGA criticisms that Harris’ speeches and interviews are a “word salad.”

When asked on the show about her thoughts on Mark Cuban‘s remark on the absence of strong, intelligent women around former President Donald Trump, Musk responded by suggesting that Harris struggles to form coherent sentences. She then proceeded with her impression of the Vice President.

“Well, it’s certainly not us. And it’s certainly not my friends because they can put sentences together. And you know who can’t?” Musk said, referring to Harris before launching into her impression. “‘The absurdity of the absurd in the absurdity is absurd.’ I mean, ha ha ha ha, really?”

In the same segment, Musk shared her experience of attending a MAGA rally at New York’s Madison Square Garden. Despite the event’s ridicule of various ethnic and gender groups, Musk expressed her enjoyment.

Also Read: Elon Musk’s Mother Under Fire For Alleged Endorsement Of Voter Fraud

“We need to guard that spirit. We have to guard that spirit. Let it always inspire us. Let it always be the source of our optimism, which is that spirit that is uniquely American. Let that then inspire us by helping us to be inspired to solve the problems that so many face, including our small business owners,” she added.

Th host of the show highlighted the diverse crowd at the rally, to which Musk agreed. She also mentioned a post she had seen about Jewish attendees feeling safe at the event.

Why It Matters: The episode has stirred controversy and generated a wave of reactions, highlighting the polarizing nature of political discourse in the U.S.

The incident also underscores the influence of prominent figures in shaping public opinion, particularly in the context of ongoing debates around diversity and representation in politics.

The reactions to Musk’s imitation of Harris reflect the broader societal tensions and divisions that continue to shape the American political landscape.

Read Next

Elon Musk’s Mom Says She Sleeps In His ‘Garage’ When She Visits The Tesla CEO

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackRock Reveals a Mistake That Can Cost Workers Up to $625,000 in Retirement Savings

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

A recent study by BlackRock and Human Interest reveals an eye-catching gap in retirement savings between workers with access to employer-sponsored retirement plans and those without. The data shows that median-income employees lacking workplace retirement benefits saved one-eighth as much as those with employer-sponsored retirement plans. And by the time they retire, these workers could have almost $625,000 less than their counterparts with employer retirement programs. The research also showed that building up emergency savings could drive employees without workplace retirement plans to save more for retirement.

If you don’t have access to a workplace retirement plan, a financial advisor can walk you through different options to reach your retirement goals.

Research from asset manager BlackRock and 401(k) provider Human Interest examined savings rates and projected nest eggs for U.S. workers earning median annual incomes of $60,000. According to their findings, those with access to automated, employer-based retirement savings tools contributed an average of 7.4% of their salaries. Comparatively, workers without such benefits saved just 0.9% annually.

This eight-fold gap in savings rates creates a similarly wide disparity in long-term retirement fund accumulation. The study projects that at age 65, the average worker using their employer’s retirement plan would have accrued $710,900 for retirement. Their counterpart without this benefit would have only $86,500, which is $624,400 less.

Note that this analysis does not account for the effects of potential employer matches. In many employer-sponsored plans, employers will match employee contributions up to a specified percentage of the employee’s salary. This benefit can significantly increase the amount of money going into a retirement savings account.

Saving less than 1% annually makes it difficult for most workers to accumulate sufficient retirement savings. According to widely employed guidelines, the average American needs approximately 75% of preretirement income after leaving the workforce. With only $86,500 in retirement accounts, workers without employment-based savings plans will likely face significant financial shortfalls in their later years.

Deficits of that magnitude can lead to all sorts of undesirable outcomes, including inadequate income, diminished quality of life and over-reliance on government programs in retirement. Accessing workplace retirement accounts makes it far easier for employees to save consistently so they can maintain their standard of living after leaving full-time employment. Get matched with a financial advisor if you need help building a retirement plan.

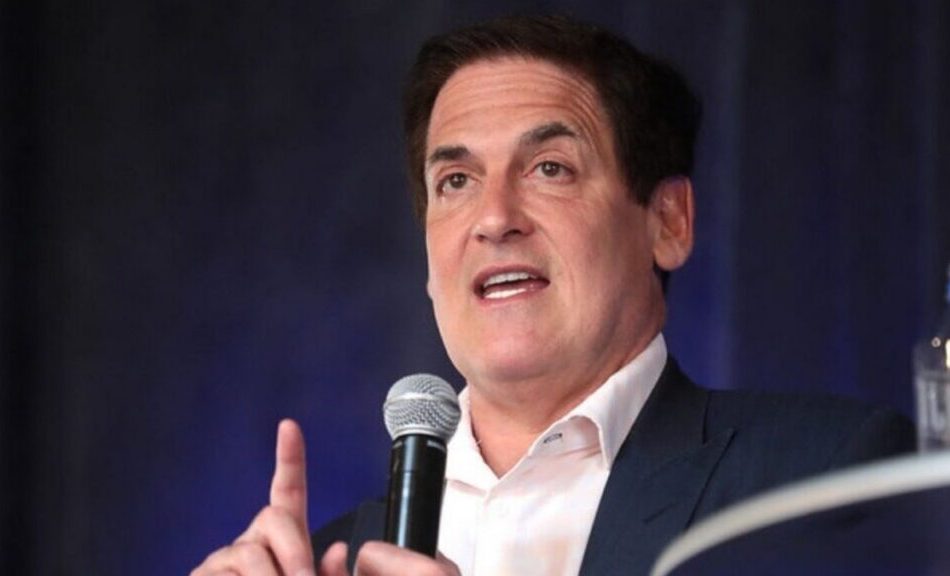

Don't Ever Use This Word Around Mark Cuban: 'You Sound Stupid … Because You're Trying To Sound Smart'

Billionaire entrepreneur Mark Cuban tries to keep things as simple as possible when it comes to communication. Complicated business language bothers him — and there’s one word that really stands out.

What To Know: Cuban is not a fan of jargon, especially when people use certain words in an attempt to sound smart.

“Always use the simpler word,” Cuban once said, according to a CNBC report citing a Q&A session with Wired.

“There’s no reason to ever use the word ‘cohort’ when you could use the word ‘group.’ A cohort is a group of people. Say ‘group,’ you sound stupid when you use the word ‘cohort’ because you’re trying to sound smart.”

Check This Out: Mark Cuban Says, ‘If You Use A Credit Card, You Don’t Want To Be Rich’ — Why Financial Icons Warren Buffett And Dave Ramsey Agree

Why It Matters: Business buzzwords and corporate jargon often get on the nerves of those who hear the same language used repeatedly. Terms including “circle back,” “new normal” and “company culture” were deemed to be the most annoying based on a recent Preply survey.

Given Cuban’s business background, it’s no surprise that he has developed a distaste for overused and often superfluous business buzzwords. His argument that using words like “cohort” actually makes you sound stupid is also supported by studies.

Columbia Business School professor Adam Galinsky recently argued that people use jargon when they are feeling insecure about their intelligence or importance. People substitute simple words for more complicated ones to feel as if they have a higher status, but higher status individuals are actually more concerned about articulating themselves appropriately for clear communication.

Galinksy and Cuban appear to be in the same cohort when it comes to corporate jargon, but don’t tell Cuban that.

Read Next:

Photo: Shutterstock.

Some elements of this story were previously reported by Benzinga and it has been updated.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Top Artificial Intelligence (AI) Stock Down 33% to Buy Hand Over Fist Before It Skyrockets

This has been a difficult year for Lam Research (NASDAQ: LRCX) investors as shares of the semiconductor manufacturing equipment supplier have dropped 4% in 2024, underperforming the 25% gains clocked by the PHLX Semiconductor Sector index, and it is worth noting that the past few months have been even more brutal for the company.

More specifically, Lam stock is down 33% since hitting a 52-week high on July 11. One of the reasons why that has been the case is because of the overall negativity surrounding the semiconductor equipment space, with industry bellwether ASML Holding finding it difficult to live up to Wall Street’s expectations.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

However, recent developments within the memory market, which accounts for a significant chunk of Lam’s revenue, have been positive. More importantly, the company’s latest results indicate that it could turn its poor stock market performance around and go on a bull run. In this article, we will take a closer look at Lam’s performance last quarter and check why buying this semiconductor stock could turn out to be a smart move.

Lam Research had a forgettable fiscal year 2024 as its revenue and earnings declined on account of poor memory demand, which was a result of the decline in the smartphone and personal computer (PC) markets. However, the company has started fiscal 2025 on a solid note.

Lam released its fiscal Q1 2025 results (for the three months ended Sept. 29) on Oct. 23. The company reported revenue of $4.17 billion, an increase of 20% from the prior-year period. The company’s adjusted earnings also increased an impressive 25% year over year to $0.86 per share. Analysts expected Lam to earn $0.81 per share on revenue of $4.01 billion.

The guidance was the icing on the cake. Lam expects $4.3 billion in revenue in the current quarter at the midpoint, which would be a 14% improvement over the year-ago quarter, along with adjusted earnings of $0.87 per share. Analysts would have settled for $0.85 per share in earnings on revenue of $4.26 billion.

Lam CEO Timothy Archer remarked on the latest earnings conference call that artificial intelligence (AI) is “driving strong investments in leading-edge logic nodes as well as advanced packaging segments, including high bandwidth memory or HBM.” Memory industry participants such as Micron Technology (NASDAQ: MU) have been witnessing robust demand for HBM, which is used in AI accelerators because of its power efficiency, higher capacity, and enhanced data transfer speeds.

Kim Jong Un's Sister: Ukraine And South Korea Are 'Bad Dogs' Bred By US

Kim Yo Jong, the sister of North Korean leader Kim Jong Un, has issued a severe warning to Ukraine and South Korea, referring to them as “bad dogs bred by the U.S.” This statement comes in response to reports suggesting that North Korean troops are being deployed to Russia.

What Happened: Last week, Kim Yo Jong issued these threats hinting at the possibility of nuclear retaliation. She criticized the “reckless remarks” made by Seoul and Kyiv about nuclear-armed states, cautioning that military provocation against such states could lead to a “horrible” and “unimaginable” situation.

These remarks follow reports from Ukraine and South Korea that North Korea is deploying approximately 10,000 soldiers to assist Russia in its conflict with Ukraine.

Ukrainian President Volodymyr Zelenskyy suggested that North Korea’s support for Russia is driven by financial incentives.

Also Read: North Korea Threatens Nuclear War, But South’s President Calls It A Bid For US Attention

According to the report by Politico, South Korea’s permanent representative to the United Nations, Hwang Joon-kook, speculated that Russia could be rewarding North Korea’s support with nuclear weapons technologies.

Despite these allegations, North Korea has dismissed its involvement in the war as “groundless rumors”.

While Russia has neither confirmed nor denied these claims, Putin’s spokesperson Dmitry Peskov stated that Russia has the right to cooperate with North Korea, provided the cooperation is not directed at third countries.

Why It Matters: The escalating tensions and harsh rhetoric from North Korea add a new dimension to the ongoing conflict between Russia and Ukraine.

The potential involvement of North Korea, a nuclear-armed state, raises the stakes and introduces a new level of complexity and uncertainty.

The international community will be closely watching the developments, as the repercussions could have far-reaching implications for global security and stability.

Read Next

Kim Jong Un Threatens Nuclear Retaliation Against South Korea If Attacked

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Exxon, Chevron top Q3 profit expectations as US oil output hits record high

By Shariq Khan

NEW YORK (Reuters) -U.S. oil producers Exxon Mobil and Chevron posted better-than-expected third-quarter profits on Friday, outperforming their European rivals, as record U.S. oil production cushioned the blow from a plunge in fuel margins.

The two focused on expanding oil and gas production as rivals BP and Shell spent heavily on wind, solar and renewables that have yet to pay off. Both U.S. oil firms have meanwhile benefited from acquisitions of smaller oil producers.

Still, their surging production could soon face a challenge from uncertain demand, especially in top oil importer China, and the potential for OPEC to lift production curbs as soon as next month. The group is expected to delay a plan to add 180,000 barrels per day amid concerns over weak demand and oversupply.

Exxon pumped a record 4.6 million barrels of oil equivalent per day (boepd) in the third-quarter, up more than 24% from a year-ago, as its $60 billion bet on Pioneer Natural Resources and purchase of Denbury paid dividends.

Chevron, whose $53-billion takeover of Hess has been held up, posted a 7% increase in third-quarter output to 3.36 million boepd, mostly from gains in its U.S. shale business which pumped a record 1.61 million boepd. It added a drilling rig in the Permian basin last quarter and will begin a production expansion in Kazakhstan next quarter.

Both companies reported lower year-over-year profits as weak global refining margins that hit BP and TotalEnergies hard and also cut their oil earnings. Exxon’s third-quarter profits were 5% lower than last year, while Chevron’s fell 21%.

But their declines were smaller than Wall Street expectations and not as steep as top European rivals. BP this week reported a 30% drop in profits from a year ago, and TotalEnergies posted a 37% decline in adjusted net income.

Exxon’s $1.92 per share profit was four cents higher than Wall Street’s outlook, whereas Chevron’s $2.51 per share adjusted income was well ahead of analysts’ average estimates of $2.42, according to LSEG data.

Chevron shares gained 3.1% to $153.41 in midday trading while Exxon was largely unchanged at $116.77.

Both pumped record amounts of oil and gas from the Permian basin, the top U.S. shale field. Exxon’s output from the basin, which spans across Texas and New Mexico, hit a record 1.4 million boepd.

Exxon is not planning to take its foot off the gas.

“We see tremendous opportunities to invest in profitable growth in both our existing and new businesses,” said finance chief Kathryn Mikells.

Boeing slashes DEI department in latest staff shake-up

This story originally appeared on AirlineGeeks.com

Boeing dismantled its global diversity, equity and inclusion department on Thursday, according to a report by Bloomberg citing sources familiar with the matter.

The report stated that staff from Boeing’s DEI office will be combined with another human resources team focused on talent and employee experience. Sara Bowen, Boeing’s vice president leading the DEI department, also announced her resignation from the company on LinkedIn Thursday.

“Today I turn in my blue badge,” Bowen said in her LinkedIn post. “It has been the privilege of my lifetime to lead Equity, Diversity, and Inclusion at the Boeing company these past 5+ years. Our team strived every day to support the evolving brilliance and creativity of our workforce. The team achieved so much – sometimes imperfectly, never easily – and dreamed of doing much more still. All of it has been worth it.”

The DEI department is the latest staffing cuts within the company as 17,000 jobs are reportedly on the chopping block for layoffs by early next year.

AirlineGeeks has reached out to Boeing for comment.

The move comes as striking members of the International Association of Machinists and Aerospace Workers (IAM) are scheduled to vote on a new contract offer Monday. Over 33,000 IAM members have been on strike at Boeing locations in Washington, Oregon and California since Sept. 13.

According to a news release from IAM, the new contract proposal would deliver a 38% wage increase over four years and a $12,000 ratification bonus. It would also reinstate Boeing’s Aerospace Machinists Performance Program (AMPP) incentive plan with a guaranteed minimum annual payout of 4% for both 2024 and February 2025.

Additionally, the contract includes a 401(k) employer match of 100% up to 8%, a special company retirement contribution of 4% into 401(k) and a $105 pension multiplier per year for those vested in the pension plan.

The union rejected a previous contract from Boeing after putting it to a vote last week, though sentiment may now be growing toward accepting the newest offer. IAM District 751 posted an endorsement of the newest offer on X/Twitter, calling for members to approve the new contract.

“Your Union is endorsing and recommending the latest IAM/Boeing Contract Proposal,” IAM District 751 posted. “It is time for our Members to lock in these gains and confidently declare victory. We believe asking members to stay on strike longer wouldn’t be right as we have achieved so much success.”

IAM District 751 President Jon Holden and IAM District W24 President Brandon Bryant issued the following joint statement in a news release from the union: