FHLBank Topeka Awards More Than $5.3 Million in Native American Housing Grants Through Its Members

12 Tribes and Tribally Designated Housing Entities in Colorado, Kansas, Nebraska and Oklahoma to Benefit

TOPEKA, Kansas, Nov. 1, 2024 /PRNewswire/ — From accessible renovations for tribal elders to making the dream of homeownership a reality for new Native American homeowners, the second year of FHLBank Topeka’s Native American Housing Initiatives (NAHI) Grants Program is poised to make a sizable difference. Applications opened in June with a planned $3.8 million available for grassroots efforts serving Native American housing.

12 Tribes & Tribally Designated Housing Entities in Colorado, Kansas, Nebraska & Oklahoma to Benefit from $5.3 million

“We are proud to continue to support Native American communities across Colorado, Kansas, Nebraska, and Oklahoma with more than $5.3 million for their housing and community development efforts,” said Jeff Kuzbel, FHLBank Topeka president and CEO. “Once we saw the quality of requests from Native American tribes across our district, we knew we could do more to help. Feedback from our members and Native American partners from last year’s inaugural offering has shown this flexible program is a model that works to serve Native American communities, an important population in our area. We are pleased to increase our commitment to NAHI.”

As a part of the voluntary programs that fulfill its housing and community development mission, FHLBank Topeka chose to expand NAHI contributions by an additional $1.5 million bringing the 2024 total funding level to $5.3 million and assisting four more projects than in 2023.

Funds will be used to support affordable housing and community development for Native American communities. Following is a full list of the selected applicants (in no particular order):

- $333,265 to Citizen Potawatomi Nation in Shawnee, Oklahoma, in partnership with Exchange Bank, Kearney, Nebraska, for the rehabilitation of 20 units, including improved accessibility of bathrooms and water heater and water softener replacements for low-income tribal elders

- $500,000 to the Housing Authority of the Seminole Nation of Oklahoma in partnership with Security State Bank of Wewoka, Oklahoma, for staff, supplies and equipment for two new youth homeless shelters built with a 2023 NAHI award

- $500,000 to Iowa Tribe Housing Authority in White Cloud, Kansas, in partnership with Chickasaw Community Bank, Oklahoma City, Oklahoma, to build three energy efficient three-bedroom, two-bathroom modular homes on tribal land

- $500,000 to Muscogee Creek National Department of Housing in Okmulgee, Oklahoma, in partnership with Chickasha Community Bank, Oklahoma City, Oklahoma, for a multi-year project to purchase land and develop infrastructure for a new housing community

- $500,000 to Northern Ponca Housing Authority in Norfolk, Nebraska, in partnership with First National Bank of Omaha, Omaha, Nebraska, to provide up to $25,000 in down payment assistance for 10 eligible households and up to $10,000 in repair and rehabilitation costs for 25 current homeowners

- $480,233 to Prairie Band Potawatomi Nation in Mayetta, Kansas, in partnership with CoreFirst Bank & Trust in Topeka, Kansas, to fund a drainage repair project that will divert water away from low-lying homes that routinely flood

- $500,000 to Southern Ute Indian Tribe in Ignacio, Colorado, in partnership with First National Bank, Cortez, Colorado, for maintenance and repair projects, such as new windows and water supply improvements for at least 20 homes

- $500,000 to Ute Mountain Ute Tribal Council in Towaoc, Colorado, in partnership with First National Bank, Cortez, Colorado, for the rehabilitation of four to six homes to address health and safety issues

- $500,000 to the Housing Authority of the Cherokee Nation in Tahlequah, Oklahoma, in partnership with Chickasha Community Bank, Oklahoma City, Oklahoma, to jumpstart a neighborhood development project by building two three-bedroom, two-bathroom, lease-to-own homes

- $500,000 to Kickapoo Housing Authority in Horton, Kansas, in partnership with GNBank NA, Horton, Kansas, to provide repair assistance to approximately 20 homeowners to make their aging homes safe and livable

- $250,000 to Sac and Fox Housing Authority in Reserve, Kansas, in partnership with Bank of Blue Valley, Hiawatha, Kansas, to repair and maintain rental properties and purchase additional housing for larger Native families

- $250,000 to Tonkawa Tribe of Indians of Oklahoma, Tonkawa, Oklahoma, in partnership with First National Bank of Oklahoma, Tonkawa, Oklahoma, for repair and rehabilitation projects such as new roofs, HVAC units, plumbing and windows that will improve living conditions for tribal members

To read two stories from the 2023 NAHI round, visit fhlbtopeka.com/case-studies. One profile features a new community room and storm shelter for Cherokee Nation elders in Tahlequah, Oklahoma. The other shows how the Wewoka, Oklahoma community came together to transform youth homelessness.

FHLBank Topeka is one of 11 Federal Home Loan Banks that provides liquidity and funding to build vibrant communities for its member banks, thrifts, credit unions, insurance companies and community development financial institutions. With $79.8 billion in assets and more than $4.1 billion in capital, FHLBank Topeka serves 670 member financial institutions in Colorado, Kansas, Nebraska and Oklahoma.

Contact:

Tamara Taylor, FVP, Director of Corporate Communications

tamara.taylor@fhlbtopeka.com

785.478.8157

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fhlbank-topeka-awards-more-than-5-3-million-in-native-american-housing-grants-through-its-members-302293461.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fhlbank-topeka-awards-more-than-5-3-million-in-native-american-housing-grants-through-its-members-302293461.html

SOURCE Federal Home Loan Bank of Topeka

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Moves Higher; Apple Shares Slide After Q4 Results

U.S. stocks traded higher toward the end of trading, with the Nasdaq Composite gaining more than 100 points on Friday.

The Dow traded up 0.67% to 42,043.38 while the NASDAQ surged 0.75% to 18,230.53. The S&P 500 also rose, gaining, 0.47% to 5,732.21.

Check This Out: Top 2 Real Estate Stocks You May Want To Dump This Quarter

Leading and Lagging Sectors

Consumer discretionary shares rose by 2.3% on Friday.

In trading on Friday, utilities shares fell by 2.1%.

Top Headline

Apple Inc. AAPL shares fell around 2% on Friday after the company reported results for the fourth quarter.

The company reported fiscal fourth-quarter revenue of $94.9 billion, beating analyst estimates of $94.56 billion. The iPhone maker reported fourth-quarter adjusted earnings of $1.64 per share, beating analyst estimates of $1.60 per share.

Equities Trading UP

- ChromaDex Corporation CDXC shares shot up 53% to $5.34 after the company reported a year-over-year increase in third-quarter EPS results and raised its FY24 revenue guidance.

- Shares of Proto Labs, Inc. PRLB got a boost, surging 33% to $36.42 after the company reported better-than-expected third-quarter financial results and issued fourth-quarter adjusted EPS guidance with its midpoint above estimates.

- Interface, Inc. TILE shares were also up, gaining 33% to $23.23 after the company reported better-than-expected third-quarter financial results and raised its FY24 net sales guidance above estimates.

Equities Trading DOWN

- ESSA Pharma Inc. EPIX shares dropped 71% to $1.51 after the company announced it terminated its Phase 2 study evaluating masofaniten combined with enzalutamide in patients with mCRPC.

- Shares of Myriad Genetics, Inc. MYGN were down 21% to $17.30. Myriad Genetics will hold its third quarter earnings conference call on Thursday, Nov. 7.

- Lexicon Pharmaceuticals, Inc. LXRX was down, falling 37% to $1.2250. Lexicon Pharmaceuticals announced the outcome of the FDA’s Endocrinologic and Metabolic Drugs Advisory Committee Meeting to review the company’s New Drug Application (NDA) for Zynquista (sotagliflozin). The company is seeking approval for the oral SGLT1/SGLT2 inhibitor as an adjunct to insulin therapy for glycemic control in adults with type 1 diabetes (T1D) and chronic kidney disease (CKD).

Commodities

In commodity news, oil traded up 0.8% to $69.79 while gold traded down 0.1% at $2,745.60.

Silver traded down 0.7% to $32.555 on Friday, while copper rose 0.3% to $4.3520.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 1.09%, Germany’s DAX gained 0.93% and France’s CAC 40 gained 0.80%. Spain’s IBEX 35 Index surged 1.46%, while London’s FTSE 100 rose 0.83%.

Asia Pacific Markets

Asian markets closed mostly lower on Friday, with Japan’s Nikkei 225 falling 2.63%, Hong Kong’s Hang Seng Index gaining 0.93%, China’s Shanghai Composite Index declining 0.24% and India’s BSE Sensex falling 0.27%.

Economics

- The U.S. economy added 12,000 jobs in October compared to a revised 223,000 gain in September and versus market estimates of 113,000.

- Average hourly earnings increased by 0.4% over a month to $35.46 in October, while unemployment rate came in unchanged at 4.1% in October.

- U.S. construction spending increased by 0.1% month-over-month to an annual rate of $2,148.8 billion in September.

- The S&P Global Flash manufacturing PMI was revised upward to 48.5 in October versus a preliminary reading of 47.8.

- The ISM manufacturing PMI declined to 46.5 in October versus 47.2 in the previous month and down from estimates of 47.6.

- The total number of active U.S. oil rigs fell by one to 479 rigs this week, Baker Hughes Inc reported.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

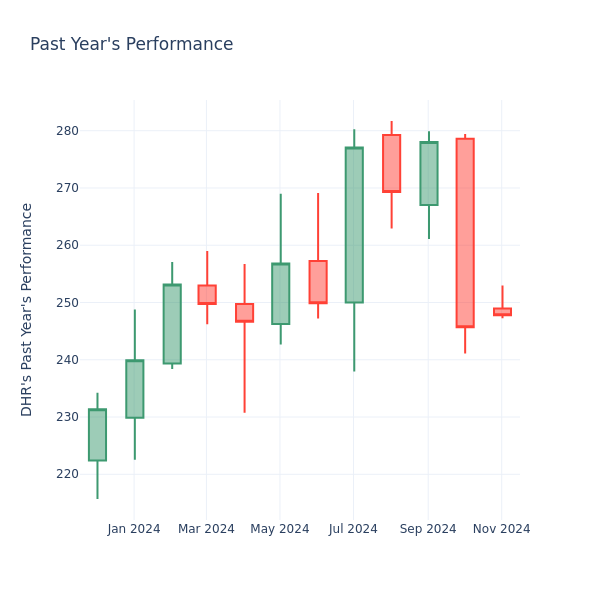

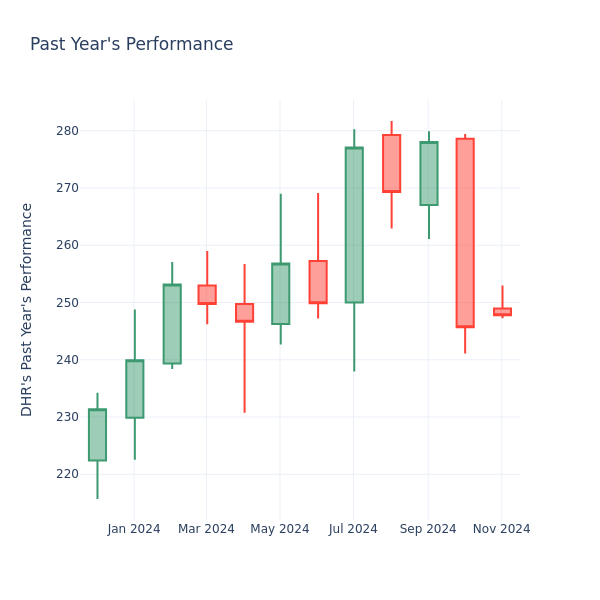

A Look Into Danaher Inc's Price Over Earnings

In the current market session, Danaher Inc. DHR share price is at $242.91, after a 0.09% spike. Moreover, over the past month, the stock decreased by 8.25%, but in the past year, went up by 26.72%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

Danaher P/E Compared to Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Danaher has a better P/E ratio of 45.79 than the aggregate P/E ratio of 43.15 of the Life Sciences Tools & Services industry. Ideally, one might believe that Danaher Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Conference Call – 4th Quarter 2024 Results

VANCOUVER, British Columbia, Nov. 01, 2024 (GLOBE NEWSWIRE) — Rogers Sugar Inc. (RSI) will be holding a conference call to discuss their 2024 fourth quarter results on Thursday, November 28, 2024, at 8h00 (Eastern Time).

The conference call will be chaired by Mr. Michael Walton, Chief Executive Officer and Mr. Jean-Sébastien Couillard, Chief Financial Officer.

If you wish to participate, please dial 1-800-717-1738. A recording of the conference call will be accessible shortly after the conference, by dialing 1-888-660-6264, access code 67841#. This recording will be available until December 28, 2024.

The discussion along with a presentation will be accessible through a webcast at the following address:

For further information:

Jean-Sébastien Couillard

Vice President of Finance, Chief Financial Officer and Corporate Secretary

Tel.: (514) 940-4350

www.lanticrogers.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Montfort Capital Closes Sale of TIMIA Group

(All figures in Canadian dollars)

TORONTO, Nov. 1, 2024 /CNW/ – Montfort Capital Corp. (“Montfort” or the “Company”) MONT, a trusted provider of focused private credit strategies for institutional investors, family wealth offices, and wealth managers, is pleased to announce it has closed the transaction previously announced on October 17, 2024, pursuant to which an affiliate of Round 13 Capital (“Round 13“), an arm’s length third party, acquired from the Company all of its right, title and interest to the entities comprising the TIMIA Capital business unit (the “TIMIA Group“), together with Montfort’s equity interests in the TIMIA Group investment funds.

The sale of the TIMIA Group included all-cash consideration of $4.5 million, subject to certain purchase price adjustments, and the purchaser’s acquisition from Pivot Financial I Limited Partnership (“Pivot“), an affiliate of Montfort, of $2 million in principal indebtedness of TIMIA Capital Holdings Limited Partnership, an entity comprising the TIMIA Group.

About Montfort Capital Corp.

Montfort is a trusted provider of focused private credit strategies for institutional investors, family offices, and wealth managers. Our experienced management teams employ focused strategies to drive superior risk-adjusted investment returns. Montfort’s business lines include:

- Brightpath Capital, one of Canada’s leading providers of alternative residential mortgages.

- Langhaus Financial, provides insurance policy-backed lending solutions to high-net-worth individuals and entrepreneurs in Canada.

- Nuvo Financial, is focused on providing net asset value (NAV) loans to small and mid-sized investment funds in Canada.

- Pivot Financial which specializes in asset-backed private credit targeting mid-market borrowers in Canada.

For further information, please visit www.montfortcapital.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of applicable Canadian securities legislation and information that are based on the beliefs of management and reflect the Company’s current expectations. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. Such statements and information reflect the current view of the Company. Risks and uncertainties may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

ON BEHALF OF THE BOARD

Ken Thomson

Director and CEO

SOURCE Montfort Capital Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/01/c7248.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/01/c7248.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First National Corporation Reports Third Quarter 2024 Financial Results

STRASBURG, Va., Nov. 01, 2024 (GLOBE NEWSWIRE) — First National Corporation (the “Company” or “First National”) FXNC, reported unaudited consolidated net income of $2.2 million and basic and diluted earnings per common share of $0.36 for the third quarter of 2024 and adjusted net income(1) of $2.4 million and adjusted basic and diluted earnings per common share(1) of $0.39.

| (Dollars in thousands, except earnings per share) | Three Months Ended | |||||||||||

| Sept 30, 2024 | Jun 30, 2024 | Sept 30, 2023 | ||||||||||

| Net income | $ | 2,248 | $ | 2,442 | $ | 3,121 | ||||||

| Basic and diluted earnings per share | $ | 0.36 | $ | 0.39 | $ | 0.50 | ||||||

| Return on average assets | 0.62 | % | 0.68 | % | 0.91 | % | ||||||

| Return on average equity | 7.28 | % | 8.31 | % | 10.96 | % | ||||||

| Non-GAAP Measures: | ||||||||||||

| Adjusted net income(1) | $ | 2,448 | $ | 3,008 | $ | 3,121 | ||||||

| Adjusted basic and diluted earnings per share(1) | $ | 0.39 | $ | 0.48 | $ | 0.50 | ||||||

| Adjusted return on average assets(1) | 0.67 | % | 0.84 | % | 0.91 | % | ||||||

| Adjusted return on average equity(1) | 7.93 | % | 10.23 | % | 10.96 | % | ||||||

| Adjusted pre-provision, pre-tax earnings(1) | $ | 4,712 | $ | 4,092 | $ | 3,952 | ||||||

| Adjusted pre-provision, pre-tax return on average assets(1) | 1.29 | % | 1.14 | % | 1.16 | % | ||||||

| Net interest margin(1) | 3.43 | % | 3.40 | % | 3.35 | % | ||||||

| Efficiency ratio(1) | 67.95 | % | 70.65 | % | 70.67 | % | ||||||

*See “Non-GAAP Financial Measures” and “Non-GAAP Reconciliations” for additional information and detailed calculations of adjustments.

“During the third quarter the company saw continued improvement in net interest margin thanks to proactive deposit pricing boosted by sticky noninterest-bearing deposits continuing to represent 31% of total deposits,” said Scott C. Harvard, President and CEO. “We also benefited from a 16% increase in ATM and check card fees and an 8% increase in wealth management fees in the quarter. During the quarter loans acquired from third party lenders continued to be a drag on what otherwise was excellent financial performance, with an adjusted pre-provision, pre-tax return on average assets of 1.29% for the period. We continue to be excited about the recent acquisition of Touchstone Bankshares, Inc., which closed on October 1, and look forward to integrating our two companies and building value for our shareholders.”

THIRD QUARTER HIGHLIGHTS

Key highlights of the three months ending September 30, 2024, are as follows. Comparisons are to the three-month period ending June 30, 2024, unless otherwise stated:

| ● | Net interest margin(1) continued to improve to 3.43% | |

| ● | Loan balances increased by 2%, annualized | |

| ● | Noninterest-bearing deposits were stable at 31% of total deposits | |

| ● | Noninterest income increased by 19% | |

| ● | Adjusted ROA and ROE(1) of 0.67% and 7.93% respectively | |

| ● | Tangible book value per share(1) increased to $19.37 from $17.38 one year ago |

MERGER WITH TOUCHSTONE BANKSHARES, INC.

The Company completed the acquisition of Touchstone Bankshares, Inc. (“Touchstone”) with and into the Company, effective October 1, 2024 (the “Merger”). Immediately following the Merger, Touchstone Bank, the wholly owned subsidiary of Touchstone, was merged with and into First Bank. Pursuant to the previously announced terms of the Merger, each outstanding share of Touchstone common stock and preferred stock (on an as-converted, one-for-one basis, which shares of preferred stock converted automatically to common stock at the effective time of the Merger) received 0.8122 shares of the Company’s common stock.

Following the Merger, the former branches of Touchstone Bank assumed in the Merger continued to operate in Virginia as Touchstone Bank, a division of First Bank, and, in North Carolina, as Touchstone Bank, a division of First Bank, Strasburg, Virginia, until the systems integration is completed in February 2025. With the addition of Touchstone, the Company would have had approximately $2.1 billion in assets, $1.5 billion in loans and $1.8 billion in deposits on a combined pro-forma basis as of September 30, 2024. The combined company delivers banking services through thirty-three branch offices in Virginia and North Carolina and three loan production offices, in addition to its full complement of online banking services. During the third quarter of 2024, the Company incurred pre-tax merger costs of approximately $219 thousand related to the Merger. Effective October 1, 2024, common stock outstanding of First National Corporation totaled 8,970,345.

NET INTEREST INCOME

Net interest income increased $255 thousand, or 2%, to $11.7 million for the third quarter of 2024 compared to the second quarter of 2024. Total interest income increased by $389 thousand, or 2%, and was partially offset by a $134 thousand, or 2%, increase in total interest expense. The net interest margin(1) increased to 3.43%, up from 3.40% for the second quarter.

The $389 thousand increase in total interest income was attributable to a $475 thousand increase in interest and fees on loans, which was partially offset by a $43 thousand decrease in interest income on securities and a $41 thousand decrease in interest on deposits in banks. The increase in interest and fees on loans was attributable to a 9-basis point increase in the yield on the loan portfolio and a $9.2 million increase in the average balance of loans. The decrease in interest income on deposits in other banks was attributable to a $2.9 million decrease in average balances. The decrease in interest income on securities was attributable to a $1.7 million decrease in the average balance of total securities and an 8-basis point decrease in yield. The yield on total earning assets increased to 5.08% from 5.03% in the second quarter.

The $134 thousand increase in total interest expense was primarily attributable to a $138 thousand increase in interest expense on deposits. The increase in interest expense on deposits resulted from a $933 thousand increase in the average balance of interest-bearing deposits and a 4-basis point increase in cost. The total cost of funds was 1.72% for the third quarter of 2024, which was a 3-basis point increase compared to the second quarter of 2024.

NONINTEREST INCOME

Noninterest income totaled $3.2 million for the third quarter of 2024, which was a $517 thousand, or 19%, increase from the second quarter of 2024 and was attributable to increases in all income categories. ATM and check card fees and fees for other customer services increased $125 thousand and $98 thousand, respectively. There were also increases in wealth management fees, service charges on deposit accounts, and brokered mortgage fees of $73 thousand, $63 thousand, and $60 thousand, respectively.

NONINTEREST EXPENSE

Noninterest expense totaled $10.5 million for the third quarter of 2024, which was a decrease of $200 thousand, or 2%, compared to the second quarter of 2024. The decrease was primarily attributable to a $528 thousand decrease in legal and professional fees, which was a result of lower merger-related expenses in the third quarter compared to the prior period. Merger expenses totaled $219 thousand for the third quarter of 2024 compared to $571 thousand in the second quarter of 2024.

ASSET QUALITY

Overview

Loans that were past due greater than 30 days and still accruing interest as a percentage of total loans were 0.24% on September 30, 2024, 0.24% on June 30, 2024, and 0.18% on September 30, 2023. Nonperforming assets (“NPAs”) as a percentage of total assets decreased to 0.41% on September 30, 2024, compared to 0.59% on June 30, 2024, and increased from 0.23% on September 30, 2023. Annualized net charge-offs as a percentage of total loans were 0.63% for the third quarter of 2024, 0.19% for the second quarter of 2024 and 0.03% for the third quarter of 2023. The allowance for credit losses on loans totaled $12.7 million, or 1.28% of total loans on September 30, 2024, $12.6 million, or 1.27% of total loans on June 30, 2024, and $8.9 million, or 0.93% of total loans on September 30, 2023.

Past Due Loans

Loans past due greater than 30 days and still accruing interest totaled $2.4 million on September 30, 2024, $2.4 million on June 30, 2024, and $1.8 million on September 30, 2023. There were no loans greater than 90 days past due and still accruing on September 30, 2024 and June 30, 2024, compared to $370 thousand on September 30, 2023.

Nonperforming Assets

NPAs decreased to $6.0 million on September 30, 2024 from $8.5 million on June 30, 2024. NPA’s totaled $3.1 million on September 30, 2023. NPA’s represented 0.41%, 0.59%, and 0.23% of total assets, respectively. The NPAs were primarily comprised of commercial and industrial loans.

Net Charge-offs

Net charge-offs totaled $1.6 million for the third quarter of 2024, $482 thousand for the second quarter of 2024, and $83 thousand for the third quarter of 2023.

Provision for Credit Losses

The provision for credit losses totaled $1.7 million for the third quarter of 2024, $400 thousand for the second quarter of 2024, and $100 thousand in the third quarter of 2023. The provision in the third quarter of 2024 was comprised of a $1.7 million provision for credit losses on loans, a $5 thousand recovery of credit losses on held-to-maturity securities, and a $17 thousand recovery of credit losses on unfunded commitments. The provision for credit losses on loans in the third quarter of 2024 was primarily attributable to increases in specific reserves on commercial and industrial loans and an increase in the general reserve component of the allowance for credit losses on loans related to an increase in projected losses, which resulted from a higher projected unemployment rate when compared to the prior quarterly period.

Allowance for Credit Losses on Loans

The allowance for credit losses on loans totaled $12.7 million on September 30, 2024, $12.6 million on June 30, 2024, and $8.9 million on September 30, 2023. During the third quarter of 2024, the specific reserve component of the allowance decreased by $373 thousand, while the general reserve component of the allowance increased by $524 thousand. Net charge-offs increased in the third quarter and were primarily comprised of commercial and industrial loans with specific reserves that were established in prior periods.

The following table provides the changes in the allowance for credit losses on loans for the three-month periods ended (dollars in thousands):

| Sept 30, 2024 | Jun 30, 2024 | Sept 30, 2023 | ||||||||||

| Allowance for credit losses on loans, beginning of period | $ | 12,553 | $ | 12,603 | $ | 8,858 | ||||||

| Net charge-offs | (1,572 | ) | (482 | ) | (83 | ) | ||||||

| Provision for credit losses on loans | 1,723 | 432 | 121 | |||||||||

| Allowance for credit losses on loans, end of period | $ | 12,704 | $ | 12,553 | $ | 8,896 | ||||||

The allowance for credit losses on loans as a percentage of total loans totaled 1.28% on September 30, 2024, 1.27% on June 30, 2024, and 0.93% on September 30, 2023.

Allowance for Credit Losses on Unfunded Commitments

The allowance for credit losses on unfunded commitments totaled $370 thousand on September 30, 2024, $387 thousand on June 30, 2024 and $189 on September 30, 2023. There was a $17 thousand recovery of credit losses on unfunded commitments in the third quarter of 2024, a $26 thousand recovery of credit losses on unfunded commitments in the second quarter of 2024, and an $8 thousand recovery of credit losses on unfunded commitments in the third quarter of 2023.

Allowance for Credit Losses on Securities

The allowance for credit losses on securities held-to-maturity (“HTM”) totaled $105 thousand on September 30, 2024, compared to $110 thousand on June 30, 2024, and $131 thousand on September 30, 2023. The recovery of credit losses on securities totaled $5 thousand for the third quarter of 2024, $7 thousand for the second quarter of 2024 and $12 thousand for the third quarter of 2023.

LIQUIDITY

Liquidity sources available to the Bank, including interest-bearing deposits in banks, unpledged securities available for sale, at fair value, unpledged securities held-to-maturity, at par, that were eligible to be pledged to the Federal Reserve Bank through its Bank Term Funding Program, and available lines of credit totaled $499.1 million on September 30, 2024, $533.3 million on June 30, 2024, and $532.1 million on September 30, 2023.

The Bank maintains liquidity to fund loan growth and to meet potential demand from deposit customers. The estimated amount of uninsured customer deposits totaled $400.1 million on September 30, 2024, $419.4 million on June 30, 2024, and $346.9 million on September 30, 2023. Excluding municipal deposits, the estimated amount of uninsured customer deposits totaled $322.6 million on September 30, 2024, $324.6 million on June 30, 2024, and $268.4 million on September 30, 2023.

BALANCE SHEET

Assets totaled $1.5 billion on September 30, 2024, which was a $6.8 million, or 2% (annualized), decrease from June 30, 2024, and an $84.8 million, or 6%, increase from September 30, 2023. The decrease in total assets from the second quarter of 2024 was primarily due to a $9.1 million decrease in cash and cash equivalents and a $2.2 million decrease in other assets, which was partially offset by a $4.6 million increase in loans, net of allowance for credit losses. Total assets increased from September 30, 2023 primarily from a $76.4 million increase in cash and cash equivalents and a $38.4 million increase in loans, net of the allowance for credit losses on loans, which were partially offset by a $28.5 million decrease in securities held to maturity.

On September 30, 2024, loans totaled $994.7 million, an increase of $4.7 million or 1.9% (annualized) from $990.0 million, on June 30, 2024. Quarterly average loans totaled $991.2 million, an increase of $9.2 million or 3.8% (annualized) from the second quarter of 2024. On September 30, 2024, loans increased $42.2 million, or 4%, from one year ago, and quarterly average loans increased $68.2 million, or 7%, when comparing the third quarter of 2024 to the same period in 2023.

On September 30, 2024, securities totaled $269.6 million, a decrease of $875 thousand from June 30, 2024, and a decrease of $30.7 million from September 30, 2023. AFS securities totaled $146.0 million on September 30, 2024, $144.8 million on June 30, 2024, and $148.2 million on September 30, 2023. On September 30, 2024, total net unrealized losses on the AFS securities portfolio were $17.3 million, a decrease of $4.6 million from total net unrealized losses on AFS securities of $21.9 million on June 30, 2024. HTM securities are carried at cost and totaled $121.5 million on September 30, 2024, $123.6 million on June 30, 2024, and $150.0 million on September 30, 2023, and had net unrealized losses of $7.8 million on September 30, 2024, a decrease of $3.6 million compared to the prior quarter.

On September 30, 2024, total deposits were $1.3 billion, a decrease of $12.5 million or approximately 4% (annualized) from June 30, 2024. Quarterly average deposits decreased from the second quarter of 2024 by $5.3 million or 2% (annualized). Total deposits increased $18.1 million or 1% from September 30, 2023, and quarterly average deposits for the third quarter of 2024 increased $31.2 million or 3% from the third quarter of 2023. Total deposits decreased from the prior quarter due to a $14.4 million decrease in noninterest-bearing deposits and a $1.3 million decrease in interest-bearing demand deposits, which were partially offset by a $3.1 million increase in time deposits.

On September 30, 2024 and June 30, 2024, other borrowings totaled $50.0 million and were comprised of funds borrowed from the Federal Reserve Bank through their Bank Term Funding Program. On September 30, 2024, other borrowings had a fixed interest rate of 4.76% and a maturity date of January 15, 2025. The Bank benefited from the borrowings with a reduction in interest rate risk and an increase in net interest income. There were no other borrowings on September 30, 2023.

The following table provides capital ratios at the periods ended:

| Sept 30, 2024 | Jun 30, 2024 | Sept 30, 2023 | ||||||||||

| Total capital ratio(2) | 14.29 | % | 14.13 | % | 14.80 | % | ||||||

| Tier 1 capital ratio(2) | 13.04 | % | 12.88 | % | 13.86 | % | ||||||

| Common equity Tier 1 capital ratio(2) | 13.04 | % | 12.88 | % | 13.86 | % | ||||||

| Leverage ratio(2) | 9.23 | % | 9.17 | % | 9.96 | % | ||||||

| Common equity to total assets(3) | 8.62 | % | 8.23 | % | 8.20 | % | ||||||

| Tangible common equity to tangible assets(1)(3) | 8.43 | % | 8.03 | % | 8.00 | % | ||||||

During the third quarter of 2024, the Company declared and paid cash dividends of $0.15 per common share, which was consistent with the second quarter of 2024 and the third quarter of 2023.

NON-GAAP FINANCIAL MEASURES

In addition to financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), the Company uses certain non-GAAP financial measures that the Company’s management believes provide useful information for financial and operational decision making, evaluating trends, and comparing financial results to other financial institutions. The non-GAAP financial measures presented in this document include adjusted net income, adjusted basic and diluted earnings per share, adjusted return on average assets, adjusted return on average equity, pre-provision pre-tax earnings, adjusted pre-provision pre-tax earnings, fully taxable equivalent interest income, the net interest margin, the efficiency ratio, tangible book value per share, and tangible common equity to tangible assets.

The Company believes certain non-GAAP financial measures enhance the understanding of its business, performance and financial position. Non-GAAP financial measures are supplemental and not a substitute for, or more important than, financial measures prepared in accordance with GAAP and may not be comparable to those reported by other financial institutions. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measure is included at the end of this release.

ABOUT FIRST NATIONAL CORPORATION

First National Corporation FXNC is the parent company and bank holding company of First Bank (the “Bank”), a community bank that first opened for business in 1907 in Strasburg, Virginia. The Bank offers loan and deposit products and services through its website, www.fbvirginia.com, its mobile banking platform, a network of ATMs located throughout its market area, three loan production offices, a customer service center in a retirement community, and thirty-three bank branch office locations located throughout the Shenandoah Valley, the Roanoke Valley, the central and south-central regions of Virginia, the city of Richmond, and in northern North Carolina. In addition to providing traditional banking services, the Bank operates a wealth management division under the name First Bank Wealth Management. The Bank also owns First Bank Financial Services, Inc., which owns an interest in an entity that provides title insurance services.

FORWARD-LOOKING STATEMENTS

Certain information contained in this discussion may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements relate to the Company’s plans, objectives, expectations and intentions and other statements that are not historical facts, and other statements identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,” as well as similar expression. Although the Company believes that its expectations with respect to the forward-looking statements are based upon reliable assumptions within the bounds of its knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties. For details on factors that could affect expectations, future events, or results, see the risk factors and other cautionary language included in First National’s Annual Report on Form 10-K for the year ended December 31, 2023, and most recent Quarterly Report on Form 10-Q and other filings with the Securities and Exchange Commission (the “SEC”).

Additional risks and uncertainties may include, but are not limited to: (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, including due to the state of the economy or other competitive factors in the areas in which the parties operate, (2) disruption from the Merger of customer, supplier, employee or other business partner relationships, including diversion of management’s attention from ongoing business operations and opportunities due to the Merger, (3) the possibility that the costs, fees, expenses and charges related to the Merger may be greater than anticipated, (4) reputational risk and the reaction of each of the parties’ customers, suppliers, employees or other business partners to the Merger, (5) the risks relating to the integration of Touchstone’s operations into the operations of First National, including the risk that such integration will be materially delayed or will be more costly or difficult than expected, (6) the risk of expansion into new geographic or product markets, (7) the dilution caused by First National’s issuance of additional shares of its common stock in the Merger, and (8) general competitive, economic, political and market conditions. All subsequent written and oral forward-looking statements concerning First National or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. First National does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

CONTACTS

| Scott C. Harvard | M. Shane Bell | |

| President and CEO | Executive Vice President and CFO | |

| (540) 465-9121 | (540) 465-9121 | |

| sharvard@fbvirginia.com | sbell@fbvirginia.com |

FIRST NATIONAL CORPORATION

Performance Summary

(in thousands, except share and per share data)

(unaudited)

| As of or For the Three Months Ended | As of or For the Nine Months Ended | |||||||||||||||||||

| Sept 30, 2024 | Jun 30, 2024 | Sept 30, 2023 | Sept 30, 2024 | Sept 30, 2023 | ||||||||||||||||

| Income Statement | ||||||||||||||||||||

| Interest and dividend income | ||||||||||||||||||||

| Interest and fees on loans | $ | 14,479 | $ | 14,004 | $ | 12,640 | $ | 41,967 | $ | 36,038 | ||||||||||

| Interest on deposits in banks | 1,538 | 1,579 | 338 | 4,405 | 1,441 | |||||||||||||||

| Taxable interest on securities | 1,091 | 1,134 | 1,323 | 3,449 | 3,968 | |||||||||||||||

| Tax-exempt interest on securities | 303 | 306 | 304 | 914 | 917 | |||||||||||||||

| Dividends | 33 | 32 | 26 | 98 | 81 | |||||||||||||||

| Total interest and dividend income | $ | 17,444 | $ | 17,055 | $ | 14,631 | $ | 50,833 | $ | 42,445 | ||||||||||

| Interest expense | ||||||||||||||||||||

| Interest on deposits | $ | 4,958 | $ | 4,820 | $ | 3,810 | $ | 14,549 | $ | 9,428 | ||||||||||

| Interest on subordinated debt | 69 | 69 | 69 | 207 | 207 | |||||||||||||||

| Interest on junior subordinated debt | 68 | 66 | 69 | 202 | 203 | |||||||||||||||

| Interest on other borrowings | 600 | 606 | — | 1,782 | 3 | |||||||||||||||

| Total interest expense | $ | 5,695 | $ | 5,561 | $ | 3,948 | $ | 16,740 | $ | 9,841 | ||||||||||

| Net interest income | $ | 11,749 | $ | 11,494 | $ | 10,683 | $ | 34,093 | $ | 32,604 | ||||||||||

| Provision for credit losses | 1,700 | 400 | 100 | 3,100 | 200 | |||||||||||||||

| Net interest income after provision for credit losses | $ | 10,049 | $ | 11,094 | $ | 10,583 | $ | 30,993 | $ | 32,404 | ||||||||||

| Noninterest income | ||||||||||||||||||||

| Service charges on deposit accounts | $ | 675 | $ | 612 | $ | 733 | $ | 1,941 | $ | 2,062 | ||||||||||

| ATM and check card fees | 934 | 809 | 976 | 2,513 | 2,624 | |||||||||||||||

| Wealth management fees | 952 | 879 | 811 | 2,714 | 2,336 | |||||||||||||||

| Fees for other customer services | 276 | 178 | 122 | 649 | 538 | |||||||||||||||

| Brokered mortgage fees | 92 | 32 | 38 | 162 | 73 | |||||||||||||||

| Income from bank owned life insurance | 191 | 149 | 175 | 491 | 459 | |||||||||||||||

| Net gains on securities available for sale | 39 | — | — | 39 | — | |||||||||||||||

| Other operating income | 44 | 27 | 198 | 1,427 | 623 | |||||||||||||||

| Total noninterest income | $ | 3,203 | $ | 2,686 | $ | 3,053 | $ | 9,936 | $ | 8,715 | ||||||||||

| Noninterest expense | ||||||||||||||||||||

| Salaries and employee benefits | $ | 5,927 | $ | 5,839 | $ | 5,505 | $ | 17,637 | $ | 16,040 | ||||||||||

| Occupancy | 585 | 548 | 534 | 1,668 | 1,586 | |||||||||||||||

| Equipment | 726 | 691 | 598 | 2,008 | 1,756 | |||||||||||||||

| Marketing | 262 | 273 | 204 | 730 | 720 | |||||||||||||||

| Supplies | 123 | 115 | 128 | 354 | 423 | |||||||||||||||

| Legal and professional fees | 596 | 1,124 | 439 | 2,172 | 1,204 | |||||||||||||||

| ATM and check card expense | 394 | 368 | 440 | 1,123 | 1,265 | |||||||||||||||

| FDIC assessment | 195 | 203 | 161 | 575 | 479 | |||||||||||||||

| Bank franchise tax | 262 | 261 | 262 | 785 | 778 | |||||||||||||||

| Data processing expense | 290 | 163 | 266 | 699 | 720 | |||||||||||||||

| Amortization expense | 4 | 5 | 5 | 13 | 14 | |||||||||||||||

| Other real estate owned expense (income), net | 10 | — | 15 | 10 | (201 | ) | ||||||||||||||

| Net losses on disposal of premises and equipment | 2 | — | — | 50 | — | |||||||||||||||

| Other operating expense | 1,083 | 1,069 | 1,227 | 3,181 | 3,358 | |||||||||||||||

| Total noninterest expense | $ | 10,459 | $ | 10,659 | $ | 9,784 | $ | 31,005 | $ | 28,142 | ||||||||||

| Income before income taxes | $ | 2,793 | $ | 3,121 | $ | 3,852 | $ | 9,924 | $ | 12,977 | ||||||||||

| Income tax expense | 545 | 679 | 731 | 2,025 | 2,502 | |||||||||||||||

| Net income | $ | 2,248 | $ | 2,442 | $ | 3,121 | $ | 7,899 | $ | 10,475 | ||||||||||

FIRST NATIONAL CORPORATION

Performance Summary

(in thousands, except share and per share data)

(unaudited)

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||||||

| Sept 30, 2024 | Jun 30, 2024 | Sept 30, 2023 | Sept 30, 2024 | Sept 30, 2023 | ||||||||||||||||

| Common Share and Per Common Share Data | ||||||||||||||||||||

| Earnings per common share, basic | $ | 0.36 | $ | 0.39 | $ | 0.50 | $ | 1.26 | $ | 1.67 | ||||||||||

| Adjusted earnings per common share, basic (1) | $ | 0.39 | 0.48 | 0.50 | $ | 1.38 | $ | 1.67 | ||||||||||||

| Weighted average shares, basic | 6,287,997 | 6,278,113 | 6,256,663 | 6,278,668 | 6,266,707 | |||||||||||||||

| Earnings per common share, diluted | $ | 0.36 | $ | 0.39 | $ | 0.50 | $ | 1.26 | $ | 1.67 | ||||||||||

| Adjusted earnings per common share, diluted (1) | $ | 0.39 | 0.48 | 0.50 | $ | 1.38 | $ | 1.67 | ||||||||||||

| Weighted average shares, diluted | 6,303,282 | 6,289,405 | 6,271,351 | 6,291,775 | 6,276,502 | |||||||||||||||

| Shares outstanding at period end | 6,296,705 | 6,280,406 | 6,260,934 | 6,296,705 | 6,260,934 | |||||||||||||||

| Tangible book value per share at period end (1) | $ | 19.37 | $ | 18.59 | $ | 17.38 | $ | 19.37 | $ | 17.38 | ||||||||||

| Cash dividends | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | 0.45 | $ | 0.45 | ||||||||||

| Key Performance Ratios | ||||||||||||||||||||

| Return on average assets | 0.62 | % | 0.68 | % | 0.91 | % | 0.73 | % | 1.03 | % | ||||||||||

| Adjusted return on average assets (1) | 0.67 | % | 0.84 | % | 0.91 | % | 0.80 | % | 1.03 | % | ||||||||||

| Return on average equity | 7.28 | % | 8.31 | % | 10.96 | % | 8.84 | % | 12.57 | % | ||||||||||

| Adjusted return on average equity (1) | 7.93 | % | 10.23 | % | 10.96 | % | 9.70 | % | 12.57 | % | ||||||||||

| Net interest margin(1) | 3.43 | % | 3.40 | % | 3.35 | % | 3.36 | % | 3.44 | % | ||||||||||

| Efficiency ratio (1) | 67.95 | % | 70.65 | % | 70.67 | % | 68.05 | % | 68.17 | % | ||||||||||

| Average Balances | ||||||||||||||||||||

| Average assets | $ | 1,449,185 | $ | 1,448,478 | $ | 1,355,113 | $ | 1,441,965 | $ | 1,360,154 | ||||||||||

| Average earning assets | 1,374,566 | 1,370,187 | 1,275,111 | 1,366,639 | 1,278,135 | |||||||||||||||

| Average shareholders’ equity | 122,802 | 118,255 | 112,987 | 119,303 | 111,460 | |||||||||||||||

| Asset Quality | ||||||||||||||||||||

| Loan charge-offs | $ | 1,667 | $ | 521 | $ | 143 | $ | 2,601 | $ | 1,228 | ||||||||||

| Loan recoveries | 95 | 39 | 60 | 185 | 326 | |||||||||||||||

| Net charge-offs | 1,572 | 482 | 83 | 2,416 | 902 | |||||||||||||||

| Non-accrual loans | 5,929 | 8,549 | 3,116 | 5,929 | 3,116 | |||||||||||||||

| Other real estate owned, net | 56 | — | — | 56 | — | |||||||||||||||

| Nonperforming assets (5) | 5,985 | 8,549 | 3,116 | 5,985 | 3,116 | |||||||||||||||

| Loans 30 to 89 days past due, accruing | 2,358 | 2,399 | 1,395 | 2,358 | 1,395 | |||||||||||||||

| Loans over 90 days past due, accruing | — | — | 370 | — | 370 | |||||||||||||||

| Special mention loans | 516 | 1,380 | — | 516 | — | |||||||||||||||

| Substandard loans, accruing | 1,713 | 279 | 1,683 | 1,713 | 1,683 | |||||||||||||||

| Capital Ratios (2) | ||||||||||||||||||||

| Total capital | $ | 148,477 | $ | 147,500 | $ | 146,163 | $ | 148,477 | $ | 146,163 | ||||||||||

| Tier 1 capital | 135,490 | 134,451 | 136,947 | 135,490 | 136,947 | |||||||||||||||

| Common equity Tier 1 capital | 135,490 | 134,451 | 136,947 | 135,490 | 136,947 | |||||||||||||||

| Total capital to risk-weighted assets | 14.29 | % | 14.13 | % | 14.80 | % | 14.29 | % | 14.80 | % | ||||||||||

| Tier 1 capital to risk-weighted assets | 13.04 | % | 12.88 | % | 13.86 | % | 13.04 | % | 13.86 | % | ||||||||||

| Common equity Tier 1 capital to risk-weighted assets | 13.04 | % | 12.88 | % | 13.86 | % | 13.04 | % | 13.86 | % | ||||||||||

| Leverage ratio | 9.23 | % | 9.17 | % | 9.97 | % | 9.23 | % | 9.97 | % | ||||||||||

FIRST NATIONAL CORPORATION

Performance Summary

(in thousands, except share and per share data)

(unaudited)

| For the Period Ended | ||||||||||||||||||||

| Sept 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sept 30, 2023 | ||||||||||||||||

| Balance Sheet | ||||||||||||||||||||

| Cash and due from banks | $ | 18,197 | $ | 16,729 | $ | 14,476 | $ | 17,194 | $ | 17,168 | ||||||||||

| Interest-bearing deposits in banks | 108,319 | 118,906 | 124,232 | 69,967 | 32,931 | |||||||||||||||

| Cash and cash equivalents | $ | 126,516 | $ | 135,635 | $ | 138,708 | $ | 87,161 | $ | 50,099 | ||||||||||

| Securities available for sale, at fair value | 146,013 | 144,816 | 147,675 | 152,857 | 148,175 | |||||||||||||||

| Securities held to maturity, at amortized cost (net of allowance for credit losses) | 121,425 | 123,497 | 125,825 | 148,244 | 149,948 | |||||||||||||||

| Restricted securities, at cost | 2,112 | 2,112 | 2,112 | 2,078 | 2,077 | |||||||||||||||

| Loans, net of allowance for credit losses | 982,016 | 977,423 | 960,371 | 957,456 | 943,603 | |||||||||||||||

| Other real estate owned, net | 56 | — | — | — | — | |||||||||||||||

| Premises and equipment, net | 22,960 | 22,205 | 21,993 | 22,142 | 21,363 | |||||||||||||||

| Accrued interest receivable | 4,794 | 4,916 | 4,978 | 4,655 | 4,502 | |||||||||||||||

| Bank owned life insurance | 24,992 | 24,802 | 24,652 | 24,902 | 24,734 | |||||||||||||||

| Goodwill | 3,030 | 3,030 | 3,030 | 3,030 | 3,030 | |||||||||||||||

| Core deposit intangibles, net | 104 | 108 | 113 | 117 | 122 | |||||||||||||||

| Other assets | 16,698 | 18,984 | 17,738 | 16,653 | 18,567 | |||||||||||||||

| Total assets | $ | 1,450,716 | $ | 1,457,528 | $ | 1,447,195 | $ | 1,419,295 | $ | 1,366,220 | ||||||||||

| Noninterest-bearing demand deposits | $ | 383,400 | $ | 397,770 | $ | 384,092 | $ | 379,208 | $ | 403,774 | ||||||||||

| Savings and interest-bearing demand deposits | 663,925 | 665,208 | 677,458 | 662,169 | 646,980 | |||||||||||||||

| Time deposits | 205,930 | 202,818 | 197,587 | 192,349 | 184,419 | |||||||||||||||

| Total deposits | $ | 1,253,255 | $ | 1,265,796 | $ | 1,259,137 | $ | 1,233,726 | $ | 1,235,173 | ||||||||||

| Other borrowings | 50,000 | 50,000 | 50,000 | 50,000 | — | |||||||||||||||

| Subordinated debt, net | 4,999 | 4,998 | 4,998 | 4,997 | 4,997 | |||||||||||||||

| Junior subordinated debt | 9,279 | 9,279 | 9,279 | 9,279 | 9,279 | |||||||||||||||

| Accrued interest payable and other liabilities | 8,068 | 7,564 | 5,965 | 5,022 | 4,792 | |||||||||||||||

| Total liabilities | $ | 1,325,601 | $ | 1,337,637 | $ | 1,329,379 | $ | 1,303,024 | $ | 1,254,241 | ||||||||||

| Preferred stock | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Common stock | 7,871 | 7,851 | 7,847 | 7,829 | 7,826 | |||||||||||||||

| Surplus | 33,409 | 33,116 | 33,021 | 32,950 | 32,840 | |||||||||||||||

| Retained earnings | 99,270 | 97,966 | 96,465 | 94,198 | 95,988 | |||||||||||||||

| Accumulated other comprehensive (loss), net | (15,435 | ) | (19,042 | ) | (19,517 | ) | (18,706 | ) | (24,675 | ) | ||||||||||

| Total shareholders’ equity | $ | 125,115 | $ | 119,891 | $ | 117,816 | $ | 116,271 | $ | 111,979 | ||||||||||

| Total liabilities and shareholders’ equity | $ | 1,450,716 | $ | 1,457,528 | $ | 1,447,195 | $ | 1,419,295 | $ | 1,366,220 | ||||||||||

| Loan Data | ||||||||||||||||||||

| Mortgage real estate loans: | ||||||||||||||||||||

| Construction and land development | $ | 61,446 | $ | 60,919 | $ | 53,364 | $ | 52,680 | $ | 50,405 | ||||||||||

| Secured by farmland | 9,099 | 8,911 | 9,079 | 9,154 | 7,113 | |||||||||||||||

| Secured by 1-4 family residential | 351,004 | 346,976 | 347,014 | 344,369 | 340,773 | |||||||||||||||

| Other real estate loans | 440,648 | 440,857 | 436,006 | 438,118 | 426,065 | |||||||||||||||

| Loans to farmers (except those secured by real estate) | 633 | 349 | 332 | 455 | 667 | |||||||||||||||

| Commercial and industrial loans (except those secured by real estate) | 114,190 | 115,951 | 113,230 | 112,619 | 116,463 | |||||||||||||||

| Consumer installment loans | 5,396 | 5,068 | 4,808 | 4,753 | 4,596 | |||||||||||||||

| Deposit overdrafts | 253 | 365 | 251 | 222 | 368 | |||||||||||||||

| All other loans | 12,051 | 10,580 | 8,890 | 7,060 | 6,049 | |||||||||||||||

| Total loans | $ | 994,720 | $ | 989,976 | $ | 972,974 | $ | 969,430 | $ | 952,499 | ||||||||||

| Allowance for credit losses | (12,704 | ) | (12,553 | ) | (12,603 | ) | (11,974 | ) | (8,896 | ) | ||||||||||

| Loans, net | $ | 982,016 | $ | 977,423 | $ | 960,371 | $ | 957,456 | $ | 943,603 | ||||||||||

FIRST NATIONAL CORPORATION

Non-GAAP Reconciliations

(in thousands, except share and per share data)

(unaudited)

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||||||

| Sept 30, 2024 | Jun 30, 2024 | Sept 30, 2023 | Sept 30, 2024 | Sept 30, 2023 | ||||||||||||||||

| Adjusted Net Income | ||||||||||||||||||||

| Net income (GAAP) | $ | 2,248 | $ | 2,442 | $ | 3,121 | $ | 7,899 | $ | 10,475 | ||||||||||

| Add: Merger-related expenses | 219 | 571 | — | 790 | — | |||||||||||||||

| Subtract: Tax effect of adjustment (4) | (19 | ) | (5 | ) | — | (24 | ) | — | ||||||||||||

| Adjusted net income (non-GAAP) | $ | 2,448 | $ | 3,008 | $ | 3,121 | $ | 8,665 | $ | 10,475 | ||||||||||

| Adjusted Earnings Per Share, Basic | ||||||||||||||||||||

| Weighted average shares, basic | 6,287,997 | 6,278,113 | 6,256,663 | 6,278,668 | 6,266,707 | |||||||||||||||

| Basic earnings per share (GAAP) | $ | 0.36 | $ | 0.39 | $ | 0.50 | $ | 1.26 | $ | 1.67 | ||||||||||

| Adjusted earnings per share, basic (Non-GAAP) | $ | 0.39 | $ | 0.48 | $ | 0.50 | $ | 1.38 | $ | 1.67 | ||||||||||

| Adjusted Earnings Per Share, Diluted | ||||||||||||||||||||

| Weighted average shares, diluted | 6,303,282 | 6,289,405 | 6,271,351 | 6,291,775 | 6,276,502 | |||||||||||||||

| Diluted earnings per share (GAAP) | $ | 0.36 | $ | 0.39 | $ | 0.50 | $ | 1.26 | $ | 1.67 | ||||||||||

| Adjusted diluted earnings per share (Non-GAAP) | $ | 0.39 | $ | 0.48 | $ | 0.50 | $ | 1.38 | $ | 1.67 | ||||||||||

| Adjusted Pre-Provision, Pre-Tax Earnings | ||||||||||||||||||||

| Net interest income | $ | 11,749 | $ | 11,494 | $ | 10,683 | $ | 34,093 | $ | 32,604 | ||||||||||

| Total noninterest income | 3,203 | 2,686 | 3,053 | 9,936 | 8,715 | |||||||||||||||

| Net revenue | $ | 14,952 | $ | 14,180 | $ | 13,736 | $ | 44,029 | $ | 41,319 | ||||||||||

| Total noninterest expense | 10,459 | 10,659 | 9,784 | 31,005 | 28,142 | |||||||||||||||

| Pre-provision, pre-tax earnings | $ | 4,493 | $ | 3,521 | $ | 3,952 | $ | 13,024 | $ | 13,177 | ||||||||||

| Add: Merger expenses | 219 | 571 | – | 790 | – | |||||||||||||||

| Adjusted pre-provision, pre-tax, earnings | $ | 4,712 | $ | 4,092 | $ | 3,952 | $ | 13,814 | $ | 13,177 | ||||||||||

| Adjusted Performance Ratios | ||||||||||||||||||||

| Average assets | $ | 1,449,264 | $ | 1,448,478 | $ | 1,355,178 | $ | 1,441,996 | $ | 1,360,154 | ||||||||||

| Return on average assets (GAAP) | 0.62 | % | 0.68 | % | 0.91 | % | 0.73 | % | 1.03 | % | ||||||||||

| Adjusted return on average assets (Non-GAAP) | 0.67 | % | 0.84 | % | 0.91 | % | 0.80 | % | 1.03 | % | ||||||||||

| Average shareholders’ equity | $ | 122,802 | $ | 118,255 | 11,309 | $ | 119,303 | $ | 111,460 | |||||||||||

| Return on average equity (GAAP) | 7.28 | % | 8.31 | % | 10.96 | % | 8.87 | % | 12.57 | % | ||||||||||

| Adjusted return on average equity (Non-GAAP) | 7.93 | % | 10.23 | % | 10.96 | % | 9.70 | % | 12.57 | % | ||||||||||

| Pre-provision, pre-tax return on average assets | 1.23 | % | 0.98 | % | 1.16 | % | 1.21 | % | 1.30 | % | ||||||||||

| Adjusted pre-provision, pre-tax return on average assets | 1.29 | % | 1.14 | % | 1.16 | % | 1.28 | % | 1.30 | % | ||||||||||

| Net Interest Margin | ||||||||||||||||||||

| Tax-equivalent net interest income | $ | 11,842 | $ | 11,587 | $ | 10,764 | $ | 34,360 | $ | 32,848 | ||||||||||

| Average earning assets | 1,374,566 | 1,370,187 | 1,275,111 | 1,366,639 | 1,278,136 | |||||||||||||||

| Net interest margin | 3.43 | % | 3.40 | % | 3.35 | % | 3.36 | % | 3.44 | % | ||||||||||

FIRST NATIONAL CORPORATION

Non-GAAP Reconciliations

(in thousands, except share and per share data)

(unaudited)

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||

| Sept 30, 2024 | June 30, 2024 | Sept 30, 2023 | Sept 30, 2024 | Sept 30, 2023 | |||||||||||||||||||||||

| Efficiency Ratio | |||||||||||||||||||||||||||

| Total noninterest expense | $ | 10,459 | $ | 10,659 | $ | 9,784 | $ | 31,005 | $ | 28,142 | |||||||||||||||||

| Add: other real estate owned income, net | (10 | ) | — | (15 | ) | (10 | ) | 201 | |||||||||||||||||||

| Subtract: amortization of intangibles | (4 | ) | (4 | ) | (5 | ) | (13 | ) | (14 | ) | |||||||||||||||||

| Subtract: loss on disposal of premises and equipment, net | (2 | ) | — | — | (50 | ) | — | ||||||||||||||||||||

| Subtract: merger expenses | (219 | ) | (571 | ) | — | (790 | ) | — | |||||||||||||||||||

| Subtotal | $ | 10,224 | $ | 10,084 | $ | 9,764 | $ | 30,142 | $ | 28,329 | |||||||||||||||||

| Tax-equivalent net interest income | $ | 11,842 | $ | 11,587 | $ | 10,764 | $ | 34,360 | $ | 32,848 | |||||||||||||||||

| Total noninterest income | 3,203 | 2,686 | 3,053 | 9,936 | 8,715 | ||||||||||||||||||||||

| Subtotal | $ | 15,045 | $ | 14,273 | $ | 13,817 | $ | 44,296 | $ | 41,563 | |||||||||||||||||

| Efficiency ratio | 67.95 | % | 70.65 | % | 70.67 | % | 68.05 | % | 68.16 | % | |||||||||||||||||

| Tax-Equivalent Net Interest Income | ||||||||||||||||||||

| GAAP measures: | ||||||||||||||||||||

| Interest income – loans | $ | 14,479 | $ | 14,004 | $ | 12,640 | $ | 41,967 | $ | 36,038 | ||||||||||

| Interest income – investments and other | 2,965 | 3,051 | 1,991 | 8,866 | 6,407 | |||||||||||||||

| Interest expense – deposits | (4,958 | ) | (4,820 | ) | (3,810 | ) | (14,549 | ) | (9,428 | ) | ||||||||||

| Interest expense – subordinated debt | (69 | ) | (69 | ) | (69 | ) | (207 | ) | (207 | ) | ||||||||||

| Interest expense – junior subordinated debt | (68 | ) | (66 | ) | (69 | ) | (202 | ) | (203 | ) | ||||||||||

| Interest expense – other borrowings | (600 | ) | (606 | ) | – | (1,782 | ) | (3 | ) | |||||||||||

| Net interest income | $ | 11,749 | $ | 11,494 | $ | 10,683 | $ | 34,093 | $ | 32,604 | ||||||||||

| Non-GAAP measures: | ||||||||||||||||||||

| Add: Tax benefit realized on non-taxable interest income – loans (4) | $ | 13 | $ | 12 | $ | — | $ | 25 | $ | — | ||||||||||

| Add: Tax benefit realized on non-taxable interest income – municipal securities (4) | 80 | 81 | 81 | 242 | 244 | |||||||||||||||

| Tax benefit realized on non-taxable interest income | $ | 93 | $ | 93 | $ | 81 | $ | 267 | $ | 244 | ||||||||||

| Tax-equivalent net interest income | $ | 11,842 | $ | 11,587 | $ | 10,764 | $ | 34,360 | $ | 32,848 | ||||||||||

| Tangible Common Equity and Tangible Assets | ||||||||||||||||||||

| Total assets (GAAP) | $ | 1,450,716 | $ | 1,457,528 | $ | 1,366,220 | $ | 1,451,032 | $ | 1,366,220 | ||||||||||

| Subtract: goodwill | (3,030 | ) | (3,030 | ) | (3,030 | ) | (3,030 | ) | (3,030 | ) | ||||||||||

| Subtract: core deposit intangibles, net | (104 | ) | (108 | ) | (122 | ) | (104 | ) | (122 | ) | ||||||||||

| Tangible assets (Non-GAAP) | $ | 1,447,582 | $ | 1,454,390 | $ | 1,363,068 | $ | 1,447,898 | $ | 1,363,068 | ||||||||||

| Total shareholders’ equity (GAAP) | $ | 125,115 | $ | 119,891 | $ | 111,979 | $ | 125,115 | $ | 111,979 | ||||||||||

| Subtract: goodwill | (3,030 | ) | (3,030 | ) | (3,030 | ) | (3,030 | ) | (3,030 | ) | ||||||||||

| Subtract: core deposit intangibles, net | (104 | ) | (108 | ) | (122 | ) | (104 | ) | (122 | ) | ||||||||||

| Tangible common equity (Non-GAAP) | $ | 121,981 | $ | 116,753 | $ | 108,827 | $ | 121,981 | $ | 108,827 | ||||||||||

| Tangible common equity to tangible assets ratio | 8.43 | % | 8.03 | % | 8.00 | % | 8.43 | % | 8.00 | % | ||||||||||

FIRST NATIONAL CORPORATION

Non-GAAP Reconciliations

(in thousands, except share and per share data)

(unaudited)

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||||||||

| Sept 30, 2024 | June 30, 2024 | Sept 30, 2023 | Sept 30, 2024 | Sept 30, 2023 | ||||||||||||||||||

| Tangible Book Value Per Share | ||||||||||||||||||||||

| Tangible common equity | $ | 121,981 | $ | 116,753 | $ | 108,827 | $ | 121,981 | $ | 108,827 | ||||||||||||

| Common shares outstanding, ending | 6,296,705 | 6,280,406 | 6,260,934 | 6,296,705 | 6,260,934 | |||||||||||||||||

| Tangible book value per share | $ | 19.37 | $ | 18.59 | $ | 17.38 | $ | 19.37 | $ | 17.38 | ||||||||||||

(1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” and “Non-GAAP Reconciliations” for additional information and detailed calculations of adjustments.

(2) Capital ratios are for First Bank.

(3) Capital ratios presented are for First National Corporation.

(4) The tax rate utilized in calculating the tax benefit is 21%. Certain merger-related expenses are non-deductible.

(5) Nonperforming assets are comprised of nonaccrual loans and other real estate owned.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ORIC® Pharmaceuticals Reports Inducement Grants under Nasdaq Listing Rule 5635(c)(4)

SOUTH SAN FRANCISCO, Calif. and SAN DIEGO, Nov. 01, 2024 (GLOBE NEWSWIRE) — ORIC Pharmaceuticals, Inc. ORIC, a clinical stage oncology company focused on developing treatments that address mechanisms of therapeutic resistance, today announced that on November 1, 2024 (the “Grant Date”), ORIC granted a total of 61,800 non-qualified stock options and 10,400 restricted stock units to two new non-executive employees who began their employment with ORIC in October 2024.

These inducement grants were granted pursuant to the ORIC Pharmaceuticals, Inc. 2022 Inducement Equity Incentive Plan, subject to recipient’s continued employment or service through each applicable vesting date. The stock options have an exercise price equal to the closing price of ORIC’s common stock on the Grant Date. Twenty-five percent (25%) of the shares subject to the stock options will vest on the one (1) year anniversary of the Grant Date, with one thirty-sixth (1/36th) of the remaining shares vesting each one-month period thereafter. One-third (1/3rd) of the restricted stock units will vest on each of the first three anniversaries of the Grant Date. The inducement grants are subject to the terms and conditions of the applicable stock option and restricted stock unit agreements and the ORIC Pharmaceuticals, Inc. 2022 Inducement Equity Incentive Plan.

The inducement grants were approved by ORIC’s Compensation Committee of the Board of Directors, as required by Nasdaq Rule 5635(c)(4), and were granted as a material inducement to employment in accordance with Nasdaq Rule 5635(c)(4).

About ORIC Pharmaceuticals, Inc.

ORIC Pharmaceuticals is a clinical stage biopharmaceutical company dedicated to improving patients’ lives by Overcoming Resistance In Cancer. ORIC’s clinical stage product candidates include (1) ORIC-114, a brain penetrant inhibitor that selectively targets EGFR exon 20, HER2 exon 20 and EGFR atypical mutations, being developed across multiple genetically defined cancers, (2) ORIC-944, an allosteric inhibitor of the polycomb repressive complex 2 (PRC2) via the EED subunit, being developed for prostate cancer, and (3) ORIC-533, an orally bioavailable small molecule inhibitor of CD73, a key node in the adenosine pathway believed to play a central role in resistance to chemotherapy- and immunotherapy-based treatment regimens, being developed for multiple myeloma. Beyond these three product candidates, ORIC® is also developing multiple precision medicines targeting other hallmark cancer resistance mechanisms. ORIC has offices in South San Francisco and San Diego, California. For more information, please go to www.oricpharma.com, and follow us on X or LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements in this press release that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things, statements regarding the vesting of the inducement grants; target indications for ORIC’s product candidates; the potential advantages of ORIC’s product candidates; and plans underlying ORIC’s clinical trials and development. Words such as “believes,” “anticipates,” “plans,” “expects,” “intends,” “will,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements. The forward-looking statements contained herein are based upon ORIC’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results could differ materially from those projected in any forward-looking statements due to numerous risks and uncertainties, including but not limited to: risks associated with the process of discovering, developing and commercializing drugs that are safe and effective for use as human therapeutics and operating as an early clinical stage company; ORIC’s ability to develop, initiate or complete preclinical studies and clinical trials for, obtain approvals for and commercialize any of its product candidates; changes in ORIC’s plans to develop and commercialize its product candidates; the potential for clinical trials of ORIC’s product candidates to differ from preclinical, initial, interim, preliminary or expected results; negative impacts of health emergencies, economic instability or international conflicts on ORIC’s operations, including clinical trials; the risk of the occurrence of any event, change or other circumstance that could give rise to the termination of ORIC’s license and collaboration agreements; the potential market for our product candidates, and the progress and success of competing therapeutics currently available or in development; ORIC’s ability to raise any additional funding it will need to continue to pursue its business and product development plans; regulatory developments in the United States and foreign countries; ORIC’s reliance on third parties, including contract manufacturers and contract research organizations; ORIC’s ability to obtain and maintain intellectual property protection for its product candidates; the loss of key scientific or management personnel; competition in the industry in which ORIC operates; general economic and market conditions; and other risks. Information regarding the foregoing and additional risks may be found in the section titled “Risk Factors” in ORIC’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on August 12, 2024, and ORIC’s future reports to be filed with the SEC. These forward-looking statements are made as of the date of this press release, and ORIC assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law.

Contact:

Dominic Piscitelli, Chief Financial Officer

dominic.piscitelli@oricpharma.com

info@oricpharma.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Volatility Soars Ahead Of Elections, Tech Earnings Mixed, Strikes And Hurricanes Knock Employment Down: This Week In The Markets

The U.S. stock market experienced a setback at the end of October, breaking a five-month winning streak as election uncertainties and mixed tech earnings dampened risk sentiment.

A key measure of market turbulence, the CBOE Volatility Index, or VIX, surged by 34% last month, marking the third-largest increase for an October in an election year.

Tech giants’ earnings were underwhelming, except for Alphabet Inc. GOOGL and Amazon.com Inc. AMZN. None of the other “Magnificent Seven” companies posted positive weekly performance. As a result, the Roundhill Magnificent Seven ETF MAGS fell nearly 2% for the week. This marks the worst weekly performance in two months.

Among mega-cap companies, the top performers for the week were Charter Communications Inc. CHTR and Booking Holdings Inc. BKNG, both rising approximately 9%. Booking also marked the strongest weekly gains since August 2022.

The main laggards were Advanced Micro Devices Inc. AMD and Eli Lilly and Company LLY, down 9% and 8%, respectively, for the week.

On the macroeconomic front, the U.S. economy saw a surprising slowdown in job growth in October, with nonfarm payrolls increasing by just 12,000—nearly a four-year low and well below the expected 113,000.

Factors such as hurricanes and strikes likely contributed to the hiring slowdown, while unemployment held relatively steady, indicating no significant rise in layoffs.

The labor market report has strengthened expectations for Federal Reserve rate cuts. Markets are fully pricing in a 25-basis-point cut at Thursday’s meeting and assigning an 85% probability to a similar cut at the Fed’s final meeting of the year in of December.

State Betting Odds

As the 2024 U.S. presidential election approaches, state-by-state betting odds reveal a tight race between Donald Trump and Kamala Harris, with key battleground states like Pennsylvania, Michigan, and Arizona showing narrow margins, making them pivotal in the final outcome.

Gold ETF Surge

The SPDR Gold Trust GLD saw $1.8 billion in inflows during October, its highest in over two years. Rising investment demand continues pushing gold toward record highs as investors turn to this safe-haven asset at a time of political upheaval and fiscal uncertainty.

Ford Halts F-150 Lightning Production

Ford Motor Co. F is pausing F-150 Lightning production from Nov. 18 to Jan. 6, responding to Tesla Inc. TSLA‘s Cybertruck sales surge. The move aims to recalibrate production with demand and improve profitability for the Michigan-based automaker.

Now Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Gainers And Losers From November 1, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Chubb Announces Estimated Net Losses for Hurricane Milton of $250-300 Million Pre-Tax and $208-250 Million After-Tax

ZURICH, Nov. 1, 2024 /PRNewswire/ — Chubb Limited CB today announces losses in the fourth quarter of 2024 attributable to Hurricane Milton are estimated to be $250-300 million pre-tax and $208-250 million after-tax, net of reinsurance and including reinstatement premiums.

These estimates include losses generated from the company’s commercial and personal property and casualty insurance businesses as well as its reinsurance operations.

About Chubb

Chubb is a world leader in insurance. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. The company is defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange CB and is a component of the S&P 500 index. Chubb employs approximately 40,000 people worldwide. Additional information can be found at: www.chubb.com.

Cautionary Statement Regarding Forward-Looking Statements:

Forward-looking statements made in this press release related to losses reflect Chubb Limited’s current preliminary views with respect to future events, and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties, which may cause actual results and accounting determinations to differ from those set forth in these statements. The forward-looking statements could be affected by the number of insureds and ceding companies impacted by the relevant catastrophe, the amount and timing of losses actually incurred and reported by insureds, the preliminary nature of reports and estimates of loss to date, impact on the company’s reinsurers, the amount and timing of reinsurance recoverable actually received, coverage and regulatory issues, and other factors identified in the company’s filings with the Securities and Exchange Commission, among other things. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/chubb-announces-estimated-net-losses-for-hurricane-milton-of-250-300-million-pre-tax-and-208-250-million-after-tax-302294502.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/chubb-announces-estimated-net-losses-for-hurricane-milton-of-250-300-million-pre-tax-and-208-250-million-after-tax-302294502.html

SOURCE Chubb Limited

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.