These Analysts Increase Their Forecasts On Universal Technical Institute After Strong Earnings

Universal Technical Institute, Inc. UTI reported better-than-expected earnings for its fourth quarter on Wednesday.

The company posted quarterly earnings of 34 cents per share which beat the analyst consensus estimate of 30 cents per share. The company reported quarterly sales of $196.36 million which beat the analyst consensus estimate of $191.39 million.

“We concluded the first stage of our North Star Strategy in fiscal 2024 achieving both strong results and momentum,” said Jerome Grant, CEO of Universal Technical Institute, Inc. “We met or exceeded guidance across all key metrics with full year revenue and adjusted EBITDA increasing over 21% and 60% year-over-year, respectively. These results reflect our consistent execution on the growth, diversification, and optimization tenets of our strategic plan as we continue ramping newly launched programs across both divisions, while further improving margins through workforce and facilities optimization.

Universal Technical Institute said it sees FY25 earnings of 93 cents to $1.01 per share on revenue of $800 million to $815 million.

Universal Technical Institute shares jumped 20.3% to trade at $23.92 on Thursday.

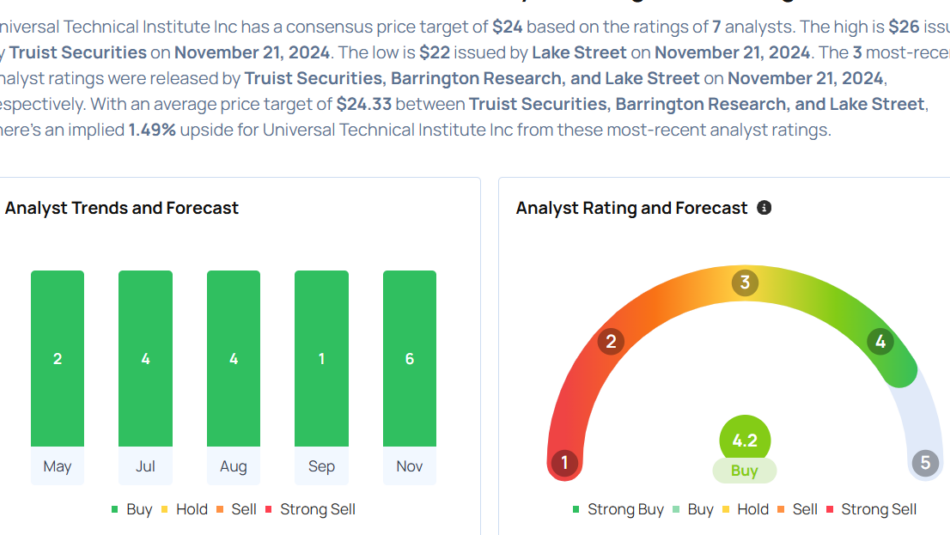

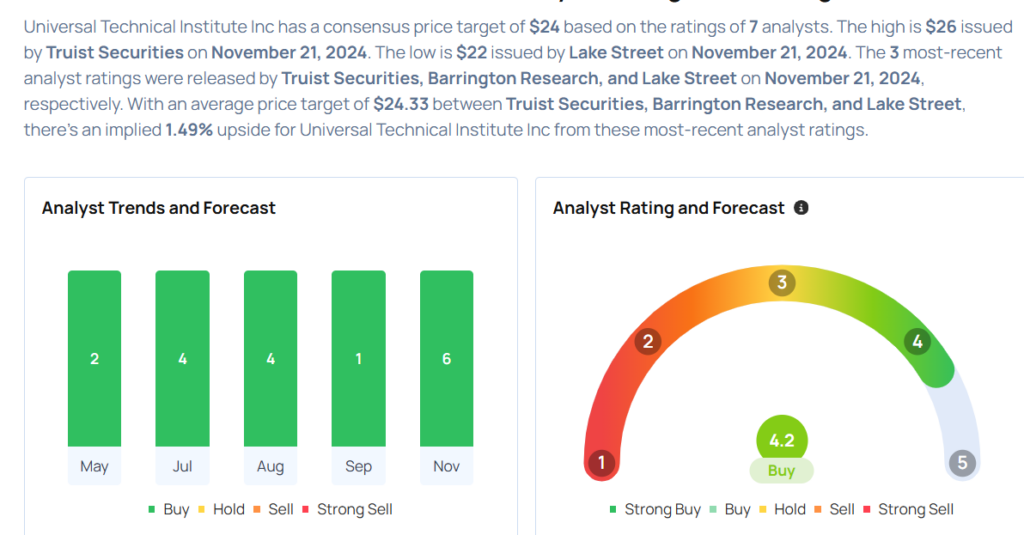

These analysts made changes to their price targets on Universal Technical Institute following earnings announcement.

- Lake Street analyst Eric Martinuzzi maintained Universal Technical with a Buy and raised the price target from $19 to $22.

- Barrington Research analyst Alexander Paris maintained the stock with an Outperform rating and raised the price target from $22 to $25.

- Truist Securities analyst Jasper Bibb maintained Universal Technical with a Buy and raised the price target from $22 to $26.

Considering buying UTI stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Analysts Boost Their Forecasts On Wix.com After Upbeat Earnings

Wix.com Ltd WIX reported better-than-expected fiscal third-quarter 2024 results on Wednesday.

Revenue grew 13% year over year to $444.7 million, beating the analyst consensus estimate of $444.0 million. Adjusted EPS of $1.50 beat the analyst consensus estimate of $1.43.

Wix.com expects fiscal 2024 revenue of $1.757 billion—$1.764 billion(prior $1.747 billion—$1.761 billion) vs. the consensus of $1.76 billion. Wix.com projects 2024 bookings of $1.822 billion—$1.832 billion(prior$1.802 billion—$1.822 billion).

The company expects to generate free cash flow, excluding headquarters costs, of $483 million—$488 million(prior view $460 million—$470 million). Wix.com expects fourth-quarter revenue of $457 million—$464 million versus consensus $457.08 million.

Wix.com shares gained 3.6% to trade at $217.76 on Thursday.

These analysts made changes to their price targets on Wix.com following earnings announcement.

- Piper Sandler analyst Clarke Jeffries maintained Wix.com with an Overweight rating and raised the price target from $200 to $249.

- Cantor Fitzgerald analyst Deepak Mathivanan maintained the stock with an Overweight and raised the price target from $200 to $240.

- RBC Capital analyst Brad Erickson maintained Wix.com with an Outperform and raised the price target from $190 to $245.

- Benchmark analyst Mark Zgutowicz maintained the stock with a Buy and raised the price target from $225 to $250.

- B. Riley Securities analyst Naved Khan maintained Wix.com with a Buy and raised the price target from $190 to $220.

Considering buying WIX stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Small Caps Rally, Alphabet Plummets, Bitcoin Flirts With $100,000: What's Driving Markets Thursday?

Wall Street witnessed a positive momentum on Thursday as investor risk appetite remained resilient despite escalating geopolitical tensions in Europe. The market brushed off concerns following a Russian missile strike on a Ukrainian military facility overnight, which came in response to Ukrainian missile attacks earlier this week.

Russian President Vladimir Putin, in a televised address on Thursday, stated that after the use of long-range missiles from Ukraine, “the regional conflict gained elements of global one.”

Major U.S. indices traded higher by midday trading in New York, with standout performances among blue-chip stocks and small-cap equities.

The Dow Jones Industrial Average surged 500 points, reaching 43,965, marking a 1.3% gain and its strongest session in over two weeks.

The Russell 2000 outperformed with a 1.7% jump, setting up its best day since the post-election rally.

In contrast, the Nasdaq 100 lagged slightly, rising 0.5%. Nvidia Corp. NVDA, despite higher-than-expected earnings, failed to spark broader optimism in the tech sector. Meanwhile, shares of Alphabet Inc. GOOGLGOOG tumbled nearly 6% after the Department of Justice (DOJ) mandated the sale of Google Chrome aimed at curbing Google’s dominant position in search and digital advertising.

Geopolitical uncertainties drove strong gains in the commodities market. Natural gas Henry Hub prices soared 5%, bringing year-to-date gains to over 50% and marking the best monthly performance since July 2022. Crude oil prices also climbed 0.9%, supported by supply concerns.

Gold extended its winning streak, rising 0.7% for its fourth consecutive session of gains as investors sought safe-haven assets.

Bitcoin BTC/USD continued its rally, rising over 3% and hitting an intraday high of $98,367. The largest cryptocurrency now hovers tantalizingly close to the $100,000 milestone.

| Major Indices | Price | 1-day % chg |

| Russell 2000 | 2,365.25 | 1.7% |

| Dow Jones | 43,965.39 | 1.3% |

| S&P 500 | 5,949.37 | 0.5% |

| Nasdaq 100 | 20,739.86 | 0.4% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.6% to $593.78.

- The SPDR Dow Jones Industrial Average DIA rose 1.3% to $439.81.

- The tech-heavy Invesco QQQ Trust Series QQQ rose 0.3% to $504.89.

- The iShares Russell 2000 ETF IWM soared 1.7% to $234.91.

- The Financial Sector Select Sector SPDR Fund XLF outperformed, rising 1.6%. The Communication Services Select Sector SPDR Fund XLC lagged, down 0.5%.

- Nvidia Corp. fell 0.6% despite surpassing Street’s consensus estimates on both earnings per share and revenue during the third quarter. Analysts have raised price targets with Wedbush at $175, Baird at $195 and Barclays at $160.

- Despite the dismal reaction by Nvidia, semiconductor stocks, as tracked by the iShares Semiconductor ETF SOXX rose 1.9%. Major gainers on Thursday were Micron Technology Inc. MU, up 4.7%; Marvell Technology Inc. MRVL, up 3.9% and Applied Materials Inc. AMAT, up 3.7%.

- PDD Holdings Inc. – ADR PDD tumbled nearly 10% after missing earnings and revenue estimates.

- Other stocks reacting to earnings included Deere & Co DE, up 8.8%; Warner Music Group Corp. WMG, down 8%; Palo Alto Networks Inc. PANW, up 1.4% and Snowflake Inc. SNOW, up 32%.

- Companies slated to report their earnings after the close include Intuit Inc. INTU, Copart Inc. CPRT, Ross Stores Inc. ROSS and NetApp Inc. NTAP.

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's Post-Earnings Jitters: Can NVDA Stock Regain Its AI-Fueled Momentum?

Despite the stellar numbers in its latest earnings report, Nvidia Corp NVDA stock slipped 3% in after-hours trading on Wednesday.

In premarket Thursday, Nvidia shares swung between gains and losses, ultimately opening 5% higher before losing steam.

By mid-morning, Nvidia shares were down 1.23%, trading at $144.10—a move many attribute to the priced-for-perfection environment surrounding the AI giant. It seems the market’s insatiable appetite for upside surprises left even Nvidia’s blockbuster results struggling to impress.

Nvidia Stock’s Underlying Resilience

The Santa Clara, California-based company reported an 8% beat on earnings per share and a nearly 6% revenue beat compared to estimates. Revenue soared 93.71% year-over-year, reaching $35.1 billion, fueled by the relentless demand for AI chips.

Despite Thursday’s volatile trading, Nvidia’s technical indicators suggest underlying resilience.

Chart created using Benzinga Pro

The stock is trading above its eight-day, 20-day, 50-day and 200-day simple moving averages, signaling a strong bullish foundation:

- 8-day SMA: Nvidia sits at $145.29, above its $145.20 SMA, generating a short-term bullish signal.

- 20-day SMA: The stock’s $145.29 price exceeds the $142.79 average, reinforcing the bullish narrative.

- 50-day SMA: Nvidia’s $145.29 eclipses its 50-day average of $133.52, pointing to solid momentum.

- 200-day SMA: At $110.41, the 200-day average remains far below current levels, reflecting long-term bullish strength.

The MACD (moving average convergence/divergence) indicator also supports a bullish outlook with a reading of 3.19, while the RSI (relative strength index) at 56.51 shows the stock is comfortably neutral, leaving room for further upward movement without triggering overbought alarms.

Can Nvidia Break Free?

Nvidia’s fundamentals remain as robust as its AI ambitions, but the question lingers: Can the stock sustain its high-altitude trajectory amid sky-high expectations?

Investors will be watching closely as Nvidia tries to stabilize after its earnings-induced turbulence.

Read Next:

Image: Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TJX Analysts Increase Their Forecasts After Upbeat Earnings

TJX Companies, Inc. TJX reported better-than-expected earnings for its third quarter on Wednesday.

The company reported third-quarter earnings per share of $1.14 (+11%), beating the street view of $1.09. Quarterly sales of $14.06 billion (+6%) beat the analyst consensus estimate of $13.95 billion.

TJX Companies reported a 3% increase in consolidated comparable store sales at the high end of the company’s plan, driven entirely by higher customer transactions.

“I want to specifically highlight our European team for their strong results, which drove the 7% comp increase at our TJX International division,” said Ernie Herrman, Chief Executive Officer and President of The TJX Companies.

TJX Companies expects fourth-quarter GAAP EPS to be between $1.12 and $1.14, below the consensus estimate of $1.17. For the fourth quarter, the company continues to expect consolidated comparable store sales to be up 2% to 3%.

For FY25, the company revised its GAAP EPS forecast to $4.15 – $4.17, slightly above the prior guidance of $4.09 – $4.13 and in line with the consensus of $4.16. For the full year fiscal 2025, the company continues to expect consolidated comparable store sales to be up 3%

TJX shares fell 0.5% to trade at $119.20 on Thursday.

These analysts made changes to their price targets on TJX following earnings announcement.

- Deutsche Bank analyst Gabriella Carbone maintained TJX with a Buy and raised the price target from $130 to $131.

- Evercore ISI Group analyst Michael Binetti maintained TJX with an Outperform rating and raised the price target from $138 to $142.

- Telsey Advisory Group analyst Dana Telsey maintained the stock with an Outperform rating and maintained a $134 price target.

Considering buying TJX stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

41-Year-Old Retired American Living Off Dividends In The Philippines With Family Shares Stock Portfolio–'Life Is Good. Freedom To Choose'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Rising costs of living and shrinking savings force millions of Americans to consider retiring overseas. Last year, data from the Social Security Administration showed that about 450,000 people received benefits outside the U.S. as of the end of 2021, significantly up from 307,000 in 2008.

Don’t Miss:

Retired in the Philippines For a ‘Fraction’ of U.S. Costs

Earlier this month, an American dividend investor shared his retirement story on /Dividends, a community of over 618,000 income investors on Reddit. The investor, 41, said he retired in the Philippines four years ago “for a fraction” of the costs he was paying back home.

“We own our property. I lost 40 lbs. Our health is great. My wife gardens, we have 10 dogs, we have a rice field – 3 plantings a year. I work around the property tending the fruit-bearing trees. We travel in-country a lot. Life is good. Freedom to choose.”

Earning Monthly Dividend Income After Selling House Back Home

The investor, who said he was married to a 39-year-old Filipino woman, sold his house in the U.S. for about $175,000 and invested in two closed-ended funds. According to the data provided, he was earning about $2,700 a month in dividends from these two funds. He also had a leveraged ETF in his portfolio, which he said was mostly for “capital gains.”

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s a limited time opportunity to invest at $1,000 for only $0.50/share before it closes TONIGHT.

Life in the Philippines – Own Land, Starlink, Driver, Cook and Caretaker

Redditors initially grilled the investor on his choice of risky ETFs and the sustainability of his retirement plan. However, he sounded self-assured and spoke about the quality of life in the Philippines.

“We own over 10,000 sqm of land, gated. We use Starlink. We own two (2) vehicles. We have a staff of three (3) people – live-in driver, cook and caregiver. I’ve been through a bear market already. If living this way is dumb, then here I am. We can compare annually if you want.”

Bitcoin jumps back to $98,000 after SEC announces Gary Gensler will step down

Bitcoin (BTC-USD) rose back above $98,000 to trade near record highs reached earlier on Thursday after the Securities and Exchange Commission announced Chair Gary Gensler will step down effective January 20, the day Donald Trump is scheduled to be sworn into the White House.

The token had surpassed $98,300 in early trading before paring gains as investors remained bullish on pro-crypto policies from the incoming Trump administration.

Bitcoin has soared roughly 40% since the presidential election on Nov. 5, hitting multiple milestones as investors eye targets of $100,000.

Reports of President-elect Donald Trump’s transition team discussing the possibility of a first-ever role for crypto policy also sent the token higher over the past 24 hours.

Bitcoin has been a key component of the Trump trade, as Trump has promised to explore crypto-friendly initiatives, including the creation of a bitcoin national stockpile and the replacement of the Securities and Exchange Commissioner Gary Gensler.

Read more: Bitcoin clears another record: Is this a good time to invest?

Digital asset firm Galaxy Digital (GLXY.TO, BRPHF) CEO Mike Novogratz told Yahoo Finance on Wednesday that whomever Trump chooses to head the SEC will be positive for bitcoin given the “overall pro-crypto attitude” of the president-elect’s team.

“All the guys around the table like our space. They believe in the digital asset world. They believe in blockchains and bitcoin, and so the whole energy of this administration is going to be so different than the Elizabeth Warren, Gary Gensler era,” Novogratz said.

The move higher in bitcoin this week also comes on the heels of a Financial Times report stating that Trump Media & Technology Group (DJT) is in advanced talks to acquire crypto trading company Bakkt (BKKT), a tie-up that could further encourage initiatives within the sector.

Meanwhile, bitcoin spot ETFs have also seen massive inflows in recent weeks.

As Yahoo Finance’s David Hollerith reported earlier this week, BlackRock’s spot bitcoin ETF (IBIT) saw its assets rise by $13 billion in the wake of Trump’s presidential win, according to Yahoo Finance data. This pushed assets in the iShares Bitcoin Trust past $40 billion just 10 months after its launch.

Options tied to IBIT also began trading on the Nasdaq on Tuesday, pushing additional trading activity into the crypto space.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Vice President At Federated Hermes Sells $261K Of Stock

It was reported on November 20, that Paul Uhlman, Vice President at Federated Hermes FHI executed a significant insider sell, according to an SEC filing.

What Happened: Uhlman opted to sell 6,311 shares of Federated Hermes, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $261,200.

As of Thursday morning, Federated Hermes shares are down by 0.0%, currently priced at $41.42.

All You Need to Know About Federated Hermes

Federated Hermes provides asset-management services for institutional and individual investors. The firm had $782.7 billion in managed assets at the end of June 2024, composed of equity (10%), multi-asset (less than 1%), fixed-income (12%), alternative (3%), and money market (75%) funds. The firm’s cash-management operations are expected to generate around 50% of Federated’s revenue this year, compared with 28%, 12%, and 10%, respectively, for the equity, fixed-income, and alternatives/multi-asset operations. The company’s products are distributed via trust banks, wealth managers, and retail broker/dealers (64% of AUM), institutional investors (27%), and international clients (9%).

Understanding the Numbers: Federated Hermes’s Finances

Revenue Growth: Federated Hermes displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 1.44%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 66.7%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Federated Hermes’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 1.06.

Debt Management: With a below-average debt-to-equity ratio of 0.41, Federated Hermes adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 13.11 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 2.08, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Federated Hermes’s EV/EBITDA ratio at 7.75 suggests potential undervaluation, falling below industry averages.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Closer Look at Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Federated Hermes’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

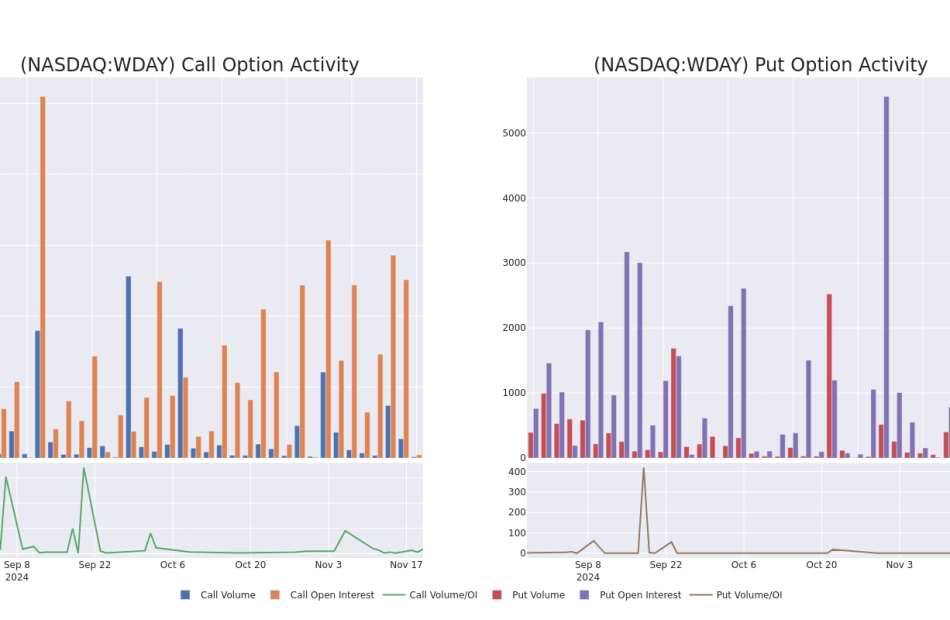

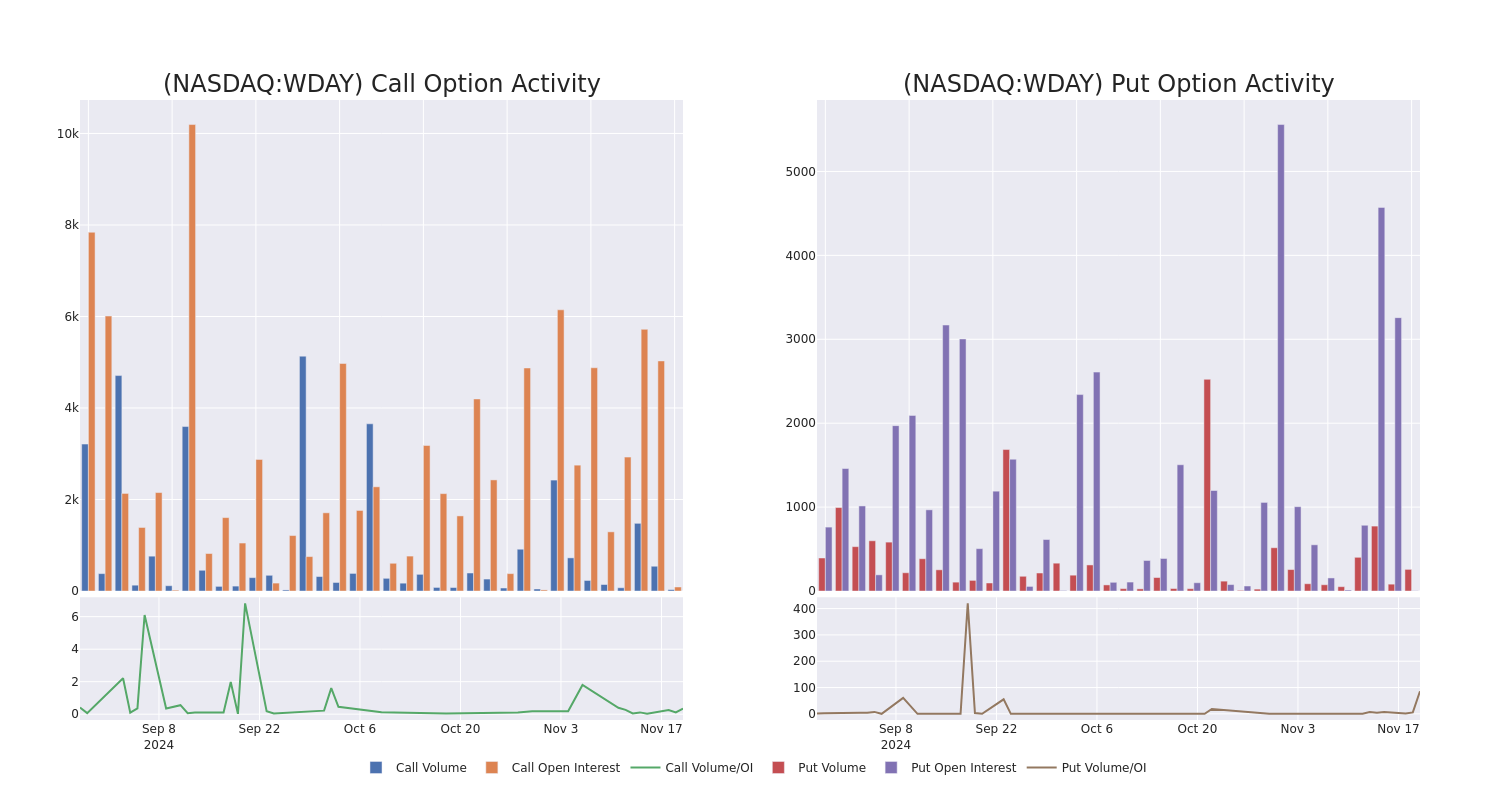

Looking At Workday's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Workday WDAY, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WDAY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Workday. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 33% bearish. Among these notable options, 2 are puts, totaling $244,664, and 7 are calls, amounting to $284,340.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $220.0 to $282.5 for Workday over the recent three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Workday’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday’s whale activity within a strike price range from $220.0 to $282.5 in the last 30 days.

Workday Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | PUT | SWEEP | BULLISH | 12/27/24 | $2.2 | $1.8 | $1.9 | $220.00 | $189.0K | 0 | 0 |

| WDAY | PUT | SWEEP | BULLISH | 12/20/24 | $1.75 | $1.7 | $1.7 | $220.00 | $55.6K | 587 | 275 |

| WDAY | CALL | TRADE | BULLISH | 12/20/24 | $10.3 | $9.9 | $10.2 | $280.00 | $50.9K | 751 | 101 |

| WDAY | CALL | TRADE | BEARISH | 12/20/24 | $9.4 | $9.1 | $9.1 | $280.00 | $45.5K | 751 | 51 |

| WDAY | CALL | TRADE | BULLISH | 12/20/24 | $8.0 | $7.7 | $7.9 | $282.50 | $42.6K | 1 | 54 |

About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

After a thorough review of the options trading surrounding Workday, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Workday

- With a volume of 937,628, the price of WDAY is up 1.34% at $262.92.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 5 days.

What The Experts Say On Workday

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $305.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Scotiabank lowers its rating to Sector Outperform with a new price target of $340.

* An analyst from Loop Capital persists with their Hold rating on Workday, maintaining a target price of $270.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Workday options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Super Micro Computer Stock Is Soaring Today

Super Micro Computer (NASDAQ: SMCI) stock is posting big gains in Thursday’s trading. The company’s share price was up 15.4% as of 1:15 p.m. ET.

Supermicro stock is gaining ground on the heels of Nvidia‘s recently published third-quarter results. Supermicro is one of Nvidia’s largest customers, and the artificial intelligence (AI) leader’s Q3 results, commentary, and forward guidance are sending bullish signals for other AI stocks.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia published its Q3 results after the market closed yesterday and reported sales and earnings for the period that beat Wall Street’s expectations. The company reported non-GAAP (adjusted) earnings per share of $0.81 on revenue of $35.08 billion, beating the average analyst estimate’s call for per-share earnings of $0.75 on revenue of $33.16 billion.

The company also said that it was expecting revenue of roughly $37.5 billion in the fourth quarter, surpassing the average analyst estimate’s call for sales of $37.08 billion in the period. On the heels of 94% year-over-year sales growth in Q3, the company’s guidance for Q4 suggests annual sales growth of roughly 70%.

Nvidia’s strong performance and outlook suggest a favorable demand backdrop for Supermicro. And while some reports have suggested that the GPU leader has been diverting orders from Supermicro in favor of other customers, Nvidia CEO Jensen Huang name-checked the server specialist as one of his company’s “great partners” during its conference call.

Nvidia’s Q3 report and commentary suggest that spending on AI infrastructure continues to be quite strong and will remain so in the near term. The company’s GPUs are the core components of Supermicro’s high-performance AI servers, and its sales performance and forward guidance provide trustworthy bellwethers for the kind of demand backdrop the server specialist is seeing.

On the other hand, there are still questions surrounding Supermicro that make the outlook for its stock unclear. The company was recently able to avoid having its stock delisted from the Nasdaq stock exchange by submitting a filing plan to regain compliance with the Securities and Exchange Commission (SEC).

Ernst & Young resigned as Supermicro’s financial auditor in October due to concerns about the reliability of information from the company’s management and audit committee. BDO has now come on board as the tech specialist’s auditor. With BDO now hired, the company should be able to progress with the filing of its annual 10-K report for its last fiscal year. But there’s still a risk that the stock could be delisted from the Nasdaq — or that previously reported financial results could see significant downward revisions.