Here's Why Energy Transfer Stock Is a Buy Before Nov. 6

It’s important to take the long-term view when investing. You should think in terms of years and decades, not months and days. However, it’s also wise to keep an eye on the calendar before investing to get ahead of a potential catalyst.

Those interested in buying midstream giant Energy Transfer (NYSE: ET) should circle Nov. 6 on their calendar. It’s an important date for the master limited partnership (MLP) because it precedes the company’s next earnings report and distribution payment. Here’s why investors might want to buy before that date.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Energy Transfer will report its third-quarter earnings after the market closes on Nov. 6. The midstream giant will likely report strong results.

The company is coming off an excellent second quarter. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) jumped 20% to $3.8 billion, while its distributable cash flow soared 32% to $2 billion. The MLP delivered record volumes across several segments, fueled by strong market conditions, recently completed expansion projects, and acquisitions.

That strong momentum likely flowed into the third quarter. Energy Transfer should continue to benefit from its needle-moving merger with Crestwood Equity Partners, which closed last November. In addition, it should continue to get a boost from recently completed expansion projects, including two new ones that started service in July, which should impact its results in the third quarter. And the company closed its highly accretive $3.1 billion acquisition of WTG Midstream in July.

Meanwhile, the company will likely provide an update on its progress in securing additional expansion projects. For example, it took another step toward finally approving its long-delayed Lake Charles LNG project last month. Securing additional expansion projects would further enhance its growth outlook.

Units of Energy Transfer are already up about 20% this year. Reporting stronger-than-expected third-quarter results or progress on securing additional expansion projects could give it more fuel to continue rallying. Because of that, investors might get a better price if they buy before Energy Transfer reports earnings.

Energy Transfer recently declared its latest distribution payment of $0.3225 per unit. That’s a $0.0025-per-unit increase from last quarter and a 3.2% pay bump compared to the year-ago level. That aligns with the MLP’s plan to increase its distribution by 3% to 5% annually.

9 High-Yield Dividend ETFs to Buy to Generate Passive Income

Passive income — what’s not to like? It’s money that comes to you without your having to actively work for it. There are many kinds of passive income, such as income from rental properties and interest from bonds.

A particularly powerful kind of passive income is that from dividend-paying stocks, because they offer the chance of stock-price appreciation, dividend income, and dividend growth. It can be hard to hunt for the best dividend payers out there, though, so you might instead want to simply park your long-term dollars in one or more exchange-traded funds (ETFs) that focus on dividend income.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

An ETF is a fund that trades like a stock — and often tracks a particular index, too. Here are nine high-yield ETFs to consider. (Note that some have yields that are currently on the high side, while others feature lower yields that are likely to grow faster.)

While these ETFs are focused on delivering income, understand that they’re not the only dividend-paying ETFs out there. In fact, a simple S&P 500 index fund is a dividend payer, too — because many of the 500 companies in the S&P 500 pay dividends. The S&P 500 recently sported a dividend yield near 1.3%.

Check out these ETFs below, which are very dividend-focused. At the end of the table is an S&P 500 index fund, for comparison. Note that I’m including a fairly big bunch because I’m trying to encompass funds from several major fund companies. I’m doing so because depending on which company administers the 401(k) account at your workplace, if you have such an account, you might be able to invest in one or more of the funds below via your 401(k).

|

ETF |

Recent Yield |

5-Year Avg. Annual Return |

10-Year Avg. Annual Return |

|---|---|---|---|

|

iShares Preferred & Income Securities ETF (NASDAQ: PFF) |

6.00% |

3.11% |

3.95% |

|

SPDR Portfolio S&P 500 High Dividend ETF (NYSEMKT: SPYD) |

4.18% |

8.67% |

N/A |

|

Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) |

3.61% |

13.05% |

12.02% |

|

Fidelity High Dividend ETF (NYSEMKT: FDVV) |

2.87% |

14.91% |

N/A |

|

Vanguard High Dividend Yield ETF (NYSEMKT: VYM) |

2.65% |

11.34% |

10.53% |

|

iShares Core Dividend Growth ETF (NYSEMKT: DGRO) |

2.24% |

12.59% |

12.49% |

|

SPDR S&P Dividend ETF (NYSEMKT: SDY) |

2.22% |

9.55% |

10.42% |

|

Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) |

1.65% |

12.93% |

12.33% |

|

First Trust Rising Dividend Achievers ETF (NASDAQ: RDVY) |

1.49% |

15.05% |

13.21% |

|

Vanguard S&P 500 ETF (NYSEMKT: VOO) |

1.3% |

16.07% |

13.70% |

Data source: Morningstar.com, as of Oct. 22, 2024.

Trump Vs. Harris: A Nail-Biting Pre-Election Showdown

The upcoming presidential election is witnessing a nail-biting competition between former President Donald Trump and Vice President Kamala Harris. With Election Day just around the corner, the race is tightening.

What Happened: Recent national polls suggest a neck-and-neck race between Trump and Harris. Some polls even indicate a slight edge for Trump. A USA Today/Suffolk poll released on Friday shows a close contest in Pennsylvania, a key swing state.

Both Trump and Harris have scheduled events in North Carolina, another swing state, on Saturday. Trump is set to make appearances in Charlotte and Greensboro, North Carolina, and Salem, Virginia. Harris, on the other hand, will rally in Atlanta, Georgia, before heading to Charlotte.

A new Washington Post poll shows Harris leading Trump by a slim margin among likely and registered voters in Pennsylvania. The poll, conducted from Oct. 26-30, also found high voter enthusiasm in the state, with 20% of respondents already having voted and 73% certain to vote.

Also Read: More Than $100M Wagered On Presidential Race On Kalshi

A HarrisX/Forbes poll released Thursday shows Harris leading Trump 49% to 48% among likely voters nationwide and in the seven battleground states. However, her lead in the battleground states has slimmed from a HarrisX/Forbes poll released a week earlier.

In Michigan, Harris leads Trump 48% to 45%, according to a Detroit Free Press poll. In contrast, a Stetson University Center for Public Opinion Research poll shows Trump leading Harris 53% to 46% in Florida. In Massachusetts, Harris leads Trump 61% to 31%, according to the MassINC Polling Group.

Why It Matters: The tight race between Trump and Harris underscores the high stakes and unpredictable nature of the upcoming election.

The outcome in key swing states could potentially tip the balance in favor of either candidate. The high voter enthusiasm indicated by the polls suggests that the election results could hinge on voter turnout.

The slimming lead for Harris in battleground states, as indicated by the HarrisX/Forbes poll, further adds to the uncertainty of the election outcome.

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Israel Englander Just Tripled His Investment in This Stock That Warren Buffett and Cathie Wood Also Own

Billionaire money managers often have strikingly different approaches to investing. Consider Warren Buffett, whose holding company, Berkshire Hathaway, only owns about 45 stocks at a given time, and Israel Englander, head of Millenium Management, who owns several thousand. Add someone like Cathie Wood into the mix, who runs investing firm Ark Invest and buys disruptive tech stocks for Ark’s exchange-traded funds (ETF), and you have three different investing mindsets.

What’s something they all have in common? They all own Amazon stock, which is a no-brainer stock for any portfolio, and they also all own young upstart Nu Holdings (NYSE: NU) stock.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Buffett, or someone on his team, first recognized Nu’s potential when he invested $500 million in the company before it went public in 2021. It now owns 107,118,784 shares, or 2.2% of the company, although it makes up a tiny 0.5% of Berkshire Hathaway’s equity portfolio. Cathie Wood owns 1,238,918 shares as part of Ark’s Fintech Innovation ETF, accounting for 2.1% of the portfolio. Millennium owns 39,192,266 shares of Nu, which is a 371% increase in his position from last quarter.

Let’s see why three very different money managers are all excited about this growth stock.

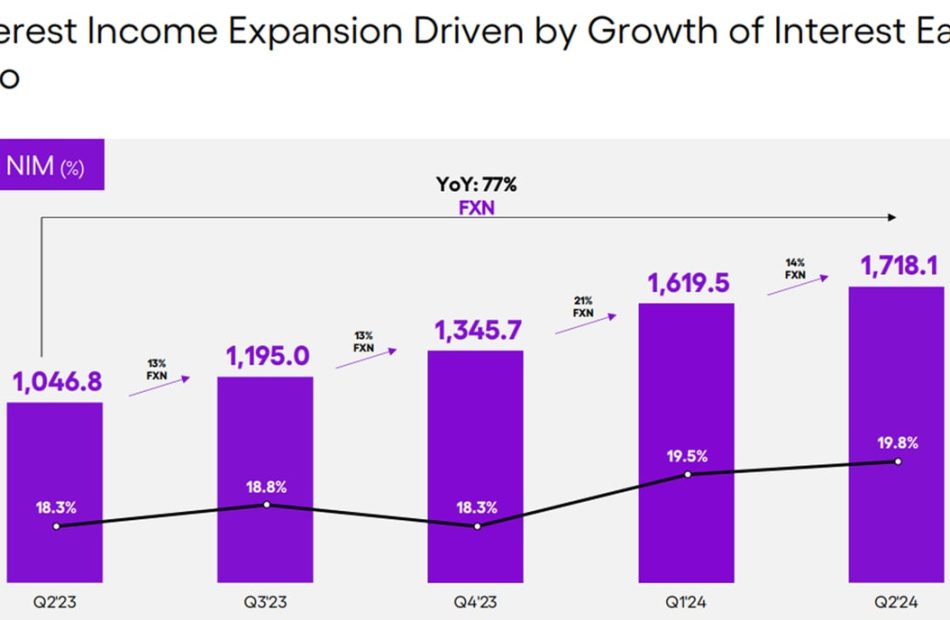

Nu is an all-digital bank based in Brazil. It has also recently entered Mexico and Colombia, but they’re small businesses for now. It’s growing quickly in every way, and it has been reporting incredible results every quarter since it went public.

It added 5.2 million customers in the 2024 second quarter, reaching a total of 104.5 million. Most of them are still in Brazil, where it has 95.5 million, or more than half of the adult population. Nu was a challenger when it premiered just over 10 years ago, offering a simple and easy-to-use alternative to the rigid banking services offered by a handful of large, traditional banks. Banking was so complicated and expensive before Nu came onto the scene that a large percentage of the population didn’t even have a bank account. Nu has a leg up on the legacy banks since it was built to be flexible and agile, and customers are flocking to its platform. That’s something Buffett loves.

That leaves about 9 million customers in its other two markets, 7.8 million of whom are in Mexico, and Nu’s performance in Mexico has already surpassed how it did in Brazil at a similar growth stage. It added 1.2 million customers in Mexico in the second quarter, or a 15% increase over last quarter.

Chart of the Week: Robinhood's earnings showed investors' love affair with options is growing

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

One of the biggest changes in investing over the last couple of decades has been the rise in popularity of passive funds as more and more people follow Warren Buffett’s advice to log out of their accounts and simply invest in the S&P 500.

And while this has happened, something else is going on at the other end of the spectrum. In what appears to be a classic barbell-shaped pattern, risk tolerance is both getting more sensible and more risky at the same time.

Options trading is reaching fresh highs for popularity — and it’s playing a greater financial role at brokerages like Robinhood. The company, which just published its quarterly results this week, saw trading volume surge, and with it came a significant jump in options revenue.

As you can see from our Chart of the Week, it’s up to $202 million for the third quarter — and it’s pulled away from the revenue from stock trading.

Robinhood’s innovative free trading transformed the brokerage industry, making the no-cost transactions ubiquitous. And with the key barrier to making moves gone, price-sensitive retail investors piled in, likely aided by stimulus checks. As trading grew significantly, investors also explored derivatives and margin.

“Retail participation in options market trading rose sharply during the pandemic, peaking at 48% in July 2022. While it has bounced around since then, it hit 45% in July 2023,” wrote NYSE’s director of research, Steven W. Poser, late last year. “This data suggests that substantial retail options trading is here for the foreseeable future.”

At the same time, Robinhood continuously beat the drum that it was a place for set-and-forget index fund investors, which was also true. There’s evidence that its retail investors also helped stabilize the market during the 2020 pandemic crash by buying the S&P 500’s dip.

These two things, however, are very different. While the S&P 500 is composed of volatile stocks that are subject to big fluctuations that require risk tolerance, there’s no debate that throwing your lot in with them is an investment. If there are wounds, time will almost certainly heal them.

But options trading, though traditionally used to hedge risk, is an easy way to speculate and place high-risk, high-payout bets. And as is the case with certain types of leveraged investing, the downside can be infinite. As Merrill Lynch’s website notes, “If you write an uncovered call, you face unlimited potential loss, since there is no cap on how high a stock price can rise.”

Warren Buffett's Berkshire Hathaway Sells Apple Stock, Boosts Cash Pile to Record

-

Warren Buffett’s Berkshire Hathaway reported its profit declined in the third quarter while its cash pile ballooned to a record of more than $320 billion.

-

Berkshire trimmed its stakes in both Apple and Bank of America, bringing its total proceeds from stock sales this year to about $133 billion.

-

Berkshire paused stock buybacks last quarter as its share price surged to a record high.

Berkshire Hathaway (BRK.A; BRK.B) on Saturday reported its profit fell in the third quarter while its cash pile swelled to a record as it trimmed its stakes in Apple (AAPL) and Bank of America (BAC).

Berkshire reported third-quarter operating earnings of $10.1 billion, down from $10.7 billion a year ago and $11.6 billion in the prior quarter.

The conglomerate’s cash pile ballooned to a record $320.3 billion from $271.5 billion in the second quarter. The vast majority of Berkshire’s cash ($288 billion) is invested in short-term Treasury bills.

Investors watch the firm’s cash hoard closely for its potential as “dry powder,” money that can be invested in businesses that meet Berkshire’s value-focused acquisition and investment strategy.

Berkshire paused share repurchases in the quarter. Buffett has touted the benefits of repurchases in the past, writing in his 2022 letter to shareholders: “Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect.” But Buffett is famously thrifty, and the price of Berkshire shares surged to a record high in the quarter.

The value of Berkshire’s equity portfolio declined to $271.7 billion from $284.9 billion in the prior quarter. Berkshire has aggressively trimmed its equity positions this year to take profits from a buoyant stock market. The firm has sold $133 billion of stock so far this year, compared with just $33 billion in the first nine months of 2023.

The value of Berkshire’s Apple stock suggests Buffett continued to trim his stake in the iPhone maker. Apple shares rose more than 10% in the third quarter. Yet Berkshire’s stake shrank from $84.2 billion to $69.9 billion, suggesting Buffett sold about a quarter of his position. Buffett had already dumped nearly half of his Apple stock, worth nearly $175 billion at the end of 2023, in the first six months of the year.

The only other major change Buffett made to Berkshire’s five largest equity positions was his well-documented offloading of Bank of America stock. Berkshire began trimming its stake in the lender in mid-July. At the end of the quarter, Berkshire’s stake stood at $31.7 billion, down from $41.1 billion at the end of June.

58-Year-Old Retiree Living Off Dividends Shares His Portfolio: Top 12 Stocks, ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Can you live entirely off dividends? This question piques the interest of millions of young Americans thinking about early retirement and breaking free of their 9-to-5 jobs.

A few days ago, someone on r/Dividends – a Reddit discussion board related to dividend investing – asked if anyone on the forum is living off dividends.

“I’m yet to hear testimony of someone who’s actually made it to a point where they are living off their dividends. If you’re out there, could you share your story? What’s it like being free? How long have you invested?” the post said.

Don’t Miss:

The question received an outpouring of responses, with many investors sharing their personal stories and advice. One response stood out and got our attention.

An investor, who said he is 58 and retired, responded to the questioner that he’s been living off dividends for about three years.

“I started investing about 37 years ago. Retirement off dividends is nice but not really any different from living off any other source of income such as social security. I saved and invested pretty well over the years. I never focused on dividends until the last five years or so. I also don’t suggest young people do so,” he said.

The investor shared how he was able to increase his wealth via investing, leading to his retirement:

“My big break was being mostly cash in early 2020 because I felt the market had gotten too expensive. That was largely luck but it worked great. March 2020 was really fun. I spent between $1-2M on stocks in about 30 days and the resulting market rise after that secured my retirement.”

Trending: Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

The investor reiterated that young investors should focus on total returns instead of solely dividend income.

Musk Loses Bid to Dismiss Ex-Twitter CEO’s Severance Claim

(Bloomberg) — Elon Musk was dealt a significant setback in a court fight over compensation sought by the top Twitter Inc. executives he fired when he took over the company in 2022.

Most Read from Bloomberg

A judge ruled late Friday that former chief executive officer Parag Agrawal and other high-ranking officers can proceed with claims that Musk terminated them right as he was closing the deal to cheat them out of severance pay before they could submit resignation letters.

In the complaint the ex-executives filed in March, they cited a passage in Walter Isaacson’s biography of Musk in which the billionaire is quoted telling the author as he rushed to complete the acquisition there was a “200-million differential in the cookie jar between closing tonight and doing it tomorrow morning.”

Musk has been fighting legal claims for back pay by thousands of Twitter staff he laid off when he acquired the social media company for $44 billion two years ago and rebranded it as X Corp.

At least one former employee was awarded unpaid severance in September in a closed-door arbitration that could set a precedent for other similar cases, the worker’s lawyer told Bloomberg News.

In July, Musk and X Corp. defeated a lawsuit alleging that at least $500 million in severance pay was owed to about 6,000 laid-off employees under provisions of the federal Employee Retirement Income Security Act.

US District Judge Maxine Chesney on Friday rejected arguments by Musk’s lawyers that Agrawal’s claims should be dismissed. Agrawal was joined in the lawsuit by Vijaya Gadde, who was Twitter’s top legal and policy official; Ned Segal, the chief financial officer; and Sean Edgett, the company’s general counsel.

They allege they’re owed severance benefits equal to one year’s salary plus unvested stock awards valued at the acquisition price.

Chesney is overseeing two other suits brought by Twitter executives, including one by Nicholas Caldwell, who was general manager for “core tech” and is seeking $20 million as compensation for lost severance. The judge on Friday denied Musk’s request to dismiss a claim by Caldwell that mirrors Agrawal’s allegations.

Representatives of X didn’t respond outside regular business hours to a request for comment.

The case is Agrawal v. Musk, 24-cv-01304, US District Court, Northern District of California (San Francisco).

Think Nvidia Stock Is Expensive? This Chart Might Change Your Mind

Nvidia (NASDAQ: NVDA) has been this year’s most influential stock, and it has posted huge gains in the process. The artificial intelligence (AI) leader’s sales and earnings have continued to expand at an impressive pace, and the company’s share price is up roughly 180% so far this year.

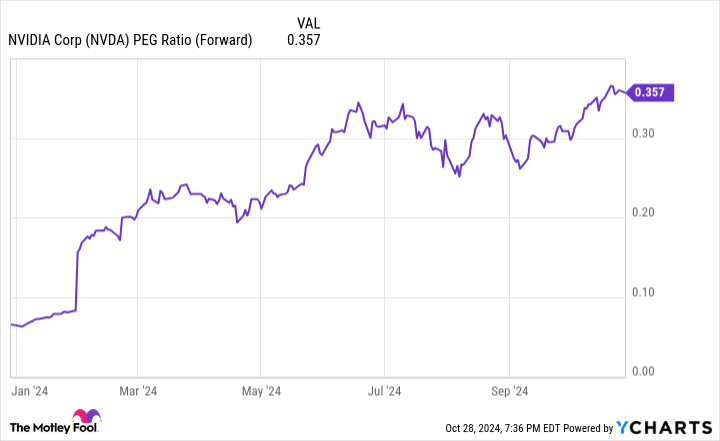

That is just the latest leg of an incredible run that has seen the company’s share price soar almost 860% since the beginning of 2023, and more than 2,650% over the last five years. Thanks to these explosive gains, the company’s price-to-earnings multiple has ballooned to 66 as of this writing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Such a valuation comes with heavy expectations for growth, and it’s not unreasonable to have concerns the chip company’s stock price has climbed too far, too quickly. But there’s another valuation metric that suggests the red-hot AI stock still has upside potential.

The stock’s gains don’t look excessive in light of Nvidia’s recent business results. For example, revenue rose 205% year over year through the first half of fiscal 2025 (the six months ended July 28, 2024) — and earnings per share were up 285% over the same period.

With expectations for its impressive growth to continue, Nvidia is trading at a forward price/earnings-to-growth (PEG) ratio of roughly 0.36. A PEG ratio of less than 1.0 is often viewed as a signal the stock is undervalued because its anticipated earnings growth is high relative to its earnings-based valuation.

While there’s no doubt Nvidia’s sales and earnings growth will have to decelerate eventually, the company’s leadership position, momentum, and PEG ratio suggest the stock still has room to run. With the launch of its next-generation Blackwell processors set for later this year, the company could have another major sales and earnings catalyst on the near horizon.

Spending on GPUs to power AI applications will undoubtedly go through some cyclical shifts, but the rise of artificial intelligence is still in its early innings — and Nvidia remains essential to that rise.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

AGNC Sports a Gigantic 15% Yield. Are Investors Paying Too Much for It?

AGNC Investment (NASDAQ: AGNC) is a very complex business, but its 15% dividend yield is like a siren’s song to dividend investors traveling along Wall Street. There are a lot of good reasons why income-focused investors should avoid AGNC, and the mortgage real estate investment trust (REIT) added a new one when it reported third-quarter earnings. Here’s what you need to know before buying AGNC.

A property-owning REIT buys a building, like an apartment or warehouse, and leases it out to generate rental income. That’s fairly easy to understand because it’s exactly what you would do if you had a rental property. The only difference is the scale of the asset, with REITs owning institutional-level properties.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The whole point of a REIT is that it gives smaller investors access to such cash-producing assets, which would normally be outside of their investment capacity.

AGNC isn’t a property-owning REIT; it is a mortgage REIT. It buys mortgages that have been pooled into bond-like securities. In some ways, it is more like a mortgage-focused mutual fund that just happens to trade as a company. Mortgage bonds can be very hard to track for small investors.

Factors that affect the price of such securities include interest rates, housing market dynamics, mortgage repayment rates, and even the year of creation of the mortgage bond (sometimes called the vintage). As a shareholder, it is highly unlikely that you will be able to keep tabs on AGNC’s portfolio.

There’s another wrinkle here. AGNC Investment isn’t really an income stock; it is a total return investment. Just look at the chart below — the dividend has not only been volatile over time but it has been trending lower for years. The stock price has followed the dividend lower. And yet, if you reinvested the dividend, your total return would have been strongly positive. The big takeaway here is that if you spend AGNC’s dividend on living expenses, like most dividend investors are probably looking to do, you will end up with less income and less capital.

AGNC data by YCharts.

AGNC Investment proudly noted that it sold stock to raise capital when it reported third-quarter 2024 results. That’s not unusual at all; REITs issue stock to fund investments all the time. But here’s the oddity: The CFO noted, “During the third quarter, we issued $781 million in common stock through our ATM program at a considerable premium to our tangible net book value.” To simplify that just a little, the company sold stock for more than the company’s shares were really worth.