US Stocks Likely To Open Higher After 'Mag 7' Wrap Up Busy Week, Apple, Amazon And Intel On Radar: Investors Eye Monthly Jobs Report, Economist Says Earnings Won't Trump Bonds

Investors on Wall Street could see some respite after major indices registered a downbeat session on Thursday. Index futures point to a positive start on Friday, ahead of the crucial monthly report on jobs data.

Thursday was a busy day as far as tech earnings are concerned, with Apple Inc. AAPL, Meta Platforms Inc. META, Amazon.com Inc. AMZN, and Intel Corp. INTC reported their September quarter results.

While Meta and Microsoft both fell in after-market hours, Amazon surged after the company handily beat Street consensus. The company expects its fourth-quarter sales to surge between 7% to 11%.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.47% |

| S&P 500 | 0.39% |

| Dow Jones | 0.35% |

| R2K | 0.12% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY rose 0.43% to $571.07 and the Invesco QQQ ETF QQQ gained 0.51% to $486.33, according to Benzinga Pro data.

Cues From Last Session:

All three major indices registered a downbeat Thursday, with S&P 500 and Nasdaq Composite posting their biggest single-day fall since Sept. 3.

The overall investor sentiment declined, with the Greed index entering the “Fear” territory.

Most sectors on the S&P 500 closed on a negative note, with information technology, consumer discretionary, and real estate stocks recording the biggest losses on Thursday. However, utilities and energy stocks bucked the overall market trend, closing the session higher.

Crude oil prices edged up, mostly recovering their losses over the previous weekend due to Israel’s missile strikes on Iran.

Treasury yields continued to climb amid fears of higher deficits due to a possible re-election of former President Donald Trump.

Besides, the International Monetary Fund has also warned about the long-term trajectory of U.S. national debt

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -2.76% | 18,095.15 |

| S&P 500 | -1.86% | 5,705.45 |

| Dow Jones | -0.90% | 41,763.46 |

| Russell 2000 | -1.63% | 2,196.55 |

Insights From Analysts:

Ryan Detrick, Chief Market Strategist at Carson Group, highlighted that November is the “best month of the year” as far as equity markets are concerned.

“The last time it fell more than 1% was in 2008, and it has been higher 11 of the past 12 years. Not to be outdone, it is the best month since 1950, in the past decade, and in election years, while it ranks as the second-best month the past 20 years (only July is better).”

Detrick added that the bull market is here to stay. After experiencing a bull run for the past three years, the expert highlighted that “the potential for many more years of gains is actually quite high.”

WisdomTree and Wharton School economist Jeremy Siegel, too, thinks earnings will beat interest rates, but there’s something more important to consider.

He added that there could be increased anxiety in the markets until the election is over, after which there could be a bounce back.

However, Siegel added that he now anticipates only three 25-basis point rate cuts between now and June next year.

“Earnings will trump interest rates for stocks, but certainly for bonds, they are not good,” Siegel told CNBC in an interview.

On the economic data front, U.S. initial jobless claims declined by 12,000 from the previous week to 216,000 in the week ending Oct. 26.

The personal consumption expenditure price index rose 0.2% month-over-month in September following a 0.1% increase in August.

See Also: Best Futures Trading Software

Upcoming Economic Data:

- The monthly jobs report is scheduled to be released at 8 a.m. ET.

- S&P’s final U.S. manufacturing PMI will be released at 9:30 a.m. ET.

- Construction spending data will be released at 10 a.m. ET.

- Auto sales data is expected to be released during the day.

Stocks In Focus:

- Apple Inc. AAPL shares fell 1.2% in premarket even as the company posted record quarterly revenue on the back of a rebound in iPhone sales.

- Amazon.com Inc. AMZN will be on investors’ radar after the company reported better-than-expected results during the September quarter. The stock is up 6.8% in premarket trading.

- Intel Corp. INTC is up nearly 6% in premarket trading even after the company posted a record loss of $16.6 billion during the September quarter.

- Exxon Mobil Corp. XOM shares surged 1.3% in premarket trading after the company beat earnings per share (EPS) estimates, even though it posted a slight miss on revenue.

- Trump Media & Technology Group Corp. DJT shares continued to fall amid increased volatility, falling 3.3% in premarket trading. The stock fell 11.7% on Thursday.

- Investors are awaiting earnings results from Chevron Corp. CVX and Cardinal Health Inc. CAH today.

Commodities, Bonds And Global Equity Markets:

Crude oil futures gained in the early New York session, rising 2.08% as Iran prepares for another attack on Israel.

The benchmark 10-year Treasury note yield rose marginally to 4.289%.

Most Asian markets closed in the red on Friday, while European stocks were mostly higher in early trading.

Read Next:

Photo courtesy: Wikimedia

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Economy Adds Only 12,000 Jobs In October, Sharply Misses Estimates As Hurricanes, Strikes Pummel Hiring

The U.S. economy experienced almost no job growth in October as the pace of employment creation slowed to its lowest level since December 2020, according to the official jobs report released Friday.

This downturn likely reflects the impact of hurricane disruptions, strikes in manufacturing and election-related uncertainties, all of which affected hiring nationwide.

Total nonfarm payrolls grew by only 12,000 last month, a sharp decline from the average monthly gain of 194,000 over the previous year.

Despite the hiring freeze, the unemployment rate held steady at 4.1%, suggesting that businesses are retaining their existing workforce even as new job creation stalls.

October Employment Situation: Key Highlights

- Nonfarm payrolls rose by 12,000, sharply decelerating from the previous downwardly revised 223,000 and well below the expected 113,000 as per TradingEconomics estimates.

- “Employment continued to trend up in health care and government. Temporary help services lost jobs. Employment declined in manufacturing due to strike activity,” the Bureau of Labor Statistics wrote in the report.

- Private payrolls contracted by 28,000, weighed down by 46,000 layoffs in manufacturing.

- Government sector employment rose by 40,000 in October, close to the monthly average gain of 43,000 over the past year.

- Total nonfarm payroll employment was revised down by 81,000 for August, from an initial estimate of 159,000, and by 31,000 for September, from 254,000, totaling 112,000 fewer jobs than previously reported.

- The unemployment rate stood at 4.1%, as expected.

- Average hourly earnings advanced at a 0.4% monthly pace, accelerating from September’s downwardly revised 0.3% increase and surpassing expectations of 0.3%.

- On an annual basis, wages rose 4%, as predicted, up from September’s 3.9% rate.

Stocks Rally As Fed Rate-Cut Expectations Soar

Following the release of the October jobs report, futures on major U.S. equity indices rallied, driven by increased expectations of Federal Reserve rate cuts.

Contracts on the S&P 500 and Nasdaq 100 both rose by 0.5%, while Russell 2000 futures surged 0.8%. This rebound comes after the SPDR S&P 500 ETF Trust SPY closed 1.9% lower on Thursday, marking its steepest one-day decline since early September and ending a five-month winning streak.

The disappointing jobs data led markets to fully price in a 25-basis-point rate cut at the Fed’s upcoming meeting on November 7, according to the CME FedWatch Tool. Additionally, the probability of another quarter-point cut in December increased to 86%, up from 75% previously.

Read Next:

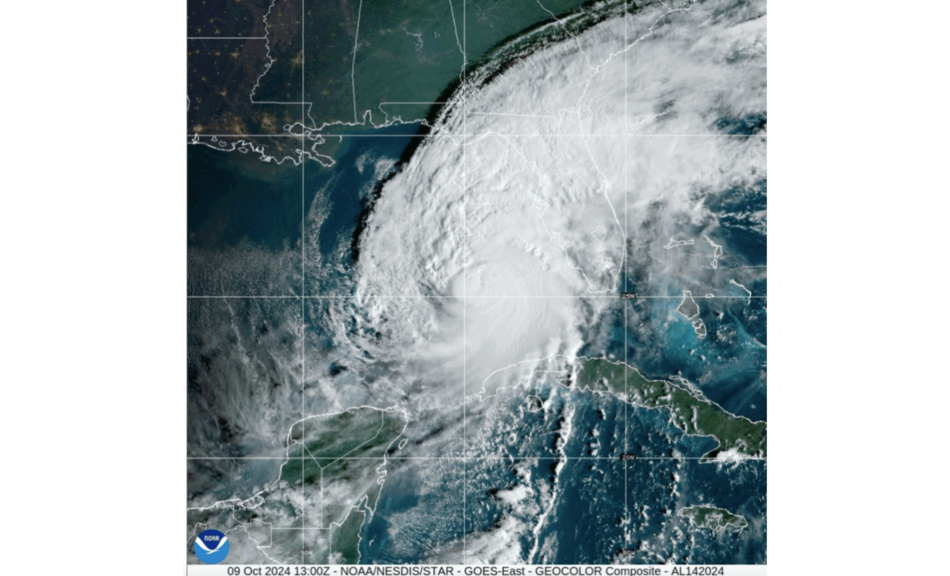

Photo: National Oceanic and Atmospheric Adminstration (NOAA).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Rebound After Selloff As October Hiring Slump Fuels Interest Rate Cut Bets: 10 ETFs To Watch Friday

A hiring freeze in October lifted market expectations for a Federal Reserve interest rate cuts, providing relief to U.S. stocks after Thursday’s decline.

The U.S. economy added only 12,000 jobs in October, 211,000 fewer than in September. This marked the lowest monthly pace since December 2020 and sharply missed estimates of 113,000.

Market pricing now reflects a full probability of a 25-basis-point rate cut at next week’s Federal Reserve meeting, with the likelihood of another cut in December surging to 85%, according to the CME FedWatch tool.

Hurricanes, Strikes Knock October Employment Down

Beyond the dismal October employment figures, which suggest a recession-like scenario, factors such as hurricanes and strikes have significantly disrupted hiring across the nation.

Hurricane Helene hit Florida’s Gulf Coast on Sept. 26, followed by Hurricane Milton on Oct. 9, prompting widespread evacuations and disrupting multiple economic sectors.

“It is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect on the over-the-month change in national employment, hours, or earnings estimates,” the Bureau of Labor Statistics (BLS) stated in its report.

Additionally, layoffs surged in manufacturing, rising to 46,000 — the highest since 2009, excluding the pandemic months of March and April 2020. “Manufacturing employment decreased by 46,000 in October, reflecting a decline of 44,000 in transportation equipment manufacturing largely due to strike activity,” the BLS added.

Despite stagnant job growth in October, the unemployment rate held steady at 4.1%, indicating that businesses remain committed to retaining their workforce.

Equity ETFs Rise On Rising Rate-Cut Bets

- The SPDR S&P 500 ETF Trust SPY, tracking the S&P 500 index, rebounded 0.7% after Thursday’s 1.9% slump.

- The tech-heavy Invesco QQQ Trust QQQ, replicating the Nasdaq 100, was 0.6% higher.

- Small caps outperformed, with the iShares Russell 2000 ETF IWM soaring 1.2%.

- The Roundhill Magnificent Seven ETF MAGS rose 1.4%. On Thursday, it tumbled 3.9%, marking the sharpest 1-day drop since late July.

- Sector-wise, the Consumer Discretionary Select Sector SPDR Fund XLY led gains, up over 2%, fueled by a 6% post-earnings rally from Amazon.com Inc. AMZN.

- The Direxion Daily AMZN Bull 2X Shares AMZU skyrocketed by 13%.

- Rising expectations for Fed rate cuts fueled gains in real estate industries, with the iShares U.S. Home Construction ETF ITB rising 1.8%.

- Semiconductors rebounded after tumbling by 3.9% on Thursday. The iShares Semiconductor ETF SOXX rose 1.6%. Intel Corp. INTC was among the best performers following better-than-expected results.

- The SPDR Gold Trust GLD – the biggest physically-backed gold ETF – also rose 0.5%, rebounding after Thursday’s 1.6% decline.

- The United States Oil Fund USO, which tracks West Texas Intermediate (WTI) crude performance, gained 1% amid rising geopolitical tensions in the Middle East following Iran’s retaliatory attack on Israel.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CPABC: Greater Victoria's workforce posts healthy growth in 2024

VICTORIA, British Columbia, Nov. 01, 2024 (GLOBE NEWSWIRE) — According to BC Check-Up: Work, an annual report by the Chartered Professional Accountants of British Columbia (CPABC) on labour market trends across the province, there were 243,200 Greater Victoria residents working in September 2024, up 6.2 per cent from one year earlier.

“We saw some of the strongest employment growth in the province over the past year,” said Simon Philp, FCPA, FCMA, Market Vice President at CIBC. “It’s good to see that resilience at the local level, especially when the B.C. labour market as a whole has shown some weakness.”

Greater Victoria’s unemployment rate fell slightly to 3.9 per cent in September 2024 and was the third lowest among all census metropolitan areas in Canada. The labour force participation rate—the proportion of the working-age population who were either working or looking for work—was 67.2 per cent, up 4.3 percentage points in the two years since September 2022.

“Unemployment and labour force participation have been trending in the right direction for two years now,” noted Philp. “It’s been challenging given the higher interest rate environment, but we are starting to get some relief on that front.”

Employment in the goods sector increased by 6,200 workers (+23.1 per cent) between September 2023 and September 2024. Meanwhile, the services sector also added workers during the year, led by the information, culture, and recreation industry, where employment increased by 6,100 workers (+79.2 per cent).

“This year’s growth was driven by industries not usually seen as major employers in Greater Victoria,” noted Philp. “It’s a great reminder of the diverse opportunities available, which contributes to economic stability in the area.”

To learn more, see www.bccheckup.com.

About CPA British Columbia

The Chartered Professional Accountants of British Columbia (CPABC) is the training, governing, and regulatory body for over 40,000 CPA members and 6,000 CPA candidates and students. CPABC carries out its primary mission to protect the public by enforcing the highest professional and ethical standards and contributing to the advancement of public policy.

CPABC Media Contact: Jack Blackwell, Economist 604.259.1143 news@bccpa.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shock October Jobs Report Leaves Fed In 'Tight Spot': Experts Say Interest Rate Cuts Ahead

The October employment report released Friday morning showed the U.S. economy added only 12,000 jobs in October, well-below estimates of 113,000 and the lowest monthly pace since December 2020. Economists are weighing in on the impact of the hurricanes on the report and the potential for future interest rate cuts.

Experts Weigh In: Jeffrey Roach, chief economist for LPL Financial, indicated that hurricanes across the Southeast likely affected the establishment survey. He also noted response rates for the household survey were within normal ranges.

He said investors should focus on the household survey data which showed long-term unemployment rose to 22% of total unemployed persons and the number of permanent job losers edged up to 1.8 million in October versus 1.2 million in February 2020. Roach sees the Fed cutting rates at its next two meetings as economic conditions weakened.

“Given the storm-related distortion, the Fed is in a tight spot as they adhere to data-dependency,” Roach stated.

Quincy Krosby, chief global strategist for LPL Financial, said the Federal Reserve will have to “do the math” on the weaker-than-expected employment report to determine if it reflects only the effects of the hurricanes and the Boeing workers’ strike or if it shows a broader deterioration in the labor market.

Bill Adams, chief economist for Comerica Bank, highlighted the impact of the hurricanes on the jobs report and expects employment to rebound quickly as recovery efforts are underway. However, Adam noted the downward revisions to August and September data reveal the job market was cooler than previously thought. He anticipates the Fed will cut interest rates by a quarter percent at next week’s post-election decision.

Joseph Brusuelas, chief economist for RSM, sees hiring as slowing from its “turbocharged” pace following the pandemic and returning to a more sustainable pace for an economy at full-employment.

Brusuelas said that after removing “the noise” resulting from hurricanes and the strike, RSM sees hiring slowed to near a 120,000 pace per month. He expects the Fed to “ignore the noisy topline” and cut its federal funds policy rate by twenty-five basis points at next week’s meeting.

The Takeaway: Overall, economists seem to agree that the hurricanes and Boeing strike had a major impact on the October jobs report and noted the unemployment rate remained steady at 4.1%. Most expect the Federal Reserve to look past the distorted October hiring number and cut rates by 0.25% at its next meeting.

Markets are reacting to the cooler-than-anticipated jobs report by moving higher Friday on rate cut expectations. The SPDR S&P 500 ETF Trust SPY is up 1.14% at the time of publication, rebounding from a 1.9% decline on Thursday.

Read More:

Image: Csaba Nagy from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Seanergy Maritime Releases its 2023 Environmental, Social and Governance Report

GLYFADA, Greece, Nov. 01, 2024 (GLOBE NEWSWIRE) — Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”) SHIP announced today the release of its Environmental, Social and Governance Report (the “ESG Report”), for the year ended December 31, 2023.

The ESG Report outlines Seanergy’s strategy and commitments related to the ESG pillars and reflects on the Company’s performance through sustainability-related Key Performance Indicators. The ESG Report is aligned with the Global Reporting Initiative (GRI 2021) Standards and follows the Sustainability Accounting Standards Board (SASB) for Marine Transportation. Specific GRI disclosures and SASB indicators have received limited level of assurance from CSE North America.

The ESG Report is available on Seanergy’s website at https://www.seanergymaritime.com/en/sustainability.

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is a prominent pure-play Capesize shipping company publicly listed in the U.S. Seanergy provides marine dry bulk transportation services through a modern fleet of Capesize vessels. The Company’s operating fleet consists of 19 vessels (1 Newcastlemax and 18 Capesize) with an average age of approximately 13.5 years and an aggregate cargo carrying capacity of approximately 3,417,608 dwt.

The Company is incorporated in the Republic of the Marshall Islands and has executive offices in Glyfada, Greece. The Company’s common shares trade on the Nasdaq Capital Market under the symbol “SHIP”.

Please visit our Company website at: www.seanergymaritime.com.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events, including with respect to upcoming annual meeting, the declaration of dividends, market trends and shareholder returns. Words such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the Company’s operating or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, impacts of litigation, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations outside the United States; broader market impacts arising from trade disputes or war (or threatened war) or international hostilities, such as between Israel and Hamas or Iran and between Russia and Ukraine; risks associated with the length and severity of pandemics (including COVID-19), including their effects on demand for dry bulk products and the transportation thereof; and other factors listed from time to time in the Company’s filings with the SEC, including its most recent annual report on Form 20-F. The Company’s filings can be obtained free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor Relations

Tel: +30 213 0181 522

E-mail: ir@seanergy.gr

Capital Link, Inc.

Paul Lampoutis

230 Park Avenue Suite 1536

New York, NY 10169

Tel: (212) 661-7566

Email: seanergy@capitallink.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VEON Files its Dutch Annual Report with Audited Financial Statements for Year Ended 31 December 2023

Amsterdam and Dubai, 1 November 2024 – VEON Ltd. VEONVEON), a global digital operator, (“VEON” or the “Company” or together with its subsidiaries, the “Group”), announces that today it has filed its 2023 Dutch Annual Report, including audited consolidated financial statements for the year ended 31 December 2023 prepared in accordance with International Financial Reporting Standards as adopted by the European Union and with Part 9 of Book 2 of the Dutch Civil Code (the “Statutory Financial Statements”), with the Dutch Authority for the Financial Markets (“AFM”). A copy of the Company’s 2023 Dutch Annual Report can be found on the Financial Results section of VEON website at https://www.veon.com/investors/#tab-item-104.

About VEON

VEON is a global digital operator provides converged connectivity and digital services to nearly 160 million customers. Operating across six countries that are home to more than 7% of the world’s population, VEON is transforming lives through technology-driven services that empower individuals and drive economic growth. VEON is listed on Nasdaq and Euronext. For more information visit: https://www.veon.com.

Contact information

VEON

Group Director of Investor Relations

Faisal Ghori

ir@veon.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rise48 Equity Expands Services with Launch of Rise48 Residential, Taking Over Management of Four Dallas-Fort Worth Properties

PHOENIX, Nov. 1, 2024 /PRNewswire/ — Rise48 Equity, a multifamily investment group headquartered in Phoenix, Arizona, has announced the launch of its new third-party fee management company, Rise48 Residential. This expansion marks a significant step in the company’s growth, as Rise48 Residential has already taken on the management of four properties in Dallas and Fort Worth, TX, with plans to expand further in Q4.

After establishing a presence in the Dallas market in 2022 and expanding to North Carolina earlier this year, Rise48 Equity continues to strengthen its footprint by diversifying into property management. Rise48 Residential is a full-suite professional property management company, equipped with a full-time, experienced team specializing in operations, financial reporting, and marketing. The company focuses on assets built from the 1960s to the early 2000s, delivering tailored management solutions to optimize property performance.

Zach Haptonstall, CEO & Co-Founder of Rise48 Equity said, “We’ve recently had numerous lenders reach out to us saying they’re very happy with how we manage and operate the assets we currently own as a borrower, and these same lenders have asked us to help take over third-party fee management for other assets that they have foreclosed on from other borrowers. We saw an opportunity to expand on what we do best, which is manage and execute value-add business plans on existing multifamily properties.

The launch of Rise48 Residential allows us to share and expand our proprietary methods to third parties for marketing, recruiting staff, hiring, training, controlling supply chain, and executing on business plans. In Q4 we are taking over third-party management for other property owners in Arizona and have more assets in the pipeline from lenders coming in Texas. We will serve property owners and lenders in the Southwest, Southeast, and Texas markets for third-party fee management.

Our goal is to manage 50,000 units nationwide in the next 5 years for third parties. We will continue to grow our investment platform Rise48 Equity where we acquire and manage assets that we own.

Launching Rise48 Residential allows us to extend our high standard of property management to more communities, ensuring we can drive value not only for investors and lenders, but most importantly for residents,” said Zach Haptonstall, CEO & Co-Founder of Rise48 Equity. “We’re excited to bring this level of expertise to Dallas and are committed to continued growth in this market and beyond.”

Rise48 Residential provides a comprehensive range of services, including operations, financial planning & analysis, human resources, advanced data analytics, and marketing, designed to streamline operations and enhance asset value.

The company aims to bring its unique blend of operational expertise and strategic focus to each property it manages, ensuring maximum returns for investors and a high-quality living experience for residents.

About Rise48 Equity:

Rise48 Equity has completed over $2.3 Billion+ in total transactions and purchased 54 assets, 10,000+ units since 2019. They currently have $1.8 Billion+ of Assets Under Management in Phoenix, AZ and Dallas, TX. They have completed 11 Full-Cycle Dispositions and returned capital to investors. The company has 240+ full-time W2 employees on full healthcare benefits.

Rise48 Equity provides multifamily investment opportunities for accredited investors to protect and grow their wealth and achieve passive cash-flow. The team brings expertise to acquire, reposition and return capital to investors upon reaching the business plan.

Rise48 Communities is the vertically integrated property management company that manages all assets owned by Rise48 Equity. The company does all of the construction management, property management, and asset management in-house.

For more information about Rise48 Equity, visit their website: rise48equity.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/rise48-equity-expands-services-with-launch-of-rise48-residential-taking-over-management-of-four-dallas-fort-worth-properties-302294272.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/rise48-equity-expands-services-with-launch-of-rise48-residential-taking-over-management-of-four-dallas-fort-worth-properties-302294272.html

SOURCE Rise48 Equity

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Michael Saylor The 'Egg Man'? Peter Schiff Points Out A Potential Pitfall Of MicroStategy's $42B Debt-Funded Bitcoin Bet

On Thursday, influential economist Peter Schiff took a swipe at MicroStrategy Inc.MSTR CEO Michael Saylor’s $42 billion Bitcoin BTC/USD investment strategy, likening it to a market trap.

What Happened: Schiff took to X, formerly Twitter, and compared Saylor to “the Egg Man” in a metaphorical critique of his Bitcoin investment plans.

Schiff used an egg futures analogy to express his concerns about Saylor’s strategy. He suggested that MicroStrategy could end up holding a large amount of Bitcoin with no potential buyers, should the market turn.

“Sell to whom, you’re the egg man!” Schiff concluded, implying that Saylor’s aggressive Bitcoin buying could potentially trap the company in a volatile market.

See Also: If You Invested $1,000 In Dogecoin On Jan. 1, 2021, Here’s How Much You’d Have Today

Why It Matters: Saylor’s Bitcoin strategy has been a hot topic in the financial world. Last month, he announced that MicroStrategy plans to invest an additional $42 billion in Bitcoin over the next three years, funded by issuing $21 billion in debt and $21 billion in equity.

Other companies like Coinbase Global Inc. COIN have also shown interest in expanding their cryptocurrency investment portfolios.

Coinbase CFO Alesia Haas on Thursday said that the company holds a cryptocurrency investment portfolio on its balance sheet, valued at approximately $1.3 billion at the close of the third quarter.

This portfolio represented close to 25% of Coinbase’s total cash reserves.

Meanwhile, Bitcoin ETFs are edging closer to becoming the largest collective holder of Bitcoin, potentially surpassing Satoshi Nakamoto’s legendary holdings.

Price Action: On Thursday, MicroStrategy shares ended the day 1.1% lower at $244.50 and gained 0.7% in the after-hours trading. Bitcoin was seen trading 4.1% lower at $69,321.65, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Century Complete Unveils New Model Home in Bullhead City, AZ

Exceptional lineup of ranch-style floor plans now selling from the $240s at Rancho Colorado

BULLHEAD CITY, Ariz., Oct. 31, 2024 /PRNewswire/ — Century Communities, Inc. CCS—a top national homebuilder, industry leader in online home sales, and featured on America’s Most Trustworthy Companies and World’s Most Trustworthy Companies by Newsweek—is excited to invite homebuyers and real estate agents to tour the newest model home from its Century Complete brand at Rancho Colorado in Bullhead City, Arizona.

Offering a walkthrough of the community’s ranch-style Verbena plan, the new model showcases a versatile open-concept layout with features like granite countertops, Kohler® water fixtures, stainless-steel appliances, luxury vinyl plank flooring, and a covered patio—included features with every home at Rancho Colorado.

“We’re thrilled to open our new model home for tours, giving buyers a firsthand look at the craftsmanship and lifestyle available at Rancho Colorado,” said Dave Hodgman, Executive Vice President of Field Operations. “With affordable and quality homes available for quick move-in at this scenic location, it’s the perfect time for buyers to come find their dream home.”

Learn more and explore available homes at www.CenturyCommunities.com/RanchoColorado.

More Century Complete communities now selling in the Mohave Valley area:

- Chaparral Terrace in Bullhead City (final opportunity)

- Twin Palm Estates in Fort Mohave (USDA eligible, zero down payment)

- Desert Lakes in Fort Mohave (golf course community)

MORE ABOUT RANCHO COLORADO | BULLHEAD CITY, AZ

Now selling from the $240s

- 150+ single-family homesites

- Ranch floor plans

- Up to 4 bedrooms, 2 bathrooms, 1,155 to 1,815 square feet

- 1- and 2-bay garages

- Granite countertops, luxury vinyl plank flooring, Kohler® fixtures, stainless-steel appliances, walk-in closets, white shaker cabinets, covered patios and more included

- Less than a mile from the Colorado River, with fast access to Laughlin

Location:

2419 Vista Del Oro

Bullhead City, AZ 86442

520.213.8607

THE FREEDOM OF ONLINE HOMEBUYING

Century Complete is proud to feature its industry-first online homebuying experience on all available homes in Arizona, allowing homebuyers to easily find their best fit and purchase when they’re ready—all while continuing to work with their local real estate agent of choice. Homebuyers can further streamline the homebuying process by financing online with Century Complete’s affiliate lender, Inspire Home Loans®.

How it works:

- Shop homes at CenturyCommunities.com

- Click “Buy Now” on any available home

- Fill out a quick Buy Online form

- Electronically submit an initial earnest money deposit

- Electronically sign a purchase contract via DocuSign®

Learn more about the Buy Online experience at www.CenturyCommunities.com/online-homebuying.

About Century Communities

Century Communities, Inc. CCS is one of the nation’s largest homebuilders, an industry leader in online home sales, and the highest-ranked homebuilder on Newsweek’s list of America’s Most Trustworthy Companies 2024—consecutively awarded for a second year—and Newsweek’s list of the World’s Most Trustworthy Companies 2024. Through its Century Communities and Century Complete brands, Century’s mission is to build attractive, high-quality homes at affordable prices to provide its valued customers with A HOME FOR EVERY DREAM®. Century is engaged in all aspects of homebuilding — including the acquisition, entitlement and development of land, along with the construction, innovative marketing and sale of quality homes designed to appeal to a wide range of homebuyers. The Company operates in 18 states and over 45 markets across the U.S., and also offers title, insurance and lending services in select markets through its Parkway Title, IHL Home Insurance Agency, and Inspire Home Loans subsidiaries. To learn more about Century Communities, please visit www.centurycommunities.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/century-complete-unveils-new-model-home-in-bullhead-city-az-302293388.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/century-complete-unveils-new-model-home-in-bullhead-city-az-302293388.html

SOURCE Century Communities, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.