Jobs Report Preview: Could October Nonfarm Payrolls Defy Hurricane Disruptions, Strikes And Election Uncertainty?

Traders are eagerly awaiting October’s official jobs data, set for release on Friday at 8:30 a.m. ET — widely viewed as the week’s most crucial economic event.

The Employment Situation report is expected to provide valuable insights into the resilience of the U.S. labor market, especially in light of recent disruptions from hurricanes, strikes and uncertainties surrounding the imminent U.S. elections.

What are economists forecasting, and how have markets responded to recent jobs reports?

See Also: US Economy Grows Less Than Expected In Q3, Yet Private Employment Soars By 233,000 In October

October Jobs Report: What Do Economists Expect?

The consensus among Wall Street economists is forecasting a sharp deceleration in the pace of employment growth in October.

Nonfarm payrolls are expected to slow down from 254,000 in September to 113,000 in October, an outcome that would represent the lowest monthly employment gain since April, suggesting that U.S. firms have hold back in their hiring plans.

“We expect nonfarm payrolls to rise by 100,000 in October after coming in at 254,000 in September. Although this is below consensus, we’d still view it as a solid print, since we estimate that Hurricane Milton and the Boeing strike temporarily lowered payrolls in October,” Bank of America economist Shruti Mishra stated.

According to Bank of America, Hurricane Milton’s landfall in Florida on Oct. 9, which coincided with the jobs survey week, likely weighed on payroll figures, particularly in sectors like leisure and hospitality. Additionally, lingering effects from Hurricane Helene, which struck in late September, may have added a slight drag on employment.

Bank of America analysts also noted that the Bureau of Labor Statistics estimates a 41,000 increase in striking workers from September to October, largely driven by the Boeing Co. BA strike. Taken together, these factors could have reduced October payrolls by at least 50,000 jobs.

On the positive side, government payrolls may see a 25,000 boost due to temporary hiring for election-related roles.

Looking at other indicators in the October jobs report, the unemployment rate is expected to hold steady at 4.1%, suggesting that the pace of job losses has also not advanced.

Wages are broadly expected to hold their recent trend, as average hourly earnings are expected to surge 0.3% month-over-month, down from 0.4% in September, and by 4.1% year-over-year as seen in the previous month.

Recent Data Shows Potential For Positive Employment Surprises

Earlier this week, the ADP National Employment report showed that private payrolls surged by 233,000 in October, sharply accelerating from 143,000 in September and well above economist expectations of 115,000, as tracked by TradingEconomics.

Nearly the whole increase in private employment came from services, with education, health services, trade, transportation, utilities and leisure and hospitality being the most active in the monthly increases.

The ADP data — which uses anonymized payroll data of more than 25 million U.S. employees – offered encouraging insights ahead of Friday’s official jobs report, suggesting the U.S. economy likely maintained robust job growth throughout the month.

“Even amid hurricane recovery, job growth was strong in October. As we round out the year, hiring in the U.S. is proving to be robust and broadly resilient,” said Nela Richardson, chief economist at ADP.

Stock Reactions To Recent Jobs Reports

The last three jobs reports have highlighted how market sentiment shifts depending on whether employment numbers come in hotter or cooler than expected.

In the July jobs report, released on Aug. 2, the U.S. economy added 114,000 jobs, later revised up to 144,000 — significantly below the consensus estimate of 175,000. On that day, the S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, dropped 1.9% as investors grew concerned about potential economic slowdown.

Another cooler-than-expected report arrived with the August jobs data, published on Sep. 6. The U.S. added 142,000 jobs in August, missing forecasts of 160,000. The S&P 500 responded with a 1.7% decline, reflecting ongoing worries about weakening labor market momentum.

In contrast, the September jobs report, released on Oct. 4, showed the U.S. economy added a robust 254,000 jobs, well above the revised 159,000 in August and far exceeding expectations of 140,000. This marked the strongest job growth in six months, significantly above the prior 12-month average of 203,000.

The S&P 500 responded positively, rallying 0.9% on the day as investors saw this as a sign of resilience in the labor market.

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Tumble, Nasdaq 100 Selloffs As Tech Giants Disappoint, Crypto Companies Plummet: What's Driving Markets Thursday?

Risk aversion swept across markets on Thursday as investor disappointment over third-quarter tech earnings triggered the steepest drop in major U.S. indices in nearly two months.

Microsoft Corp. MSFT plummeted over 5% by midday trading in New York, on track for its worst session in two years. Although the company surpassed earnings estimates, it forecasted slower growth in its Azure cloud business, dampening future revenue expectations.

Meta Platforms Inc. META also declined by over 4% despite a strong quarterly performance, as the social media giant projected “significant” capital expenditure growth next year, particularly for AI infrastructure.

The elite “Magnificent Seven” tech group shed nearly $500 billion in market capitalization within a single day after reaching a record high of $16.8 trillion. Apple Inc. AAPL and Amazon.com Inc. AMZN are set to report earnings after the market close.

In economic news, inflation sent mixed signals for September. The Personal Consumption Expenditures (PCE) price index slowed as expected to 2.1% annually, while the Fed’s preferred inflation measure, the core PCE price index, remained at 2.7% year over year, slightly above the expected 2.6%.

The S&P 500 dropped 1.4%, and the tech-heavy Nasdaq 100 slid 2.2%, both tracking their worst session since Sept. 6. The CBOE Volatility Index (VIX) surged 12%.

Risk aversion also weighed on commodities, with gold prices dropping 1.7%, marking their worst day since July, and silver plunging 3% after a 2% decline on Wednesday.

Bitcoin BTC/USD slid 2.4%, and crypto-related stocks suffered significant losses. Coinbase Global Inc. COIN tumbled over 10% on disappointing earnings, eyeing its worst day since May.

Thursday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Dow Jones | 41,832.30 | -0.7% |

| Russell 2000 | 2,213.10 | -0.9% |

| S&P 500 | 5,729.43 | -1.4% |

| Nasdaq 100 | 19,943.07 | -2.2% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY fell 1.5% to $571.51.

- The SPDR Dow Jones Industrial Average DIA fell 0.8% to $418.60.

- The tech-heavy Invesco QQQ Trust Series QQQ tumbled 2.2% to $485.78.

- The iShares Russell 2000 ETF IWM fell 0.7% to $219.65.

- The Utilities Select Sector SPDR Fund XLU outperformed, rising 1.4%. The Technology Select Sector SPDR Fund XLK lagged, down 2.4%.

Thursday’s Stock Movers

Stocks reacting to corporate earnings were:

- Booking Holdings Inc. BKNG, up over 5%,

- Amgen Inc. AMGN, up 1.7%,

- Starbucks Corp. SBUX, down 0.6%,

- eBay Inc. EBAY, down over 8%,

- MicroStrategy Inc. MSTR, up 1.9%,

- Carvana Co. CVNA, up 24%,

- Mastercard Inc. MA, down 1.8%,

- Merck & Company Inc. MRK, down 2.8%,

- Linde plc LIN, down 2.9%,

- Comcast Corp. CMCSA, up 2.9%,

- Uber Technologies Inc. UBER, down over 11%,

- Eaton Corp. plc ETN, down 5%,

- ConocoPhillips COP, up 6%,

- Bristo-Myers Squibb Co. BMY, up 3.3%,

- Southern Company SO, up 2.2%,

- Altria Group Inc. MO, up 7.6%,

- Regeneron Pharmaceuticals Inc. REGN, down 9%,

- The Cigna Group CI, up 3%,

- Norwegian Cruise Line Holdings Ltd. NCLH, up over 9%.

- Cheniere Energy Inc. LNG, up over 5%.

Large-cap companies slated to report their earnings after the close include Apple Inc, Amazon.com Inc, Intel Corp. INTC, Atlassian Corp. TEAM and Coterra Energy Inc. CTRA.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

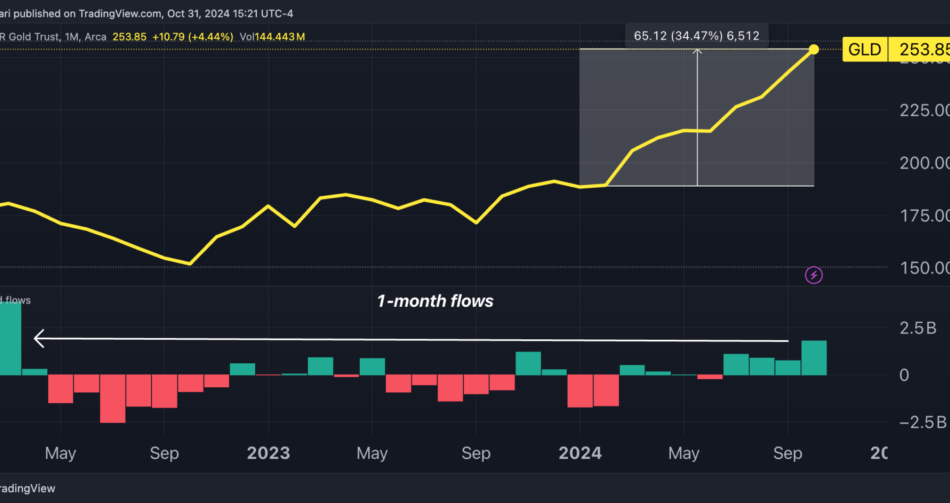

Biggest Gold ETF Posts Highest Monthly Inflows In 2.5 Years As Investors Rush To Safe Haven Ahead Of Presidential Election

The SPDR Gold Trust GLD, the largest physically backed gold ETF, saw a significant influx of capital this month as economic and policy uncertainties surrounding the upcoming U.S. presidential election drive investors toward safe-haven assets.

GLD’s assets under management reached $79.7 billion as of Oct. 30, bolstered by $1.8 billion in net inflows for October — the fund’s strongest monthly inflow since March 2022, data from TradingView shows.

Additionally, the ETF notched its fourth consecutive month of gains and its eleventh positive month out of the last 13, with a remarkable 50% rally from the lows of October 2023.

Gold Demand Surges As ETF Investments Soar

Global demand for gold surged 5% year-over-year in the third quarter of 2024, reaching 1,313 tonnes, a record level for the third quarter, according to a report from the World Gold Council released this week.

This increase reflects a rising appetite for the precious metal as macroeconomic concerns and market uncertainty drive both institutional and retail investors toward gold-backed assets.

Gold prices touched new record highs throughout the quarter as demand continued to build.

A key factor behind this growth was a resurgence in gold ETF investment, with global gold ETF inflows reaching 95 tonnes in the third quarter, the first quarter of positive inflows since the first quarter of 2022.

This marked a sharp year-over-year turnaround from the third quarter of 2023, when ETFs saw outflows of 139 tonnes.

“Gold is continuing its relentless rally and may even have the $3,000 level in its sights before too long,” said Michael Gayed, CFA.

The pace of central bank buying slowed to 186 tonnes in the third quarter, yet year-to-date purchases remain on track with 2022 levels, the World Gold Council wrote.

Central banks, particularly in emerging market economies, continue to diversify away from the U.S. dollar, reflecting a strong and steady institutional demand for gold as a reserve asset.

Fiscal, Geopolitical Uncertainty Sparks Investor Rush to Gold

Gold prices have surged 33% in 2024, positioning the commodity for its third-strongest year in the last 50. Notably, this rally has defied traditional drivers like falling Treasury yields or a weakening dollar that typically boost gold.

Instead, two primary factors are fueling investor demand for the safe-haven asset.

The first driver is concern over the U.S. government’s fiscal policies, which some fear could trigger renewed inflationary pressures.

“Gold is rising as the market begins to price in the likelihood of a Fed forced to cut rates further, despite persistent inflation,” said Otavio Costa, macro strategist at Crescat Capital.

Bank of America analysts agree, noting that regardless of the outcome of the upcoming presidential election, both political parties seem reluctant to tackle the precarious budget deficit and soaring national debt.

“Gold may be the last perceived safe haven asset standing,” wrote Bank of America commodity analyst Michael Widmer, emphasizing the risks posed by unchecked government spending.

A second key factor is the evolving role of gold as “a hedge against U.S. economic sanctions.”

Veteran Wall Street investor Ed Yardeni recently described gold as an asset that can protect nations from Western financial controls.

After Russia invaded Ukraine in February 2022, the U.S. and its allies froze Russia’s foreign exchange reserves held abroad. Since then, there have been proposals to seize nearly $300 billion of these assets to support Ukraine’s defense and reconstruction — a move that has sent a clear signal to other nations.

“China and other countries have been increasing their allocations of gold in their countries’ international reserves,” Yardeni added, suggesting that gold is becoming a preferred reserve asset for nations looking to insulate themselves from potential U.S.-led sanctions.

By holding more gold, countries can reduce their dependence on assets vulnerable to Western financial controls, diversifying away from the U.S. dollar.

Read Next:

Photo via Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VIX Index Notches Third-Strongest October Spike In An Election Year, S&P 500 Snaps 5-Month Winning Streak: Why Volatility 'Is Unlikely To Pull Back,' Analyst Says

The CBOE Volatility Index (VIX), often referred to as the market’s “fear gauge,” saw a sharp 34% increase in October, signaling intensified investor concern as the U.S. presidential election looms.

This spike marks the third-strongest October VIX increase for an election year, with only 2008 and 2020 witnessing larger jumps.

Excluding the extraordinary 52% spike in October 2008, driven by the financial crisis, and the 44% rise in October 2020 amid the COVID-19 pandemic, October 2024’s surge marks the highest volatility for an election-year October since the VIX’s index inception in 1990.

| Election Year | CBOE VIX (% change) | VIX Level (Close on 31/10) |

|---|---|---|

| October 1992 | 13.1 | 16.15 |

| October 1996 | 6.8 | 18.11 |

| October 2000 | 14.9 | 23.63 |

| October 2004 | 22.0 | 16.27 |

| October 2008 | 52.0 | 59.89 |

| October 2012 | 18.2 | 18.6 |

| October 2016 | 28.4 | 17.6 |

| October 2020 | 44.2 | 38.02 |

| October 2024 | 34.1 | 22.43 |

Political uncertainty is a significant driver of this volatility, with Vice President Kamala Harris and former President Donald Trump neck-and-neck in polling data, though Trump holds a substantial lead in betting markets.

Market-implied odds from CFTC-regulated platform Kalshi currently give Trump a 57% chance of re-election.

Concerns over the candidates’ fiscal policies and the country’s ballooning national debt levels are adding to market tension, as neither candidate has outlined a plan to tackle the fiscal risk.

S&P 500 Ends Five-Month Rally

Alongside political anxiety, disappointing earnings from major tech companies fueled a late-month selloff.

The S&P 500, as measured by the SPDR S&P 500 ETF Trust SPY, fell in October, snapping a five-month winning streak. Microsoft Corp. MSFT led the decline, dropping 6% on Thursday — its worst single-day performance in over two years — as guidance over 2025 revenue disappointed earnings.

Quincy Krosby, chief global strategist at LPL Financial, highlighted that mega-cap tech’s forward guidance disappointed markets, particularly around AI spending and the slower-than-expected integration of AI into Microsoft’s cloud services. “The market overall has been disappointed with mega tech guidance,” she said, highlighting the potential impact on market sentiment as the election draws near.

Analysts Warn of Further Volatility

Many analysts see no immediate end to the current bout of market anxiety.

Michael Gayed, CFA, commented, “I think the markets could be a little more prepared for a Trump win this time around, but I wouldn’t be surprised to see the VIX start to pick up again.”

David Morrison, senior market analyst at Trade Nation, echoed this sentiment, warning that “volatility remains elevated and is unlikely to pull back until there’s certainty over the result of next week’s Presidential Election.”

Morrison added that a decisive election outcome could alleviate some market fears, but with polling data as tight as it is, uncertainty is likely to persist.

Now Read:

Image:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Progress Completes Acquisition of ShareFile

ShareFile’s AI-powered, document-centric collaboration platform expands Progress’ industry-leading product portfolio and marks a major milestone in the company’s Total Growth Strategy

BURLINGTON, Mass., Oct. 31, 2024 (GLOBE NEWSWIRE) — Progress PRGS, the trusted provider of AI-powered infrastructure software, today announced the completion of the acquisition of ShareFile, a business unit of Cloud Software Group, Inc., providing a SaaS-native, AI-powered, document-centric collaboration platform, focusing on industry segments including business and professional services, financial services, industrial and healthcare.

“This acquisition marks the latest major milestone in Progress’ Total Growth Strategy, which is built on three pillars: Invest and Innovate, Acquire and Integrate and Drive Customer Success. The addition of ShareFile significantly enhances our product capabilities, benefiting our customers and meaningfully expanding the customer base we serve,” said Yogesh Gupta, CEO of Progress. “We are thrilled to welcome ShareFile customers and employees to the Progress community and look forward to a bright future with ShareFile now part of Progress.”

Progress products help organizations to develop, deploy and manage responsible AI-powered applications and experiences. ShareFile fits strategically with Progress’ Digital Experience portfolio to enable customers to deliver more efficient and effective client and team collaboration, while simplifying the sharing of documents and prioritizing security.

As previously announced, Progress acquired ShareFile for a purchase price of $875 million, funded with a combination of cash and Progress’ existing revolving credit facility. ShareFile is expected to add more than $240M in annual revenue and more than 86,000 customers to Progress.

About Progress

Progress PRGS empowers organizations to achieve transformational success in the face of disruptive change. Our software enables our customers to develop, deploy and manage responsible AI-powered applications and experiences with agility and ease. Customers get a trusted provider in Progress, with the products, expertise and vision they need to succeed. Over 4 million developers and technologists at hundreds of thousands of enterprises depend on Progress. Learn more at www.progress.com.

Note Regarding Forward-Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Progress has identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “should,” “expect,” “intend,” “plan,” “target,” “anticipate” and “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Risks, uncertainties and other important factors that could cause actual results to differ from those expressed or implied in the forward-looking statements include: uncertainties as to the effects of disruption from the acquisition of ShareFile (i.e., making it more difficult to maintain relationships with employees, licensees, other business partners or governmental entities); other business effects, including the effects of industry, economic or political conditions outside of Progress’ or ShareFile’s control; transaction costs; actual or contingent liabilities; uncertainties as to whether anticipated synergies will be realized; and uncertainties as to whether ShareFile’s business will be successfully integrated with Progress’ business. For further information regarding risks and uncertainties associated with Progress’ business, please refer to Progress’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended November 30, 2023. Progress undertakes no obligation to update any forward-looking statements, which speak only as of the date of this press release.

| Press Inquiries: Erica McShane VP, Corporate Communications Progress Software +1 781-280-4000 pr@progress.com |

Investor Relations: Mike Micciche SVP, Investor Relations Progress Software +1 781-280-4000 Investor-relations@progress.com |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IPX1031 Spins Its Frightfully Fun 10-31 Day Video On 10/31

Get Ready to Crawl with Excitement!

CHICAGO, Oct. 31, 2024 /PRNewswire/ — National 1031 Qualified Intermediary leader, Investment Property Exchange Services, Inc. (IPX1031) celebrates October 31st with its Day of the 10-31 video. Halloween is here, and there is no more fitting day in the 1031 industry for a fun video showcasing what IPX1031 does best – helping you navigate the web of tax deferral. Whether you’re a real estate investor or a Halloween lover, IPX1031’s Itsy Bitsy Spider video will be a treat for you.

The video features the classic nursery rhyme character of “The Itsy Bitsy Spider,” but with a twist – the spider climbs up the tax deferral process. You’ll laugh, you’ll learn, and you might even scream – as this video alludes to the enticing benefits of tax deferral through a 1031 Exchange.

“Through a fun and lively video, we wanted to show real estate owners and investors how strategic tax planning can be advantageous by utilizing 1031 Exchanges,” said John Wunderlich, IPX1031 President.

Halloween can be frightening, but 1031 Exchanges don’t have to be. IPX1031 works with your advisors to make the 1031 Exchange process simple and stress-free. Don’t be afraid to check out IPX1031’s website or social media channels for even more 10-31 Day info on 1031 Exchanges. www.ipx1031.com

Because who doesn’t love a little extra deferral?

About IPX1031

Investment Property Exchange Services, Inc. (IPX1031) is the largest and one of the oldest Qualified Intermediaries in the United States. As a wholly owned subsidiary of Fidelity National Financial FNF, a Fortune 500 company, IPX1031 provides industry leading security for exchange funds as well as expertise and experience in facilitating all types of 1031 Exchanges. IPX1031’s nationwide staff, which includes industry experts, veteran attorneys and accountants, are available to provide answers and guidance to clients and their legal and tax advisors. For more information about IPX1031 visit www.ipx1031.com.

For more information, contact:

Cindi Marinez, VP, National Marketing Director

cindi.marinez@ipx1031.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ipx1031-spins-its-frightfully-fun-10-31-day-video-on-1031-302293483.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ipx1031-spins-its-frightfully-fun-10-31-day-video-on-1031-302293483.html

SOURCE IPX1031

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.