Plexus President & CEO Trades Company's Stock

Todd P Kelsey, President & CEO at Plexus PLXS, reported an insider sell on November 6, according to a new SEC filing.

What Happened: Kelsey’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday unveiled the sale of 8,000 shares of Plexus. The total transaction value is $1,253,233.

During Thursday’s morning session, Plexus shares down by 1.66%, currently priced at $164.0.

Unveiling the Story Behind Plexus

Plexus Corp is a U.S based Electronic Manufacturing Services company that provides a range of services, from conceptualization and design to fulfilling orders and providing sustaining solutions, such as replenishment and refurbishment. The company’s segments comprise AMER, APAC,ge and EMEA.

Financial Milestones: Plexus’s Journey

Revenue Growth: Plexus’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 9.35%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 10.27%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Plexus’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.52.

Debt Management: Plexus’s debt-to-equity ratio is below the industry average. With a ratio of 0.21, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: Plexus’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 41.59.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.18 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Plexus’s EV/EBITDA ratio of 28.25 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Plexus’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: Rohit Kapoor Sells $8.48M Worth Of ExlService Holdings Shares

A substantial insider sell was reported on November 6, by Rohit Kapoor, Chairman & CEO at ExlService Holdings EXLS, based on the recent SEC filing.

What Happened: Kapoor’s recent move involves selling 200,000 shares of ExlService Holdings. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value is $8,482,000.

Monitoring the market, ExlService Holdings‘s shares down by 0.0% at $45.15 during Thursday’s morning.

Delving into ExlService Holdings’s Background

ExlService Holdings Inc. is a business process management company that provides digital operations and analytical services to clients driving enterprise-scale business transformation initiatives that leverage company’s deep expertise in analytics, AI, ML and cloud. The company offers business process outsourcing and automation services, and data-driven insights to customers across multiple industries. The company operates through four segments based on the products and services offered and markets served: Insurance, Healthcare, Emerging, Analytics. The vast majority of the company’s revenue is earned in the United States, and more than half of its revenue comes from Analytics segment.

Financial Insights: ExlService Holdings

Revenue Growth: ExlService Holdings’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 14.87%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 37.76%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): ExlService Holdings’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.33.

Debt Management: With a below-average debt-to-equity ratio of 0.47, ExlService Holdings adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: ExlService Holdings’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 39.6.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.21, ExlService Holdings’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 21.86, ExlService Holdings demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Deciphering Transaction Codes in Insider Filings

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of ExlService Holdings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Plaza Retail REIT Announces Third Quarter 2024 Results

FREDERICTON, NB, Nov. 7, 2024 /CNW/ – Plaza Retail REIT PLZ (“Plaza” or the “REIT”) today announced its financial results for the three and nine months ended September 30, 2024.

“We are pleased with our Q3 results as we continue to achieve strong lease renewal spreads and same-asset NOI growth” said Michael Zakuta, President and CEO. “Our portfolio, dominated by open-air essential needs and value retail properties, continues to perform, and demand for our retail space remains strong. As interest rates decline, we also benefit from lower borrowing costs, which we anticipate will positively contribute to our results through the remainder of the year and into 2025.”

|

Summary of Selected IFRS Financial Results |

||||||||

|

(CAD$000s, except percentages) |

Three Months Ended September 30, 2024 |

Three Months Ended September 30, 2023 |

$ Change |

% Change |

Nine Months Ended September 30, 2024 |

Nine Months Ended September 30, 2023 |

$ Change |

% Change |

|

Revenues |

$30,414 |

$28,294 |

$2,120 |

7.5 % |

$90,657 |

$85,102 |

$5,555 |

6.5 % |

|

Net operating income (NOI)(1) |

$19,651 |

$18,460 |

$1,191 |

6.5 % |

$56,093 |

$52,918 |

$3,175 |

6.0 % |

|

Net change in fair value of investment properties |

($3,596) |

($10,919) |

$7,323 |

– |

($12,224) |

($10,472) |

($1,752) |

– |

|

Profit and total comprehensive income |

$5,119 |

$3,355 |

$1,764 |

– |

$17,012 |

$24,091 |

($7,079) |

– |

|

(1) |

This is a non-GAAP financial measure. Refer to the Non-GAAP Financial Measures defined here and in Part I and VII of the Management’s Discussion and Analysis (“MD&A”) ending September 30, 2024 for more information on each non-GAAP financial measure. |

Quarterly Highlights

- NOI was $19.7 million, up $1.2 million or 6.5% from the same period in 2023. The increase in NOI is from rent escalations and lease-up in same-asset properties, developments and properties transferred to income-producing in 2023 and 2024, partially offset by a decrease in NOI from properties sold.

- Profit and total comprehensive income for the current quarter was $5.1 million compared to $3.4 million in the same period in the prior year. The increase was mainly due to the change in fair value of investment properties, with a $3.6 million decrease in the current quarter compared to a $10.9 million decrease recorded in the same quarter in the prior year. Profit and total comprehensive income was also impacted by an increase in finance costs and administrative expenses, offset by the NOI increase noted above. Profit was also impacted by changes in non-cash fair value adjustments relating to share of profit from associates, interest rate swaps, the Class B exchangeable LP units, and convertible debentures.

Year-To-Date Highlights

- NOI was $56.1 million, up $3.2 million or 6.0% from the same period in 2023. NOI was impacted by rent escalations and lease-up in same-asset properties, an increase in NOI from developments and properties transferred to income producing in 2023 and 2024, offset by a decrease in NOI from properties sold.

- Profit and total comprehensive income for the current year to date was $17.0 million compared to $24.1 million in the same period in the prior year. The decrease was mainly due to the change in fair value of investment properties, with a $12.2 million decrease recorded in the current year compared to a $10.5 million decrease recorded in the same period in the prior year. Profit and total comprehensive income was also impacted by an increase in finance costs and administrative expenses, offset by the NOI increase noted above Profit was also impacted by an increase in the share of profit of associates relating to the non-cash fair value adjustment of the underlying properties in the current year, a decrease in investment and other income, along with changes in non-cash fair value adjustments relating to interest rate swaps, the Class B exchangeable LP units, and convertible debentures.

|

Summary of Selected Non-IFRS Financial Results |

||||||||

|

(CAD$000s, except percentages, units repurchased and per unit amounts) |

Three Months Ended September 30, 2024 |

Three Months Ended September 30, 2023 |

$ Change |

% Change |

Nine Months Ended September 30, 2024 |

Nine Months Ended September 30, 2023 |

$ Change |

% Change |

|

FFO(1) |

$11,405 |

$11,392 |

$13 |

0.1 % |

$31,948 |

$31,458 |

$490 |

1.6 % |

|

FFO per unit(1) |

$0.102 |

$0.102 |

– |

– |

$0.286 |

$0.289 |

($0.003) |

(1.0 %) |

|

FFO payout ratio(1) |

68.4 % |

68.5 % |

n/a |

(0.1 %) |

73.3 % |

73.2 % |

n/a |

0.1 % |

|

AFFO(1) |

$9,640 |

$9,424 |

$216 |

2.3 % |

$25,873 |

$25,360 |

$513 |

2.0 % |

|

AFFO per unit(1) |

$0.086 |

$0.085 |

$0.001 |

1.2 % |

$0.232 |

$0.233 |

($0.001) |

(0.4 %) |

|

AFFO payout ratio(1) |

81.0 % |

82.8 % |

n/a |

(2.2 %) |

90.5 % |

90.8 % |

n/a |

(0.3 %) |

|

Same-asset NOI(1) |

$18,618 |

$18,266 |

$352 |

1.9 % |

$53,984 |

$52,491 |

$1,493 |

2.8 % |

|

Normal course issuer bid – units repurchased |

– |

8,054 |

n/a |

n/a |

4,920 |

19,627 |

n/a |

n/a |

|

Committed occupancy – including non-consolidated investments(2) |

97.5 % |

97.2 % |

n/a |

0.3 % |

||||

|

Same-asset committed occupancy(3) |

96.9 % |

96.9 % |

n/a |

– |

||||

|

(1) This is a non-GAAP financial measure. Refer to the Non-GAAP Financial Measures defined here and in Part I and VII of the MD&A ending September 30, 2024 for more information on each non-GAAP financial measure. (2) Excludes properties under development. (3) Same-asset committed occupancy excludes properties under development and non-consolidated investments. |

Quarterly Highlights

- FFO & AFFO: For the three months ended September 30, 2024, FFO on a dollar basis increased $13 thousand or 0.1%. FFO per unit was consistent with the same period in the prior year. FFO was impacted by higher NOI from same-asset, developments, and properties transferred to income producing, offset by a decrease in NOI from property dispositions and higher administrative and finance costs. AFFO on a dollar basis increased $216 thousand or 2.3%, and AFFO per unit increased by $0.001 or 1.2% compared to the same period in the prior year. AFFO was impacted mainly due to the changes in FFO noted above, as well as increased maintenance capital expenditures and lower leasing costs.

- Same-asset NOI increased by $352 thousand or 1.9% due to lease-up and rent escalations, along with the completion of the repositioning of certain properties, offset by higher operating expenses.

Year-To-Date Highlights

- FFO & AFFO: For the nine months ended September 30, 2024, FFO on a dollar basis increased $490 thousand or 1.6%. FFO per unit decreased by $0.003 or (1.0%) compared to the same period in the prior year. FFO was impacted by higher NOI from same-asset, developments, and properties transferred to income producing, offset by a decrease in NOI from property dispositions and higher administrative and finance costs. AFFO on a dollar basis increased $513 thousand or 2.0%. AFFO per unit decreased by $0.001 or (0.4%) compared to the same period in the prior year mainly due to the changes in FFO noted above, as well as increased maintenance capital expenditures from extraordinary expenditures, and lower leasing costs. FFO and AFFO per unit were also impacted by the issue of 8.5 million trust units in March 2023.

- Same-asset NOI increased by $1.5 million or 2.8% due to lease-up and rent escalations, along with the completion of the repositioning of certain properties, and lower operating expenses.

Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures including FFO, AFFO and same-asset NOI. These measures are commonly used by entities in the real estate industry as useful metrics for measuring performance. However, they do not have a standardized meaning prescribed by IFRS Accounting Standards and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should be considered as supplemental in nature and not as a substitute for related financial information prepared in accordance with IFRS Accounting Standards. For further explanation of non-GAAP measures and their usefulness in assessing Plaza’s performance, please refer to the section “Basis of Presentation” in Part I and the section “Explanation of Non-GAAP Measures” in Part VII of the REIT’s Management’s Discussion and Analysis as at September 30, 2024, which can be found on Plaza’s website at www.plaza.ca and on SEDAR at www.sedar.com.

The following tables reconcile the non-GAAP measures FFO, AFFO, and NOI to the most comparable IFRS measures.

Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO)

Plaza’s summary of FFO and AFFO for the three and nine months ended September 30, 2024, compared to the three and nine months ended September 30, 2023, is presented below:

|

(000s – except per unit amounts and percentage data, unaudited) |

3 Months |

3 Months |

Change |

9 Months September |

9 Months September |

Change |

|

Profit and total comprehensive income for the period attributable to unitholders |

$ 5,073 |

$ 3,375 |

$ 16,862 |

$ 24,009 |

||

|

Incremental leasing costs included in administrative expenses(7) |

383 |

319 |

1,248 |

1,056 |

||

|

Amortization of debenture issuance costs(8) |

(18) |

(18) |

(54) |

(123) |

||

|

Distributions on Class B exchangeable LP units included in finance costs – operations |

81 |

81 |

243 |

245 |

||

|

Deferred income taxes |

(99) |

(143) |

97 |

(119) |

||

|

Right-of-use land lease principal repayments |

(205) |

(202) |

(611) |

(601) |

||

|

Fair value adjustment to restricted and deferred units |

280 |

(227) |

134 |

(383) |

||

|

Fair value adjustment to investment properties |

3,596 |

10,919 |

12,224 |

10,472 |

||

|

Fair value adjustment to investments(9) |

(1,460) |

(451) |

(1,400) |

121 |

||

|

Fair value adjustment to Class B exchangeable LP units |

544 |

(416) |

243 |

(1,017) |

||

|

Fair value adjustment to convertible debentures |

426 |

(450) |

279 |

(658) |

||

|

Fair value adjustment to interest rate swaps |

2,366 |

(1,486) |

1,737 |

(2,014) |

||

|

Fair value adjustment to right-of-use land lease assets |

205 |

202 |

611 |

601 |

||

|

Equity accounting adjustment(10) |

264 |

(33) |

370 |

(58) |

||

|

Non-controlling interest adjustment(6) |

(31) |

(78) |

(35) |

(73) |

||

|

FFO(1) |

$ 11,405 |

$ 11,392 |

$ 13 |

$ 31,948 |

$ 31,458 |

$ 490 |

|

FFO change over prior period – % |

0.1 % |

1.6 % |

||||

|

FFO(1) |

$ 11,405 |

$ 11,392 |

$ 31,948 |

$ 31,458 |

||

|

Non-cash revenue – straight-line rent(5) |

(169) |

(16) |

(387) |

(27) |

||

|

Leasing costs – existing properties(2) (5) (11) |

(1,022) |

(1,732) |

(3,952) |

(5,173) |

||

|

Maintenance capital expenditures – existing properties(12) |

(603) |

(223) |

(1,778) |

(901) |

||

|

Non-controlling interest adjustment(6) |

29 |

3 |

42 |

3 |

||

|

AFFO(1) |

$ 9,640 |

$ 9,424 |

$ 216 |

$ 25,873 |

$ 25,360 |

$ 513 |

|

AFFO change over prior period – % |

2.3 % |

2.0 % |

||||

|

Weighted average units outstanding – basic(1)(3) |

111,537 |

111,530 |

111,528 |

108,797 |

||

|

FFO per unit – basic(1) |

$ 0.102 |

$ 0.102 |

– |

$ 0.286 |

$ 0.289 |

(1.0 %) |

|

AFFO per unit – basic(1) |

$ 0.086 |

$ 0.085 |

1.2 % |

$ 0.232 |

$ 0.233 |

(0.4 %) |

|

Gross distribution to unitholders(1)(4) |

$ 7,806 |

$ 7,806 |

$ 23,417 |

$ 23,020 |

||

|

FFO payout ratio – basic(1) |

68.4 % |

68.5 % |

73.3 % |

73.2 % |

||

|

AFFO payout ratio – basic(1) |

81.0 % |

82.8 % |

90.5 % |

90.8 % |

||

|

FFO(1) |

$ 11,405 |

$ 11,392 |

$ 31,948 |

$ 31,458 |

||

|

Interest on dilutive convertible debentures |

180 |

179 |

537 |

533 |

||

|

FFO – diluted(1) |

$ 11,585 |

$ 11,571 |

$ 14 |

$ 32,485 |

$ 31,991 |

$ 494 |

|

Diluted weighted average units outstanding(1)(3) |

114,067 |

114,060 |

114,058 |

111,327 |

||

|

AFFO(1) |

$ 9,640 |

$ 9,424 |

$ 25,873 |

$ 25,360 |

||

|

Interest on dilutive convertible debentures |

180 |

179 |

537 |

533 |

||

|

AFFO – diluted(1) |

$ 9,820 |

$ 9,603 |

$ 217 |

$ 26,410 |

$ 25,893 |

$ 517 |

|

Diluted weighted average units outstanding(1)(3) |

114,067 |

114,060 |

114,058 |

111,327 |

||

|

FFO per unit – diluted(1) |

$ 0.102 |

$ 0.101 |

1.0 % |

$ 0.285 |

$ 0.287 |

(0.7 %) |

|

AFFO per unit – diluted(1) |

$ 0.086 |

$ 0.084 |

2.4 % |

$ 0.231 |

$ 0.233 |

(0.9 %) |

|

(1) |

This is a non-GAAP financial measure. Refer to the Non-GAAP Financial Measures defined here and in Part I and VII of the REIT’s MD&A ending September 30, 2024 for more information on each non-GAAP financial measure. |

|

(2) |

Based on actuals. |

|

(3) |

Includes Class B exchangeable LP units. |

|

(4) |

Includes distributions on Class B exchangeable LP units. |

|

(5) |

Includes proportionate share of revenue and expenditures at equity-accounted investments. |

|

(6) |

The non-controlling interest (“NCI”) adjustment, includes adjustments required to translate the profit and total comprehensive income attributable to NCI of $46 thousand and $150 thousand for the three and nine months ending September 30, 2024, respectively (September 30, 2023 – loss of $20 thousand and profit of $82 thousand, respectively) to FFO and AFFO for the NCI. |

|

(7) |

Incremental leasing costs included in administrative expenses include leasing costs of salaried leasing staff directly attributed to signed leases that would otherwise be capitalized if incurred from external sources. These costs are excluded from FFO in accordance with RealPAC’s definition of FFO. |

|

(8) |

Amortization of debenture issuance costs is deducted on a straight-line basis over the remaining term of the related convertible debentures, in accordance with RealPAC. |

|

(9) |

Fair value adjustment to investments relate to the unrealized change in fair value of equity accounted entities which are excluded from FFO in accordance with RealPAC’s definition of FFO. |

|

(10) |

Equity accounting adjustment for interest rate swaps includes the change in non-cash fair value adjustments relating to interest rate swaps held by equity accounted entities, which are excluded from FFO in accordance with RealPAC’s definition of FFO. |

|

(11) |

Leasing costs – existing properties include internal and external leasing costs except to the extent that leasing costs relate to development projects, in accordance with RealPAC’s definition of AFFO. See the Gross Capital Additions Including Leasing Fees note on page 27 of the MD&A. |

|

(12) |

Maintenance capital expenditures – existing properties include expenditures related to sustaining and maintaining existing space, in accordance with RealPAC’s definition of AFFO. See the Gross Capital Additions Including Leasing Fees note on page 27 of the MD&A. |

Net Property Operating Income (NOI) and Same-Asset Net Property Operating Income (Same-Asset NOI)

|

(000s) |

3 Months Ended September 30, 2024 (unaudited) |

3 Months Ended September 30, 2023 (unaudited) |

9 Months Ended September 30, 2024 (unaudited) |

9 Months Ended September 30, 2023 |

|

|

Same-asset NOI(1) |

$ 18,618 |

$ 18,266 |

$ 53,984 |

$ 52,491 |

|

|

Developments and redevelopments transferred to income producing in 2023 & 2024 ($7.5 million annual stabilized NOI) |

1,490 |

906 |

3,767 |

1,684 |

|

|

NOI from properties currently under development and redevelopment ($650 thousand annual stabilized NOI) |

– |

(179) |

– |

(51) |

|

|

Straight-line rent |

169 |

22 |

387 |

42 |

|

|

Administrative expenses charged to NOI |

(887) |

(898) |

(2,963) |

(2,829) |

|

|

Lease termination revenue |

168 |

– |

201 |

– |

|

|

Properties disposed |

80 |

324 |

697 |

1,500 |

|

|

Other |

13 |

19 |

20 |

81 |

|

|

Total NOI(1) |

$ 19,651 |

$ 18,460 |

$ 56,093 |

$ 52,918 |

|

|

Percentage increase over prior period |

6.5 % |

6.0 % |

|||

|

(1) This is a non-GAAP financial measure. Refer to the Non-GAAP Financial Measures defined here and in Part I and VII of the REIT’s MD&A for more information on each non-GAAP financial measure. |

Cautionary Statements Regarding Forward-looking Information

This press release contains forward-looking statements relating to Plaza’s operations, prospects, outlook, condition and the environment in which it operates, including with respect to Plaza’s outlook or expectations regarding the future of its business, continuation of strong retailer demand and the impact of lower interest rates on Plaza’s overall success through the remainder of the year and into 2025. Forward-looking statements are not future guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Plaza to be materially different from any future results, performance or achievements expressed, implied or projected by forward-looking statements contained in this press release, including but not limited to changes in economic, retail, capital market, or debt market conditions, including recessions and changes in, or the extent of changes in, interest rates and the rate of inflation; supply chain constraints; competitive real estate conditions; and others described in Plaza’s Annual Information Form for the year ended December 31, 2023 and Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 which can be obtained on the REIT’s website at www.plaza.ca or on SEDAR+ at www.sedarplus.ca. Forward-looking statements are based on a number of expectations and assumptions made in light of management’s experience and perceptions of historical trends and current conditions, including that progress continues on Plaza’s development and redevelopment program, the strength of Plaza’s tenant base, that tenant demand for space continues, that Plaza is able to lease or re-lease space at anticipated rents and that interest rates continue to decline. Although based upon information currently available to management and what management believes are reasonable expectations and assumptions, there can be no assurances that forward-looking statements will prove to be accurate. Readers, therefore, should not place undue reliance on any forward-looking statements. Plaza undertakes no obligation to publicly update any such statements, except as required by law. These cautionary statements qualify all forward-looking statements contained in this press release.

Further Information

Information appearing in this press release is a select summary of results. A more detailed analysis of the REIT’s financial and operating results is included in the REIT’s Management’s Discussion and Analysis and Consolidated Financial Statements, which can be found on the REIT’s website at www.plaza.ca or on SEDAR at www.sedar.com.

Conference Call

Michael Zakuta, President and CEO, Jim Drake, CFO, and Jason Parravano, COO, will host a conference call for the investment community on Friday, November 8, 2024 at 10:00 a.m. EST. The call-in numbers for participants are 1-437-900-0527 (local Toronto) or 1-888-510-2154 (toll free, within North America).

A replay of the call will be available until November 15, 2024. To access the replay, dial 1-289-819-1450 (local Toronto) or 1-888-660-6345 (Passcode: 52498#). The audio replay will also be available for download on the REIT’s website for 90 days following the conference call.

About Plaza

Plaza is an open-ended real estate investment trust and is a leading retail property owner and developer, focused on Ontario, Quebec and Atlantic Canada. Plaza’s portfolio at September 30, 2024 includes interests in 218 properties totaling approximately 8.8 million square feet across Canada and additional lands held for development. Plaza’s portfolio largely consists of open-air centres and stand-alone small box retail outlets and is predominantly occupied by national tenants with a focus on the essential needs, value and convenience market segments. For more information, please visit www.plaza.ca.

SOURCE Plaza Retail REIT

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/07/c6434.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/07/c6434.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

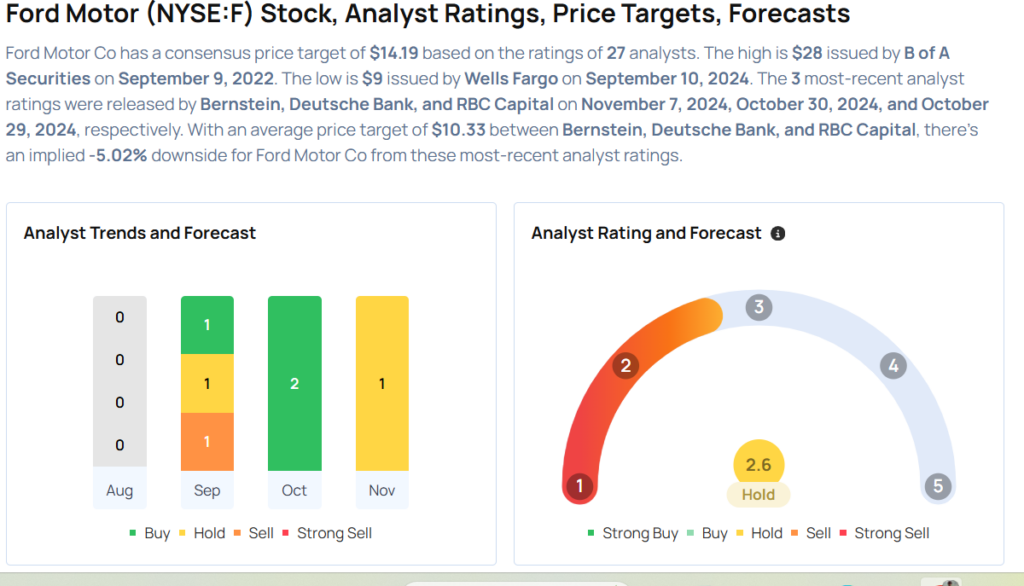

This Ford Analyst Is No Longer Bullish; Here Are Top 5 Downgrades For Thursday (CORRECTED)

Editor’s note: This story has been updated to correct the name of the Bernstein analyst covering Ford.

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

Considering buying Ford stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stellus Capital Investment Corporation Reports Results for its Third Fiscal Quarter Ended September 30, 2024

HOUSTON, Nov. 7, 2024 /PRNewswire/ — Stellus Capital Investment Corporation SCM (“Stellus”, “we”, or the “Company”) today announced financial results for its fiscal quarter ended September 30, 2024.

Robert T. Ladd, Chief Executive Officer of Stellus, stated, “I am pleased to report solid operating results for the quarter ended September 30, 2024, in which we earned U.S. GAAP net investment income of $0.39 per share and core net investment income of $0.40 per share, which covered the regular dividend declared of $0.40 per share. Net asset value per share increased by $0.19 per share from the prior quarter end. Subsequent to the quarter end, we increased our capital base by $55 million through the upsizing of our Credit Facility to $315 million. As we celebrate the completion of twelve years of operations, I’m also pleased to report that our investors have received a total of $273 million in distributions, equivalent to $16.28 per share, since we began operations.”

FINANCIAL HIGHLIGHTS

($ in millions, except data relating to per share amounts and shares outstanding)

|

Three Months Ended |

Nine Months Ended |

||||||||||

|

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

||||||||

|

Amount |

Per Share |

Amount |

Per Share |

Amount |

Per Share |

Amount |

Per Share |

||||

|

Net investment income |

$10.26 |

$0.39 |

$10.82 |

$0.47 |

$32.29 |

$1.29 |

$30.30 |

$1.42 |

|||

|

Core net investment income(1) |

10.62 |

0.40 |

11.16 |

0.49 |

33.59 |

1.34 |

30.81 |

1.45 |

|||

|

Net realized (loss) gain on investments |

(3.30) |

(0.13) |

0.60 |

0.03 |

(21.69) |

(0.87) |

0.32 |

0.01 |

|||

|

Net realized loss on foreign currency translation |

(0.02) |

— |

(0.02) |

— |

(0.08) |

— |

(0.07) |

— |

|||

|

Total realized income(2) |

$6.94 |

$0.26 |

$11.40 |

$0.50 |

$10.52 |

$0.42 |

$30.55 |

$1.43 |

|||

|

Distributions |

(10.63) |

(0.40) |

(9.27) |

(0.41) |

(30.32) |

(1.21) |

(25.88) |

(1.22) |

|||

|

Net unrealized change in appreciation (depreciation) on investments |

8.51 |

0.33 |

(13.80) |

(0.61) |

26.44 |

1.05 |

(24.34) |

(1.14) |

|||

|

Net unrealized change in appreciation (depreciation) on foreign currency translation |

0.01 |

— |

— |

— |

— |

— |

(0.02) |

— |

|||

|

Benefit (provision) for taxes on unrealized depreciation (appreciation) on investments in taxable subsidiaries |

— |

— |

— |

— |

0.19 |

0.01 |

(0.14) |

(0.01) |

|||

|

Net increase (decrease) in net assets resulting from operations |

$15.46 |

$0.59 |

($2.40) |

($0.11) |

$37.15 |

$1.48 |

$6.05 |

$0.28 |

|||

|

Weighted average shares outstanding |

26,326,426 |

22,824,221 |

25,066,626 |

21,289,880 |

|||||||

|

(1) |

Core net investment income, as presented, excludes the impact of capital gains incentive fees (reversal) and income taxes, the majority of which are excise taxes. The Company believes presenting core net investment income and the related per share amount is a useful supplemental disclosure for analyzing its financial performance. However, core net investment income is a non-U.S. generally accepted accounting principles (“U.S. GAAP”) measure and should not be considered as a replacement for net investment income and other earnings measures presented in accordance with U.S. GAAP. A reconciliation of net investment income in accordance with U.S. GAAP to core net investment income is presented in the table below the financial statements. |

|

(2) |

Total realized income is the sum of net investment income, net realized gains (losses) on investments, net realized gains (losses) on foreign currency, and loss on debt extinguishment; all U.S. GAAP measures. |

PORTFOLIO ACTIVITY

($ in millions, except data relating to per share amounts and number of portfolio companies)

|

As of |

As of |

|||||||

|

September 30, 2024 |

December 31, 2023 |

|||||||

|

Investments at fair value |

$908.7 |

$874.5 |

||||||

|

Total assets |

$957.1 |

$908.1 |

||||||

|

Net assets |

$366.3 |

$319.9 |

||||||

|

Shares outstanding |

27,039,364 |

24,125,642 |

||||||

|

Net asset value per share |

$13.55 |

$13.26 |

||||||

|

Three Months Ended |

Nine Months Ended |

|||||||

|

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

|||||

|

New investments |

$17.8 |

$51.9 |

$112.6 |

$139.7 |

||||

|

Repayments of investments |

(15.5) |

(34.8) |

(87.3) |

(79.1) |

||||

|

Net activity |

$2.3 |

$17.1 |

$25.3 |

$60.6 |

||||

|

As of |

As of |

|||||||

|

September 30, 2024 |

December 31, 2023 |

|||||||

|

Number of portfolio company investments |

99 |

93 |

||||||

|

Number of debt investments |

86 |

81 |

||||||

|

Weighted average yield of debt and other income producing investments (3) |

||||||||

|

Cash |

10.2 % |

11.0 % |

||||||

|

Payment-in-kind (“PIK”) |

0.4 % |

0.5 % |

||||||

|

Fee amortization |

0.4 % |

0.4 % |

||||||

|

Total |

11.0 % |

11.9 % |

||||||

|

Weighted average yield on total investments (4) |

||||||||

|

Cash |

9.5 % |

10.3 % |

||||||

|

PIK |

0.4 % |

0.5 % |

||||||

|

Fee amortization |

0.4 % |

0.3 % |

||||||

|

Total |

10.3 % |

11.1 % |

||||||

|

(3) |

The dollar-weighted average annualized effective yield is computed using the effective interest rate for our debt investments and other income producing investments, including cash and PIK interest, as well as the accretion of deferred fees. The individual investment yields are then weighted by the respective cost of the investments (as of the date presented) in calculating the weighted average effective yield of the portfolio. The dollar-weighted average annualized yield on the Company’s investments for a given period will generally be higher than what investors in the Company’s common stock would realize in a return over the same period because the dollar-weighted average annualized yield does not reflect the Company’s expenses or any sales load that may be paid by investors. |

|

(4) |

The dollar-weighted average yield on total investments takes the same yields as calculated in the footnote above but weights them to determine the weighted average effective yield as a percentage of the Company’s total investments, including non-income producing loans and equity. |

Results of Operations

Investment income for the three months ended September 30, 2024 and 2023 totaled $26.5 million and $27.2 million, respectively, most of which was interest income from portfolio investments.

Gross operating expenses for the three months ended September 30, 2024 and 2023 totaled $16.2 million and $16.3 million, respectively. For the same respective periods, base management fees totaled $3.9 million for both periods, income incentive fees totaled $2.6 million and $2.7 million, fees and expenses related to our borrowings totaled $8.0 million for both periods (including interest and amortization of deferred financing costs), administrative expenses totaled $0.5 million for both periods, income tax totaled $0.4 million and $0.3 million and other expenses totaled $0.8 million and $0.9 million.

Net investment income was $10.3 million and $10.8 million, or $0.39 and $0.47 per common share based on weighted average common shares outstanding of 26,326,426 and 22,824,221 for the three months ended September 30, 2024 and 2023, respectively. Core net investment income, which is a non-U.S. GAAP measure that excludes the capital gains incentive fee (reversal) and income tax expense accruals, for the three months ended September 30, 2024 and 2023 was $10.6 million and $11.2 million, or $0.40 and $0.49 per share, respectively.

For the three months ended September 30, 2024 and 2023, the Company’s investment portfolio had a net change in unrealized appreciation (depreciation) of $8.5 million and ($13.8) million, respectively, and the Company had net realized (losses) gains of ($3.3) million and $0.6 million, respectively.

Net increase (decrease) in net assets resulting from operations totaled $15.5 million and ($2.4) million, or $0.59 and ($0.11) per common share, based on weighted average common shares outstanding of 26,326,426 and 22,824,221 for the three months ended September 30, 2024 and 2023, respectively.

Liquidity and Capital Resources

As of September 30, 2024, the Company’s amended senior secured revolving credit agreement with certain bank lenders and Zions Bancorporation, N.A. dba Amegy Bank, as administrative agent (as amended from time to time, the “Credit Facility”) provided for borrowings in an aggregate amount of up to $260.0 million on a committed basis. As of September 30, 2024 and December 31, 2023, the Credit Facility had an accordion feature which allowed for potential future expansion of the facility size up to $350.0 million.

As of September 30, 2024 and December 31, 2023, the Company had $157.4 million and $160.1 million in outstanding borrowings under the Credit Facility, respectively.

The Company issued 1,058,366 shares during the three months ended September 30, 2024 under the At-the-Market Program (“ATM Program”) for gross proceeds of $14.6 million. The average per share offering price of shares issued under the ATM Program during the three months ended September 30, 2024 was $13.79. Stellus Capital Management, LLC, the Company’s investment adviser (the “Advisor”), agreed to reimburse the Company for underwriting fees to the extent the per share price of the shares to the public, less underwriting fees, was less then net asset value per share. For the three months ended September 30, 2024, the Advisor was not required to reimburse underwriting fees as all shares were issued at a premium to net asset value.

Distributions

For the three months ended September 30, 2024 and 2023, the Company declared aggregate distributions of $0.40 per share for both periods ($10.6 million and $9.3 million in the aggregate, respectively). Tax characteristics of all distributions will be reported to stockholders on Form 1099-DIV after the end of the calendar year. None of these dividends are expected to include a return of capital.

Recent Portfolio Activity

The Company invested in the following portfolio companies during the three months ended September 30, 2024:

|

Activity Type |

Date |

Company Name |

Company Description |

Investment Amount |

Instrument Type |

||||||

|

Add-On Investment |

July 31, 2024 |

PCS Software, Inc.* |

Provider of integrated transportation management software for the inland trucking industry |

$ |

9,995 |

Equity |

|||||

|

Add-On Investment |

August 12, |

Trade Education Acquisition, L.L.C.* |

Online education platform for retail investors |

$ |

80,000 |

Revolver Commitment |

|||||

|

New Investment |

August 16, |

Bart & Associates, LLC |

Provides IT modernization services for federal customers |

$ |

8,942,723 |

Senior Secured – First Lien |

|||||

|

$ |

1,733,387 |

Delayed Draw Term Loan Commitment |

|||||||||

|

$ |

1,046,677 |

Revolver Commitment |

|||||||||

|

$ |

418,671 |

Equity |

|||||||||

|

Add-On Investment |

August 26, |

Impact Home Services LLC* |

Residential garage door, electrical, and plumbing services provider |

$ |

1,571,984 |

Delayed Draw Term Loan Commitment |

|||||

|

Add-On Investment |

September 11, |

Service Minds Company, LLC* |

Provider of residential electrical services |

$ |

20,000 |

Revolver Commitment |

|||||

|

Add-On Investment |

September 30, |

The Hardenbergh Group, Inc. * |

Provider of temporary professional staffing of medical services professionals, external peer review, consulting and physician leadership solutions |

$ |

804,031 |

Senior Secured – First Lien |

|||||

|

Add-On Investment |

September 30, |

Monitorus Holding, LLC* |

Provider of media monitoring and evaluation services |

$ |

11,629 |

Unsecured Convertible Bond |

|||||

|

Add-On Investment |

September 30, |

ADS Group Opco, LLC* |

Full-service manufacturer for OEMs, prime contractors, and Tier I suppliers across the defense, space, and aerospace industries |

$ |

69,453 |

Revolver Commitment |

|||||

|

*Existing portfolio company |

The Company realized investments in the following portfolio companies during the three months ended September 30, 2024:

|

Activity Type |

Date |

Company Name |

Company Description |

Proceeds Received |

Realized Gain |

Instrument Type |

||||||||

|

Full Realization |

August 1, 2024 |

ICD Holdings, LLC* |

Financial company that connects corporate treasury departments with money market and short duration bond funds |

$ |

2,599,378 |

$ |

2,192,411 |

Equity |

||||||

|

Full Repayment |

September 27, 2024 |

EHI Buyer, Inc.* |

Provider of design, engineering, installation, and maintenance services for building management systems |

$ |

6,050,229 |

$ |

— |

Senior Secured – First Lien |

||||||

|

$ |

2,322,310 |

$ |

— |

Delayed Draw Term Loan |

||||||||||

|

*Existing portfolio company |

Events Subsequent to September 30, 2024

The Company’s management has evaluated subsequent events through November 7, 2024. There have been no subsequent events that require recognition or disclosure except for the following described below.

Investment Portfolio

The Company invested in the following portfolio companies subsequent to September 30, 2024:

|

Activity Type |

Date |

Company Name |

Company Description |

Investment Amount |

Instrument Type |

||||||

|

Add-On Investment |

October 18, 2024 |

Compost 360 Investments, LLC* |

Organic waste recycler and producer of compost, mulch, and engineered soils |

$ |

49,280 |

Equity |

|||||

|

New Investment |

October 31, 2024 |

Norplex Micarta Acquisition, Inc. |

Manufacturer of thermoset composite laminates |

$ |

13,000,000 |

Senior Secured – First Lien |

|||||

|

$ |

500,000 |

Revolver Commitment |

|||||||||

|

$ |

739,804 |

Equity |

|||||||||

|

Add-On Investment |

November 7, 2024 |

Green Intermediateco II, Inc.* |

Cyber-security focused value-added reseller and associated service provider |

$ |

1,300,000 |

Senior Secured – First Lien |

|||||

|

*Existing portfolio company |

The Company realized an investment in the following portfolio company subsequent to September 30, 2024:

|

Activity Type |

Date |

Company Name |

Company Description |

Proceeds Received |

Realized Gain |

Instrument Type |

||||||||

|

Full Repayment |

November 4, 2024 |

Baker Manufacturing Company, LLC* |

Manufacturer of water well equipment, specialized filtration pumps, and custom castings |

$ |

12,738,093 |

$ |

— |

Senior Secured – First Lien |

||||||

|

Full Realization |

November 5, 2024 |

Health Monitor Holdings, LLC* |

Provider of point-of-care patient engagement and marketing solutions for pharmaceutical companies |

$ |

1,704,298 |

$ |

651,379 |

Equity |

||||||

|

*Existing portfolio company |

Credit Facility

On October 30, 2024, the Company entered into an Increase Agreement to the Credit Facility which, among other things, amends the Credit Facility to increase the total available commitments under the Credit Facility from $260.0 million to $315.0 million on a committed basis.

The outstanding balance under the Credit Facility as of November 7, 2024 was $158.0 million.

Distributions Declared

On October 10, 2024, our Board of Directors declared a regular monthly distribution for each of October, November, and December 2024, as follows:

|

Ex-Dividend |

Record |

Payment |

Amount per |

||||||

|

Declared |

Date |

Date |

Date |

Share |

|||||

|

10/10/2024 |

10/31/2024 |

10/31/2024 |

11/15/2024 |

$ |

0.1333 |

||||

|

10/10/2024 |

11/29/2024 |

11/29/2024 |

12/13/2024 |

$ |

0.1333 |

||||

|

10/10/2024 |

12/31/2024 |

12/31/2024 |

1/15/2024 |

$ |

0.1333 |

||||

Conference Call Information

Stellus Capital Investment Corporation will host a conference call to discuss these results on Friday, November 8, 2024 at 11:00 AM, Central Time. The conference call will be led by Robert T. Ladd, Chief Executive Officer, and W. Todd Huskinson, Chief Financial Officer, Chief Compliance Officer, Treasurer, and Secretary.

For those wishing to participate by telephone, please dial (888) 506-0062. Use passcode 122799. Starting approximately two hours after the conclusion of the call, a replay will be available through Friday, November 22, 2024 by dialing (877) 481-4010 and entering passcode 51477. The replay will also be available on the Company’s website.

For those wishing to participate via Live Webcast, connect via the Public (SCIC) section of our website at www.stelluscapital.com, under the Events tab. A replay of the conference will be available on our website for approximately 90 days.

About Stellus Capital Investment Corporation

The Company is an externally-managed, closed-end, non-diversified investment management company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. The Company’s investment objective is to maximize the total return to its stockholders in the form of current income and capital appreciation by investing primarily in private middle-market companies (typically those with $5.0 million to $50.0 million of EBITDA (earnings before interest, taxes, depreciation and amortization)) through first lien (including unitranche) loans, second lien loans and unsecured debt financing, with corresponding equity co-investments. The Company’s investment activities are managed by its investment adviser, Stellus Capital Management. To learn more about Stellus Capital Investment Corporation, visit www.stelluscapital.com under the “Public (SCIC)” tab.

Forward-Looking Statements

Statements included herein may contain “forward-looking statements” which relate to future performance or financial condition. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission including the final prospectus that will be filed with the Securities and Exchange Commission. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Contacts

Stellus Capital Investment Corporation

W. Todd Huskinson, Chief Financial Officer

(713) 292-5414

thuskinson@stelluscapital.com

|

STELLUS CAPITAL INVESTMENT CORPORATION CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES |

|||||||

|

September 30, 2024 |

|||||||

|

(unaudited) |

December 31, 2023 |

||||||

|

ASSETS |

|||||||

|

Controlled investments at fair value (amortized cost of $17,934,808 and $17,285,138, respectively) |

$ |

7,749,169 |

$ |

6,175,994 |

|||

|

Non-controlled, non-affiliated investments, at fair value (amortized cost of $891,385,080 and $884,858,412, respectively) |

900,969,724 |

868,284,689 |

|||||

|

Cash and cash equivalents |

38,580,261 |

26,125,741 |

|||||

|

Receivable for sales and repayments of investments |

1,358,421 |

371,877 |

|||||

|

Interest receivable |

6,272,194 |

4,882,338 |

|||||

|

Income tax receivable |

1,817,371 |

1,588,708 |

|||||

|

Other receivables |

67,995 |

42,995 |

|||||

|

Deferred offering costs |

— |

7,312 |

|||||

|

Prepaid expenses |

256,724 |

606,674 |

|||||

|

Total Assets |

$ |

957,071,859 |

$ |

908,086,328 |

|||

|

LIABILITIES |

|||||||

|

Notes Payable |

$ |

99,331,757 |

$ |

98,996,412 |

|||

|

Credit Facility payable |

154,578,467 |

156,564,776 |

|||||

|

SBA-guaranteed debentures |

321,058,121 |

320,273,358 |

|||||

|

Dividends payable |

3,604,347 |

— |

|||||

|

Management fees payable |

3,959,554 |

2,918,536 |

|||||

|

Income incentive fees payable |

3,154,576 |

2,885,180 |

|||||

|

Interest payable |

1,253,031 |

5,241,164 |

|||||

|

Related party payable |

1,898,854 |

— |

|||||

|

Unearned revenue |

550,348 |

397,725 |

|||||

|

Administrative services payable |

401,033 |

402,151 |

|||||

|

Deferred tax liability |

— |

188,893 |

|||||

|

Other accrued expenses and liabilities |

996,484 |

278,345 |

|||||

|

Total Liabilities |

$ |

590,786,572 |

$ |

588,146,540 |

|||

|

Commitments and contingencies (Note 7) |

|||||||

|

Net Assets |

$ |

366,285,287 |

$ |

319,939,788 |

|||

|

NET ASSETS |

|||||||

|

Common stock, par value $0.001 per share (100,000,000 shares authorized; 27,039,364 and 24,125,642 issued and outstanding, respectively) |

$ |

27,039 |

$ |

24,125 |

|||

|

Paid-in capital |

375,430,445 |

335,918,984 |

|||||

|

Total distributable loss |

(9,172,197) |

(16,003,321) |

|||||

|

Net Assets |

$ |

366,285,287 |

$ |

319,939,788 |

|||

|

Total Liabilities and Net Assets |

$ |

957,071,859 |

$ |

908,086,328 |

|||

|

Net Asset Value Per Share |

$ |

13.55 |

$ |

13.26 |

|||

|

STELLUS CAPITAL INVESTMENT CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) |

|||||||||||||

|

For the three months ended |

For the nine months ended |

||||||||||||

|

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

||||||||||

|

INVESTMENT INCOME |

|||||||||||||

|

From controlled investments: |

|||||||||||||

|

Interest income |

$ |

— |

$ |

— |

$ |

81,636 |

$ |

— |

|||||

|

From non-controlled, non-affiliated investments |

|||||||||||||

|

Interest income |

25,338,361 |

26,223,986 |

75,460,156 |

75,295,485 |

|||||||||

|

Other income |

1,159,898 |

941,040 |

3,579,415 |

2,529,905 |

|||||||||

|

Total Investment Income |

$ |

26,498,259 |

$ |

27,165,026 |

$ |

79,121,207 |

$ |

77,825,390 |

|||||

|

OPERATING EXPENSES |

|||||||||||||

|

Management fees |

$ |

3,959,554 |

$ |

3,933,121 |

$ |

11,664,020 |

$ |

11,533,811 |

|||||

|

Valuation fees |

151,535 |

139,267 |

343,753 |

332,762 |

|||||||||

|

Administrative services expenses |

469,274 |

470,846 |

1,441,436 |

1,399,188 |

|||||||||

|

Income incentive fees |

2,564,922 |

2,705,200 |

7,616,562 |

7,433,039 |

|||||||||

|

Capital gains incentive fee reversal |

— |

— |

— |

(569,528) |

|||||||||

|

Professional fees |

312,034 |

276,592 |

847,866 |

877,276 |

|||||||||

|

Directors’ fees |

93,250 |

93,250 |

315,750 |

303,750 |

|||||||||

|

Insurance expense |

126,362 |

123,725 |

376,840 |

366,156 |

|||||||||

|

Interest expense and other fees |

7,956,403 |

8,049,063 |

23,840,473 |

24,037,462 |

|||||||||

|

Income tax expense |

360,192 |

335,508 |

1,304,948 |

1,082,057 |

|||||||||

|

Other general and administrative expenses |

245,043 |

217,655 |

908,185 |

727,754 |

|||||||||

|

Total Operating Expenses |

$ |

16,238,569 |

$ |

16,344,227 |

$ |

48,659,833 |

$ |

47,523,727 |

|||||

|

Income incentive fee waiver |

— |

— |

(1,826,893) |

— |

|||||||||

|

Total Operating Expenses, net of fee waivers |

$ |

16,238,569 |

$ |

16,344,227 |

$ |

46,832,940 |

$ |

47,523,727 |

|||||

|

Net Investment Income |

$ |

10,259,690 |

$ |

10,820,799 |

$ |

32,288,267 |

$ |

30,301,663 |

|||||

|

Net realized (loss) gain on non-controlled, non-affiliated investments |

$ |

(3,297,615) |

$ |

600,403 |

$ |

(21,689,864) |

$ |

324,782 |

|||||

|

Net realized loss on foreign currency translations |

(22,095) |

(22,166) |

(76,990) |

(72,782) |

|||||||||

|

Net change in unrealized appreciation on controlled investments |

248,746 |

— |

923,505 |

— |

|||||||||

|

Net change in unrealized appreciation (depreciation) on non-controlled, non-affiliated investments |

8,255,272 |

(13,793,320) |

25,512,422 |

(24,338,195) |

|||||||||

|

Net change in unrealized appreciation (depreciation) on foreign currency translations |

14,588 |

(2,794) |

5,099 |

(21,243) |

|||||||||

|

(Provision) benefit for taxes on net unrealized (appreciation) depreciation on investments |

— |

(312) |

188,893 |

(144,425) |

|||||||||

|

Benefit for taxes on net realized loss on investments |

2,221 |

— |

2,221 |

— |

|||||||||

|

Net Increase (Decrease) in Net Assets Resulting from Operations |

$ |

15,460,807 |

$ |

(2,397,390) |

$ |

37,153,553 |

$ |

6,049,800 |

|||||

|

Net Investment Income Per Share—basic and diluted |

$ |

0.39 |

$ |

0.47 |

$ |

1.29 |

$ |

1.42 |

|||||

|

Net Increase (Decrease) in Net Assets Resulting from Operations Per Share – basic and diluted |

$ |

0.59 |

$ |

(0.11) |

$ |

1.48 |

$ |

0.28 |

|||||

|

Weighted Average Shares of Common Stock Outstanding—basic and diluted |

26,326,426 |

22,824,221 |

25,066,626 |

21,289,880 |

|||||||||

|

Distributions Per Share—basic and diluted |

$ |

0.40 |

$ |

0.41 |

$ |

1.21 |

$ |

1.22 |

|||||

|

STELLUS CAPITAL INVESTMENT CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS (unaudited) |

||||||||||||||

|

Common Stock |

Total |

|||||||||||||

|

Number |

Par |

Paid-in |

distributable |

|||||||||||

|

of shares |

value |

capital |

earnings (loss) |

Net Assets |

||||||||||

|

Balances at December 31, 2022 |

19,666,769 |

$ |

19,667 |

$ |

275,114,720 |

$ |

642,226 |

$ |

275,776,613 |

|||||

|

Net investment income |

— |

— |

— |

9,067,620 |

9,067,620 |

|||||||||

|

Net realized gain on investments |

— |

— |

— |

34,967 |

34,967 |

|||||||||

|

Net realized loss on foreign currency translations |

— |

— |

— |

(39,912) |

(39,912) |

|||||||||

|

Net change in unrealized depreciation on investments |

— |

— |

— |

(4,249,642) |

(4,249,642) |

|||||||||

|

Net change in unrealized appreciation on foreign currency translations |

— |

— |

— |

1,874 |

1,874 |

|||||||||

|

Provision for taxes on unrealized appreciation on investments |

— |

— |

— |

(78,760) |

(78,760) |

|||||||||

|

Distributions from net investment income |

— |

— |

— |

(7,951,284) |

(7,951,284) |

|||||||||

|

Issuance of common stock, net of offering costs(1) |

581,614 |

581 |

8,289,988 |

— |

8,290,569 |

|||||||||

|

Balances at March 31, 2023 |

20,248,383 |

$ |

20,248 |

$ |

283,404,708 |

$ |

(2,572,911) |

$ |

280,852,045 |

|||||

|

Net investment income |

— |

— |

— |

10,413,244 |

10,413,244 |

|||||||||

|

Net realized loss on non-controlled, non-affiliated investments |

— |

— |

— |

(310,588) |

(310,588) |

|||||||||

|

Net realized loss on foreign currency translation |

— |

— |

— |

(10,704) |

(10,704) |

|||||||||

|

Net change in unrealized depreciation on non-controlled, non-affiliated investments |

— |

— |

— |

(6,295,233) |

(6,295,233) |

|||||||||

|

Net change in unrealized depreciation on foreign currency translations |

— |

— |

— |

(20,323) |

(20,323) |

|||||||||

|

Provision for taxes on unrealized appreciation on investments |

— |

— |

— |

(65,353) |

(65,353) |

|||||||||

|

Distributions from net investment income |

— |

— |

— |

(8,659,144) |

(8,659,144) |

|||||||||

|

Issuance of common stock, net of offering costs(1) |

2,309,521 |

2,310 |

32,418,774 |

— |

32,421,084 |

|||||||||

|

Balances at June 30, 2023 |

22,557,904 |

$ |

22,558 |

$ |

315,823,482 |

$ |

(7,521,012) |

$ |

308,325,028 |

|||||

|

Net investment income |

— |

— |

— |

10,820,799 |

10,820,799 |

|||||||||

|

Net realized gain on investments |

— |

— |

— |

600,403 |

600,403 |

|||||||||

|

Net realized loss on foreign currency translation |

— |

— |

— |

(22,166) |

(22,166) |

|||||||||

|

Net change in unrealized depreciation on investments |

— |

— |

— |

(13,793,320) |

(13,793,320) |

|||||||||

|

Net change in unrealized depreciation on foreign currency translations |

— |

— |

— |

(2,794) |

(2,794) |

|||||||||

|

Provision for taxes on unrealized appreciation on investments |

— |

— |

— |

(312) |

(312) |

|||||||||

|

Distributions from net investment income |

— |

— |

— |

(9,269,208) |

(9,269,208) |

|||||||||

|

Issuance of common stock, net of offering costs(1) |

1,567,738 |

1,567 |

21,465,783 |

— |

21,467,350 |

|||||||||

|

Balances at September 30, 2023 |

24,125,642 |

$ |

24,125 |

$ |

337,289,265 |

$ |

(19,187,610) |

$ |

318,125,780 |

|||||

|

Balances at December 31, 2023 |

24,125,642 |

$ |

24,125 |

$ |

335,918,984 |

$ |

(16,003,321) |

$ |

319,939,788 |

|||||

|

Net investment income |

— |

— |

— |

10,235,916 |

10,235,916 |

|||||||||

|

Net realized loss on investments |

— |

— |

— |

(20,384,731) |

(20,384,731) |

|||||||||

|

Net realized loss on foreign currency translations |

— |

— |

— |

(25,106) |

(25,106) |

|||||||||

|

Net change in unrealized appreciation on investments |

— |

— |

— |

23,518,590 |

23,518,590 |

|||||||||

|

Net change in unrealized depreciation on foreign currency translations |

— |

— |

— |

(3,602) |

(3,602) |

|||||||||

|

Provision for taxes on unrealized appreciation on investments |

— |

— |

— |

(192,607) |

(192,607) |

|||||||||

|

Distributions from net investment income |

— |

— |

— |

(9,647,844) |

(9,647,844) |

|||||||||

|

Balances at March 31, 2024 |

24,125,642 |

$ |

24,125 |

$ |

335,918,984 |

$ |

(12,502,705) |

$ |

323,440,404 |

|||||

|

Net investment income |

— |

— |

— |

11,792,661 |

11,792,661 |

|||||||||

|

Net realized gain on investments |

— |

— |

— |

1,992,482 |

1,992,482 |

|||||||||

|

Net realized loss on foreign currency translations |

— |

— |

— |

(29,789) |

(29,789) |

|||||||||

|

Net change in unrealized depreciation on investments |

— |

— |

— |

(5,586,681) |

(5,586,681) |

|||||||||

|

Net change in unrealized depreciation on foreign currency translations |

— |

— |

— |

(5,887) |

(5,887) |

|||||||||

|

Benefit for taxes on unrealized depreciation on investments |

— |

— |

— |

381,500 |

381,500 |

|||||||||

|

Distributions from net investment income |

— |

— |

— |

(10,049,073) |

(10,049,073) |

|||||||||

|

Issuance of common stock, net of offering costs(1) |

1,855,356 |

1,856 |

25,248,020 |

— |

25,249,876 |

|||||||||

|

Balances at June 30, 2024 |

25,980,998 |

$ |

25,981 |

$ |

361,167,004 |

$ |

(14,007,492) |

$ |

347,185,493 |

|||||

|

Net investment income |

— |

— |

— |

10,259,690 |

10,259,690 |

|||||||||

|

Net realized loss on investments |

— |

— |

— |

(3,297,615) |

(3,297,615) |

|||||||||

|

Net realized loss on foreign currency translation |

— |

— |

— |

(22,095) |

(22,095) |

|||||||||

|

Net change in unrealized appreciation on investments |

— |

— |

— |

8,504,018 |

8,504,018 |

|||||||||

|

Net change in unrealized appreciation on foreign currency translations |

— |

— |

— |

14,588 |

14,588 |

|||||||||

|

Benefit for taxes on net realized loss on investments |

— |

— |

— |

2,221 |

2,221 |

|||||||||

|

Distributions from net investment income |

— |

— |

— |

(10,625,512) |

(10,625,512) |

|||||||||

|

Issuance of common stock, net of offering costs(1) |

1,058,366 |

1,058 |

14,263,441 |

— |

14,264,499 |

|||||||||

|

Balances at September 30, 2024 |

27,039,364 |

$ |

27,039 |

$ |

375,430,445 |

$ |

(9,172,197) |

$ |

366,285,287 |

|||||

|

(1) |

See Note 4 to the Consolidated Financial Statements on Form 10-Q filed with the Securities and Exchange Commission on November 7, 2024 for more information on offering costs. |

||||||

|

STELLUS CAPITAL INVESTMENT CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) |

||||||

|

For nine months ended |

||||||

|

September 30, 2024 |

September 30, 2023 |

|||||

|

Cash flows from operating activities |

||||||

|

Net increase in net assets resulting from operations |

$ |

37,153,553 |

$ |

6,049,800 |

||

|

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: |

||||||

|

Purchases of investments |

(112,624,812) |

(139,650,422) |

||||

|

Proceeds from sales and repayments of investments |

87,308,914 |

79,053,967 |

||||

|

Net change in unrealized (appreciation) depreciation on investments |

(26,435,927) |

24,338,195 |

||||

|

Net change in unrealized (appreciation) depreciation on foreign currency translations |

(5,099) |

21,087 |

||||

|

Increase in investments due to PIK |

(2,490,856) |

(2,732,530) |

||||

|

Amortization of premium and accretion of discount, net |

(2,045,992) |

(2,078,183) |

||||

|

Deferred tax (benefit) provision |

(188,893) |

144,425 |

||||

|

Amortization of loan structure fees |

825,891 |

436,257 |

||||

|

Amortization of deferred financing costs |

335,345 |

334,122 |

||||

|

Amortization of loan fees on SBA-guaranteed debentures |

784,763 |

938,247 |

||||

|

Net realized loss (gain) on investments |

21,689,864 |

(324,782) |

||||

|

Changes in other assets and liabilities |

||||||

|

Increase in interest receivable |

(1,389,856) |

(1,615,612) |

||||

|

Increase in income tax receivable |

(228,663) |

— |

||||

|

Increase in other receivables |

(25,000) |

(26,250) |

||||

|

Decrease in prepaid expenses |

349,950 |

517,512 |

||||

|

Increase (decrease) in management fees payable |

1,041,018 |

(3,217,286) |

||||

|

Increase in income incentive fees payable |

269,396 |

594,142 |

||||

|

Decrease in capital gains incentive fees payable |

— |

(569,528) |

||||

|

(Decrease) increase in administrative services payable |

(1,118) |

45,708 |

||||

|

Decrease in interest payable |

(3,988,133) |

(3,324,507) |

||||

|

Increase (decrease) in related party payable |

1,898,854 |

(1,060,321) |

||||

|

Increase in unearned revenue |

152,623 |

22,535 |

||||

|

Decrease in income tax payable |

— |

(59,004) |

||||

|

Increase (decrease) in other accrued expenses and liabilities |

718,139 |

(272,305) |

||||

|

Net Cash Provided (Used) in Operating Activities |

$ |

3,103,961 |

$ |

(42,434,733) |

||

|

Cash flows from Financing Activities |

||||||

|

Proceeds from the issuance of common stock |

$ |

40,370,901 |

$ |

63,348,436 |

||

|

Sales load for common stock issued |

(606,145) |

(943,248) |

||||

|

Offering costs paid for common stock issued |

(243,067) |

(225,085) |

||||

|

Stockholder distributions paid |

(26,718,082) |

(22,663,688) |

||||

|

Proceeds from SBA-guaranteed debentures |

— |

11,400,000 |

||||

|

Financing costs paid on SBA-guaranteed debentures |

— |

(277,590) |

||||

|

Financing costs paid on Credit Facility |

(101,348) |

(35,000) |

||||

|

Borrowings under Credit Facility |

122,400,000 |

79,700,000 |

||||

|

Repayments of Credit Facility |

(125,751,700) |

(116,701,700) |

||||

|

Net Cash Provided by Financing Activities |

$ |

9,350,559 |

$ |

13,602,125 |

||

|

Net Increase (Decrease) in Cash and Cash Equivalents |

$ |

12,454,520 |

$ |

(28,832,608) |

||

|

Cash and Cash Equivalents Balance at Beginning of Period |

$ |

26,125,741 |

$ |