S&P 500 Records Worst Session In Over A Month, Meta And Microsoft Tumble: Greed Index Moves To 'Fear' Zone

The CNN Money Fear and Greed index showed a decline in the overall market sentiment, while the index moved to the “Fear” zone on Thursday.

U.S. stocks settled lower on Thursday, with the Nasdaq Composite falling more than 500 points during the session. The S&P 500 and Nasdaq both recorded their biggest single-day declines since Sept. 3.

Shares of Meta Platforms Inc. META fell around 4% on Thursday after the company reported third-quarter financial results. Shares of Microsoft Corp. MSFT fell around 6% on Thursday after the company reported first-quarter financial results.

On the economic data front, U.S. initial jobless claims declined by 12,000 from the previous week to 216,000 in the week ending Oct. 26. The personal consumption expenditure price index rose 0.2% month-over-month in September following a 0.1% increase in August.

Most sectors on the S&P 500 closed on a negative note, with information technology, consumer discretionary, and real estate stocks recording the biggest losses on Thursday. However, utilities and energy stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 378 points to 41,763.46 on Thursday. The S&P 500 fell 1.86% to 5,705.45, while the Nasdaq Composite fell 2.76% at 18,095.15 during Thursday’s session.

Investors are awaiting earnings results from Chevron Corporation CVX, Exxon Mobil Corporation XOM, and Cardinal Health, Inc. CAH today.

What is CNN Business Fear & Greed Index?

At a current reading of 43.5, the index moved to the “Fear” zone on Thursday, versus a prior reading of 54.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BrightSpring Health Services, Inc. Reports Third Quarter 2024 Financial Results and Increases Full Year 2024 Guidance

LOUISVILLE, Ky., Nov. 01, 2024 (GLOBE NEWSWIRE) — BrightSpring Health Services, Inc. (“BrightSpring” or the “Company”) BTSG, a leading provider of home and community-based health services for complex populations, today announced financial results for the third quarter ended September 30, 2024, and increases 2024 revenue and Adjusted EBITDA1 guidance.

Financial Highlights

- Net Revenue of $2,907 million, up 28.8% compared to $2,257 million in the third quarter of 2023.

- Net loss of $9.0 million, compared to net loss of $130.1 million in the third quarter of 2023.

- Adjusted EBITDA1 of $151 million, up 15.7% versus $131 million in the third quarter of 2023

- Increased 2024 Revenue and Adjusted EBITDA Guidance:

- Revenue: $11,000 – $11,300 million

- Adjusted EBITDA1: $580 – $585 million

“We are pleased with the broad-based strength in revenue and earnings growth across Pharmacy Solutions and Providers Services in the third quarter,” said Jon Rousseau, Chairman, President and Chief Executive Officer of the Company. “At BrightSpring we are focused on driving operational excellence and efficiencies while increasing scale across our organization to deliver lower-cost and high-quality care to patients. We are confident that the Company remains well positioned to execute on providing a high level of quality care to patients and continuing to grow our businesses for the remainder of 2024 and in 2025.”

Third Quarter 2024 Financial Results

Net revenue of $2,907 million, up 28.8% compared to $2,257 million in the third quarter of 2023. Net revenue growth was driven by strength across the business, with robust growth in Specialty and Infusion Pharmacy.

Gross profit of $408 million, up 13.9% compared to $358 million in the third quarter of 2023.

Net loss of $9.0 million, compared to net loss of $130.1 million in the third quarter of 2023.

Adjusted EBITDA1 of $151 million, up 15.7% compared to $131 million in the third quarter of 2023

1Adjusted EBITDA is a non-GAAP financial measure. Please see “Non-GAAP Financial Information” and the end of this press release for a reconciliation of Adjusted EBITDA to net loss, the most directly comparable financial measure prepared in accordance with GAAP.

Key Financials:

| Three Months Ended | |||||||||||

| September 30, (Unaudited) | |||||||||||

| 2024 | 2023 | % |

|||||||||

| ($ in millions) | |||||||||||

| Pharmacy Solutions Revenue | $ | 2,266 | $ | 1,673 | 35% | ||||||

| Provider Services Revenue | 641 | 583 | 10% | ||||||||

| Total Revenue | $ | 2,907 | $ | 2,257 | 29% | ||||||

| Three Months Ended | |||||||||||

| September 30, (Unaudited) | |||||||||||

| 2024 | 2023 | % |

|||||||||

| ($ in millions) | |||||||||||

| Pharmacy Solutions segment EBITDA | $ | 99 | $ | 86 | 15% | ||||||

| Provider Services segment EBITDA | 93 | 81 | 14% | ||||||||

| Total Segment Adjusted EBITDA | $ | 192 | $ | 168 | 14% | ||||||

| Corporate Costs | (41) | (37) | – | ||||||||

| Total Company Adjusted EBITDA | $ | 151 | $ | 131 | 15.7% | ||||||

Full Year 2024 Financial Guidance

For the full year 2024, BrightSpring is increasing guidance, which excludes the effects of any future closed acquisitions.

- Net revenue of $11,000 million to $11,300 million, or 24.6% to 28.0% growth over 2023

- Pharmacy Segment Revenue of $8,500 million to $8,750 million, or 30.3% to 34.2% growth over full year 2023

- Provider Segment Revenue of $2,500 million to $2,550 million, or 8.5% to 10.7% growth over full year 2023

- Adjusted EBITDA2 of $580 million to $585 million, or 14.2% to 15.2% growth over full year 2023, excluding the impact from a certain Quality Incentive Payment in 2023

A copy of the Company’s third quarter earnings presentation is available on the company’s investor relations website, https://ir.brightspringhealth.com/

2 A reconciliation of the foregoing guidance for the non-GAAP metric of Adjusted EBITDA to GAAP net loss cannot be provided without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliation that have not yet occurred, are out of our control, or cannot be reasonably predicted. For the same reasons, the Company is unable to assess the probable significance of the unavailable information, which could have a material impact on its future GAAP financial results.

Webcast and Conference Call Details

BrightSpring will host a conference call today, November 1, 2024, at 8:30 a.m. Eastern Time. Investors interested in listening to the conference call are required to register online.

A live and archived webcast of the event will be available on the “Events & Presentations” section of the BrightSpring website at https://ir.brightspringhealth.com/. The Company has posted supplemental financial information on the third quarter results that it will reference during the conference call. The supplemental information can be found under the “Events & Presentations” on the Company’s investor relations page.

About BrightSpring Health Services

BrightSpring Health Services provides complementary and integrated home- and community-based pharmacy and health solutions for complex populations in need of specialized and/or chronic care. Through the Company’s service lines, including pharmacy, home health care and primary care, and rehabilitation and behavioral health, we provide comprehensive care and clinical solutions in all 50 states to over 400,000 customers, clients and patients daily.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, our operations and financial performance. Forward-looking statements include all statements that are not historical facts. These forward-looking statements may relate to matters which include, but are not limited to, industries, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. In some cases, we have used words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable,” “target,” “guidance,” the negative version of these words, or similar terms and phrases to identify these forward-looking statements.

The forward-looking statements are based on management’s current expectations and are not historical facts or guarantees of future performance. The forward-looking statements relate to the future and are therefore subject to various risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, and projections will result or be achieved. Actual results may differ materially from these expectations due to changes in global, regional, or local economic, business, competitive, market, regulatory, and other factors, many of which are beyond our control. We believe that these factors include but are not limited to the following:

- our operation in a highly competitive industry;

- our inability to maintain relationships with existing patient referral sources or establish new referral sources;

- changes to Medicare and Medicaid rates or methods governing Medicare and Medicaid payments for our services;

- cost containment initiatives of third-party payors, including post-payment audits;

- the implementation of alternative payment models and the transition of Medicaid and Medicare beneficiaries to managed care organizations may limit our market share and could adversely affect our revenues;

- changes in the case mix of patients, as well as payor mix and payment methodologies, and decisions and operations of third-party organizations;

- our reliance on federal and state spending, budget decisions, and continuous governmental operations which may fluctuate under different political conditions;

- changes in drug utilization and/or pricing, PBM contracts, and Medicare Part D/Medicaid reimbursement, which may negatively impact our profitability;

- changes in our relationships with pharmaceutical suppliers, including changes in drug availability or pricing;

- reliance on the continual recruitment and retention of nurses, pharmacists, therapists, caregivers, direct support professionals, and other qualified personnel, including senior management;

- compliance with or changes to federal, state, and local laws and regulations that govern our employment practices, including minimum wage, living wage, and paid time-off requirements;

- fluctuation of our results of operations on a quarterly basis;

- harm caused by labor relation matters;

- limitations in our ability to control reimbursement rates received for our services if we are unable to maintain or reduce our costs to provide such services;

- delays in collection or non-collection of our accounts receivable, particularly during the business integration process;

- failure to manage our growth effectively, which may inhibit our ability to execute our business plan, maintain high levels of service and satisfaction or adequately address competitive challenges;

- our ability to identify, successfully complete and manage acquisitions, joint ventures, and other strategic initiatives;

- our ability to continue to provide consistently high quality of care;

- maintenance of our corporate reputation or the emergence of adverse publicity, including negative information on social media or changes in public perception of our services;

- contract continuance, expansion and renewal with our existing customers, including renewals at lower fee levels, customers declining to purchase additional services from us, or reduction in the services received from us pursuant to those contracts;

- effective investment in, implementation of improvements to and proper maintenance of the uninterrupted operation and data integrity of our information technology and other business systems;

- security breaches, loss of data, and other disruptions, which could compromise sensitive business or patient information; cause a loss of confidential patient data, employee data or personal information; or prevent access to critical information and thereby expose us to liability, litigation, and federal and state governmental inquiries and damage our reputation and brand;

- risks related to credit card payments and other payment methods;

- potential substantial malpractice or other similar claims;

- various risks related to governmental inquiries, regulatory actions, and whistleblower and other lawsuits, which may not be entirely covered by insurance;

- our current insurance program, which may expose us to unexpected costs, particularly if we incur losses not covered by our insurance or if claims or losses differ from our estimates;

- factors outside of our control, including those listed, which have required and could in the future require us to record an asset impairment of goodwill;

- a pandemic, epidemic, or outbreak of an infectious disease, including the ongoing effects of COVID-19;

- inclement weather, natural disasters, acts of terrorism, riots, civil insurrection or social unrest, looting, protests, strikes, or street demonstrations;

- our inability to adequately protect our intellectual property rights

The forward-looking statements included in this press release are made only as of the date of this press release, and we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law. These factors should not be construed as exhaustive, and should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward- looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments, or other strategic transactions we may make.

For additional information on these and other factors that could cause BrightSpring’s actual results to differ materially from expected results, please see our filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov.

Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures,” including “EBITDA” and “Adjusted EBITDA,” which are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with accounting principles generally accepted in the United States, or GAAP.

EBITDA and Adjusted EBITDA have been presented in this release as supplemental measures of financial performance that are not required by, or presented in accordance with, GAAP, because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management also believes that these measures are useful to investors in highlighting trends in our operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management uses EBITDA and Adjusted EBITDA to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, to establish and award discretionary annual incentive compensation, and to compare our performance against that of other peer companies using similar measures.

Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. EBITDA and Adjusted EBITDA are not GAAP measures of our financial performance and should not be considered as an alternative to net loss as a measure of financial performance or any other performance measures derived in accordance with GAAP. Additionally, these measures are not intended to be a measure of free cash flow available for management’s discretionary use as they do not consider certain cash requirements such as tax payments, debt service requirements, total capital expenditures, and certain other cash costs that may recur in the future.

Management defines EBITDA as net loss before income tax expense (benefit), interest expense, and depreciation and amortization. Management also defines Adjusted EBITDA as EBITDA, further adjusted to exclude non-cash share-based compensation, acquisition, integration and transaction-related costs, restructuring and divestiture-related and other costs, goodwill impairment, legal costs and settlements associated with certain historical matters for PharMerica, significant projects, management fees, and unreimbursed COVID-19 related costs.

The presentations of these measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. Please see the end of this press release for reconciliations of non-GAAP financial measures to the most directly comparable financial measure prepared in accordance with GAAP.

BrightSpring Contact:

Investor Relations:

David Deuchler, CFA

Gilmartin Group LLC

ir@brightspringhealth.com

Media Contact:

Leigh White

leigh.white@brightspringhealth.com

502.630.7412

| BrightSpring Health Services, Inc. and Subsidiaries Condensed Consolidated Balance Sheets September 30, 2024 and December 31, 2023 (In thousands, except share and per share data) (Unaudited) |

|||||||

| September 30, 2024 | December 31, 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 35,973 | $ | 13,071 | |||

| Accounts receivable, net of allowance for credit losses | 1,025,711 | 881,627 | |||||

| Inventories | 478,319 | 402,776 | |||||

| Prepaid expenses and other current assets | 169,582 | 159,167 | |||||

| Total current assets | 1,709,585 | 1,456,641 | |||||

| Property and equipment, net of accumulated depreciation of $426,484 and $368,089 at September 30, 2024 and December 31, 2023, respectively | 248,548 | 245,908 | |||||

| Goodwill | 2,672,791 | 2,608,412 | |||||

| Intangible assets, net of accumulated amortization | 842,479 | 881,476 | |||||

| Operating lease right-of-use assets, net | 259,138 | 267,446 | |||||

| Deferred income taxes, net | 6,678 | — | |||||

| Other assets | 46,748 | 72,838 | |||||

| Total assets | $ | 5,785,967 | $ | 5,532,721 | |||

| Liabilities, Redeemable Noncontrolling Interests, and Equity | |||||||

| Current liabilities: | |||||||

| Trade accounts payable | $ | 783,838 | $ | 641,607 | |||

| Accrued expenses | 349,101 | 492,363 | |||||

| Current portion of obligations under operating leases | 69,763 | 71,053 | |||||

| Current portion of obligations under financing leases | 12,367 | 11,141 | |||||

| Current portion of long-term debt | 48,853 | 32,273 | |||||

| Total current liabilities | 1,263,922 | 1,248,437 | |||||

| Obligations under operating leases, net of current portion | 195,921 | 201,655 | |||||

| Obligations under financing leases, net of current portion | 24,988 | 22,528 | |||||

| Long-term debt, net of current portion | 2,608,537 | 3,331,941 | |||||

| Deferred income taxes, net | — | 23,668 | |||||

| Long-term liabilities | 73,502 | 91,943 | |||||

| Total liabilities | 4,166,870 | 4,920,172 | |||||

| Redeemable noncontrolling interests | 4,125 | 27,139 | |||||

| Shareholders’ equity: | |||||||

| Common stock, $0.01 par value, 1,500,000,000 and 137,398,625 shares authorized, 174,078,977 and 117,857,055 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 1,741 | 1,179 | |||||

| Preferred stock, $0.01 par value, 250,000,000 authorized, no shares issued and outstanding at September 30, 2024; no shares authorized, issued or outstanding at December 31, 2023 | — | — | |||||

| Additional paid-in capital | 1,848,115 | 771,336 | |||||

| Accumulated deficit | (234,380 | ) | (200,319 | ) | |||

| Accumulated other comprehensive (loss) income | (705 | ) | 12,544 | ||||

| Total shareholders’ equity | 1,614,771 | 584,740 | |||||

| Noncontrolling interest | 201 | 670 | |||||

| Total equity | 1,614,972 | 585,410 | |||||

| Total liabilities, redeemable noncontrolling interests, and equity | $ | 5,785,967 | $ | 5,532,721 | |||

| BrightSpring Health Services, Inc. and Subsidiaries Condensed Consolidated Statements of Operations For the three and nine months ended September 30, 2024 and 2023 (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenues: | |||||||||||||||

| Products | $ | 2,265,697 | $ | 1,673,152 | $ | 6,357,223 | $ | 4,736,993 | |||||||

| Services | 641,126 | 583,377 | 1,856,448 | 1,714,638 | |||||||||||

| Total revenues | 2,906,823 | 2,256,529 | 8,213,671 | 6,451,631 | |||||||||||

| Cost of goods | 2,077,121 | 1,509,845 | 5,815,981 | 4,226,075 | |||||||||||

| Cost of services | 421,590 | 388,388 | 1,231,154 | 1,160,477 | |||||||||||

| Gross profit | 408,112 | 358,296 | 1,166,536 | 1,065,079 | |||||||||||

| Selling, general, and administrative expenses | 351,272 | 410,549 | 1,039,215 | 986,161 | |||||||||||

| Operating income (loss) | 56,840 | (52,253 | ) | 127,321 | 78,918 | ||||||||||

| Loss on extinguishment of debt | — | — | 12,726 | — | |||||||||||

| Interest expense, net | 56,061 | 83,678 | 173,520 | 241,539 | |||||||||||

| Income (loss) before income taxes | 779 | (135,931 | ) | (58,925 | ) | (162,621 | ) | ||||||||

| Income tax expense (benefit) | 9,760 | (5,807 | ) | (23,000 | ) | (12,987 | ) | ||||||||

| Net loss | (8,981 | ) | (130,124 | ) | (35,925 | ) | (149,634 | ) | |||||||

| Net (loss) income attributable to noncontrolling interests | (751 | ) | 548 | (1,864 | ) | (1,568 | ) | ||||||||

| Net loss attributable to BrightSpring Health Services, Inc. and subsidiaries | $ | (8,230 | ) | $ | (130,672 | ) | $ | (34,061 | ) | $ | (148,066 | ) | |||

| Net loss per common share: | |||||||||||||||

| Loss per share – basic | $ | (0.04 | ) | $ | (1.11 | ) | $ | (0.18 | ) | $ | (1.26 | ) | |||

| Loss per share – diluted | $ | (0.04 | ) | $ | (1.11 | ) | $ | (0.18 | ) | $ | (1.26 | ) | |||

| Weighted average shares outstanding: | |||||||||||||||

| Basic | 198,491 | 117,864 | 190,541 | 117,871 | |||||||||||

| Diluted | 198,491 | 117,864 | 190,541 | 117,871 | |||||||||||

| BrightSpring Health Services, Inc. and Subsidiaries Condensed Consolidated Statements of Cash Flows For the three and nine months ended September 30, 2024 and 2023 (In thousands) (Unaudited) |

|||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Operating activities: | |||||||||||||||

| Net loss | $ | (8,981 | ) | $ | (130,124 | ) | $ | (35,925 | ) | $ | (149,634 | ) | |||

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | |||||||||||||||

| Depreciation and amortization | 50,608 | 50,774 | 149,601 | 151,324 | |||||||||||

| Impairment of long-lived assets | 2,801 | 2,181 | 4,781 | 8,295 | |||||||||||

| Provision for credit losses | 8,778 | 6,753 | 21,896 | 18,927 | |||||||||||

| Amortization of deferred debt issuance costs | 2,540 | 5,182 | 9,477 | 15,691 | |||||||||||

| Share-based compensation | 15,210 | 825 | 55,194 | 2,100 | |||||||||||

| Deferred income taxes, net | 21,479 | (10,810 | ) | (27,781 | ) | (36,565 | ) | ||||||||

| Loss on extinguishment of debt | — | — | 12,726 | — | |||||||||||

| (Gain) loss on disposition of fixed assets | (79 | ) | 438 | (55 | ) | 957 | |||||||||

| Other | 479 | (582 | ) | (959 | ) | (210 | ) | ||||||||

| Change in operating assets and liabilities, net of acquisitions and dispositions: | |||||||||||||||

| Accounts receivable | (51,474 | ) | (11,520 | ) | (163,996 | ) | (116,922 | ) | |||||||

| Prepaid expenses and other current assets | (24,207 | ) | (22,272 | ) | (2,470 | ) | (162 | ) | |||||||

| Inventories | (103,985 | ) | 16,536 | (74,265 | ) | 53,244 | |||||||||

| Trade accounts payable | 114,234 | 31,353 | 155,563 | (58,313 | ) | ||||||||||

| Accrued expenses | 3,860 | 89,671 | (150,032 | ) | 159,353 | ||||||||||

| Other assets and liabilities | (4,017 | ) | 5,286 | (20,593 | ) | 298 | |||||||||

| Net cash provided by (used in) operating activities | $ | 27,246 | $ | 33,691 | $ | (66,838 | ) | $ | 48,383 | ||||||

| Investing activities: | |||||||||||||||

| Purchases of property and equipment | $ | (20,043 | ) | $ | (17,899 | ) | $ | (65,602 | ) | $ | (56,693 | ) | |||

| Acquisitions of businesses, net of cash acquired | (17,225 | ) | (37,044 | ) | (59,755 | ) | (62,508 | ) | |||||||

| Other | 360 | 296 | 900 | 1,790 | |||||||||||

| Net cash used in investing activities | $ | (36,908 | ) | $ | (54,647 | ) | $ | (124,457 | ) | $ | (117,411 | ) | |||

| Financing activities: | |||||||||||||||

| Long-term debt borrowings | $ | — | $ | — | $ | 2,566,000 | $ | — | |||||||

| Long-term debt repayments | (13,663 | ) | (7,536 | ) | (3,384,633 | ) | (22,857 | ) | |||||||

| Proceeds from issuance of common stock on initial public offering, net | — | — | 656,485 | — | |||||||||||

| Proceeds from issuance of tangible equity units, net | — | — | 389,000 | — | |||||||||||

| Borrowings of the Revolving Credit Facility, net | 41,300 | 31,650 | 46,400 | 98,250 | |||||||||||

| Payment of debt issuance costs | — | — | (43,188 | ) | — | ||||||||||

| Repurchase of shares of common stock | — | (325 | ) | (650 | ) | (325 | ) | ||||||||

| Shares issued under share-based compensation plan, including tax effects |

127 | 453 | 531 | 598 | |||||||||||

| Payment of acquisition earn-outs | (1,500 | ) | — | (4,156 | ) | — | |||||||||

| Purchase of redeemable noncontrolling interest | (2,016 | ) | — | (2,316 | ) | — | |||||||||

| Payment of financing lease obligations | (3,640 | ) | (2,901 | ) | (9,276 | ) | (8,625 | ) | |||||||

| Net cash provided by financing activities | $ | 20,608 | $ | 21,341 | $ | 214,197 | $ | 67,041 | |||||||

| Net increase (decrease) in cash and cash equivalents | 10,946 | 385 | 22,902 | (1,987 | ) | ||||||||||

| Cash and cash equivalents at beginning of year | 25,027 | 11,256 | 13,071 | 13,628 | |||||||||||

| Cash and cash equivalents at end of year | $ | 35,973 | $ | 11,641 | $ | 35,973 | $ | 11,641 | |||||||

BrightSpring Health Services, Inc. and Subsidiaries

Reconciliation of EBITDA and Adjusted EBITDA

For the three and nine months ended September 30, 2024 and 2023

(Unaudited)

The following table reconciles net loss to EBITDA and Adjusted EBITDA:

| ($ in thousands) | For the Three Months Ended | For the Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net loss | $ | (8,981 | ) | $ | (130,124 | ) | $ | (35,925 | ) | $ | (149,634 | ) | |||

| Income tax expense (benefit) | 9,760 | (5,807 | ) | (23,000 | ) | (12,987 | ) | ||||||||

| Interest expense, net | 56,061 | 83,678 | 173,520 | 241,539 | |||||||||||

| Depreciation and amortization | 50,608 | 50,774 | 149,601 | 151,324 | |||||||||||

| EBITDA | $ | 107,448 | $ | (1,479 | ) | $ | 264,196 | $ | 230,242 | ||||||

| Non-cash share-based compensation (1) | 15,210 | 825 | 55,194 | 2,100 | |||||||||||

| Acquisition, integration, and transaction-related costs (2) | 11,767 | 6,319 | 25,331 | 13,754 | |||||||||||

| Restructuring and divestiture-related and other costs (3) | 6,672 | 4,527 | 28,065 | 16,172 | |||||||||||

| Legal costs and settlements (4) | 8,920 | 117,042 | 21,886 | 121,706 | |||||||||||

| Significant projects (5) | 1,000 | 1,935 | 2,604 | 6,899 | |||||||||||

| Management fee (6) | — | 1,383 | 23,381 | 4,248 | |||||||||||

| Unreimbursed COVID-19 related costs | — | (48 | ) | — | 88 | ||||||||||

| Total adjustments | $ | 43,569 | $ | 131,983 | $ | 156,461 | $ | 164,967 | |||||||

| Adjusted EBITDA | $ | 151,017 | $ | 130,504 | $ | 420,657 | $ | 395,209 | |||||||

| (1) | Represents non-cash share-based compensation to certain members of our management and full-time employees. The three and nine months ended September 30, 2024 includes $14.4 million and $35.8 million of costs, respectively, related to new equity awards granted upon the completion of our IPO under the 2024 Equity Incentive Plan. The nine months ended September 30, 2024 includes $15.0 million of previously unrecognized share-based compensation expense related to performance-vesting options under the 2017 Stock Plan, a portion of which vested upon completion of the IPO. |

| (2) | Represents transaction costs incurred in connection with planned, completed, or terminated acquisitions, which include investment banking fees, legal diligence and related documentation costs, finance and accounting diligence and documentation; costs associated with the integration of acquisitions, including any facility consolidation, integration travel, or severance; and costs associated with other planned, completed, or terminated non-routine transactions. The three months ended September 30, 2024 includes acquisition and integration related costs of $7.5 million, earn-out adjustments from previous acquisitions of $0.9 million, and other non-routine transaction costs of $2.9 million, as compared to acquisition and integration related costs of $3.7 million and other non-routine transaction costs of $0.9 million for the three months ended September 30, 2023. These costs also included $0.5 million and $6.0 million of costs related to the IPO Offerings which were not capitalizable for the three and nine months ended September 30, 2024, respectively, compared to $1.7 million and $1.9 million for the three and nine months ended September 30, 2023, respectively. |

| (3) | Represents costs associated with restructuring-related activities, including closure, and related license impairment, and severance expenses associated with certain enterprise-wide or significant business line cost-savings measures. These costs included $12.7 million of unamortized debt issuance costs associated with the extinguishment of our Second Lien Facility in the nine months ended September 30, 2024. These costs also included $1.8 million and $3.7 million of intangible asset and other non-cash investment impairment for the three and nine months ended September 30, 2024, respectively, as compared to $1.4 million and $7.4 million for the three and nine months ended September 30, 2023, respectively. |

| (4) | Represents settlement and defense costs associated with certain historical PharMerica litigation matters, including the Silver matter, all of which are expected to be completed in 2024. See Note 10 within the unaudited condensed consolidated financial statements and related notes in this Quarterly Report on Form 10-Q for additional information. |

| (5) | Represents costs associated with certain transformational projects and for the periods presented primarily included general ledger system implementation and pharmacy billing system implementation, which both completed in the second fiscal quarter of 2024; and ransomware attack response costs. Ransomware attack response costs were $1.0 million for the three and nine months ended September 30, 2024, compared to $0.6 million and $3.1 million for the three and nine months ended September 30, 2023, respectively. |

| (6) | Represents annual management fees payable to the Managers under the Monitoring Agreement through the date of the IPO, and $22.7 million of termination fees resulting from the Monitoring Agreement being terminated upon completion of the IPO Offerings. All management fees have ceased following the completion of the IPO. |

BrightSpring Health Services, Inc. and Subsidiaries

Reconciliation of Adjusted EPS

For the three and nine months ended September 30, 2024 and 2023

(Unaudited)

The following table reconciles diluted EPS to Adjusted EPS:

| (shares in thousands) | For the Three Months Ended | For the Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Diluted EPS | $ | (0.04 | ) | $ | (1.11 | ) | $ | (0.18 | ) | $ | (1.26 | ) | |||

| Non-cash share-based compensation (1) | 0.07 | 0.01 | 0.28 | 0.02 | |||||||||||

| Acquisition, integration, and transaction-related costs (1) | 0.06 | 0.05 | 0.13 | 0.11 | |||||||||||

| Restructuring and divestiture-related and other costs (1) | 0.03 | 0.04 | 0.14 | 0.13 | |||||||||||

| Legal costs and settlements (1) | 0.04 | 0.93 | 0.11 | 0.96 | |||||||||||

| Significant projects (1) | — | 0.02 | 0.01 | 0.05 | |||||||||||

| Management fee (1) | — | 0.01 | 0.12 | 0.03 | |||||||||||

| Unreimbursed COVID-19 related costs (1) | — | — | — | — | |||||||||||

| Income tax impact on adjustments (2)(3) | (0.05 | ) | (0.03 | ) | (0.27 | ) | (0.10 | ) | |||||||

| Adjusted EPS | $ | 0.11 | $ | (0.08 | ) | $ | 0.34 | $ | (0.06 | ) | |||||

| Weighted average common shares outstanding used in calculating diluted U.S. GAAP net loss per share | 198,491 | 117,864 | 190,541 | 117,871 | |||||||||||

| Weighted average common shares outstanding used in calculating diluted Non-GAAP earnings (loss) per share | 208,694 | 126,346 | 199,930 | 126,428 | |||||||||||

| (1) | This adjustment reflects the per share impact of the adjustment reflected within the definition of Adjusted EBITDA. |

| (2) | The income tax impact of non-GAAP adjustments is calculated using the estimated tax rate for the respective non-GAAP adjustment. |

| (3) | For the nine months ended September 30, 2024, the income tax impact on adjustments is inclusive of a discrete tax benefit related to the Silver matter that was finalized in connection with the signing of the settlement agreement during the second fiscal quarter of 2024. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Loses $1.9B In Net Worth As DJT Stock Tumbles 2nd Time This Week

Former President Donald Trump has seen a significant decline in his net worth, losing approximately $1.9 billion due to a steep drop in Trump Media & Technology Group Corp DJT stock.

What Happened: According to Benzinga Pro, DJT shares fell by 11.72%, closing at $35.34 on Thursday. This followed a 22% decline on Wednesday after the stock had reached an intraday high of $54.68 on Tuesday. The reasons for the two-day sell-off remain unclear, but the stock has attracted the attention of speculators and shortsellers.

S3 Partners, a research group, indicated that the surge in DJT shares during October might have been driven by short sellers covering their positions, resulting in a short squeeze. They noted the stock’s high squeeze risk due to limited float and significant short interest, which is closely linked to Trump’s election prospects, CBS News reported on Thursday.

Trump, the largest shareholder with around 115 million shares in Trump Media, saw his stake’s value drop from nearly $6.3 billion at Tuesday’s peak to about $4 billion based on Thursday’s closing price.

Trump Media and his company are yet to respond to Benzinga’s queries.

Why It Matters: The volatility in DJT stock is not new, as it has been highly unpredictable since going public following a SPAC merger. The stock’s movements are closely tied to Trump’s 2024 election prospects, with potential outcomes significantly impacting its value. According to a report from S3 Partners, a Trump victory could push the stock to $60, while a loss might render shares “worthless.”

Earlier this week, DJT stock experienced multiple volatility halts as prices fluctuated significantly. The stock was halted several times on Tuesday, reflecting its unpredictable nature and the market’s sensitivity to political developments.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biodesix Announces Third Quarter 2024 Results and Highlights

Q3 2024 revenue grew 35% over Q3 2023 to $18.2 million;

Q3 2024 gross profit margin of 77.0%, up from 76.1% in Q3 2023;

Q3 2024 Net loss improved by 6% compared to Q3 2023;

Conference Call and Webcast Today at 8:30 a.m. ET

LOUISVILLE, Colo., Nov. 01, 2024 (GLOBE NEWSWIRE) — Biodesix, Inc. BDSX, a leading diagnostic solutions company, today announced its financial and operating results for the third quarter ended September 30, 2024.

“The Biodesix team is pleased to report another solid quarter focused on executing and delivering on our three main goals – driving revenue growth through the adoption of our lung diagnostic tests and biopharma services, continued implementation of operational efficiencies, and maintaining a cost-disciplined approach as we drive our business to profitability,” said Scott Hutton, CEO of Biodesix.

“We reported 40% year-over-year growth in lung diagnostics revenue, a growing book of biopharma services contracts, sustained gross margins in the high 70% range, and improved Net Loss on our path to profitability. In addition, at the annual meeting of the American College of Chest Physicians (CHEST), we presented new clinical data on our Nodify XL2® and Nodify CDT® tests, and announced a new clinical study (CLARIFY) to expand our data in diverse patient populations tested in a real-world clinical setting. Building on this momentum, we are reiterating our prior guidance of $70-$72 million for 2024 and we look forward to achieving Adjusted EBITDA profitability in the second half of 2025. At Biodesix, our tests play a vital role in treating the deadliest of all cancers. Our committed and driven team embraces the opportunity, and the responsibility, to transform the standard of care to improve outcomes for patients.”

Third Quarter Ended September 30, 2024 Business Highlights

- Grew Lung Diagnostic test volume to 13,900, a 34% improvement over the third quarter of 2023.

- Quarterly gross profit margin of 77.0% versus 76.1% for the third quarter of 2023.

- Presented compelling new data at the CHEST Annual Meeting and announced the launch of a new clinical study, CLARIFY.

- New data was presented detailing the experience of healthcare providers using the Nodify Lung® Nodule Risk Assessment Tests (Nodify XL2 and Nodify CDT tests) in over 35,000 patients tested in a real-world clinical setting. Results shared were consistent with prior studies, highlighting the high proportion of results that up- or down-classify patients into actionable risk categories with clear, guideline-recommended, diagnostic plans.

- The new study, CLARIFY, is designed to confirm performance of the Nodify CDT and Nodify XL2 tests in diverse patient subgroups through a retrospective chart review of up to 4,000 patients that were tested in a real-world clinical setting. The study’s intent is to expand the extensive evidence characterizing the validation and utility of Nodify Lung testing.

Third Quarter Ended September 30, 2024 Financial Highlights

- Total revenue of $18.2 million, an increase of 35% over the third quarter 2023:

- Lung Diagnostic revenue of $17.2 million reflected a year-over-year increase of 40% driven by the continued adoption of Nodify XL2 and Nodify CDT nodule risk assessment tests and strong reimbursement. However, test volumes were impacted at the end of the third quarter by disruption to patients, healthcare providers, and Biodesix teammates in the southeast due to Hurricane Helene;

- Biopharmaceutical Services revenue of $1.0 million decreased 17% year-over-year, driven by the timing of receipt of samples and shift of the completion of certain projects from the end of the third quarter into the beginning of the fourth;

- Third quarter 2024 gross profit of $14.0 million, or 77.0% gross margin compared to 76.1% gross margin in the comparable prior year period. Our steady margin performance is primarily driven by volume growth in Lung Diagnostic testing that continues to drive down the per test costs;

- Operating expenses (excluding direct costs and expenses) of $22.6 million, an increase of 29% as compared to the third quarter 2023, which includes $3.0 million of non-cash stock compensation expense and depreciation and amortization as compared to $1.7 million in third quarter of 2023. This increase is primarily attributable to an increase in sales and marketing costs to support both business lines’ sales growth to enhance product awareness and drive adoption, and an increase in depreciation expense related to the leasehold improvements in the Company’s Louisville, CO offices and laboratory which opened in January 2024;

- Net loss of $10.3 million, an improvement of 6% as compared to the same period of 2023;

- Adjusted EBITDA was a loss of $5.6 million, a slight increase over the loss of $5.4 million in the third quarter of 2023 and consistent with the second quarter of 2024;

- Cash and cash equivalents of $31.4 million as of September 30, 2024, a decrease from $42.2 million from June 30, 2024;

- Cash and cash equivalents as of September 30, 2024 includes the final milestone payment of $6.1 million for the acquisition of Integrated Diagnostics in 2018.

2024 – 2025 Financial Outlook

The Company is reiterating the 2024 revenue forecast of between $70 million and $72 million.

Conference call and webcast information

Listeners can register for the webcast via this link. Analysts who wish to participate in the question-and-answer session should use this link. A replay of the webcast will be available via the Company’s investor relations page on the website approximately two hours after the call’s conclusion. Participants are advised to join 15 minutes prior to the start time.

For a full list of Biodesix press releases and webinars, please visit biodesix.com.

About Biodesix

Biodesix is a leading diagnostic solutions company with five Medicare-covered tests available for patients with lung diseases. The blood-based Nodify Lung® Nodule Risk Assessment, consisting of the Nodify XL2® and the Nodify CDT® tests, evaluates the risk of malignancy in pulmonary nodules, enabling physicians to better triage patients to the most appropriate course of action. The blood-based IQLung™ test portfolio for lung cancer patients integrates the GeneStrat® targeted ddPCR™ test, the GeneStrat NGS® test, and the VeriStrat® test to support treatment decisions across all stages of lung cancer and expedite personalized treatment. In addition, Biodesix collaborates with the world’s leading biopharmaceutical companies to provide biomarker discovery, diagnostic test development, and clinical trial support services. For more information about Biodesix, visit biodesix.com.

Trademarks: Biodesix, Nodify Lung, Nodify XL2, Nodify CDT, IQLung, GeneStrat, GeneStrat NGS, and VeriStrat are trademarks or registered trademarks of Biodesix, Inc. The ddPCR technology is a trademark of Bio-Rad Laboratories, Inc.

Use of Non-GAAP Financial Measure

Biodesix reported results are presented in accordance with generally accepted accounting principles in the United States (GAAP). Biodesix has provided in this press release financial information that has not been prepared in accordance with GAAP. Biodesix uses the non-GAAP financial measure, Adjusted EBITDA, internally in analyzing its financial results and believes that use of this non-GAAP financial measure is useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing Biodesix financial results with other companies in its industry, many of which present similar non-GAAP financial measures. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with Biodesix financial statements prepared in accordance with GAAP. A reconciliation of Biodesix historical non-GAAP financial measure to the most directly comparable GAAP measure has been provided in the financial statement tables included in this press release, and investors are encouraged to review the reconciliation.

Adjusted EBITDA is a key performance measure that our management uses to assess our financial performance and is also used for internal planning and forecasting purposes. We believe that this non-GAAP financial measure is useful to investors and other interested parties in analyzing our financial performance because it provides a comparable overview of our operations across historical periods. In addition, we believe that providing Adjusted EBITDA, together with a reconciliation of Net loss to Adjusted EBITDA, helps investors make comparisons between our Company and other companies that may have different capital structures, different tax rates, and/or different forms of employee compensation.

Adjusted EBITDA is used by our management team as an additional measure of our performance for purposes of business decision-making, including managing expenditures. Period-to-period comparisons of Adjusted EBITDA help our management identify additional trends in our financial results that may not be shown solely by period- to-period comparisons of Net loss or Loss from operations. Our management recognizes that Adjusted EBITDA has inherent limitations because of the excluded items and may not be directly comparable to similarly titled metrics used by other companies.

We calculate Adjusted EBITDA as Net loss adjusted to exclude interest, income tax expense, if any, depreciation and amortization, share-based compensation expense, loss on debt extinguishments, net, COVID-19 revenue, COVID-19 direct costs and expenses, change in fair value of warrant liabilities, net, other income, net, and other non-recurring items. Non-recurring items are excluded as they are not representative of our underlying operating performance. We also exclude revenue and direct costs and expenses associated with COVID-19 because we believe that these revenues and expenses do not reflect expected future operating results as they do not represent our Lung Diagnostic and Biopharmaceutical Services business. Adjusted EBITDA should be viewed as a measure of operating performance that is a supplement to, and not a substitute for Loss from operations, Net loss, and other GAAP measures.

Note Regarding Forward-Looking Statements

This press release may contain forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical fact, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect,” “predict,” “potential,” “opportunity,” “goals,” or “should,” and similar expressions are intended to identify forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors. Biodesix has based these forward-looking statements largely on its current expectations and projections about future events and trends. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions. Forward-looking statements may include information concerning the impact of backlog and the timing and assumptions regarding collection of revenues on projections, availability of funds and future capital including under the term loan facility, expectations regarding revenue and margin growth and its impact on profitability, and the impact of a pandemic, epidemic, or outbreak, including the COVID-19 pandemic, on Biodesix and its operations and financial performance. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. The Company’s ability to continue as a going concern could cause actual results to differ materially from those contemplated in this press release and additionally, other factors that could cause actual results to differ materially from those contemplated in this press release can be found in the Risk Factors section of Biodesix most recent annual report on Form 10-K, filed March 1, 2024 or subsequent quarterly reports on Form 10-Q during 2024, if applicable. Biodesix undertakes no obligation to revise or publicly release the results of any revision to such forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

Contacts:

Media:

Natalie St. Denis

natalie.stdenis@

biodesix.com

(720) 925-9285

Investors:

Chris Brinzey

chris.brinzey@

westwicke.com

(339) 970-2843

| Biodesix, Inc. Condensed Balance Sheets (unaudited) (in thousands, except share data) |

||||||||

| September 30, 2024 | December 31, 2023 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 31,406 | $ | 26,284 | ||||

| Accounts receivable, net of allowance for credit losses of $246 and $65 | 8,036 | 7,679 | ||||||

| Other current assets | 4,575 | 5,720 | ||||||

| Total current assets | 44,017 | 39,683 | ||||||

| Non-current assets | ||||||||

| Property and equipment, net | 28,683 | 27,867 | ||||||

| Intangible assets, net | 6,438 | 7,911 | ||||||

| Operating lease right-of-use assets | 1,918 | 1,745 | ||||||

| Goodwill | 15,031 | 15,031 | ||||||

| Other long-term assets | 6,656 | 6,859 | ||||||

| Total non-current assets | 58,726 | 59,413 | ||||||

| Total assets | $ | 102,743 | $ | 99,096 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 2,537 | $ | 2,929 | ||||

| Accrued liabilities | 8,553 | 7,710 | ||||||

| Deferred revenue | 676 | 324 | ||||||

| Current portion of operating lease liabilities | 624 | 252 | ||||||

| Current portion of contingent consideration | — | 21,857 | ||||||

| Current portion of notes payable | 29 | 51 | ||||||

| Other current liabilities | 544 | 293 | ||||||

| Total current liabilities | 12,963 | 33,416 | ||||||

| Non-current liabilities | ||||||||

| Long-term notes payable, net of current portion | 36,112 | 35,225 | ||||||

| Long-term operating lease liabilities | 25,191 | 25,163 | ||||||

| Other long-term liabilities | 620 | 712 | ||||||

| Total non-current liabilities | 61,923 | 61,100 | ||||||

| Total liabilities | 74,886 | 94,516 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Preferred stock, $0.001 par value, 5,000,000 authorized; 0 (2024 and 2023) issued and outstanding |

— | — | ||||||

| Common stock, $0.001 par value, 200,000,000 authorized; 145,465,941 (2024) and 96,235,883 (2023) shares issued and outstanding |

145 | 96 | ||||||

| Additional paid-in capital | 481,958 | 424,050 | ||||||

| Accumulated deficit | (454,246 | ) | (419,566 | ) | ||||

| Total stockholders’ equity | 27,857 | 4,580 | ||||||

| Total liabilities and stockholders’ equity | $ | 102,743 | $ | 99,096 | ||||

| Biodesix, Inc. Condensed Statements of Operations (unaudited) (in thousands, except per share data) |

||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | ||||||||||||||||

| Diagnostic Testing revenue | $ | 17,168 | $ | 12,301 | $ | 47,503 | $ | 32,395 | ||||||||

| Biopharmaceutical Services and other revenue | 983 | 1,190 | 3,391 | 2,024 | ||||||||||||

| Total revenues | 18,151 | 13,491 | 50,894 | 34,419 | ||||||||||||

| Direct costs and expenses | 4,179 | 3,229 | 11,231 | 9,636 | ||||||||||||

| Research and development | 2,547 | 1,938 | 7,145 | 8,099 | ||||||||||||

| Sales, marketing, general and administrative | 20,016 | 15,496 | 60,232 | 51,136 | ||||||||||||

| Impairment loss on intangible assets | — | — | 135 | 20 | ||||||||||||

| Total operating expenses | 26,742 | 20,663 | 78,743 | 68,891 | ||||||||||||

| Loss from operations | (8,591 | ) | (7,172 | ) | (27,849 | ) | (34,472 | ) | ||||||||

| Other (expense) income: | ||||||||||||||||

| Interest expense | (2,041 | ) | (2,386 | ) | (6,506 | ) | (7,207 | ) | ||||||||

| Loss on extinguishment of liabilities | — | — | (248 | ) | — | |||||||||||

| Change in fair value of warrant liability, net | — | (1,393 | ) | — | (1,332 | ) | ||||||||||

| Other (expense) income, net | 374 | 2 | (77 | ) | 4 | |||||||||||

| Total other expense | (1,667 | ) | (3,777 | ) | (6,831 | ) | (8,535 | ) | ||||||||

| Net loss | $ | (10,258 | ) | $ | (10,949 | ) | $ | (34,680 | ) | $ | (43,007 | ) | ||||

| Net loss per share, basic and diluted | $ | (0.07 | ) | $ | (0.14 | ) | $ | (0.28 | ) | $ | (0.55 | ) | ||||

| Weighted-average shares outstanding, basic and diluted | 146,296 | 79,709 | 123,634 | 78,672 | ||||||||||||

| Biodesix, Inc. Reconciliation of Net Loss to Adjusted EBITDA (unaudited) (in thousands) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net loss | $ | (10,258 | ) | $ | (10,949 | ) | $ | (34,680 | ) | $ | (43,007 | ) | |||

| Interest expense | 2,041 | 2,386 | 6,506 | 7,207 | |||||||||||

| Depreciation and amortization | 1,492 | 782 | 4,324 | 2,351 | |||||||||||

| Share-based compensation expense | 1,515 | 954 | 5,373 | 4,292 | |||||||||||

| Loss on extinguishment of liabilities | — | — | 248 | — | |||||||||||

| COVID-19 Revenue | — | — | — | (13 | ) | ||||||||||

| COVID-19 Direct costs and expenses | — | — | — | 1 | |||||||||||

| Change in fair value of warrant liability, net | — | 1,393 | — | 1,332 | |||||||||||

| Other expense (income), net | (374 | ) | (2 | ) | 77 | (4 | ) | ||||||||

| Adjusted EBITDA | $ | (5,584 | ) | $ | (5,436 | ) | $ | (18,152 | ) | $ | (27,841 | ) | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

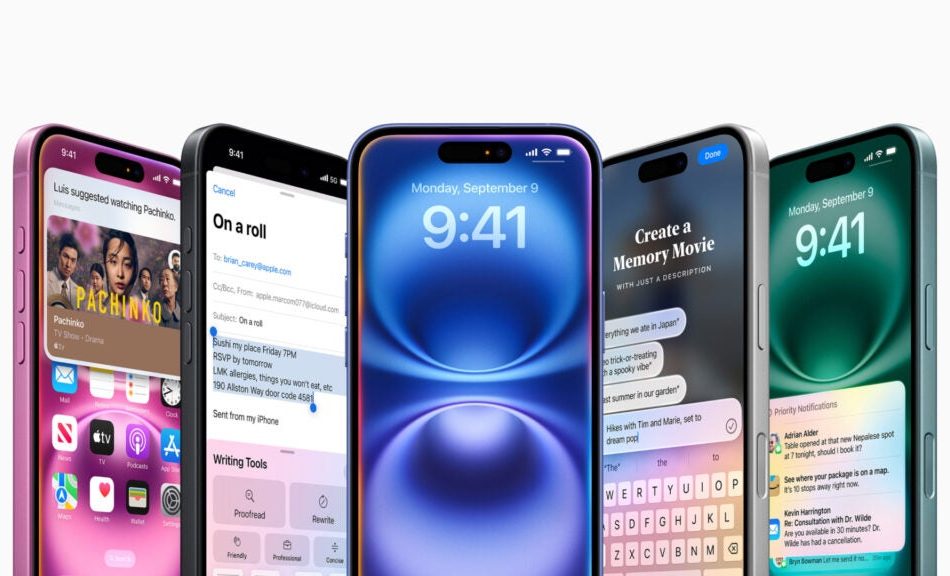

Jim Cramer Warns Apple Stock Should Have 'Never Been Up That Much' After Q3 Earnings Even As This Analyst Defends iPhone 16 Launch

After Apple Inc.’s AAPL forecast cuts following the company’s fourth-quarter results, “Mad Money” host Jim Cramer cautions that “the stock should never have been up that much,” while Dan Ives defends the company’s strong iPhone 16 launch.

What Happened: On Thursday, Cramer took to X, formerly Twitter, and suggested that Apple’s lowered financial forecast, indicating a slowdown, has now been “absorbed” by the market, which he thinks brings down overhyped expectations to a more “reasonable” level

Cramer also implied Apple hasn’t faced as much criticism for spending on AI compared to other tech giants, possibly because investors don’t think Apple’s AI efforts are as significant or game-changing.

“Oh and, tell me, please, who was surprised by the forecast guidedown? The stock should never have been up that much…,” he stated.

Contrarily, Wedbush analyst Ives defended Apple’s fourth-quarter performance. He lauded the successful launch of iPhone 16 and forecasted a robust December quarter for the company, propelled by the rollout of Apple Intelligence.

Ives also conveyed his conviction that the strong performance will persist throughout the rest of the fiscal year 2025, despite a lower guide delta for wearables, Mac, and iPad.

Why It Matters: Apple announced fiscal fourth-quarter revenue of $94.9 billion, surpassing analyst predictions of $94.56 billion. The company also reported adjusted earnings of $1.64 per share for the quarter, exceeding expectations of $1.60 per share.

This marks the seventh consecutive quarter that Apple has exceeded analyst forecasts for both revenue and earnings, according to Benzinga Pro.

During the earnings call on Thursday, Apple CEO Tim Cook said that the adoption rate of iOS 18.1 has doubled that of its predecessor, iOS 17.1, indicating a strong demand for the new iPhone 16.

However, previously it was reported that Apple had to resort to aggressive pricing strategies, including discounts on Alibaba’s Tmall, to counter the initial lukewarm response to the iPhone 16 in China.

Price Action: Apple’s stock fell 1.8% on Thursday to close at $225.91, and fell over 1.2% in premarket trading on Friday. Year-to-date, Apple’s shares are up 21.7%, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Apple

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing Sweetens Deal With 38% Wage Hike, $12K Bonus And More To End 7-Week Strike: Vote Set For Monday

Striking employees at Boeing Co. BA are poised to vote on a new contract proposal on Monday. The proposal, which includes a 38% wage increase over four years and a larger signing bonus, has received backing from the workers’ union.

What Happened: The International Association of Machinists and Aerospace Workers (IAM) stated that they have negotiated the best possible terms with Boeing. Previously, union members had turned down two offers from the company.

Reuters reported on Friday that this new offer comes as Boeing attempts to stabilize its finances amid a seven-week strike involving over 33,000 factory workers on the U.S. West Coast. The strike has significantly affected Boeing’s cash flow and halted production of key aircraft models.

Acting U.S. Secretary of Labor Julie Su facilitated recent negotiations, lauding both parties for their efforts. President Joe Biden also praised the union and Boeing for reaching a new contract proposal, highlighting the sacrifices made by Boeing’s machinists.

See Also: Cathie Wood Shuffles Her Tech Deck: Continues Dumping Tesla And Palantir, Stocks Up On AMD And Meta

Boeing’s latest offer includes a $12,000 ratification bonus, integrating previous bonuses into workers’ 401(k) retirement accounts. Despite the improved terms, approval remains uncertain as some workers express dissatisfaction due to the absence of a defined-benefit pension.

Why It Matters: The ongoing strike has already cost Boeing an estimated $2 billion over the last five weeks. The machinists’ rejection of previous offers has added further uncertainty to Boeing’s financial recovery efforts.

In a bid to bolster its finances, Boeing recently expanded its stock offering, aiming for a $20.7 billion windfall. The company priced its public offerings at 112.5 million shares of common stock at $143.00 each.

Price Action: Boeing saw its stock climb higher by 2.77% during the after-hours market after it closed at $149.31 on Thursday, according to Benzinga Pro.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RE/MAX HOLDINGS, INC. REPORTS THIRD QUARTER 2024 RESULTS

Total Revenue of $78.5 Million, Adjusted EBITDA of $27.3 Million

DENVER, Oct. 31, 2024 /PRNewswire/ —

Third Quarter 2024 Highlights

(Compared to third quarter 2023 unless otherwise noted)

- Total Revenue decreased 3.4% to $78.5 million

- Revenue excluding the Marketing Funds1 decreased 3.3% to $58.4 million, driven by negative 3.0% organic growth2 and 0.3% adverse foreign currency movements

- Net income attributable to RE/MAX Holdings, Inc. of $1.0 million and earnings per diluted share (GAAP EPS) of $0.05

- Adjusted EBITDA3 increased 2.0% to $27.3 million, Adjusted EBITDA margin3 of 34.8% and Adjusted earnings per diluted share (Adjusted EPS3) of $0.38

- Total agent count increased 174 agents, or 0.1%, to 145,483 agents

- U.S. and Canada combined agent count decreased 4.4% to 78,201 agents

- Total open Motto Mortgage franchises decreased 3.3% to 234 offices4

RE/MAX Holdings, Inc. (the “Company” or “RE/MAX Holdings”) RMAX, parent company of RE/MAX, one of the world’s leading franchisors of real estate brokerage services, and Motto Mortgage (“Motto”), the first and only national mortgage brokerage franchise brand in the U.S., today announced operating results for the quarter ended September 30, 2024.

“We continue to drive operational efficiency across the enterprise, which helped generate better-than-forecasted third-quarter financial results,” said Erik Carlson, RE/MAX Holdings Chief Executive Officer. “Our team is developing new revenue opportunities while working to run our core business better each day. That effort has contributed to our strong margin performance the past two quarters, which is an encouraging trend.”

Carlson continued: “Business optimization, having a growth mindset, and delivering the absolute best customer experience possible are the cornerstones of our playbook. We are making measurable progress on each of these. With increasing optimism about the trajectory of future interest rates, our growing global agent count, and our bold new initiatives – including providing innovative and enhanced technology products to our RE/MAX affiliates, improving the agent-customer experience by cultivating leads, and starting to monetize our digital assets – we are well-positioned to finish the year with positive momentum.”

Third Quarter 2024 Operating Results

Agent Count

The following table compares agent count as of September 30, 2024 and 2023:

|

As of September 30, |

Change |

||||||||

|

2024 |

2023 |

# |

% |

||||||

|

U.S. |

52,808 |

56,494 |

(3,686) |

(6.5) |

|||||

|

Canada |

25,393 |

25,288 |

105 |

0.4 |

|||||

|

Subtotal |

78,201 |

81,782 |

(3,581) |

(4.4) |

|||||

|

Outside the U.S. & Canada |

67,282 |

63,527 |

3,755 |

5.9 |

|||||

|

Total |

145,483 |

145,309 |

174 |

0.1 |

|||||

Revenue

RE/MAX Holdings generated revenue of $78.5 million in the third quarter of 2024, a decrease of $2.7 million, or 3.4%, compared to $81.2 million in the third quarter of 2023. Revenue excluding the Marketing Funds was $58.4 million in the third quarter of 2024, a decrease of $2.0 million, or 3.3%, versus the same period in 2023. The decrease in Revenue excluding the Marketing Funds was attributable to negative organic revenue growth of 3.0% and adverse foreign currency movements of 0.3%. Negative organic revenue growth was principally driven by a decrease in U.S. agent count and a reduction in revenue from previous acquisitions, partially offset by an increase in Broker fee revenue.

Recurring revenue streams, which consist of continuing franchise fees and annual dues, decreased $1.5 million, or 3.8%, compared to the third quarter of 2023 and accounted for 66.4% of Revenue excluding the Marketing Funds in the third quarter of 2024 compared to 66.7% of Revenue excluding the Marketing Funds in the prior-year period.

Operating Expenses

Total operating expenses were $63.3 million for the third quarter of 2024, a decrease of $39.0 million, or 38.1%, compared to $102.2 million in the third quarter of 2023. During the third quarter of 2023, the Company agreed to pay $55.0 million to settle various industry class-action lawsuits, which was recorded in the third quarter of 2023. A $24.9 million gain on reduction in tax receivable agreement liability was also recorded in the third quarter of 2023.

Selling, operating and administrative expenses were $35.9 million in the third quarter of 2024, a decrease of $7.2 million, or 16.6%, compared to the third quarter of 2023 and represented 61.5% of Revenue excluding the Marketing Funds, compared to 71.4% in the prior-year period. Third quarter 2024 selling, operating and administrative expenses decreased primarily due to lower personnel costs and a decrease in bad debt, legal, and other technology expenses.

Net Income (Loss) and GAAP EPS

Net income attributable to RE/MAX Holdings was $1.0 million for the third quarter of 2024 compared to net loss of ($59.5) million for the third quarter of 2023. Reported basic and diluted GAAP earnings per share were $0.05 each for the third quarter of 2024 compared to basic and diluted GAAP loss per share of ($3.28) each in the third quarter of 2023.

Adjusted EBITDA and Adjusted EPS

Adjusted EBITDA was $27.3 million for the third quarter of 2024, an increase of $0.5 million, or 2.0%, compared to the third quarter of 2023. Third quarter 2024 Adjusted EBITDA increased primarily due to a decrease in bad debt, legal, personnel, and other technology expenses, partially offset by a decrease in U.S. agent count. Adjusted EBITDA margin was 34.8% in the third quarter of 2024, compared to 32.9% in the third quarter of 2023.

Adjusted basic and diluted EPS were $0.39 and $0.38, respectively, for the third quarter of 2024 compared to Adjusted basic and diluted EPS of $0.40 each for the third quarter of 2023. The ownership structure used to calculate Adjusted basic and diluted EPS for the quarter ended September 30, 2024, assumes RE/MAX Holdings owned 100% of RMCO, LLC (“RMCO”). The weighted average ownership RE/MAX Holdings had in RMCO was 60.0% for the quarter ended September 30, 2024.

Balance Sheet

As of September 30, 2024, the Company had cash and cash equivalents of $83.8 million, an increase of $1.2 million from December 31, 2023. As of September 30, 2024, the Company had $441.8 million of outstanding debt, net of an unamortized debt discount and issuance costs, compared to $444.6 million as of December 31, 2023.

Share Repurchases and Retirement

As previously disclosed, in January 2022 the Company’s Board of Directors authorized a common stock repurchase program of up to $100 million. During the three months ended September 30, 2024, the Company did not repurchase any shares. As of September 30, 2024, $62.5 million remained available under the share repurchase program.

Impact of Hurricanes Helene and Milton

Several of the Company’s affiliates were impacted by the recent hurricanes. While the extent of the hurricanes’ full impact on the Company’s networks is not entirely known at this time, the Company currently estimates that its fourth quarter revenue will be lower than previously expected as financial support is provided to affected affiliates for a limited time. As a result, the Company’s fourth quarter and full year revenue (below) was reduced by approximately $1.0 million to $1.5 million, of which approximately 40% relates to the Marketing Funds, to reflect expected foregone revenue in the form of fee waivers provided to affiliates impacted by these storms.

Outlook

The Company’s fourth quarter and full year 2024 Outlook includes the impact of the fee waivers to hurricane-impacted affiliates and assumes no further currency movements, acquisitions, or divestitures.

For the fourth quarter of 2024, RE/MAX Holdings expects:

- Agent count to change 0.0% to 1.0% over fourth quarter 2023;

- Revenue in a range of $71.0 million to $76.0 million (including revenue from the Marketing Funds in a range of $18.5 million to $20.5 million); and

- Adjusted EBITDA in a range of $20.5 million to $23.5 million.

For the full year 2024, the Company now expects:

- Agent count to change 0.0% to 1.0% over full year 2023, changed from negative 1.0% to positive 1.0%;

- Revenue in a range of $306.0 million to $311.0 million (including revenue from the Marketing Funds in a range of $78.5 million to $80.5 million), changed from $305.0 million to $315.0 million (including revenue from the Marketing Funds in a range of $78.0 million to $82.0 million); and

- Adjusted EBITDA in a range of $95.0 million to $98.0 million, changed from $93.0 million to $98.0 million.

Webcast and Conference Call

The Company will host a conference call for interested parties on Friday, November 1, 2024, beginning at 8:30 a.m. Eastern Time. Interested parties can register in advance for the conference call using the link below:

https://registrations.events/direct/Q4I941153

Interested parties also can access a live webcast through the Investor Relations section of the Company’s website at http://investors.remaxholdings.com. Please dial-in or join the webcast 10 minutes before the start of the conference call. An archive of the webcast will be available on the Company’s website for a limited time as well.

Basis of Presentation

Unless otherwise noted, the results presented in this press release are consolidated and exclude adjustments attributable to the non-controlling interest.

Footnotes:

1Revenue excluding the Marketing Funds is a non-GAAP measure of financial performance that differs from U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) and a reconciliation to the most directly comparable U.S. GAAP measure is as follows (in thousands):

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 30, |

September 30, |

|||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

Revenue excluding the Marketing Funds: |

||||||||||||

|

Total revenue |

$ |

78,478 |

$ |

81,223 |

$ |

235,218 |

$ |

249,071 |

||||

|

Less: Marketing Funds fees |

20,098 |

20,853 |

60,331 |

63,272 |

||||||||

|

Revenue excluding the Marketing Funds |

$ |

58,380 |

$ |

60,370 |

$ |

174,887 |

$ |

185,799 |

||||

2The Company defines organic revenue growth as revenue growth from continuing operations excluding (i) revenue from Marketing Funds, (ii) revenue from acquisitions, and (iii) the impact of foreign currency movements. The Company defines revenue from acquisitions as the revenue generated from the date of an acquisition to its first anniversary (excluding Marketing Funds revenue related to acquisitions where applicable).

3Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EPS are non-GAAP measures. These terms are defined at the end of this release. Please see Tables 5 and 6 appearing later in this release for reconciliations of these non-GAAP measures to the most directly comparable GAAP measures.

4Total open Motto Mortgage franchises includes only “bricks and mortar” offices with a unique physical address with rights granted by a full franchise agreement with Motto Franchising, LLC and excludes any “virtual” offices or BranchiseSM offices.

# # #

About RE/MAX Holdings, Inc.

RE/MAX Holdings, Inc. RMAX is one of the world’s leading franchisors in the real estate industry, franchising real estate brokerages globally under the RE/MAX® brand, and mortgage brokerages within the U.S. under the Motto® Mortgage brand. RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. Now with more than 140,000 agents in nearly 9,000 offices and a presence in more than 110 countries and territories, nobody in the world sells more real estate than RE/MAX, as measured by total residential transaction sides. Dedicated to innovation and change in the real estate industry, RE/MAX launched Motto Franchising, LLC, a ground-breaking mortgage brokerage franchisor, in 2016. Motto Mortgage, the first and only national mortgage brokerage franchise brand in the U.S., has grown to over 225 offices across more than 40 states.

Forward-Looking Statements