3 Ultra-High-Yield Dividend Stocks to Buy in November and Hold Forever

There are lots of ways to put your money to work on Wall Street, but none are as reliable as investing in dividend-paying stocks. That’s because companies rarely commit to distributing a portion of their profits to shareholders unless they’re already profitable and likely to stay that way.

Dividend-paying businesses have to be extra careful with their cash flows, which tends to benefit investors. These increased returns that come with regular distributions are measurable and stronger than you might expect.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

During the 50-year period between 1973 and 2023, non-dividend-paying stocks in the S&P 500 index delivered a 4.27% average annual return. Their dividend-paying cousins performed more than twice as well with an average annual return of 9.17% over the same time frame.

At recent prices, Ares Capital (NASDAQ: ARCC), PennantPark Floating Rate Capital (NYSE: PFLT), and Rithm Capital (NYSE: RITM) offer dividend yields of 9.1% and better. Generally, stocks don’t offer yields this high unless investors have concerns about their underlying businesses. These three stand out because they are on better financial footing than their ultra-high yields suggest.

Ares Capital is the world’s largest publicly traded business development company (BDC). These specialized entities fill the gap left by big banks that no longer lend directly to most businesses. They’re also popular among income-seeking investors because they can legally avoid paying income taxes by distributing at least 90% of their earnings as dividend payments.

At recent prices, Ares Capital offers investors a 9.1% yield and confidence that comes with a highly diversified portfolio. At the end of September, it had investments worth $25.9 billion spread out among 535 borrowers. Its single-largest borrower is responsible for just 1.7% of the portfolio.

Ares Capital’s dividend hasn’t risen in a straight line, but it is up by 26% over the past decade. The odds of a dividend cut in the quarters ahead seem extremely slim. Loans representing just 1.3% of total investments at cost were on non-accrual status at the end of September.

PennantPark Floating Rate Capital is another lender for mid-sized companies that can’t get banks to return their calls. As its name implies, this BDC isn’t very sensitive to interest rate adjustments because the loans it originates collect interest at variable rates.

Money market account rates today, November 3, 2024 (best account provides 5.05% APY)

Between March 2022 and July 2023, the Federal Reserve raised its benchmark rate 11 times. As a result, money market account (MMA) interest rates rose sharply.

However, the Fed slashed the federal funds rate by 50 basis points in September. So deposit rates — including money market account rates — have started falling. It’s more important than ever to compare MMA rates and ensure you earn as much as possible on your balance.

The national average money market account rate stands at 0.64%, according to the FDIC. This might not seem like much, but consider that just two years ago, it was just 0.23%, reflecting a sharp rise in a short period of time.

This is largely due to monetary policy decisions by the Fed, which began raising its benchmark rate in March 2022 to combat skyrocketing inflation. In fact, the Fed increased rates 11 times. But it finally cut its benchmark rate in September, causing deposit account rates to start dropping

Even so, some of the top accounts are currently offering upwards of 5% APY. Since these rates may not be around much longer, consider opening a money market account now to take advantage of today’s high rates.

Here’s a look at some of the top MMA rates available today:

See our picks for the 10 best money market accounts available today>>

Additionally, the table below features some of the best savings and money market account rates available today from our verified partners.

The amount of interest you can earn from a money market account depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (money market account interest typically compounds daily).

Say you put $1,000 in an MMA at the average interest rate of 0.64% with daily compounding. At the end of one year, your balance would grow to $1,006.42 — your initial $1,000 deposit, plus just $6.42 in interest.

Now let’s say you choose a high-yield money market account that offers 5% APY instead. In this case, your balance would grow to $1,051.27 over the same period, which includes $51.27 in interest.

The more you deposit in a money market account, the more you stand to earn. If we took our same example of a money market account at 5% APY, but deposit $10,000, your total balance after one year would be $10,512.67, meaning you’d earn $512.67 in interest.

How One of the Tiniest Oil Markets Cost Trafigura Over $1 Billion

(Bloomberg) — Trafigura Group is a giant of commodity trading. On any given day, it handles enough oil to supply the entire needs of France three times over. Its global reach stretches from US crude oil export infrastructure to fuel stations in more than 20 countries across Africa, Asia and Latin America.

Yet in a distant corner of its empire, far from the attention of top executives in Geneva and Singapore, a crisis has been brewing for some time.

Last week, the company admitted it faces a loss in Mongolia of up to $1.1 billion, linked in part to suspected fraud by its own employees. Trafigura alleges that staff manipulated payments while concealing a mountain of overdue debts, allowing the exposure to run out of control for years without raising any red flags.

For people inside and outside Trafigura, the revelation was a bombshell. Most shocking was the scale of the likely loss relative to the size of Mongolia’s oil market. There are over 100 countries that use more oil than Mongolia, according to data from the US Energy Information Administration, among them Luxembourg and Nepal. Its consumption of about 35,000 barrels a day is worth roughly $1 billion a year. For Trafigura, Mongolia made up less than 0.3% of all the oil it traded.

This account is based on interviews with eight people with direct knowledge of Trafigura and its activities in Mongolia, who asked not to be identified due to the sensitivity of the subject. Last week, Trafigura Chief Executive Officer Jeremy Weir said the company was “bitterly disappointed” by the situation and was confident it was isolated to the Mongolia business, and the company’s investigation is still ongoing.

Last week’s announcement, confirming an earlier report by Bloomberg, represents a painful sequel to last year’s revelation that Trafigura had fallen victim to a massive alleged nickel fraud.

The debacle is shining another harsh light on the company’s internal controls, and raises questions about why it took almost a year to fully disclose the situation. For outsiders, it reinforces commodity trading’s fast-and-loose reputation, coming months after some of the biggest players — including Trafigura itself — pleaded guilty to corruption charges in the US.

Morgan Stanley Predicts Up to 670% Jump for These 2 ‘Strong Buy’ Stocks

We’re now just days away from the ’24 elections, and what a race it’s been. Polls have been all over the place, and both parties can make legitimate claims to holding the advantage as we approach Tuesday’s vote.

Amidst the political drama, the stock market has remained robust, with the S&P 500 surging 20% year-to-date. Historically, the index tends to perform well in election years, but this year has been exceptional, making it the most bullish election-year market in decades. A mix of macroeconomic factors, especially expectations of further Fed rate cuts, has fueled strong investor confidence.

Morgan Stanley’s analysts are embracing this momentum, picking out stocks they believe are primed for gains regardless of the election outcome. They’ve zeroed in on two specific stocks poised for substantial growth in the coming year – including one with a potential upside as high as 670%.

As if that weren’t compelling enough, according to the TipRanks database, both stocks are also rated as Strong Buys by the analyst consensus. Let’s see what’s driving this optimism among market experts.

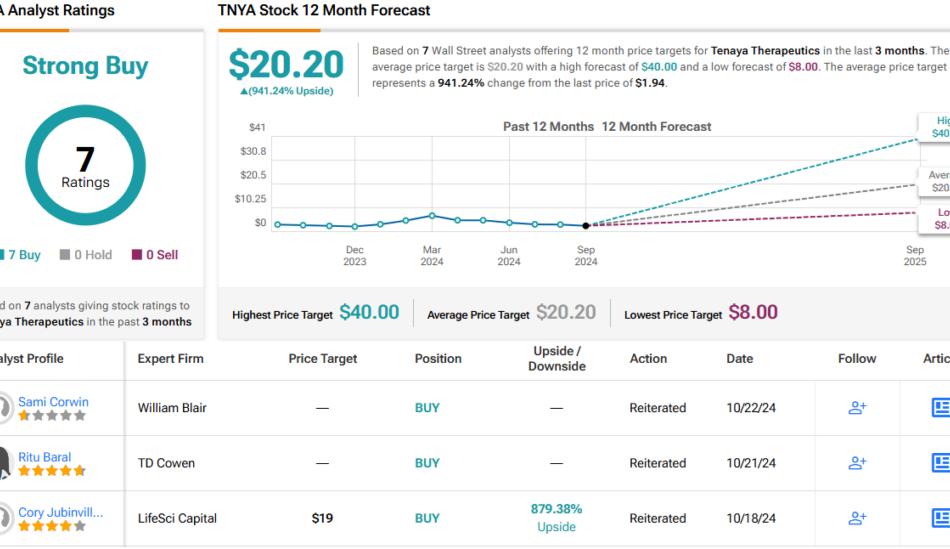

Tenaya Therapeutics (TNYA)

We’ll start with Tenaya Therapeutics, a research-oriented biopharmaceutical company that is focused on developing and producing new therapeutic drugs for the treatment of heart disease. Tenaya is targeting its approach on the underlying causes of heart disease, including rare genetic disorders. The company’s approach includes gene therapies, cellular regeneration, and precision medicines.

Heart disease is the world’s leading cause of death among adults, making its treatment an important niche. Tenaya currently has two primary drug candidates under investigation, TN-201 and TN-401, for the treatment of MYBPC3-associated hypertrophic cardiomyopathy and PKP2-associated arrhythmogenic right ventricular cardiomyopathy, respectively.

The leading candidate, TN-201, is currently undergoing a Phase 1b human clinical trial. The study is focused on safety and tolerability and will enroll up to 24 adults. Data from the first patient cohort in the study are expected to be released in December, presenting a significant milestone for the stock. Meanwhile, enrollment is ongoing for the second cohort.

The second candidate, TN-401, entered its Phase 1 RIDGE-1 trial earlier this year. This global, open-label, dose-escalation study, which will continue patient dosing through Q4 2024, aims to evaluate the safety, tolerability, and effectiveness of a single intravenous dose of TN-401.

Morgan Stanley analyst Michael Ulz views TNYA as a compelling investment, with TN-201 as the primary value driver. Ulz notes, “Interim Ph1b MyPEAK-1 data for TN-201 in nHCM are expected in [December] and represent a key catalyst for Tenaya’s lead program. We see a favorable risk/reward on initial data, which could provide early de-risking, followed by more robust data in 2025.”

Fueled by a Needle-Moving Acquisition, This Oil Stock Is Boosting Its Dividend by 34% and Plans to Buy Back $20 Billion of Its Stock

ConocoPhillips (NYSE: COP) is firing on all cylinders these days. The oil giant’s legacy business is performing extremely well. Meanwhile, the company is about to get a big boost from closing its needle-moving acquisition of Marathon Oil (NYSE: MRO).

Those factors are giving the oil stock the confidence to return a lot more cash to its shareholders. It’s boosting its dividend and share repurchase program.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

ConocoPhillips recently reported its third-quarter results. The oil giant produced over 1.9 million barrels of oil equivalent per day (BOE/d) during the period, surpassing the high end of its production guidance. It achieved record production in the lower 48 states, with strong results across its Permian, Bakken, and Eagle Ford operating areas. Its production rose 3% year over year after adjusting for acquisitions and asset sales.

That strong production helped mute some of the impacts of lower oil and gas prices. ConocoPhillips realized an average of $54.18 per BOE in the period, 10% lower than the year-ago quarter. As a result, its adjusted earnings declined from $2.6 billion to $2.1 billion.

However, the company produced robust cash flows during the third quarter. It generated $4.7 billion in cash from operations. ConocoPhillips used $2.9 billion to fund capital expenses to maintain and expand its operations. Meanwhile, it distributed $2.1 billion to investors, including repurchasing $1.2 billion of shares and making $900 million in cash payments (dividends and its variable return of cash (VORC)). That left the company with $7.1 billion of cash on its balance sheet at the end of the third quarter, along with another $1 billion of long-term investments.

ConocoPhillips expects the fourth quarter to be an active one. It anticipates closing its $22.5 billion merger with Marathon Oil. The deal will deepen its portfolio, adding high-quality, low-cost supply inventory near its existing positions throughout the lower 48 states.

The company also expects the transaction to be immediately accretive to its earnings, cash from operations, free cash flow, and return of capital per share. The company initially expected to capture at least $500 million in cost and capital synergies within the first year of closing the deal. However, it now anticipates significantly exceeding that tally.

On top of buying Marathon, ConocoPhillips also recently agreed to bulk up on its position in Alaska. It exercised its rights and signed agreements to buy additional working interests in the Kuparuk River and Prudhoe Bay units for $300 million. That deal will increase its earnings and cash flow from the state.

Consumer Tech News (Oct 28-Nov 1): Apple Starts Manufacturing Entry-Level iPhone Model, US Bans Investments In China's Semiconductor & AI, & More

The United States has announced a ban on investments in China’s semiconductor and AI sectors, potentially affecting Tesla, Inc. TSLA and its operations in the region.

The Video Game History Foundation (VGHF) and the Software Preservation Network faced a major setback in their ongoing campaign to preserve and grant research access to out-of-print video games.

With the U.S. 2024 presidential election just days away, Vice President Kamala Harris is making a unique play to connect with gamers—an audience often sidelined in political campaigns.

Earnings

Alphabet Inc. GOOG reported third-quarter revenue of $88.27 billion, up 15% year-over-year, beating the Street consensus estimate of $86.31 billion. EPS of $2.12 exceeded the Street consensus estimate of $1.84.

Snap Inc. SNAP reported third-quarter revenue of $1.373 billion, beating the consensus estimate of $1.358 billion. Adjusted EPS of 8 cents per share, beating analyst estimates of 5 cents per share.

Read: Snap Touts New Ad Formats And ‘Simple Snapchat’ — 10M Users Trial Growth-Driving Feature

Gaming

Call of Duty: Black Ops 6 has set a new franchise record for the biggest release ever, with sales on PlayStation and Steam jumping 60 percent compared to last year’s Modern Warfare III.

Tencent Holdings ADR TCEHY officially denied rumors of layoffs and restructuring within the company, while acknowledging recent changes in its leadership structure.

Ubisoft has launched its first blockchain game, Champions Tactics: Grimoria Chronicles, a tactical NFT battler now available on PC.

Sony Group Corporation SONY announced the November PlayStation Plus lineup, featuring Death Note Killer Within.

Technology

A Russian court has ordered Alphabet Inc.‘s Google to pay a massive fine of $20 decillion for restricting content from Russian media outlets. The fine, which is expected to increase, is a result of a long-standing legal dispute.

Jim Cramer said that Alphabet plans to increase investments in artificial intelligence infrastructure next year can significantly benefit NVIDIA Corp NVDA.

Smartphones

Apple Inc. AAPL is all set to integrate the powerful M4 processor into its Mac lineup. The new chip will significantly increase core counts compared to its predecessor. This will ensure a marked improvement in daily usage from older models.

Apple is working on developing a new smart home display inspired by the iMac G4’s design.

The release of iOS 18.1 brought Apple’s new AI-powered features, known as Apple Intelligence, to iPhone users.

Apple has reportedly initiated initial manufacturing efforts for next year’s entry-level iPhone model, expected to be named the iPhone 17. For the first time, this early-stage development is taking place in India, moving away from Apple’s traditional reliance on China.

Apple introduced a fresh Mac mini Tuesday featuring the new M4 and M4 Pro chips, compactly engineered to maximize performance within a smaller 5×5-inch form factor.

Artificial Intelligence (AI)

Sierra, the AI startup co-founded by former Salesforce co-CEO and OpenAI chairman Bret Taylor, has achieved a valuation of $4.5 billion following a successful funding round.

OpenAI CFO Sarah Friar revealed that a monumental 75% of the AI startup’s revenue comes from consumer subscriptions to just one service – ChatGPT.

OpenAI announced that its flagship product, ChatGPT, is now capable of crawling the web for up-to-date news, sports scores, stock quotes and more.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

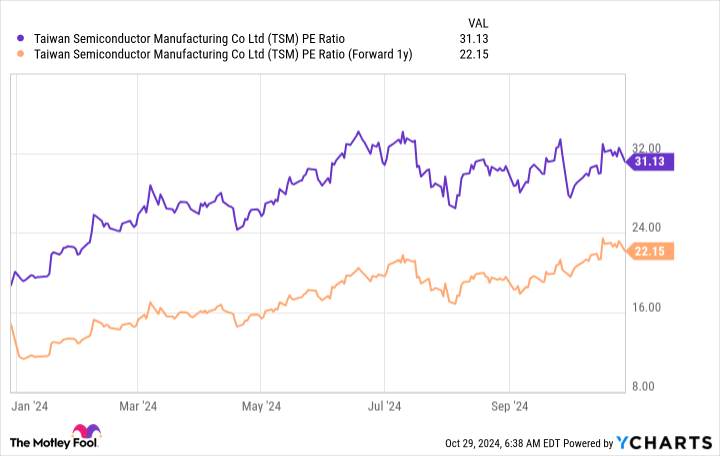

You'll Never Believe What Taiwan Semiconductor's CEO Just Said About Artificial Intelligence (AI) Chip Demand

Taiwan Semiconductor Manufacturing (NYSE: TSM) is the world’s largest chip foundry company. Without it, much of the technology we see today wouldn’t exist in the same capacity, and it could be argued that it is one of the world’s most important companies.

Recently, the company reported outstanding quarterly earnings, and the CEO said something unbelievable in the quarterly conference call. The results in one sector of the chip market have blown away expectations, and investors should consider loading up on more Taiwan Semi stock, if they haven’t already.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Taiwan Semiconductor’s products are used in all sorts of devices, but most notably, some of its biggest clients are Apple and Nvidia, the world’s two largest companies. These two would grind to a halt without TSMC’s chips, which shows how critical TSMC is. Both of these companies are participating in the artificial intelligence (AI) arms race, which should boost TSMC’s sales in the AI chip space.

Taiwan Semiconductor saw this trend coming from a ways out and projected that AI chips would grow at a 50% compound annual rate for five years, when they would then make up around a low-teens percentage of revenue. Considering that AI chips made up about 6% of total revenue at that time, it seemed like an ambitious projection when they announced that guidance in Q2 2023.

However, we now know that management wasn’t ambitious enough. In its Q3 2024 conference call, CEO C.C. Wei had this to say about AI chip demand:

We now forecast the revenue contribution from several AI processors to more than triple this year and account for mid-teens percentage of our total revenue in 2024, supported by our technology leadership and broader customer base, we are well-positioned to capture the industry’s growth opportunities.

So, just a year-and-a-half after it gave the projection that AI chips would make up a “low-teens percentage” in five years, it is on track to make up a “mid-teens percentage.” This shows the incredible demand for AI chips that go into graphics processing units (GPUs), AI accelerators (custom chips that the big tech companies utilize for themselves), and CPUs.

Thanks to AI revenue tripling, management raised its full-year revenue forecast to rise by 30% year over year. AI chips are clearly having a huge effect on Taiwan Semiconductor, and it’s well-positioned to take advantage, but does that make the stock a buy right now?

Markets brace for presidential election, Fed meeting: What to know this week

Election Day is almost here. The looming question remains how a Donald Trump or Kamala Harris victory will shape the market narrative for the rest of the year and beyond.

Investors should soon learn the answer, with Americans heading to the polls next Tuesday. In the week before the election, the S&P 500 (^GSPC) fell about 1.37% while the tech-heavy Nasdaq Composite (^IXIC) shed 1.5% despite hitting its first record close since June during the week. Meanwhile, the Dow Jones Industrial Average (^DJI) dropped just over 0.1%.

It’s not the only big event of the week ahead. On Thursday the Federal Reserve will announce its latest policy decision, with markets largely anticipating that the central bank will cut interest rates by a quarter percentage point.

Earnings season rolls on with a week headlined by reports from Palantir (PLTR), Super Micro Computer (SMCI), Arm (ARM), Qualcomm (QCOM), and Moderna (MRNA).

One of the top potentially market-moving events that strategists have discussed throughout the year has finally arrived with the 2024 presidential election slated for Tuesday, Nov. 5.

But it’s been an abnormal election year for markets. When analyzing the S&P 500’s average intraday trading range, Carson Group chief markets strategist Ryan Detrick found that this past October was the second-least volatile month leading into an election in the past 50 years.

Zooming out further, research from Bespoke Investment Group shows the S&P 500 had its best start to an election year since 1932, with a 20% year-to-date return for the benchmark index through the end of October.

Still, Election Day itself is considered a risk event for markets. Speculation has built that a “Trump Trade” has been forming in markets as the betting odds of the former president winning the election have risen. But some market strategists aren’t convinced there’s a clear read on what outcome investors will be rooting for come Tuesday.

“I think the market would do fine with Harris,” Yardeni Research chief markets strategist Eric Wallerstein told Yahoo Finance. “I think the market would do fine with Trump. I don’t think the stock market is really pricing any presidential odds.”

Franklin Templeton chief markets strategist Stephen Dover told Yahoo Finance that the key for markets could simply be getting past the event itself.

“Just having those elections settled, whichever way it goes, would be positive,” Dover said.

Baird market strategist Michael Antonelli agreed, telling Yahoo Finance that the riskiest scenario from the election is “one where we just don’t know the winner.”

Scaramucci Says Trump 'Should Be Taken Into Custody' Over Alleged Threat Against Liz Cheney

Former White House Communications Director Anthony Scaramucci has called for the arrest of Donald Trump, alleging that the former president violated his bail conditions with his controversial comments about Liz Cheney.

What Happened: Scaramucci’s remarks on X came in response to a question from ex-Fox News host Tucker Carlson, where Trump made a provocative statement about Cheney, a Republican who has endorsed and is campaigning for Kamala Harris.

Scaramucci, who will be a headline speaker at Benzinga’s upcoming Future of Digital Assets event on Nov. 19, stated, “Trump should be taken into custody. He is a convicted felon and just violated the conditions of his bail agreement by threatening someone’s life. He needs to be sent away.”

Also Read: Scaramucci: Election ‘Too Close To Call’ But Expects Harris To Win And Trump To Try To Avoid Jail

The specific bail condition that Scaramucci is referring to remains unclear. Trump is currently living under bail restrictions set by the state of Georgia due to an ongoing investigation into his alleged criminal attempts to overturn the 2020 election. Trump denies any wrongdoing.

The term “felon” used by Scaramucci in reference to Trump is related to the trial in New York where Trump was found guilty on 34 counts following his hush money payment trial.

Trump, who continues to maintain his innocence, is awaiting sentencing in New York.

Why It Matters: This development adds another layer of complexity to the ongoing legal battles faced by Trump.

The former president’s controversial comments about Cheney, coupled with Scaramucci’s call for his arrest, have once again brought Trump’s legal issues into the spotlight.

The allegations of bail violation, if proven true, could potentially lead to further legal consequences for Trump.

Read Next

Anthony Scaramucci: Trump Will Lose, Then ‘Start Panicking’ Over November Sentencing

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Up 264%, Is MicroStrategy On Track to Become the First $1 Trillion Crypto Stock?

Right now, there are only a handful of companies with a market cap exceeding $1 trillion. With the exception of Warren Buffett’s Berkshire Hathaway, all of them are high-growth tech stocks. So the natural assumption is that the next great $1 trillion company will be yet another tech company.

But what if the next $1 trillion company is a crypto company instead? That’s the vision for MicroStrategy Inc. (NASDAQ: MSTR), which has absolutely soared in value as a result of its massive Bitcoin (CRYPTO: BTC) holdings. For the year, MicroStrategy is up a resounding 264%, and since 2020, it has outperformed every single S&P 500 stock. So is MicroStrategy really on track to become the first $1 trillion crypto stock?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The first thing you need to know about MicroStrategy is that it holds 252,220 Bitcoins on its balance sheet, worth a cumulative total of $17 billion at today’s prices. This makes MicroStrategy easily the largest corporate holder of Bitcoin in the world. In fact, MicroStrategy now holds over 1% of all Bitcoin in circulation today.

The company shows no signs of stopping anytime soon. MicroStrategy has been on a Bitcoin buying spree since 2020, and makes regular Bitcoin purchases nearly every month. If anything, MicroStrategy is now ramping up its purchases of Bitcoin. The company’s newest strategy is to issue convertible debt as a way to buy even more Bitcoin in the future.

The path to $1 trillion is actually remarkably simple: Buy as much Bitcoin as possible, and wait for it to appreciate in price. Given that Michael Saylor, founder and executive chairman of MicroStrategy, now thinks that Bitcoin can hit $13 million by the year 2045, a trillion-dollar valuation is certainly within the realm of possibility.

In October, Saylor outlined a brand-new strategy. The plan, quite simply, is to transform MicroStrategy from an enterprise software company into an investment bank. As Saylor notes: “The endgame is to be the leading Bitcoin bank, or merchant bank, or you could call it a Bitcoin finance company.”

As part of this strategic transformation, MicroStrategy will begin to create new Bitcoin capital market instruments. From a broad conceptual standpoint, think of MicroStrategy as a giant Wall Street investment bank doing everything that a Goldman Sachs or Morgan Stanley does, but with Bitcoin instead of dollars.