DEA Judge Blocks Researcher's Motion In Cannabis Rescheduling Case,

A DEA administrative law judge has denied MedPharm’s motion to participate in the December 2 marijuana rescheduling hearing, deferring to DEA Administrator Anne Milgram’s authority.

MedPharm, a DEA-registered research firm, criticized the exclusion of marijuana researchers and the inclusion of prohibitionist organizations, calling the process biased.

MedPharm’s Motion And Criticism

MedPharm filed a motion to intervene after being excluded from the witness list, arguing the fact that no DEA-licensed marijuana researchers were included.

“The deck appears to be stacked against those in favor” of rescheduling marijuana from Schedule I to Schedule III of the Controlled Substances Act (CSA), MedPharm noted.

It also alleged that the witness list, which included the anti-cannabis prohibitionist group Smart Approaches to Marijuana (SAM), undermines the legitimacy of the process, describing the decision as an attempt to “thwart a legitimate process,” as reported Marijuana Moment.

Read Also: DEA Slammed For Unlawful Talks With Cannabis Opponents – The Plot Thickens

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Judge Mulrooney’s Decision

DEA Administrative Law Judge John Mulrooney denied MedPharm’s motion, citing statutory limits on his authority.

“The Administrator exercised her discretion to fix the number of participants,” Mulrooney said, adding that expanding the list would exceed his role under the Administrative Procedures Act.

Mulrooney acknowledged the value of wider input but noted that the DEA prioritizes participants who can demonstrate adverse impacts from the proposed policy change, which becomes apparent by viewing the biased list.

The exclusion of key scientific voices has raised concerns about the process’s fairness, particularly as the Department of Health and Human Services (HHS) and the DEA’s Office of Legal Counsel support rescheduling.

The upcoming hearing will allow cross-examination of witnesses from both sides, but critics warn the imbalance could skew outcomes. Mulrooney is leading another case where the DEA is accused of engaging in unlawful conversations with anti-cannabis groups ahead of the December 2 hearing.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Macy's delays Q3 earnings report, says employee hid up to $154 million in expenses

Macy’s (M) on Monday delayed its Q3 earnings release as it conducts an internal investigation into an employee hiding hundred of millions of dollars of expenses.

An employee responsible for small package delivery expense accounting intentionally made “erroneous accounting accrual entries” that hid nearly $132 million to $154 million from Q4 2021 through the fiscal quarter that ended Nov. 2, 2024, the company said.

Macy’s said the employee was no longer with the company and there was “no indication that the accounting error had any impact on the cash management activities or vendor payments.”

America’s largest department store was expected to post its Q3 earnings report on Tuesday before market open. In its preliminary results, same-store sales were down 1.3%, slightly better than expectations.

Its shares dropped 3% as investors digests the expense error and preliminary results.

“The preliminary numbers basically match exactly what people were looking for,” Morningstar analyst David Swartz told Yahoo Finance over the phone, adding the latest news were disappointing, but not a major issue.

“Macy’s has over $8 billion a year in operating expenses, so even if it’s $50 million a year underreported, that’s immaterial for Macy’s, that would be less than 1% of Macy’s annual expenses.”

“From what we know with the limited amount…a rogue employee did something wrong,” Swartz said. “Why it was not caught earlier is certainly a question that will be asked, because this should not happen, but it does happen sometimes.”

Net sales of $4.74 billion came in slightly below the $4.75 billion expected. The company did not reported adjusted earnings, which Wall Street expects to come in at a loss of one cent.

“While we work diligently to complete the investigation as soon as practicable and ensure this matter is handled appropriately, our colleagues across the company are focused on serving our customers and executing our strategy for a successful holiday season,” Chairman and CEO Tony Spring said in the release.

The company said it plans to provide its fourth quarter and full year outlook by December 11, 2024 “to allow for completion of the independent investigation.”

Many are left wondering how this employee got away with it for so long.

“Personal and professional greed, has reached unprecedented proportions, in part, fueled by gambling,” Burt Flickinger III of Strategic Resource Group told Yahoo Finance in a phone call.

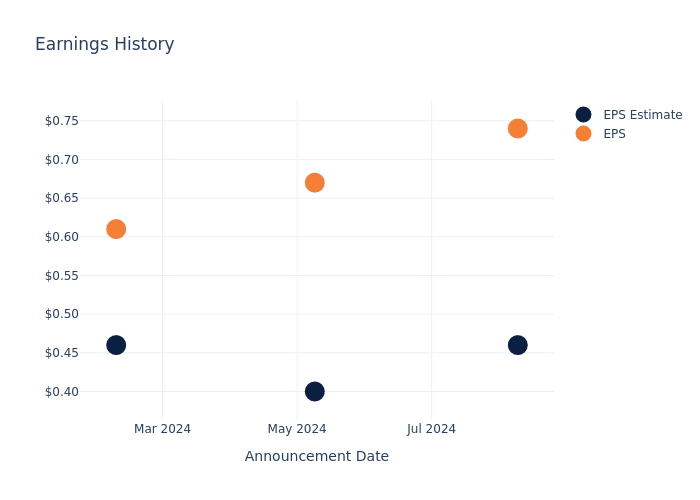

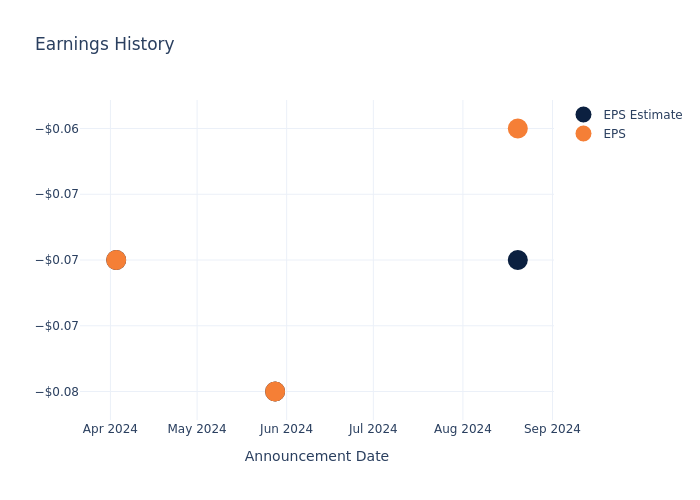

What to Expect from Icecure Medical's Earnings

Icecure Medical ICCM will release its quarterly earnings report on Tuesday, 2024-11-26. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Icecure Medical to report an earnings per share (EPS) of $-0.07.

The market awaits Icecure Medical’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

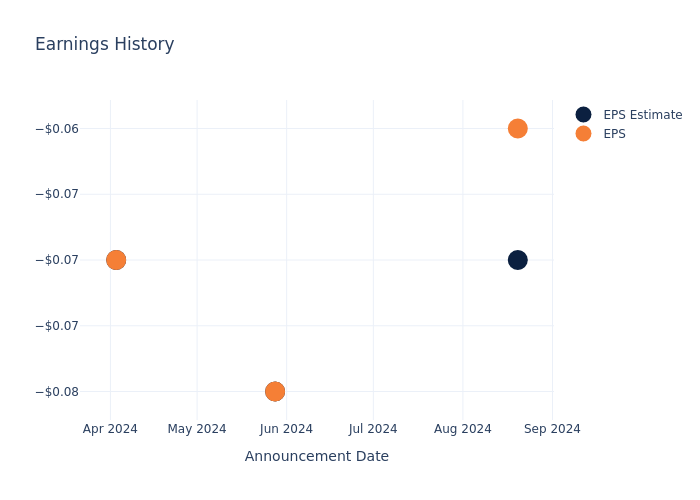

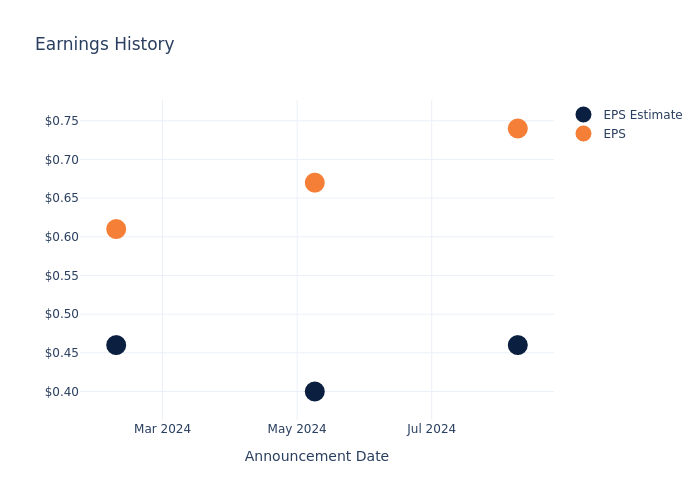

Historical Earnings Performance

The company’s EPS beat by $0.01 in the last quarter, leading to a 0.98% drop in the share price on the following day.

Here’s a look at Icecure Medical’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.07 | -0.08 | -0.07 | -0.07 |

| EPS Actual | -0.06 | -0.08 | -0.07 | -0.09 |

| Price Change % | -1.0% | -1.0% | 0.0% | -6.0% |

Market Performance of Icecure Medical’s Stock

Shares of Icecure Medical were trading at $0.7122 as of November 22. Over the last 52-week period, shares are down 39.48%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Icecure Medical visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

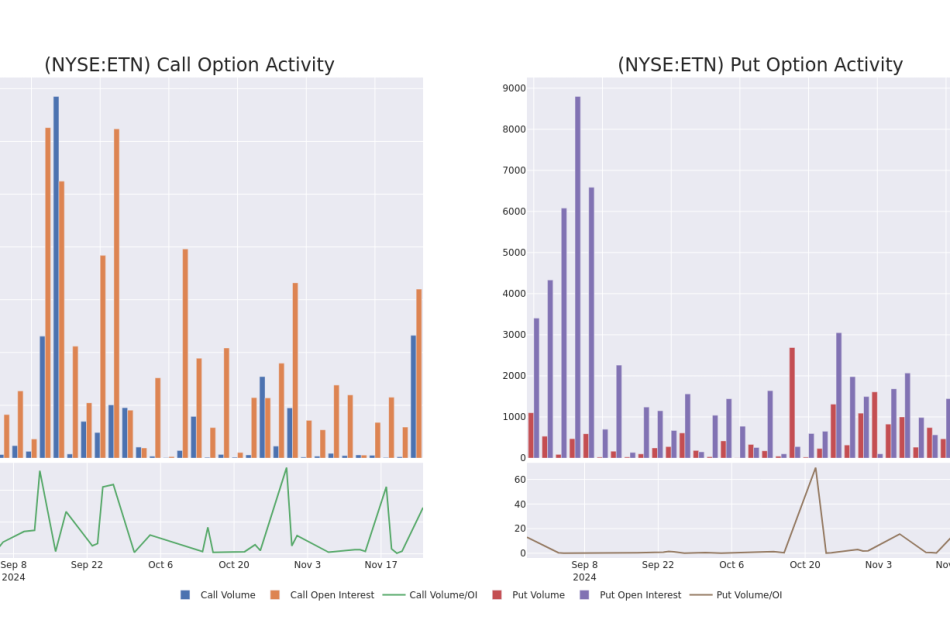

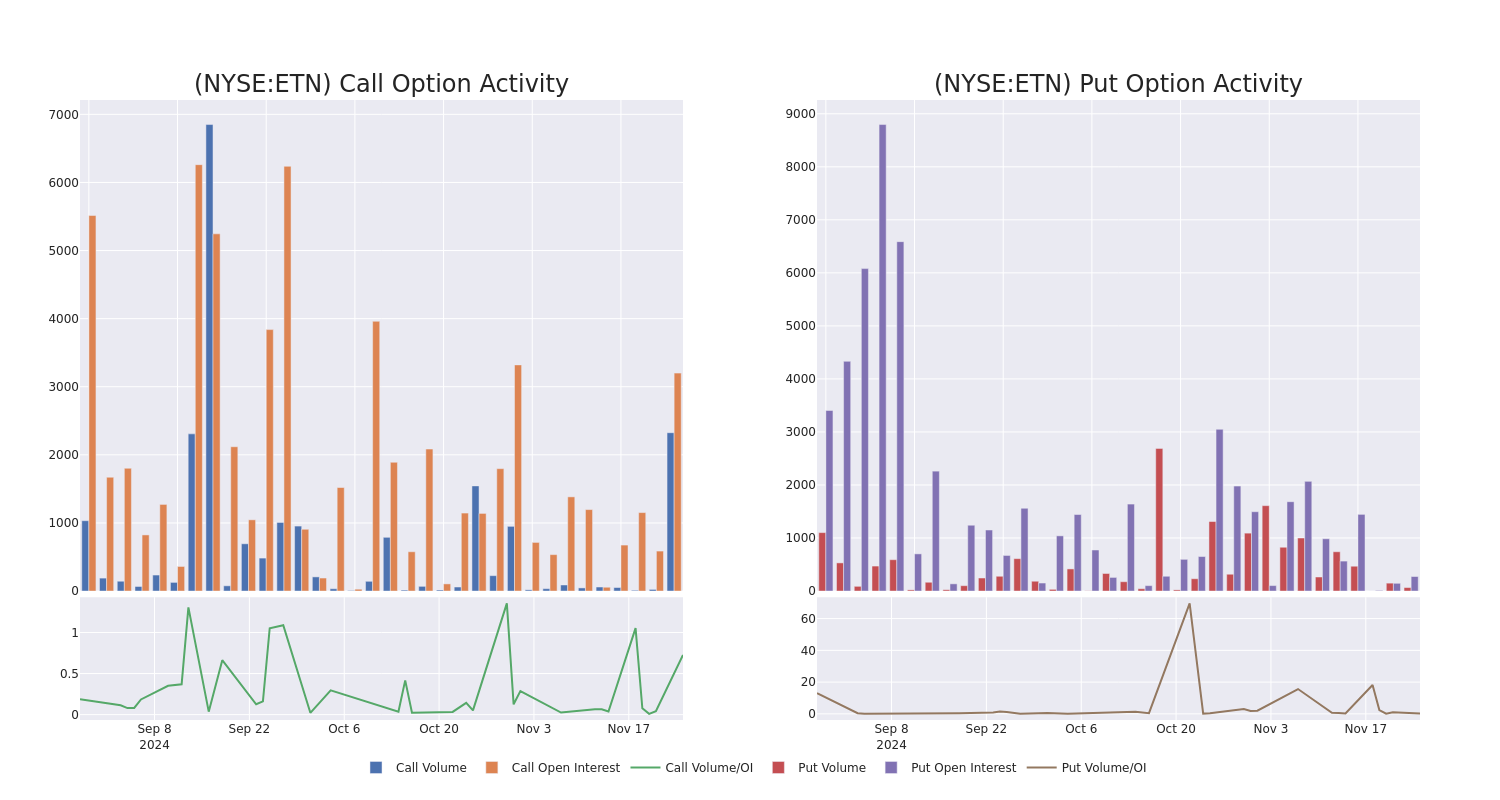

Eaton Corp's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on Eaton Corp ETN.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ETN, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 11 options trades for Eaton Corp.

This isn’t normal.

The overall sentiment of these big-money traders is split between 54% bullish and 36%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,780, and 10, calls, for a total amount of $449,756.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $270.0 to $390.0 for Eaton Corp over the recent three months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Eaton Corp’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Eaton Corp’s significant trades, within a strike price range of $270.0 to $390.0, over the past month.

Eaton Corp Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | CALL | SWEEP | BULLISH | 12/20/24 | $15.0 | $14.0 | $14.92 | $370.00 | $80.4K | 1.3K | 56 |

| ETN | CALL | TRADE | BEARISH | 12/20/24 | $19.0 | $18.2 | $18.3 | $360.00 | $75.0K | 604 | 43 |

| ETN | CALL | SWEEP | BEARISH | 12/20/24 | $14.9 | $14.0 | $14.51 | $370.00 | $60.0K | 1.3K | 543 |

| ETN | CALL | SWEEP | BULLISH | 12/20/24 | $14.7 | $13.9 | $14.56 | $370.00 | $45.8K | 1.3K | 456 |

| ETN | CALL | TRADE | BEARISH | 01/17/25 | $112.2 | $108.9 | $109.94 | $270.00 | $43.9K | 564 | 4 |

About Eaton Corp

Founded in 1911 by Joseph Eaton, the eponymous company began by selling truck axles in New Jersey. Eaton has since become an industrial powerhouse largely through acquisitions in various end markets. Eaton’s portfolio can broadly be divided into two parts: its electrical and industrial businesses. Its electrical portfolio (representing around 70% of company revenue) sells components within data centers, utilities, and commercial and residential buildings, while its industrial business (30% of revenue) sells components within commercial and passenger vehicles and aircraft. Eaton receives favorable tax treatment as a domiciliary of Ireland, but it generates over half of its revenue within the US.

Eaton Corp’s Current Market Status

- Trading volume stands at 732,546, with ETN’s price down by -0.95%, positioned at $373.81.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 66 days.

Professional Analyst Ratings for Eaton Corp

In the last month, 5 experts released ratings on this stock with an average target price of $385.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for Eaton Corp, targeting a price of $385.

* Reflecting concerns, an analyst from Bernstein lowers its rating to Outperform with a new price target of $382.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Eaton Corp with a target price of $320.

* An analyst from UBS downgraded its action to Buy with a price target of $431.

* An analyst from B of A Securities persists with their Buy rating on Eaton Corp, maintaining a target price of $410.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eaton Corp with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ethereum Classic Surges 60% In A Month: What's Driving the Rally?

Ethereum Classic ETC/USD has surged 60% to $31.17 over the past month, drawing attention in a crypto market increasingly driven by institutional interest and renewed enthusiasm for blockchain technologies. This rise aligns with a record $3.13 billion inflow into digital asset investment products last week, as reported by CoinShares.

What To Know: Ethereum Classic is the original Ethereum blockchain, preserved after a contentious 2016 split following the DAO hack. While Ethereum ETH/USD adopted a new chain to reverse the effects of the hack, Ethereum Classic retained the unaltered blockchain.

ETC has carved out a niche as a decentralized smart contract platform, appealing to purists and developers who value its fixed monetary policy and proof-of-work consensus mechanism.

Read Also: Dogecoin Is ‘Harder Money’ Than Bitcoin, Says Raoul Pal: Here’s What The Numbers Say

Bitcoin ETFs accounted for $3.12 billion of the record inflows last week, fueling optimism across the digital asset ecosystem. Altcoins like Ethereum Classic benefited from the trickle-down effect as investors sought alternatives that offered potential for high returns.

Additionally, Ethereum Classic may be gaining traction as a proof-of-work alternative to Ethereum, which transitioned to a proof-of-stake model in 2022. ETC miners displaced by Ethereum’s shift could find a home on Ethereum Classic’s network, further enhancing its security and utility.

While the record inflows into Bitcoin-dominated headlines, Ethereum Classic’s outsized gains highlight the growing interest in assets beyond Bitcoin and Ethereum.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Zillow predicts more buyers will come out ahead in a bumpy 2025

Unpredictable mortgage rates will play a big role in shaping next year’s housing market

- The housing market is expected to slowly become unstuck, but mortgage rates could be a spoilsport, with their unpredictability expected to make planning for a home purchase a challenge.

- Buyers markets will spread to the Southwest unless rates fall dramatically.

- As the biggest multifamily construction boom in 50 years fizzles out, Zillow predicts fewer rent concessions in the second half of 2025.

SEATTLE, Nov. 25, 2024 /PRNewswire/ — Mortgage rates are once again in the spotlight as 2025 approaches. Zillow® predicts a more active housing market and more buyers gaining the upper hand in 2025, but those hoping to buy — or even refinance — should buckle up for a bumpy ride and stay ready to move when conditions are right.

“Buying a home in 2024 was surprisingly competitive given how high the affordability hurdle became. More inventory should shake loose in 2025, giving buyers a bit more room to breathe,” said Skylar Olsen, Zillow chief economist. “Americans are adapting to sky-high costs by embracing coziness, a term that for so long has been a thinly veiled critique in real estate lingo. Many are also viewing renting as a longer-term lifestyle. A construction boom has eased pressure on rent prices, putting rent affordability on track to improve next year — that is, as long as wages continue to grow.”

Housing market activity will pick up

Expect to see more sales and only modest home value growth in 2025 as the market slowly becomes unstuck.

Zillow forecasts 2.6% home value growth in 2025, a relatively slow pace that is similar to this year’s growth. For existing home sales, Zillow forecasts 4.3 million in the coming year, up slightly from 4.1 million in 2023 and a projected 4 million in 2024.

While affordability challenges will remain, buyers should expect more homes on the market, meaning more time to consider their options and more leverage in negotiations.

Mortgage rates will fall (then rise, then fall again)

Signs point to mortgage rates easing in 0225, but as we saw in 2024, mortgage rates rarely follow the expected path. What is more certain is that buyers should expect plenty of ups and downs throughout the year.

Mortgage rates fell in September, briefly bringing the share of affordable listings to a 19-month high. They have since climbed back to nearly 7%,1 changing the affordability picture for home buyers. More swings like this are expected in 2025, with refinancing sprints occurring during the dips.

Home buyers should stay ready to move forward when the time is right. Zillow Home Loans’ BuyAbilitySM tool can help by giving buyers a personalized estimate of the home price and monthly payment that fits within their budget at any given moment (based on current mortgage rates), and showing them homes they can afford.

Buyers markets will spread to the Southwest

Currently, 13 major metro areas are buyers markets — where buyers have the upper hand in negotiations, according to Zillow’s market heat index — with most of those in the Southeast. Zillow predicts buyers markets will spread to the Southwest in 2025 as inventory continues to come unstuck in relatively affordable markets.

Sellers will feel the heat of competition as buyers will have more homes to choose from. It will be more important than in recent years to work with a great agent to help price and market a home listing well. Tools like Zillow Showcase, an immersive listing experience, can help drive more page views, saves and shares from buyers searching for homes with those attributes, compared to similar neighboring non-Showcase listings on Zillow.2

If mortgage rates fall more than expected, that dims the prospect that buyers markets will spread west. It is anticipated that a significant mortgage rate dip would bring more buyers than sellers back to the market, increasing competition and tilting negotiating power in favor of sellers.

Americans embrace small-home living

The pandemic-era need for more and more space is over. Home buyers will increasingly lean into smaller homes as a more sustainable, affordable and desirable way to live.

The term “cozy” is appearing in more listing descriptions — 35% more in 2024 compared to 2023 — reflecting current design trends that have shifted away from cavernous open floor plans, toward contained spaces that have their own style and purpose.

Last call for rent concessions

Apartment renters enjoyed a relatively friendly market this year, at least compared to the record rent growth seen in 2022. Rent growth has held steady at a reasonable pace, and the share of rental listings on Zillow offering a concession — such as free weeks of rent or free parking — is at a record high. Zillow expects renters will not have as much opportunity to negotiate for that free month of rent by the end of next year.

The multifamily-construction boom is the primary reason for the rise in concessions. More multifamily units are hitting the market than at any time in the past 50 years, pushing property managers to compete for renters. Those fireworks are predicted to fizzle in 2025, especially in the second half of the year.

Pet-friendliness will become nonnegotiable for property managers

Renters are getting older, and they are not putting off “adulting” milestones such as moving in together or getting a pet before they buy a home. The median age of a renter has risen to 42, and they are settling into the renter lifestyle — fewer renters considered buying this year, which is understandable given conditions that make renting the more affordable option in many markets.

With 58% of renters having a pet — up from 46% before the pandemic — it is no wonder that nearly half said they passed on a particular property because it was not pet-friendly. In today’s more competitive rental landscape, not allowing pets may put property managers behind the eight ball.

About Zillow Group

Zillow Group, Inc. Z is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing, and renting experiences.

Zillow Group’s affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Zillow Rentals®, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce®, and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2024 MFTB Holdco, Inc., a Zillow affiliate.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/zillow-predicts-more-buyers-will-come-out-ahead-in-a-bumpy-2025-302314673.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/zillow-predicts-more-buyers-will-come-out-ahead-in-a-bumpy-2025-302314673.html

SOURCE Zillow

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Intel Stock Popped on Monday

Intel (NASDAQ: INTC) stock gained 4.1% through 9:45 a.m. ET Monday morning after CNBC reported this morning that the U.S. Commerce Department is close to awarding Intel an $8 billion subsidy to assist with expanding its semiconductor chip operations.

The Wall Street Journal had previously reported (last week) that this grant was on the way.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

One quirk to this story is that last week, WSJ indicated Intel was in line for an $8.5 billion grant for factory-building, on top of a separate $3 billion award to build chip plants geared to production of semiconductors for the U.S. military. CNBC notes that the government appears to have shaved down the size of the first grant by $500 million, to $8 billion, “due to uncertainties about Intel’s ability to execute on its investment commitment, and because of Intel’s shifting technology roadmap and customer demand.”

Either way, Intel could really use the cash. The company has racked up $16 billion in losses already over the last 12 months, and burned through $15.1 billion in negative free cash flow, and its revenue declined again last quarter.

As CNBC points out, Intel’s planning to sell off assets and lay off up to 15,000 workers to conserve cash.

The $8 billion in government cash will help, but it won’t solve Intel’s problems — not by a long shot. True, analysts polled by S&P Global Market Intelligence expect Intel to return to generally accepted accounting principles (GAAP) profitability sometime next year. But Wall Street anticipates Intel continuing to burn cash, with negative free cash flow exceeding $11 billion over the next three years. It’s not till 2028 that analysts think Intel will be back to health and able to generate cash on its own to keep its business running.

Meanwhile, debt will continue to pile up (Intel owes $26 billion and counting), and share dilution is a distinct possibility. Subsidies or no subsidies, it’s hard to call Intel stock a buy.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

A Look Ahead: United Maritime's Earnings Forecast

United Maritime USEA is preparing to release its quarterly earnings on Tuesday, 2024-11-26. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect United Maritime to report an earnings per share (EPS) of $-0.05.

The announcement from United Maritime is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Here’s a look at United Maritime’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | ||||

| EPS Actual | 0.09 | -0.13 | -0.07 | 0.95 |

| Price Change % | 0.0% | 3.0% | -1.0% | 1.0% |

United Maritime Share Price Analysis

Shares of United Maritime were trading at $2.08 as of November 22. Over the last 52-week period, shares are down 13.33%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

To track all earnings releases for United Maritime visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

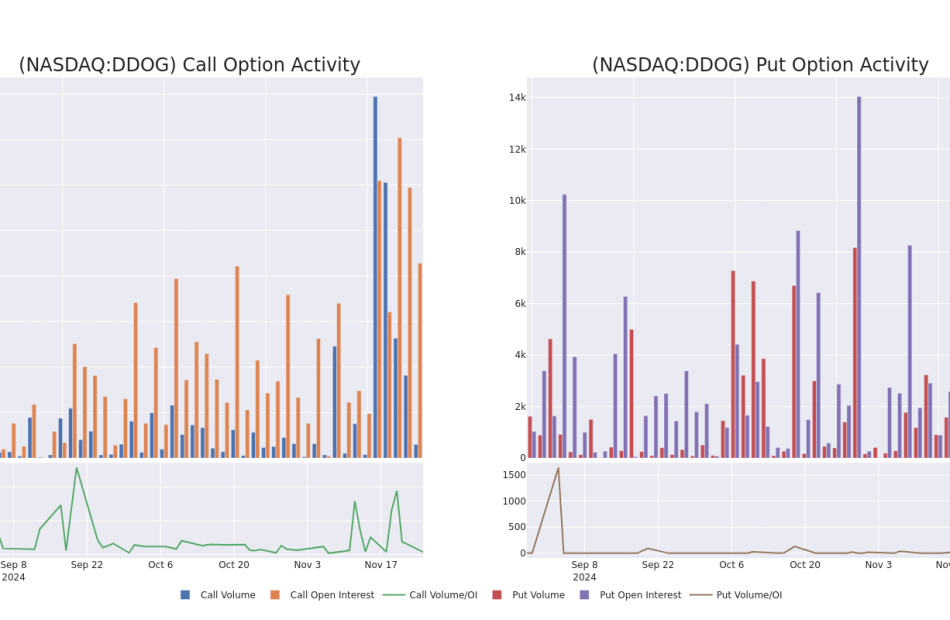

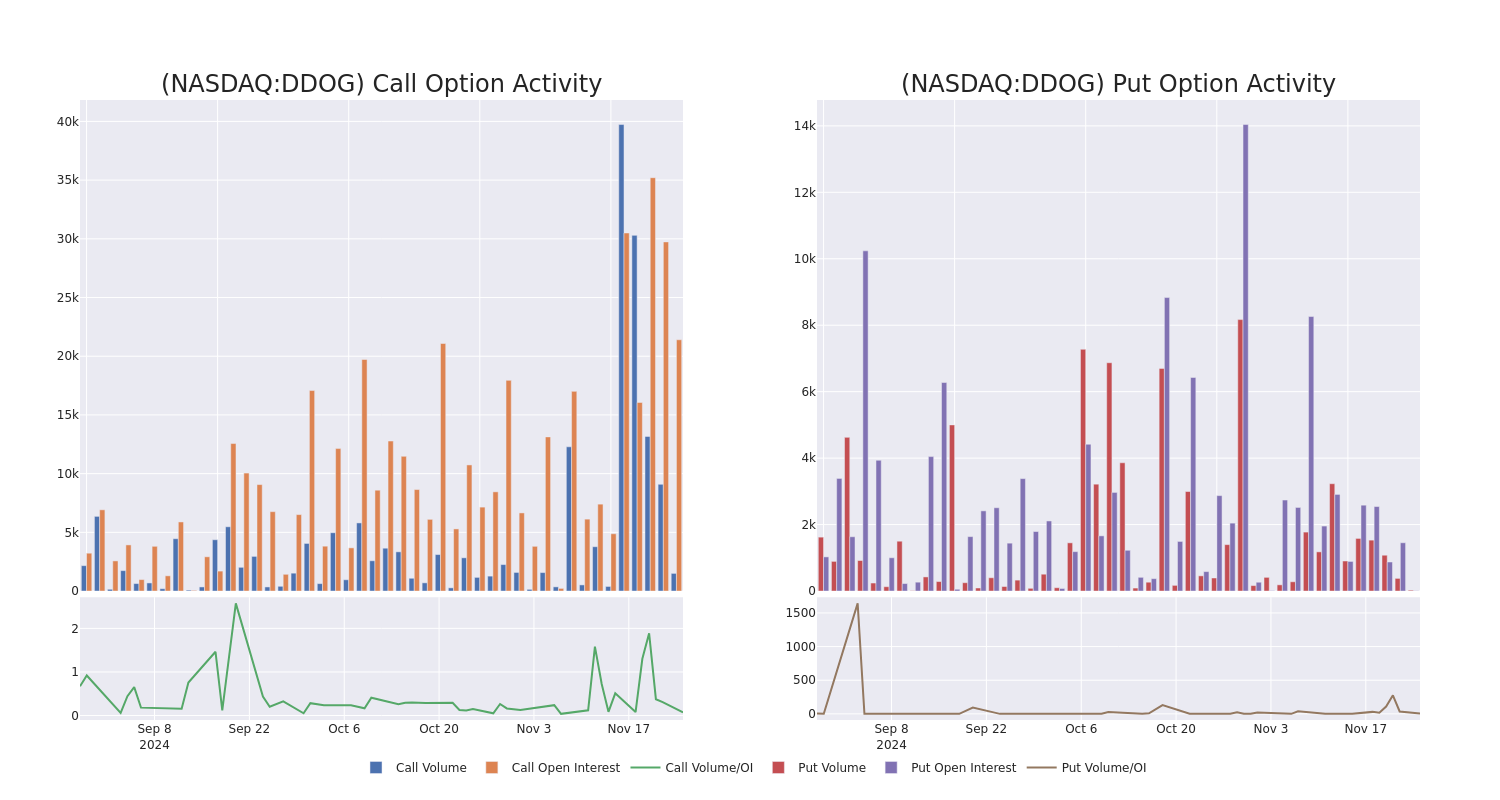

Spotlight on Datadog: Analyzing the Surge in Options Activity

High-rolling investors have positioned themselves bullish on Datadog DDOG, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DDOG often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 16 options trades for Datadog. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $28,125, and 15 calls, totaling $1,025,159.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $185.0 for Datadog over the recent three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Datadog’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Datadog’s substantial trades, within a strike price spectrum from $100.0 to $185.0 over the preceding 30 days.

Datadog 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DDOG | CALL | TRADE | BEARISH | 01/03/25 | $15.55 | $13.75 | $13.75 | $144.00 | $137.5K | 100 | 100 |

| DDOG | CALL | TRADE | BULLISH | 01/16/26 | $65.4 | $62.95 | $64.45 | $100.00 | $128.9K | 141 | 27 |

| DDOG | CALL | SWEEP | BEARISH | 01/17/25 | $27.65 | $26.35 | $26.74 | $130.00 | $120.0K | 6.9K | 108 |

| DDOG | CALL | SWEEP | BEARISH | 01/17/25 | $27.55 | $26.4 | $26.75 | $130.00 | $106.7K | 6.9K | 148 |

| DDOG | CALL | TRADE | BULLISH | 01/16/26 | $27.5 | $27.35 | $27.5 | $160.00 | $74.2K | 677 | 0 |

About Datadog

Datadog is a cloud-native company that focuses on analyzing machine data. The firm’s product portfolio, delivered via software as a service, allows a client to monitor and analyze its entire IT infrastructure. Datadog’s platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to utilize it for a variety of applications throughout their businesses.

In light of the recent options history for Datadog, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Datadog

- Currently trading with a volume of 2,695,586, the DDOG’s price is up by 0.89%, now at $156.22.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 78 days.

What Analysts Are Saying About Datadog

In the last month, 5 experts released ratings on this stock with an average target price of $150.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Rosenblatt persists with their Buy rating on Datadog, maintaining a target price of $148.

* An analyst from Barclays persists with their Overweight rating on Datadog, maintaining a target price of $155.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Datadog with a target price of $165.

* An analyst from Scotiabank persists with their Sector Outperform rating on Datadog, maintaining a target price of $133.

* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Datadog with a target price of $150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Datadog, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uncovering Potential: Embecta's Earnings Preview

Embecta EMBC is preparing to release its quarterly earnings on Tuesday, 2024-11-26. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Embecta to report an earnings per share (EPS) of $0.36.

The announcement from Embecta is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Historical Earnings Performance

Last quarter the company beat EPS by $0.28, which was followed by a 0.0% drop in the share price the next day.

Here’s a look at Embecta’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.46 | 0.40 | 0.46 | 0.40 |

| EPS Actual | 0.74 | 0.67 | 0.61 | 0.59 |

| Price Change % | 7.000000000000001% | 1.0% | -8.0% | 3.0% |

Tracking Embecta’s Stock Performance

Shares of Embecta were trading at $13.82 as of November 22. Over the last 52-week period, shares are down 19.65%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

To track all earnings releases for Embecta visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.