Economist Warns Trump That BRICS Will 'Act Collectively' And Spark A Trade War With US Over 100% Tariff Threats

President-elect Donald Trump’s threat to impose 100% tariffs on BRICS nations if they create an alternative to the U.S. dollar has drawn mixed reactions from leading economists, highlighting tensions over global trade and currency dominance.

What Happened: Milken Institute Chief Economist William Lee suggests Trump’s approach reflects his preference for direct bilateral negotiations over multilateral agreements.

“Trump has shown his desire for direct negotiations,” Lee said, noting the contrast with President Joe Biden‘s behind-the-scenes approach to trade deals. Lee emphasized that Trump’s tariff threats serve as leverage to drive negotiations, particularly with major trading partners.

However, British economist Dr. Rodney Shakespeare warns that such aggressive tactics could backfire. “Trump thinks he can target BRICS countries individually, but doing this will cause BRICS to act collectively,” Shakespeare told Sputnik, suggesting that America’s declining economic hegemony could leave it vulnerable in a potential trade war.

Economist Peter Schiff offered a different perspective on X, arguing that BRICS nations are making a poor trade by exchanging goods for U.S. fiat currency, contradicting Trump’s assertion that America is being taken advantage of in current trade relationships.

Why It Matters: The debate comes as BRICS, which now includes nine member nations, reportedly attracts interest from 34 additional countries. Russian President Vladimir Putin recently emphasized the bloc’s expanding influence and its plans to develop an alternative currency system, potentially challenging dollar supremacy in international trade.

Trump’s stance, posted on X, maintains that any move by BRICS to create an alternative currency would face severe economic consequences, including restricted access to U.S. markets. This position sets up a potential confrontation with the growing economic bloc, which represents a significant portion of global GDP and trade volume.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Rival BYD Marks 68% Growth In November Sales Driven By Popularity Of Plug-In Hybrid EVs

Chinese EV giant BYD Co Ltd. BYDDY BYDDF said on Sunday that the company sold 506,804 new energy passenger vehicles in November, marking a jump of nearly 68% from last year, thanks to a major jump in plug-in hybrid passenger vehicle sales.

What Happened: Pure passenger EV (battery electric vehicle) sales of the Chinese player rose to 198,065 in November, marking a rise of 16.4% from the corresponding month of last year.

Plug-in hybrid passenger vehicle sales in the period rose 133% to 305,938 units.

The company also sold 2,801 commercial vehicles in November, including 449 buses.

Why It Matters: BYD is the biggest rival to American EV giant Tesla Inc. TSLA. The company took over Tesla as the world’s largest BEV seller in the fourth quarter of 2023. However, Tesla took back the crown in the first quarter of 2024 and has been holding on to it since.

For the third quarter between July and September, BYD’s operating revenue rose 24% to 201.12 billion yuan ($28.25 billion), the company said in a filing.

Tesla, meanwhile, reported a total revenue of only $25.18 billion in the same quarter, making it the first time since 2022 that BYD has trumped Elon Musk’s EV giant in quarterly revenue. BYD stopped making combustion engine vehicles in March 2022 to focus on electric vehicles.

Despite reporting higher revenue than Tesla in the third quarter, BYD’s net profit continued to trail behind Tesla’s net income of $2.167 billion. The company reported a diluted earnings per share of 4 yuan (56 cents) for the quarter, lower than Tesla’s adjusted earnings per share of 72 cents. Tesla, however, makes only battery electric vehicles, unlike BYD which also manufactures plug-in hybrids.

BYD Executive Vice President He Zhiqi said on Weibo in November that the company hired over 200,000 people from August to October for car and components manufacturing and increased production by nearly 200,000 vehicles.

In November alone, the company made 540,588 new energy vehicles as compared to 316,510 in the corresponding month of 2023.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Exclusive-Latest US strike on China's chips hits semiconductor toolmakers

By Karen Freifeld and David Shepardson

(Reuters) – The U.S. will launch its third crackdown in three years on China’s semiconductor industry on Monday, restricting exports to 140 companies including chip equipment maker Naura Technology Group, among other moves, according to two people familiar with the matter.

The effort to hobble Beijing’s chipmaking ambitions will also hit Chinese chip toolmakers Piotech and SiCarrier Technology with new export restrictions as part of the package, which also takes aim at shipments of advanced memory chips and more chipmaking tools to China.

The move marks one of the Biden Administration’s last large scale effort to stymy China’s ability to access and produce chips that can help advance artificial intelligence for military applications or otherwise threaten U.S. national security.

It comes just weeks before the swearing in of Republican former president Donald Trump, who is expected to keep in place many of Biden’s tough-on-China measures.

The package includes curbs on China-bound shipments of high bandwidth memory (HBM) chips, which are critical for high-end applications like AI training; new curbs on 24 additional chipmaking tools and three software tools; and new export restrictions on chipmaking equipment manufactured in countries including Singapore and Malaysia.

The tool controls will likely hurt Lam Research, KLA and Applied Materials, as well as non-U.S. companies like Dutch equipment maker ASM International.

Among Chinese companies facing new restrictions are nearly two dozen semiconductor companies, two investment companies and over 100 chipmaking tool makers, the sources said. U.S. lawmakers say some of the companies, including Swaysure Technology Co, Qingdao SiEn, and Shenzhen Pensun Technology Co, work with China’s Huawei Technologies, the telecommunications equipment leader once hobbled by U.S. sanctions and now at the center of China’s advanced chip production and development.

They will be added to the entity list, which bars U.S. suppliers from shipping to them without first receiving a special license. China has stepped up its drive to become self-sufficient in the semiconductor sector in recent years, as the U.S. and other countries have restricted exports of the advanced chips and the tools to make them. However, it remains years behind chip industry leaders like Nvidia in AI chips and chip equipment maker ASML in the Netherlands.

The U.S. also is poised to place additional restrictions on Semiconductor Manufacturing International, China’s largest contract chip manufacturer, which was placed on the Entity List in 2020 but with a policy that allowed billions of dollars worth of licenses to ship goods to it to be granted.

Stock market today: Asian shares gain as China is boosted by strong factory orders

BANGKOK (AP) — Shares started the week higher in Asia, led by gains in China as monthly surveys showed improving conditions for manufacturing.

Oil prices rose and U.S. futures edged lower.

Both official and private sector surveys of factory managers showed strong new orders and export orders, possibly partly linked to efforts by importers in the U.S. to beat potential tariff hikes by President-elect Donald Trump once he takes office.

On Saturday, President-elect Donald Trump threatened 100% tariffs against the so-called BRIC bloc of nine nations if they act to undermine the U.S. dollar. The BRICs include Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran and the United Arab Emirates. Trump said he wants the bloc to promise it won’t create a new currency or otherwise try to undercut the U.S. dollar.

“Asia’s markets are riding a wave of optimism, catching a significant tailwind from Wall Street’s record-setting day on Friday and buoyed further by emerging signs that China’s economic funk might be easing,” Stephen Innes of SPI Asset Management said in a commentary.

He noted that investors are also anticipating further moves by authorities in China to boost the economy ahead of Trump’s inauguration next month.

Hong Kong’s Hang Seng gained 0.2% to 19,468.27, while the Shanghai Composite index jumped 1% to 3,360.38. Taiwan’s Taiex surged 2.4%.

In Tokyo, the Nikkei 225 index surged 0.7% to 38,482.47.

Automaker Nissan Motor Corp.’s shares fell 1% as reports said the company’s CFO, Stephen Ma, plans to step down as the company slashes jobs and production due to weakening sales in China and other markets.

In South Korea, the Kospi added 0.4% to 2,466.24, while Australia’s S&P/ASX 200 edged 0.1% to 8,440.00.

In Bangkok, the SET was nearly unchanged.

Friday’s half-day post-Thanksgiving session ended with the S&P 500 up 0.6% at 6,032.38, while the Dow Jones Industrial Average gained 0.4% to 44,910.65. The Nasdaq added 0.8% to 19,218.17.

Some retailers advanced as Black Friday unofficially kicked off the holiday shopping season, although retailers had been offering early deals for weeks. Macy’s and Best Buy each gained around 2%.

Tesla shares rose 3.7% Friday and posted a monthly increase of more than 38%. The electric vehicle maker is expected to benefit from CEO Elon Musk’s support of Trump.

Musk also gave a boost to Hasbro shares after he triggered takeover speculation when he asked in a post on X how much the toy and game company was worth. Hasbro, which owns the role-playing game Dungeon & Dragons, rose 2%.

XRP Beats Solana To Become 4th Largest Crypto By Market Cap On Ripple's RLUSD Stablecoin Approval Buzz

Payment-focused cryptocurrency XRP XRP/USD flipped Solana SOL/USD to become the fourth-largest cryptocurrency after a searing rally on Sunday.

What happened: The coin surged over 26% in the last 24 hours, reclaiming the $2 level after a gap of nearly seven years.

The coin topped $136 billion in market capitalization, knocking Solana out of fourth place among the largest cryptocurrencies in valuation.

The latest rally has catapulted XRP’s year-to-date gains to 286%, significantly outpacing Bitcoin BTC/USD and Ethereum ETH/USD.

The rally was spurred by a Fox Business report about the New York Department of Financial Services’ imminent green light to stablecoin RLUSD by Ripple Labs—the blockchain-based company using XRP for its offerings.

Ripple plans to expand beyond cross-border payments—used for remittances, Treasury management, supplier payments, and international disbursements—with the launch of the new stablecoin.

Additionally, as the countdown to SEC Chair Gary Gensler’s resignation has begun, XRP investors have been aggressively loading their bags.

Ripple has been locked in a nearly four-year-long legal battle with the SEC over the status of XRP, and any change in the agency’s top leadership was viewed with optimism.

Price Action: At the time of writing, XRP was trading at $2.40, up 26.66% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy were up 2.15% in after-hours trading.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are ChatGPT Like LLMS 'Digital Gods' Or Just 'Imitating Monkeys' — Investor In Elon Musk's Grok Shares His Thoughts

Tesla bull and Grok investor Pierre Ferragu has shared his thoughts on the true nature of large language models (LLMs) amid ongoing debates in the AI space.

What Happened: Over the weekend, Carlos E. Perez, co-founder of Intuition Machine, took to X, formerly Twitter, questioning the capabilities of LLMs.

In his post, Perez noted that while LLMs can tackle complex problems, they often falter on seemingly simple logical steps.

His post spotlighted a study titled “Procedural Knowledge in Pretraining Drives Reasoning in Large Language Models,” which found that LLMs’ reasoning abilities are significantly influenced by programming code logic.

The study used EK-FAC influence functions to identify the specific training data that most impact the model’s output for a given query.

See Also: SpaceX’s Starlink Direct-To-Cell Service Gets Commercial License From FCC: Here’s What It Means

The research discovered a stark contrast in how LLMs handle factual and reasoning questions. LLMs often used a retrieval-based approach for factual questions.

However, for reasoning questions, LLMs consistently relied on documents demonstrating procedures—algorithms, formulas, and, importantly, code—for solving similar problems.

Sharing his post, Ferragu, an analyst at New Street Research, stated, “My left brain: LLM are digital gods. My right brain: LLM are glorified digital imitating monkeys. Time will tell and the truth is likely right in-between.”

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The debate on LLMs’ capabilities is not new. Earlier this year, a software engineer at Alphabet Inc.’s Google expressed concerns that OpenAI, the parent company of ChatGPT, had hindered the progress of AGI by 5 to 10 years.

Salesforce CEO Marc Benioff also warned that the world was nearing the “upper limits” of LLMs like OpenAI’s ChatGPT.

He predicted that the future of AI would focus on autonomous agents capable of performing tasks independently, rather than relying on LLMs for advancements.

Tony Fadell, the co-creator of the iPod, also expressed concerns about LLMs.

Previously, Nvidia CEO Jensen Huang said that humans will eventually work with AI agents and AI employees. Nvidia has also partnered with Accenture to deploy AI agents in businesses.

Microsoft Corporation also announced plans to let companies create their own autonomous agents, following Salesforce’s launch of Agentforce in September 2024.

OpenAI is also reportedly planning to launch a new AI agent, “Operator,” in January.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

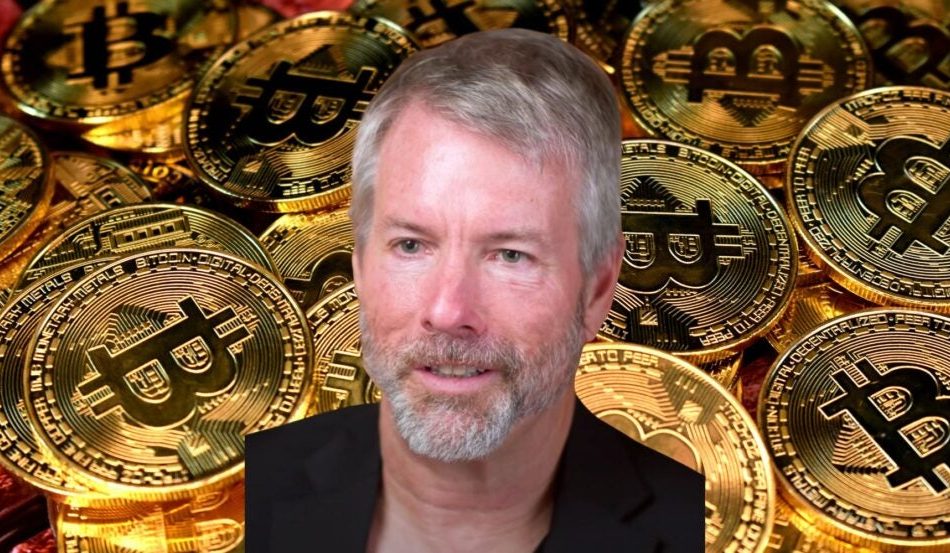

Michael Saylor Says Bitcoin Could Boost Microsoft's Valuation By Nearly $5 Trillion And Add $584 To The Stock By 2034

MicroStrategy Inc. MSTR Chairman Michael Saylor pitched a strong case for Bitcoin BTC/USD adoption to the Microsoft Corp. MSFT board, projecting a $5 trillion market cap addition in case of a full embrace.

What happened: In a 3-minute presentation, Saylor called Bitcoin the “highest performing uncorrelated asset” a corporation can have on its books.

Citing data, he showed how Bitcoin beat Microsoft’s shares by up to 10X annually over the past four years.

Saylor highlighted the new wave of political support after President-elect Donald Trump’s victory and his choice of cabinet picks who support Bitcoin.

He also noted the support coming from Wall Street and top asset managers. with the launch of spot exchange-traded funds (ETFs) tracking the cryptocurrency.

Saylor said Bitcoin could add $584 to Microsoft’s stock price by 2034 if the company employs all its corporate resources, including treasury, debt, cashflows, buybacks, and dividends, to purchase the cryptocurrency.

Additionally, this strategy could contribute nearly $5 trillion to Microsoft’s market capitalization while significantly reducing its enterprise value at risk, which is currently heavily reliant on future earnings forecasts.

Why It Matters: Microsoft was set to vote on an assessment of investing in Bitcoin during the upcoming shareholders meeting. The shareholders requested the board conduct the assessment, citing Bitcoin’s healthy gains over the last five years.

The proposal explicitly mentioned MicroStrategy, a pioneer in corporate Bitcoin adoption, whose shares have outperformed Microsoft in 2024.

Indeed, MicroStrategy’s stock was up 459% year to date, well outperforming Microsoft’s 13.27% returns.

MicroStrategy currently holds 386,700 BTC, acquired at an average purchase price of approximately $21.94 billion, and worth over $37 billion at current market prices, according to bitcointreasuries.net.

Price Action: At the time of writing, Bitcoin was trading at $96,555.40, up 0.03% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy were up 2.15% in after-hours trading.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tech Stocks Set For Strong Santa Rally As Wall Street Looks For An End To 'Regulatory Spider Web' In The Trump Era, Says Dan Ives

Major technology stocks are positioned for a strong year-end rally as artificial intelligence initiatives accelerate and regulatory pressures ease under President-elect Donal Trump, marking a potential end to Federal Trade Commission Chair Lina Khan‘s aggressive oversight of Big Tech companies according to Wedbush Securities Managing Director Dan Ives.

What Happened: “We expect tech stocks to be strong with a Santa rally as the Street further digests a less regulatory spider web under Trump with Khan/FTC days in the rearview mirror, stronger AI initiatives on the way, and a goldilocks foundation for Big Tech and Tesla into 2025,” Ives wrote on X.

The forecast comes amid projections of unprecedented AI-related spending reaching $1 trillion by the end of 2025.

JPMorgan echoes this optimistic outlook, projecting the United States to lead global growth in 2025. The financial giant highlights the Magnificent 7 tech companies – Amazon.com Inc. AMZN, Microsoft Corp. MSFT, Meta Platforms Inc. META, NVIDIA Corp. NVDA, Alphabet Inc. GOOGL GOOG, Tesla Inc. TSLA, and Apple Inc. AAPL – planning combined investments exceeding $500 billion in capital expenditure and R&D.

Why It Matters: However, Morgan Stanley‘s chief U.S. equity strategist Mike Wilson urges caution, describing the S&P 500 as “extremely expensive” at 23 times forward earnings. The firm projects a 5% contraction in valuation multiples for 2025, despite anticipated earnings growth.

The technology sector’s trajectory may also be influenced by potential regulatory shifts in cryptocurrency markets. Reports suggest the incoming Trump administration plans to transfer oversight of Bitcoin BTC/USD and Ethereum ETH/USD spot markets to the Commodity Futures Trading Commission, potentially reshaping the $2.24 trillion digital asset landscape.

Read Next:

Image Via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Food banks are cutting services as surging demand outpaces resources, reports Feed Ontario

TORONTO, Dec. 02, 2024 (GLOBE NEWSWIRE) — Feed Ontario released its 2024 Hunger Report today, revealing that record-high food bank use has surpassed the capacity and resources of the provincial food bank network. As released earlier this year, Ontario’s food banks were accessed by more than 1 million people, a 25 per cent increase over 2023 and the eighth consecutive year of growth. The report details the economic trends, including high housing costs and precarious work, that are driving this increase. In addition to forcing more people to turn to food banks for help, the affordability crisis has resulted in fewer Ontarians being able to donate or provide the same level of support as they have in the past.

“People only turn to food banks after they’ve exhausted all other options – and yet over one million Ontarians still needed our help,” says Carolyn Stewart, CEO of Feed Ontario. “This is the highest number of people on record, and is occurring at a time when donations are declining as more individuals can no longer afford to give. As a result, food banks are being stretched beyond their capacity and running out of resources at a time when people and families need them the most.”

The report’s release is accompanied by a video featuring food bank representatives from across the province who speak about the increased need they are seeing in their communities and the challenges they face in meeting this demand. Record-high food bank use is consistent across the province, with every region in Ontario seeing double-digit increases in food bank use over the last year alone. As shared by Christine Clarke-Lefleur from Port Cares in Port Colborne, “We’re seeing people that we used to see years ago, and people who were donors, now have to come for support.”

The 2024 Hunger Report and video also touch upon the difficult decisions that food banks have been forced to make as they try to meet record demand and stretch already limited resources even further. This includes reducing the amount of food provided to people in need, cutting wrap-around programs and services, and even contemplating the very-real possibility of having to close their doors.

“Food banks are doing everything they can to keep their doors open and their shelves full, but when donors start turning into clients, an impossible situation starts to emerge,” says Stewart. “Food banks do not have the resources to adequately meet the level of need in our province. As a result, even with the help of food banks, people and families are going hungry.”

Feed Ontario is very clear in its message that food banks are not a solution to poverty or food insecurity. People turn to food banks because public policies and social support programs are failing them. Specifically, the report outlines that the primary drivers of food bank use are:

Unaffordable housing and living costs: Food banks have seen an 80 per cent increase in the number of households who rent their housing, as well as a 109 per cent increase in the number of people who are experiencing some form of homelessness (unsheltered, emergency shelter, or provincially sheltered) over the last four years.

Precarious employment and inadequate job opportunities: 1 in 4 food bank visitors are employed, with 42 per cent indicating that they earn minimum wage or less. Only 11 per cent of surveyed food bank visitors have access to paid sick days.

Failing social support programs: Almost 2 out of 3 food bank visitors are social assistance recipients. The financial support provided through Ontario Works and the Ontario Disability Support Program (ODSP) falls 66 per cent and 53 per cent respectively below the poverty line.

“We need immediate and bold action against poverty,” says Stewart. “We need all levels of government to prioritize poverty reduction and affordability, to set clear targets, and to be accountable. We want to see the number of people needing food banks go down. And we want to close our doors because our services are not needed, not because demand has grown beyond our capacity to be of service.”

Feed Ontario outlines several policy recommendations that the Government of Ontario could implement today to start addressing this crisis. These include a new and bolder approach to its poverty reduction strategy, improvements to Ontario Works and the Ontario Disability Support Program, including addressing the barriers that program recipients face when trying to work, improvements to Ontario’s labour and employment laws, and further investments in affordable housing.

“While we continue to advocate for public policy solutions, food banks urgently need your help today,” says Stewart. “If you are in a position to give, your donation will make an incredible difference. With so many people in need, your support will help keep food bank shelves full for everyone needing help this holiday season.”

Food banks are not government funded and rely on donations to keep their doors open and shelves full. Feed Ontario is asking that anyone who is able to give this holiday season to consider donating to Feed Ontario and their local food bank. For every $1 donated, Feed Ontario can provide two meals to a person or family in need.

2024 Hunger Report Highlights and Trends

Food bank use data

- Unique Individuals: Over 1 million people accessed a food bank in Ontario between April 1, 2023, and March 31, 2024, an increase of 25% over last year and 86% since 2019-2020.

- This represents 1 in 16 Ontarians and is greater than the entire population of Nova Scotia.

- Visits: Ontario’s food banks were visited a total of 7,689,580 times throughout the year, an increase of 31% over last year and 134% since 2019-2020.

- First-time users: 2 in 5 visitors had never accessed a food bank before, an increase of 43% since 2019-20.

Drivers of food bank use

- Unaffordable housing: 76% of visitors are rental tenants and 9% are experiencing some form of homelessness (precarious housing, unsheltered, emergency shelter, etc.).

- Precarious employment: Food bank visitors who cited employment as their primary source of income increased by 91% over pre-pandemic levels and 17% over the previous year.

- Inadequate social supports: Social assistance remains the primary source of income for the majority of food bank visitors with 30% relying on OW and 29% relying on ODSP.

Food Bank Sustainability

- Reduction in food support: 38% of food banks have reported having to reduce the amount of food they can give.

- Reduction in wrap-around supports: Half (50%) of all food banks that offered wrap-around supports have been forced to cut or reduce programming due to insufficient resources.

To download a full copy of the 2024 Hunger Report, or to find out more about food banks in Ontario, please visit: https://www.feedontario.ca/hunger-report-2024.

About Feed Ontario:

From securing fresh and healthy food sources to driving change through policy research and innovative programming, Feed Ontario unites food banks, industry partners, and local communities in its work to end poverty and hunger. Join Feed Ontario and help build a healthier province. Every $1 raised provides the equivalent of 2 meals to an Ontarian facing hunger. Learn more at: www.feedontario.ca.

For more information, please contact:

Andrea Waters | Feed Ontario | andrea@feedontario.ca | 416-656-4100 x2941

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

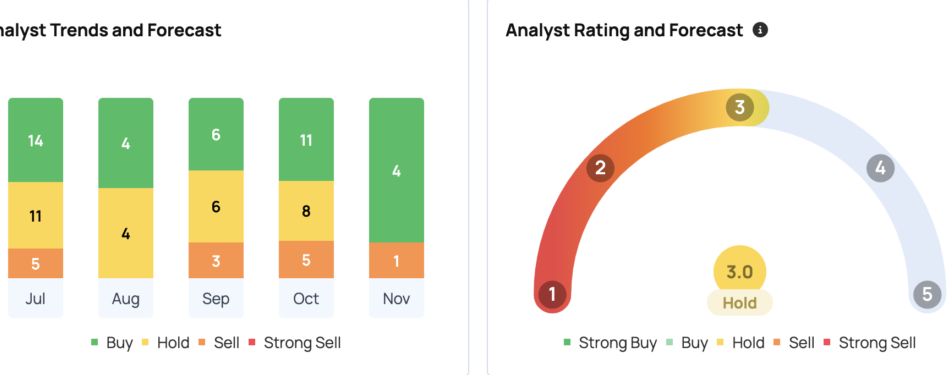

Tesla Investor Gary Black Says Price Cuts Alone Won't Do It For Tesla, Emphasizes The Need For New Models To Drive 2025 Growth

The Future Fund LLC Managing Partner Gary Black argues that Tesla Inc. TSLA needs new vehicle form factors, rather than stripped-down versions of existing models, to achieve its targeted 20-30% volume growth in fiscal year 2025.

What Happened: Black’s analysis comes amid ongoing discussions about Tesla’s strategy for maintaining growth in an increasingly competitive electric vehicle market.

Black emphasized on X, formerly Twitter, that Tesla’s 2022-2023 price reduction strategy demonstrated that simply offering cheaper versions of the Model 3 and Model Y won’t generate sufficient growth.

Instead, he suggests Tesla needs to expand into new market segments, specifically pointing to potential offerings like a four-seat Cybercab or a Model 3 hatchback that could tap into the compact segment, which represents 12-15% of global market share.

The investor’s comments follow Tesla’s recent third-quarter earnings report, where the company posted revenue of $25.18 billion, up 8% year-over-year, though missing analyst expectations.

Tesla maintains its commitment to launching more affordable vehicles in the first half of 2025, with CEO Elon Musk linking this initiative to the company’s projected 20-30% annual volume growth.

Why It Matters: Black challenges the notion that these goals can be met through stripped-down versions of existing models, noting that Tesla needs an interim solution before the full deployment of autonomous Cybercab technology, expected in 2026.

His analysis suggests that Tesla’s strategy must extend beyond price adjustments to include new vehicle categories that can capture additional market segments.

This discussion occurs against a backdrop of increasing competition in the electric vehicle market, with Tesla facing pressure from both U.S. automakers and Chinese manufacturers.

The company’s third-quarter operating margin of 10.8% and record-low cost of goods sold per vehicle at $35,100 demonstrate its ongoing efforts to balance profitability with market expansion.

Price Action: Tesla stock closed at $345.16 on Friday, up 3.69% for the day, according to data from Benzinga Pro. In after-hours trading, the stock edged higher by 0.081%. Year to date, Tesla shares have surged 38.94%.

According to Benzinga Pro data, Tesla has a consensus price target of $232.20, with a high of $400 and a low of $24.86. Recent analyst ratings imply a 9.39% downside, with an average target of $313.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.