C3.ai's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bearish approach towards C3.ai AI, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for C3.ai. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 58% bearish. Among these notable options, 5 are puts, totaling $241,895, and 7 are calls, amounting to $293,775.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $55.0 for C3.ai, spanning the last three months.

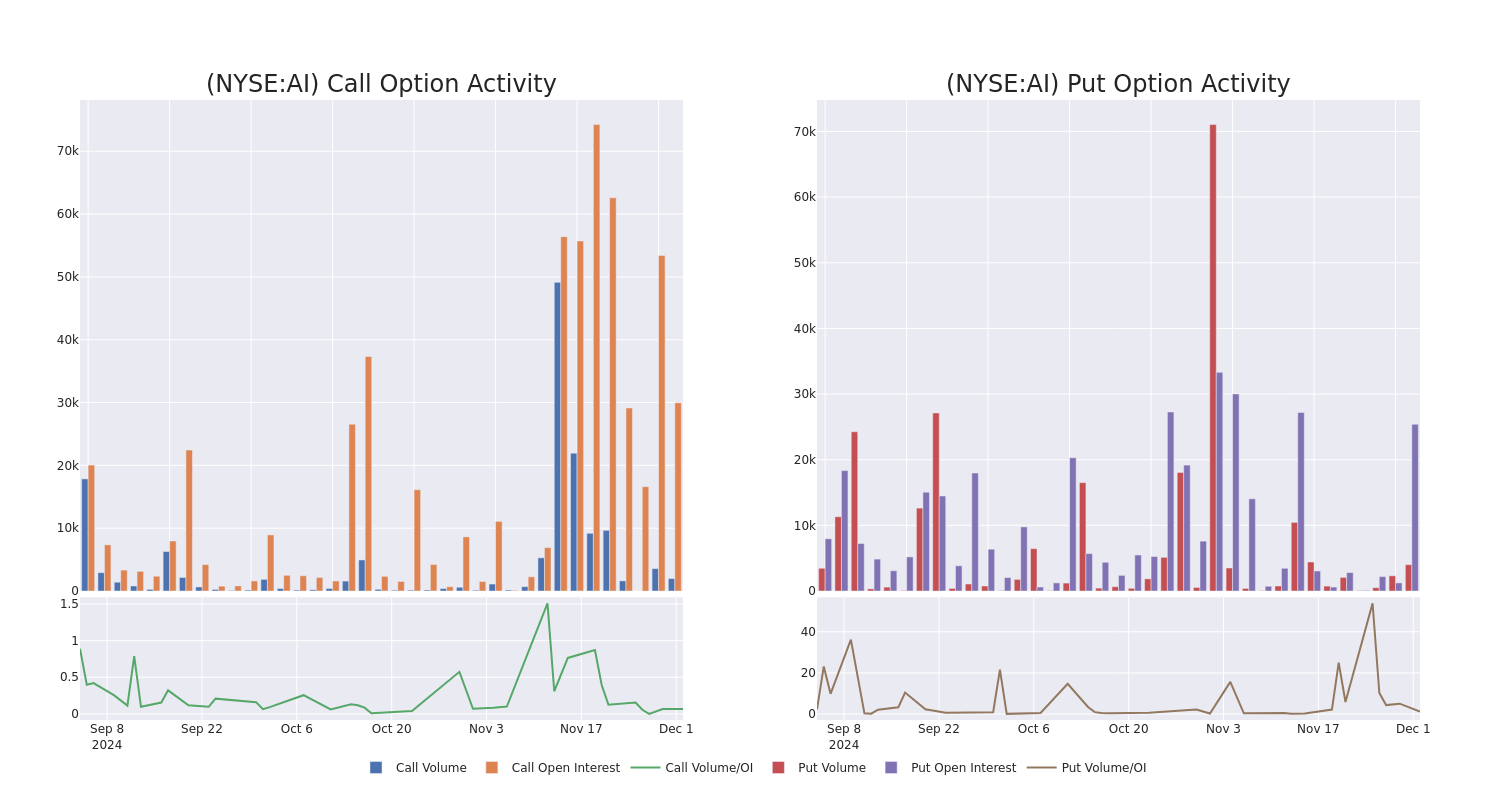

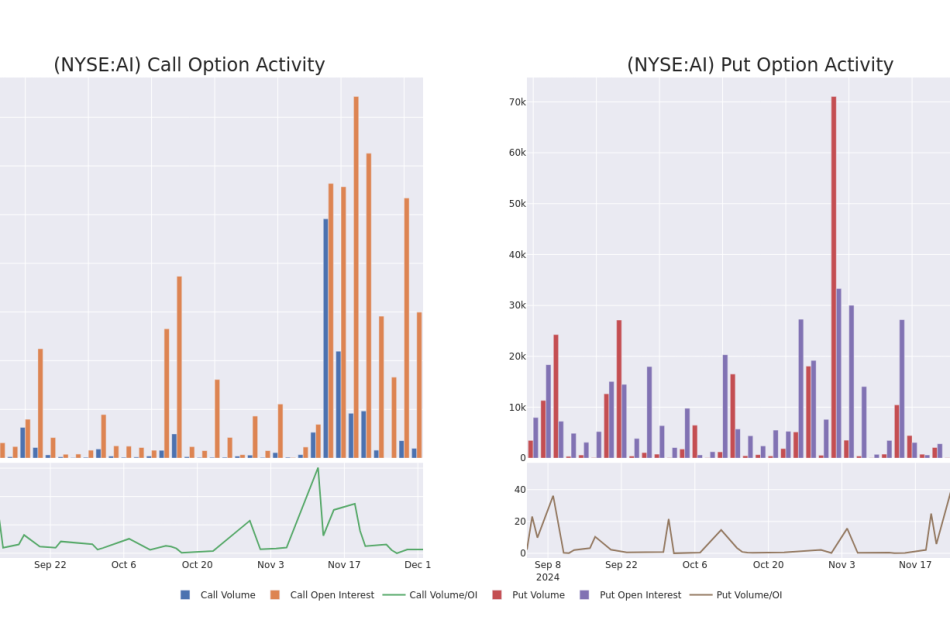

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for C3.ai’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of C3.ai’s whale trades within a strike price range from $20.0 to $55.0 in the last 30 days.

C3.ai Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AI | PUT | TRADE | BULLISH | 01/17/25 | $1.16 | $1.11 | $1.12 | $30.00 | $100.8K | 19.0K | 1.2K |

| AI | CALL | SWEEP | BEARISH | 01/17/25 | $1.01 | $0.98 | $1.01 | $50.00 | $80.8K | 6.2K | 906 |

| AI | CALL | TRADE | BEARISH | 01/17/25 | $5.65 | $5.4 | $5.43 | $35.00 | $48.8K | 12.7K | 3 |

| AI | PUT | TRADE | BEARISH | 01/17/25 | $0.2 | $0.16 | $0.2 | $22.50 | $46.0K | 5.8K | 2.3K |

| AI | CALL | TRADE | BEARISH | 01/16/26 | $6.25 | $6.0 | $6.0 | $55.00 | $43.8K | 4.2K | 201 |

About C3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

Having examined the options trading patterns of C3.ai, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of C3.ai

- With a volume of 4,099,239, the price of AI is up 1.67% at $37.8.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 7 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for C3.ai with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply