CEO turnover reaches record levels in 2024 as 'increasing complexity' drives execs to the exits

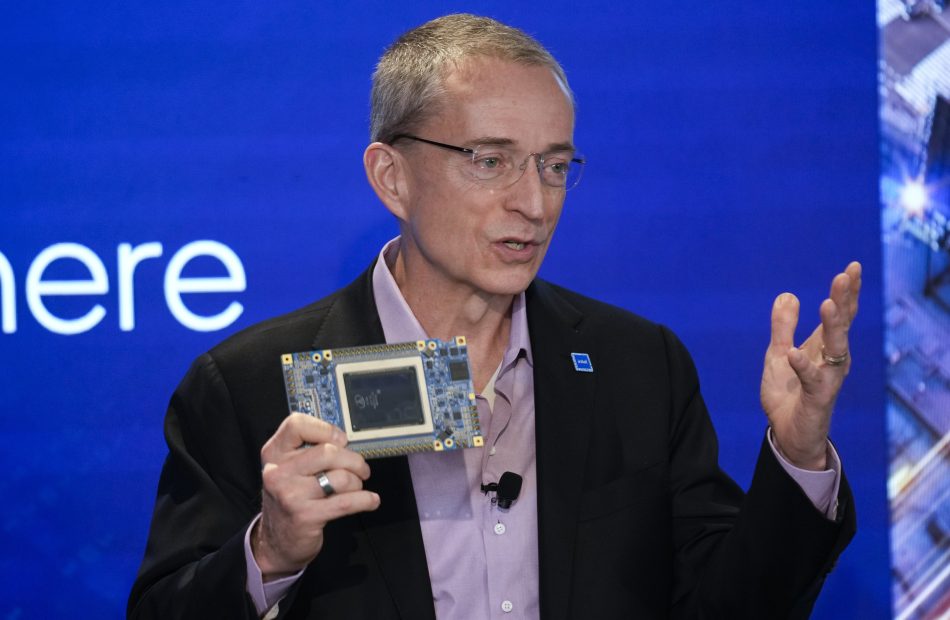

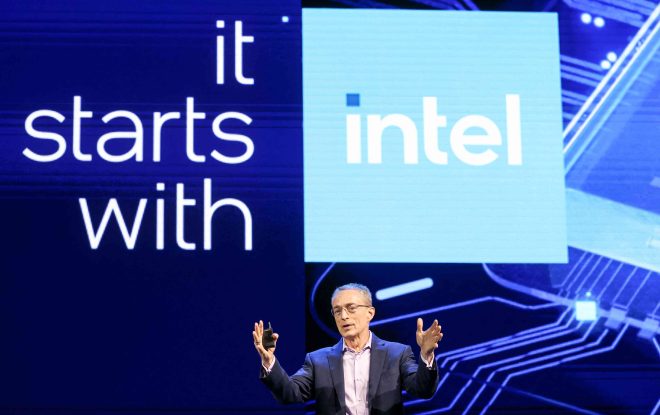

The end of the holiday weekend added two fresh examples of a historic shift on Wall Street: More CEOs than ever are heading for the exits. Over the past 24 hours, the leaders of chipmaker Intel (INTC) and auto giant Stellantis (STLA) have both announced their departures, bolstering the CEO turnover tally.

The leadership changes highlight the idiosyncrasies and challenges of each company — from a struggling auto lineup to a too-late computer chip turnaround. But they also reflect a broader trend across corporate America.

Through October, more than 1,800 CEOs have announced their departures, according to data by global outplacement firm Challenger, Gray & Christmas. That’s the highest year-to-date figure observed since the firm began tracking CEO changes in 2002. The number of exits is up 19% from the more than 1,500 departures during the same period last year, which was the previous year-to-date record.

Boards of directors are becoming more independent, holding their CEOs accountable for underperformance — both in terms of profits and stock price, David Kass, a professor of finance at the University of Maryland, told Yahoo Finance. The expected length of tenure as a CEO, on average, is declining as a result of these performance pressures, he said.

The massive stock market gains of the past two years — the S&P gained roughly 20% in 2023 and is set to gain more than that by the end of 2024 — also pose challenges to US companies. Benchmark returns are coming in well above the long-term average. And a few big winners, including the Magnificent Seven tech stocks, are separating themselves from everyone else. That’s forcing the boards of underperforming companies to pressure their CEOs for stronger results, Kass said.

The consulting firm Russell Reynolds, which also tracks CEO changes, said high turnover shows growing risk appetites and “a desire for leaders who can navigate increasing complexity in the macro business environment, including tech transformation, sustainability, geopolitical crises, and social issues.”

The recent changeovers at Starbucks (SBUX) illustrates several of these shifts. Poached from Chipotle, whose stock has increased nearly 300% over the past five years, CEO Brian Niccol was hired to lead a turnaround at the embattled coffee chain, where shares were barely positive over the same time period. His predecessor, Laxman Narasimhan, worked as CEO for less than 2 years. In addition, Michael Conway, who served as the North America CEO of Starbucks, resigned after only six months in the role.

Leave a Reply