Check Out What Whales Are Doing With DOW

Whales with a lot of money to spend have taken a noticeably bearish stance on Dow.

Looking at options history for Dow DOW we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 61% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $888,815 and 2, calls, for a total amount of $130,140.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $40.0 and $55.0 for Dow, spanning the last three months.

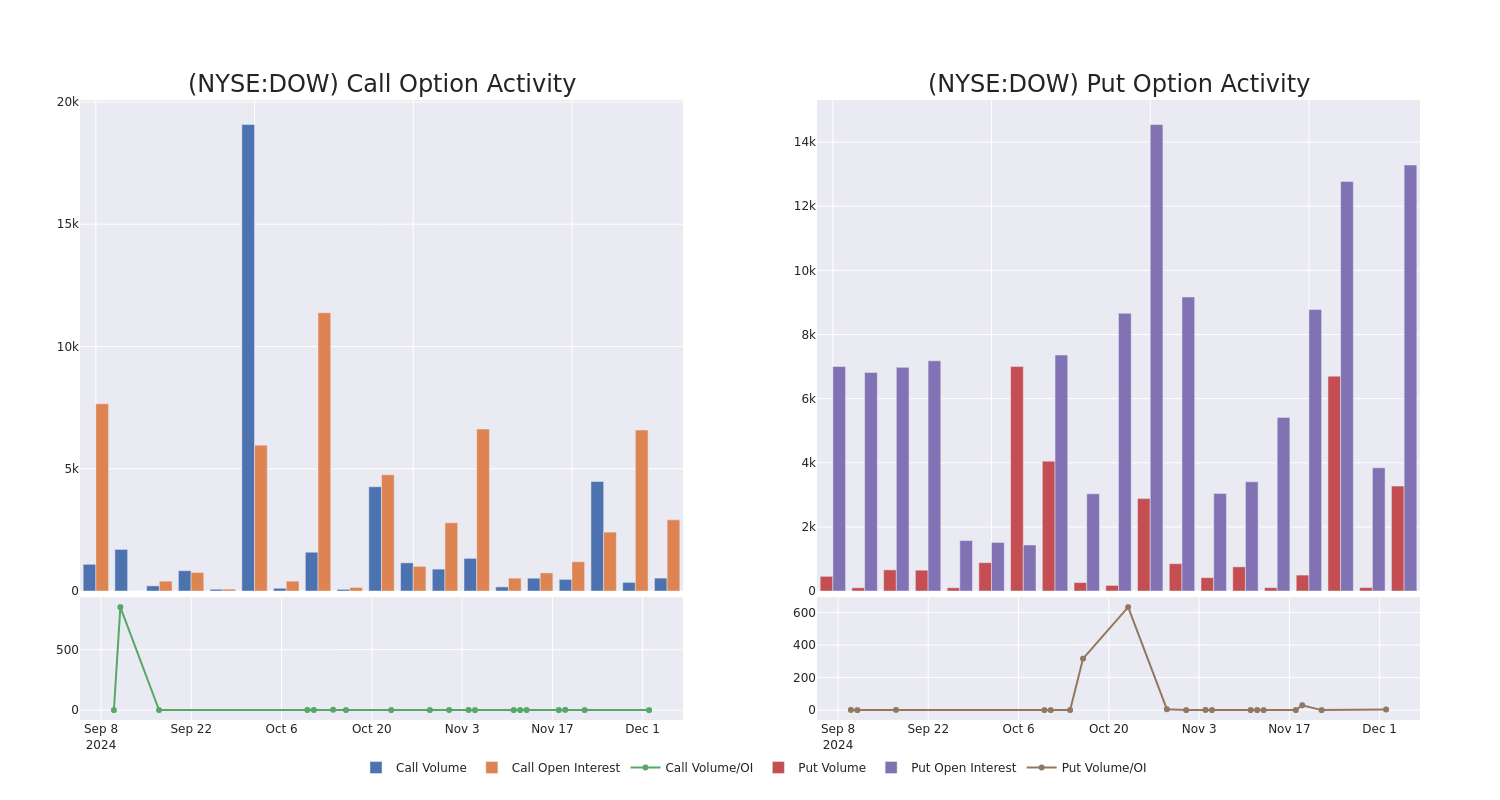

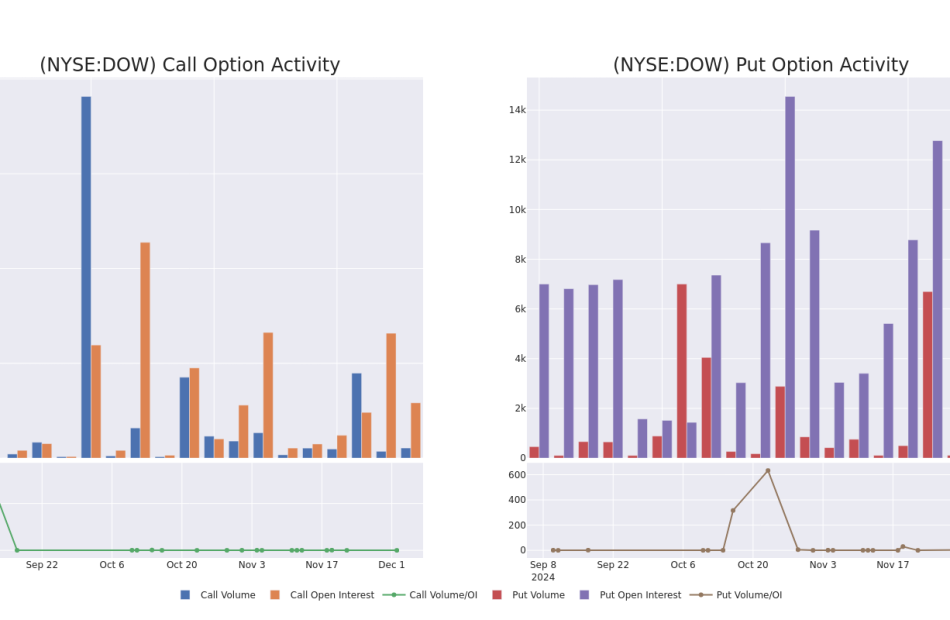

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Dow options trades today is 2314.0 with a total volume of 3,804.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dow’s big money trades within a strike price range of $40.0 to $55.0 over the last 30 days.

Dow Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DOW | PUT | TRADE | BEARISH | 06/20/25 | $11.35 | $11.15 | $11.32 | $55.00 | $249.0K | 1.3K | 719 |

| DOW | PUT | SWEEP | BEARISH | 06/20/25 | $11.65 | $11.4 | $11.53 | $55.00 | $111.9K | 1.3K | 97 |

| DOW | PUT | TRADE | BULLISH | 02/21/25 | $6.15 | $5.95 | $6.0 | $50.00 | $111.0K | 92 | 185 |

| DOW | CALL | TRADE | BEARISH | 03/21/25 | $2.21 | $2.0 | $2.0 | $45.00 | $82.0K | 2.6K | 413 |

| DOW | PUT | SWEEP | BEARISH | 06/20/25 | $11.45 | $11.3 | $11.42 | $55.00 | $76.6K | 1.3K | 288 |

About Dow

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

After a thorough review of the options trading surrounding Dow, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Dow’s Current Market Status

- Trading volume stands at 2,808,526, with DOW’s price up by 0.16%, positioned at $44.28.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 59 days.

Professional Analyst Ratings for Dow

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $60.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Dow with a target price of $60.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dow, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply