Wall Street's Most Accurate Analysts Give Their Take On 3 Financial Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financials sector.

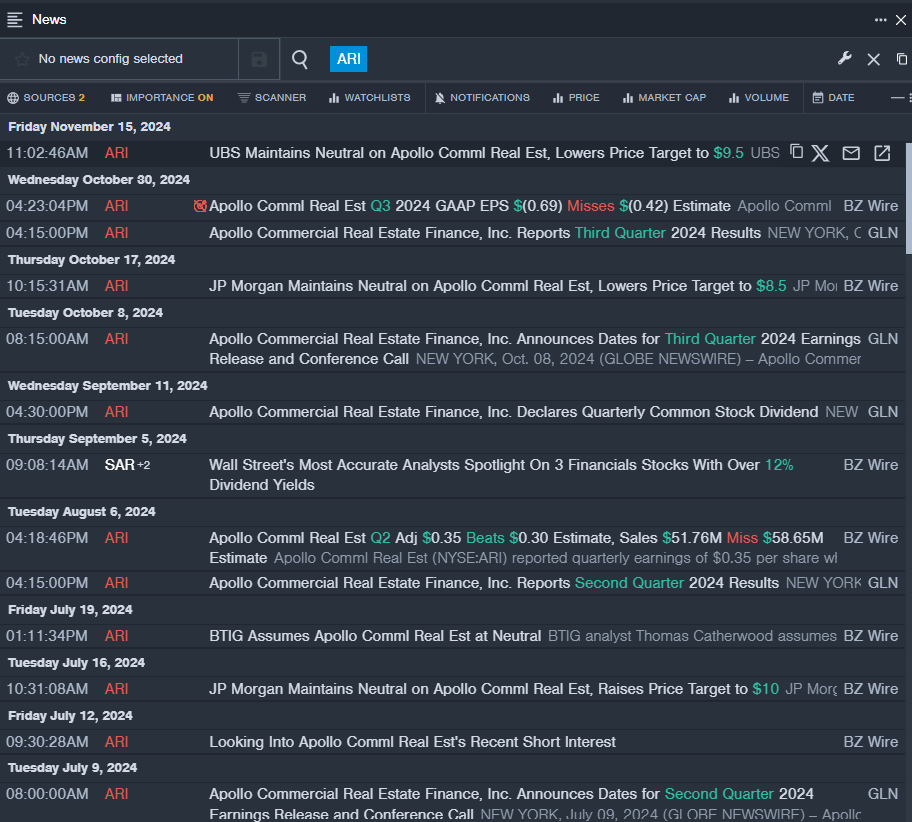

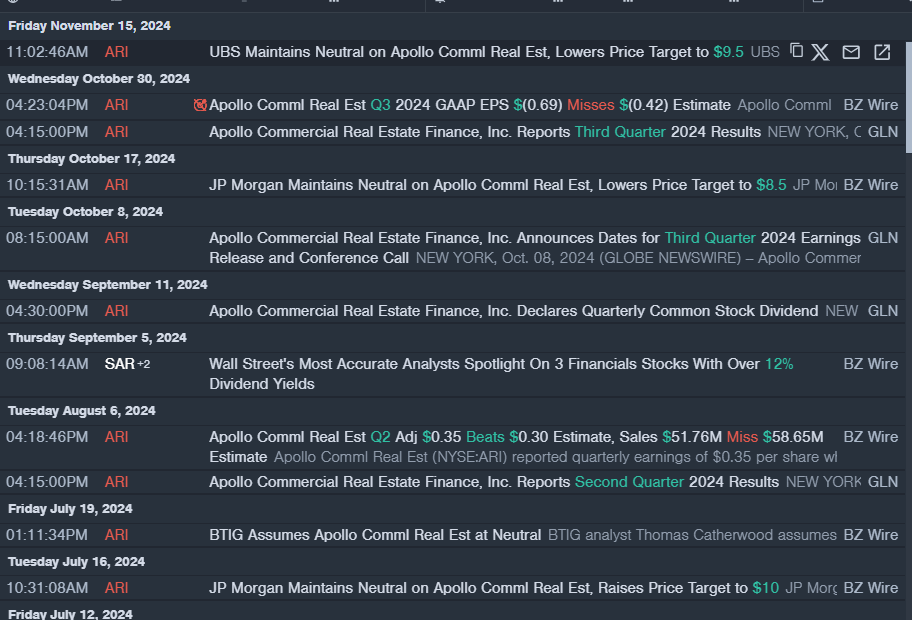

Apollo Commercial Real Estate Finance, Inc. ARI

- Dividend Yield: 10.81%

- UBS analyst Douglas Harter maintained a Neutral rating and cut the price target from $10 to $9.5 on Nov. 15. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Richard Shane maintained a Neutral rating and decreased the price target from $9.5 to $8.5 on Oct. 17. This analyst has an accuracy rate of 69%.

- Recent News: On Oct. 30, the company reported a quarterly loss of 69 cents per share which missed the analyst consensus estimate of a loss of 42 cents per share.

- Benzinga Pro’s real-time newsfeed alerted to latest ARI news

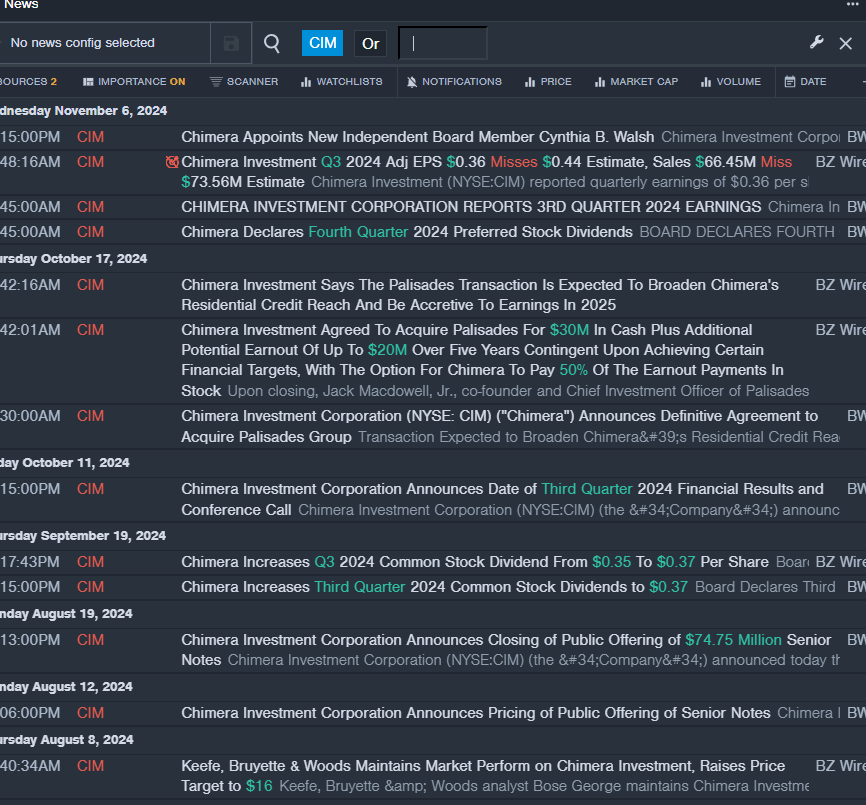

Chimera Investment Corporation CIM

- Dividend Yield: 9.97%

- Keefe, Bruyette & Woods analyst Bose George maintained a Market Perform rating and raised the price target from $15 to $16 on Aug. 8. This analyst has an accuracy rate of 70%.

- UBS analyst Douglas Harter initiated coverage on the stock with a Neutral rating and a price target of $16.5 on Dec. 6, 2023. This analyst has an accuracy rate of 66%.

- Recent News: On Nov. 6, the company posted downbeat quarterly earnings.

- Benzinga Pro’s real-time newsfeed alerted to latest CIM news

Starwood Property Trust, Inc. STWD

- Dividend Yield: 9.43%

- UBS analyst Douglas Harter maintained a Neutral rating and increased the price target from $19.5 to $20 on Nov. 15. This analyst has an accuracy rate of 66%.

- JMP Securities analyst Steven Delaney maintained a Market Outperform rating and lowered the price target from $24 to $23 on Nov. 7. This analyst has an accuracy rate of 69%.

- Recent News: On Nov. 6, the company posted better-than-expected quarterly earnings.

- Benzinga Pro’s charting tool helped identify the trend in STWD stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Psoriasis Drug Market is Expected to Reach US$27.57 Billion with 6.9% CAGR by 2034 | Fact.MR Report

Next Post

Leave a Reply