Walt Disney's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bearish on Walt Disney DIS, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DIS often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 15 options trades for Walt Disney. This is not a typical pattern.

The sentiment among these major traders is split, with 20% bullish and 60% bearish. Among all the options we identified, there was one put, amounting to $103,000, and 14 calls, totaling $614,516.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $125.0 for Walt Disney, spanning the last three months.

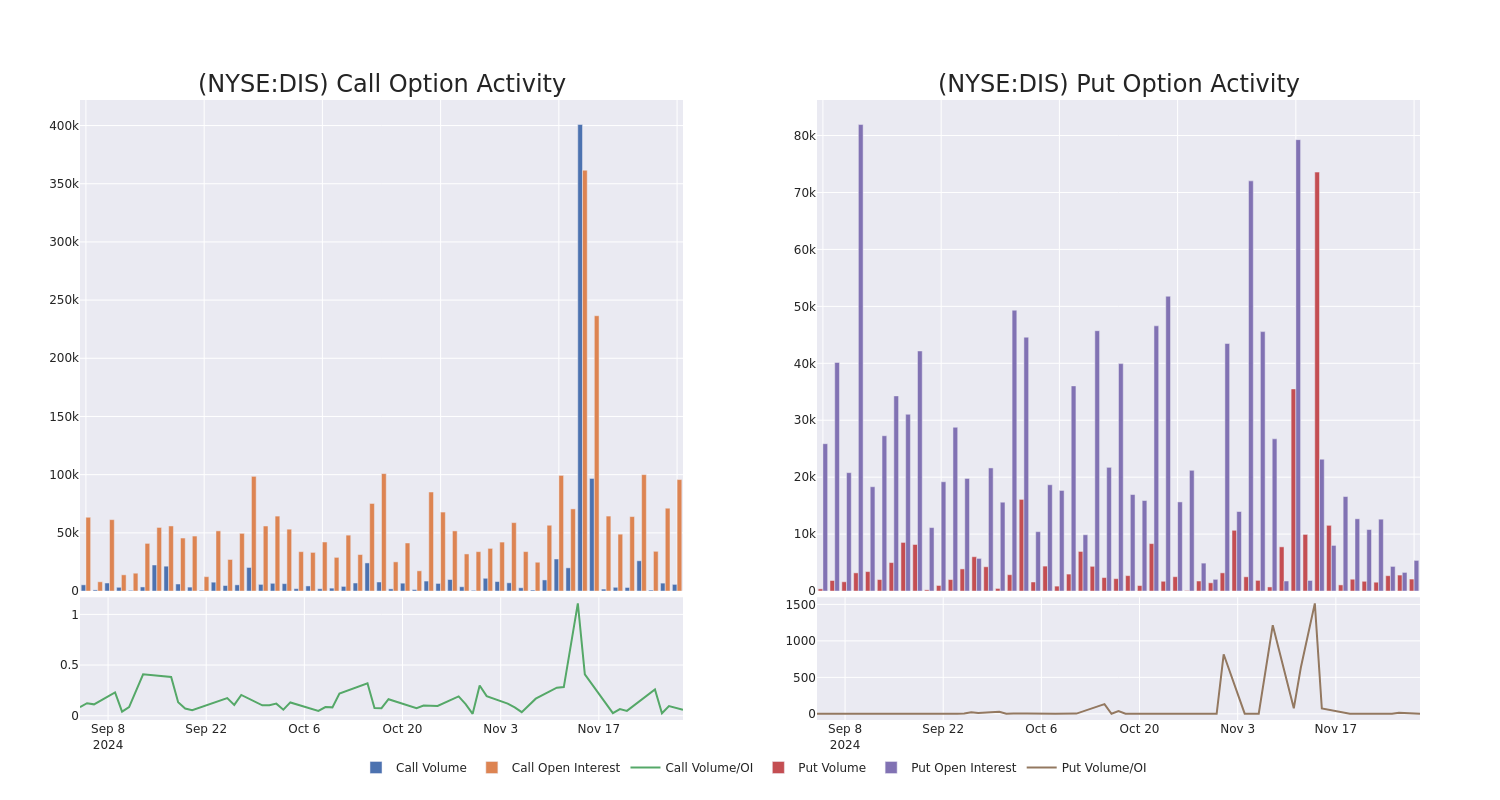

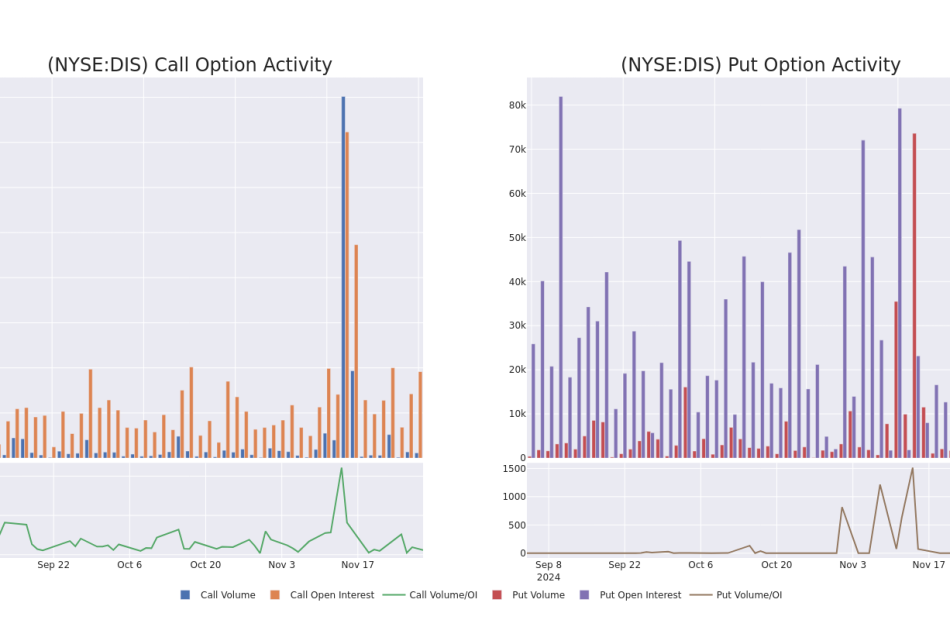

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Walt Disney’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Walt Disney’s substantial trades, within a strike price spectrum from $60.0 to $125.0 over the preceding 30 days.

Walt Disney 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | PUT | TRADE | BEARISH | 12/18/26 | $10.3 | $10.05 | $10.3 | $110.00 | $103.0K | 95 | 0 |

| DIS | CALL | TRADE | BEARISH | 06/20/25 | $35.5 | $35.2 | $35.2 | $85.00 | $70.4K | 785 | 23 |

| DIS | CALL | TRADE | BULLISH | 12/06/24 | $7.4 | $7.2 | $7.33 | $110.00 | $64.5K | 1.2K | 110 |

| DIS | CALL | TRADE | BULLISH | 01/16/26 | $60.5 | $58.05 | $60.5 | $60.00 | $60.5K | 178 | 0 |

| DIS | CALL | SWEEP | NEUTRAL | 03/21/25 | $11.6 | $11.5 | $11.6 | $110.00 | $58.0K | 5.3K | 7 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm’s ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney’s own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney’s theme parks and vacation destinations, and also benefits from merchandise licensing.

In light of the recent options history for Walt Disney, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Walt Disney

- With a volume of 3,642,835, the price of DIS is down -0.7% at $116.64.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 65 days.

What The Experts Say On Walt Disney

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $126.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Walt Disney with a target price of $128.

* An analyst from Macquarie has decided to maintain their Neutral rating on Walt Disney, which currently sits at a price target of $110.

* An analyst from Deutsche Bank has decided to maintain their Buy rating on Walt Disney, which currently sits at a price target of $131.

* An analyst from Morgan Stanley persists with their Overweight rating on Walt Disney, maintaining a target price of $125.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Walt Disney, which currently sits at a price target of $138.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walt Disney, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply