Looking At Walmart's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Walmart WMT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WMT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 54 extraordinary options activities for Walmart. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 40% bearish. Among these notable options, 8 are puts, totaling $746,807, and 46 are calls, amounting to $7,104,729.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $115.0 for Walmart during the past quarter.

Volume & Open Interest Trends

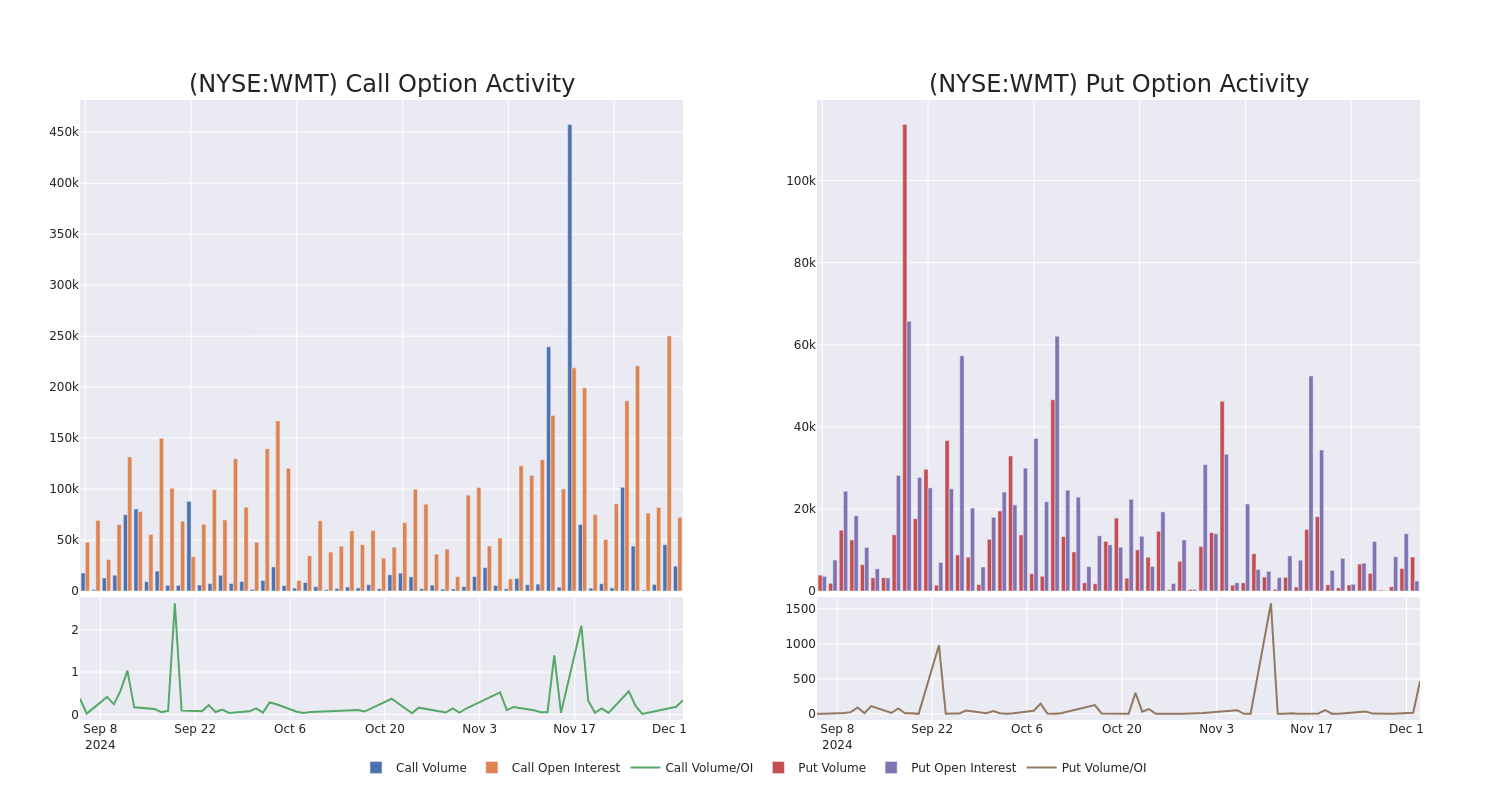

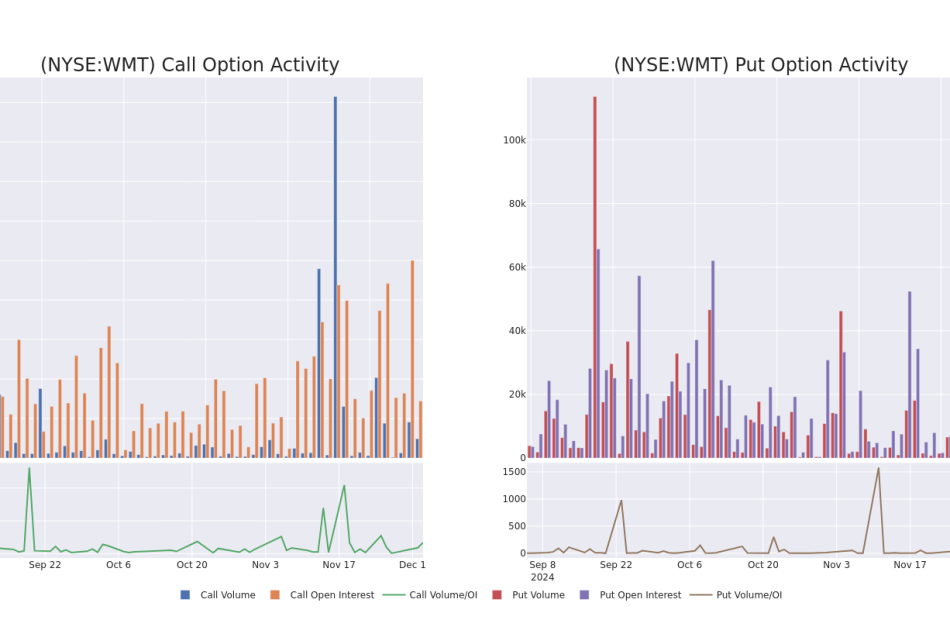

In today’s trading context, the average open interest for options of Walmart stands at 2264.12, with a total volume reaching 32,733.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walmart, situated within the strike price corridor from $40.0 to $115.0, throughout the last 30 days.

Walmart Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | SWEEP | BEARISH | 03/21/25 | $31.35 | $31.2 | $31.2 | $62.50 | $2.0M | 692 | 643 |

| WMT | CALL | TRADE | BULLISH | 12/20/24 | $33.25 | $33.1 | $33.2 | $60.00 | $899.7K | 3.6K | 864 |

| WMT | CALL | TRADE | BEARISH | 03/21/25 | $31.1 | $31.0 | $31.02 | $62.50 | $620.4K | 692 | 1.6K |

| WMT | CALL | TRADE | BEARISH | 03/21/25 | $31.1 | $31.0 | $31.02 | $62.50 | $620.4K | 692 | 1.4K |

| WMT | CALL | SWEEP | BEARISH | 12/20/24 | $20.25 | $20.15 | $20.15 | $73.33 | $364.7K | 3.1K | 307 |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 locations globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

After a thorough review of the options trading surrounding Walmart, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Walmart’s Current Market Status

- Trading volume stands at 10,052,675, with WMT’s price up by 0.9%, positioned at $93.47.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 77 days.

What The Experts Say On Walmart

In the last month, 5 experts released ratings on this stock with an average target price of $97.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Walmart, which currently sits at a price target of $92.

* Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Walmart, targeting a price of $105.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Walmart, which currently sits at a price target of $96.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Walmart, targeting a price of $105.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Walmart, targeting a price of $89.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walmart with Benzinga Pro for real-time alerts.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply