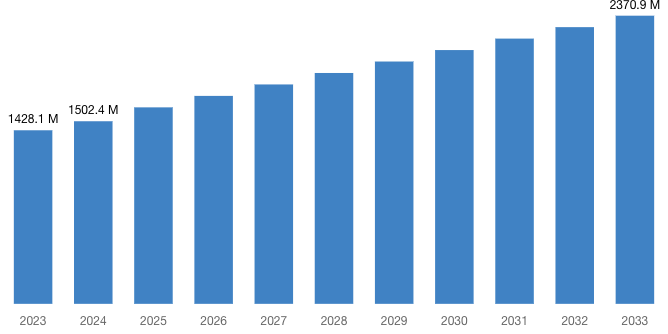

[Latest] Global Vibration Monitoring Market Size/Share Worth USD 2,370.9 Million by 2033 at a 5.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Dec. 03, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Vibration Monitoring Market Size, Trends and Insights By Component Type (Hardware, Accelerometers, Proximity Probes, Velocity Sensors, Others, Software, Vibration Analyzers, Data Collectors, Condition Monitoring Software, Others), By Monitoring Process (Online Monitoring, Portable Monitoring), By System Type (Embedded Systems, Vibration Analyzers, Vibration Meters, Vibration Transmitters, Others), By Application (Machinery Monitoring, Bearing Condition Monitoring, Gearbox Monitoring, Fan & Pump Monitoring, Rotor Dynamics Analysis, Others), By Industry Vertical (Oil & Gas, Energy & Power, Automotive, Aerospace & Defense, Chemicals & Petrochemicals, Mining & Metals, Food & Beverages, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Vibration Monitoring Market size & share was valued at approximately USD 1,428.1 Million in 2023 and is expected to reach USD 1,502.4 Million in 2024 and is expected to reach a value of around USD 2,370.9 Million by 2033, at a compound annual growth rate (CAGR) of about 5.2% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Vibration Monitoring Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54917

Vibration Monitoring Market: Growth Factors and Dynamics

- Increasing Emphasis on Predictive Maintenance: Industries are increasingly adopting vibration monitoring systems to implement predictive maintenance strategies. These systems help in identifying potential equipment failures before they occur, minimizing downtime and optimizing operational efficiency.

- Rising Demand for Condition-Based Monitoring: There is a growing preference for condition-based monitoring solutions that rely on vibration analysis to assess the health and performance of machinery. This trend is driven by the need to enhance asset reliability and reduce maintenance costs.

- Technological Advancements in Sensors and Data Analytics: Continuous advancements in sensor technologies, such as MEMS accelerometers and wireless sensors, coupled with developments in data analytics and machine learning, are enhancing the accuracy and capabilities of vibration monitoring systems.

- Expansion in Industrial Automation: The integration of vibration monitoring with industrial automation systems is expanding. Automated monitoring and analysis processes enable real-time insights into machinery health, facilitating proactive maintenance and operational efficiency.

- Regulatory Requirements and Standards: Compliance with stringent regulatory standards and requirements across industries, such as manufacturing, aerospace, and energy, is driving the adoption of vibration monitoring systems. These systems ensure adherence to safety and performance standards.

- Increasing Adoption in Emerging Markets: Emerging economies are witnessing rapid industrialization and infrastructure development, leading to increased adoption of vibration monitoring solutions. These markets present significant growth opportunities due to the growing awareness of predictive maintenance benefits and the need for operational efficiency improvements.

- Focus on Remote Monitoring and IIoT Integration: There is a growing trend towards remote monitoring capabilities and integration with Industrial Internet of Things (IIoT) platforms. This allows for real-time monitoring of equipment health from anywhere, enabling proactive maintenance and reducing the need for on-site inspections.

- Increasing Complexity of Machinery and Equipment: As industrial machinery and equipment become more complex, the need for accurate and sensitive vibration monitoring systems grows. These systems can detect subtle changes in vibration patterns that indicate potential faults or performance degradation, ensuring optimal operation and reliability of critical assets.

Request a Customized Copy of the Vibration Monitoring Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=54917

Vibration Monitoring Market: Partnership and Acquisitions

- In 2023, IMI Sensors, a division of PCB Piezotronics Inc., introduced the Model 655A91, a cost-effective 4-20 mA velocity transmitter featuring a 4-pin M12 connector for easy integration into industrial monitoring systems. It boasts a built-in piezoelectric component for improved accuracy and a wide frequency response range from 3.5 to 2 kHz.

- In 2022, Banner Engineering launched Snap Signal, a new IIoT product line designed to capture data from industrial machines, convert it to standard protocols, and facilitate Industry 4.0 upgrades. Its modular hardware and software enable versatile applications, including advanced vibration monitoring systems for enhanced facility performance.

- In 2022, Samsung introduced the Galaxy A53 5G smartphone, featuring an octa-core processor for robust performance. It includes a 6.50-inch touchscreen display with a 120 Hz refresh rate and 1080 x 2400 pixels resolution, delivering a sharp viewing experience at 407 pixels per inch.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1,502.4 Million |

| Projected Market Size in 2033 | USD 2,370.9 Million |

| Market Size in 2023 | USD 1,428.1 Million |

| CAGR Growth Rate | 5.2% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Component Type, Monitoring Process, System Type, Application, Industry Vertical and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Vibration Monitoring report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Vibration Monitoring report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Vibration Monitoring Market Report @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

Vibration Monitoring Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Vibration Monitoring Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Temporary Slowdown in Industrial Activities: During the pandemic, many industries experienced a temporary slowdown or shutdown of operations, affecting the demand for vibration monitoring systems used for machinery condition monitoring and predictive maintenance.

- Supply Chain Disruptions: Global supply chain disruptions caused delays in the delivery of vibration monitoring components and systems, impacting project timelines and installation schedules.

- Shift towards Remote Work and Reduced On-Site Inspections: The pandemic necessitated remote work arrangements and minimized on-site inspections, impacting the installation and maintenance of vibration monitoring systems that typically require physical presence.

- Resurgence in Industrial Activities: As economies recover, industrial activities are resuming, leading to increased investments in predictive maintenance and condition monitoring solutions, including vibration monitoring systems.

- Accelerated Adoption of Remote Monitoring Solutions: The pandemic accelerated the adoption of remote monitoring and IIoT-enabled solutions. Vibration monitoring systems with remote monitoring capabilities are increasingly sought after to enable real-time monitoring and minimize on-site personnel requirements.

- Focus on Operational Efficiency and Cost Optimization: Industries are prioritizing operational efficiency and cost optimization strategies post-pandemic. Vibration monitoring systems help in optimizing maintenance schedules, reducing downtime, and improving overall equipment effectiveness (OEE).

- Technological Advancements: Continued advancements in sensor technology, data analytics, and machine learning algorithms are enhancing the capabilities and effectiveness of vibration monitoring systems, driving their adoption in diverse industrial applications.

- Rising Demand in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing increased investments in industrial infrastructure and manufacturing facilities. This surge in industrialization is boosting the demand for vibration monitoring solutions as companies prioritize asset reliability and operational safety.

- Increased Focus on Workplace Safety and Risk Mitigation: Post-pandemic, there is heightened awareness and prioritization of workplace safety measures. Vibration monitoring systems play a crucial role in ensuring equipment reliability and minimizing operational risks.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Vibration Monitoring Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Vibration Monitoring Market Report @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

Key questions answered in this report:

- What is the size of the Vibration Monitoring market and what is its expected growth rate?

- What are the primary driving factors that push the Vibration Monitoring market forward?

- What are the Vibration Monitoring Industry’s top companies?

- What are the different categories that the Vibration Monitoring Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Vibration Monitoring market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Vibration Monitoring Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

Vibration Monitoring Market – Regional Analysis

The Vibration Monitoring Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, the Vibration Monitoring Market is characterized by a strong adoption of advanced analytics and machine learning algorithms. Industries here are at the forefront of integrating these technologies into predictive maintenance strategies, leveraging vibration data to optimize equipment performance and reduce downtime. The region’s emphasis on Industry 4.0 initiatives further drives the demand for IoT-enabled solutions that provide real-time monitoring and actionable insights for proactive maintenance.

- Europe: In Europe, stringent regulatory standards play a significant role in shaping the Vibration Monitoring Market. Industries such as aerospace and automotive adhere closely to these standards, driving the adoption of vibration monitoring systems to ensure compliance and enhance operational safety. Moreover, there is a growing focus on sustainability, with manufacturers leveraging vibration monitoring to optimize energy efficiency and reduce environmental impact across production processes.

- Asia-Pacific: Asia-Pacific is experiencing rapid industrialization, leading to increased adoption of vibration monitoring systems. As emerging economies in the region continue to invest heavily in infrastructure and manufacturing sectors, there is a rising demand for reliable machinery condition monitoring solutions. This growth is driven by the need to enhance operational efficiency, minimize downtime, and maintain high production standards amidst expanding industrial activities.

- LAMEA: In the LAMEA (Latin America, Middle East, and Africa) region, infrastructure development is a key driver for the Vibration Monitoring Market. Countries here are investing significantly in critical infrastructure projects, necessitating the deployment of vibration monitoring systems to ensure the reliability and safety of assets. In particular, the oil & gas sector in the Middle East and Africa region is a major contributor, utilizing vibration monitoring for predictive maintenance to optimize production processes and mitigate operational risks.

Request a Customized Copy of the Vibration Monitoring Market Report @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Vibration Monitoring Market Size, Trends and Insights By Component Type (Hardware, Accelerometers, Proximity Probes, Velocity Sensors, Others, Software, Vibration Analyzers, Data Collectors, Condition Monitoring Software, Others), By Monitoring Process (Online Monitoring, Portable Monitoring), By System Type (Embedded Systems, Vibration Analyzers, Vibration Meters, Vibration Transmitters, Others), By Application (Machinery Monitoring, Bearing Condition Monitoring, Gearbox Monitoring, Fan & Pump Monitoring, Rotor Dynamics Analysis, Others), By Industry Vertical (Oil & Gas, Energy & Power, Automotive, Aerospace & Defense, Chemicals & Petrochemicals, Mining & Metals, Food & Beverages, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/vibration-monitoring-market/

List of the prominent players in the Vibration Monitoring Market:

- SKF Group

- Bently Nevada (a Baker Hughes business)

- Schaeffler AG

- PCB Piezotronics Inc.

- Meggit PLC

- Rockwell Automation Inc.

- National Instruments Corporation

- General Electric Corporation

- Emerson Electric Company

- Honeywell International Inc.

- Bruel & Kjaer Sound & Vibration Measurement A/S

- Fluke Corporation

- ION Science Ltd.

- Data Physics Corporation

- Monarch Instrument

- Others

Click Here to Access a Free Sample Report of the Global Vibration Monitoring Market @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Silicon Wafer Market: Silicon Wafer Market Size, Trends and Insights By Wafer Size (Less than 150 mm, 200 mm, 300 mm, 450 mm), By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, Solar Cells), By Node Type (180 nm, 130 nm, 90 nm, 65 nm, 45 nm, 22 nm, 14 nm, 7 nm, 5 nm and below), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Smart Speaker Market: Smart Speaker Market Size, Trends and Insights By Type (Virtual Assistants, Wireless Speakers, Others), By Application (Residential, Commercial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

MEMS Gas Sensor Market: MEMS Gas Sensor Market Size, Trends and Insights By Type (Inflammable Gas, Toxic Gas, Others), By Application (Air Quality Monitoring, Industrial Safety, Emission Control, Research Application, Storage Monitoring, Others), By End-user Industry (Automotive, Healthcare, Water & Water Treatment, Metal Industry, Building Automation, Food & Beverage, Mining Industry, Power Stations, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Smart Speaker Market: US Smart Speaker Market Size, Trends and Insights By Intelligent Virtual Assistance (Alexa, Google Assistance, Siri, Others), By Component (Hardware, Software), By Price (Low, Mid, Premium), By Application (Smart Home, Consumer, Smart Office, Others), By End Use Industry (Residential, Commercial), By Distribution Channel (Online, Offline), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Commercial Refrigeration Equipment Market: Europe Commercial Refrigeration Equipment Market Size, Trends and Insights By Product Type (Refrigerators and Freezers, Refrigerated Display Cases, Beverage Refrigeration, Ice Machines, Others), By Application (Food Service, Food and Beverage Retail, Healthcare, Hotels and Hospitality, Other), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Technology (Self-contained Refrigeration Units, Remote Condensing Units, Smart Refrigeration), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Multimeter Market: Digital Multimeter Market Size, Trends and Insights By Product Type (Handheld, Desktop, Mounted), By Ranging Type (Auto-ranging, Manual), By Application (Automotive, Energy & Utility, Consumer electronics, Medical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Panel Meter Market: Digital Panel Meter Market Size, Trends and Insights By Type (Temperature Meters, Voltage Meters, Current Meters, Power Meters, Multifunction Meters), By Display Type (LED Display, LCD Display, OLED Display), By Application (Industrial Automation, Energy Management, Process Control, Environmental Monitoring), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Data Center CPU Market: Data Center CPU Market Size, Trends and Insights By Chip Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Field-Programmable Gate Array (FPGA), Application Specific Integrated Circuit (ASIC), Others), By Data Center Size (Small and medium size, Large size), By Vertical Industry (BFSI, Government, IT and telecom, Transportation, Energy & utilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Vibration Monitoring Market is segmented as follows:

By Component Type

- Hardware

- Accelerometers

- Proximity Probes

- Velocity Sensors

- Others

- Software

- Vibration Analyzers

- Data Collectors

- Condition Monitoring Software

- Others

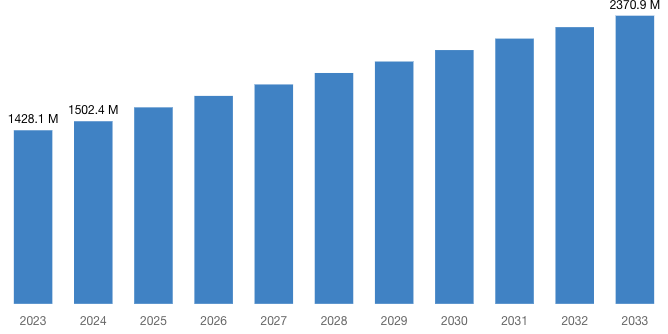

By Monitoring Process

- Online Monitoring

- Portable Monitoring

By System Type

- Embedded Systems

- Vibration Analyzers

- Vibration Meters

- Vibration Transmitters

- Others

By Application

- Machinery Monitoring

- Bearing Condition Monitoring

- Gearbox Monitoring

- Fan & Pump Monitoring

- Rotor Dynamics Analysis

- Others

By Industry Vertical

- Oil & Gas

- Energy & Power

- Automotive

- Aerospace & Defense

- Chemicals & Petrochemicals

- Mining & Metals

- Food & Beverages

- Others

Click Here to Get a Free Sample Report of the Global Vibration Monitoring Market @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Vibration Monitoring Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Vibration Monitoring Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Vibration Monitoring Market? What Was the Capacity, Production Value, Cost and PROFIT of the Vibration Monitoring Market?

- What Is the Current Market Status of the Vibration Monitoring Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Vibration Monitoring Market by Considering Applications and Types?

- What Are Projections of the Global Vibration Monitoring Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Vibration Monitoring Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Vibration Monitoring Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Vibration Monitoring Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Vibration Monitoring Industry?

Click Here to Access a Free Sample Report of the Global Vibration Monitoring Market @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

Reasons to Purchase Vibration Monitoring Market Report

- Vibration Monitoring Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Vibration Monitoring Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Vibration Monitoring Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Vibration Monitoring Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Vibration Monitoring market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Vibration Monitoring Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Vibration Monitoring market analysis.

- The competitive environment of current and potential participants in the Vibration Monitoring market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Vibration Monitoring market should find this report useful. The research will be useful to all market participants in the Vibration Monitoring industry.

- Managers in the Vibration Monitoring sector are interested in publishing up-to-date and projected data about the worldwide Vibration Monitoring market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Vibration Monitoring products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Vibration Monitoring Market Report @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Vibration Monitoring Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/vibration-monitoring-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Archer Aviation Crashed Today — Is It Time to Buy the Stock Right Now?

Archer Aviation (NYSE: ACHR) stock plummeted in Monday’s trading. The flying-taxi company’s share price closed out the daily session down 23.7% and had been down as much as 28.7% earlier in the day. For comparison, the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC) closed out the day up 0.2% and 0.9%, respectively.

Archer Aviation faced bearish pressures along multiple lines today. For starters, short-sellers have started to place more bets against the stock on the heels of an explosive rally. Despite today’s pullback, the stock is up 122% over the last month.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The resignation of Stellantis CEO Carlos Tavares may have also played a role in today’s sell-off. Stellantis has been a significant investor in Archer Aviation, and it’s possible investors are concerned that the automaker’s next CEO won’t be a similarly eager partner. Along similar lines, some investors also appear to be concerned that Archer will move to raise funds by selling more stock soon.

Despite today’s precipitous pullback, it’s not clear that anything has materially changed for the company’s outlook. The change of leadership at Stellantis could potentially limit future funding opportunities through the company, but it’s also not clear that will happen.

Whether it’s to Stellantis or any number of other potential investors, Archer will likely move to sell more shares to raise funds at some point in the not-too-distant future. The company is still in a pre-revenue state, and it’s in the early phases of ramping up manufacturing and getting its Midnight flying vehicles commercialized. There’s a very good chance that the stock will see some significant dilution as the company raises funds to scale the business, and long-term investors shouldn’t view that as an indication of weakness.

Similarly, an increase of bets against the stock from short-sellers could pressure the stock in the near term — but it won’t define Archer’s long-term stock performance. An increase in short interest could also open the door for a potential short squeeze if the company gets favorable news on the regulatory front, or lands new partnerships and contracts.

Investors should move forward with the understanding that Archer Aviation is a high-risk, high-reward stock. For those without high risk tolerance, making a substantial investment in the company is probably inadvisable. The company’s outlook is highly speculative, and the flying-vehicle specialist could see dramatic valuation contraction if macroeconomic conditions or other factors cause the market to pivot away from growth stocks.

Honeywell, Salesforce And 3 Stocks To Watch Heading Into Tuesday

With U.S. stock futures trading sightly higher this morning on Tuesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Core & Main, Inc. CNM to report quarterly earnings at 65 cents per share on revenue of $1.99 billion before the opening bell, according to data from Benzinga Pro. Core & Main shares rose 0.04% to $48.31 in after-hours trading.

- Honeywell International Inc. HON announced a strategic agreement with Bombardier and slashed its 2024 outlook. The company lowered its full-year 2024 revenue guidance from a range of $38.6 billion to $38.8 billion to a new range of $38.2 billion to $38.4 billion, versus estimates of $38.69 billion. Honeywell also lowered its full-year earnings outlook from a range of $10.15 to $10.25 per share to a new range of $9.68 to $9.78 per share, versus estimates of $10.19 per share. Honeywell shares fell 1.7% to $226.00 in the after-hours trading session.

- Analysts expect Salesforce, Inc. CRM to post quarterly earnings at $2.44 per share on revenue of $9.35 billion. The company will release earnings after the markets close. Salesforce shares gained 0.3% to close at $331.01 on Monday.

Check out our premarket coverage here

- Zscaler Inc ZS reported upbeat earnings for its fiscal first quarter. The company said it expects fiscal second-quarter revenue to be in the range of $633 million to $635 million versus estimates of $633.84 million. The company anticipates second-quarter adjusted earnings of 68 cents to 69 cents per share versus estimates of 69 cents per share. Zscaler shares dipped 8.4% to $191.10 in the after-hours trading session.

- Analysts expect Marvell Technology, Inc. MRVL to post quarterly earnings at 41 cents per share on revenue of $1.46 billion after the closing bell. Marvell Technology shares gained 1.5% to $98.29 in after-hours trading.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shopify's Growth Is Picking Back Up and It Just Partnered With 3 Tech Giants to Keep the Momentum Going

Shopify (NYSE: SHOP) is a software company serving e-commerce businesses. And it’s one of the most important players in the world. Over just the last four quarters, its software has facilitated more than $270 billion in gross merchandise volume — the dollar value of all transactions combined.

That certainly gives Shopify a large slice of the e-commerce software pie. And as competitive as business can be, one would think that Shopify has ascended with a ruthless push to get ahead of its rivals. But in reality, the company has a long history of seeking out partnerships whenever possible, even if it’s with direct competitors.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

It’s somewhat counterintuitive. But Shopify’s management believes that the best way to grow its business is by offering its customers as many options as possible. And to offer more options than it could on its own, it finds ways to partner.

This collaborative spirit is still thriving at Shopify. Here are three partnerships the company has forged just in recent months.

Roblox (NYSE: RBLX) is a video game platform, but not like the games I grew up with in the 1980s. Rather, games tend to be more interactive, social experiences. And with nearly 90 million daily active users, it’s certainly popular.

What’s fascinating with Roblox’s business model is that games are created by third-party developers. Roblox is free to play. But certain game elements can be purchased for its in-game currency, providing an opportunity for developers to make some money.

Now Roblox is upping the opportunities for its developer community by partnering with Shopify. Just announced in September and launching in 2025, developers will be able to sell physical products with integrations to Shopify.

For Shopify, this is really a no-brainer partnership. Roblox isn’t a competitor at all. But it still will provide a new use case and a potentially expanded audience for the e-commerce player.

In 2006, tech giant Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) — then Google — acquired upstart video-sharing platform YouTube. Now YouTube is a major part of the business. And in August, it expanded on its existing partnership with Shopify.

In 2022, YouTube had already made it possible for content creators to link their Shopify sites with their YouTube channels. But now Shopify Plus and Advanced merchants can become YouTube affiliates, making it easier for content creators to highlight products.

Michael Saylor Says MARA On The 'Bitcoin Standard' As Company Doubles Market Cap, Stock Price In Last 3 Months

MARA Holdings Inc. MARA more than doubled its market valuation over the last three months, powered by gains in the apex cryptocurrency and its gradual pivot toward the Bitcoin BTC/USD “Standard.”

What happened: Shares of the leading Bitcoin mining company closed at a 9-month high of $27.42 last Friday. The rally brought the firm’s market capitalization to an all-time high of $8.825 billion.

At Monday’s close, MARA was valued at $8.24 billion, reflecting an addition of $4.31 billion since Sept. 6, or 109%. During this time, the stock price has nearly doubled from $13.37 to $25.63.

Interestingly, its gains in this period have surpassed those of other major miners, including Riot Platforms Inc. RIOT and Core Scientific Inc. CORZ, which grew by 89% and 72%, respectively.

Why It Matters: The gains have coincided with Bitcoin’s rally, which has gained 70% since Sept. 6.

Furthermore, MARA significantly expanded its Bitcoin stockpile in the period, growing it from 25,945 to 34,794, an addition of 8,849, according to data from bitcointreasuries.net.

MARA was the second-largest corporate holder of Bitcoin as of this writing and was strongly replicating market leader MicroStrategy Inc.’s MSTR playbook of using interest-free debt to acquire more of the digital asset.

The company announced another private offering of $700 million of zero-coupon convertible senior notes Monday after completing a $1 billion offering of 0% convertible senior notes in November.

MicroStrategy co-founder Michael Saylor referred to MARA as the company on the “Bitcoin Standard.”

Price Action: At the time of writing, Bitcoin was trading at $95,953.94, down 1.02% in the last 24 hours, according to data from Benzinga Pro.

Shares of MARA closed 6.53% lower at 25.63 during Monday’s regular trading session. The stock has a consensus price target of $23.83 based on the ratings of 17 analysts.

Image via Mara

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood-Led Ark's Prediction: AI Will Turn Digital Wallets Into $9 Trillion E-Commerce Powerhouses — Google, Amazon Dominance Set For Disruption?

ARK Invest said in November that artificial intelligence-powered digital wallets could revolutionize e-commerce, potentially driving nearly $9 trillion in global online spending by 2030 through the integration of Large Language Models into payment platforms.

What Happened: The Cathie Wood-led firm’s latest research suggests that AI “purchasing agents” embedded in digital wallets like Shopify Inc‘s SHOP Shop Pay, Cash App owned by Block Inc SQ, and Apple Inc.’s AAPL Apple Pay could transform the traditional one-click checkout into a streamlined one-query purchase experience.

This development comes as major tech companies, including Alphabet Inc. GOOGL GOOG and Amazon.com Inc. AMZN, are rapidly advancing their AI shopping capabilities.

ARK’s research suggests AI purchasing agents could disrupt Google and Amazon’s dominance by automating product comparisons and purchase decisions, reducing reliance on search engines and marketplaces.

Klarna‘s integration with Microsoft Corp. MSFT backed OpenAI technology demonstrates early adoption of this trend, with its shopping assistant combining search and aggregation based on user preferences.

“Digital wallets helmed by purchasing agents could increase their share of global e-commerce purchase volume from 50% in 2023 to 72% by 2030,” according to Ark Invest’s analysis.

The firm projects that if 10% of global AI agent spending occurs through digital wallets with a 5% lead generation fee, these AI purchasing agents could generate $43 billion for digital wallet providers.

Why It Matters: Recent market developments support this trajectory. Amazon’s AI shopping assistant Rufus, launched nationwide in July, has already demonstrated the potential of AI in e-commerce by helping customers with product details, recommendations, and comparisons.

Meanwhile, Google’s reported development of “Project Jarvis,” an AI system designed to handle shopping and travel bookings, suggests growing competition in this space.

The impact of AI on e-commerce was particularly evident during Black Friday 2024, when online sales reached $10.8 billion, marking a 10.2% increase from 2023. Retailers using AI chatbots saw a 1,800% increase in website traffic and a 9% higher conversion rate compared to those without AI integration, according to Salesforce data.

Ark Invest emphasizes that success in this space will require digital wallet providers to balance personalization with user privacy and trust. The firm suggests that similar to credit card rewards programs which distributed $40 billion in rewards in 2022, digital wallets will need to offer compelling incentives to drive adoption.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Robbins LLP Urges ASML Stockholders with Large Losses to Contact the Firm for Information About the ASML Holding N.V. Class Action Lawsuit

SAN DIEGO, Dec. 03, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds shareholders that a class action was filed on behalf of all investors that purchased or otherwise acquired ASML Holding N.V. ASML ordinary shares between January 24, 2024 and October 15, 2024. ASML is a leading supplier to the semiconductor industry, providing chipmakers with hardware, software, and services to mass produce integrated circuits (i.e., microchips).

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that ASML Holding N.V. (ASML) Misled Investors About How Issues in the Semiconductor Industry Would Impact the Company

According to the complaint, during the class period, defendants failed to disclose that: (1) the issues being faced by suppliers, like ASML, in the semiconductor industry were much more severe than defendants had indicated to investors; (2) the pace of recovery of sales in the semiconductor industry was much slower than defendants had publicly acknowledged; (3) defendants had created the false impression that they possessed reliable information pertaining to customer demand and anticipated growth, while also downplaying risk from macroeconomic and industry fluctuations, as well as stronger regulations restricting the export of semiconductor technology, including the products that ASML sells; and (4) as a result, defendants’ statements about the Company’s business, operations, and prospects lacked a reasonable basis. As a result of these acts, ASML stock has declined significantly, harming investors.

What Now: You may be eligible to participate in the class action against ASML Holding N.V. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by January 13, 2025. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against ASML Holding N.V. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4a5fd11c-859b-4575-b6f4-862a0506d704

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can Your Bitcoin Be Confiscated If Trump Establishes A National Reserve? Analyst Says Government Can Employ Carrot-And-Stick Policy

The expectations of a U.S. strategic Bitcoin BTC/USD reserve have skyrocketed following Donald Trump’s presidential victory, with the cryptocurrency sector firmly behind the ambitious idea.

Trump called for a strategic national Bitcoin stockpile at a conference earlier this year, while also advocating against selling state-owned Bitcoin stash.

While nothing concrete has come from Trump since this advocacy, his Republican colleagues, especially Sen. Cynthia Lummis (R-Wy.), have proposed legislation, called the BITCOIN Act, to purchase one million Bitcoins over five years.

Individuals connected to the digital assets industry have given a thumbs up to the idea.

The For And Against Debate

Joe McCann, founder and CEO of cryptocurrency hedge fund Asymmetric, told Benzinga that the move could position the U.S. as a “leader in crypto.”

McCann said that if the reserve gains more buzz and moves closer to reality, it’s likely to spur Bitcoin’s increase significantly.

“The market is already somewhat anticipating the potential impact, but I don’t think a lot of people have “priced in” the idea that if this were to actually pass [BITCOIN Act], other countries would also want to acquire a percentage of the total Bitcoin supply for their reserves, driving even more demand.”

See Also: Michael Saylor Says Bitcoin Could Boost Microsoft’s Valuation By Nearly $5 Trillion And Add $584 To The Stock By 2034

However, critics like Peter Schiff have slammed the idea, predicting that such a move would end in the dollar’s devaluation and hyperinflation, as the government would have to print more money to buy more Bitcoin.

In defense, Lummis has maintained that the government won’t have to spend “any new dollars” to fund the purchases. Instead, it could use the Federal Reserve-held gold certificates, currently valued at 1970s prices, update them to the fair market value, and then sell them to buy Bitcoin.

Will Your Bitcoin Holdings Be At Risk?

Another lesser-talked-about aspect of a potential reserve is whether it’d give the federal government supreme authority on holding Bitcoin, given the asset’s limited supply. And whether, in an emergency situation, the government would enact something similar to Franklin D. Roosevelt’s Executive Order 6102 of 1933, which required Americans to surrender a large portion of their gold holdings to the Federal Reserve.

“Bitcoin is an entirely different animal from gold. It is not tied to our monetary system like gold was in 1930,” Neil Bergquist, CEO of Seattle-headquartered cryptocurrency exchange Coinme, said.

“Seizing an individual’s Bitcoin would be a logistically and legally complex operation since it is on a decentralized blockchain, and such confiscation actions would likely be determined illegal,” he argued.

Denis Sklyarov, CEO and co-founder of decentralized physical infrastructure company WiFi Map, also agreed with the view that Bitcoin’s digital, decentralized nature would make such an endeavor as difficult.

“Additionally, legal and cultural shifts in the U.S. over the past century emphasize financial freedom and personal property rights, making such a sweeping confiscation almost impossible under current laws,” he added.

McCann took a middle ground, saying that the government would encourage people to sell Bitcoin voluntarily rather than forcing them to surrender.

“If the U.S. were to establish a strategic Bitcoin Reserve, it might use tax breaks or premium buy-back programs as carrots instead of sticks,” he remarked.

Bettors on the popular prediction market platform Polymarket priced in a 29% possibility of Trump creating a Bitcoin reserve in the first 100 days of his presidency as of this writing.

Price Action: At the time of writing, Bitcoin was exchanging hands at $96,474.28, down 0.29% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Extra Space Announces Pricing of $300 Million Add-On Offering of 5.700% Senior Notes due 2028

SALT LAKE CITY, Dec. 2, 2024 /PRNewswire/ — Extra Space Storage Inc. (“Extra Space”) EXR, a leading owner and operator of self-storage facilities in the United States and a member of the S&P 500, today announced that its operating partnership, Extra Space Storage LP (the “operating partnership”), has priced a public offering of $300 million aggregate principal amount of additional 5.700% senior notes due 2028 (the “Notes”). The Notes will be issued as additional notes under the indenture pursuant to which the operating partnership previously issued $500 million of 5.700% senior notes due 2028 (the “Initial Notes”). The Notes will be treated as a single series of securities with the Initial Notes under the indenture and will have the same CUSIP number as, and be fungible with, the Initial Notes. The Notes were priced at 102.857% of the principal amount and will mature on April 1, 2028. J.P. Morgan, BMO Capital Markets, TD Securities, BofA Securities, PNC Capital Markets LLC, Truist Securities, Wells Fargo Securities and US Bancorp are acting as the joint book-running managers for the offering. Regions Securities LLC, BOK Financial Securities, Inc., Citigroup, Huntington Capital Markets, Scotiabank, Zions Capital Markets, Fifth Third Securities, Academy Securities and Ramirez & Co., Inc. are acting as the co-managers for the offering. The offering is expected to close on or about December 5, 2024, subject to the satisfaction of customary closing conditions. The Notes will be fully and unconditionally guaranteed by Extra Space and certain of its subsidiaries.

The operating partnership intends to use the net proceeds from this offering to repay amounts outstanding from time to time under its lines of credit, and for other general corporate and working capital purposes, including funding potential acquisition opportunities.

The Notes will be issued pursuant to an effective shelf registration statement filed with the Securities and Exchange Commission. This release does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale is not permitted. The offering will be made only by means of a prospectus supplement and accompanying prospectus, copies of which, when available, may be obtained from J.P. Morgan Securities LLC, 383 Madison Avenue, New York, New York, 10179, Attention: Investment Grade Syndicate Desk, 3rd Floor, telephone collect at (212) 834-4533; BMO Capital Markets Corp., Attention: IG Syndicate, 151 W 42nd Street, 9th Floor, New York, NY 10036, by telephone at (888) 200-0266; or TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, New York 10017, by telephone at (855) 495-9846.

A prospectus supplement related to the offering will also be available free of charge on the SEC’s website at http://www.sec.gov.

About Extra Space Storage Inc.:

Extra Space Storage Inc., headquartered in Salt Lake City, Utah, is a fully integrated, self-administered and self-managed real estate investment trust, and a member of the S&P 500. As of September 30, 2024, the Company owned and/or operated 3,862 self-storage properties, which comprise approximately 2.7 million units and approximately 296.0 million square feet of rentable storage space operating under the Extra Space brand. The Company offers customers a wide selection of conveniently located and secure storage units across the country, including boat storage, RV storage and business storage. It is the largest operator of self-storage properties in the United States.

Forward-Looking Statements:

Certain information set forth in this release contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include statements concerning the terms, timing and completion of the offering of securities by Extra Space and the operating partnership, including the anticipated use of proceeds therefrom. In some cases, forward-looking statements can be identified by terminology such as “believes,” “estimates,” “expects,” “may,” “will,” “should,” “anticipates,” or “intends,” or the negative of such terms or other comparable terminology, or by discussions of strategy. All forward-looking statements are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this release. Such risks and uncertainties include without limitation those associated with market risks and uncertainties and the satisfaction of customary closing conditions for an offering of securities, as well as the risks referenced in the “Risk Factors” section included in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. All forward-looking statements apply only as of the date of this release. We undertake no obligation to publicly update or revise forward-looking statements which may be made to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/extra-space-announces-pricing-of-300-million-add-on-offering-of-5-700-senior-notes-due-2028–302320101.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/extra-space-announces-pricing-of-300-million-add-on-offering-of-5-700-senior-notes-due-2028–302320101.html

SOURCE Extra Space Storage Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.