Diversify Around And Find Out: Can Vegas Superstore And Florida Sales Boost This Weed Penny Stock?

Planet 13 Holdings PLNH, a key player in the cannabis retail and cultivation space has seen its stock drop 29% over the last 30 days, reflecting broader market pressures. However, the company presents an attractive opportunity for investors, given its discounted valuation relative to peers and its substantial growth prospects, particularly in Florida.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Valuation: Discounted Yet Attractive

PLNHF is trading at $0.40 per share, with an enterprise value (EV) of $137 million, factoring in net cash of $19 million, net leases, and tax debt. A sales multiple is a common valuation metric that compares a company’s market value to its revenue. This places PLNHF at a 1.1x sales multiple, lower than its competitors: Green Thumb Industries GTBIF and Curaleaf CURLF, both at 2x, and AYR Wellness AYRWF at 1.5x. PLNHF’s lower multiple suggests it is valued more cheaply relative to these competitors, meaning investors are paying less for each dollar of PLNHF’s revenue compared to the others.

Zuanic & Associates notes, “PLNH trades at 1.1x current sales vs. 1.5x for the group and 2x for the likes of Green Thumb and Curaleaf.”

Growth Catalysts And Regulatory Exposure

While PLNHF lacks “regulatory unlock” optionality in Ohio and Pennsylvania, where potential legalization could offer future upside, the company’s Florida expansion is poised to drive growth. Zuanic points out, “With several organic growth catalysts and a strong balance sheet, PLNH’s downside risk is minimized compared to peers.”

In Florida, the company plans to open 8 new stores by the end of 2024 and improve cultivation yields by 40%. PLNHF is also expanding its Nevada retail operations.

Zuanic explained that despite missing out in states like Ohio and Pennsylvania, PLNHF holds a solid financial position.

Read Also: NASDAQ-Listed High Tide Under The Magnifying Glass: Key Insights For Cannabis Investors

Bottom Line: Think Long-Term

Despite short-term challenges, PLNHF’s strategic growth initiatives—especially in Florida and Nevada—position the company for long-term success. With an attractive valuation discount compared to peers, Planet 13 represents a compelling opportunity for investors looking to capitalize on the cannabis sector’s evolution.

Read Next: EXCLUSIVE: Why Cannabis Industry Workers And Employees Should Think About 401(k) Plans

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Box: Q3 Earnings Insights

Box BOX reported its Q3 earnings results on Tuesday, December 3, 2024 at 04:05 PM.

Here’s what investors need to know about the announcement.

Earnings

Box beat estimated earnings by 7.000000000000001%, reporting an EPS of $0.45 versus an estimate of $0.42.

Revenue was up $14.38 million from the same period last year.

Overview of Past Earnings

In the previous quarter, the company beat on EPS by $0.04, resulting in a 11.0% increase change in the share price the following day.

Here’s a look at Box’s past performance:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.40 | 0.36 | 0.38 | 0.38 |

| EPS Actual | 0.44 | 0.39 | 0.42 | 0.36 |

| Revenue Estimate | 269.18M | 262.04M | 262.97M | 263.69M |

| Revenue Actual | 270.04M | 264.66M | 262.88M | 261.54M |

To track all earnings releases for Box visit their earnings calendar here.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Breakdown: Pure Storage Q3

Pure Storage PSTG reported its Q3 earnings results on Tuesday, December 3, 2024 at 04:05 PM.

Here’s what investors need to know about the announcement.

Earnings

Pure Storage beat estimated earnings by 19.0%, reporting an EPS of $0.5 versus an estimate of $0.42.

Revenue was up $68.23 million from the same period last year.

Historical Earnings Summary

During the previous quarter, the company beat on EPS by $0.07, leading to a 16.0% drop share price change the next day.

Here’s a look at Pure Storage’s past performance:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.37 | 0.21 | 0.44 | 0.4 |

| EPS Actual | 0.44 | 0.32 | 0.50 | 0.5 |

| Revenue Estimate | 755.06M | 680.97M | 782.31M | 763.36M |

| Revenue Actual | 763.77M | 693.48M | 789.80M | 762.84M |

To track all earnings releases for Pure Storage visit their earnings calendar here.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key Stocks, ETF To Watch As French Government Faces No-Confidence Vote

French Prime Minister Michel Barnier faces a critical vote of no confidence tomorrow (Dec. 4) after invoking Article 49.3 to pass a controversial 2025 austerity budget without parliamentary approval.

The move, designed to address France’s soaring deficit with $42 billion in spending cuts and $21 billion in tax hikes, has polarized the fractured National Assembly. Marine Le Pen‘s National Rally and the leftist New Popular Front have united in opposition, calling for Barnier’s ouster. In on interview on TV today, Barnier warned that if the motion succeeds, millions of French citizens could face economic instability, including rising interest rates and tax hikes, per the Guardian.

A failure to secure support would result in Barnier’s government being the shortest-lived in modern French history, he only took office in September, further destabilizing the eurozone. President Emmanuel Macron would then need to appoint a new prime minister to navigate the deeply divided parliament.

France has often been a volatile market for foreign companies, but its size, manpower, favorable geographical position, and pole position in global tourism have made it a lucrative economy.

The following publicly listed companies have exposure to the French economy.

McDonald’s MCD has been operating in France since 1972. Since then, it has grown into a network of 1,485 restaurants — the most in Europe — generating billions in revenue. However, the franchise got caught evading taxes after a trade union asked the company to raise wages and introduce profit-sharing bonuses. Eventually, the firm paid a $1.3 billion fine.

Walt Disney Co. DIS opened its resort in Paris in 1992, growing it into one of the top attractions in Europe. Around 16.1 million tourists visited the park in 2023, generating $343 million in profits. The park is the largest single-site employer in the country, with 17,000 workers — making it prone to strikes that last occurred in 2023. Despite its popularity, the park has been a problematic part of Disney’s portfolio and is often a drain on its resources.

IBM IBM has a long-standing relationship with France as one of the IT pioneers that expanded overseas seeking foreign talent. Nowadays, IBM has over 7,000 employees in the country, working on technology services, cloud computing, AI and digital transformation solutions for businesses.

Carmaker Stellantis NV STLA has a vital presence in the country, owing to its origins in the French PSA Group. It is the fourth largest automotive firm by sales, managing established brands like Citroen, Peugeot and DS Automobiles. Stellantis currently has five operating factories in different regions, producing at least 14 different models.

For investors monitoring broad exposure to domestically incorporated French companies there is iShares MSCI France ETF EWQ. It holds 60 largest French companies, including market leaders such as LVMH Moet Hennessy Louis Vuitton SE LVMUY, Schneider Electric, TotalEnergies SE TTE and Airbus SE EADSY.

Read Next:

• South Korea ETFs, Won Pare Losses As Yoon Makes U-Turn On Martial Law Declaration

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marvell Technology Stock Climbs After Better-Than-Expected Q3 Results, Strong Q4 Guidance

Marvell Technology Inc. MRVL reported its third-quarter results after Tuesday’s closing bell. Here’s a look at the key figures from the quarter.

The Details: Marvell Technology reported quarterly earnings of 43 cents per share, which beat the analyst consensus estimate of 41 cents. Quarterly revenue came in at $1.52 billion, which beat the consensus estimate of $1.46 billion and is an increase over sales of $1.42 billion from the same period last year.

Read Next: TikTok Shop Bags More Than $100 Million In Black Friday Sales With Potential Ban Ahead

“Marvell’s fiscal third quarter 2025 revenue grew 19% sequentially, well above the mid-point of our guidance, driven by strong demand from AI. For the fourth quarter, we are forecasting another 19% sequential revenue growth at the midpoint of guidance, while year-over-year, we expect revenue growth to accelerate significantly to 26%, marking the beginning of a new era of growth for Marvell,” said Matt Murphy, Marvell’s CEO.

“The exceptional performance in the third quarter, and our strong forecast for the fourth quarter, are primarily driven by our custom AI silicon programs, which are now in volume production, further augmented by robust ongoing demand from cloud customers for our market-leading interconnect products. We look forward to a strong finish to this fiscal year and expect substantial momentum to continue in fiscal 2026,” Murphy added.

Outlook: Marvell sees fourth-quarter earnings of 59 cents per share, plus or minus five cents, versus the 52-cent estimate. The company expects fourth-quarter revenue of $1.8 billion, plus or minus 5%, versus the $1.65 billion estimate.

MRVL Price Action: According to Benzinga Pro, Marvell Technology shares are up 8.99% after-hours at $104.54 at the time of publication on Tuesday.

Read More:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tavia Acquisition Corp. Announces Pricing of $100 Million Initial Public Offering

London, United Kingdom, Dec. 03, 2024 (GLOBE NEWSWIRE) — Tavia Acquisition Corp. (the “Company”) announced today the pricing of its initial public offering of 10,000,000 units, at a price of $10.00 per unit. The units are expected to commence trading on December 4, 2024 on the Nasdaq Global Market under the symbol “TAVIU.”

The Company is strategically focused on sectors pivotal to advancing sustainability and innovation, including energy transition and critical materials, circular economy initiatives, and innovative agricultural and food technologies.

Each unit consists of one ordinary share and one right entitling the holder thereof to receive one-tenth of one ordinary share upon the completion of an initial business combination. Once the securities comprising the units begin separate trading, the ordinary shares and rights are expected to be listed on the Nasdaq Global Market under the symbols “TAVI” and “TAVIR,” respectively.

EarlyBirdCapital, Inc. is serving as the sole book-running manager of the offering. The underwriters have been granted a 45-day option to purchase up to an additional 1,500,000 units at the initial public offering price to cover over-allotments, if any.

The offering is expected to close on or about December 5, 2024, subject to customary closing conditions.

A registration statement relating to these securities has been declared effective by the Securities and Exchange Commission (the “SEC”) on December 3, 2024. The offering is being made only by means of a prospectus, copies of which may be obtained by contacting EarlyBirdCapital, Inc. at 366 Madison Avenue, 8th Floor, New York, New York 10017, Attention: Syndicate Department, by telephone at 212-661-0200.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Tavia Acquisition Corp.

Tavia Acquisition Corp. is a blank check company organized for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, or reorganization or engaging in any other similar business combination with one or more businesses or entities. The Company is led by Chief Executive Officer Kanat Mynzhanov and Chief Financial Officer Askar Mametov, along with independent directors, Christophe Charlier, Darrell Mays, and Marsha Kutkevich. The Company’s team brings substantial expertise in deal sourcing, investing, and operations. The Company may pursue a business combination with a target in any industry or geographic location it chooses, although it intends to primarily direct its attention on target businesses in North America and Europe focused on energy transition, the circular economy, and food technologies. The Company believes these areas are critical to addressing environmental challenges, demographic shifts, and the transition towards sustainable practices.

Forward-Looking Statements

This press release includes forward-looking statements that involve risks and uncertainties. Forward-looking statements are statements that are not historical facts. Such forward-looking statements, including with respect to the initial public offering and the anticipated use of the proceeds thereof, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements, including those set forth in the risk factors section of the registration statement and preliminary prospectus for the Company’s initial public offering. Copies of these documents can be accessed through the SEC’s website at www.sec.gov. No assurance can be given that the offering discussed above will be completed on the terms described, or at all, or that the net proceeds of the offering will be used as indicated. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based, except as required by law.

Media Contact:

Tavia Acquisition Corp.

info@tavia.co

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NexPoint Comments on Proposed Acquisition of UDF IV by Ready Capital

Proposed Transaction Demonstrates NexPoint’s Ongoing Impact at UDF IV

If Elected, NexPoint Nominees Would Review and Pursue Transaction to Maximize Shareholder Value

DALLAS, Dec. 3, 2024 /PRNewswire/ — NexPoint Real Estate Opportunities, LLC (together with its affiliates “NexPoint”) today commented on the proposed transaction between United Development Funding IV (“UDF IV” or the “Company”), a real estate investment trust, and Ready Capital Corporation (“Ready Capital”), a multi-strategy real estate finance company:

“NexPoint is pleased that our multi-year advocacy and litigation continues to benefit UDF IV shareholders by bringing forward a potential transaction that could deliver much-needed liquidity. While we evaluate this proposal further, shareholders should note upfront that the potential $5.89 per share capped value offered under the acquisition is significantly below the $9.47 per share book value that UDF IV provided in its latest financials.

Over 40% of that potential value is comprised of $75 million in contingent cash distributions, which would represent a continued return of capital rather than meaningful value creation. Even so, the merger agreement does not guarantee this distribution; it merely allows UDF IV to make distributions ‘up to’ that amount. Given the latest financials and other cash obligations outlined in the agreement, the feasibility and likelihood of achieving the full distribution appears questionable.

Though the proposed transaction shows that our efforts are making an impact, we remain concerned about the lack of accountability and transparency at UDF IV under the current Board, which includes Trustees who presided over years of fraud, disclosure violations, poor performance, and persistent illiquidity. Notably, our concerns are reinforced by the intentional withholding of the material terms set forth in the Disclosure Schedules to the merger agreement, without which shareholders cannot accurately evaluate the proposed merger.

If elected, NexPoint’s nominees would thoroughly review the proposed terms of the transaction and pursue the best possible outcome for shareholders. We therefore continue to urge UDF IV shareholders to support NexPoint’s nominees at the upcoming annual meeting.”

NexPoint’s ongoing efforts to drive accountability at UDF IV have already led to a court order compelling the Company to hold an annual meeting and fair election of all independent Trustees for the first time in over eight years. These efforts now continue to benefit shareholders by spurring this potential acquisition.

The Company has announced the court-ordered annual meeting will take place on December 10, 2024, which will be the last opportunity for shareholders to vote in the critical Board election. NexPoint urges shareholders to vote for its nominees: Paul S. Broaddus, Edward N. Constantino, John A. Good, and Julie Silcock, and reject UDF IV’s current Board, which has overseen criminal and fraudulent behavior and significant losses in shareholder value and liquidity.

If elected, NexPoint’s nominees are dedicated to working on behalf of all shareholders to drive accountability and maximize value at UDF IV, including by reviewing and pursuing transactions that align with shareholders’ interests.

- Shareholders are encouraged to vote FOR NexPoint’s nominees using the GREEN proxy materials.

For more information, visit udfaccountability.com or email NexPoint at udfinvestors@nexpoint.com.

About NexPoint

NexPoint Real Estate Opportunities, LLC is a wholly owned subsidiary of NexPoint Diversified Real Estate Trust, Inc. NXDT, an affiliate of NexPoint Advisors, L.P.

NexPoint Advisors, L.P. is an SEC-registered adviser on the NexPoint alternative investment platform. It serves as the adviser to a suite of funds and investment vehicles, including a closed-end fund, interval fund, business development company, and various real estate vehicles. For more information visit www.nexpoint.com

IMPORTANT INFORMATION

NexPoint Real Estate Opportunities, LLC (“NexPoint”) intends to deliver a proxy statement with respect to its solicitation of proxies for nominees to be elected to the United Development Funding IV (“UDF IV”) Board of Trustees at the Annual Meeting of Shareholders of UDF IV. The date for the Annual Meeting has not yet been set and NexPoint is not soliciting proxies at this time. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE NEXPOINT PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN AVAILABLE IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Copies of the documents will be made available free of charge from NexPoint by accessing the website www.udfaccountability.com.

NexPoint, its affiliates, their directors and executive officers and other members of management and employees may be participants (collectively “Participants”) in the solicitation of proxies by NexPoint. Information about NexPoint’s nominees to the UDF IV Board of Trustees and information regarding the direct or indirect interests in UDF IV, by security holdings or otherwise, of NexPoint, the other Participants and NexPoint’s nominees will be available in the proxy statement. NexPoint’s disclosure of any security holdings will be based on information made available to NexPoint by such Participants and nominees. UDF IV is no longer subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. Consequently, NexPoint’s knowledge of significant security holders of UDF IV and as to UDF IV itself is limited.

CONTACT INFORMATION

UDF IV Investor Contacts

Chuck Garske / Jeremy Provost / Theo Caminiti (Okapi Partners):

Email: info@okapipartners.com

Phone: (212) 297-0720

For Additional Information/Updates on UDF IV

Website: www.udfaccountability.com

Email: udfinvestors@nexpoint.com

Media Contacts

Lucy Bannon (NexPoint): lbannon@nexpoint.com

Paul Caminiti/Pamela Greene (Reevemark): nexpointteam@reevemark.com

NexPoint Investor Relations

Kristen Thomas: ir@nexpoint.com

![]() View original content:https://www.prnewswire.com/news-releases/nexpoint-comments-on-proposed-acquisition-of-udf-iv-by-ready-capital-302321644.html

View original content:https://www.prnewswire.com/news-releases/nexpoint-comments-on-proposed-acquisition-of-udf-iv-by-ready-capital-302321644.html

SOURCE NexPoint Advisors, L.P.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Salesforce Q3 Earnings: Revenue Beat, EPS Miss, Free Cash Flow Up 30%, AI Driving 'Groundbreaking Transformation' And More

Salesforce Inc CRM reported third-quarter financial results after the market close on Tuesday. Here’s a look at the key metrics from the quarter.

Q2 Earnings: Salesforce reported third-quarter revenue of $9.44 billion, beating the consensus estimate of $9.35 billion. The enterprise cloud solutions company reported adjusted earnings of $2.41 per share, missing analyst estimates of $2.44 per share, according to Benzinga Pro.

Total revenue was up 8% on a year-over-year basis. Operating margin came in at 20%, and non-GAAP operating margin was 33.1%. Cash flow from operations was up 29% year-over-year and free cash flow was up 30% year-over-year to $1.78 billion. The company ended the quarter with remaining performance obligations of $26.4 billion, up 10% year-over-year.

“We delivered another quarter of exceptional financial performance across revenue, margin, cash flow and cRPO,” said Marc Benioff, chair and CEO of Salesforce.

“Agentforce, our complete AI system for enterprises built into the Salesforce Platform, is at the heart of a groundbreaking transformation. The rise of autonomous AI agents is revolutionizing global labor, reshaping how industries operate and scale.”

Don’t Miss: ‘American Exceptionalism Trade’ Gains Steam As Dollar, S&P 500 Surge In Lockstep: Bank Of America

Salesforce said it repurchased $1.2 billion worth of its stock in the quarter and returned $400 million to shareholders in the form of dividend payments.

Guidance: Salesforce expects fourth-quarter revenue to be in the range of $9.9 billion to $10.1 billion. The company anticipates fourth-quarter adjusted earnings of $2.57 to $2.62 per share.

Salesforce sees full-year 2025 revenue of $37.8 billion to $38 billion. The company expects full-year adjusted earnings to be between $9.98 and $10.03 per share.

“With Agentforce, we’re not just witnessing the future — we’re leading it, unleashing a new era of digital labor for every business and every industry,” Benioff said.

Management will further discuss the quarter on a conference call with analysts and investors at 5 p.m. E.T.

CRM Price Action: Salesforce shares were up 7.72% in after-hours, trading at $357 at publication Tuesday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Okta Q3 Earnings: Revenue Beat, EPS Beat, Strong Guidance, Shares Surge

Okta Inc OKTA reported third-quarter financial results after the market close on Tuesday. Here’s a rundown of the report.

Q3 Earnings: Okta reported third-quarter revenue of $665 million, beating analyst estimates of $649.7 million. The cloud-native cybersecurity company reported adjusted earnings of 67 cents per share, beating analyst estimates of 58 cents per share, according to Benzinga Pro.

Total revenue and subscription revenue were both up 14% on a year-over-year basis. Remaining performance obligations totaled $3.66 billion at quarter’s end, up 19% year-over-year.

Net cash provided by operations was $159 million, up from $154 million in the prior year’s quarter. The company generated free cash flow of $154 million in the quarter, up from $150 million year-over-year. Okta ended the quarter with $2.25 billion in cash, cash equivalents and short-term investments.

“Our solid third-quarter results were underpinned by continued strong profitability and cash flow. The focused investments we’ve made in our partner ecosystem, the public sector vertical, and large customers are materializing in our business with each of these areas contributing meaningfully to top-line growth,” said Todd McKinnon, co-founder and CEO of Okta.

“Okta’s commitment to innovation and elevating identity security is resonating with customers of all sizes as they look to Okta to modernize their identity infrastructure.”

What’s Next: Okta sees fourth-quarter revenue in the range of $667 million to $669 million versus estimates of $650.64 million. The company anticipates fourth-quarter adjusted earnings of 73 to 74 cents per share versus estimates of 67 cents per share.

Okta expects full-year revenue to be in the range of $2.595 billion to $2.597 billion versus estimates of $2.563 billion. The company expects full-year adjusted earnings to be between $2.75 and $2.76 per share versus estimates of $2.61 per share.

Management will hold a conference call with analysts and investors at 5 p.m. ET to further discuss the company’s quarterly performance.

OKTA Price Action: Okta shares were up 19.31% in after-hours, trading at $97.49 at the time of publication, per Benzinga Pro.

Read Next:

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

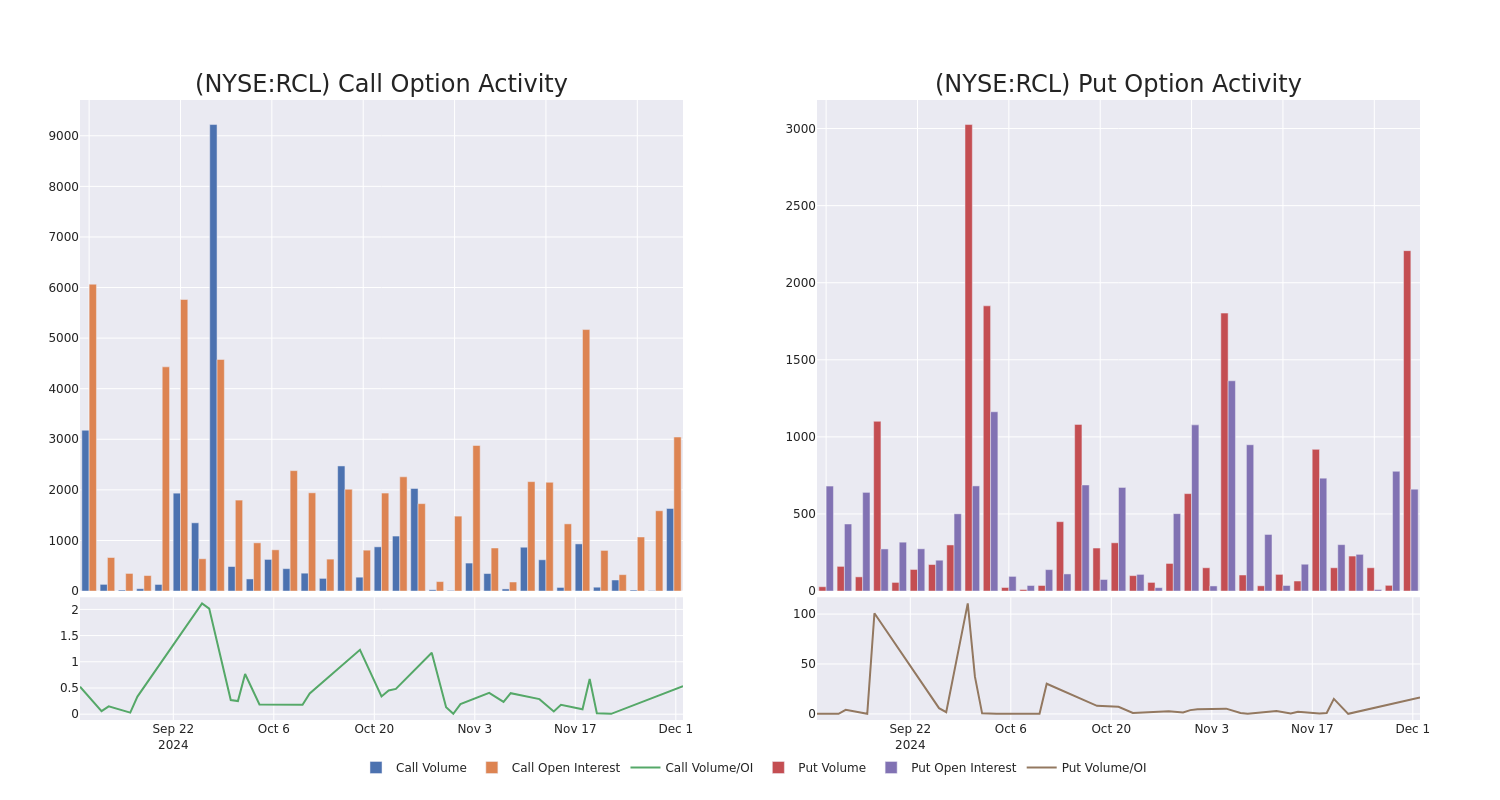

A Closer Look at Royal Caribbean Gr's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Royal Caribbean Gr.

Looking at options history for Royal Caribbean Gr RCL we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $338,561 and 12, calls, for a total amount of $1,659,416.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $330.0 for Royal Caribbean Gr over the recent three months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Royal Caribbean Gr’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Royal Caribbean Gr’s substantial trades, within a strike price spectrum from $150.0 to $330.0 over the preceding 30 days.

Royal Caribbean Gr Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCL | CALL | TRADE | NEUTRAL | 01/17/25 | $72.45 | $70.8 | $71.63 | $175.00 | $358.1K | 604 | 100 |

| RCL | CALL | SWEEP | BEARISH | 01/17/25 | $72.25 | $71.05 | $71.05 | $175.00 | $355.1K | 604 | 150 |

| RCL | CALL | TRADE | BULLISH | 01/17/25 | $70.55 | $70.0 | $70.55 | $175.00 | $352.7K | 604 | 50 |

| RCL | PUT | TRADE | BEARISH | 01/16/26 | $11.8 | $11.35 | $11.85 | $185.00 | $118.5K | 1 | 100 |

| RCL | PUT | TRADE | BULLISH | 01/17/25 | $7.45 | $7.25 | $7.25 | $240.00 | $110.2K | 573 | 154 |

About Royal Caribbean Gr

Royal Caribbean is the world’s second-largest cruise company, operating 68 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021.

In light of the recent options history for Royal Caribbean Gr, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Royal Caribbean Gr’s Current Market Status

- With a trading volume of 642,785, the price of RCL is up by 0.24%, reaching $247.0.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 58 days from now.

Professional Analyst Ratings for Royal Caribbean Gr

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $268.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Bernstein downgraded its action to Outperform with a price target of $290.

* An analyst from Truist Securities persists with their Buy rating on Royal Caribbean Gr, maintaining a target price of $272.

* Consistent in their evaluation, an analyst from Tigress Financial keeps a Buy rating on Royal Caribbean Gr with a target price of $270.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Royal Caribbean Gr, targeting a price of $240.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Royal Caribbean Gr with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.