Check Out What Whales Are Doing With ABBV

Financial giants have made a conspicuous bullish move on AbbVie. Our analysis of options history for AbbVie ABBV revealed 13 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $276,786, and 6 were calls, valued at $363,437.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $200.0 for AbbVie over the recent three months.

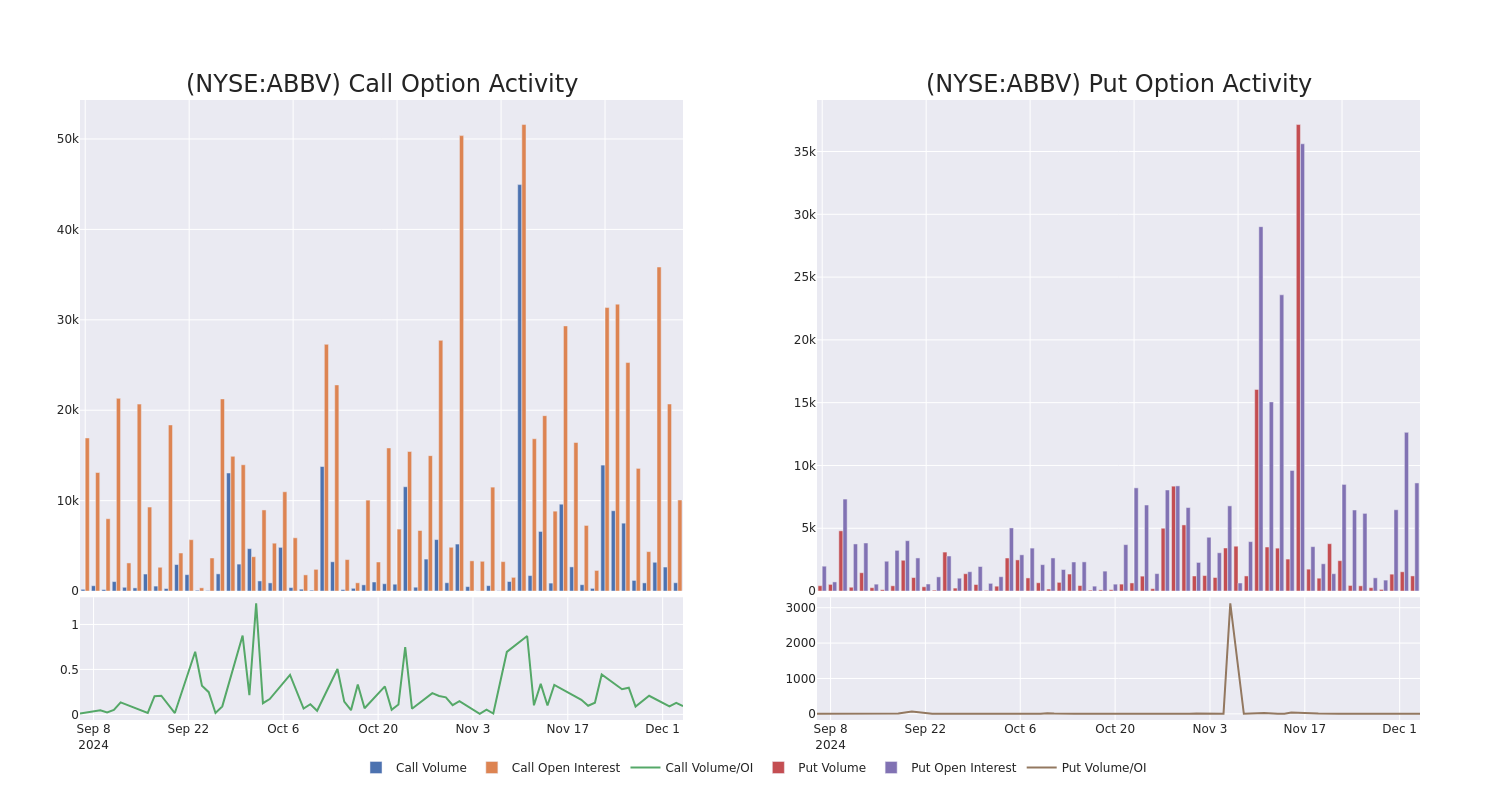

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for AbbVie’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AbbVie’s whale activity within a strike price range from $150.0 to $200.0 in the last 30 days.

AbbVie Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | CALL | TRADE | BULLISH | 01/17/25 | $20.05 | $19.6 | $19.87 | $160.00 | $135.1K | 2.9K | 71 |

| ABBV | CALL | TRADE | BULLISH | 08/15/25 | $24.55 | $24.3 | $24.55 | $160.00 | $68.7K | 43 | 28 |

| ABBV | CALL | SWEEP | BULLISH | 12/20/24 | $1.74 | $1.63 | $1.64 | $182.50 | $50.6K | 716 | 499 |

| ABBV | PUT | SWEEP | BEARISH | 06/20/25 | $9.6 | $9.4 | $9.6 | $175.00 | $48.0K | 1.3K | 67 |

| ABBV | PUT | SWEEP | BULLISH | 01/16/26 | $6.85 | $6.45 | $6.42 | $150.00 | $46.9K | 830 | 299 |

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

In light of the recent options history for AbbVie, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is AbbVie Standing Right Now?

- Trading volume stands at 2,777,110, with ABBV’s price down by -2.71%, positioned at $176.59.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 58 days.

What The Experts Say On AbbVie

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $212.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Showing optimism, an analyst from Leerink Partners upgrades its rating to Outperform with a revised price target of $206.

* Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on AbbVie with a target price of $208.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for AbbVie, targeting a price of $224.

* An analyst from Wolfe Research downgraded its action to Outperform with a price target of $205.

* An analyst from Guggenheim persists with their Buy rating on AbbVie, maintaining a target price of $221.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AbbVie with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply