Decoding Humana's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Humana. Our analysis of options history for Humana HUM revealed 13 unusual trades.

Delving into the details, we found 15% of traders were bullish, while 69% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $368,917, and 7 were calls, valued at $569,390.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $260.0 to $410.0 for Humana during the past quarter.

Analyzing Volume & Open Interest

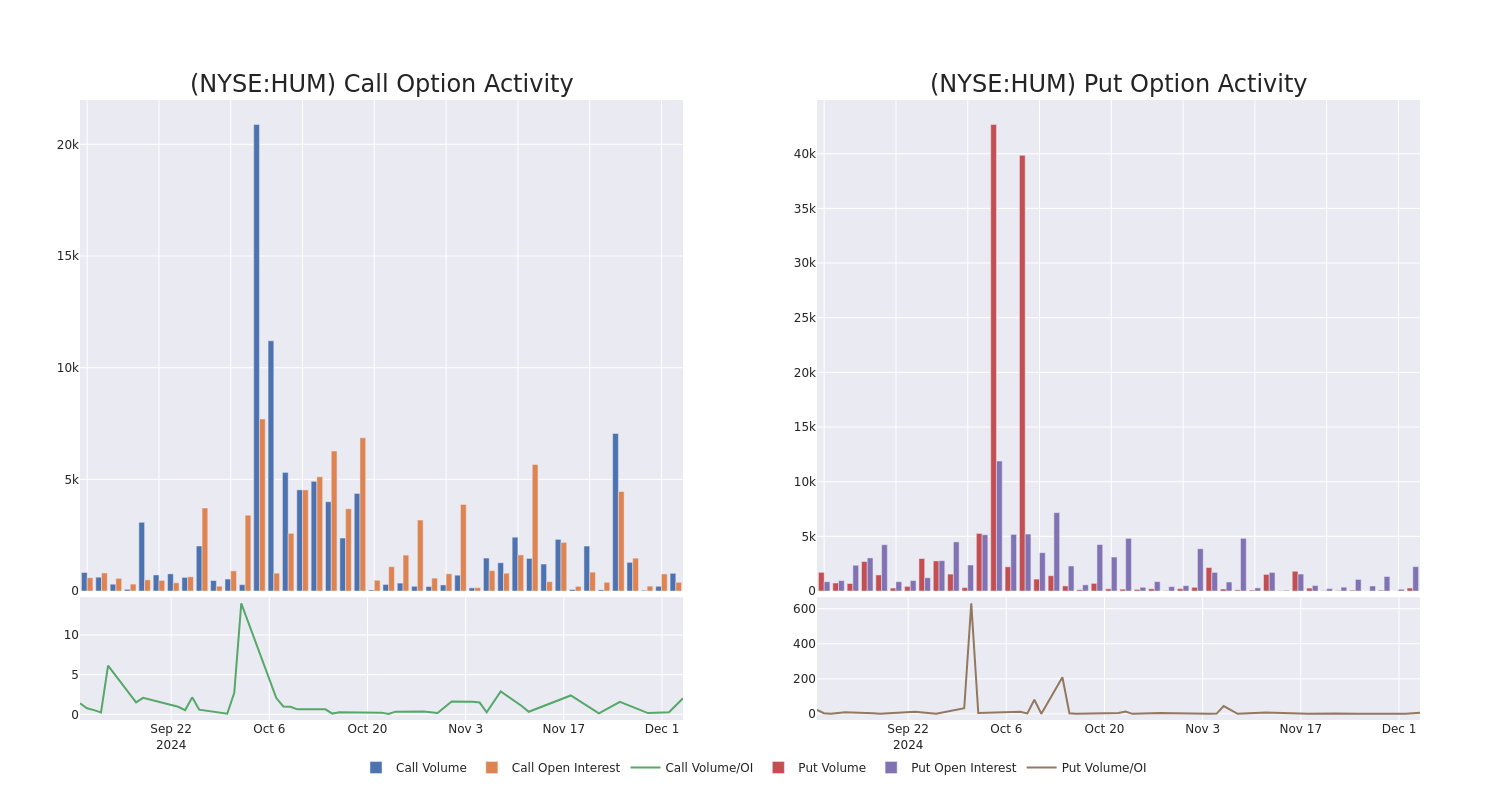

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Humana’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Humana’s whale trades within a strike price range from $260.0 to $410.0 in the last 30 days.

Humana Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUM | PUT | TRADE | NEUTRAL | 01/15/27 | $39.7 | $31.7 | $35.0 | $260.00 | $175.0K | 9 | 50 |

| HUM | CALL | TRADE | BEARISH | 01/17/25 | $9.5 | $8.5 | $8.7 | $305.00 | $173.9K | 42 | 201 |

| HUM | CALL | TRADE | BEARISH | 03/21/25 | $22.7 | $21.8 | $21.9 | $300.00 | $78.8K | 350 | 200 |

| HUM | CALL | TRADE | BEARISH | 03/21/25 | $22.9 | $21.8 | $22.0 | $300.00 | $74.8K | 350 | 163 |

| HUM | CALL | TRADE | BEARISH | 03/21/25 | $23.0 | $21.8 | $22.0 | $300.00 | $72.6K | 350 | 4 |

About Humana

Humana is one of the largest private health insurers in the us with a focus on administering Medicare Advantage plans. The firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from individual and group Medicare Advantage, Medicaid, and the military’s Tricare program. The firm is also a leader in stand-alone prescription drug plans for seniors enrolled in traditional fee-for-service Medicare. Beyond medical insurance, the company provides other healthcare services, including primary-care services, at-home services, and pharmacy benefit management.

After a thorough review of the options trading surrounding Humana, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Humana’s Current Market Status

- With a trading volume of 623,874, the price of HUM is down by -1.46%, reaching $286.87.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 50 days from now.

What The Experts Say On Humana

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $308.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a positive move, an analyst from B of A Securities has upgraded their rating to Neutral and adjusted the price target to $308.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Humana options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply