Looking At Altimmune's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Altimmune ALT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ALT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 13 extraordinary options activities for Altimmune. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 38% leaning bullish and 53% bearish. Among these notable options, 2 are puts, totaling $76,800, and 11 are calls, amounting to $506,795.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $15.0 for Altimmune over the recent three months.

Analyzing Volume & Open Interest

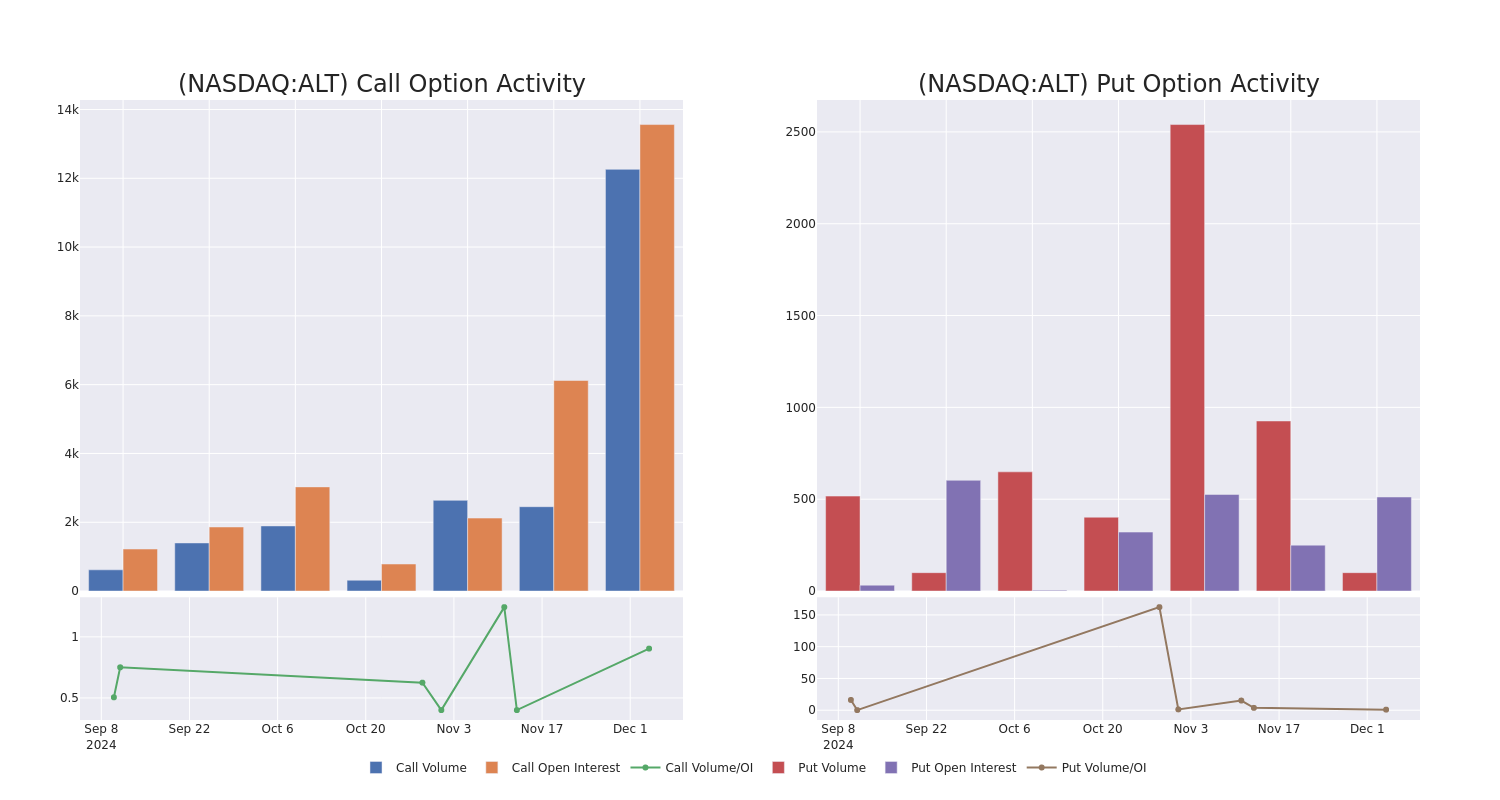

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Altimmune’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Altimmune’s whale activity within a strike price range from $5.0 to $15.0 in the last 30 days.

Altimmune Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALT | CALL | SWEEP | BEARISH | 12/27/24 | $3.6 | $3.4 | $3.4 | $7.00 | $102.0K | 315 | 307 |

| ALT | CALL | SWEEP | BULLISH | 01/15/27 | $7.4 | $7.2 | $7.25 | $5.00 | $72.4K | 335 | 100 |

| ALT | CALL | TRADE | BULLISH | 03/21/25 | $5.8 | $5.5 | $5.74 | $5.00 | $45.9K | 68 | 85 |

| ALT | CALL | TRADE | BULLISH | 03/21/25 | $2.15 | $2.0 | $2.15 | $11.00 | $43.0K | 355 | 201 |

| ALT | CALL | TRADE | BEARISH | 01/16/26 | $4.8 | $4.0 | $4.0 | $10.00 | $40.0K | 3.6K | 100 |

About Altimmune

Altimmune Inc is engaged in developing treatments for obesity and liver diseases. The Company’s pipeline includes next-generation peptide therapeutics for obesity and non-alcoholic steatohepatitis (NASH) (for both, pemvidutide, formerly known as ALT-801), and for chronic hepatitis B (HepTcell). The Company is managed and operates as a single business focused on the research and development of treatments for various diseases and disorders, and vaccines.

Following our analysis of the options activities associated with Altimmune, we pivot to a closer look at the company’s own performance.

Current Position of Altimmune

- With a volume of 8,911,145, the price of ALT is up 14.11% at $10.03.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 112 days.

Expert Opinions on Altimmune

2 market experts have recently issued ratings for this stock, with a consensus target price of $19.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from HC Wainwright & Co. lowers its rating to Buy with a new price target of $12.

* An analyst from UBS downgraded its action to Buy with a price target of $26.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Altimmune options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply