Macy's's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bullish on Macy’s M, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in M often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Macy’s. This is not a typical pattern.

The sentiment among these major traders is split, with 87% bullish and 12% bearish. Among all the options we identified, there was one put, amounting to $25,801, and 7 calls, totaling $299,906.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $20.0 for Macy’s over the recent three months.

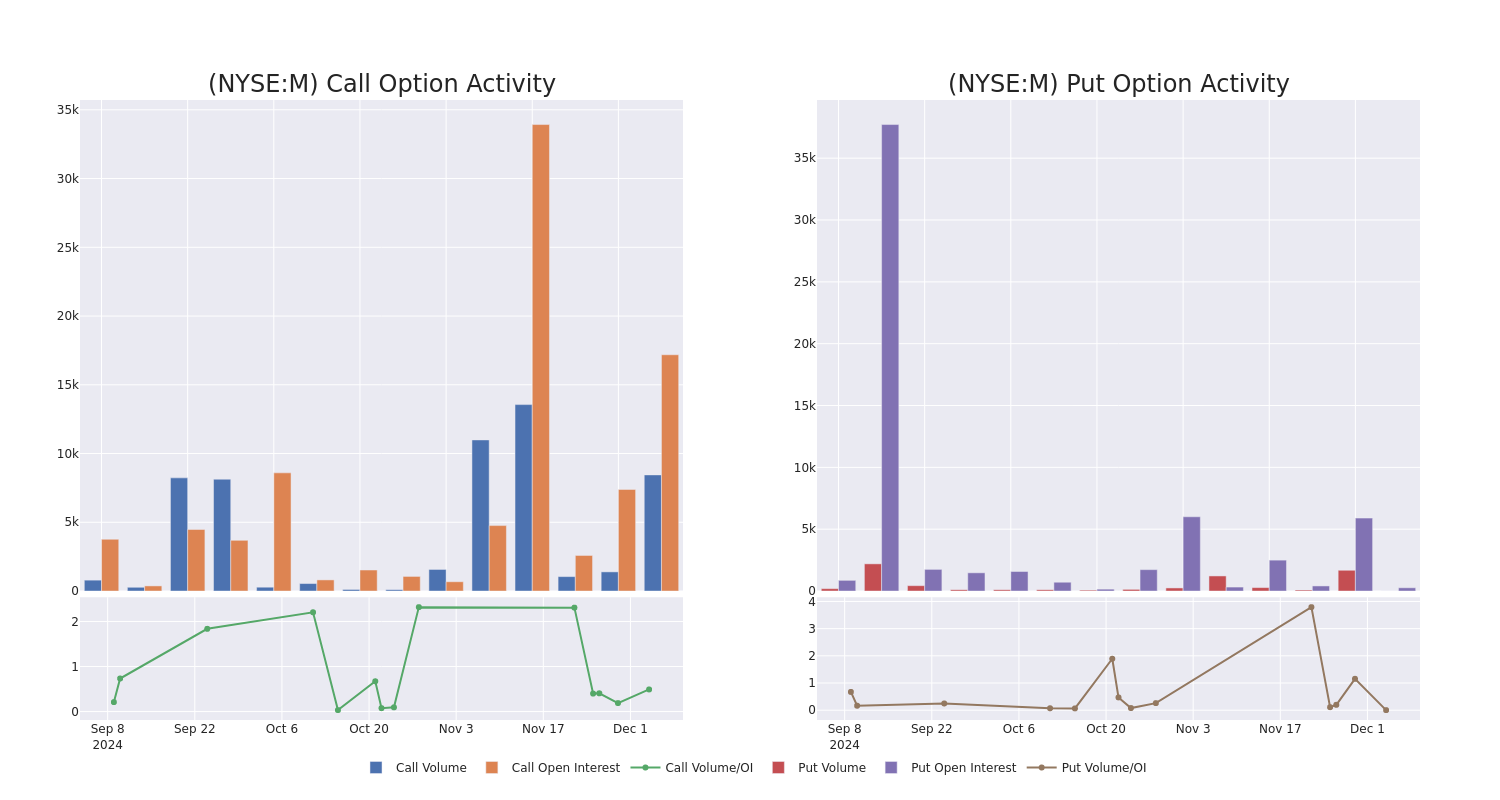

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Macy’s’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Macy’s’s whale activity within a strike price range from $15.0 to $20.0 in the last 30 days.

Macy’s Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M | CALL | SWEEP | BULLISH | 12/20/24 | $0.65 | $0.62 | $0.65 | $17.00 | $68.6K | 8.2K | 1.9K |

| M | CALL | SWEEP | BULLISH | 12/20/24 | $0.67 | $0.62 | $0.67 | $17.00 | $65.2K | 8.2K | 2.8K |

| M | CALL | SWEEP | BULLISH | 12/20/24 | $0.62 | $0.58 | $0.62 | $17.00 | $38.5K | 8.2K | 859 |

| M | CALL | TRADE | BULLISH | 12/27/24 | $0.7 | $0.65 | $0.69 | $17.00 | $34.5K | 338 | 545 |

| M | CALL | SWEEP | BULLISH | 12/27/24 | $0.68 | $0.67 | $0.68 | $17.00 | $34.0K | 338 | 1.0K |

About Macy’s

Founded in 1858 and based in New York City, Macy’s operates about 500 stores under the Macy’s nameplate, nearly 60 stores under the Bloomingdale’s (full-price and outlet) and Bloomie’s nameplates, and 157 freestanding Bluemercury specialty beauty stores. Macy’s also operates e-commerce sites and licenses Bloomingdale’s stores in the United Arab Emirates and Kuwait. Women’s apparel, accessories, shoes, cosmetics, and fragrances composed 62% of Macy’s 2023 sales.

Having examined the options trading patterns of Macy’s, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Macy’s

- With a trading volume of 1,944,065, the price of M is down by -0.15%, reaching $16.45.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 83 days from now.

What Analysts Are Saying About Macy’s

1 market experts have recently issued ratings for this stock, with a consensus target price of $17.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Telsey Advisory Group keeps a Market Perform rating on Macy’s with a target price of $17.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Macy’s options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply