New Fortress Energy's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on New Fortress Energy. Our analysis of options history for New Fortress Energy NFE revealed 13 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $195,375, and 9 were calls, valued at $398,025.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.0 to $12.0 for New Fortress Energy during the past quarter.

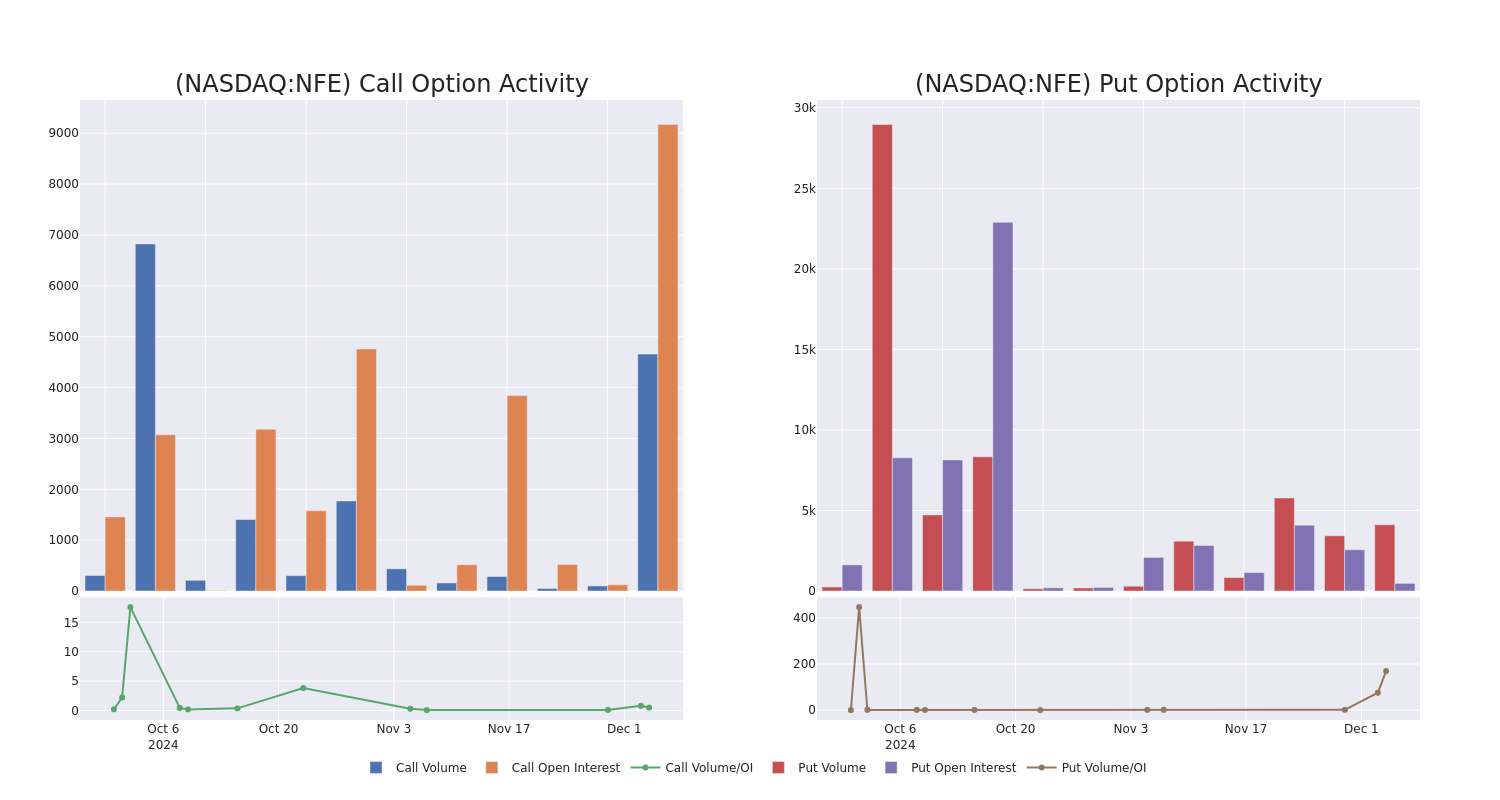

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for New Fortress Energy’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across New Fortress Energy’s significant trades, within a strike price range of $7.0 to $12.0, over the past month.

New Fortress Energy 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFE | PUT | SWEEP | BEARISH | 12/13/24 | $0.25 | $0.2 | $0.25 | $10.50 | $82.8K | 20 | 3.3K |

| NFE | CALL | SWEEP | BULLISH | 03/21/25 | $3.3 | $3.0 | $3.3 | $9.00 | $66.0K | 863 | 225 |

| NFE | CALL | TRADE | BEARISH | 03/21/25 | $3.2 | $3.1 | $3.1 | $9.00 | $62.0K | 863 | 625 |

| NFE | CALL | TRADE | BULLISH | 03/21/25 | $1.8 | $1.55 | $1.75 | $12.00 | $61.2K | 1.2K | 391 |

| NFE | CALL | SWEEP | NEUTRAL | 01/17/25 | $0.95 | $0.8 | $0.81 | $12.00 | $52.3K | 3.8K | 1.0K |

About New Fortress Energy

New Fortress Energy is an integrated gas-to-power company. Its business model spans the entire production and delivery chain from natural gas procurement and liquefaction to logistics, shipping, terminals, and conversion or development of a natural gas-fired generation. It has invested in floating, liquefied natural gas vessels to both lower the cost of acquiring gas while securing a long-term supply for its terminals. Its segments include terminals and infrastructure, or T&I, and ships.

Following our analysis of the options activities associated with New Fortress Energy, we pivot to a closer look at the company’s own performance.

Present Market Standing of New Fortress Energy

- Trading volume stands at 5,978,715, with NFE’s price up by 8.58%, positioned at $11.46.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 85 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for New Fortress Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply