Why Super Micro Computer Stock Crashed 28.6% This Week

Super Micro Computer (NASDAQ: SMCI) stock got hit hard over the last week of trading. The company’s share price ended the period down 28.6% from last Friday’s market close, according to data from S&P Global Market Intelligence.

On Tuesday, Hindenburg Research published bearish coverage and alleged that Supermicro was a serial offender when it came to bad accounting practices. The short-seller also raised other concerns about the strength of the business. Just one day later, the server specialist announced that it was delaying the filing of its annual 10-K report with the Securities and Exchange Commission (SEC).

Supermicro’s filing delay added weight to Hindenburg’s report

With its short note, Hindenburg stated that it had found evidence of new accounting manipulations by Supermicro. The report highlighted $983.1 million in payments made over the last three years to private companies owned by brothers of Supermicro CEO Charles Liang as being suspicious. The company previously had significant accounting scandals in 2018 and 2020.

Hindenburg also said that it believed the server specialist was guilty of evading sanctions imposed by the U.S. government. Supermicro’s high-performance rack servers use advanced processors from Nvidia that are prohibited from being exported to China, and reports have suggested that the server company has continued to sell these technologies to Chinese customers.

Just one day after Hindenburg’s report was published, Supermicro said it was delaying its 10-K filing to complete an assessment of the design and operating effectiveness of its internal controls over financial reporting. The company did not provide a timing window as to when the 10-K filing might be submitted.

Wall Street doesn’t like Supermicro’s uncertain outlook

In a note published Wednesday, Wells Fargo maintained an equal-weight rating on Supermicro but lowered its price target on the stock from $650 per share to $375 per share. The firm’s analysts cited uncertainty about the company’s revenue picture and previous history with accounting problems as reasons for the target cut.

The next day, Bank of America (BofA) lifted its rating on Supermicro and shifted its status on the stock to under review. Citing the review of the company’s financials and internal oversight processes, BofA’s analysts said that they were unable to get a read on Supermicro’s fundamentals.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

Why Super Micro Computer Stock Crashed 28.6% This Week was originally published by The Motley Fool

What the gap between retirement expectations and reality tells us

How much money Americans think they need for retirement and what retirees say they can live on are miles apart.

For many folks who are still on the job, the future looks bleak. But check in with retirees, and it turns out, things aren’t so bad. Several recent reports illustrate this duality.

Let’s start with the hand-wringing pre-retirees.

Americans with employer-provided retirement plans estimate that they will need $1.2 million to retire comfortably, according to a survey from investment manager Schroders. Nearly half expect to have less than $500,000.

Another study found that only 1 in 5 middle-class people are very confident in their ability to fully retire or maintain a comfortable lifestyle throughout their retirement.

So the pre-retirement panic is real.

Post-retirement? Eight in 10 retirees ages 65 through 80 say they have enough money to live comfortably, a new Gallup poll found.

“It’s a matter of the unknown,” Craig Copeland, director of Wealth Benefits Research at EBRI, told Yahoo Finance. “People don’t know what to expect, don’t know how much they have, and don’t know how they’ll be able to live. When they actually retire, they adapt.”

Take a short survey and get matched with a vetted financial adviser

Retirement concerns are ‘terrifying’

About a quarter of non-retired folks say not having a regular paycheck is “terrifying,” Schroders found.

“The transition from retirement savings accumulation to the decumulation phase is not an easy one to make,” Deb Boyden, Schroders’s head of US defined contribution, told Yahoo Finance.

Asked to forecast how much monthly income they would need to live comfortably, workers said $4,947 on average, which is higher than the $4,258 of monthly income today’s retirees report they live on just fine.

Meanwhile, these worried pre-retirees are planning to start Social Security benefits before age 67 — the full retirement age for everyone born in 1960 or later. Just 1 in 10 plan to wait until at least 70 — the age you hit your monthly maximum benefit for the rest of your life.

It’s not that they aren’t hip to the upside of delaying their checks. But they don’t care for these reasons: They’ll need the money and want it as soon as possible, and they’re worried Social Security will go kaput.

“Americans will pay a high price for taking their Social Security benefits early,” Boyden said. “The money generated by Social Security is the most reliable source of income for many retirees, and yet few maximize these payments.”

With so many Americans behind on retirement savings, waiting to collect Social Security benefits can have a significant impact on their quality of life once they’ve left the workforce, she said.

Read more: What is the retirement age for Social Security, 401(k), and IRA withdrawals?

Many retirees have enough money to live comfortably

The retirement reality versus expectations gap has been consistent across the 23 years Gallup has tracked views on retirement in its surveys.

“This generally positive picture of retirement contrasts with the more negative expectations among those who have yet to retire,” according to the report’s authors Frank Newport and Jeffrey M. Jones.

There are all kinds of reasons for better outcomes in retirement. The cost of living can turn out to be far less onerous due to lower healthcare bills thanks to Medicare enrollment, or cheaper housing costs if you move to a smaller home or relocate to a more affordable part of the country.

In this year’s survey by the Employee Benefit Research Institute (EBRI) and Greenwald Research, nearly 4 in 5 retirees agree they are able to spend money how they want, and even more believe they are having the retirement lifestyle they envisioned.

Not only are retirees managing their current expenses, but also more than half say they are still saving for the future, Copeland said.

There are some important contributing factors. Namely, planning ahead.

Those who have thought about when they would claim Social Security and how that would impact their benefit amount, estimated how much income they would need, planned for how they would cover an emergency, and considered how many years they would spend in retirement have a leg up, according to the EBRI research.

“They’ve faced the big scary questions and realized they weren’t so bad,” Justin Samples, a wealth adviser at Ameriprise Financial, told Yahoo Finance.

Many retirees are also better prepared than they might realize, Samples said.

“For most people, getting their arms around what it takes to fund their current lifestyle is the first step to gain a realistic understanding of what they will need in the future.”

Then, periodic reviews and rebalancing of asset allocations can keep you on track when markets gyrate. Finally, seeking advice from a professional can cool the anxiety that comes with preparing for retirement. It certainly has for me.

“It’s also important to note many retirees have lived through multiple once-in-a-lifetime events, this century alone,” Samples said. “If as a retiree you’ve lived through a global financial crisis and a global pandemic and are still able to make ends meet, you’re likely to be fairly optimistic about your ability to handle what comes in the future.”

Read more: Retirement planning: A step-by-step guide

Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist, and the author of 14 books, including “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Get Rich.” Follow her on X @kerryhannon.

Read the latest financial and business news from Yahoo Finance

3 Dividend Stocks to Buy Now and Hold Forever

It can be comforting to hold stocks of strong companies that regularly pay passive income to shareholders. By selecting the right dividend stocks, an investor can easily put together a portfolio that yields around 3% every year in dividend income. If the companies you select grow their earnings, they’ll also boost the dividend payment and the yield on your original investment.

To get you started, three Motley Fool contributors were asked to come up with their best stock picks that can pay you passive income for the rest of your life. Here’s why they selected Coca-Cola (NYSE: KO), Philip Morris International (NYSE: PM), and Home Depot (NYSE: HD).

Invest in Warren Buffett’s favorite

John Ballard (Coca-Cola): Investing in companies with strong competitive advantages can protect and grow your money over decades. Coca-Cola’s global brand power and high annual sales volume would certainly fit the bill. They’re why Warren Buffett has held a large position in the stock for over 30 years.

People consume 2.2 billion servings of Coke products every day or about 800 billion servings annually. This includes the 200-plus brands it owns, including Fanta, Sprite, Minute Maid juices, Dasani water, Costa Coffee, Fuze Tea, Powerade, and Simply. A large product portfolio provides many avenues to drive sales.

All those servings generated $10 billion in profit on $46 billion of revenue over the last four quarters. The company paid out three-quarters of its earnings in dividends over the last year, or $0.485 per share, bringing the forward dividend yield to 2.71%.

Coca-Cola has increased its dividend for 62 consecutive years and increased the quarterly payment by 5% earlier this year. Management continues to wisely allocate capital and remove costs from operations to boost margins, all of which go toward supporting growing earnings and dividends to shareholders.

Investors have rewarded the company for its ability to continue growing earnings at double-digit rates despite a challenging retail environment. Wall Street analysts expect the company’s adjusted earnings to be up 14% this year. That’s why the stock is hitting new highs, but its above-average dividend yield suggests the shares are still reasonably priced for new investors to start a position.

A transformative tobacco stock

Jeremy Bowman (Philip Morris International): PMI might seem like an odd recommendation for a dividend stock to buy and hold forever. After all, smoking rates have been declining for generations. But that hasn’t stopped PMI, which operates in international markets in which smoking rates are higher than in the U.S., from continuing to grow and deliver strong results.

In fact, this is much more than a traditional tobacco company today. Roughly 40% of its revenue comes from next-gen, smoke-free products like its iQOS heat-not-burn devices and Zyn chewable nicotine pouches, which it gained through its acquisition of Swedish Match in 2023.

Now, Philip Morris International is playing offense. For instance:

-

The company recently acquired the rights to sell iQOS in the U.S. from Altria and is ramping up plans for a launch of the product later this year.

-

Similarly, the company also just announced that it was investing $232 million to expand a Zyn production plant in Kentucky.

-

Last month, it said it would spend $600 million to build a Zyn facility in Colorado.

PMI’s recent numbers also show the company is delivering strong growth for a dividend stock. Organic revenue was up 9.6% year over year in the second quarter to $9.5 billion. Revenue growth from its smoke-free business was even stronger at 18.3%, while combustibles grew by a respectable 4.8%. Adjusted earnings per share also jumped 11% to $1.77.

As a dividend payer, PMI currently offers a yield of 4.3%, which should keep investors happy, especially considering the strong growth in the business. Considering its mix of growth and yield, Philip Morris International deserves a place in any dividend investor’s portfolio.

A market-beating stock with an excellent dividend

Jennifer Saibil (Home Depot): Home Depot is a market-beating stock that also pays a growing dividend with an attractive yield. In other words, it’s an excellent dividend stock.

This isn’t the best time for Home Depot. Customers are switching down to cheaper products all over retail, and Home Depot’s larger and more expensive products aren’t essentials that customers are going to binge on right now. The company is being further pressured by a real estate industry that’s still underwater.

But Home Depot is the largest home improvement chain in the world, and it’s become the leader in the industry by offering a great experience for shoppers with an omnichannel focus. Comparable sales were down 3.3% from last year in the 2024 fiscal second quarter (ended July 28), but total sales were up a little bit (0.6%).

Management isn’t expecting any magic right now. It’s doing what it does best: giving customers what they need and waiting out the inflationary environment while strengthening the business’s position. It’s still expecting a decline in comparable sales and a lower operating margin for the full year.

In the meantime, it pays a top dividend. Home Depot has paid a dividend for close to 40 years, and it has increased the payout by more than 4,500% since it started. The dividend has added tremendous value to the stock price. Even without the dividend, shareholders would have beaten the market over the past 10 years, but with the dividend, the gain moves from 306% to 412%.

Home Depot stock is trailing the market this year, but it’s up 8%. Its business should easily rebound under better macroeconomic conditions, and it should get back to beating the market over the long term. It’s highly profitable, with $4.60 in earnings per share (EPS) in the second quarter and $4.7 billion in free cash flow, plenty to fund the dividend.

At the current price, Home Depot’s dividend yields 2.3%. The company has paid it under all sorts of circumstances, and shareholders can benefit from market-beating potential and passive income.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jennifer Saibil has no position in any of the stocks mentioned. Jeremy Bowman has no position in any of the stocks mentioned. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

3 Dividend Stocks to Buy Now and Hold Forever was originally published by The Motley Fool

A slew of retail names this week offered repeat warnings about 'cash-strapped' US consumers

In late August, Walmart (WMT) offered investors worried about the health of the US consumer a lifeline. Its CFO, John David Rainey, told investors Walmart’s customers were being “choiceful,” but when asked about signs of a broader slowdown, Rainey added: “We’re not seeing it.”

Results this week from a slew of big retail names, however, make the situation for the US consumer appear much more uncertain.

Retail names ranging from Dollar General (DG) and Lululemon (LULU) to Abercrombie & Fitch (ANF) and Ulta Beauty (ULTA) received a mixed reaction this week after making cautious comments about the overall spending environment and the potential impacts on their business.

Dollar General stock was judged most harshly, falling 32%, the most on record, after the discount retailer cut its full-year outlook, blaming softer sales on a financially strapped core customer.

CEO Todd Vasos highlighted the last week of each of the calendar months in the quarter as “the weakest by far,” with customers leaning into a mix of the 2,000 items still priced at $1 or below.

“All those points would indicate that this is a cash-strapped consumer, even more than we saw in Q1,” Vasos told analysts during the company’s earnings call on Thursday. Dollar General noted consumers gravitated more toward consumable goods and less toward home goods and seasonal items.

The latest retail sales data showed a rise of 1% in July, above Wall Street’s expectations for 0.4% growth.

But a look under the hood showed less optimistic signs, according to Forrester Research retail analyst Sucharita Kodali.

“Consumer spending is essentially in line and in some categories below the rates of inflation. So that means that even though the numbers may be positive, the consumer is really, really softening,” Kodali said in a recent interview with Yahoo Finance.

The data, which isn’t inflation-adjusted, showed a 0.1% monthly drop in spending at clothing stores; department stores saw sales fall 0.2%.

Kodali, like other analysts have pointed to giant stores like Walmart, which has been increasing its market share across a variety of classes.

“Lower income consumers are continuing to take out debt, they are the most stretched and they are likely driving some of these Walmart numbers,” said the analyst. “Walmart’s growth I would argue is probably coming at the expense of other retailers.”

However even brands that target a higher-income consumer making discretionary purchases, like Ulta Beauty, pointed to a more money-conscious shopper as part of the reason for a miss on the company’s top and bottom lines.

“Consumer behavior is starting to shift as consumers increasingly focus on value and become more cautious with their spending,” said CEO Dave Kimbell during the company earnings call.

Kimbell went on to call out greater competition within the high-margin makeup industry as an added challenge to the business.

“Today, there are significantly more places to buy beauty, especially prestige beauty, with more than 1,000 new points of distribution opened in the last three years. As a result, our market share continues to be challenged, particularly within prestige beauty,” said Kimbell.

Between consumers being more choosy and increased competition, there’s little room for error for retailers.

Lululemon noted its US women’s business slowed amid a lack of “newness,” or seasonal updates within styles typically expressed as color, print, and patterns.

“It’s become clear to us that this reduced newness, which is below our historical levels and stems from earlier product decisions, has impacted conversion rates given the fewer new options available to our female guests,” CEO Calvin McDonald said during the company’s earnings call.

“The newness that we had performed well — we simply did not have enough to inspire her to purchase.” said McDonald.

Even following a strong quarter at Abercrombie and Fitch, its CEO Fran Horowitz warned of the economic backdrop during the company’s earnings call.

“In addition to record second quarter sales, this is our seventh consecutive quarter of net sales growth in a dynamic, often uncertain, consumer environment which underlies the strength of our brands,” said Horowitz.

Abercrombie’s stock sold off 14% following the results, though the stock has been one of the S&P 500’s best performers over the last year.

“We think investors might be a little bit scared that this could be peak growth for [Abercrombie],” CFRA analyst Zachary Warring told Yahoo Finance.

“It was a great quarter. We think they’re the best-performing apparel brand in the US right now.”

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Forget AMD: 2 Tech Stocks to Buy Instead

Advanced Micro Devices (NASDAQ: AMD) has a potent role in tech, supplying its chips to companies across the industry. Its hardware powers everything, from video game consoles to cloud platforms, consumer-built personal computers, laptops, and AI models. As a result, AMD formed lucrative partnerships with companies like Microsoft (NASDAQ: MSFT), Sony, and Meta Platforms.

AMD’s success over the years saw its revenue and operating income increase by 224% and 45%, relatively, since 2019. Meanwhile, its stock climbed by 384% in the last five years. The company boasts a long growth history and has a solid outlook as it expands into high-growth sectors like AI.

However, a rally over the last year and a business that has only recently begun seeing returns on its significant investment in AI means its stock isn’t exactly a bargain.

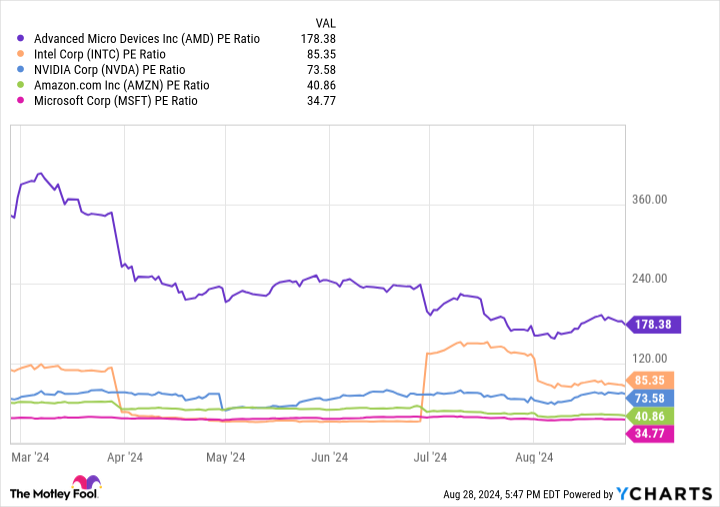

When you consider the price-to-earnings (P/E) ratios of some of the most prominent names in AI, including three chipmakers and two leading cloud providers, AMD has the highest P/E among these companies, indicating its stock offers the least value.

AMD’s P/E might prove inconsequential over the long term, as the company’s stock will likely continue rising as the tech industry expands. However, for anyone looking for bargains, it might be best to avoid AMD for now.

So, forget AMD this month and consider buying these two tech stocks instead.

1. Nvidia

Nvidia (NASDAQ: NVDA) isn’t a screaming value with a P/E of 74. However, its stock remains a compelling option with a lower P/E than its rivals, AMD and Intel, and a majority market share in AI.

Chip stocks are one of the best ways to invest in tech, with their hardware crucial to the industry’s development. Advances in chip technology bolstered countless markets over the last decade, encouraging innovation in cloud computing, virtual/augmented reality, data centers, consumer tech, gaming, and more. As a result, chip demand has skyrocketed in recent years.

As leading chipmakers, Nvidia and AMD enjoyed solid gains over the last half-decade thanks to increased chip sales. While both companies have delivered stellar growth, it’s hard to ignore how much higher Nvidia’s earnings and share price have risen compared to AMD’s. Nvidia’s has also proven to be more reliable, with its earnings and stock steadily trending up, while AMD experienced more volatility.

Nvidia’s success is mainly due to its dominance in graphics processing units (GPUs), which are high-performance chips capable of completing multiple tasks simultaneously. GPUs are critical for training AI models and powering data centers. Consequently, the AI chip market is projected to hit $71 billion this year, with Nvidia’s hardware accounting for an estimated 90% of the industry.

Nvidia has a solid role in tech, and its business will likely continue expanding as demand for its chips rises. This year, the company reached $39 billion in free cash flow, significantly outperforming AMD’s just over $1 billion. Nvidia has the financial resources to continue investing in AI and maintain its lead. Meanwhile, its better-valued stock makes it a no-brainer right now.

2. Microsoft

When investing in tech, it’s a good idea to diversify your holdings in software and hardware. While Nvidia is an excellent option for securing a position in the hardware side of the industry, Microsoft has years of experience dominating software. Home-grown products like Windows, Office, Xbox, Azure, and LinkedIn have helped the company build a massive user base and a powerful role in tech.

Since 2019, Microsoft delivered less earnings and share price growth than AMD. However, like Nvidia, Microsoft has been far more consistent, making it a less risky investment. As a result, the company’s stock is potentially a better long-term hold.

Microsoft’s reliability is mainly due to its thoroughly diverse business model. The company has leading positions in multiple tech areas, from productivity software to operating systems, video games, social media, cloud computing, and digital advertising.

Moreover, Microsoft is never still for long, consistently reinvesting in its business and seeking out new growth markets. The company’s commitment to innovation saw it become an early investor in AI, sinking $1 billion into ChatGPT developer OpenAI in 2019. That figure has since risen to about $13 billion, with the powerful partnership giving Microsoft access to some of the most advanced AI software.

Meanwhile, Microsoft has already begun seeing earnings boosts from AI, thanks to recently launched AI solutions on its cloud platform, Azure, and paid-for features in Office. In fiscal 2024 (ending in June), Microsoft’s revenue increased by 16% year over year, while operating income soared 24%. The period benefited from a 20% rise in cloud sales and a 12% increase in its productivity and business processes segment, with both divisions expanding their AI offerings.

Microsoft’s diverse business provides it with countless ways to monetize its AI venture. Alongside $74 billion in free cash flow and a better-valued stock, it’s worth picking up Microsoft over AMD this August.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Forget AMD: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool

3 No-Brainer Stocks to Buy in September

Don’t want to think too hard about your investing decisions? Then go with the stocks of highly profitable companies with strong growth prospects.

Three Motley Fool contributors identified several stocks that fit this description. Here’s why they think Eli Lilly (NYSE: LLY), Novo Nordisk (NYSE: NVO), and Vertex Pharmaceuticals (NASDAQ: VRTX) are no-brainer healthcare stocks to buy in September.

The growth machine that never runs out of opportunities

David Jagielski (Eli Lilly): Eli Lilly continually gives investors reason to become even more bullish on its already plentiful growth opportunities. Right now, it’s all about the growing upside and potential for tirzepatide — the active ingredient in its type 2 diabetes and weight loss drugs, Mounjaro and Zepbound.

On Aug. 20, Eli Lilly released the results of a phase 3 study involving tirzepatide which further highlights just what kind of a game changer the drug could be for the healthcare industry. In the 176-week study, participants who were prediabetic and who were overweight or obese were able to reduce their risk of developing type 2 diabetes by 94% as a result of weekly tirzepatide injections.

That’s a huge risk reduction that could lead to even greater demand for Mounjaro, which is now Eli Lilly’s top-selling blockbuster drug. Last quarter (which ended June 30), its revenue topped $3.1 billion and more than tripled from the $980 million it generated in the prior-year period.

Eli Lilly is still in the early innings of not just rolling out Zepbound and Mounjaro to patients but also in studying the drug’s possible wide-ranging benefits. And as those indications start to pile up, doctors could see plenty more reasons to prescribe the drug. While weight loss may be the most popular reason for patients to want to try it, reducing the risk of diabetes, heart failure, sleep apnea, and many other obesity-related issues could be what leads to greater insurance coverage for tirzepatide, and unlocks many more growth opportunities for Eli Lilly.

The stock possesses loads of potential and is an absolute no-brainer buy as its sales and profits are likely to continue to soar for years to come.

It’s not too late to jump on the bandwagon

Prosper Junior Bakiny (Novo Nordisk): One of the challenges of investing in stocks is knowing when to buy a company’s shares. Investors are supposed to “buy low,” but does it ever make sense to buy a stock after it’s soared? It does. When a stock has solid prospects and looks likely to continue beating the market, any point can be considered “low.” Novo Nordisk is still on what looks like an unstoppable growth path.

Sales for the company’s two main growth drivers, Ozempic (type 2 diabetes) and Wegovy (weight), have risen rapidly. Novo Nordisk aims to earn various label expansions for both drugs that will increase their sales. These successes aren’t a fluke. Novo Nordisk has been a leader in the diabetes drug market for about 100 years. It is a pioneer in the GLP-1 receptor agonist space that is now driving the fast-growing weight loss market. While plenty of companies want to challenge Novo Nordisk, most are falling short.

The company boasts one of the most promising GLP-1 medicines in development: Cagrisema, which could generate $20.2 billion in revenue by 2030, according to some estimates. Cagrisema, which is currently in late-stage testing, is by no means the only promising product in Novo Nordisk’s pipeline. It features several other candidates targeting weight loss and other areas. Novo Nordisk’s plan to diversify its lineup is slowly taking shape as the company is developing drugs across various other diseases. The drugmaker’s portfolio should look different and much more diverse in five years.

One thing that won’t change is the company’s ability to generate strong revenue, earnings, and superior stock market performances. Novo Nordisk remains a no-brainer for healthcare investors.

Six reasons to buy this biotech stock

Keith Speights (Vertex Pharmaceuticals): Currently, Vertex Pharmaceuticals has one blockbuster drug in its lineup — Trikafta/Kaftrio. The cystic fibrosis (CF) therapy is a massive winner that’s on pace to rake in over $10 billion in sales this year. However, Trikafta/Kaftrio isn’t the main reason to buy this biotech stock. There are six other reasons.

First on the list is Casgevy. It’s the first CRISPR gene-editing therapy on the market. Casgevy doesn’t just treat sickle cell disease and transfusion-dependent beta-thalassemia, it cures the two rare blood disorders. Unsurprisingly, Vertex thinks the product has a multibillion-dollar opportunity.

The company awaits regulatory approvals for the second and third reasons to buy the stock. The U.S. Food and Drug Administration (FDA) set a PDUFA date of Jan. 2, 2025, to make an approval decision on Vertex’s newest CF therapy, a triple-drug combination featuring vanzacaftor. And the FDA expects to announce its approval decision for suzetrigine in treating acute pain on Jan. 30, 2025. Both drugs will likely be blockbusters if approved (which seems likely).

Reasons four and five require a little more waiting. Vertex is evaluating two other drugs in pivotal clinical studies. Inaxaplin targets APOL1-mediated kidney disease, which affects around 100,000 people (roughly 8,000 more than CF). Meanwhile, povetacicept is a “pipeline-in-a-product” targeting autoimmune kidney diseases.

What’s the sixth reason to buy Vertex? Its earlier-stage pipeline. The biggest game changers to watch out for are VX-880 and VX-264. Both are islet cell therapies that hold the potential to cure type 1 diabetes.

Vertex doesn’t need all of these programs to succeed to grow much larger over the next decade. However, I suspect that most of them will and I think the stock is absolutely a buy.

Should you invest $1,000 in Vertex Pharmaceuticals right now?

Before you buy stock in Vertex Pharmaceuticals, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vertex Pharmaceuticals wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

David Jagielski has no position in any of the stocks mentioned. Keith Speights has positions in Vertex Pharmaceuticals. Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Vertex Pharmaceuticals. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

3 No-Brainer Stocks to Buy in September was originally published by The Motley Fool

In Our 50s With $1 Million in 401(ks): Should We Switch to Roth Contributions Before Retiring?

Should you make 401(k) or Roth IRA contributions?

In a perfect world, the answer would be both. If you have the means, maximizing your traditional 401(k) and Roth contributions is a great way to build a diversified set of retirement savings. But, of course, your paycheck gets a vote. So, if you have to choose, should you switch from contributing to a 401(k) to Roth 401(k) or Roth IRA contributions? The answer is… it depends on a lot of factors.

Do you have questions about retirement planning? Speak with a financial advisor today.

Age and Taxes Are the Most Important Factors

“The Roth IRA is the closest thing to a free lunch from Congress — the gift that actually keeps giving over the long term. But that’s why the earlier one takes advantage of it, the better,” said Vijay Marolia, a managing partner at Regal Point Capital.

Alongside tax rates, age is a critical issue when considering whether to switch to a post-tax account. The younger you are, the longer this account will grow, and that can be even more impactful given you pay taxes on the contributions and not returns.

Here, in your 50’s, you’re on the bubble. You’re not in the near-unambiguous range of, say, a 25-year-old investor, but you still have some saving years left. The difference will come down to growth and taxes.

“Given your combined $1 million in 401(k) accounts, incorporating Roth IRAs into your retirement strategy is wise. Planning for retirement and making smart investment choices are vital steps for securing long-term financial stability.” said Dutch Mendenhall, CEO of RAD Diversified.

But Mendenhall also warns that it’s important to understand the rules around your various retirement options. Specifically, if you switch from traditional 401(k) contributions to a Roth 401(k) or Roth IRA, your taxes will increase. This is because you’ll lose the tax deduction for your original portfolio contributions, meaning you pay taxes on any money that goes into the Roth accounts. Now, this effect could be modest depending on the rest of your tax situation, but it should be accounted for.

Pay Attention to Contribution and Income Limits

Unless you make only modest contributions to your 401(k), which could be unlikely given a $1 million account balance, you may not be able to shift entirely to a Roth IRA. The annual contribution cap for these accounts is only a percentage of that of a 401(k). Here’s a breakdown for 2024:

Additionally, the IRS sets income limits on who can participate in a Roth IRA. In 2024, a married couple can only fully contribute to a Roth IRA if they make less than $230,000 per year, and cannot contribute at all if the make more than $240,000.

Consider speaking with a financial advisor to build a plan for your retirement income.

Is This a Good Idea for Your Retirement Plan?

“[T]he main difference between the Roth and traditional retirement plans is based on the timing and payment of income taxes. The variable that matters most when planning for the future is your estimate of your future income, or at least a ballpark estimate,” said Marolia.

Once you have that, you need to estimate your future tax rates. The lower your tax rates in retirement, the less value you will get from a Roth IRA because you will save less on taxes now. Instead, as Marolia says, “[T]he Roth option is ideal for people that feel that tax rates will be higher in the future and for those that believe their income will continue to rise in the future.”

Essentially, with a Roth IRA you trade taxes today for no taxes tomorrow. That means that the more time you will spend in retirement and the higher your tax bracket, the more value you’ll get out of this account. On the other hand, the later you plan on retiring and the lower your taxes in retirement compared with your taxes now, the less value you will get compared with the tax-deferred nature of a traditional 401(k) or IRA.

Retirement Planning Tips

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

If you have significant savings, it may mean you also have significant income. In that case, the IRS might not allow you to make Roth contributions at all. Instead, you may want to consider a Roth IRA conversion.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/PIKSEL, ©iStock.com/mbbirdy, ©iStock.com/monkeybusinessimages

The post My Husband and I Are in Our 50s, Have $1 Million in Our 401(k)s and Want to Retire at 65. Should We Switch to Roth Contributions? appeared first on SmartReads by SmartAsset.

Wells Fargo analyst cuts target on Prospect Capital one day after berating by CEO

Finian O’Shea, an analyst from investment bank Wells Fargo, has trimmed the price target on Prospect Capital Corporation (NASDAQ:PSEC) a day after the company’s CEO and founder, John F. Barry III, lashed out at him during a quarterly earnings call.

The analyst and CEO bickered on the company’s earnings call on Thursday after O’Shea asked under what circumstances the company would force the conversion of some of its preferred stock into common shares. Barry responded that the firm has no reason to contemplate this.

“No, we’re not rushing to break the glass here. I’m just astonished by these questions,” Barry said during a heated exchange with the analyst. “Is the house on fire? Why are we even discussing this?”

Later in the exchange, Barry added, “By the way, why don’t you do the world a favor and do a little research before you come on an earnings call with absurd questions like this? You don’t even know what you’re talking about.”

O’Shea has now reduced Prospect Capital’s stock price target to $4.50 from $5.00 and retained the stock’s Underweight rating. The analysts’ rating is equivalent to a sell rating at other firms.

“Though management described this quarter’s conversion rate as more one-off, we see risk of heavier dilution should market conditions change. PSEC’s recent performance (with NAV down 18% since Dec. ’21) and a downward pointing SOFR curve could put the dividend at risk, which at a ~14% yield is likely a major pillar of support to today’s stock price. Full conversion today would impact NAV by another ~20%, we estimate,” O’Shea said in an analysis released on Thursday.

Prospect, on Wednesday, reported that its net investment income declined 8.7% to $102.9 million in the fourth fiscal quarter as compared to the same quarter last year. Its net asset value stood at $3.71 billion. It saw an increase in the weighted average cost of unsecured debt financing to 4.25%. It declared monthly common shareholder distributions of $0.06 per share for September and October.

Wells Fargo has also noted some changes on the asset side, including roughly flat non-accruals with the Strategic Materials exit at a realized loss.

“Near-term maturity Atlantis Health was kicked out a year (to May ’25), Rosa Mexicano was extended two years (now Jun. ’26) and Town&Country was extended from Feb ’26 to Aug. ’28, said O’Shea, adding, “The structured credit book was described as non-impactful to NAV, which would indicate an accelerated return of capital given the fair value drop was sharper than recent trends.”

Wells Fargo has also updated its net operating income (NOI) forecasts for Prospect Capital for fiscal years 2025 and 2026. The new estimates are set at $0.61 and $0.50 respectively, a decrease from the earlier predictions of $0.67 and $0.60, respectively.

“Our NOI estimates for fiscal ’25 and ’26 moved to $0.61 and $0.50, from $0.67 and $0.60, previously, primarily on a lower SOFR curve, and a higher share count through conversions of prefs / DRIP issuance. Our PT moves to $4.50 (from $5), which continues to reflect a 13% yield on forward NOI. We maintain our Underweight rating,” said the analyst.

Related Articles

Wells Fargo analyst cuts target on Prospect Capital one day after berating by CEO

Greece stocks higher at close of trade; Athens General Composite up 0.30%

Lula says Musk must respect Brazil’s top court as X braces for shutdown

United Therapeutics Shares Thrive

The biotechnology company develops multiple treatments for pulmonary arterial hypertension, which is a form of elevated blood pressure in the lungs, as well as treatments for other diseases. Its Tyvaso medicine should benefit from a regulatory approval delay for a competing drug, leaving UTHR without direct competition to hinder its business development efforts.

Financially, the company’s second-quarter performance featured revenue growth of almost 20% and per-share earnings growth of 12%. UTHR’s pipeline is promising too. Analysts suggest the commercialization of new therapies could generate 50% returns or more in the next few years.

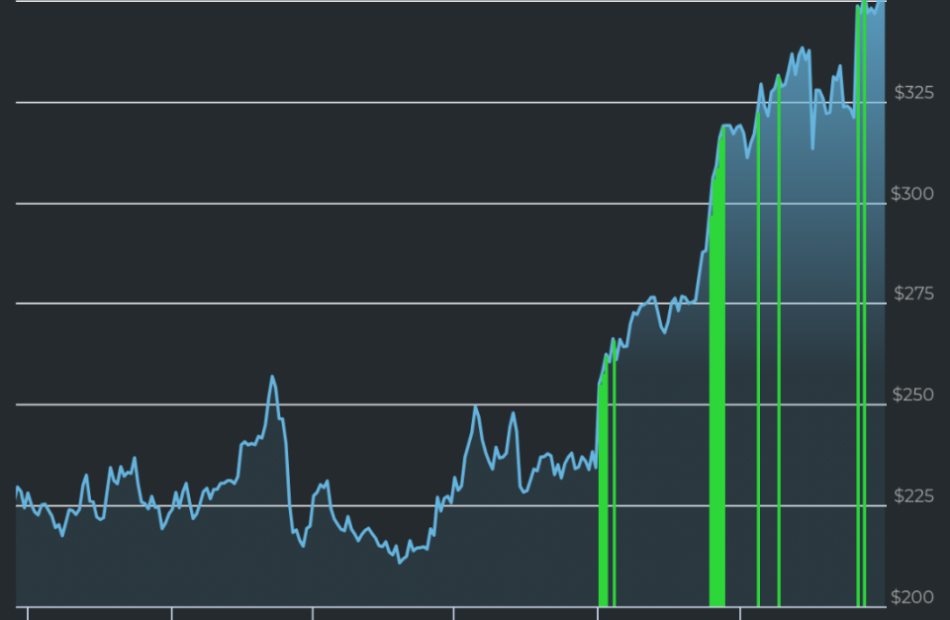

It’s no wonder UTHR shares are up 64% this year – and they could rise more. MAPsignals data shows how Big Money investors are betting heavily on the forward picture of the stock.

United Therapeutics Under Heavy Accumulation

Institutional volumes reveal plenty. Recently, UTHR has enjoyed strong investor demand, which we believe to be institutional support.

Each green bar signals unusually large volumes in UTHR shares. They reflect our proprietary inflow signal, pushing the stock higher:

Plenty of health care names are under accumulation right now. But there’s a powerful fundamental story happening with United Therapeutics.

United Therapeutics Fundamental Analysis

Institutional support and a healthy fundamental backdrop make this company worth investigating. As you can see, UTHR has had strong sales and earnings growth:

Source: FactSet

Also, EPS is estimated to ramp higher this year by +14.8%.

Now it makes sense why the stock has been powering to new heights. UTHR has a track record of strong financial performance.

Marrying great fundamentals with our proprietary software has found some big winning stocks over the long term.

United Therapeutics has been a top-rated stock at MAPsignals for years. That means the stock has unusual buy pressure and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

It’s made the rare Top 20 report multiple times in the last year. The blue bars below show when UTHR was a top pick…sending shares upward:

Tracking unusual volumes reveals the power of money flows.

This is a trait that most outlier stocks exhibit…the best of the best. Big Money demand drives stocks upward.

United Therapeutics Price Prediction

The UTHR rally isn’t new at all. Big Money buying in the shares is signaling to take notice. Given the historical gains in share price and strong fundamentals, this stock could be worth a spot in a diversified portfolio.

Disclosure: the author holds no position in UTHR at the time of publication.

If you are a Registered Investment Advisor (RIA) or are a serious investor, take your investing to the next level, learn more about the MAPsignals process here.

This article was originally posted on FX Empire

More From FXEMPIRE:

Institutional Investors Eye $10T Digital Asset Boom

Digital assets are gaining traction among institutional investors, with cryptocurrencies, non-fungible tokens, and tokenized securities leading the way, according to a new report from Economist Impact.

The study, commissioned by OKX, highlights the growing convergence between traditional finance and digital-native players in the evolving ecosystem.

By 2030, the value of tokenized assets is projected to surpass $10 trillion, up from $400 billion in 2023, the report states. This market opportunity has 69% of institutional investors anticipating increased allocations to digital assets or related products in the next two to three years.

Current digital asset allocations in institutional portfolios range from 1% to 5%, depending on risk appetite, the study notes. Bitcoin and ether, the token of the Ethereum smart contracts blockchain, remain the largest investment avenues, but institutional investors are showing an appetite for other types of crypto assets.

Surge in Crypto ETF Approvals

The approval of 11 spot bitcoin ETFs in the United States led to cumulative institutional investment reaching over $40 billion in March 2024, according to the report. Additionally, spot ethereum ETFs exceeded $1 billion in trading volume on their debut trading day in July.

IBIT 3-month flows

Source: etf.com

Institutional-grade custody solutions are emerging as a driver of mainstream adoption among institutional investors, the study found. These solutions address challenges posed by digital assets, such as cybersecurity risks, hacking, and loss of private keys.

Regulatory developments are shaping the digital landscape. The report highlights recent initiatives, such as the United Arab Emirates establishing the first regulatory authority dedicated to virtual assets and Hong Kong’s Securities and Futures Commission approving the launch of spot bitcoin and ether ETFs.

Risk management remains a consideration for institutional investors entering the digital asset space. The report suggests adapting traditional finance strategies, such as value-at-risk models, scenario analysis, and reverse stress testing, to account for the characteristics of digital assets.

As of May 2024, stablecoins have reached a total market capitalization of $169.5 billion, the study notes. These digital assets serve as a bridge between fiat currencies and blockchain technology, combining traditional financial instruments with other features.

The maturing ecosystem of market participants is unlocking institutions’ access to digital assets, the report states. Financial players that streamline diverse products and services can become partners for institutional investors looking to enter the space.