Is This 13%-Yielding Stock Due for a Dividend Cut?

A divided yield of more than 10% can appear enticing for investors who are seeking a high level of recurring income. And while a stock that pays that much can generate a lot of income for you, it may not be the safest option to put in your portfolio. Stocks with yields that high often come with inherent risks. If they were safe investments, investors wouldn’t hesitate to buy up such high-yielding payouts, which, in turn, would likely boost their share prices and shrink their yields. When a stock’s yield remains high, that usually means there’s ample reason to remain cautious about the investment.

One high-yielding stock that isn’t getting much love these days is Medical Properties Trust (NYSE: MPW), which pays investors nearly 13% in dividends. But the real estate investment trust (REIT) has been one of the riskier income stocks to own this year, and its shares are down about 5% so far this year. Could investors simply be bracing for another dividend cut?

Medical Properties Trust’s focus has been on raising liquidity

The problem with Medical Properties Trust (MPT) is that the company has been selling off assets in order to improve its cash flow position. That’s not a great sign for a dividend stock. It effectively tells investors that it isn’t generating sufficient cash to maintain its day-to-day operations and pay its dividend.

Last week, the REIT announced the sales of 11 healthcare facilities in Colorado, which will net it $86 million. The company is going to use that money “to reduce debt and for general corporate purposes.” And when the REIT announced its latest quarterly results on Aug. 8, it led with the news that it had executed $2.5 billion in liquidity transactions thus far in 2024. While that may be positive news for the business, highlighting the importance of raising liquidity isn’t what dividend investors want to see, as it underscores the perilous condition of the company’s financial results.

Earlier this year, one of MPT’s key tenants, Steward Health, entered bankruptcy protection and announced it was going to try to sell all of its hospitals in an effort to pay down $9 billion in liabilities on its books. The problems and uncertainty relating to Steward have weighed on MPT’s share price in recent years.

Medical Properties Trust’s financials haven’t been strong

MPT has been incurring losses in recent quarters and through the first six months of the year, its funds from operations (FFO) per share have totaled a negative $1.45 versus the previous year, when it was a positive $0.88. Its normalized FFO, which excludes the impact of impairment charges, total $0.47 for the year thus far. While that is positive, it’s down significantly from $0.85 in the same period last year.

The good news for investors is that the rate is higher than the $0.30 per share that MPT has paid out during the first two quarters in dividends. That does suggest that the dividend may be sustainable, at least for the immediate future. But the danger is that with the company selling off assets and the future relating to Steward Health remaining unclear, it still may not offer investors much comfort.

Investors shouldn’t rely on this dividend

MPT’s dividend isn’t safe. Although the recent FFO numbers may suggest there’s a bit of safety there, the REIT is going through a tumultuous time, and as it sells off more assets, its numbers could deteriorate further, and a dividend reduction could be in the cards.

There are many better dividend stocks to own than MPT, and unless you have an extremely high risk tolerance, you’re better off avoiding it as things can still get worse before they get better for the stock.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is This 13%-Yielding Stock Due for a Dividend Cut? was originally published by The Motley Fool

This Growth Stock Is Down 83%, but Billionaire Investors Are Scooping It Up. Is It a Buy?

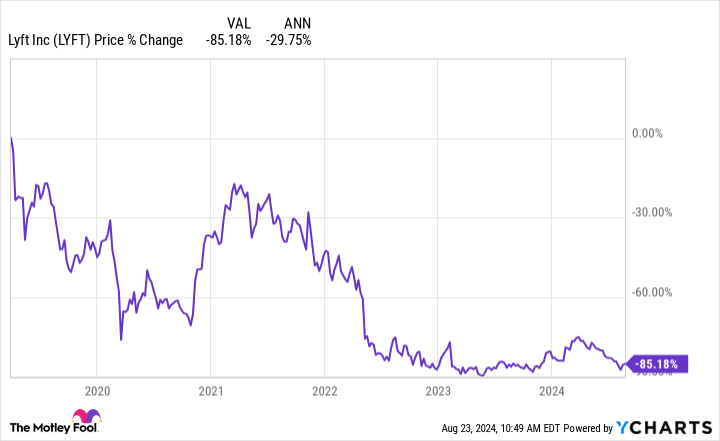

Lyft (NASDAQ: LYFT), the No. 2 ride-sharing operator behind Uber Technologies, has burned nearly every investor who has bought the stock.

As you can see from the chart below, the stock is down sharply from its 2019 initial public offering (IPO).

Lyft stock has fallen in three separate episodes. First, the stock crashed after a successful IPO as investors believed the money-losing company was overvalued in 2019. The following year, it fell along with the rest of the stock market when the pandemic started, and after a recovery in 2021, the stock faded again in the bear market as its growth rates slowed.

However, there are signs that the stock is finally making a genuine turnaround. In the second quarter, the company reported its first-ever profit on a generally accepted accounting principles (GAAP) basis at $5 million and also reported surging revenue growth of 41% up to $1.4 billion on 17% gross bookings growth to $4 billion. That discrepancy is driven in part by growth in Lyft Media, its advertising business that delivered revenue growth of more than 70% in the quarter. New initiatives to increase its driver pool, speed up arrival time, and reduce the impact of prime time, or surge, pricing, are paying off.

Now, a number of billionaire investors seem to be taking notice as 13-F filings revealed some well-known investors bought shares of Lyft in the second quarter.

The smart money likes Lyft

David Tepper‘s Appaloosa Management is one of the most successful hedge funds in the world. The fund currently manages about $14 billion and counts Alibaba as its biggest holding.

Tepper is known for investing in distressed debt and deep-value stocks, which seems to explain his current interest in Chinese stocks like Alibaba, as well as Lyft, which is arguably a value stock. In fact, Lyft was Tepper’s biggest purchase during Q2 as Appaloosa bought 7.5 million shares of the stock in the quarter, bringing its stake in the company to nearly 8 million, which is worth roughly $100 million today.

Tepper hasn’t made public remarks on his Lyft purchase, but it’s worth noting that he added to his stake in Uber as well, buying 140,000 shares of that to bring his holdings of the ride-sharing leader to 1.5 million shares. Tepper has roughly equal stakes in Lyft and Uber, and he began buying shares of Uber in the second quarter of 2021, anticipating the turnaround in the ride-sharing leader. Tepper seems to be betting on a similar turnaround in Lyft.

Another billionaire who’s taken a shine to Lyft is Ken Griffin, whose Citadel Advisors hedge fund is one of the biggest hedge funds in the world, with assets under management of roughly $400 billion.

Griffin is known for using quantitative analysis and data-driven decision-making, and the company has thousands of positions in its fund. Lyft is a high-risk stock, but Citadel’s track record is impeccable as it’s considered the most profitable hedge fund of all time.

Citadel bought 4.4 million shares of Lyft in the second quarter, bringing its stake to 6.5 million shares, or roughly $75 million worth of the stock. Citadel had originally taken a stake in Lyft in the first quarter of 2019, so the company is sitting on some losses from that initial investment, but now looks like a better time to buy the stock.

Is Lyft a buy?

Lyft expects solid growth over the rest of the year, calling for a mid-teens increase in rides and gross bookings to grow slightly faster.

With the company finally shifting into profitability, tapping into new businesses like advertising, improving its product in a way that pleases both riders and drivers, and adding new features, the business looks to be headed in the right direction.

It’s rare to see two high-profile billionaire investors going after a beaten-down stock like Lyft, but the ride-sharing company has a lot of the hallmarks of a turnaround opportunity, including the beaten-down share price. If its current momentum continues, the stock looks likely to pay off.

Should you invest $1,000 in Lyft right now?

Before you buy stock in Lyft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lyft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

This Growth Stock Is Down 83%, but Billionaire Investors Are Scooping It Up. Is It a Buy? was originally published by The Motley Fool

Wall Street Analysts Are Bearish on This Artificial Intelligence (AI) Stock. Here's Why I'm Not.

Artificial intelligence (AI) stocks have been all the rage on Wall Street, and it’s easy to see why.

Stocks like Nvidia have surged since the launch of ChatGPT nearly two years ago, creating trillions of dollars in market value for investors. However, Wall Street isn’t so fond of every AI stock on the market.

Take Upstart (NASDAQ: UPST), for example. The AI-based consumer loan provider has struggled recently, and Wall Street looks downright bearish on it. Of the 18 analysts covering the stock (as tracked by The Wall Street Journal), just one rates it a buy, and eight recommend selling. The average price target on the stock is $23.47, implying about 40% downside from its value as of this writing.

However, the stock has been surging since its second-quarter earnings report went out on Aug. 6, and the stock looks poised for more gains. Here are two reasons why.

1. Interest rates are set to come down

Upstart’s business is highly sensitive to interest rates, much like most lending companies. In 2021, shortly after the company went public, business was soaring as interest rates were at rock bottom, and demand for consumer loans during the pandemic was high. Not only was the company growing rapidly with revenue jumping triple digits, but its operating margins were also strong, in the teens.

However, as interest rates rose and fears of a recession swept the market and the economy, the business froze, and the stock plunged.

Now, the company has an opportunity to reverse some of those losses. The Federal Reserve is highly likely to begin lowering interest rates at its next meeting in September, easing pressure on companies like Upstart and stoking demand for loans again.

It will take time for falling interest rates to juice demand, but the Fed sees interest rates falling to less than 3% over the long term, down from 5.25% to 5.50% currently, which should give a significant boost to borrowers.

The stock should move higher as rates start to come down.

2. Its technology is still an advantage

Upstart stock soared on its recent earnings report, even as revenue is still falling and losses mount.

However, conversion on rate requests improved from 9% in the year-ago quarter to 15%, showing more applicants are getting loans. It also expects revenue growth to return in the second half of the year.

Beyond that, Upstart’s technology still holds a lot of promise. The company claims its AI-based lending model is more accurate than traditional models like the FICO score. For example, as of the second quarter, loan approval rates were twice as high as traditional models, and it was able to achieve a 38% lower APR than competing models.

The company has also expanded significantly since the boom in 2021. At the time, it did not offer a home loan product, and it now offers a home equity line of credit in 30 states and the District of Columbia.

Finally, its own Upstart macro index shows conditions improving, which will lower default rates and support increased loan approvals.

Why Upstart is a buy

Upstart’s struggles aren’t due to fundamental problems with its product. The business is just highly cyclical, and poor macroeconomic conditions in the form of higher interest rates have suppressed demand.

However, the reversal of the Fed’s monetary policy is likely to unleash pent-up demand for consumer loans, much like it’s expected to do the same for mortgages in the housing market.

In better market conditions, Upstart has the potential to deliver the kind of profits investors saw back in 2021, when it finished the year with a generally accepted accounting principles (GAAP) net income of $135 million and adjusted net income of $224 million. A return to those levels would give the company a price-to-earnings ratio of 16 at the current stock price (based on adjusted earnings).

Once the company returns to revenue growth and profitability, the stock has the potential to move a lot higher from here.

Should you invest $1,000 in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jeremy Bowman has positions in Upstart. The Motley Fool has positions in and recommends Nvidia and Upstart. The Motley Fool has a disclosure policy.

Wall Street Analysts Are Bearish on This Artificial Intelligence (AI) Stock. Here’s Why I’m Not. was originally published by The Motley Fool

Ask an Advisor: What's My Tax Liability with $800k in a 401(k) and $5k/Month Between Pension and Social Security?

My monthly Social Security is $3,178, my pension will be $2,090 per month and my 401(k) has $800,000. If I use the 4% rule, where do I stand tax-wise?

– Reggie

This is a great question. I hope it goes without saying, but without having all of your information and completing a full tax return I can’t give you an exact number. What we discuss here will cover the major items to help you estimate a rough ballpark figure of your tax liability. I still encourage you to do your research and modify the estimate to fit your unique circumstances or work with a tax professional.

Do you need help calculating your tax liability in retirement? Speak with a financial advisor today.

Add Up Your Taxable Income

Start by adding up the components of your income that are taxed as ordinary income. In your case, that would be your pension and 401(k) withdrawals.

Since you have $800,000 in your 401(k) and plan to withdraw 4% in your first year, you’ll have $32,000 in income from your 401(k). Your pension will pay you $2,090 per month or $25,080 for the year. These two items together add up to $57,080. (And if you need more help managing your taxes in retirement, consider speaking with a financial advisor.)

Include the Taxable Portion of Your Social Security

You may have to include a portion of your Social Security in your taxable income. Unfortunately, calculating how much isn’t as straightforward as adding up your other types of income. But there’s good news: you’ll never have to pay taxes on 100% of your benefits.

You’ll need to calculate what the Social Security Administration (SSA) calls your “combined income.” To do this, you’ll add your adjusted gross income (AGI), any tax-exempt interest that you’ve collected and one-half of your Social Security benefits together.

For you, I’m assuming you have no above-the-line deductions or adjustments to income (though you may) so your AGI is $57,080 (reference form 1040). You didn’t mention any tax-exempt interest and half of your Social Security benefit is $19,068. So, your combined income is $76,148 under these assumptions. (Planning for Social Security is critically important and a financial advisor can help.)

Calculate How Much of Your Benefits Are Taxable

Admittedly this next part is complicated, so buckle up. Assuming you’re single since you didn’t mention any spousal benefits, the following income thresholds will determine how much of your Social Security benefits are taxable:

-

If your combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxable.

-

If your combined income is more than $34,000, up to 85% of your benefits may be taxable.

Calculating how much of your particular benefit is taxable is relatively straightforward. Since your combined income exceeds the $34,000 limit by more than your total benefit, you can simply multiply your Social Security payment by 0.85. As a result, $32,416 of your benefits are taxable.

Keep in mind that just because a person’s combined income exceeds the $34,000 limit, that doesn’t mean 85% of their benefit is automatically taxable. Instead, it depends on how much their combined income exceeds the $34,000 threshold.

Consider a hypothetical retiree named Jim who has a full benefit of $30,000 and a combined income of $40,000. Although his combined income exceeds the upper limit, only $9,600 of his Social Security would be taxable. So how’d he get there?

First, he would multiply $9,000 by 0.5 and get $4,500. That’s because his combined income fills up the first tax bracket ($25,000-$34,000). And since Jim’s combined income is $6,000 over the $34,000 limit, he’d then multiply that number by 0.85 and get $5,100. Adding those two figures together – $4,500 + $5,100 – gives Jim the total amount of his Social Security that’s subject to taxes: $9,600.

If you need additional help calculating how much of your benefits are taxable, speak with a financial advisor.

Your Total Income Subject to Taxation

Now we can put it all together and calculate how much you’ll roughly pay in taxes based on the assumptions we’ve made.

Just add your $57,080 taxable income to your $32,416 of taxable Social Security benefits and you get $89,496. We still get to take some deductions. You may have itemized deductions, but rather than guess what those might be we’ll assume you are single and at least 65 years old and you are taking the 2023 standard deduction of $15,700 (people 65 and older can take a higher standard deduction):

$89,496 – $15,700 = $73,796

This is the amount that your tax bill will be based on. Now, let’s review the federal income tax brackets for 2023 to see where you stand. Remember, the federal income tax is progressive, meaning you’ll pay higher rates as your income increases.

-

Your first $11,000 of income is taxed at 10%, so you’ll owe $1,100.

-

Income that falls between $11,000 and $44,725 is taxed at 12%. You fill that bracket up, so you’ll owe $4,047 in taxes on this segment of your income ($33,725 x 0.12).

-

The remaining portion of your income ($73,796 – 44,725 = $29,071) is taxed at 22%, so you’ll owe another $6,396.

Add it all up to get a total tax bill of $11,543. Remember, this figure is based on the information you provided and the assumptions we made. This likely won’t be your actual tax bill, but it’s far closer than a random guess and should at least give you an idea of how to calculate it. (Calculating and managing your taxes in retirement can be complicated, but a financial advisor can help.)

Bottom Line

This gives you a rough idea of where you stand with some basic assumptions. However, there are several things not present here that may impact your tax liability. You may have state and local taxes depending on where you live. Not only do these create additional tax liability, but they may provide you with a deduction on your federal return. Other items may also be relevant, such as deductible mortgage or student loan interest for example.

Retirement Planning Tips

-

Retirement planning can be complex and overwhelming, but a financial advisor can helpful. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Building a retirement income plan starts with estimating your expenses and figuring out how much income you’ll to meet them. Experts recommend replacing anywhere from 55% to 80% of your pre-retirement income with Social Security, retirement account withdrawals and other sources. T. Rowe Price, meanwhile, recommends you aim to replace 75% of your pre-retirement income and then adjust your replacement rate up or down rate based on your savings and spending expectations.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article. Questions may be edited for clarity or length.

Photo credit: ©iStock.com/Inside Creative Housel, ©iStock.com/Thapana Onphalai

The post Ask an Advisor: I Have $800k in a 401(k) and $5,270 in Monthly Income From Social Security and My Pension. How Much Will I Pay in Taxes in Retirement? appeared first on SmartReads by SmartAsset.

Forget NextEra Energy Partners: Buy This Top-Notch Ultra-High-Yield Stock Instead

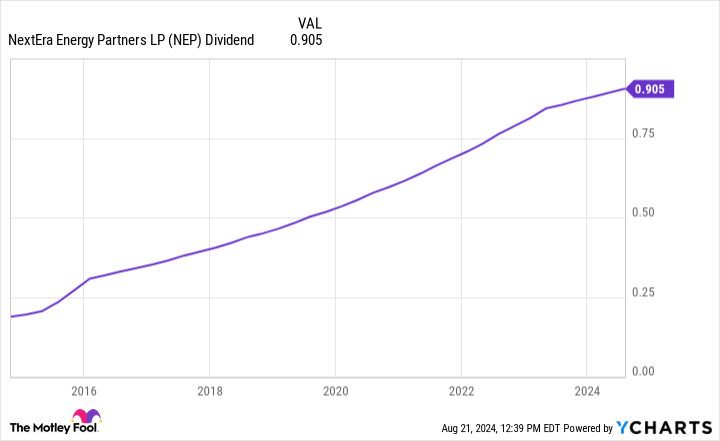

NextEra Energy Partners (NYSE: NEP) currently offers a monster dividend yield. The renewable energy company’s payout yields more than 14%, which is about 10 times higher than the S&P 500‘s dividend yield. Further, the company plans to continue growing its payout in the future.

However, as attractive as this renewable energy dividend stock might seem, those seeking a sustainable income stream should forget about it right now. Instead, income-focused investors should buy Brookfield Renewable (NYSE: BEPC)(NYSE: BEP). While it offers a lower yield (over 5%), it’s on a much more sustainable foundation.

Running low on power

NextEra Energy Partners currently has a terrific record of paying dividends. The renewable power producer has increased its payout every single quarter since it came public over a decade ago.

The company expects that steady upward trend to continue. It plans to increase its payment by 5% to 8% per year through 2026, with a target of 6% annually. While that is a much slower pace than initially expected (12% to 15% annually), it’s a solid rate, especially for such a high-yielding dividend stock.

NextEra Energy Partners had to tap on the brakes with its growth plans due to its surging cost of capital. Rising interest rates and its plummeting stock price have made it too expensive to borrow money to refinance maturing funding and finance new acquisitions at attractive rates due to its junk-rated credit. That forced the company to pivot is strategy. It’s selling its natural gas pipeline operations to cover its upcoming funding buyouts. It’s also relying on organic expansion projects (primarily wind repowering projects) to boost its cash flow in support of its dividend growth plan.

The company expects its dividend payout ratio will be in the mid-90% range through 2026, which is way too high. Because of that, there’s a high risk that the company will need to cut its payout in the coming years. That makes it too risky for income-seeking investors right now.

Ample power to continue growing

Brookfield Renewable’s financial profile is on a much more sustainable foundation these days. Unlike NextEra Energy Partners, Brookfield Renewable has a strong investment-grade credit rating. Meanwhile, the company doesn’t rely on short-term financing to fund acquisitions. It primarily uses equity and low-cost, long-term, fixed-rate debt. Because of that, higher interest rates haven’t had any impact on its growth strategy.

Instead of tapping the brakes, Brookfield Renewable has stomped on the accelerator. The company expects to grow its funds from operations (FFO) per share at a more than 10% annual rate through at least 2028. It sees several factors driving its growth, including inflation-linked contractual rate increases, margin enhancement activities, its development pipeline, and acquisitions.

Whereas NextEra Energy Partners has primarily relied on acquisitions to power its growth (mainly drop-down transactions from its parent, NextEra Energy), Brookfield focuses on higher-return organic development projects. The company has a massive backlog of projects that should power its growth for years to come.

Meanwhile, the company has a much different acquisition funding strategy: capital recycling. Brookfield routinely sells mature assets to fund higher-returning new investments. For example, the company expects to generate $1.3 billion from capital recycling activities this year, which will help it fund the $970 million it has committed to invest across several accretive acquisitions.

Brookfield expects its growing cash flows to support 5% to 9% annual dividend growth, which aligns with its expected 6% to 9% organic growth rate. That would continue its trend of increasing its payout by at least 5% per year, something it has accomplished for 13 straight years. Meanwhile, with earnings growing faster than its dividend, Brookfield’s payout ratio will steadily decline from its already comfy sub-75% level.

A much more sustainable income stream

NextEra Energy Partners’ double-digit dividend yield might seem alluring. However, that payout isn’t on a solid foundation these days due to its weak financial profile. Because of that, income-focused investors should forget about it until the company fixes its issues.

They should buy Brookfield Renewable instead. The company has a long history of growing its high-yielding payout, which should continue. It backs its dividend with a much stronger financial profile and highly visible growth prospects. Because of that, it offers a much more sustainable income stream that should steadily rise in the future.

Should you invest $1,000 in NextEra Energy Partners right now?

Before you buy stock in NextEra Energy Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in Brookfield Renewable, Brookfield Renewable Partners, NextEra Energy, and NextEra Energy Partners. The Motley Fool has positions in and recommends Brookfield Renewable and NextEra Energy. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

Forget NextEra Energy Partners: Buy This Top-Notch Ultra-High-Yield Stock Instead was originally published by The Motley Fool

If You Like Eli Lilly, Then You'll Love This Little-Known Specialty Manufacturing Stock

Mark Twain is rumored to have said: “During the gold rush, it’s a good time to be in the pick and shovel business.”

Whether he did in fact say these words or not isn’t really all that important. The bigger idea here is that there tend to be less obvious ways to profit from situations whenever a hot new product hits the shelves.

A great example of this is found in the pharmaceutical industry. Over the last couple of years, glucagon-like peptide 1 (GLP-1) agonists such as Mounjaro and Zepbound have revolutionized the way care is provided to diabetes and obesity patients. Eli Lilly is the manufacturer of these blockbuster drugs, and investors have sent the stock soaring over the last two years.

However, the investment opportunity surrounding the GLP-1 realm goes much deeper than pharma stocks. One company that is benefiting big time from rising demand for GLP-1 drugs is Jacobs Solutions (NYSE: J).

Let’s break down what Jacobs Solutions does, and explore why now looks like a lucrative opportunity to scoop up some shares.

What does Jacobs Solutions do?

Jacobs Solutions is in the construction business, but not in the way you might think. Instead of building houses, Jacobs specializes in extremely sophisticated and time-consuming infrastructure projects, such as data centers, spacecraft, city planning, and life sciences facilities.

Some of the company’s customers include NASA, Procter & Gamble, and Bristol Myers Squibb.

What makes Jacobs Solutions so unique?

During a recent interview with CNBC’s Jim Cramer, Jacobs’ CEO Bob Pragada shared a really interesting perspective on how the company is playing a key role in the future of GLP-1 development working alongside Lilly.

Big news! 📺🚨

CEO Bob Pragada stopped by @CNBC to discuss end-to-end lifecycle solutions in consulting & advisory across infrastructure, advanced facilities, life sciences, water & more.

Watch here ➡️ https://t.co/AFXnQ0LgB0

— Jacobs (@JacobsConnects) Aug. 16, 2024

There are a couple of important ideas to unpack from the video shared above.

Pragada explains just how complicated Lilly’s GLP-1 facilities are. He makes it clear that these projects are not simply up for grabs and available for a variety of builders to bid on. Since competition is extremely limited and the need for Jacobs’ expertise is high, the company is in a good position to command pricing power for its services.

Given these dynamics, I’d argue that Jacobs has built a relative competitive moat. Furthermore, the subtle opportunity with Jacobs is that the company tends to win repeat business from its customers during expansion phases.

As Cramer alludes, it’s entirely possible for Lilly to build additional factories in Asia and Europe should demand for its GLP-1 medications warrant the investment. If this happens, Jacobs looks well-positioned to win this business in the future and be a tangential beneficiary of various themes fueling its customers.

Why now looks like a great opportunity to buy Jacobs Solutions stock

I see a few reasons to buy Jacobs stock right now.

First, the company recently announced that it is spinning off its Critical Mission Solutions (CMS) business, as well as segments of its Divergent Solutions business — specifically the Cyber & Intelligence business.

Pragada notes that divesting these non-core assets will help make Jacobs “a more focused, higher-margin company more closely aligned with key global mega trends.”

I find these remarks encouraging and see the spin-off as a sign that Jacobs understands where its growth is coming from, and where the company wants to continue investing.

According to JP Morgan, the total addressable market (TAM) for GLP-1 treatments could reach $100 billion by 2030 just in the U.S.

To me, these forecasts imply that GLP-1 demand will be here for quite some time. Therefore, I am bullish that Lilly will need to continue investing in infrastructure in order to meet supply and demand capacities. For these reasons, I think Jacobs’ relationship with Lilly could be transformative.

Outside of the weight loss space, Jacobs is also playing a quiet role in various areas of artificial intelligence (AI), including data centers and electric vehicle production.

As of the time of this article, Jacobs trades at a forward price-to-earnings (P/E) multiple of 16.1. In comparison, the forward P/E of the S&P 500 is around 21.7.

The company’s discounted valuation relative to the broader market could suggest that investors are overlooking Jacobs Solutions. While the company itself may not be selling breakthrough medications or AI software, these opportunities still represent major bellwethers for Jacobs as it helps leading players in the background.

The long-run secular tailwinds fueling many of the markets in which Jacobs operates, combined with the company’s competitive edge and reasonable valuation, make it a compelling investment opportunity in my eyes.

Should you invest $1,000 in Jacobs Solutions right now?

Before you buy stock in Jacobs Solutions, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Jacobs Solutions wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Eli Lilly. The Motley Fool has positions in and recommends Bristol Myers Squibb and JPMorgan Chase. The Motley Fool has a disclosure policy.

If You Like Eli Lilly, Then You’ll Love This Little-Known Specialty Manufacturing Stock was originally published by The Motley Fool

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring

Semiconductor specialist Cirrus Logic (NASDAQ: CRUS) may not be a household name like some of its industry peers, but the company has done impressively well on the market so far this year with gains of 69% as of this writing.

Cirrus, which is known for supplying chips for Apple‘s (NASDAQ: AAPL) products, has outpaced the broader Nasdaq-100 Technology Sector index’s gains of 10% by a big margin. The good news is that Cirrus’ outstanding growth is here to stay, and the company could finish the year strongly thanks to its largest customer. What’s more, the arrival of artificial intelligence (AI)-enabled smartphones is likely to unlock a massive long-term growth opportunity for Cirrus Logic.

Let’s take a closer look at the reasons why investors should consider buying Cirrus Logic stock hand over fist before it’s too late.

Cirrus Logic’s recent results point toward a bright future

Cirrus Logic released fiscal 2025 first-quarter results (for the three months ended June 29) on Aug. 6. The company’s revenue increased 18% year over year to $374 million and was well ahead of the consensus estimate of $318 million. What’s more, Cirrus’ adjusted earnings jumped a solid 67% year over year to $1.12 per share, crushing Wall Street’s $0.61 per share estimate.

The positive news didn’t end here, as Cirrus expects its fiscal Q2 revenue to land between $490 million and $550 million. The midpoint of the guidance range stands at $520 million, and that’s well above the Wall Street estimate of $485 million. Cirrus clocked revenue of $481 million in the same quarter last year, indicating that its top line is on track to increase by 8% on a year-over-year basis.

Cirrus’ top line could land closer to the higher end of its guidance range thanks to its largest customer, Apple, which accounted for a whopping 88% of its top line last quarter. Cirrus management pointed out on the recent earnings conference call that its revenue exceeded the top end of its original guidance range thanks to “stronger than expected shipments into smartphones.”

Because Apple is Cirrus’ largest customer, the stronger-than-expected performance means that Cirrus got more orders for its chips last quarter. That’s not surprising, as Apple seems to be preparing for an aggressive rollout of its next-generation iPhones that are all set to support generative AI features.

Apple’s rumored iPhone 16 is expected to hit the market next month and the tech giant is expected to ship 90 million units of its updated smartphone lineup this year. That would be a 10% increase over last year. But at the same time, supply chain reports indicate that Apple is stocking up on 120 million display panels, suggesting that it may end up manufacturing more units than what the market is currently anticipating.

If that’s indeed the case, Cirrus Logic’s growth in the current quarter is likely to exceed expectations once again. But more importantly, the integration of the Apple Intelligence suite of generative AI features into the tech giant’s upcoming smartphones is expected to trigger a solid upgrade cycle. Apple’s smartphone shipments are expected to increase by 10% in fiscal years 2025 and 2026, according to JPMorgan‘s estimates.

Cirrus is expected to land more dollar content in the next generation of iPhones, which means that it should be able to receive more revenue from each unit of the iPhone that Apple produces. So, the stage seems set for Cirrus Logic to end the year strongly, and it should be able to sustain its newly found momentum in the future as well thanks to Apple’s entry into the AI smartphone market, a space that’s currently in its early phases of growth.

A couple more reasons to buy the stock

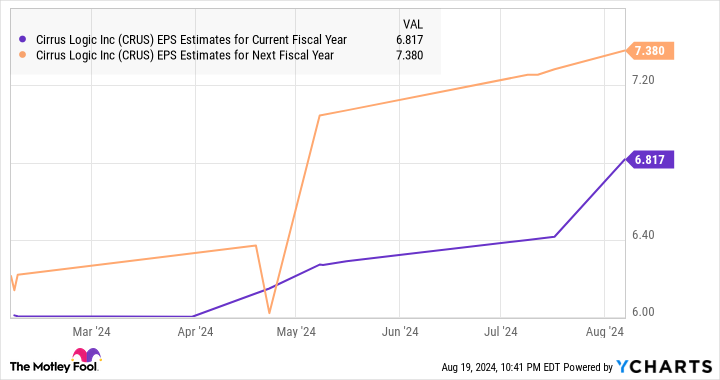

Analysts have been quick to raise their earnings growth expectations for Cirrus Logic, as is evident from the chart below.

Cirrus Logic finished fiscal 2024 (ended on March 30) with non-GAAP earnings of $6.59 per share. The above chart tells us that analysts weren’t expecting an increase in Cirrus’ earnings in the current fiscal year, but that has changed of late. Additionally, the company’s bottom-line growth forecast for the next fiscal year points toward an improvement in its growth rate.

However, if Apple indeed decides to ramp up the production of its upcoming iPhones and Cirrus ends up supplying more content to the tech giant, there is a good chance of Cirrus’ earnings easily outpacing analysts’ expectations going forward.

That’s why now would be a good time for investors to buy this semiconductor stock. It’s trading at just 26 times trailing earnings, a discount to the Nasdaq-100 index’s earnings multiple of 31. And the AI-driven growth in the smartphone market and Cirrus’ tight relationship with one of the largest players in this space could lead to better-than-expected growth going forward.

Should you invest $1,000 in Cirrus Logic right now?

Before you buy stock in Cirrus Logic, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cirrus Logic wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and JPMorgan Chase. The Motley Fool recommends Cirrus Logic. The Motley Fool has a disclosure policy.

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring was originally published by The Motley Fool

Flight Attendant Hasn't Paid Rent For 10 Years, Tax-Free Salary Helps Her Live 'Dream Life'

The idea of not having to pay rent while working a job might sound like a great perk. One flight attendant did just that and now lives a “dream life” thanks to the airline industry.

What Happened: To be able to travel around the world is a dream come true.

Thirty-three-year-old Alexandra Cosoff has done just that, leaving Queensland, Australia, to serve as a flight attendant for Emirates. Cosoff lives in Dubai but hasn’t paid rent in ten years.

Don’t Miss:

Cosoff enjoys a “generous benefit package” working as a cabin supervisor for Emirates, as reported by news.com.au in 2023.

“Our accommodation is provides and salary is tax free — and not just that, we have a lot of other things taken care of like transport, laundry, we have full medical and dental coverage,” Cosoff told news.com.au. “We are very well looked after.”

Cosoff said that a large portion of her salary used to go to rent and bills while working in Australia. Working for Emirates, a United Arab Emirates airline, Cosoff is now able to save more of her income and travel the world.

Trending: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

“What was very attractive to me was also not paying tax on top of my salary,” she said.

Cosoff said she lives in an apartment provided by the airline.

“You can either get company-provided accommodation or opt for accommodation allowance,” she said.

Cosoff, who was formerly a makeup artist, said she is now living the “dream life.”

“I have been so lucky. I’ve had the most amazing time,” she said.

Cosoff told the outlet that training to be a flight attendant with Emirates can be intense and takes eight weeks.

“It’s such a rigorous training, but you will keep that with you for life – it give you cultural awareness, how to maintain calm and composure, and once you have all those skills no one can take that away from you,” she said.

Did You Know?

Why It’s Important:

The report states that new Emirates flight attendants receive a base salary of approximately $1,236 per month, along with an hourly rate of about $17.86. They typically work between 80 to 100 flight hours each month and also receive meal allowances.

On average, economy class flight attendants earn around $3,435 per month, while cabin attendants tend to earn more.

Cosoff, who holds a degree in marketing and public relations, mentioned that a career in aviation had always appealed to them.

“Ever since I was a young girl I wanted to be a flight attendant. I remember seeing Emirates cabin crew on TV with their red hats and striking red lipstick and thinking, ‘Wow, they’re so beautiful,'” she said.

Cosoff told the outlet that she recommends those interested in becoming flight attendants to apply for what she called “a dream come true.”

Read Next:

For more inspiring stories about people around the world, check out Benzinga Inspire.

This article was previously published by Benzinga and has been updated.

Photo: Yaroslav Astakhov/Shutterstock.com

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Flight Attendant Hasn’t Paid Rent For 10 Years, Tax-Free Salary Helps Her Live ‘Dream Life’ originally appeared on Benzinga.com

Nvidia Is Next Week's Top Stock, Market Strategist Says: Why Best Long-Term Idea Is 'Just Buy Nvidia And Put It Away'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

An earnings report from NVIDIA Corporation (NASDAQ:NVDA) will be closely watched by investors and could be a market-leading indicator, a market strategist tells Benzinga ahead of the results coming Aug. 28 after market close.

Nvidia Earnings on Watch: Analysts expect Nvidia to report second-quarter revenue of $28.46 billion, up from $13.51 billion in last year’s second quarter, according to data from Benzinga Pro.

Estimates call for Nvidia to report second-quarter earnings pre share of 64 cents, compared to 27 cents per share in last year’s second quarter.

Trending Now:

-

Don’t miss out on the next NVIDIA – you can invest in the future of AI for only $10.

**This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Nvidia has beaten revenue estimates in seven straight quarters and nine of the last 10 quarters. The company has also beaten earnings per share estimates in six straight quarters and eight of the last 10 quarters.

Freedom Capital Markets Chief Global Strategist Jay Woods emphasized the importance of Nvidia’s earnings report on the market during an interview on Benzinga’s “PreMarket Prep.”

Woods said there’s been a pause in Magnificent 7 stocks, including Nvidia.

“We’re seeing consolidation in those Mag 7 names now,” Woods said.

The market strategist said Nvidia was the tell to the market changing last August.

On Aug. 23, 2023, the stock gapped up at the open, filled the gap, and closed slightly higher after reporting earnings. In the months that followed, the stock declined from $480 (now split-adjusted to $48) to $400 (now split-adjusted to $40) before breaking out in January 2024.

Woods said Nvidia is the one stock to watch next week and the $140 level could be a key metric ahead of earnings, a level the market strategist does not see the stock hitting before Wednesday.

Why It’s Important: Woods calls Nvidia a market leader and as a top stock, one that could move the markets.

The market strategist said the stock could take a lot of boats with it, depending on how investors react to the earnings.

As one of the most valuable companies in the world, Nvidia has a large weighting in many indexes and ETFs, Woods warned.

The SPDR S&P 500 ETF Trust SPY lists Nvidia as the third-largest holding at 6.5%, trailing only Apple Inc AAPL at 6.9% and Microsoft Corporation MSFT at 6.6%.

Read More:

-

When today’s AI startups go public, most of the rapid growth will be behind them — here’s how not to get left out.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Woods warned that investors should be aware that a new rebalancing of the SPDR Select Technology ETF XLK has made Nvidia more important than Apple. The current weightings for the fund have Microsoft first at 21.2%, Nvidia second at 20.9% and Apple third at 4.9%.

“You better know that Nvidia [is] now more important than Apple is.”

Although Woods is cautious about Nvidia’s momentum ahead of its second-quarter results, he still considers the stock one of the best long-term picks.

“My best idea is just buy Nvidia and put it away and don’t look at it.”

Woods recalled his father buying shares of Nvidia after hearing him talk about it on TV in 2019. His father put the stock away and forgot about it, before asking Woods what a 10-for-1 stock split meant for his stake. Woods said the investment went from $3,000 to over $100,000.

The example could perfectly illustrate Benzinga’s “if you invested $1,000” story series on how a small investment could pay off over time based on key catalysts and events.

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a low minimum investment of just $1,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Nvidia Is Next Week’s Top Stock, Market Strategist Says: Why Best Long-Term Idea Is ‘Just Buy Nvidia And Put It Away’ originally appeared on Benzinga.com

asdasdadasd

asdasdasdasdasd