Prediction: 2 Stocks That'll Be Worth More Than Apple 10 Years From Now

In the world of finance, 10 years is the blink of an eye. Want proof? Take a close look at the table below:

|

Company |

2014 Market Cap (in billions) |

2024 Market Cap (in billions) |

|---|---|---|

|

IBM |

$182 |

$178 |

|

Nvidia |

$10 |

$2,965 |

In August 2014, IBM‘s market cap was roughly 18 times larger than Nvidia‘s (NASDAQ: NVDA). But oh, how the tables have turned. Today, Nvidia boasts a market cap of about $3 trillion — roughly 17 times larger than IBM.

So, looking ahead to the next 10 years, what are the companies that could surpass Apple‘s enormous market cap? Here are two that could pull it off.

Microsoft

If a company is going to surpass Apple over the next decade, it will need a gigantic market cap. Even assuming Apple’s market cap holds steady, that would mean a company would need to reach a market cap of $3.4 trillion to catch Apple.

That’s a very tall order, and there are only so many companies that could do it. Microsoft (NASDAQ: MSFT) is one of them.

For starters, Microsoft already has a market cap of $3.1 trillion as of this writing. As recently as June, Microsoft did have a market cap larger than Apple. What’s more, Microsoft holds a few competitive advantages that should, over time, help the company’s market cap ease past Apple.

First, Microsoft has a more diversified business. The company has its hands in cloud computing, gaming, advertising, hardware, software, social networking, and artificial intelligence (AI). In short, Microsoft has many pathways to success. Apple, on the other hand, has traditionally benefited from its excellent hardware innovation. And while Apple services and AI could boost the company’s revenue, flagging iPhone sales could present a real challenge to Apple over the next decade.

In my book, that means an advantage for Microsoft.

Nvidia

I have reservations about Nvidia right now. Its sky-high valuation makes it vulnerable to a nasty correction if the company’s sales show any signs of slowing. That said, this article is about what could happen over the next 10 years. And in that case, I think Nvidia is well positioned to surpass Apple.

That’s because Nvidia’s core business — making the graphics processing units (GPUs) that will power cutting-edge AI systems for the next decade — is on a long-term growth trajectory that Apple simply can’t match.

Sales of Apple’s signature product — the iPhone — grew every year between 2007 and 2015, but they’ve been flat since then.

Nvidia, on the other hand, is still growing. Over the last two years, the company has tripled its revenue as GPUs have sold like hotcakes. That growth isn’t likely to slow in the next few years. Most analysts expect Nvidia’s sales to double again to around $160 billion by 2026.

Sure, there are likely to be some bumps in the road as the competitors take some market share from Nvidia in the red-hot AI chips market. But even if Nvidia’s sales growth slows, it could easily close the $500 billion market cap difference between it and Apple over the next decade.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jake Lerch has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: 2 Stocks That’ll Be Worth More Than Apple 10 Years From Now was originally published by The Motley Fool

Redditor Who Earns $550 a Month in Dividends Shares His Top 13 Stocks and ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Investors are gearing up for a potential rate cut in September and assessing the opportunities in the market to funnel their capital. Dividend stocks are set to be back in action as history suggests they tend to perform well when the Fed starts a rate-cut cycle. According to a report from Raymond James earlier this year, stocks usually face “tough” times when interest rate cuts begin because the Fed only starts cutting rates when the economy is under pressure. However, the firm said dividend stocks have historically provided “downside risk mitigation” in this environment.

Thousands of dividend investors regularly share their tips and secrets on earning a stable income in dividend-related communities on Reddit. About five months ago, someone ran a poll on r/Dividends asking people to share their monthly dividend income.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

While many high-profile portfolios earn thousands of dollars a month, for this article, we picked a portfolio that makes a modest $550 a month since we are focusing on dividend investing strategies for beginner investors. The Redditor sharing this portfolio said he’s making this income on a $60,000 investment.

Many of the stocks in the portfolio are high-yield, risky REITs and business development companies.

The ETFs and stocks mentioned in the article are purely for informational purposes and are based on an income report/comment shared by an investor on Reddit. These are not recommendations or investing advice.

Energy Transfer LP

Energy Transfer LP Unit (NYSE:ET) is an energy dividend stock with an almost 8% yield. The company is less exposed to volatile commodity prices than its rivals since most of its revenue comes from fee-based contracts. Earlier this month, Energy Transfer LP Unit (NYSE:ET) increased its full-year profit outlook after posting strong volumes for the second quarter.

Icahn Enterprises LP

Billionaire Carl Icahn’s Icahn Enterprises LP Common Stock (NASDAQ:IEP) yields over 23%, but it’s not the safest dividend stock out there. The company recently posted second-quarter results, according to which the conglomerate’s loss came in higher than Wall Street estimates, and revenue also missed expectations. The stock is down about 12% so far this year.

Altria Group

Altria Group (NYSE:MO) has a 7.6% dividend yield and about 54 years of consistent dividend growth history. It’s one of the most popular high-yield dividend stocks among income investors on Reddit. While the tobacco industry’s troubles amid declining use of traditional tobacco products have made Altria Group (NYSE:MO) investors uneasy, they are hopeful about the company’s transition toward e-vapors and nicotine pouches.

Annaly Capital Management

New York-based mortgage REIT Annaly Capital Management, Inc. (NYSE:NLY) is another high-yield dividend stock in the Redditor portfolio. The stock yields about 12% and pays $550 per month in dividend income.

Blackstone Mortgage Trust

Blackstone Mortgage Trust Inc. (NYSE:BXMT) has a dividend yield of about 9% even after a 24% dividend cut announced last month, mainly due to office loan performance problems. However, the company also announced plans to buy back up to $150 million of its class A common stock.

FS KKR Capital

FS KKR Capital Corp (NYSE:FSK) is a business development company with a dividend yield of about 13%. The company’s second-quarter results showed signs of improving asset quality. It has an investment portfolio of $1.4 billion, mainly focused on senior secured debt.

Easterly Government Properties

Easterly Government Properties Inc. (NYSE:DEA) is a Washington-based REIT that lends properties to the U.S. government. Over 90% of the company’s rental income comes from government leases, which makes its business model safe since government-backed leases are considered trustworthy and long-term. The stock has a dividend yield of about 7.8%.

Rithm Capital

Rithm Capital Corp (NYSE:RITM) is a real estate credit services company. The company manages a portfolio of mortgage-related investments, focusing on mortgage servicing rights (MSRs). As of the end of the June quarter, MSRs were the largest asset on Rithm Capital’s balance sheet, valued at $9.7 billion.

JPMorgan Nasdaq Equity Premium Income ETF

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) is a high-yield covered call ETF that distributes monthly dividend income. The ETF invests in Nasdaq companies and generates extra income by selling call options. Its dividend yield is about 9%.

Hercules Capital

Hercules Capital Inc. (NYSE:HTGC) is another high-yield BDC dividend stock in the portfolio generating $550 per month. Jefferies recently increased the stock’s price target to $25 from $23, reiterating its Buy rating following second-quarter results. Hercules Capital Inc. (NYSE:HTGC) has more than a decade of consistent dividend growth. Since 2019, the company has paid 16 special dividends.

Read More:

-

Don’t miss out on the next NVIDIA – you can invest in the future of AI for only $10.

**This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

When today’s AI startups go public, most of the rapid growth will be behind them — here’s how not to get left out.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Don’t miss the real AI boom – here’s how to use just $10 to invest in high growth private tech companies.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Innovation Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Arbor Realty Trust

Arbor Realty Trust Inc. (NYSE:ABR) is a mortgage REIT with a 13% dividend yield. Earlier this month Arbor Realty posted second-quarter results. Distributable EPS in the quarter totaled $0.45, beating Wall Street estimates of $0.42. Net interest income was $88 million, missing the market’s estimate of $97 million.

Blue Owl Capital

Blue Owl Capital Corp. (NYSE:OBDC) is a business development company. It recently announced strong Q2 results and revealed plans to merge with Blue Owl Capital Corp. III (NYSE:OBDE). Analysts believe that after the merger, OBDC will become the second-largest publicly traded business development company after Ares Capital. Since Blue Owl Capital Corp. (NYSE:OBDC) lends at floating rates and borrows at fixed rates, the upcoming rate cut could be a headwind. However, the company’s merger with OBDE could increase deal volumes, potentially offsetting rate-related troubles.

Ares Capital Corporation

Another business development company in the dividend portfolio generating $550 a month, Ares Capital Corporation (NASDAQ:ARCC), has a yield of about 9%. The stock has seen about 10% gain in value over the past 12 months. During the second quarter, both the core EPS and net investment income rose year over year while the company funded a net $1.77 billion in new investments.

This article Redditor Who Earns $550 a Month in Dividends Shares His Top 13 Stocks and ETFs originally appeared on Benzinga.com

US stocks are overvalued because of unrealistic expectations for AI-powered economic growth, Vanguard says

-

Investors are too optimistic about the near-term prospects of AI, Vanguard said.

-

Firms would need to growth profit by 40% annually for the next three years to match valuations, the firm said.

-

“This is double the annualized rate of the 1920s, when electricity lit up the nation,” Vanguard wrote.

With tech companies still pushing the boundaries of artificial intelligence, market excitement for it seems endless.

But this enthusiasm expects too much from the technology in too little time, Vanguard wrote on Thursday.

Wall Street is rife with upbeat forecasts about what AI could do to the economy and corporate profits. Most of them are pinned to a US workplace revolution and a productivity boom.

That optimism has helped fuel strong stock gains, with the benchmark S&P 500 up 18% year-to-date through Thursday.

But Vanguard global chief economist Joe Davis thinks expectations are too high, and says that stocks are overvalued even if the AI boom plays out as anticipated.

He estimates that US corporate profits would have to growth by 40% annually over the next three years to justify where stocks are trading now. For context, the S&P 500’s trailing one-year earnings growth rate through the second quarter of 2024 was 10.9%, according to FactSet data.

“I’m optimistic about the long-term potential of artificial intelligence to power big increases in worker productivity and economic growth,” global chief economist Joe Davis wrote. “But I’m pessimistic that AI can justify lofty equity valuations or save us from an economic soft patch this year or next.”

He continued: “This is double the annualized rate of the 1920s, when electricity lit up the nation — not to mention economic output and corporate income statements.”

Such a historic surge in corporate performance looks even less probable if the economy cools down next year. Vanguard expects GDP to expand by just 1% to 1.5% in 2025.

It’s not that the investment firm has no faith in AI’s potential — its research suggests 45% to 55% odds that AI will trigger a boom in labor productivity. Between 2028 and 2040, that could spur a 3.1% annualized rate of US growth in real terms.

But investors need to let go of any notions that this will happen immediately, Davis said. While firms have poured billions to advance their position in the sector, some market players are incorrect in thinking that AI investing will reach $1 trillion in the near term:

“$1 trillion in AI investment by 2025 would require 286% growth. That’s probably not going to happen, which means we’re unlikely to experience an AI-driven economic boom in 2025,” he said.

Some on Wall Street are much more pessimistic. BlackRock has said there’s a strong chance that heavy AI investing will trigger higher inflation before any production boom can come. That could erode corporate profit growth.

Read the original article on Business Insider

As Twitter's Revenue Collapses By 84%, Tesla Bulls Fear Elon Musk Will Liquidate More Tesla Stock, Bringing Its Value Down For Everyone

Elon Musk is facing serious financial problems with X, formerly known as Twitter. Since he bought the platform, its revenue has dropped by an incredible 84%, creating a huge financial gap that Musk might have to fill by selling more of his Tesla stock. This has some Tesla investors worried, as selling more stock could cause Tesla’s value to drop, hurting everyone who owns shares in the company.

Don’t Miss:

Twitter’s Revenue Takes a Huge Hit

Musk bought Twitter for $44 billion, but turning the company around has been a big challenge. The New York Times recently reported that X made only $114 million in revenue in the U.S. during the second quarter of 2024, according to the documents they obtained. This is a massive drop compared to $661 million in the same quarter in 2022 before Musk took over. When we account for inflation, that’s a drop of a whopping 84%.

The main reason for this decline is that advertisers have pulled out, largely because of Musk’s controversial statements and actions. To make matters worse, X has sued some of these advertisers, which could scare off even more business.

See Also: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

As Bradford Ferguson, president and chief investment officer of asset manager Halter Ferguson Financial, said in a recent YouTube video, “Suing your customers might be a little challenging for your revenues.” It’s clear that X is in a tough spot financially, and something drastic may need to be done to keep the company afloat.

The Fear of More Tesla Stock Sales

Musk might need to sell some of his Tesla shares to deal with X’s financial problems. This is making Tesla investors nervous, as they remember what happened the last time Musk sold a large amount of Tesla stock. A few years ago, he sold about $40 billion worth of Tesla shares, which caused the stock price to drop significantly.

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $100

In the same YouTube video, equity analyst Matt Smith mentioned that Musk might need to sell between $1 and $2 billion worth of Tesla stock in succession to help X. Ferguson warned that this could cause Tesla’s stock price to drop by 5% to 10%.

Will Musk Break His Promise?

No further TSLA sales planned after today

— Elon Musk (@elonmusk) April 29, 2022

See Also: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

Musk had previously promised not to sell more Tesla shares until 2025, but with X’s finances in such bad shape, he might have to back off that promise sooner than expected. In December 2022, Musk hinted that if things got worse, he might need to sell more Tesla stock around late 2024 or early 2025.

It wouldn’t be the first time he broke such a promise, either, because he famously tweeted in April 2022, “No further TSLA sales planned after today,” but then sold billions of dollars worth of Tesla stocks.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article As Twitter’s Revenue Collapses By 84%, Tesla Bulls Fear Elon Musk Will Liquidate More Tesla Stock, Bringing Its Value Down For Everyone originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Investors rush to money market funds before Fed rate cut, BofA says

Investors poured $37 billion into cash-like money market funds (MMFs) in the week to Wednesday, Bank of America (BAC) said on Friday, as they braced for the US Federal Reserve to cut interest rates in September.

It put MMFs on track for their biggest three-week cumulative inflow since January at $145 billion, BofA said, citing figures from financial data provider EPFR.

Investors put $20.4 billion into stocks, $15.1 billion into bonds, and $1.1 billion into gold, BofA said, in its weekly round up of flows in and out of world markets.

Many fund managers hope rate cuts will lower the returns on MMFs and cause a rush of cash into stocks and bonds.

Yet big investors typically flock to money market funds before the Fed cuts rates, as the range of short-term fixed income securities in the funds means they tend to offer higher returns for longer than short-term Treasury bills.

“Rate cuts not a likely spark for equity buying from the $6.2 trillion money market fund (sector),” BofA strategists, led by Jared Woodard, wrote.

“History shows the first Fed cut precedes more cash inflows in a ‘soft’ landing, and bonds the likely winner if ‘hard’.”

Recent economic data, broadly speaking, has pointed to a gradual economic slowdown, or ‘soft landing’ as opposed to a more dramatic ‘hard’ alternative.

BofA and EPFR’s data showed investment grade bonds drew their 43rd straight week of inflows at $8.1 billion.

Emerging market equities received $4.7 billion in their 12th straight week of inflows, the longest streak since February 2024.

(Reporting by Harry Robertson, editing by Alun John and Dhara Ranasinghe)

Elon Musk, Donald Trump, and X: Why Tesla investors are in a quagmire

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

One longtime Tesla (TSLA) shareholder is looking for a reason to believe in a company taking on fire from all sides.

But he admits that it’s getting tough to stay a believer in Elon Musk’s electric vehicle maker.

“[I] fear that Tesla’s best days are behind it,” Gerber Kawasaki Wealth & Investment Management CEO Ross Gerber told Yahoo Finance executive editor Brian Sozzi on the Opening Bid podcast (watch video above or listen below).

Gerber said he recently slashed his stake in Tesla to 266,000 shares, valued at around $50 million. Last year, he owned a reported 420,000 shares and was more of a Tesla optimist.

The very active poster on X, formerly Twitter, says he invested heavily in Tesla in 2018 and 2019. At the time, “things were really tough. I stuck by [Elon Musk] and invested money when nobody else would,” he said. “It paid off for me.”

But that was then, and since, Musk has taken to calling Gerber an “idiot” on X for voicing frequent concerns about the company’s business.

As Musk has pivoted toward building humanoid robots at Tesla, reviving X, and launching rockets via SpaceX, Gerber is worried the billionaire is leaving opportunities on the table at Tesla — at the risk of Tesla shareholders such as himself.

“Elon is not focused on building Tesla,” Gerber said.

Meanwhile, the fundamentals of Tesla have taken a turn for the worse.

In late July, the company reported second quarter results that included an earnings miss while revenue exceeded expectations. Vehicle deliveries came in at 440,000, only slightly above consensus.

Gerber believes Tesla is in for a few more challenging quarters.

The used car market is presently “flooded” with languishing Teslas because the “CEO now owns [X],” Gerber warned.

Tesla shares are trading at $213, down from the 52-week high of $278.98 but higher than the low of $138.80 during that same period.

Not helping sentiment on Tesla’s stock is Musk’s pivot to support former President Donald Trump.

Musk’s close-knit status with Trump is doing the company few favors, Gerber said, referring to Trump as “the worst thing for Tesla you could ask for” since he won’t help sell cars.

Trump’s proposed policies, such as repealing the $7,500 EV tax credit and supporting the oil industry, are in opposition “to the concept of what Tesla is,” said Gerber, adding that if Musk were to get a cabinet position in a second Trump administration, “it would be because of Twitter.”

Musk and Trump “want to control the narrative on Twitter,” he said. “That’s why they have a relationship.”

To be sure, Musk and Tesla still have an intensely loyal retail investor base unshaken by volatile news of the day.

“I’m very convinced this [stock] goes to $5,000 or $10,000 [long-term] once people understand what Tesla is all about,” retail investor and Tesla shareholder Alexandra Merz said on Opening Bid. Merz is a former financial adviser and current CEO of L&F Investor Services.

To Merz, Tesla’s stock remains undervalued for two main reasons.

First, the market is not properly pricing in the company’s earnings power from the widespread adoption of its Optimus humanoid robots over time.

These robots have their doubters, including former Meta head of AI Jerome Pesenti. “Sometimes we have to call it what it is, right? I mean, have you seen this [robot] thing do anything? It’s bulls**t,” Pesenti said on Opening Bid.

Second, Tesla’s AI is a competitive advantage that can widen its moat against car rivals such as General Motors (GM).

Gerber thinks the belief in Tesla’s Optimus robot is overdone and shouldn’t play a factor in a rational analysis of the stock.

“The last thing I need is some robot built by Elon Musk in my house,” Gerber added.

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. Find more episodes on our video hub or watch on your preferred streaming service.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Ask an Advisor: I'm Selling My Home for $750k-How Much Will I Owe in Capital Gains Taxes?

I am selling my house and the price is $504,999. After paying off this house I will net $400,000. Do I have to pay a capital gains tax as I’m planning to pay off my retirement home with the money I netted?

– Thomas

The answer is solidly “it depends,” both in terms of whether you’ll have to pay capital gains tax and how much you might have to pay. Let’s talk about the rules around this situation first, and then we can get into some examples to see how they work.

Is Your Home Sale Taxable?

The IRS allows single filers to exclude up to $250,000 of capital gains from the sale of their home, and married couples filing jointly to exclude up to $500,000, if they meet certain criteria.

In order to qualify for either of those exclusions, all of the following have to be true:

-

You must have owned the home for at least two of the five years immediately preceding the sale.

-

You must have used the home as your primary residence for at least two of the five years immediately preceding the sale.

-

You can’t have claimed the exclusion in the two years immediately preceding the sale.

If you meet all of those criteria, you can claim the exclusion. If any of those criteria are not true for you, you will have to pay capital gains taxes on all of the proceeds.

Let’s look at some examples. A financial advisor can also walk you through the details in your specific situation. Get matched with a fiduciary financial advisor for free.

Example 1: Meets Exclusion Criteria, Married Filing Jointly

Let’s say that you’re selling the home you have owned and been living in for the past few years and that you are married and file taxes jointly.

In that case, you would qualify for a $500,000 exclusion on the sale of your home. Since you are netting $400,000, which is less than the exclusion, you would not have to pay any capital gains tax on those proceeds.

Example 2: Meets Exclusion Criteria, Single

Let’s assume the same situation as above, except that in this scenario you are single instead of married filing jointly. In that case, you would qualify for an exclusion but it would only be $250,000. With $400,000 in proceeds, that means that $150,000 would be subject to capital gains tax. The question then is at what rate those proceeds would be taxed. You can click here for a full breakdown of capital gains tax rates, but let’s assume that you would fall in the 15% bracket.

Multiplying $150,000 by 15%, you would have to pay $22,500 in taxes, leaving you with total net proceeds of $377,500. Of course, you may be subject to state income tax as well, which would increase the amount you have to pay.

A financial advisor can help you make calculations for your situation. Get matched with an advisor today.

Example 3: Does Not Meet Exclusion Criteria

If you don’t meet the exclusion criteria then the entire $400,000 will be taxed as capital gains. In that case, the first big question is whether those gains are taxed as short-term or long-term capital gains.

If you have owned the home for one year or less, your proceeds will be taxed as short-term capital gains, which means they will be subject to the same tax rates as ordinary income.

Let’s say that you are married filing jointly and that you and your spouse have $100,000 in income aside from your home sale. The $400,000 in proceeds would push your total ordinary income to $500,000 and into the 35% tax bracket, but because of our progressive tax code not all of that money would be taxed at the 35% rate.

Again, you can click here for a full breakdown of the 2023 tax brackets, but here’s how it would apply to your $400,000 home proceeds in this case:

-

$90,750 would be taxed at 22% = $19,965 in taxes

-

$173,450 would be taxed at 24% = $41,628 in taxes

-

$98,300 would be taxed at 32% = $31,456 in taxes

-

$37,500 would be taxed at 35% = $13,125 in taxes

That’s a total tax bill of $106,174 on just your home sale, leaving you with net proceeds of $293,826. Though again there may be state income taxes on top of that.

If you’ve held your home for one year or longer, you will only have to pay the lower long-term capital gains rate. Using the same example as above, with $100,000 in taxable income aside from the sale of your home, the entire $400,000 would be subject to a 15% capital gains tax. That’s a tax cost of $60,000, for net proceeds on your home sale of $340,000.

There Are Exceptions

There are exceptions to the general rules laid out above. You can click here for an overview of those exceptions, and you can click here for details regarding all of these rules.

But for the most part, it comes down to whether you’ve owned and lived in the home for at least two of the past five years. If so, you will qualify for a significant exclusion. If not, you will have to pay capital gains tax on the entire amount. Consider speaking with a fiduciary financial advisor if you have more questions.

Bottom Line

Figuring capital gains tax that may be owed on a home sale depends on several factors. One is whether you meet the criteria for excluding $250,000 for single filers and $500,000 for couples filing jointly. A second factor is how long you have lived in the house and whether it has been your primary residence. In addition, you must not have claimed the exclusion in the two years previous to the home sale. Keep in mind, though, that there are exceptions

Tips on Taxes

-

If you don’t have a financial advisor yet, finding one doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have free introductory calls with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Our free capital gains calculator, for both short-term and long-term, can be used for gains on the sale of a wide variety of assets, not just a residence.

-

Check out our no-cost property tax calculator to get a quick estimate of what you will owe based on the property’s location and its assessed value.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/:ArLawKa AungTun, ©iStock.com/designer491

The post AAA: I’m Selling My House and Netting $400k to ‘Pay Off My Retirement Home.’ Do I Have to Pay Capital Gains Tax? appeared first on SmartReads by SmartAsset.

2 Stocks Down 51% and 43% That I Just Made Huge Investments In

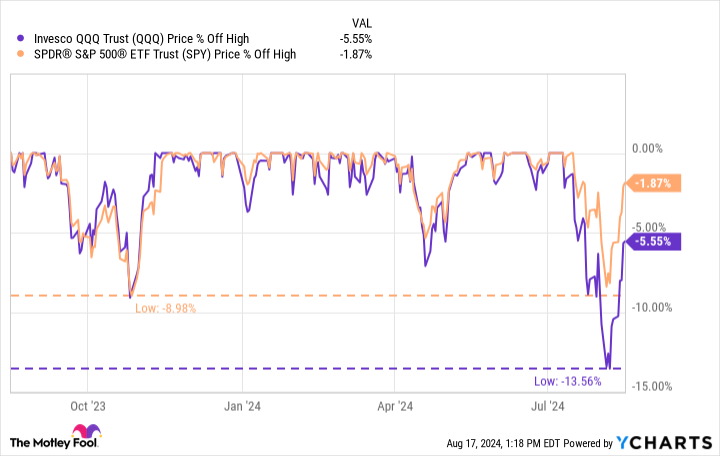

Although the early August market pullback may have been short-lived, it created opportunities to purchase excellent companies at much lower valuations. The Nasdaq Composite entered correction territory (defined as 10% off its recent high) and pulled back nearly 14%, while the S&P 500 flirted with a correction. However, both indexes recouped the majority of their losses in more recent trading sessions.

While some see sharp market pullbacks and run for the exits, savvy investors see them as fantastic opportunities. Corrections are normal and necessary events in the market. They generally occur about once a year on average and are actually healthy. Without periodic corrections, bull markets can become overheated and lead to bubbles, which are often followed by deeper crashes that can seriously harm not just the economy, but seriously dent long-term investors’ wealth building process.

And so, the best action for long-term investors amid corrections is to keep emotions at bay, and stay calm and take advantage of the volatility by purchasing shares of compelling companies at a discount.

I did this with Dell (NYSE: DELL) and Micron (NASDAQ: MU), two companies that are benefiting from the boom in artificial intelligence (AI) and data centers.

Data centers are critical to AI

The shift to cloud computing over the last couple of decades necessitated the construction of a host of massive data centers (buildings filled with infrastructure, servers, network, and storage equipment, etc.) to process and store data. Without them, software for businesses, online banking, streaming television, gaming, and many other applications wouldn’t function. The boom driven by AI programs creates another technical challenge.

Generative AI software requires much more processing power than other applications, so more capacity is needed now. Some data centers are small, less than 10,000 square feet, while others are massive, at more than 1 million square feet. So-called hyperscalers like Amazon, Meta, and Alphabet build these massive centers. Here are a few fun facts:

-

The U.S. is home to more than half of the world’s approximately 10,000 data centers.

-

120 new hyperscale data centers could become operational each year for the next 10 years.

-

Elon Musk’s xAI plans to build a gigantic data center in Tennessee that could include 100,000 Nvidia (NASDAQ: NVDA) liquid-cooled GPUs.

Dell and Micron will benefit significantly from rising data center demand. Both have industry expertise, critical products, and long-standing partnerships with AI chip leader Nvidia. But the recent correction sent their stocks tumbling, at one point down 51% and 43%, respectively, before recovering slightly, as depicted below.

Despite their strength over the past year and a half or so, the stocks are still down significantly from their recent highs. Here’s why I picked up significant positions in both.

Is Dell an overlooked AI stock?

Dell divides its business into two segments: the client solutions group (CSG) and the infrastructure solutions group (ISG). The client side includes PCs, laptops, and gaming products. CSG revenue was relatively flat in its fiscal 2025 first quarter (which ended May 3, 2024) due to a weak consumer market. However, my focus is on the infrastructure solutions segment. This segment supplies data center infrastructure, including AI-ready servers, data storage, and liquid cooling technology.

The ISG segment posted 22% growth in fiscal Q1 to reach $9.2 billion in revenue, while servers and networking sales grew 42% year over year to $5.5 billion, illustrating the increasing demand from data centers. The company also reported $1.7 billion in AI-optimized servers shipped in fiscal Q1, double the amount shipped in the prior quarter.

Dell stock trades at a price-to-earnings ratio (P/E) of 22, higher than its 3-year average. However, its forward P/E is just 14 based on analysts’ forecasts. Given the current demand, Dell has a great chance to beat these estimates.

Management believes the AI runway is long, and announced a refocused effort tailored to AI in the last earnings call. The recent pullback in its stock price should be compelling for long-term investors.

Is Micron stock a buy now?

Data centers and AI programs require boatloads of memory in addition to the infrastructure discussed above. Micron is one of the leading memory providers in the world. It operates in three main end markets: data center, PC, and mobile and intelligent edge (which includes automotive and industrial). While sales into the PC and mobile markets are expected to rise slightly, the excitement is around the data center business.

Micron produces a product called high-bandwidth memory (HBM), which is designed for AI and high-performance computing (HPC). In the latest earnings report, Micron points out that:

-

HBM sales hit $100 million in the quarter. Management expects several hundred million dollars of HBM sales this fiscal year and “several billion” next fiscal year;

-

It has already sold out of HBM through the end of 2025;

-

Its customer base is expanding.

Total revenue in its fiscal 2024 third quarter (which ended May 30) was $6.8 billion, a year-over-year increase of 82%. AI-related sales grew 50% over the prior quarter. Strong demand allowed Micron to significantly expand its margins, operating profits, and cash flow.

Micron stock is difficult to value using a simple P/E ratio because the company has substantial non-cash expenses, primarily depreciation and amortization, that skew its net income. However, analysts have more sophisticated methods of valuing companies. Currently, an overwhelming majority of analysts following the stock have given it buy or strong buy recommendations, and their average price target on it is $157. Micron stock would need to gain 45% to reach that level.

Dell and Micron will benefit from the AI/data center up cycle, which could last years. Long-term investors should consider them after the recent pullback.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon, Dell Technologies, and Micron Technology. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

2 Stocks Down 51% and 43% That I Just Made Huge Investments In was originally published by The Motley Fool

Can You Guess What Percent Of People Actually Retire With A $2 Million Nest Egg? Here's A Hint – Aim Really Low

Imagine sitting on a beach, the waves gently lapping at the shore as you sip on a drink with a tiny umbrella. That’s the $2 million retirement dream. The idea of kicking back worry-free, because you’ve saved enough to enjoy your golden years in style. But here’s the twist: how many people realize that dream? Can you guess what percentage of retirees manage to bank $2 million before they call it quits?

Don’t Miss:

Spoiler Alert: It’s a Tiny Fraction

The dream of retiring with $2 million is just that for most – a dream. According to the Federal Reserve’s Survey of Consumer Finances, only about 3.2% of retirees have over $1 million in their accounts. And if you’re aiming for the $2 million club? Well, the number of those who make it is even smaller. We’re talking about a sliver of a sliver – somewhere between that 3.2% and the razor-thin 0.1% who’ve got $5 million or more.

See Also: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

How Does $2 Million Stack Up Against Average Savings?

The average retirement savings for people 65 and older? Just $232,710 as of 2022, according to Vanguard. That’s less than one-tenth of $2 million! Even if you look at different age groups, it’s clear that the $2 million milestone is out of reach for the vast majority. Those aged 65 to 74 average around $609,230; for those 75 and older, it drops to $462,410. Both figures are impressive compared to the general population, but they’re still far from that magical $2 million mark.

What Sets the $2 Million Achievers Apart?

So, what’s the secret for those few who hit $2 million? It’s not just luck – though that never hurts. Several key factors play a role:

-

Early Start: Time is your friend when it comes to retirement savings. Start at 25, and you’d need to save about $5,677 annually to hit $2 million by age 72, assuming a 7% annual return. Delay it, and the numbers get a lot scarier.

-

Consistency is Key: It’s all about regular contributions. Financial pros often recommend saving away 10-15% of your income for retirement. It’s not glamorous, but it works.

-

Smart Investing: This isn’t just about saving – it’s about making your money work for you. Stocks, index funds, ETFs – these tools have historically provided the best returns. Just letting cash sit in a savings account won’t cut it.

-

Higher Income, Higher Savings: Whether you like it or not, those with higher incomes have an easier time saving big. The top 10% of households have an average of $769,000 saved up for retirement.

-

Education Matters: College grads tend to have more than triple the retirement savings of those with just a high school diploma. It’s a reminder of how education can impact your financial future.

-

Homeownership Helps: Homeowners typically have way more saved for retirement – 267% more, to be precise. They’ve got an average of $303,000 saved up, compared to renters.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Is $2 Million Enough?

Here’s the kicker: even if you hit $2 million, is it enough? The answer isn’t one-size-fits-all. It depends on where you live, your lifestyle, your health care needs, and whether you plan to keep working part-time. For some, $2 million might be more than enough. For others, it might just scratch the surface.

But one thing’s for sure: reaching that $2 million milestone puts you in an elite group of retirees. Whether it’s enough? That’s up to you and your unique situation. It may be a smart move to discuss your goals with a financial advisor. These experts can help you develop a game plan to reach your retirement or any other financial goals.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Can You Guess What Percent Of People Actually Retire With A $2 Million Nest Egg? Here’s A Hint – Aim Really Low originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The guest list for Mike Lynch’s fatal yacht party was a who’s who of players from the Autonomy scandal

On board the doomed Bayesian superyacht that claimed Mike Lynch’s life were not only his family and friends but also crucial business figures who encapsulated the key phases of his career.

High-flying former employees at his tech group Autonomy, allies who helped push through its multibillion-dollar sale to HP, and the legal brains who defended him after that deal turned sour were all in attendance on the Mediterranean when it ran into storms on Monday morning.

Lynch was pronounced dead on Thursday after the yacht he boarded with 21 other passengers sank off the coast of Sicily.

He was celebrating his recent acquittal on fraud charges linked to HP’s $11.7 billion acquisition of Lynch’s tech group Autonomy in 2011.

Lynch was joined by his wife, Angela Bacares, who survived, and his 18-year-old daughter, Hannah Lynch, whose body was recovered on Friday morning.

Other passengers included critical allies who had supported Lynch through the tech mogul’s most turbulent period.

The getaway was a symbolic voyage on what Lynch had described as the beginning of a “second life.”

The coincidental car crash: Steven Chamberlain

Rumors have now swirled about the connections between the guests on the boat and the coincidental death of Steven Chamberlain in a collision with a driver in Cambridgeshire, just days before the boat sank.

Chamberlain was a veteran at Autonomy and went on to become chief operating officer at Darktrace, a company widely connected with Autonomy. He took a “leave of absence” to defend himself during Lynch’s recent trial in the United States.

Former Autonomy NED: Jonathan Bloomer

The body of Jonathan Bloomer, 70, as well as that of his wife, Judy Bloomer, 71, were recovered alongside Lynch’s on Wednesday.

Autonomy appointed Bloomer as a non-executive board member in 2010. He chaired the group’s audit committee during the HP sale and was a key witness for Lynch’s defense during his fraud trial in California. At the time of his passing, Bloomer was an international chair at Morgan Stanley International.

Bloomer told prosecutors that Lynch “wasn’t particularly interested in the finance side” of Autonomy, preferring to focus on strategy and the company’s products.

Lynch’s lawyers: Chris Morvillo and Ayla Ronald

Chris Morvillo, 59, passed away aboard the Bayesian yacht with his wife, American jewelry designer Neda Morvillo, 57.

Morvillo, a lawyer at magic circle firm Clifford Chance, represented Lynch in his criminal trial in the U.S.

He told the legal podcast For the Defense that the case “covered one-third of my career” after his first meeting with Lynch in 2012, as HP’s unrest grew.

In a rare LinkedIn post following the trial, which would also prove to be one of his last, Morvillo thanked his daughters and his late wife, Neda.

“I am so glad to be home,” Morvillo wrote.

“And they all lived happily ever after…”

Ayla Ronald, a 36-year-old senior associate at Clifford Chance, was also on board the Bayesian with her partner, Matthew Fletcher. Both survived the sinking.

Ronald’s company profile details how she also defended Lynch in his fraud trial with HP.

Extensive links to Darktrace

After Lynch sold Autonomy, for which he is reported to have received £500 million ($656 million), he set up the venture capital fund Invoke Capital in 2012, which would see his influence expand deep into the U.K. tech scene in his final years.

Invoke was an early-stage investor in Darktrace, now subject to a $5.3 billion acquisition from U.S. private equity firm Thoma Bravo. The VC fund also invested in British AI company Luminance, which closed a $40 million funding round in April.

Lynch and his wife Angela held millions of their net worth in their final years through Darktrace, with a source telling Fortune they collectively had a 3% stake in the £4 billion ($5.25 billion) valued company at the time of their passing. Fortune exclusively revealed the deal is expected to still complete later in 2024.

Several former high flyers from Lynch’s Autonomy days leaped into key positions at Darktrace. Poppy Gustafsson, Darktrace’s current CEO, was a corporate controller at Autonomy. In a LinkedIn post commemorating the lives lost, Gustafsson said “Without Mike, there would be no Darktrace. We owe him so much.”

The links appear deep; Darktrace’s founding CEO Nicole Eagan also served as chief marketing officer at Autonomy, during the acquisition period involving HP. Neither Eagan or Gustafsson were on the boat, and both continue to hold leadership positions at Darktrace today.

Invoke Capital: Charlotte Golunski

Charlotte Golunski is another person with long-held business ties to Lynch. She is a partner at Invoke Capital, joining during its formation in 2012. Invoke Capital shared offices with Darktrace near London’s Trafalgar Square for a number of years.

Before joining Invoke, Golunski worked for Lynch at Autonomy and HP Autonomy for a year after the acquisition.

Golunski, 35, survived the sinking of the Bayesian alongside her partner, James Emsley, and their 1-year-old daughter. She had been asleep on the deck of the yacht with her baby when the storm hit, describing how she felt oscillations in the boat before it went down minutes later.

She told the Italian outlet La Repubblica how she held her baby above her arms in the water before she was rescued.

This story was originally featured on Fortune.com