Trump's Latest Health Care Attack on Kamala Harris: What It Could Mean for Your Premiums and Taxes

Former President Donald Trump recently sparked a debate on health care during a press conference at his Bedminster golf club. He targeted Vice President Kamala Harris over her support for Medicare for All. While Harris no longer supports a single-payer health care system, Trump’s words have many concerned about what her presidency could mean for Americans’ health care premiums and taxes.

Don’t Miss:

During the press conference, Trump accused Harris of wanting to “abolish very popular private health insurance,” which he claims would force 150 million Americans into “inferior socialist government-run health care systems.” Trump further warned of “massive tax increases” and “rationing and deadly wait times” under such a system. He argued that the U.S. has “the best health care in the world” and that Harris’s policies would destroy this system, leading to what he described as a “communist” approach where “everybody gets health care.”

See Also: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

While Trump’s statements were alarming, they were not entirely accurate. Harris has previously supported Medicare for All, which aimed to replace private insurance with a universal system. However, she has since distanced herself from this plan. A spokesperson for Harris recently clarified, “The Vice President will not push single-payer as president.” Instead, Harris now supports building on the Affordable Care Act (ACA), which allows for a combination of private and public health care options.

The clash between Trump and Harris on health care highlights a broader debate that could impact your wallet. If Harris did revert to supporting Medicare for All as Trump suggests, that could lead to higher taxes but lower overall health care costs. However, that is not currently where the Democratic candidate’s policies stand.

As it stands, Harris has emphasized her support of President Joe Biden’s initiatives to strengthen the Affordable Care Act and lower prescription drug costs. Among Harris’s plans for health care, four key areas stand out:

-

Lower prescription drug costs: Harris passed the Inflation Reduction Act in 2022, which will allow the negotiation of prescription drug prices. When these prices go into effect in 2026, Americans will save an estimated $1.5 billion.

-

Pharmacy benefit managers (PBMs): Harris has stated that she’ll start “by cracking down on pharmaceutical companies who block competition and abusive practices by pharmaceutical middlemen who squeeze small pharmacies’ profits and raise costs for consumers.”

-

Medical debt: The Harris administration plans to work with states to cancel and create policies to help prevent future medical debts.

-

Affordable Care Act (ACA): Subsidies on health care premiums are set to expire in 2025. Harris wants to expand the ACA premium tax credits so they don’t expire.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

The U.S. health care system is imperfect and will likely face ongoing reforms regardless of who takes office. Americans often pay much more for health care than people in other high-income countries. The ACA has made strides to expand coverage and reduce costs, but many Americans are still uninsured or underinsured due to expensive premiums.

As the 2024 election draws nearer, health care will be among the top issues for all parties. It’s up to Americans to take the time to understand what each party’s health care proposals will mean for them.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Trump’s Latest Health Care Attack on Kamala Harris: What It Could Mean for Your Premiums and Taxes originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kamala Harris’s critics are totally wrong about taxing unrealized gains

I’m trying to work out if I’ve ever heard as much nonsense in such a short period of time as I’m hearing right now about the Biden-Harris plan to tax unrealized capital gains.

Under the plan, an increase in the value of an asset would be taxed as income, even if the owner hasn’t sold the asset. Right now, these so-called paper profits aren’t taxed.

Most Read from MarketWatch

Never mind that this proposal is nothing new — and is nowhere near getting passed into law anytime soon, anyway.

Or that it would only apply to the tiny number of people who have a net worth of over $100 million.

Or that it would be created to fix a very specific problem, which is that many of the superrich actually pay almost no income tax at all.

Even when I put all that to one side, almost every single thing I’m hearing against the proposal is wrong and an insult to our intelligence.

I’m not even especially liberal. I’m a registered independent, an investor and a capitalist. But these arguments are so bad they make me want to hoist the hammer and sickle and start singing the “Internationale.” Low-tax conservatives and Republicans should be cringing in embarrassment.

First, let’s start with all the arguments being made against this policy that are just arguments against taxes in general — for example, that if we tax unrealized gains, it will mean people are being penalized for owning assets, or for saving money.

By that measure, I’m being penalized for working for a living, because I have to pay income tax. I’m also penalized for owning a home, because it is subject to property tax. I’m penalized for inheriting money if I have to pay inheritance tax. I’m penalized for shopping when I pay my state’s sales tax.

What’s left? Er … nothing.

Look, I get it. These people don’t like paying taxes. Nobody does. But government money has to come from somewhere. If I want to live in an untaxed anarchy with no government, I can probably move to one of the world’s failed states and take my chances.

These people are no different from left-wing extremists who also want something for nothing. They deserve each other.

Then there are the complaints that taxing unrealized gains is somehow unfair because the investment hasn’t been sold yet, or because it would be too logistically difficult to tax it before a sale.

Phooey.

Why should I have to sell something before it’s taxable? My city taxes my home on its assessed value every year. It feels no obligation to wait till I sell it.

My mutual funds and exchange-traded funds charge me a fee based on the total value of my investment. They don’t just bill me for the funds I’ve sold. I pay a percentage of the total value, including all the unrealized gains.

If you have a financial adviser or portfolio manager, they will do the same thing.

They will not charge you a fee based on realized gains. They will charge you a fee based on total assets.

Amazing, really, given that such a calculation is alleged to be totally impossible.

I have never heard anyone arguing this is unfair or a wrong way to do business.

Once upon a time, taxing unrealized capital gains probably would have been logistically impossible. Imagine all the paperwork involved, back in the days before computers.

No longer.

I’ll bet your broker tracks your total portfolio value by day, hour and minute, even if you are just a regular customer with an online account. Doing the math on this stuff now is easy.

My favorite complaint about taxing paper gains comes from those in the hedge-fund and private-equity rackets whose businesses would be most affected. These are people who make their gazillions by charging their clients hefty fees … on their total assets under management.

No, not just the realized gains, but also all the unrealized gains.

The typical manager charges clients about 2% a year on the value of their investments, just for breathing, plus 20% of the profits (if any). It’s known — widely — as the 2-and-20 model.

Neither of these ludicrous fees is levied only on realized assets. Hand $1 million to a hedge fund or private-equity fund and they start charging 2%, or $20,000, a year from Day 1 — often before they get around to investing your money.

And if your portfolio somehow goes up, say, by 50%, they’ll skim another 20% of that — $100,000 — in extra fees. No, they won’t wait till any of those gains are realized, or “crystallized,” or whatever term they use. You’ll be paying those fees quarterly, if not monthly, as the supposed performance occurs.

If the investments then tank, even before you’ve realized a nickel of personal gains, do you think they’ll give that money back? How big a sucker are you?

And these are the same people pretending to be shocked — shocked! — by the very idea of levying a charge based on asset value or unrealized gains: “What kind of Soviet tyranny is this?”

Pass the hankies.

It’s not as if these guys have any grounds to complain about the tax code. They already get a full-service massage from the IRS every year.

Hedge-fund and private-equity managers benefit from the so-called carried-interest loophole, which might better be described as the two-Ferrari tax break.

This is a special tax break, just for them, that’s so outrageous that nonexperts simply refuse to believe it when you tell them about it.

It means they pay taxes at special low rates. And they get to defer their tax bills for years.

Try doing that at home.

It’s not even as if they are creating value. As Warren Buffett has pointed out, these funds, over time, generate worse returns for their investors than low-cost index funds.

Personally, I think we should levy a special tax on all hedge-fund and private-equity managers. How about 2% of their personal assets per year, plus 20% of your gains — realized and unrealized?

Outrageous? Larcenous? Grotesque? Sure. We learned from the best.

Most Read from MarketWatch

A week ago, Starbucks’ new CEO was a ‘messiah’…and then everyone found out about his 1,000-mile private-jet supercommute

A week ago, Starbucks’ (SBUX) new CEO, Brian Niccol, was described as the “messiah” that the ailing coffee giant was looking for.

The mere announcement that the former CEO of Chipotle had a new job drove Starbucks stock up 25%—the greatest surge in value in the company’s history.

Niccol, who has a track record of success in turning around companies that have hit a rough patch, including Taco Bell and, most recently, Chipotle, is due to start at Starbucks on Sept. 9.

So far, so good.

But in the last few days the good news has been overshadowed by a public backlash over perks in his contract that allow him to work remotely from his home in Newport Beach, Calif., and commute to the company’s HQ in Seattle via private jet.

In Starbucks’ offer letter to Niccol, the company said: “During your employment with the company, you will not be required to relocate to the company’s headquarters… You agree to commute from your residence to the company’s headquarters (and engage in other business travel) as is required to perform your duties and responsibilities.”

The document also states that he will be eligible to use the company’s aircraft for “business related travel” and for “travel between [his] city of residence and the company’s headquarters.”

A Starbucks spokesperson clarified to CNBC that its new chief will still be expected to work from Starbucks’ Seattle office at least three days a week, in line with the company’s hybrid work policies.

Yet, instead of extinguishing the fire, the announcements only stoked the flames. By Thursday, the New York Times weighed in with a sarcastic headline. The BBC even produced a map of his commute.

Niccol’s commute had taken on a media life of its own.

‘What a bunch of performative hypocrites’

Some consumers have (wrongly) drawn the conclusion that as Niccol isn’t required to relocate to Seattle, he will be using the company jet on a daily basis to get to work.

Although the company denied to the BBC that Niccol will be expected to fly back and forth over 1,000 miles each day, the public has gone into overdrive, blasting his “hypocritical” commute given the company’s recent sustainability commitments. According to a 2021 report by the European Federation for Transport and Environment, private jets are up to 14 times more polluting, per passenger, than commercial planes and 50 times more polluting than trains.

“Starbucks CEO has decided to travel on a private jet for work instead of relocating. Meanwhile, we are supposed to save the environment and have our coffee with a paper straw that gets soggy in minutes,” one social media user wrote on X.

Another user joked: “Looks like we’ll have to use a lot more of reusable cups and paper straws to ‘offset’ the new Starbucks CEO’s humongous carbon footprint.”

“What a bunch of performative hypocrites with their enviro friendly branding. No company who truly cares about the climate would agree to this,” chimed a third.

“If this man is commuting regularly on a private jet, do not let @Starbucks convince you they are environmentally conscious,” another wrote. “They get on us commoners about our cars but things like private jets and yachts do way more damage to the environment per unit.”

Starbucks declined to comment on accusations that it is being hypocritical by pushing its customers to use paper straws while its CEO has access to the company jet.

“Niccol has proven himself to be one of the most effective leaders in our industry, generating significant financial returns over many years,” a spokesperson for the company told Fortune. “We’re confident in his experience and ability to serve as the leader of our global business and brand, delivering long-term, enduring value for our partners, customers and shareholders.”

The public will forget Starbucks’ hypocrisy—its workers won’t

Ben Alalouff, chief strategy officer at the marketing agency Live & Breathe, thinks that while the public backlash will blow in a matter of days, Starbucks workers won’t forget the news so quickly.

“If I was a Starbucks employee at corporate and I heard that a huge amount of costs every month is being used [to fuel a private jet] rather than investing into the workforce or investing into benefits or bonuses or whatever it may be, I’d be pretty pissed off,” he told Fortune.

As well as the anger directed at Starbucks from environmentally conscious consumers, others on social media have been quick to highlight the inconsistency with Starbucks’ decision to require office workers to return to the office at least three days a week.

Unlike Niccol, those who live far from the office (on a fraction of their boss’ salary) will have had to choose between relocating to meet the company’s in-office requirements or finding alternative work.

It’s probably a nine-day wonder

In the long run, however, Alalouff thinks the Starbucks brand will be fine.

“I think it is too large of a brand and it’s too much of a small issue in the plethora of things that are wrong with the world,” Alalouff tells Fortune. “No one’s going to change their coffee habits long-term based on the fact that the CEO is on a jet three days a week.”

“It’ll be this week’s interesting, ridiculous behaviour by an executive… But I think the worry would be internally,” he adds.

“I totally understand stretching and accommodating talent that’s going to be transformative to your business. But I think this one probably goes a tad too far.”

Niccol’s arrangements are pretty common. As few as 7% of CEOs are back in the office full-time (despite a quarter of them believing that a return to the office full-time is a priority).

Unsurprisingly, the double standard isn’t going unnoticed by employees who are often responding to rigid RTO mandates with resignation letters—or sticking around but putting in minimal effort and finding ways to flout the rules.

In Alalouff’s eyes, Starbucks will have to spend the next six months making the company “look rosy” to get buy-in from both its employees and customers.

“The longer this new CEO goes without making a huge impact that’s noticeable internally as well as externally, the worse this decision will look,” he concludes.

This story was originally featured on Fortune.com

Billionaire Bill Ackman has an idea for getting the ultrawealthy to finally pay a fair share of taxes

Acknowledging the growing number of Americans fed up with yawning income inequality, billionaire investor Bill Ackman has come up with a way to get the ultrawealthy to pay their fair share.

The founder of Pershing Square Capital Management suggested on Thursday a tailored approach to ensure people like Elon Musk and Jeff Bezos shoulder more of the burden, arguing against the blunt instrument of a proposed federal tax levied on unrealized capital gains.

In order to avoid endangering America’s entrepreneurial spirit, Ackman argued, the wealthy should be taxed on the basis of how much they borrow against stock in their own companies, closing arguably the most controversial loophole in the tax code.

“If you have $10 billion of stock in a company you founded,” he wrote on social media, “loans secured by the stock should be taxable as if you sold a like amount of stock.”

The way to fix this problem is to make borrowing an amount in excess of your basis in a stock taxable. In other words, if you have $10 billion of stock in a company you founded with zero basis, loans secured by the stock should be taxable as if you sold a like amount of stock.… https://t.co/uOcfYYfAAP

— Bill Ackman (@BillAckman) August 21, 2024

Ackman’s suggestion comes after Democratic presidential nominee Kamala Harris lent her support to a Biden administration plan to tax unrealized capital gains for those households whose net worth is a minimum of $100 million. The tax has met with fierce opposition from the likes of venture capitalists including Marc Andreessen, who believe it will smother the incentive for the innovation founders of tech startups provide.

How would Ackman’s idea work?

Under Ackman’s proposal, those risking their fortune would only be taxed if they encumbered their businesses with personal debt above and beyond what they put into it.

Let’s apply that to a practical example. Elon Musk is currently locked in a legal battle with investors to retain his 2018 pay package, which grants him the right to purchase nearly 304 million shares of Tesla at $23.34 each, a steep 89% discount to the current price.

Were he to win in Delaware court, he could, in theory, exercise the options by paying $7.1 billion, then turn around and immediately sell them for $64 billion (minus whatever the resulting drop in price would be with such a large sale). The difference he would then pocket, roughly $57 billion, would be taxable as a capital gain.

But what if he just wanted to free up a little cash to buy a megayacht like his rival, Amazon founder Jeff Bezos? Or a small island like his friend Larry Ellison? Under Ackman’s plan, he would be free to borrow against his shares up to the amount he invested to acquire them under the plan, but anything on top of that would be taxable.

If he then ever paid off that loan—unencumbering the underlying shares in the process—that money would be off-limits for the government going forward. That way, were Musk to actually liquidate that stock in the future, Uncle Sam could not tax it twice, first as an unrealized and then once again as a realized capital gain.

Pandemic-era asset price inflation a boon for the ultrawealthy

Much like the subprime crisis triggered banker-bashing, the outbreak of COVID has made billionaire-bashing fashionable and, crucially, very popular politically. Even JPMorgan CEO Jamie Dimon has dabbled in it.

During the pandemic, governments around the world unleashed a tsunami of fiscal and monetary stimulus. Much of that translated into inflation in the price of assets. In 2020, the value of Tesla stock alone soared 10-fold, catapulting Elon Musk’s already sizable wealth into the stratosphere.

“The pandemic—full of sorrow and disruption for most of humanity—has been one of the best times in recorded history for the billionaire class,” Oxfam concluded afterward.

In June 2021, a ProPublica investigation revealed some of the world’s richest Americans often paid little to no tax. Instead they pay for everything by tapping loans backed by their equity much like a homeowner would extract value from their house, by borrowing against its rising value.

Musk has borrowed against $50 billion worth of Tesla stock

Musk is a perfect example of someone who profited from unrealized capital gains. He hasn’t earned a salary in years: His entire pay package requires him to meet milestone targets in order to unlock tranches of stock options. No salary means no income tax. (He did pay a windfall tax in late 2021, which he claimed was the most in U.S. history after converting some of his stock options.)

Tesla’s annual proxy statement filed in April indicated he has borrowed against 238.4 million shares as of March 31, worth a collective $50 billion at the current price. And that’s just Tesla—who knows if he has done the same with his privately owned companies like SpaceX.

Weeks after ProPublica’s revelations sent “shock waves through Washington,” Senate Finance Committee chair Ron Wyden, a Democrat, proposed in October 2021 the first federal tax on unrealized capital gains. But the idea was still considered too radical at the time. It was also heavily opposed by Musk, who warned it would interfere with his plans to expand civilization to Mars.

In April, Biden adopted the “sea change” approach, and November’s federal elections will likely determine its fate. If the idea lacks enough support, there’s always Ackman’s proposal.

Musk couldn’t be reached by Fortune for comment.

This story was originally featured on Fortune.com

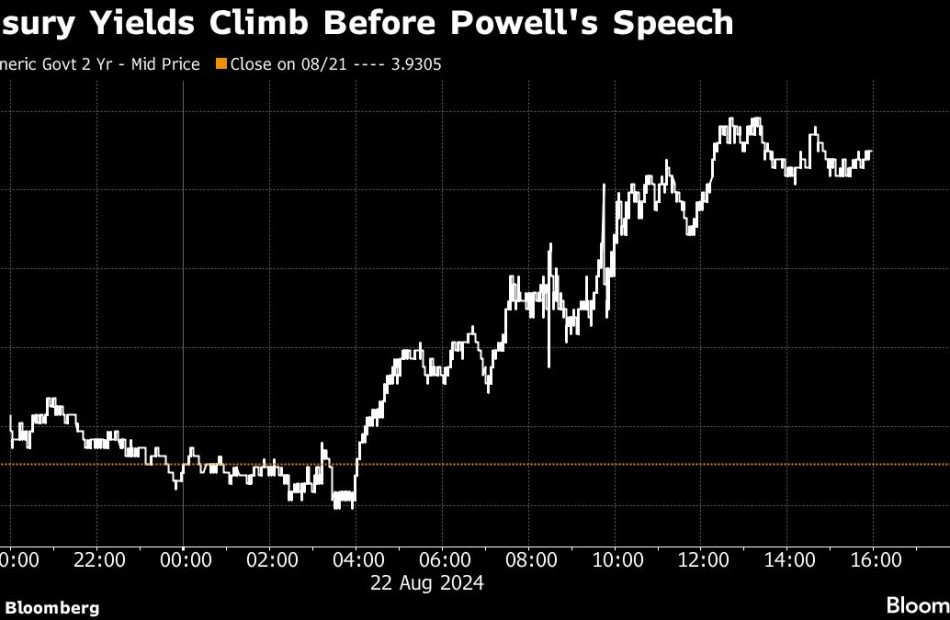

Stocks Rally as Powell ‘Locks In’ a September Cut: Markets Wrap

(Bloomberg) — Stocks rallied across the board and bond yields tumbled, with Jerome Powell giving its clearest signal yet that the Federal Reserve will begin cutting interest rates in September.

Most Read from Bloomberg

While Wall Street had already priced in the start of policy easing next month, Powell’s comments that the “time has come” validated those views. Now there are plenty of other aspects in his Jackson Hole speech that shouldn’t be overlooked. For one, the Fed chief acknowledged recent progress on inflation. Then there’s the fact the he sees the economy growing at a “solid pace” — which provides reassurance after the recent growth jitters.

But it was actually his emphasis on the “cooling labor market” that got the attention of many market observers. Basically, it was seen as an indication the Fed will do whatever it can to avoid a pronounced slowdown.

“The market should be happy with this speech because it wasn’t hawkish in any way, gave the green light for 25 basis-point rate cuts — and left the door open for even larger cuts if that becomes necessary,” said Chris Zaccarelli at Independent Advisor Alliance.

To be sure, bigger cuts could also be a warning sign for equities as they could indicate a rush prevent an economic contraction.

“It is important at this time to take a balanced approach to investing and neither plan for an imminent recession, nor chase risk and get complacent just because the Fed will be lowering rates in less than a month,” Zaccarelli noted.

Absent from Powell’s speech was any specific discussion of the destination for the federal funds rate at the end of this easing cycle or the pace of rate cuts along the way, noted Richard Clarida at Pacific Investment Management Co.

“The details are yet to come into focus, but for the Fed, the direction of travel seems clear,” said Clarida, also a former Fed vice chair. The August jobs report will likely be significant in the “25 versus 50” discussion, he said.

In the meantime, investors cheered. All major groups in the S&P 500 gained, with the gauge up over 1%. An MSCI gauge of global shares hit an all-time high. The Bloomberg “Magnificent Seven” gauge of megacaps rose 1.7%. The Russell 2000 of small firms jumped 3.2%.

A rally in Treasuries was led by shorter maturities. The two-year yield broke below 4%. The dollar lost 1%. Swap traders are now pricing in 102 basis points of easing this year, which implies a reduction at every remaining policy meeting through December, including one jumbo 50-basis-point cut.

“Here comes the punchbowl,” said David Russell at TradeStation. “Jerome Powell came out swinging today with a litany of dovish signals. He drove the point home with a clear call for adjusting policy. This keeps a tailwind at the market’s back into year-end, making it harder to expect a retest of this month’s lows.”

To Krishna Guha at Evercore, while Powell did not explicitly reference the “size” of cuts, “pace” incorporates the possibility of moving faster than 25 basis points per meeting.

“Powell has rung the bell for the start of the cutting cycle,” said Seema Shah at Principal Asset Management. “Powell has not pre-committed to a 50 basis-point cut. But make no mistake, if the labor market shows signs of further cooling, the Fed will cut with conviction.”

Neil Dutta at Renaissance Macro Research noted that the word “gradual” was missing from his speech. Unlike some of the recent Fed speakers, Powell is not removing the optionality of doing large moves as policy adjusts, he said.

“The strike price on the fabled ‘Powell Put’ is now rising,” Dutta added.

While many had their eyes peeled on Powell’s speech at the Jackson Hole symposium, to Morgan Stanley’s Michael Wilson, the jobs data in early September will be of even bigger importance.

“It’s about the labor data, period — that’s what’s going to dictate what the Fed does, they’ve said that,” Wilson, the bank’s chief US equity strategist, said in an interview with Bloomberg Television. “And that’s what the market is going to trade off of.”

Former Treasury Secretary Lawrence Summers said that, while the Fed hit a “low point” in its monetary policy history by failing to act quickly against the 2021 inflation surge, in the end it did enough to right the economy.

“I’ve got to give the Fed credit,” Summers said on Bloomberg Television’s Wall Street Week with David Westin on Friday. “While it wasn’t always obvious that this would be the case, they moved strongly enough and vigorously enough to keep expectations anchored” for inflation, he said.

Corporate Highlights:

-

Apple Inc. is planning to hold its biggest product launch event of the year on Sept. 10, when the company will unveil the latest iPhones, watches and AirPods, according to people familiar with the situation.

-

McKesson Corp. is in advanced talks to buy a controlling stake in Florida Cancer Specialists & Research Institute, a privately-held operator of oncology clinics, according to people familiar with the matter.

-

Slowing sales at Topgolf Callaway Brands Corp.’s namesake driving ranges and a hefty debt load that threatens to frighten off buyers spurred Raymond James to slash the company’s rating.

-

Workday Inc. surged after executives said the software company would sharply increase profitability over the next three years.

-

Cava Group Inc. soared after raising its full-year outlook after posting second-quarter results that beat expectations, the latest indicator that diners see good value in fast-casual restaurants.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 1.15% as of 4 p.m. New York time

-

The Nasdaq 100 rose 1.2%

-

The Dow Jones Industrial Average rose 1.1%

-

The MSCI World Index rose 1.2%

-

Bloomberg Magnificent 7 Total Return Index rose 1.7%

-

The Russell 2000 Index rose 3.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 1%

-

The euro rose 0.7% to $1.1190

-

The British pound rose 0.9% to $1.3210

-

The Japanese yen rose 1.4% to 144.27 per dollar

Cryptocurrencies

-

Bitcoin rose 4.9% to $63,655.86

-

Ether rose 4.7% to $2,749.77

Bonds

-

The yield on 10-year Treasuries declined six basis points to 3.80%

-

Germany’s 10-year yield declined two basis points to 2.22%

-

Britain’s 10-year yield declined five basis points to 3.91%

Commodities

-

West Texas Intermediate crude rose 2.6% to $74.91 a barrel

-

Spot gold rose 1% to $2,510.80 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alex Nicholson, Robert Brand and Lynn Thomasson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Want Decades of Passive Income? Buy This ETF and Hold It Forever

There is so much to love about dividends, the cash payments investors receive when a company shares its profits with them. Dividends help shareholders realize an investment return without having to sell the stock.

You can reinvest the cash or do whatever else you want. A large enough dividend portfolio can grow into a wealth machine, pumping out thousands of dollars in annual passive income.

Building such a portfolio requires high-quality stocks in companies that can grow their earnings and dividend payments year after year.

Fortunately, you don’t need to spend time and work determining which companies to own. Instead, consider this well-rounded exchange-traded fund (ETF) that will pay you decades of growing passive income.

Here are three reasons to buy and hold the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD).

1. It’s an all-in-one blue chip stock portfolio

Dividend investing is pretty straightforward, but there are two essential tips.

First, investors should avoid excessive dividend yields. Most healthy dividend stocks yield somewhere between 0.5% and 4%. There are exceptions, but stocks with very high yields are often risky; they are high because the market doesn’t trust that the company can afford its payout.

Second, investors should build a diversified portfolio so as not to rely on a few stocks for their dividend income. A diverse portfolio of blue chip dividend stocks will almost certainly keep the passive income flowing.

Schwab’s U.S. Dividend Equity ETF consists of 103 dividend stocks trading under one ticker symbol. Its top positions include established blue chips like Lockheed Martin, AbbVie, BlackRock, Home Depot, Coca-Cola, and Texas Instruments. Many of these have already raised their dividends for decades.

The beauty of an ETF like this is that you can have instant portfolio diversification. The fund managers balance the ETF and add and remove stocks for you. Investors pay a 0.06% expense fee for these services — just $0.06 for every $100 invested in the ETF. That seems like a fair price for easy access to a hands-off dividend machine.

2. A generous and growing dividend

The ETF also delivers plenty of passive income. It pays distributions (dividends) and yields 3.4% at its current price. Remember, most healthy blue chip stocks will yield up to around 4%, so this is toward the high end of that. For reference, the S&P 500 currently yields 1.3%, so investors are getting far more income than your broader market funds.

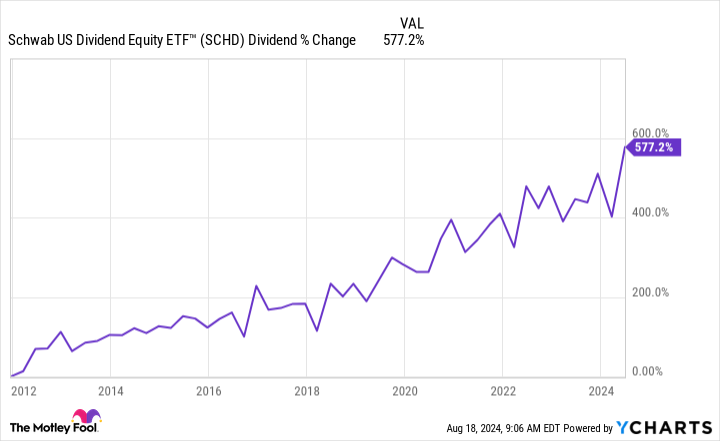

Sometimes, high yield means low growth, but that’s not the case here. The ETF has grown its dividend by more than 577% since late 2011:

That’s roughly 13 years with an annualized growth rate of over 16%! Want to build up loads of passive income? This ETF is how: Take a high starting yield and grow the payout by double digits every year. It turns out that investors can have their cake and eat it, too, with Schwab’s U.S. Dividend Equity ETF.

3. Future total return potential

The biggest knock on the ETF is that its total returns have trailed those of the S&P 500 in recent years. But that could change in the future.

You can see below that recent history is a bit of an outlier. In reality, the fund has tracked the S&P 500 pretty closely:

So, what happened?

The emergence of artificial intelligence (AI) has fueled a strong rally in technology and growth stocks, which generally exclude the types of stocks in this ETF. Most stocks in the Schwab U.S. Dividend Equity ETF are value stocks. Market conditions change over time; sometimes, growth stocks will do well, and other times, value stocks will have the spotlight.

Today, the Schwab U.S. Dividend Equity ETF trades at a price-to-earnings ratio (P/E) of 17 versus the S&P 500’s current P/E of 27. The S&P 500 is currently above its average over the past several decades.

In other words, AI stocks have stretched the broader market to a higher valuation than usual. This probably won’t last forever. Eventually, value stocks will gain favor in the market as these high-flying tech stocks come back down to earth. The ETF should perform better, and maybe even outperform the market when that happens.

You’re probably not buying the Schwab U.S. Dividend Equity ETF for potential share price gains. However, dividend investors who want competitive total returns should feel confident that it can deliver over the long term.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot and Texas Instruments. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? Buy This ETF and Hold It Forever was originally published by The Motley Fool

62% of Warren Buffett's $314 Billion Portfolio Is Invested in These 4 Unstoppable Stocks

On Wall Street, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is truly in a class of his own. Without using fancy software or trading algorithms, the Oracle of Omaha has, over nearly six decades, nearly doubled up the annualized total return, including dividends paid, of the benchmark S&P 500. On an aggregate return basis, we’re talking about Berkshire’s Class A shares (BRK.A) increasing in value by roughly 5,387,100% under Buffett’s watch.

When you deliver outsized returns on Wall Street, you tend to draw a crowd. Berkshire Hathaway’s annual meeting regularly lures in the neighborhood of 40,000 investors eager to hear Buffett speak about the U.S. economy, the stocks Berkshire holds, and his investment philosophy.

But thanks to quarterly filed Form 13Fs, we don’t have to wait a full year to get the skinny on what Warren Buffett and his top investment aides, Ted Weschler and Todd Combs, have been buying and selling.

Although Berkshire Hathaway closed out the June quarter with 45 stocks and two exchange-traded funds in its approximately $314 billion investment portfolio, one of the key traits that’s allowed Buffett and his team to vastly outperform the S&P 500 for so long is concentration. In other words, Buffett and his team strongly believe in putting extra capital to work in their best ideas.

As of the closing bell on Aug. 16, 62% ($193.3 billion) of the $314 billion portfolio Warren Buffett oversees at Berkshire Hathaway was invested in just four unstoppable stocks.

Apple: $90.42 billion (28.8% of invested assets)

As has been the case for many years, tech stock Apple (NASDAQ: AAPL) remains Berkshire’s top holding.

However, the Oracle of Omaha and his team have dumped a significant percentage of their company’s stake in Apple over the prior three quarters. This position once briefly accounted for up to 50% of Berkshire’s invested assets.

Although Buffett opined during his company’s latest annual shareholder meeting that he believes Apple is a great company, he also hinted that corporate tax rates are liable to climb in the coming years. With Berkshire Hathaway sitting on a mountain of unrealized gains from its Apple stake, Buffett presumed that investors would eventually come to appreciate he and his team locking in gains and paying a historically low tax rate.

Warren Buffett is also an unabashed fan of Apple’s market-leading share repurchase program. Adding the $26.5 billion spent on share buybacks during the company’s fiscal third quarter (ended June 29, 2024), Apple has put a whopping $700 billion to work repurchasing its stock since the start of 2013. Buybacks can incrementally increase the ownership stakes of investors, as well as provide a lift to earnings per share.

But the cautionary tale with Apple is that its growth engine has mostly stalled. While revenue tied to its subscription ecosystem have steadily grown, sales for physical devices, including iPhone, have been less than impressive.

American Express: $38.2 billion (12.2% of invested assets)

The second longest-tenured stock in Berkshire Hathaway’s portfolio, credit-services goliath American Express (NYSE: AXP), is currently Buffett’s second-largest holding. AmEx, as American Express is commonly known, has been a continuous holding since 1991 and is considered by Buffett to be one of his company’s eight “indefinite” holdings.

Financials are Buffett’s favorite sector to put his company’s money to work in, and the reason why is simple: they’re cyclical.

The Oracle of Omaha and his top aides are fully aware that economic contractions and recessions are normal and inevitable. Rather than foolishly (small ‘f’) trying to guess when these downturns will occur, Berkshire’s brightest minds are playing a numbers game that’s very much in their favor. Since recessions are short-lived — nine out of 12 recessions since the end of World War II resolved in less than 12 months — and most periods of expansion last multiple years, it pays to buy and hold high-quality businesses that grow in lockstep with the U.S. economy.

What makes AmEx special is its ability to benefit from both sides of the transaction aisle. It’s currently the No. 3 payment processor by credit card network purchase volume in the U.S., which allows it to collect fees from merchants.

But it’s also a lender to consumers and businesses via its various credit cards. This helps facilitate the collection of annual fees and interest income. Being able to double dip during lengthy periods of economic expansion and play from both sides of the retail counter has been its not-so-subtle secret to success.

Bank of America: $37.08 billion (11.8% of invested assets)

The third-largest holding in Berkshire Hathaway’s 45-stock, $314 billion portfolio overseen by Buffett is money-center giant Bank of America (NYSE: BAC). Following the sale of more than $3.8 billion worth of BofA shares by Berkshire’s investment team between July 17 and Aug. 1, Bank of America has fallen behind AmEx in the pecking order.

Buffett’s love for bank stocks also revolves around their cyclical nature. During recessions, banks usually contend with higher loan losses and credit delinquencies. By comparison, their loan portfolios typically expand during substantially longer periods of economic growth.

What’s made Bank of America such an attractive investment over the last two years is its sensitivity to changes in interest rates.

Beginning in March 2022, the Federal Reserve kicked off its steepest rate-hiking cycle since the early 1980s. No money-center bank has benefited more, in terms of added net interest income, than BofA. Conversely, an expected rate-easing cycle has the potential to adversely affect Bank of America’s net interest income more than its peers. This may be why Buffett has his crew have been sellers of late.

Furthermore, Bank of America’s management team hasn’t been shy about investing in digitization. As of the midpoint of 2024, 77% of its consumer households were banking digitally and 53% of all consumer loans were completed online or via mobile app. Digital transactions are considerably cheaper for banks than in-person interactions, which should eventually lead to improved operating efficiency for BofA.

Coca-Cola: $27.67 billion (8.8% of invested assets)

The fourth top holding in Buffett’s $314 billion portfolio at Berkshire Hathaway that, along with Apple, American Express, and Bank of America, collectively accounts for 62% of invested assets is beverage kingpin Coca-Cola (NYSE: KO). Coca-Cola is Buffett’s longest continuously held investment at 36 years (since 1988).

The beautiful thing about consumer staples stocks is they’re a necessity no matter what’s going on with the U.S./global economy or the stock market. As a provider of brand-name beverages, demand for the company’s products tends to be highly predictable year after year.

It also doesn’t hurt that Coca-Cola is one of the most recognized brands in the world. Its marketing team leans on digital media channels and artificial intelligence (AI) to reach younger audiences, while relying on well-known brand ambassadors and over a century of history to connect with its mature consumers.

To add to this point, Kantar’s annual “Brand Footprint” study found that Coke’s products have been the most-chosen from retail shelves for 12 consecutive years. Having strong branding usually translates into exceptional pricing power.

The cherry on top for Coca-Cola is that it’s a geographically diverse company. With the exception of Cuba, North Korea, and Russia, it has operations ongoing in every country. This ensures consistent operating cash flow from developed markets, as well as the ability to move the organic growth needle in emerging markets.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

American Express and Bank of America are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

62% of Warren Buffett’s $314 Billion Portfolio Is Invested in These 4 Unstoppable Stocks was originally published by The Motley Fool

If Jerome Powell Signals Rate Cuts On Friday, What Does That Mean For Crypto?

After more than two and a half years of aggressive monetary tightening, U.S. Federal Reserve Chairman Jerome Powell is widely expected to indicate an impending shift towards easing monetary policy.

What Happened: Powell’s highly anticipated keynote address at the Kansas City Fed’s Jackson Hole Economic Symposium is scheduled for Friday at 10 a.m. ET, and this event has historically been used by Fed chairs, including Powell, to signal significant changes in central bank policy, Coindesk reported.

Read Next:

Market participants have been preparing for this shift for some time, with traders already pricing in a 100% probability of at least a 25 basis point rate cut at the Fed’s upcoming September meeting.

This sentiment was further reinforced by the release of the FOMC minutes from the Fed’s July policy meeting, which revealed that a “vast majority” of participants believe a rate cut in September is “likely appropriate.”

Analysts expect Powell to not only confirm the September rate cut but also to adopt a cautious stance on further easing.

Trending: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

This could mean that the Fed might reduce rates by just 25 basis points in September and signal to markets that a continuous series of cuts should not be anticipated in the near future.

In the lead-up to this anticipated easing cycle, U.S. financial markets have largely remained buoyant.

Despite a brief dip from mid-July to early August, the S&P 500 is currently trading only about 1% below its all-time high reached in early July, while the Nasdaq is approximately 4% off its peak.

Gold has also seen a surge, hitting a record high of $2,566 earlier this week.

The bond market is similarly optimistic, with the yield on the 10-year U.S. Treasury dropping to a multi-year low of 3.77%.

Also Read: According to Cathie Wood, holding 6 Ethereum (ETH) could make you a millionaire, here’s why it can be true.

Why It Matters: However, Bitcoin (CRYPTO: BTC) has been struggling to gain traction.

Although it has recovered from the early August sell-off that briefly pushed prices below $50,000, Bitcoin remains significantly below its all-time high of around $73,500, reached back in March.

This lackluster performance is notable given other positive factors in the crypto space, including rising institutional interest and continued inflows into spot ETFs.

Moreover, Bitcoin could benefit from recent developments on the regulatory front.

According to an ABC News report, crypto-friendly Robert F. Kennedy Jr. is considering withdrawing from the presidential race on Friday and endorsing GOP candidate Donald Trump, who is also known for his favorable stance towards cryptocurrencies.

On the Democratic side, a senior official from Kamala Harris‘s campaign hinted that a Harris administration would be more supportive of the crypto industry than the current Biden administration.

The upcoming Benzinga Future of Digital Assets event on Nov. 19 will be particularly relevant in this context.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article If Jerome Powell Signals Rate Cuts On Friday, What Does That Mean For Crypto? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alibaba to upgrade Hong Kong listing in a bid to attract Chinese investment

(Reuters) — Shareholders of Chinese e-commerce giant Alibaba (BABA, 9988.HK) have approved a plan to upgrade its Hong Kong listing to primary status, the company said on Friday, a move that is expected to attract huge investments from mainland China.

The Jack Ma founded firm had originally proposed the idea a couple of years ago at a time when there was heightened geopolitical tensions between China and the U.S.

The listing status upgrade allows Alibaba to be part of a program which would connect the respective bourses in Shenzhen and Shanghai to the Hong Kong stock exchange.

The decision was expected to be approved by the company’s investors who have long been concerned over the firm’s growth prospects as it faces new market rivals such as PDD Holdings.

The conversion to dual primary listing does not involve any issue of new shares or even raising of funds by the company, Alibaba said.

Hong Kong-listed shares of the company gained as much as 0.7% to HK$82.2 in early trade.

(Reporting by Rishav Chatterjee in Bengaluru; Editing by Rashmi Aich)

Semiconductor veteran Lip-Bu Tan exits Intel's board

(Reuters) -Intel’s director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from its board, the chipmaker disclosed in a filing on Thursday.

Tan informed the company on Monday that he was resigning from the board effective immediately.

The news of Tan’s departure comes at a challenging time for Intel, which recently forecast third-quarter revenue below market estimates and announced plans to cut more than 15% of its workforce, approximately 17,500 employees, and suspend its dividend starting in the fourth quarter.

“This is a personal decision based on a need to reprioritize various commitments, and I remain supportive of the company and its important work,” Tan said in a statement.

Tan, who has served as executive chair and CEO of Cadence Design Systems Inc, joined Intel’s board in Sept. 2022.

Shares of the company were slightly up in extended trading. They closed down 6.1% at $20.10 on Thursday.

Bloomberg News first reported on the departure of Tan.

(Reporting by Juby Babu in Mexico City and Jaspreet Singh in Bengaluru; Editing by Tasim Zahid)