Why Evoke Pharma (EVOK) Stock Is Volatile

Evoke Pharma Inc EVOK shares ended Tuesday down 16.40% to 42 cents after the company announced a 1-for-12 reverse stock split of its common stock, set to take effect at 12:01 a.m. ET on August 1, 2024. After-hours trading has it up 12.44% at 47 cents.

The reverse stock split means that every 12 shares of the company’s existing common stock will be consolidated into one share. The stock will trade on a split-adjusted basis on NASDAQ under the same symbol, EVOK, starting Aug. 1.

This reverse split, approved by shareholders at the 2024 annual meeting, will not change the par value or the authorized number of shares. Fractional shares will not be issued; instead, shareholders will receive a cash payment for any fractional shares.

Should I Buy, Hold or Sell My EVOK Stock?

When deciding to buy, hold or sell a stock, investors should consider their time horizon, unrealized gains and total return.

Shares of Evoke Pharma have decreased by 75.13% in the past year. An investor who bought shares of Evoke Pharma at the beginning of the year would take a loss of $0.64 per share if they sold it today. The stock has fallen 16.7% over the past month, meaning an investor who bought shares on Jun. 1 would see a capital loss of $0.11.

Investors may also consider market dynamics. The Relative Strength Index can be used to indicate whether a stock is overbought or oversold. Evoke Pharma stock currently has an RSI of 28.29, indicating oversold conditions.

For access to advanced charting and analysis tools and stock data, check out Benzinga PRO. Try it for free.

EVOK has a 52-week high of $1.67 and a 52-week low of 36 cents.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Who is Jonathan Bloomer, Morgan Stanley’s chairman who is presumed dead in the Bayesian yacht disaster?

Morgan Stanley International chairman Jonathan Bloomer is among the missing after a tornado struck a luxury yacht off the coast of Sicily on Monday. Billionaire tech entrepreneur Mike Lynch, dubbed the “British Bill Gates,” as well as his daughter and three others, is also missing and presumed dead.

The disaster came weeks after Lynch was acquitted in the U.S. of fraud charges. Bloomer—who has served as Morgan Stanley’s chair for almost eight years and is also the chair of insurance group Hiscox, according to his LinkedIn profile—played a small role in the trial.

Lynch, 59, founded software company Autonomy in 1996 and sold it to Hewlett-Packard in 2011 for $11 billion. HP paid a 60% premium over Autonomy’s stock price, but just one year after the blockbuster deal, HP reported an $8.8 billion write-down, attributing over $5 billion of that to inflated revenue data from Autonomy. Lynch was charged with 16 counts of conspiracy and fraud, with one fraud charge later dismissed. In June, Lynch was acquitted of fraud and cleared of charges.

Bloomer, 70, served on Autonomy’s audit committee and as a non-executive on the company’s board in 2010. He also testified during Lynch’s trial, telling the court in May that Lynch was “more interested in the strategy, new products, new areas to look at, potential acquisitions,” rather than looking at the financial side of the company.

The trip aboard the Bayesian was a celebration following the decades-long trial, but Bloomer and Lynch were declared missing after high winds and a vortex of water struck and capsized the superyacht. There were 22 passengers aboard the 180-foot sailing yacht, 15 of whom were rescued, and one who was declared dead. Italian emergency services brought Lynch’s wife, Angela Bacares, who owned the yacht, to safety. Bloomer’s wife remains missing.

The Bayesian yacht accident has odd timing: It coincided with the death of Lynch’s co-defendant Stephen Chamberlain, who died after being hit by a car in Cambridgeshire, England, on Saturday.

“We are deeply shocked and saddened by this tragic event,” Hiscox CEO Aki Hussain said in a statement. “Our thoughts are with all those affected, in particular our chair, Jonathan Bloomer, and his wife Judy, who are among the missing, and with their family as they await further news from this terrible situation.”

Hiscox senior independent director Colin Keogh will serve as interim chair, the company told Fortune. Morgan Stanley did not respond to Fortune’s request for comment.

Bloomer’s tumultuous career

Prior to his tenure at Morgan Stanley and Hiscox, Bloomer was the CEO of insurance company Prudential Financial; he was ousted in 2005. The timing of Bloomer’s rising up the ranks was ill-timed, coinciding with the dotcom crash and 9/11, which sent Prudential’s share prices plummeting 40%.

During that time, Bloomer proposed buying U.S. insurer American General, a move that was largely doomed thanks to American International Group’s bid for the company that topped Prudential’s, as well as lack of investor confidence in the acquisition that sent Prudential’s shares tanking. Bloomer had to backtrack on the move, but through the takeover proposal, exposed Prudential’s relatively weak U.S. presence.

To make matters worse, Prudential’s internet banking arm, Egg, fell short of expectations, but Bloomer couldn’t find an adequate buyer. Prudential eventually sold Egg to Citigroup for about $750 million in 2007, but the company estimated a $190 million operating loss from Egg, twice what was originally expected.

Investors’ outcry reached a fever pitch in 2004, when Bloomer surprise-launched a $1.3 billion rights issue in an effort to expand the firm’s U.K. business, despite having to assuage concerns the company needed to raise more capital to do so. The CEO was ousted less than a year later and replaced with HBO’s finance chief Mark Tucker. Bloomer called it “part of the ups and downs of corporate life.”

“We have had to manage the company through difficult times and not everything has made us popular,” he said at the time. “But my job has been to lead a transformation and Prudential is now set fair to deliver further substantial growth and returns.”

This story was originally featured on Fortune.com

Wolfspeed forecasts weak first-quarter revenue on manufacturing issues

(Reuters) – Wolfspeed forecast first-quarter revenue below estimates on Wednesday, anticipating manufacturing issues that could affect its production capacity amid slowing EV sales.

Shares of the chipmaker, however, surged around 6% in extended trading, as CEO Gregg Lowe said the company continues to see strong growth from its Mohawk Valley, New York-based chip fabrication facility.

In June, Wolfspeed had said it faced issues with equipment at its Durham-based 150-mm chip fabrication plant and which could potentially impact its first-quarter revenue by about $20 million.

Meanwhile, Wolfspeed’s Mohawk Valley chip fabrication plant is targeted to reach 25% of its operating capacity in the first quarter, ahead of schedule.

“Our 200mm device fab is currently producing solid results … This improved profitability gives us the confidence to accelerate the shift of our device fabrication to Mohawk Valley,” Lowe said in a statement.

Shares started to recover as the market acknowledged the cost benefits of the new 200-mm Mohawk Valley fabrication unit, compared to the old 150-mm one, said Michael Ashley Schulman, chief investment officer, Running Point Capital.

The company counts General Motors and Mercedes-Benz among its customers and makes chips using silicon carbide, which is more energy-efficient material than standard silicon, for tasks such as transmitting power from an electric car’s batteries to its motors.

Wolfspeed expects first-quarter revenue to be between $185 million and $215 million, the mid-point of which is below analysts’ average estimate of $211.7 million, according to LSEG data.

It expects adjusted loss per share to be between $1.09 and $0.90, compared with estimate of loss of 84 cents per share.

Revenue for the fourth-quarter came in at $200.1 million, compared with average estimate of $201.2 million.

Wolfspeed’s net loss per share was $1.39 per share, compared with loss of $0.73 per share a year earlier.

(Reporting by Jaspreet Singh in Bengaluru; Editing by Mohammed Safi Shamsi)

Ask an Advisor: I Want to Avoid Dumping My RMDs Into My Checking Account – What Are My Choices?

I am approaching the time when I’ll take required minimum distributions (RMDs) from my individual retirement account (IRA). I am in a quandary about what I can do with this anticipated largesse of cash. I do not necessarily need the money dumped into my checking account.

-Tommy

Retirees who don’t need the cash from required minimum distributions (RMDs) aren’t required to dump it directly into a checking account. Fortunately, a range of options exists that allows the RMDs to work more effectively for you.

Keep in mind that how you handle your RMDs may come with tax consequences, so it’s important to keep an eye out for those repercussions. Here’s what to do with RMDs when you don’t need the cash. (If you have additional questions about investing or retirement, this tool can help match you with potential advisors.)

Consider an In-Kind Distribution

An in-kind distribution allows you to transfer or withdraw the assets from your account while maintaining their invested status, rather than cashing them out.

The benefit of distributing assets this way is that your money will stay invested in a stock, exchange-traded fund, mutual fund or other investment. That may be particularly beneficial if you’ve experienced losses recently and would like to wait to see your investments recover before cashing them in.

One downside is that you’ll still need to be able to cover the tax bill that accompanies the distribution. (If you have additional questions about the tax repercussions of investing decisions, this tool can help match you with potential advisors.)

Opt for a QCD

A qualified charitable distribution (QCD) allows taxpayers to transfer assets directly to a charity, bypassing the need to pay taxes on the distribution.

QCDs are an option for folks who truly don’t need RMD money to pay for living expenses and would prefer to use it to fund charitable causes.

Additionally, strategically utilizing QCDs can result in other important retirement benefits. They remove money from the accountholder’s taxable income, which can reduce Medicare premiums. Plus, folks who utilize this strategy before RMD age (they become available for individuals who are 70 1/2 and older) can reduce the value of their overall tax-advantaged retirement account, minimizing RMDs in the future. (If you have additional questions about investing or retirement, this tool can help match you with potential advisors.)

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Try Converting to a Roth

As you approach RMD age, consider the benefits of strategically converting dollars from your traditional IRA to a Roth.

Roth accounts are not subject to RMDs, and executing a Roth conversion may allow you to both reduce future taxes and minimize or eliminate mandated distributions, giving you more control of that money in the future. Again, there will be a tax consequence to these conversions, so plan accordingly. (If you have additional questions about the tax repercussions of investing decisions, this tool can help match you with potential advisors.)

Bottom Line

There is a range of ways to approach RMDs that don’t involve dumping them in a checking account. But some of these approaches may have implications for your tax bill, investment strategy and retirement income. Consider working with a knowledgeable financial advisor if you’re unsure of how to proceed.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Consider a few advisors before settling on one. It’s important to make sure you find someone you trust to manage your money. As you consider your options, these are the questions you should ask an advisor to ensure you make the right choice.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Susannah Snider, CFP® is SmartAsset’s financial planning columnist, and answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Susannah is not a participant in the SmartAsset AMP platform and was an employee of SmartAsset at the time of writing.

Photo credit: ©Jen Barker Worley, ©iStock.com/Halfpoint, ©iStock.com/Tom Merton

The post Ask an Advisor: I Don’t Need Them ‘Dumped Into My Checking Account.’ What Can I Do With RMDs? appeared first on SmartAsset Blog.

The banks that loaned Musk $13B to buy Twitter might be having regrets

X, formerly known as Twitter, looks like a pretty bad investment right about now.

As readers might recall, Elon Musk borrowed $13 billion from Morgan Stanley, Bank of America and five other major banks to help finance its $44 billion acquisition. According to the WSJ, the deal has since become the worst merger-finance deal for banks since the 2008-2009 financial crisis.

Why? When banks lend money for takeovers, they usually sell that debt on to others, earning fees on the transaction. That hasn’t been possible with X because of its weak financials, so the loans have weighed the banks down, becoming, in industry parlance, “hung deals.”

The WSJ notes that the banks agreed to underwrite these loans “largely because the allure of banking the world’s richest person was too attractive to pass up.” Now, it looks like a costly mistake unless they can extract interest payments from X, plus a repayment of principal once the loans mature.

Will Buffett's 'put' on oil firm Occidental halt share drop?

HOUSTON (Reuters) – Shares in U.S. oil producer Occidental Petroleum fell to $56.17 on Tuesday, below a level that has routinely triggered purchases by its biggest holder, billionaire investor Warren Buffett’s Berkshire Hathaway.

Past multimillion-share purchases were so routinely timed to drops below $60 that Wall Street analysts called it “the Berkshire put,” for setting a price floor on the oil firm’s shares.

But Occidental has traded below that price all month, the longest period since a swoon in January that ended after Berkshire acquired 4.3 million shares in early February.

The lack of purchases may reflect the Omaha, Nebraska, investor’s decision not to add to his nearly 30% stake, analysts said. Berkshire is the largest owner of Occidental shares with a stake worth $16.1 billion, and holds U.S. regulatory approval to buy up to 50% of the firm.

Spokespeople for Berkshire and Occidental did not reply to requests for comment.

Occidental shares are off 12.3% in the last 52 weeks compared with a flat performance by the XLE fund that tracks the overall energy sector.

The stock is under pressure after CrownRock LP investors this month filed to sell 29.6 million Occidental shares acquired in Occidental’s $12 billion deal for the Midland, Texas, oil producer.

Prior drops have routinely triggered big purchases. In June, Berkshire acquired 2.56 million shares at prices between $59.86 and $59.75 apiece. It bought nearly $590 million in Occidental shares after the price fell last December on the debt required in the CrownRock deal. The trend dates to fall 2022 with large Berkshire share acquisitions between $57.91 and $61.38.

In addition to its common shares, Berkshire owns warrants to purchase 83.5 million shares of Occidental at $59.62 per share, and holds preferred stock in the Houston-based company.

(Reporting by Gary McWilliams; editing by Jonathan Oatis)

Who’s going to win the presidential election? The stock market has a prediction.

There’s a 64% probability that Kamala Harris will win this November’s presidential election, given the stock market’s strong year-to-date performance.

This is moderately higher than the 58% probability I reported in a column this past May. That’s because the stock market is higher now than it was then, and there is a significant correlation between the stock market’s election-year performance and the incumbent party’s chances of retaining the White House.

Most Read from MarketWatch

Read more economic and political news

Many readers have been urging me to update that column, now that President Biden has withdrawn from the race and Kamala Harris is the presumptive Democratic Party nominee. But the change in candidates does not impact the statistical conclusion, which is based on the identity of the incumbent party rather than the nominee. The only input to my simple statistical model is the Dow Jones Industrial Average’s DJIA year-to-date return, which is higher today than three months ago.

It’s important to put this model’s conclusion in its proper context. On the one hand, it by no means is a guarantee. In 2016, for example, the stock market on Election Day was sitting on modest year-to-date gains and the incumbent party still lost. In any case, it’s entirely possible the stock market will fall between now and Election Day and thereby reduce the probabilities currently calculated by my model. Harris’s probability of winning would drop below 50%, for example, if the DJIA’s year-to-date return on Election Day were to be negative.

On the other hand, the stock market has a stronger statistical record than the several other indicators that I analyzed, such as the economy (as measured by GDP), the Conference Board’s consumer-confidence index and the University of Michigan’s consumer-sentiment survey. Look at the accompanying chart, which was built by dividing all election years since 1900 into thirds, based on the DJIA’s year-to-date return on Election Day. Notice that the incumbent party’s chances of winning rise with each tertile.

What about the electronic futures and betting markets? Given that they have been around for just a handful of presidential election cycles, there is too little data to know whether they have a better track record than the stock market. Nevertheless, I note that those markets currently are placing similar odds on a Harris victory as my stock market model. The Harris contract at PredictIt.org, for example, is giving her a 58% probability of winning.

Most Read from MarketWatch

JD Vance Shocks With Claim That Owning A New Car Costs Every American $50,000 A Year

Republican Sen. JD Vance doesn’t pull punches with his criticism, but he opened up a new can of worms during a rally in Byron Center, Michigan. Speaking before an audience in Kent County, Vance blamed Vice President Kamala Harris for what he described as a shocking increase in the cost of owning a new car.

Don’t Miss:

“Thanks to Kamala Harris’ spending policies, the average price of a new car costs nearly $50,000 a year,” Vance said, eliciting mixed reactions. The statement quickly became a trending topic, drawing attention on social media.

It certainly didn’t stop many from challenging Vance’s claim, with some questioning how a car could cost $50,000 annually. “What kind of car is Vance talking about? A luxury fleet?” was one Twitter user’s reaction – which pretty much summed up the sentiment of many others who found the number hard to swallow.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Data from the U.S. Department of Transportation offers a different perspective. In 2023, the average annual cost of owning and operating a car was $12,182, assuming the driver covers 15,000 miles yearly. That is a lot lower than what Vance said. Analysts believe Vance may be referring to the average price of new cars, which, according to Statista, stood at $47,010 as of 2023 – not the annual cost of owning a car.

The comment triggered a flurry of reactions online, with one post humorously noting, “Vance says a new car costs $50k a year? Must be nice to live in his reality.”

See Also: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

Industry analysts have pointed out that car prices rose sharply after the COVID-19 pandemic. This was mainly due to a worldwide shortage of chips that led to production problems. The United Auto Workers’ strikes in 2023 worsened the situation, further limiting new vehicle availability.

Despite these challenges, vehicle prices have started to ease. Kelley Blue Book said that the average new-car price in July 2023 was $48,401, which marked the 10th month of year-over-year declines due to improved inventory levels and higher loan rates. According to the Department of Transportation, the average auto loan interest rate 2023 was 7.2%, its highest since 2007.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

With the car industry holding such a central position in the state, Vance’s words were likely intended to resonate with Michigan voters. Michigan is home to 96 of the country’s top 100 auto suppliers; therefore, car prices are likely a core concern to its people.

Responding to those comments, Vance’s spokesperson told Newsweek, “The media is failing the American people by not showing the out-of-control costs of living under Kamala Harris’s leadership. New cars cost $50,000, groceries are up 21%, rent jumped 22%, electricity costs 32% higher, and so on. American families cannot take another four years of Kamala Harris.”

Vance has a history of ruffling feathers with his bold statements. In 2022, he ran a TV ad in which he said, “Joe Biden’s open border is killing Ohioans with more illegal drugs and more Democrat voters pouring into this country.” PolitiFact fact-checked the statement as false, saying that, upon arrival in the United States, immigrants could not vote immediately and the U.S. border was not “open,” as Vance claimed.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article JD Vance Shocks With Claim That Owning A New Car Costs Every American $50,000 A Year originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Seeking at Least 10% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

What goes up must come down, right? It works with gravity – but for the past couple of years the stock markets haven’t seemed to operate that way. The bull run shows no signs of ending – unless veteran investment strategist David Roche is right in his most recent predictions.

Roche is predicting that three factors will act together to bring the bulls to a halt by next year: disappointing rate cuts from the Federal Reserve; lower-than-expected earnings in the second half of this year; and a coming bust as investors realize that the AI boom is a classic bubble. Taking these together, Roche says, “I think there is enough in those three factors to cause a bear market of minus 20% in 2025, maybe starting at the end of this year.”

That, then, is a reminder for investors to start making defensive moves, and that will naturally turn attention to the dividend stocks.

These classic defensive plays offer the benefit of a steady income stream no matter how the markets turn – and with the high-yield div stocks, that income stream is more than enough to beat inflation. The Street’s analysts know this, and in the current environment they are recommending dividend payers with yields of at least 10%. That’s a solid return by any standard, and one that’s always worth a closer look.

For additional color, we’ve used the database at TipRanks to look up the broader view on them. Here are the details.

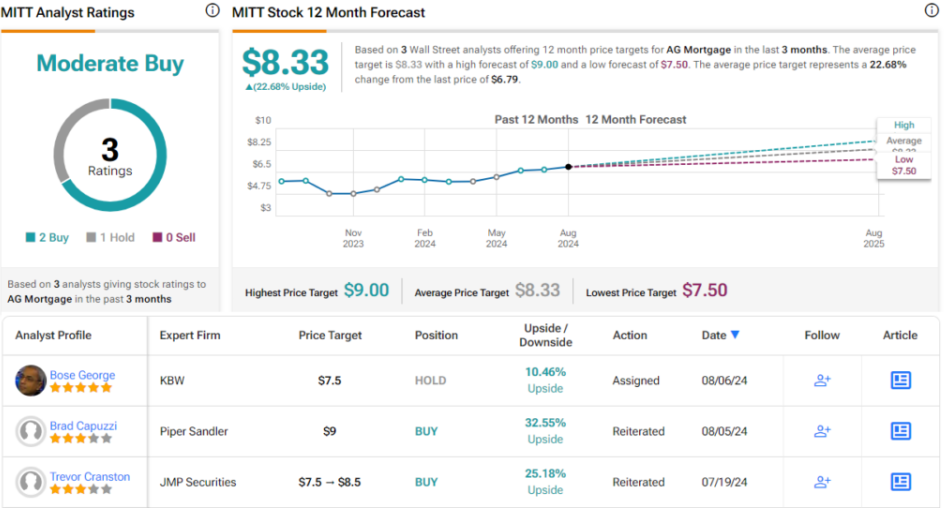

AG Mortgage Investment Trust (MITT)

The first stock we’ll look at is that of AG Mortgage Investment Trust, one of the many REITs – real estate investment trust companies – that exist to both provide capital for and to profit from the real estate sector of the US economy. AG Mortgage is externally managed by an affiliate of the larger TPG Angelo Gordon company, one of the credit and real estate platforms with the larger TPG private equity firm based in Fort Worth, Texas. AG Mortgage operates as a pure-play residential mortgage REIT, and focuses its activities on building a risk-adjusted portfolio of residential mortgage-related assets in the US market.

According to the company’s fact sheet, AG’s investment portfolio was worth $6.9 billion as of June 30 this year. By far the largest portion, worth $5.6 billion, was in securitized loans, and 55% of the portfolio’s equity allocation was in residential mortgage assets. The portion of the company’s portfolio made up of securitized loans has been growing steadily over the past several years.

REITs are well-known as dividend champions, and AG Mortgage lives up to that. With the exception of several quarters in 2020, during the COVID pandemic period, the company has kept up its dividend payments since 2011. AG Mortgage resumed its payments at the end of 2020 and has not missed one since. The last dividend was paid out on July 31, at a rate of 19 cents per common share. This annualizes to $0.76 and gives a forward yield of 11.1%. AG Mortgage has a history of adjusting the dividend payment as needed to maintain reliability.

Turning to the company’s financials, we find that the dividend payment was supported by an earnings available for distribution (EAD) of 21 cents per common share in 2Q24. This was flat quarter-over-quarter, and up from 8 cents per share in the year-ago quarter.

For analyst Brad Capuzzi, of Piper Sandler, this REIT presents investors with a sound opportunity to buy in at a favorable point of entry. He writes of the company, “In our view, MITT is well positioned to see earnings growth throughout 2024 and 2025 as net interest income trends higher while scale and operating efficiencies show through from the WMC acquisition (completed last December). We currently forecast ~130% earnings growth in 2024 and an additional 27% earnings growth in 2025, generating ROEs in the low-teens as we exit 2025. There is a scenario where our estimates could skew conservative if MITT sees better spreads in the securitization market, funding costs improve as rates decline, and if the company executes on additional share repurchases.”

Looking ahead, Capuzzi sums up his position in simple phrasing, saying, “In our view, this is an opportunistic time to buy the stock as MITT shows significant earnings expansion and starts to close the valuation gap between peers.”

These comments back up Capuzzi’s Overweight (Buy) rating on MITT shares, and his $9 price target suggests that the stock will gain 32.5% in the coming year. Combined with the dividend potential, that gives a possible return of 43% over the next 12 months. (To watch Capuzzi’s track record, click here)

Overall, this stock has a Moderate Buy consensus rating from the Street, based on 3 recent reviews that include 2 Buys and 1 Hold. The shares are priced at $6.79 and their $8.33 average target price implies a one-year gain of almost 23%. (See MITT stock forecast)

Seven Hills Realty Trust (SEVN)

Next up is Seven Hills Realty Trust, another REIT in the US market. Seven Hills’ activities are aimed mainly at the commercial real estate market in the US, and the company has marked preference for ‘middle market and transitional real estate’ in the commercial market. The company defines middle market commercial real estate as properties with values up to $100 million and defines the transitional side of the business as investments in commercial properties that are subject to either redevelopment or repositioning that will increase the property values.

The company generated Distributable Earnings of $5.6 million in Q2, translating to 38 cents per diluted share. This was 4 cents per share better than had been expected.

These earnings results backed up the company’s dividend payment, which was last sent out on August 15 at a rate of 35 cents per common share. This was the seventh consecutive quarter with the dividend at this rate. The 35-cent payment annualizes to $1.40 per common share and equates to a forward yield of 10.5%.

Covering this stock for Janney, analyst Jason Stewart is quick to explain why Seven Hills should attract investor attention. He particularly notes the company’s success in navigating the COVID era, and strategic turn away from the office properties in the commercial real estate market. Stewart writes, “In its relatively short history as a public company, SEVN has managed a portfolio of CRE loans through the COVID-19 pandemic and one of the largest rate hike cycles in history with exceptionally good credit performance. The company has proactively reduced office exposure in its portfolio (though the remaining credits still represent meaningful exposure and deserve watching), loan origination activity is set to accelerate, current vintage loans will produce cyclically high ROEs, and the dividend is covered by earnings. At 72% of 2Q24 BVPS and a [10.4%] yield, shares are overly discounted.”

In-line with this outlook, Stewart puts a Buy rating on these shares, which he complements with a $15 price target, implying a 13% gain in the next 12 months. Add the dividend yield, and the one-year total return reaches 23.5%. (To watch Stewart’s track record, click here)

There are only two recent analyst reviews on SEVN shares, but they both agree that this is a stock to buy – giving the shares a Moderate Buy consensus rating. The stock’s $13.23 trading price and $14.75 average price target together indicate potential for an 11.5% gain in the year ahead. (See SEVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Ginkgo Bioworks to Hold Special Meeting of Shareholders

Special meeting to take place virtually on August 14, 2024 at 4:00 pm ET

BOSTON, Aug. 2, 2024 /PRNewswire/ — Ginkgo Bioworks Holdings, Inc. DNA “, Ginkgo”, ))), which is building the leading platform for cell programming and biosecurity, will be holding a special meeting of shareholders virtually on August 14, 2024 at 4:00 pm ET to vote to permit, at the discretion of the Board of Directors, a reverse stock split of the issued and outstanding shares of Class A common stock and Class B common stock in a range of not less than one-for-twenty (1:20) and not more than one-for-forty (1:40), with the final ratio to be determined by the Board of Directors. Shareholders will also vote to approve Ginkgo’s Amended and Restated Certificate of Incorporation, which has been updated to permit officer exculpation and remove provisions related to our merger with Soaring Eagle Acquisition Corp. and our domestication process, which are no longer relevant to our business.

Additional information regarding the special meeting, including how to vote, are available via proxy materials filed by Ginkgo with the U.S. Securities and Exchange Commission (the “SEC”), and can be found here.

About Ginkgo Bioworks

Ginkgo Bioworks is the leading horizontal platform for cell programming, providing flexible, end-to-end services that solve challenges for organizations across diverse markets, from food and agriculture to pharmaceuticals to industrial and specialty chemicals. Ginkgo Biosecurity is building and deploying the next-generation infrastructure and technologies that global leaders need to predict, detect, and respond to a wide variety of biological threats. For more information, visit ginkgobioworks.com and ginkgobiosecurity.com, read our blog, or follow us on social media channels such as X (@Ginkgo and @Ginkgo_Biosec), Instagram (@GinkgoBioworks), Threads (@GinkgoBioworks) or LinkedIn.

Ginkgo Bioworks Contacts:

INVESTOR CONTACT:

MEDIA CONTACT:

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ginkgo-bioworks-to-hold-special-meeting-of-shareholders-302210173.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ginkgo-bioworks-to-hold-special-meeting-of-shareholders-302210173.html

SOURCE Ginkgo Bioworks

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.