1 Unstoppable Growth Stock That Could Join Nvidia, Apple, Amazon, Alphabet, Meta Platforms, and Microsoft in the Trillion-Dollar Club By 2040

In 2018, Apple famously became the first publicly traded company in the U.S. to hit a $1 trillion valuation. Since then, several more have hit that milestone, including several of Apple’s peers in the tech industry: Microsoft, Alphabet, Amazon, Nvidia, and Meta Platforms. This group remains highly exclusive, but many more corporations will join in the coming years. One of them could be Shopify (NYSE: SHOP), an e-commerce specialist currently sporting a market cap of $135 billion.

Shopify needs a compound annual growth rate (CAGR) of at least 14.3% in the next 15 years to become a trillion-dollar stock. That’s not an easy task, but let’s find out why Shopify can pull it off.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Shopify was created to address a real pain point for businesses trying to open online storefronts, which sometimes had to deal with design challenges, lack of flexibility, and other issues. Shopify changed that. The e-commerce specialist offers practically everything merchants need all in one spot, from hundreds of customizable templates and payment processing to inventory, social media tools, marketing, and more.

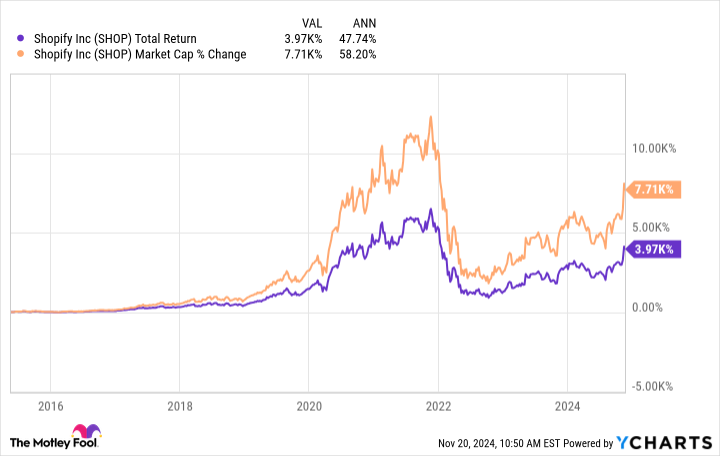

Further, there is a built-in system that gives merchants many more options. Shopify’s app store is home to thousands of apps that cater to its customers’ ultra-specific needs. Since its 2015 IPO and with co-founder Tobias Lütke at the helm, Shopify has grown at a CAGR well above what it would need in the next 15 years to become a trillion-dollar stock.

SHOP Total Return Level data by YCharts.

There is some evidence in the academic literature that founder-led companies in the S&P 500 outperform the rest. It’s hard to argue that point when looking at the list of trillion-dollar companies. Nvidia and Meta Platforms are still headed by their co-founders. Amazon was also founder-led until relatively recently, and Microsoft and Apple did have long stints with their respective founders (or co-founders) as CEOs before they stepped down.

Shopify following the same blueprint is no guarantee of success, but it’s worth pointing out that the e-commerce specialist has made it its goal to become a 100-year company. Few can come anywhere close to that, but Shopify is off to a pretty good start.

One issue Shopify had was a lack of profitability. The company recently made some changes to its business that are helping on that front. Shopify sold its logistics business, a low-margin unit that was harming its bottom line. Since then, the company’s margins and profits have looked much better. In the third quarter, Shopify’s revenue grew by 26% year over year to $2.2 billion. Shopify’s net income was up 15% year over year to $828 million.

1,200 baby boomers told us what they regret about investing for retirement

Millions of Americans facing retirement are worried they won’t be financially prepared — or fear that they’ll have to work forever.

Some are already there. Finances and retirement were major themes in the roughly 1,200 responses Business Insider received from Americans between the ages of 48 and 90 who filled out a voluntary survey about their biggest regrets. (This is part two of an ongoing series.)

Retirement — how to invest and how much one needs — is a black box for many. Some wish they’d hired a financial advisor, while others regretted expensive purchases. Others said they took Social Security too early or retired without a long-term financial plan.

And then there are those who suffered an unexpected setback such as a cancer diagnosis, a job loss, or a divorce and wish they’d been better prepared for an emergency.

Gary Lee Hayes, 70, wished he’d been more regimented with his savings and investments. The California resident briefly served in the Navy, got a degree in public administration, and worked in mental health and handyman positions. He had little financial literacy growing up and said he didn’t focus on building his career to be more lucrative.

Two of Hayes’ main money regrets are not investing in Verizon stock early on and not saving at least 10% of his income each month. He also said he was somewhat too liberal with his spending throughout his life, though he said he didn’t purchase anything too far beyond his means. He also avoided putting money into his 401(k) and said he should have chosen more stable investments instead of short-term ones.

“You can’t expect that you’re all of a sudden going to win the lottery,” said Hayes, who receives $1,846 a month in Social Security and lives in government-subsidized housing. “You can’t expect that someone’s going to pass and leave you an inheritance that will make your life more comfortable.”

A major theme among BI’s survey respondents was that they lacked knowledge about investing. For some, this meant not saving enough; for others, it meant falling into some common investing mistakes.

The stock market could be a key check on Trump's agenda in his 2nd term

-

Trump viewed the stock market as a report card in his first term and watched its performance closely.

-

A negative reaction by the market to his policies could prompt a re-think by the administration.

-

One market strategist says new tariffs could spur a negative stock-market reaction.

With President-elect Donald Trump set to begin his second term in January, the stock market could be an important check on the decisions he ultimately makes.

Trump’s ability to enact new policies has been greatly enhanced with Republicans in full control of Congress, and he’s already been exerting pressure on lawmakers to fall in line with his agenda. Those members of Congress appear keen to play ball.

The market, therefore, might be an important counterbalance to Trump’s control of Washington. If his past tenure as president is any indication, he will be alert and sensitive to negative market reactions to his policies.

During Trump’s first term, he showed that he viewed the stock market as a real-time indicator of how he was doing, taking credit when it was up and diverting blame when it was down.

Trump “demonstrated a keen focus on the stock market as a ‘scorecard’ for his administration’s success,” Mark Malek, chief investment officer at Siebert, told Business Insider.

Perhaps the best example of this came on March 13, 2020. Trump sent the late Fox News host Lou Dobbs an autographed Yahoo! Finance chart of the Dow Jones Industrial Average, which had soared nearly 2,000 points that day in response to Trump declaring COVID-19 a national emergency.

The moment demonstrated how Trump views the market’s relationship to the president’s performance, and observers say it’s possible that if he were to announce or enact policies that spark a sharp decline in stocks, he could adjust his approach.

Yardeni Research strategist Eric Wallerstein told Business Insider that certain policies that would add to the fiscal deficit and send bond investors into a panic might qualify as an event that could prompt a rethink from the administration.

“Yields would blow out, the stock market would respond unkindly to that, and then maybe he would reverse course.”

That view echoed Jeremy Siegel’s, with the Wharton professor noting shortly after the election that the President-elect will probably tread lightly when it comes to the markets.

“Both the bond market and the stock market are going to be really big constraints on many of Trump’s programs,” Siegel said.

This dynamic is top of mind for investors heading into next year given that some of Trump’s campaign promises, like mass deportations of immigrants and universal tariffs of 10%-20% on imports, could be met with dismay by stock investors. That’s because economists say the proposals could spark a rebound in inflation and limit the Federal Reserve’s ability to keep cutting interest rates.

EW ANNOUNCEMENT: Kessler Topaz Meltzer & Check, LLP Notifies Investors of a Class Action Lawsuit Against Edwards Lifesciences Corporation

RADNOR, Pa., Nov. 23, 2024 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) informs investors that a securities class action lawsuit has been filed in the United States District Court for the Central District of California against Edwards Lifesciences Corporation (“Edwards”) EW on behalf of investors who purchased or otherwise acquired Edwards securities between February 6, 2024 and July 24, 2024, inclusive (the “Class Period”) The lead plaintiff deadline is December 13, 2024.

CONTACT KESSLER TOPAZ MELTZER & CHECK, LLP:

If you suffered Edwards losses, you may CLICK HERE or go to: https://www.ktmc.com/new-cases/edwards-lifesciences-corporation?utm_campaign=mei&mktm=r&utm_source=PR&utm_medium=link&utm_campaign=ew&mktm=r

You can also contact attorney Jonathan Naji, Esq. by calling (484) 270-1453 or by email at info@ktmc.com.

DEFENDANTS’ ALLEGED MISCONDUCT:

The complaint alleges that, throughout the Class Period, Defendants provided overwhelmingly positive statements to investors related to the growth of the company’s core product, Transcatheter Aortic Valve Replacement (“TAVR”), while, at the same time, disseminating materially false and misleading statements and/or concealing material adverse facts concerning the true state of Edwards’ TAVR platform. Specifically, Edwards’ claims and confidence relied far too heavily on their perceived ability to engage the claimed low-treatment-rate population of patients and an overestimation of the desire for hospitals and other care facilities to continue to utilize and otherwise commit resources to the TAVR procedures over newer, innovative treatment alternatives.

Please CLICK HERE to view our video or copy and paste this link into your browser: https://youtu.be/hnxR1_RnFHI

THE LEAD PLAINTIFF PROCESS:

Edwards investors may, no later than December 13, 2024, seek to be appointed as a lead plaintiff representative of the class through Kessler Topaz Meltzer & Check, LLP or other counsel, or may choose to do nothing and remain an absent class member. A lead plaintiff is a representative party who acts on behalf of all class members in directing the litigation. The lead plaintiff is usually the investor or small group of investors who have the largest financial interest and who are also adequate and typical of the proposed class of investors. The lead plaintiff selects counsel to represent the lead plaintiff and the class and these attorneys, if approved by the court, are lead or class counsel. Your ability to share in any recovery is not affected by the decision of whether or not to serve as a lead plaintiff.

Kessler Topaz Meltzer & Check, LLP encourages Edwards investors who have suffered significant losses to contact the firm directly to acquire more information.

ABOUT KESSLER TOPAZ MELTZER & CHECK, LLP:

Kessler Topaz Meltzer & Check, LLP prosecutes class actions in state and federal courts throughout the country and around the world. The firm has developed a global reputation for excellence and has recovered billions of dollars for victims of fraud and other corporate misconduct. All of our work is driven by a common goal: to protect investors, consumers, employees and others from fraud, abuse, misconduct and negligence by businesses and fiduciaries. The complaint in this action was not filed by Kessler Topaz Meltzer & Check, LLP. For more information about Kessler Topaz Meltzer & Check, LLP please visit www.ktmc.com.

CONTACT:

Kessler Topaz Meltzer & Check, LLP

Jonathan Naji, Esq.

(484) 270-1453

280 King of Prussia Road

Radnor, PA 19087

info@ktmc.com

May be considered attorney advertising in certain jurisdictions. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

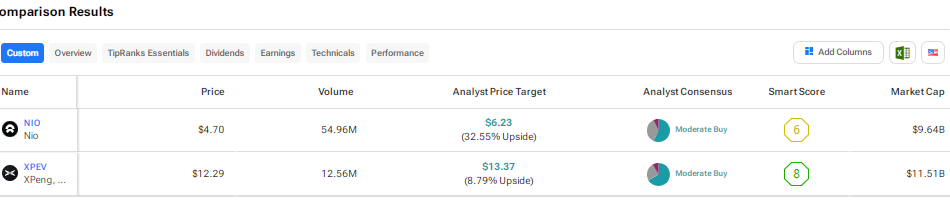

Nio or XPeng: Which Is the Best High-Growth Chinese EV Investment?

I am moderately bullish on both Nio (NIO) and XPeng (XPEV), two relatively new Chinese electric vehicle (EV) companies. However, of the two, XPeng appears to offer the best return potential, as its future growth rates are likely to surpass Nio’s. Both investments are undervalued based on my analysis, but each is likely to face challenges with profitability over the next few years. That said, with profitability expected for both companies in the medium term, I am assigning a Moderate Buy rating to each.

Using TipRanks’ Stock Comparison Tool, let us compare these two Chinese EV makers.

I’m moderately bullish on NIO stock following its recent Q3 2024 results. The company delivered 61,855 vehicles, achieving a new quarterly record. Additionally, it guided for 72,000 to 75,000 units for Q4 2024. Nio’s ONVO L60 mass-market SUV, a key growth driver, has been ramping up since late Q3, with the company targeting 20,000 units produced per month by March 2025. However, the company’s Q3 revenue did fall by 2.1% year-over-year due to pricing pressure.

In the earnings call, management emphasized long-term growth in Europe, with its global expansion strategy relying heavily on the ONVO and Firefly (a boutique compact car) models to capture mass-market demand. Compared to XPeng, Nio is less aggressive in overseas market expansion but prioritizes brand positioning and infrastructure readiness.

In many respects, XPeng focuses on efficiency, while Nio emphasizes quality. For instance, XPeng’s P7+ AI Hawkeye Visual Advanced Driver Assistance System does not rely on LiDAR or HD maps, which helps reduce costs. In contrast, Nio employs a comprehensive array of sensors, including LiDAR and HD maps. Similarly, in the U.S., Tesla (TSLA) adopts the efficiency-focused model, while Waymo follows a more comprehensive approach, akin to Nio’s strategy.

Meanwhile, Nio’s Q3 revenue grew 7% quarter-over-quarter. While its net loss remained high at RMB 5.1 billion, the company maintained a strong cash position of RMB 42.2 billion. Management is targeting breakeven by 2026. Compared to XPeng, Nio is likely to take longer to reach profitability. Although its revenue base is larger, Nio continues to invest heavily in building its long-term market position, delaying profitability in favor of a stronger future.

One of the core reasons I’m bullish on Nio is its price-to-sales (P/S) ratio of just 1x, significantly lower than historical highs (P/S of 34x in 2020). If the company continues moving toward profitability and sustains strong year-over-year revenue growth of 25% for Fiscal 2024 and 40% for Fiscal 2025, this could become a high-return investment approaching potential profitability in Fiscal 2026 or Fiscal 2027.

Stop Overpaying on Social Security Taxes. Here's What You Can Do

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Millions of Americans rely on Social Security benefits for all, or a portion, of their retirement income. Up to 85% of Social Security benefits are subject to federal income tax, depending on your total household income. However, Fidelity recently presented options for taxpayers to reduce how much they pay in taxes on Social Security benefits. Delaying Social Security claims and reducing withdrawals from traditional IRAs are two popular ways Social Security recipients can lower their tax bills. Some others may also work, depending on your specific situation.

A financial advisor can help you minimize taxes on your Social Security benefits. Speak with an advisor today.

You must pay taxes on Social Security benefits if your combined income exceeds certain thresholds. Social Security uses a figure called combined income to determine whether your income is above the thresholds where owe taxes on benefits. The formula for determining your combined income is:

Combined Income = Adjusted Gross Income (AGI) + Nontaxable Interest + 1/2 of Social Security benefits

Single filers with combined income above $25,000, and married joint filers above $32,000, may pay taxes on up to 85% of those benefits.

While Social Security benefits are subject to taxation, benefits get taxed at a lower rate than other sources of income. A maximum of 85% of Social Security benefits may be taxed, for instance, versus 100% of IRA withdrawals. This makes Social Security a valuable income source for retirees.

If you don’t do anything to manage the way your Social Security benefits are taxed, you may wind up with less after-tax income in retirement that you can use to support your lifestyle. Fidelity breaks down two widely used strategies for doing that:

-

Roth conversion: If you convert savings into a Roth IRA, you can make tax-free withdrawals from the Roth account without increasing your combined income. This Roth conversion strategy lets you claim Social Security benefits without paying more taxes on them.

-

Delaying Social Security: While you can claim Social Security benefits as early as age 62, waiting to claim boosts your benefit checks. This means that a smaller portion of what you need to pay for living expenses will have to come from taxable IRA income.

As a hypothetical example of the dollar impact of using the second strategy, assume a couple plans to retire at 65. They will pay for retirement with a combination of Social Security and IRA withdrawals totaling $70,000 after taxes. They’ll claim the standard deduction of $27,700 and use the income tax brackets for 2023.

Supermicro Shares Soar as It Looks to Avoid Being Delisted. Is Now a Good Time to Buy the Beaten-Down Stock?

It’s been a roller-coaster ride for Super Micro Computer’s (NASDAQ: SMCI) stock this year, with a lot of big moves in both directions. After a hot start to the year, the company’s shares began to slide following a short report from Hindenburg Research that accused the company of accounting manipulation. That was soon followed by the company delaying the filing of its 10-K annual report.

The Wall Street Journal later reported that Supermicro was being investigated by the Department of Justice (DOJ) over potential accounting issues, addIing fuel to the fire, although the report was never confirmed by the company nor the DOJ.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The stock later shot higher after the company announced that it has been shipping more than 100,000 graphic processing units (GPUs) per quarter.

That rally, however, faded on news that its auditor, Ernst and Young, was resigning and that it would need to find a new auditor to file its annual report. This delay put the company at risk of its stock getting delisted from the Nasdaq Stock Market.

Supermicro shares took a further hit after the company announced preliminary numbers for Q4 that came up well short of expectations. However, the stock was back to rally mode after the company announced it has found a new auditor.

For the year, the stock is currently down modestly, about 7% as of this writing, although it has a tendency to make some pretty big moves in a short period of time. Against that backdrop, let’s take a closer look at the company’s latest news and see if investors should consider buying the stock at current levels.

Supermicro shares soared over 30% after it named BDO its new auditor. Ernst and Young had earlier resigned, issuing a pretty harsh statement, saying it was “unwilling to be associated with the financial statements prepared by management” and that it has concerns about Supermicro’s governance, transparency, and internal controls.

The firm had only been Supermicro’s auditor since March 2023 after taking over from Deloitte & Touche.

Thus, getting BDO, which is one of the world’s five-largest accounting firms, to take over is a big potential win for the company. In a statement, Supermicro said, “This is an important next step to bring our financial statements current, an effort we are pursuing with both diligence and urgency.”

In addition to announcing a new auditor, Supermicro also said that it has submitted a compliance plan with the Nasdaq in hopes to get a filing extension and remain listed of the exchange. If the company were delisted, its shares would still trade, but it would now be on the over-the-counter (OTC) market. That could lead to its removal for the S&P 500 index, which is just joined earlier this year.

Real Estate Brokers Describe How The Landscape Has Changed Since Landmark Settlement On Agent Commissions

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Change is a constant in any industry, but some changes are big enough to alter how an industry operates forever. Many observers believed the real estate industry was about to experience that kind of change after a legal settlement with the National Association of Realtors (NAR) that took a sledgehammer to the industry’s traditional commission structure. Real estate brokers reflect on how the industry has changed since the settlement took effect.

Don’t Miss:

If you have ever sold a piece of real estate, you are likely familiar with “standard” broker compensation, which has traditionally been 6% of the purchase price. This compensation to the broker would be split in half with any other real estate broker who produced a buyer, meaning both brokers got 3% each. Although this was traditionally pitched to buyers and sellers as a standard practice, some people began questioning whether it was fair to the seller.

After all, paying equal compensation to a buyer’s broker, whose job is to negotiate the price of your property downward, does seem somewhat counterintuitive. However, sellers didn’t have much choice because their broker had to agree to split the commission in half with the buyer’s brokers as a condition of listing the property on the multiple listing service (MLS).

Before the internet, the MLS, operated by the NAR (or a local branch affiliated with the NAR), was almost the only way to mass-advertise a property for sale and attract qualified buyers, most of whom were represented by NAR-member brokers. The conflict revolved around whether that system created a closed loop that gave the NAR a monopoly on information and encouraged price fixing among brokerages, who almost universally charged a 6% commission.

Trending: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — you can become an investor for $0.80 per share today.

The End of the 6% Commission

After years of avoiding legal action, the NAR (and several of America’s largest real estate brokerages) settled a massive case in 2023. The settlement included $418 million in compensation for the plaintiffs and a pledge by the NAR to reform its business practices.

Dogecoin Whales Move $214.5M In A Single Day, Sparking Speculation

Large holders of Dogecoin DOGE/USD have been making significant moves, with Dogecoin whales recently buying up 550 million DOGE tokens, valued at $214.5 million, in one day.

What Happened: The transactions, recorded on blockchain monitoring services, highlight the growing activity among Dogecoin’s biggest investors.

Blockchain experts note that such whale movements often signal potential market shifts, as these transactions can precede either price rallies or sell-offs.

The transfers occurred amid a period of relative stability for Dogecoin, trading near $0.056 at the time of the transactions.

Why It Matters: Historically, Dogecoin’s price has been highly susceptible to whale activity, prompting heightened attention from the crypto community.

Dogecoin, created in 2013 as a joke, has gained significant traction thanks to endorsements from figures like Elon Musk. Despite its origins, the cryptocurrency now ranks among the top digital assets by market capitalization.

The meme coin remains a popular choice for retail investors, although its price volatility has led to mixed opinions among analysts. This latest whale activity underscores the ongoing interest in Dogecoin among major holders, hinting at potential shifts in market sentiment.

Read Next

Massive Dogecoin Moves Worth $50 Million Each Spotted On Robinhood

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You Invested $10,000 In Simon Property Stock 10 Years Ago, How Much Would You Have Now?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Simon Property Group (NYSE:SPG) owns, develops and manages premier shopping, dining, entertainment and mixed-use destinations, primarily malls, Premium Outlets, The Mills and International Properties.

It is set to report its Q4 2024 earnings on Feb. 3, 2025. Wall Street analysts expect the company to post an EPS of $3.38, down from $3.69 in the year-ago period. According to Benzinga Pro, quarterly revenue is expected to reach $1.38 billion, down from $1.53 billion in the previous year.

Don’t Miss:

The company’s stock traded at approximately $178.87 per share 10 years ago. If you had invested $10,000, you could have bought roughly 56 shares. Currently, shares trade at $180.91, meaning your investment’s value could have grown to $10,114 from stock price appreciation alone. However, Simon Property also paid dividends during these 10 years.

Simon Property’s dividend yield is currently 4.64%. Over the last 10 years, it has paid about $69.60 in dividends per share, which means you could have made $3,891 from dividends alone.

Summing up $10,114 and $3,891, we end up with the final value of your investment, which is $14,005. This is how much you could have made if you had invested $10,000 in Simon Property stock 10 years ago. This means a total return of 40.05%. However, this figure is significantly less than the S&P 500 total return for the same period, which was 225.72%.

Trending: Over the last five years, the price of gold has increased by approximately 83% — Investors like Bill O’Reilly and Rudy Giuliani are using this platform to create customized gold IRAs to help shield their savings from inflation and economic turbulence.

Simon Property has a consensus rating of “Buy” and a price target of $145.74 based on the ratings of 19 analysts. The price target implies more than 19% potential downside from the current stock price.

On Nov. 1, the company announced its Q3 2024 earnings, posting an FFO of $2.84, missing the consensus estimate of $3.03. Revenues of $1.481 billion came in above the consensus of $1.325 billion, as reported by Benzinga.