"I Knew If I Bought a Sink": What Does Elon Musk's Cryptic Tweet Mean?

Elon Musk on Saturday shared a cryptic tweet on X, hinting at a significant turning point in human history.

What Happened: Musk responded to a post on X by Bojan Tunguz, which referred to an unspecified event as “one of the major inflection points of human history.” Musk’s reply was enigmatic, stating, “I knew if I brought a sink they would have to let that sink in. How could they not?”

The Tesla and SpaceX CEO’s post on X has left his followers intrigued, as they attempt to decipher the meaning behind his cryptic words.

Also Read: Musk Tweet Sparks Dogecoin Surge, Fuels Speculation On X Payments

Why It Matters: Musk is known for his cryptic tweets, which often lead to widespread speculation. His recent tweet, which suggests a significant turning point in human history, has sparked a flurry of theories among his followers.

While the exact meaning behind Musk’s tweet remains unclear, it underscores his reputation as a thought leader in the tech industry, known for pushing boundaries and challenging conventional thinking.

Read Next

Judge Rejects SEC Bid to Penalize Musk Over Missed Deposition

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Satellite Images Reveal North Korea Reportedly Receiving Illicit Oil from Russia

Satellite images have reportedly revealed that Russia has supplied North Korea with over one million barrels of oil since March, violating United Nations sanctions that restrict oil sales to North Korea.

These transfers are part of a broader arrangement in which North Korea sends weapons, artillery shells, and even troops to aid Russia’s war in Ukraine, the BBC reports.

The oil deliveries, tracked by the UK-based Open Source Centre, are seen as a direct quid pro quo for North Korea’s military support, with the oil serving to fuel Pyongyang’s own operations and provide stability amid ongoing sanctions.

According to satellite imagery analyzed by UK-based non-profit research group the Open Source Centre and shared exclusively with the BBC, North Korean oil tankers have made 43 trips to Russia’s Far East, with vessels arriving empty and leaving full.

Despite UN sanctions capping the amount of oil North Korea can receive at 500,000 barrels per year, Russia’s illicit shipments have far exceeded this limit, with experts estimating more than a million barrels have been supplied since March.

The BBC added that these transfers not only breach UN sanctions but also involve ships that are themselves under sanction, some of which should have been impounded upon entering Russian waters, citing Go Myong-hyun, a senior research fellow at South Korea’s Institute for National Security Strategy.

The situation marks a new level of contempt for international regulations, as Russia has actively circumvented the UN panel responsible for monitoring such violations, disbanding it through its veto at the Security Council in March.

Experts worry this cooperation between two autocratic regimes may lead to even more dangerous collaborations, potentially involving military technology transfers that could further destabilize the region, the BBC adds.

While the oil deliveries provide crucial fuel for North Korea’s military, which relies on oil for its missile launchers and munitions factories, concerns are growing over the potential for more military technology exchanges, particularly in satellite and ballistic missile advancements.

Both the US and South Korea are closely monitoring the evolving ties between Russia and North Korea, with the possibility of these exchanges further threatening global security.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Picks Project 2025 Co-Author Russell Vought for OMB

President-elect Donald Trump has selected Russell Vought, co-author of the conservative policy agenda Project 2025, as director of the Office of Management and Budget (OMB) in his second term.

Vought previously served as OMB’s deputy director during Trump’s first term. But his influence extends beyond OMB. He wrote the chapter on the Executive Office of the President in Project 2025, a conservative policy framework developed by The Heritage Foundation, The Hill reports.

“He did an excellent job serving in this role in my First Term – We cut four Regulations for every new Regulation, and it was a Great Success!” Trump wrote in a post on Truth Social on Friday. “We will restore fiscal sanity to our Nation.”

Trump praised Vought’s experience in public policy, describing him as an aggressive cost-cutter and deregulator who would help advance the “America First” agenda across federal agencies.

Also Read: Judge Rejects SEC Bid to Penalize Musk Over Missed Deposition

The president-elect emphasized Vought’s knowledge of dismantling the so-called “Deep State” and restoring self-governance to the American people, alongside a promise to restore fiscal discipline.

In response to the selection, Vought posted on X, “There is unfinished business on behalf of the American people, and it’s an honor of a lifetime to get the call again.”

Project 2025, which includes input from scholars and policy experts, proposes sweeping changes such as reshaping the executive branch and reducing the size and funding of certain government agencies.

While Trump previously distanced himself from Project 2025 during his campaign, citing its controversial elements, his decision to appoint Vought as OMB director signals a strong alignment with its conservative priorities. The project has faced significant backlash from Democrats, who argue it threatens American democratic institutions.

Read Next:

Image: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy PayPal Stock While It's Below $87?

PayPal‘s (NASDAQ: PYPL) stock has rallied 41% this year as the digital payments leader has attempted to put its struggles behind it under a new CEO. Is it still worth investing in anticipation of a long-term recovery? Let’s take a fresh look at its business model, its most pressing challenges, and its valuations to decide.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

PayPal owns one of the world’s largest digital payment platforms, but a lot of its revenue came from its former parent company, eBay. That’s why it was worrisome when eBay replaced PayPal with Dutch competitor Adyen as its preferred payments platform from 2018 to 2023.

The pandemic temporarily masked PayPal’s loss of eBay’s business as more consumers and businesses relied on digital payments, but its growth in active accounts, total payment volume (TPV), and revenue decelerated after those tailwinds dissipated. Inflation, rising interest rates, and other macro headwinds for consumer spending exacerbated its slowdown in 2023.

|

Metric |

2019 |

2020 |

2021 |

2022 |

2023 |

YTD 2024 |

|---|---|---|---|---|---|---|

|

Active accounts growth |

14% |

24% |

13% |

2% |

(2%) |

1% |

|

TPV growth |

23% |

31% |

33% |

9% |

13% |

11% |

|

Revenue growth |

15% |

21% |

18% |

8% |

8% |

8% |

Data source: PayPal.

The biggest problem for PayPal is its inability to gain more active accounts. Its active accounts rose 1% year over year to 432 million in the third quarter of 2024, but that was well below the 750 million active accounts it had once planned to reach by 2025.

PayPal abandoned that long-term goal back in early 2022, and it’s clearly struggling to gain new users as it faces stiff competition from other payment platforms like Block‘s Cash App, Stripe, and Apple Pay.

To offset that pressure, PayPal relied more on its Venmo peer-to-peer payments app and Braintree back-end payments platform to grow its TPV. But that’s a double-edged sword because those two higher-growth platforms actually generate lower take rates (the percentage of each transaction it retains as revenue) than its namesake platform. As a result, PayPal’s annual transaction rate has declined every year since its spin-off from eBay in 2015.

So looking ahead, PayPal needs to grow its average TPV per existing account if it can’t win over new consumers and businesses. Under Alex Chriss, who took the helm as its CEO last year, it’s been rolling out new features — including the FastLane checkout service, Smart Receipts tool, and Cash Pass rewards program. It’s also been expanding its own buy now, pay later platform to counter disruptive challengers like Affirm and Block’s Afterpay, and it’s been using its own PayPal USD stablecoin to facilitate more cross-border transactions.

ASML INVESTOR ALERT: Robbins Geller Rudman & Dowd LLP Announces that ASML Holding N.V. Investors with Substantial Losses Have Opportunity to Lead Investor Class Action Lawsuit

SAN DIEGO, Nov. 23, 2024 (GLOBE NEWSWIRE) — Robbins Geller Rudman & Dowd LLP announces that purchasers or acquirers of ASML Holding N.V. ASML ordinary shares between January 24, 2024 and October 15, 2024, inclusive (the “Class Period”), have until January 13, 2025 to seek appointment as lead plaintiff of the ASML class action lawsuit. Captioned City of Hollywood Firefighters’ Pension Fund v. ASML Holding N.V., No. 24-cv-08664 (S.D.N.Y.), the ASML class action lawsuit charges ASML as well as certain of ASML’s top current and former executives with violations of the Securities Exchange Act of 1934.

If you suffered substantial losses and wish to serve as lead plaintiff of the ASML class action lawsuit, please provide your information here:

https://www.rgrdlaw.com/cases-asml-holding-n-v-class-action-lawsuit-asml.html

You can also contact attorneys J.C. Sanchez or Jennifer N. Caringal of Robbins Geller by calling 800/449-4900 or via e-mail at info@rgrdlaw.com.

CASE ALLEGATIONS: ASML develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers.

The ASML class action lawsuit alleges that defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (i) the issues being faced by suppliers, like ASML, in the semiconductor industry were much more severe than defendants had indicated to investors; (ii) the pace of recovery of sales in the semiconductor industry was much slower than defendants had publicly acknowledged; and (iii) defendants had created the false impression that they possessed reliable information pertaining to customer demand and anticipated growth, while also downplaying risk from macroeconomic and industry fluctuations, as well as stronger regulations restricting the export of semiconductor technology, including the products that ASML sells.

The ASML class action lawsuit further alleges that on October 15, 2024, ASML announced that it: (i) recorded quarterly booking of only €2.63 billion – a 53% decline from €5.6 billion in the second quarter of 2024; (ii) expected full year 2025 net sales to be between €30 billion and €35 billion, in the lower half of ASML’s initial range of between €30 billion and €40 billion; and (iii) materially reduced its gross margin target to between 51% and 53%, down from its prior guidance of between 54% and 56%. On this news, the price of ASML stock fell more than 16%, according to the complaint.

Then, on October 16, 2024, during the accompanying earnings call, the ASML class action lawsuit alleges that ASML’s CFO, defendant Roger Dassen, attributed the poor bookings results to “a reflection of the slow recovery in the traditional [semiconductor] end markets as customers remain cautious in the current environment.” Additionally, ASML’s CEO, defendant Christophe Fouquet, admitted that the semiconductor industry “recovery will extend well into 2025,” leading to “a reduced growth curve in 2025 and an . . . overall reduction of our lithography demand,” according to the complaint. The ASML class action lawsuit alleges that on this news, the price of ASML stock fell more than 6%.

THE LEAD PLAINTIFF PROCESS: The Private Securities Litigation Reform Act of 1995 permits any investor who purchased or acquired ASML ordinary shares during the Class Period to seek appointment as lead plaintiff in the ASML class action lawsuit. A lead plaintiff is generally the movant with the greatest financial interest in the relief sought by the putative class who is also typical and adequate of the putative class. A lead plaintiff acts on behalf of all other class members in directing the ASML class action lawsuit. The lead plaintiff can select a law firm of its choice to litigate the ASML class action lawsuit. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff of the ASML class action lawsuit.

ABOUT ROBBINS GELLER: Robbins Geller Rudman & Dowd LLP is one of the world’s leading law firms representing investors in securities fraud cases. Our Firm has been #1 in the ISS Securities Class Action Services rankings for six out of the last ten years for securing the most monetary relief for investors. We recovered $6.6 billion for investors in securities-related class action cases – over $2.2 billion more than any other law firm in the last four years. With 200 lawyers in 10 offices, Robbins Geller is one of the largest plaintiffs’ firms in the world and the Firm’s attorneys have obtained many of the largest securities class action recoveries in history, including the largest securities class action recovery ever – $7.2 billion – in In re Enron Corp. Sec. Litig. Please visit the following page for more information:

https://www.rgrdlaw.com/services-litigation-securities-fraud.html

Past results do not guarantee future outcomes.

Services may be performed by attorneys in any of our offices.

Contact:

Robbins Geller Rudman & Dowd LLP

J.C. Sanchez, Jennifer N. Caringal

655 W. Broadway, Suite 1900, San Diego, CA 92101

800-449-4900

info@rgrdlaw.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Taps Teamsters-Backed Chavez-DeRemer For Labor

Rep. Lori Chavez-DeRemer (R-Ore.), a moderate who lost her House seat this month, has been selected by President-elect Donald Trump to lead the Labor Department in his new term.

Trump praised Chavez-DeRemer, who first won her seat with just 51% of the vote in 2022 and lost it by a two-point margin this year, for her work with both business and labor groups to support American workers, The New York Times reports.

Following Trump’s announcement, National Education Association President Becky Pringle acknowledged Chavez-DeRemer’s legislative record in the House, per a report from AP News.

However, Pringle indicated that educators and working families would closely monitor the confirmation process and hoped Chavez-DeRemer would commit to supporting workers and students.

Also Read: Chamath Palihapitiya’s Suggestion For Donald Trump: ‘Make Paying Taxes Simple And Enforcement…’

Though not a major figure in labor politics, Chavez-DeRemer garnered significant union support during her campaign. She shared endorsements with her Democratic opponent, Janelle Bynum, earning the backing of groups like the Teamsters, firefighters, and ironworkers.

House Speaker Mike Johnson, who spoke at one of Chavez-DeRemer’s rallies, remarked that she received more union endorsements than any Republican he had ever seen, The New York Times added.

While labor leaders criticized Trump’s labor policies during his first term, Chavez-DeRemer’s selection was praised by some in the labor movement. Sean O’Brien, president of the Teamsters, who had been in contact with Trump throughout the campaign, called her appointment a step toward creating more union jobs. Chavez-DeRemer, whose father was a Teamster, has emphasized her work on the fentanyl crisis and law enforcement during her campaign.

As labor secretary, Chavez-DeRemer will face the challenge of possibly reversing Biden-era policies, which focused on expanding worker protections, including new overtime eligibility and protections for gig workers.

Under Trump, it’s expected that many of these measures could be rolled back, alongside stricter enforcement of child labor laws and worker classification regulations, per The New York Times.

The Labor Department’s approach to immigrant workers and workplace safety could also shift, reflecting the broader policy changes anticipated under a second Trump term.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Wall Street Analyst Who Correctly Predicted the Stock Market Collapse in 2022 Has a New Price Target for the S&P 500 Index — and It May Surprise You

The stock market has been on a tear for the last two years. The benchmark S&P 500 (SNPINDEX: ^GSPC) index is up 24% this year and nearly 50% over the last two years (as of Nov. 20). Given this incredible run and the lofty valuations that come with it, many believe the current bull market has run its course and is due for a correction.

But a team of strategists at Morgan Stanley, who recently published a report with a new price target for the S&P 500 in 2025, has an outlook that may surprise you.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The team at Morgan Stanley is led by Mike Wilson, who is known for predicting the previous bear market. Wilson has been one of the most talked-about market strategists in recent years.

In 2022, as most analysts expected stocks to continue to surge higher after an incredible run in late 2020 and 2021, Wilson and his team predicted a stock market sell-off. His call proved right — all three major indexes ended the year deep in the red, recording their worst annual losses since 2008.

Since then, Wilson has remained more bearish, incorrectly calling for another year of losses in 2023, which didn’t come to fruition. He’s also been bearish this year, initially calling for a pullback. So it might surprise investors to hear that Wilson is now a bull with a very favorable view of the market in 2025.

Morgan Stanley’s base case suggests the S&P 500 will rise about 10% next year to 6,500. Morgan Stanley’s bull case suggests an even bigger tailwind with the market reaching 7,400, implying about 25% upside from current levels:

We expect the recent broadening in earnings growth to continue in 2025 as the Fed cuts rates into next year and business cycle indicators continue to improve. A potential rise in corporate animal spirits post the election (as we saw following the 2016 election) could catalyze a more balanced earnings profile across the market in 2025.

Morgan Stanley added that valuations should remain high due to strong fundamentals bolstered by a solid macro outlook. The bank also believes the market’s earnings multiple will decline slightly to 21.5 but remain elevated compared to its 10-year average.

Wilson’s team is forecasting 13% earnings growth next year and 12% in 2026. Brent Crude oil should trade at $66 per barrel, while the yield on the 10-year Treasury bond dips from 4.41% (as of Nov. 20) to 3.55%. They are also bullish on Japanese stocks.

Top market strategists like Wilson have a lot of investing knowledge. However, predicting the stock market’s near-term price moves is an extraordinarily difficult task, so I don’t envy these strategists. Wilson and his team made some strong points. Sentiment, fundamentals, and the economic outlook have improved, so the market may continue its impressive run.

Should You Buy QuantumScape While It's Below $7.50?

Electric vehicles (EVs) aim to transform transportation. However, like any groundbreaking technology, EV batteries have hurdles to overcome before EVs become widely adopted. Some common criticisms of EVs center around their long charging times and shorter driving range compared to gas-powered vehicles.

That’s where QuantumScape (NYSE: QS) comes in. The company is dedicated to engineering batteries that overcome the obstacles current lithium-ion batteries face and make EVs more appealing to consumers. Earlier this year, QuantumScape made headlines with excellent results during an endurance test of its battery. It has also secured funding to extend its runway and recently hit a significant milestone with the shipment of its B-sample cells for further testing.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

QuantumScape is making progress, but the stock is 96% below its peak price from four years ago and near an all-time low. While its low price may make it seem appealing, there are some things you should know if you’re considering scooping up the stock today.

QuantumScape aims to revolutionize battery technology and address several obstacles that have hindered the widespread adoption of EVs. Its cutting-edge solid-state lithium-metal batteries promise to make important advancements in several key areas: increased energy density, quicker charging times, and superior safety measures when compared to traditional battery systems.

The company had established a strategic partnership with Volkswagen. Earlier this year, Volkswagen’s battery division, PowerCo, tested QuantumScape’s solid-state batteries and reported stellar results, achieving 1,000 charging cycles, with the battery cells showing minimal wear signs. This indicates that an electric vehicle equipped with their technology could potentially cover over 500,000 kilometers without experiencing a noticeable decrease in range.

Last month, QuantumScape stock surged higher after it announced it was producing and shipping out low volumes of its B-sample cells. The company says this was its most important goal for 2024, and it began shipping these cells to its automotive customers for extensive testing.

This testing by automakers will take months to complete. This is part of a three-step process, involving A, B, and C prototype cells to undergo internal and customer testing before the commercial production of its product, QSE-5. Ultimately, the company looks to validate that its technology enables EVs to drive further, charge faster, and operate more safely than those in the market today.

1 Brilliant Growth Stock to Buy Now and Hold for the Long Term

The stock market indexes recently made new all-time highs. A resilient economy, interest rates that should trend down, enthusiasm for an expected corporate-friendly incoming administration, enthusiasm for artificial intelligence (AI), and high-flying tech stocks like Nvidia and Microsoft all play a role in this bull market.

Investors should exercise some caution at these levels. Remember that 2021 euphoria quickly turned to dread in 2022. There are pockets of the market that resemble 2021 now. For instance, Palantir‘s stock trades for 56 times sales and over 160 times forward earnings. It’s a terrific company, but this is a nosebleed valuation by any measure.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

However, some companies still trade for reasonable valuations with long-term positive trends. Here is one to consider.

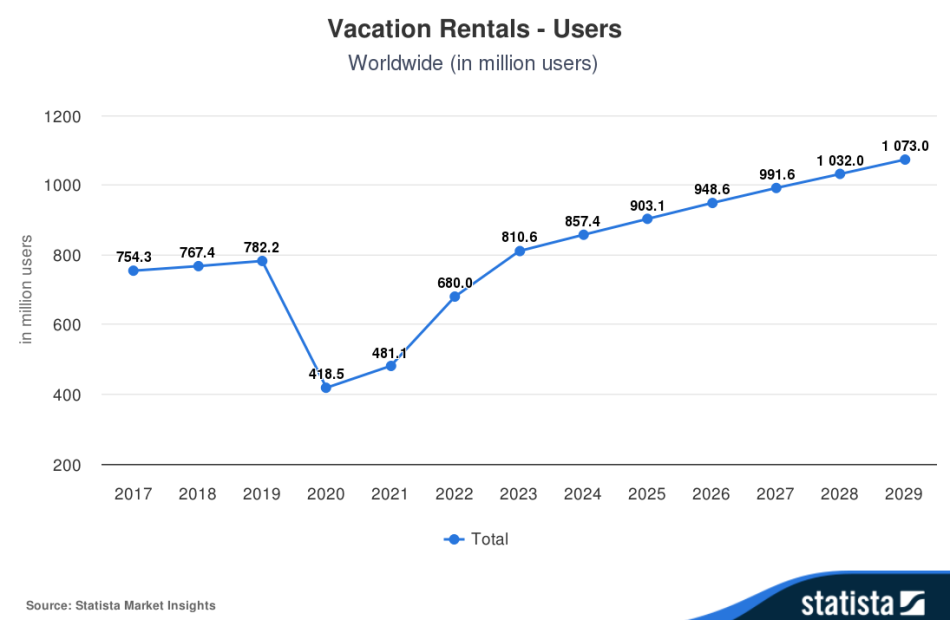

Vacation habits are changing. Younger generations book vacation rentals at a higher rate than older generations, who stick more to traditional hotels. As shown below, the number of vacation rental users will rise 25% from 2024 to 2029.

The trend means that Airbnb (NASDAQ: ABNB) has a long-term tailwind. Airbnb is also highly successful now.

Revenue hit $3.7 billion last quarter on 10% year-over-year growth, and operating income reached $1.4 billion on fantastic 37% growth. However, what I like most about the company is the ability to produce free cash flow. Airbnb operates with a lean business model and doesn’t have significant capital expenditures (capex) needs, so much of its revenue falls into the company’s pocket. Of the $10.8 billion sales over the past 12 months, $4.1 billion was converted to free cash flow, a terrific 38% margin.

Having tremendous free cash flow allows Airbnb to fund growth, maintain a fortress balance sheet, and repurchase shares. As of the third quarter, the company reported $11.3 billion in cash and investments against just $2 billion in long-term debt. The company also repurchased $2.6 billion in shares through three quarters of 2024, amounting to more than 3% of the company’s current market cap.

Airbnb stock trades at a similar valuation to its rival Booking Holdings (NASDAQ: BKNG) based on free cash flow, as shown below.

This makes sense, as the business models and financial results are similar. It also shows the importance of free cash flow in valuing these companies. Airbnb is trading slightly below its recent average and well below recent peaks.

Musk Tweet Sparks Dogecoin Surge, Fuels Speculation On X Payments

Dogecoin DOGE/USD experienced a 5% surge following a tweet by Elon Musk on X. This has sparked fresh speculations about the imminent payments service on Musk’s social app.

What Happened: Musk’s Friday post, which featured a screenshot of podcaster Joe Rogan’s X profile, triggered the increase in Dogecoin’s price.

The post displayed a unique dollar icon, different from the app’s tipping service, leading to speculations that it could be related to the anticipated X Payments service.

Musk responded to the speculation with a simple “true”, further fueling the rumors. Dogecoin’s price has historically been influenced by payment-related news from any of Musk’s ventures, including X, formerly known as Twitter.

There are speculations that once the service is live, it might support transactions with digital assets like DOGE, given Musk’s known fondness for the token.

Musk’s electric car company, already accepts DOGE payments for certain merchandise purchases in its online store.

Also Read: Dogecoin’s Active Users On The Rise, Will This Impact DOGE Price?

Over the past 24 hours, DOGE has advanced 6.16% and at the time of writing it was trading at $0.4332, outperforming the stagnant Bitcoin BTC/USD prices. The token has risen 190% over the past month, trading at its highest level since May 2021.

Why It Matters: The surge in Dogecoin’s price following Musk’s tweet is significant as it highlights the influence Musk has over the cryptocurrency market.

His tweet sparked speculations about the forthcoming X Payments service, which could potentially support transactions with digital assets like DOGE.

This is particularly noteworthy given Musk’s known fondness for the token and the fact that his electric car company, Tesla Inc., already accepts DOGE payments for certain merchandise purchases.

The rise in DOGE’s price also outperformed the stagnant bitcoin prices, indicating a growing interest in alternative cryptocurrencies.

Read Next

Crypto Analyst Predicts This Altcoin Will Explode 260% In 2024, And It’s Not Dogecoin Or Shiba Inu

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.