ZETA BREAKING NEWS: BFA Law Announces that Zeta Global Holdings has been Sued for Securities Fraud – Investors with Losses Urged to Contact the Firm (NYSE:ZETA)

NEW YORK, Nov. 24, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Zeta Global Holdings Corp. ZETA and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in Zeta, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/zeta-global-holdings-corp.

Investors have until January 21, 2025, to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Zeta securities. The case is pending in the U.S. District Court for the Southern District of New York and is captioned Davoodi v. Zeta Global Holdings Corp., et al., No. 24-cv-08961.

What is the Lawsuit About?

Zeta is a cloud-based technology company that provides a marketing platform to assist marketers in acquiring customers. The complaint alleges that Zeta represented that its marketing platform was powered by the industry’s largest opted-in data set.

On November 13, 2024, prominent investment research firm Culper Research published a report titled: “Zeta Global Holdings Corp (ZETA): Shams, Scams, and Spam.” Based on Culper’s investigation that included proprietary interviews with industry experts and former Zeta employees, the research firm found that Zeta’s data set had been generated from a network of “consent farms” – i.e., sham websites designed to gather consumer data under false pretenses or awards that did not exist. Culper Research further wrote that these consent farms drove almost the entirety of Zeta’s growth over the past 2+ years, representing 56% of its Adjusted EBITDA, and could result in devastating regulatory action.

The news caused a significant decline in the price of Zeta stock. On November 13, 2024, the price of the company’s stock fell 37%, from a closing price of $28.22 per share on November 12, 2024, to $17.76 per share on November 13, 2024.

Click here for more information: https://www.bfalaw.com/cases-investigations/zeta-global-holdings-corp.

What Can You Do?

If you invested in Zeta you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/zeta-global-holdings-corp

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/zeta-global-holdings-corp

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Smartest Dividend Stocks to Buy With $3,000 Right Now

As the stock market has moved higher, one victim has been dividend yields. With the average payout for the S&P 500 down to just 1.25%, such stocks have lost a bit of appeal at a time when investors can earn a guaranteed return of around 5% in some certificates of deposit.

Nonetheless, you don’t need to look far to find stocks with high, sustainable dividends and significant potential for stock price growth. Even with a budget of $3,000, a $1,000 investment in each of these stocks can bring a quick stream of dividend income without undermining the potential for stock price growth.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Admittedly, AT&T‘s (NYSE: T) recent dividend history may make its stock a strange choice at first glance. In 2022, the company abandoned a 35-year streak of payout hikes, slashing the dividend by 45%. It has remained at the $1.11-per-share level since then, yielding 4.8% at current prices. AT&T also carries a massive total debt of $129 billion, a huge burden considering its $116 billion in stockholders’ equity.

However, the dividend is holding up well considering this challenge. The debt fell by $8 billion over the previous nine months. Additionally, thanks to its $17 billion to $18 billion in free cash flow forecast for 2024, AT&T can pay for debt reduction while covering the $8 billion annual dividend cost.

Moreover, because of a near-exclusive focus on its wireless network and fiber, AT&T has added nearly 1.2 million wireless net customers and over 700,000 fiber net customers in the first nine months of 2024. That growing customer base allows AT&T to solidify its business.

Investors are taking notice of such improvements, and the stock price has risen 45% over the last year. With a relatively low P/E ratio of 19, investors may have an added incentive to buy AT&T stock now before the rising stock price further reduces its dividend yield.

The idea of buying a cannabis-related real estate investment trust (REIT) like Innovative Industrial Properties (IIP) (NYSE: IIPR) may seem counterintuitive right now. Although IIP serves only medical cannabis growers, the Republican sweep in the 2024 elections could slow a continued legalization process.

Also, in recent quarters, a rapid growth rate came to a halt amid problems with some non-paying tenants on its 108 properties. However, IIP proved itself adept at managing such properties by either unloading them or finding new tenants to take their places.

2 Top Tech Stocks to Buy in November

If you’re looking for tomorrow’s investment winners, the technology sector is one the best places to start. It has produced plenty of market-smashing stocks in recent decades, and artificial intelligence (AI) is a massive opportunity that could create tremendous wealth for investors in the coming years.

Here are two tech stocks ripe for the picking in November.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Shares of Micron Technology (NASDAQ: MU) rose to a high of $157 earlier this year before pulling back to around $100 at the time of this writing. That dip has made the stock’s valuation even more attractive, as the most recent earnings report still showed surging demand from data centers for the company’s high-capacity memory products.

Micron has seen a sharp rebound in its revenue over the last year. In its fiscal 2024 fourth quarter, which ended Aug. 29, revenue jumped 93% year over year, showing the company’s growth accelerating. Strong demand trends are lifting its margins, which caused Micron’s earnings per share to more than double over the year-ago quarter.

Earnings should continue to grow as Micron shifts more production to higher-margin products such as high-bandwidth memory that are expected to see surging demand in the new year. Management is seeing demand coming from AI and traditional servers, which indicates broad strength across the data center market.

Micron is ramping production up as much as it can to meet demand, as supply is the chief factor limiting its sales. This will significantly benefit the company’s margins. On average, Wall Street analysts currently expect Micron’s adjusted earnings per share to jump from $1.30 in its fiscal 2024 to $8.93 in its fiscal 2025, according to Yahoo Finance.

In light of these trends, the stock’s valuation looks attractive at just 11 times next year’s earnings. Relative to its expected fiscal 2026 results, the stock carries an even cheaper forward price-to-earnings (P/E) ratio of 8. Micron shareholders are looking at potentially substantial upsides over the next few years.

HubSpot (NYSE: HUBS) offers an easy-to-use platform that helps small businesses manage services, marketing, and sales. It has delivered robust growth in recent years and produced phenomenal returns for its investors. The stock is up 18% since the company reported its third-quarter results in early November.

Revenue grew 20% year over year on a constant-currency basis in Q3, driven by 10,000 net customer additions — bringing the total customer count to 238,000 — and continued spending by established customers. It reported strong customer interest in new AI features such as a new Copilot assistant, which is currently in beta testing.

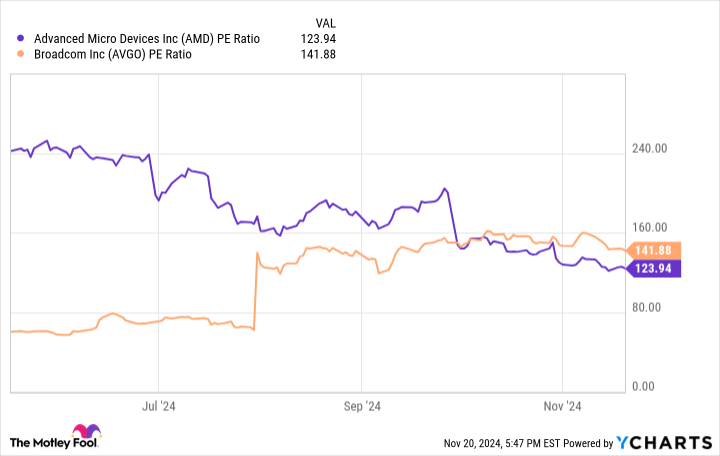

Better Artificial Intelligence Stock: Broadcom vs. AMD

It’s a good time to invest in the fast-growing artificial intelligence (AI) industry. The market for AI is expected to surpass $184 billion this year, and forecast to reach more than $826 billion by 2030.

Among AI tech stocks, semiconductor firms Broadcom (NASDAQ: AVGO) and Advanced Micro Devices (NASDAQ: AMD) are two to consider investing in. The AI industry’s growth has led to outsized sales for both as customers flocked to their offerings.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

But if you had to choose between them, is one a better AI stock than the other? Let’s compare Broadcom and AMD to help you decide which is the better AI investment for the long run.

Broadcom is basking in the AI fervor, as sales expanded 47% year over year to $13.1 billion in its fiscal third quarter, ended Aug. 4. That’s an impressive increase, but 43% of the growth came from its acquisition of VMware, which closed last November.

VMware is famous for its virtualization software, which allows IT organizations to run multiple operating systems on a single server. But its private AI technology looks like a key strategic factor behind Broadcom’s acquisition.

Private AI shields a firm’s data from access by any AI system except those designated by the business. This is important because AI tech requires mountains of data, which is taken from various sources, including from businesses that have stored data in the cloud. Broadcom believes some companies don’t want their data shared with other businesses through AI, whether to protect intellectual property or to comply with legal requirements.

Broadcom’s private AI offering is built on the VMware Cloud Foundation (VCF) platform. VCF represented more than 80% of the VMware products booked in Q3. This illustrates strong customer demand for VCF and its ability to establish a private AI for businesses.

Broadcom also generates AI-related sales from an array of semiconductor products, including those for the computer networking, storage, and broadband industries. Its semiconductor solutions division contributed $7.3 billion of its $13.1 billion in Q3 revenue, a 5% year-over-year increase.

AMD’s strategy to capture AI market share is for its semiconductor products to concentrate on accelerated computing. This computing architecture processes data-intensive work separately from other computer tasks handled by a traditional CPU. Doing so allows complex software applications, such as AI, to operate faster and more efficiently.

Billionaire Bill Ackman Bought These 2 Dividend Stocks Hand Over Fist in Q3

Diversification, schmiversification. That seems to be the attitude of billionaire hedge fund manager Bill Ackman. His Pershing Square Capital Management owns a total of 10 stocks. Two of those stocks are different share classes of the same company — Alphabet.

Ackman didn’t initiate any new positions in the third quarter of 2024. However, he did buy more of two dividend stocks hand over fist.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Going into Q3, Brookfield Corporation (NYSE: BN) wasn’t anywhere close to being Ackman’s largest holding. But the global investment company stood at the top by the end of the quarter (at least, if we don’t lump his stakes in Alphabet Class A and Class C shares together).

Pershing Square bought roughly 25.9 million shares of Brookfield in Q3, increasing its stake by almost 378%. The stock now makes up 13.5% of the hedge fund’s portfolio.

Brookfield is a dividend stock, but I doubt there’s an income investor on the planet who would get excited about the company’s dividend. The forward dividend yield is a paltry 0.55%.

Investors might be enthusiastic about Brookfield’s returns, though. The stock has grown at a compounded annual rate of around 18% over the last 30 years. Over the last 12 months alone, Brookfield’s shares have skyrocketed 70%.

Nike (NYSE: NKE) ranked among Ackman’s smallest holdings before July 2024. However, the billionaire owns a much bigger stake in the footwear and apparel giant now. Pershing Square bought over 13.2 million shares of Nike in Q3, increasing its position by roughly 436%.

Income investors will find more to like with Nike than they will with Brookfield Corporation. Nike’s forward dividend yield is a respectable 2.11%. Believe it or not, that’s the second-highest dividend yield in Ackman’s portfolio.

Unlike Brookfield, though, Nike hasn’t made shareholders very happy recently. The stock is down 30% over the last 12 months. It’s nearly 60% below the peak set in late 2021.

In Nike’s latest quarter, revenue fell 10% year over year. Diluted earnings per share plunged 26%. The company brought in a new CEO in October in the hopes of righting the ship.

Since the late 1980s, Nike’s slogan has been “Just Do It.” Ackman seems to think the company will be able to make that phrase a reality by turning things around. He might have to be patient. CFO Matthew Friend said last month: “A comeback at this scale takes time.”

Down 47% Since March, Is CRISPR Therapeutics Stock a Buy on the Dip?

On Nov. 21, shares of CRISPR Therapeutics (NASDAQ: CRSP) were down 47% from a peak they reached in March. This might be a little surprising to folks who have been following this developer of gene therapies. After all, it’s been less than a year since regulators in the U.S. and E.U. approved its first therapy, Casgevy, to treat two blood-based disorders.

Casgevy’s initial launch hasn’t been as exciting as investors and its partner, Vertex Pharmaceuticals (NASDAQ: VRTX), had hoped. Less than a year into the launch, though, it’s still too early to turn our backs on this innovative drugmaker. After all, in addition to Casgevy, it has five other therapy candidates in clinical-stage testing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

To see if adding some shares to your portfolio now makes sense, let’s look at why the stock’s been beaten down, and what could lift it back up.

The Food and Drug Administration (FDA) approved Casgevy for the treatment of sickle cell disease (SCD) last December. In January the agency followed up with approval to treat transfusion-dependent beta thalassemia (TDT).

Across the Atlantic, European regulators approved Casgevy to treat both SCD and TDT in February. Despite regulatory approvals, the launch is progressing more slowly than investors had expected.

CRISPR Therapeutics wisely partnered with Vertex Pharmaceuticals to develop and market Casgevy, but Vertex is having a hard time getting it off the ground. Despite earning approval in late 2023, Vertex didn’t record its first sale of Casgevy until the third quarter.

Sales have been slow because it’s a complicated therapy made in single batches from a patient’s stem cells. Once reinfused, the CRISPR-altered stem cells should produce functioning hemoglobin, so SCD and TDT patients no longer need regular blood transfusions. Unfortunately, reinfused Casgevy cells can’t gain a foothold unless patients first deplete their immune systems with a dangerous conditioning regimen.

Recently, a patient with SCD died during a gene-therapy trial run by Beam Therapeutics. Physicians running the study didn’t fault Beam’s candidate for the volunteer’s death; they blamed a conditioning regimen containing busulfan. Busulfan is also used to condition patients for Casgevy.

A lack of treatment options could work in Casgevy’s favor. Last year, the European Medicines Agency revoked conditional approval for an SCD drug from Novartis called Adakveo, after it failed to outperform a placebo in a confirmatory trial. And in September, Pfizer pulled Oxbryta, a daily tablet approved to treat SCD patients, from the market after it failed a postmarketing study.

CD rates today, November 24, 2024 (up to 4.42% APY)

Today’s certificate of deposit (CD) interest rates are some of the highest we’ve seen in more than a decade thanks to several rate hikes by the Federal Reserve. However, the Fed finally cut its target rate in September, so now could be your last chance to lock in a competitive rate.

CD rates vary widely across financial institutions, so it’s important to ensure you’re getting the best rate possible when shopping around for a CD. The following is a breakdown of CD rates today and where to find the best offers.

Historically, longer-term CDs offered higher interest rates than shorter-term CDs. Generally, this is because banks would pay better rates to encourage savers to keep their money on deposit longer. However, in today’s economic climate, the opposite is true.

See our picks for the best CD accounts available today>>

As of November 24, 2024, CD rates remain high by historical standards. However, the highest CD rates can be found for shorter terms of around one year or less.

Today, the highest CD rate is offered by NexBank on its 1-year CD. Account holders can earn 4.42% APY, though there is a hefty minimum opening deposit of $25,000 required.

The next highest rate is 4.10% APY, offered by Marcus by Goldman Sachs on its 6-month CD. There is a minimum opening deposit of $500 required.

Here is a look at some of the best CD rates available today from our verified partners:

The amount of interest you can earn from a CD depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (CD interest typically compounds daily or monthly).

Say you invest $1,000 in a one-year CD at 1.88% APY. At the end of that year, your balance would grow to $1,018.96 — your initial $1,000 deposit, plus $18.96 in interest.

Now let’s say you choose a one-year CD that offers 5% APY instead. In this case, your balance would grow to $1,051.16 over the same period, which includes $51.16 in interest.

The more you deposit in a CD, the more you stand to earn. If we took our same example of a one-year CD at 5% APY, but deposit $10,000, your total balance when the CD matures would be $10,511.62, meaning you’d earn $511.62 in interest.

Read more: What is a good CD rate?

When choosing a CD, the interest rate is usually top of mind. However, the rate isn’t the only factor you should consider. There are several types of CDs that offer different benefits, though you may need to accept a slightly lower interest rate in exchange for more flexibility. Here’s a look at some of the common types of CDs you can consider beyond traditional CDs:

-

Bump-up CD: This type of CD allows you to request a higher interest rate if your bank’s rates go up during the account’s term. However, you’re usually allowed to “bump up” your rate just once.

-

No-penalty CD: Also known as a liquid CD, type of CD gives you the option to withdraw your funds before maturity without paying a penalty.

-

Jumbo CD: These CDs require a higher minimum deposit (usually $100,000 or more), and often offer higher interest rate in return. In today’s CD rate environment, however, the difference between traditional and jumbo CD rates may not be much.

-

Brokered CD: As the name suggests, these CDs are purchased through a brokerage rather than directly from a bank. Brokered CDs can sometimes offer higher rates or more flexible terms, but they also carry more risk and might not be FDIC-insured.

Billionaire Bill Ackman Just Poured $2.2 Billion Into These 2 Incredible Stocks

Bill Ackman is happy to buy stocks when he believes they’re on sale, and he holds them until their prices reflect what he believes are their true values. That could be a few months or it could be a decade. For example, Ackman established a position in Chipotle Mexican Grill more than eight years ago, and it has grown to become one of the largest positions in the portfolio of his hedge fund, Pershing Square.

Over the last two quarters, Ackman has built two new significant positions for Pershing Square — Nike (NYSE: NKE) and Brookfield (NYSE: BN) — piling an estimated $2.2 billion into those stocks during the third quarter alone. Here’s why.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Ackman bought about $275 million worth of Nike stock in the calendar year’s second quarter, but he loaded up in the calendar year’s third quarter after Nike’s fiscal 2024 fourth-quarter earnings results and fiscal 2025 outlook disappointed the market back in late June 2024. Ackman added 13.2 million shares, spending over $1 billion based on its average share price during the quarter.

Nike has struggled lately as it manages what share direct-to-consumer sales should be of overall sales. Cutting off wholesale distribution in favor of its own stores and website has worked in some quarters but is not working as well lately and it’s forcing management to adjust. As a result, there was a near-term drop in revenue as its sales through big retail partners dried up while Nike shifted inventory to its own channels. Sales came in worse than expected and revenue fell 10% year over year in Nike’s fiscal 2025 Q1. In reporting the results, management guided for a slow recovery in sales due to economic uncertainty.

It’s worth pointing out, however, that its gross margin improved by 1.2 percentage points in fiscal Q1 on the back of streamlined product and warehousing spending and strategic price improvements. As Nike improves its inventory management and returns to sales growth, it should see strong improvements in both gross margin and operating margin over time.

Nike’s price-to-sales ratio of about 2.3 is near its 10-year low. And while sales are currently moving in the wrong direction, there’s good reason to believe things will turn around. Nike has one of the strongest brands in the world, China still presents a growth opportunity for its business, and it has been able to maintain its premium pricing. With earnings growth expected to rebound after this year, Nike could be a great stock to buy now and hold for several years while it works through its business model transition.

Small-Cap Surge, Trump's DOGE Initiative, Auto Loan Alarms, And Treasury Secretary Pick: This Week In Economics

The past week has been a rollercoaster ride in the financial world. From the surge in small-cap stocks to the potential impact of President-elect Donald Trump’s DOGE initiative, there’s a lot to unpack. Let’s dive into the top stories of the week.

Small-Cap Stocks Soar

U.S. small-cap stocks have been the star performers this November, following a well-established seasonal trend. The Russell 2000 index, a benchmark for small-cap equities, has seen an impressive 8% rise this month, setting the stage for a strong December. This aligns with the historical trend of small caps excelling in the final two months of the year, often leading to the so-called “Santa Rally”.

Trump’s DOGE Initiative

President-elect Donald Trump’s appointed DOGE (Department of Government Efficiency) could potentially save $50–100 billion annually, according to Congressional Budget Office analyses. However, Mario Georgiou, CFA, and executive director, head of investments at InCred Global Wealth U.K., suggests that the scale of potential savings is expected to be modest compared to total federal outlays of approximately $6.7 trillion in 2024.

See Also: Fed’s Bowman Warns On Inflation, Says Neutral Interest Rates May Be Closer ‘Than We Currently Think’

Alarm Bells for US Auto Loans

ARK Invest CEO Cathie Wood has raised concerns about the state of auto loans in America. She notes that 90-day delinquency rates have now surpassed levels seen during the 2009 financial crisis. This comes despite continued investor confidence in auto-backed securities.

Trump Picks Treasury Secretary

President-elect Donald Trump has chosen hedge fund executive Scott Bessent as the U.S. Treasury Secretary. Bessent, founder of Key Square Group, was a leading candidate, competing with former Fed Governor Kevin Warsh and private equity executive Marc Rowan.

US Business Activity Hits 31-Month High

The U.S. private sector activity posted its fastest pace of expansion in more than two and a half years in November. This was driven by exceptional growth in the services sector, which continues to far exceed even the most optimistic forecasts by economists.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Ananya Gairola

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy Super Micro Computer Stock After Its 1,480% Gain in 5 Years? Wall Street Has a Clear Answer for Investors.

Super Micro Computer (NASDAQ: SMCI) shareholders have been through a whirlwind lately. While the stock is up 1,480% in the last two years, it has also fallen over 70% from its record high in the last eight months. As one of Nvidia‘s largest partners, the server maker should benefit as demand for artificial intelligence (AI) infrastructure increases, but Supermicro has also been accused of accounting manipulation.

Among the 12 analysts who follow the company, the median 12-month price target of $30.50 per share implies an 8% downside from its current share price of $33. That means six analysts think the stock will fall more than 8% in the next year. Additionally, 19 analysts followed Supermicro three months ago, meaning seven have recently discontinued coverage. Wall Street is clearly shying away from the company.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Here are the important details.

Super Micro Computer builds servers, including full server racks equipped with storage and networking that provide customers with a turnkey solution for data center infrastructure. Its internal manufacturing capabilities and “building block” approach to product development let it bring new technologies to market more quickly than its competitors, often by two to six months.

Indeed, earlier this year, Rosenblatt analyst Hans Mosesmann wrote, “Super Micro has developed a model that is very, very quick to market. They usually have the widest portfolio of products when a new product comes out.” Those advantages have helped Supermicro secure a leadership position in AI servers, a market forecast to grow at 30% annually through 2033, according to Statista.

Importantly, Supermicro is also the top supplier of direct liquid cooling (DLC) systems, which could help the company strengthen its position in AI servers. DLC systems reduce data center power consumption by 40% and occupy 80% less space than traditional air-cooled systems. AI servers generate more heat than general-purpose servers, so demand for DLC systems is expected to rise quickly.

Indeed, while less than 1% of data centers have historically used liquid cooling, Supermicro estimates 15% (and maybe as many as 30%) of new data center installations will use liquid cooling in the next two years, and the company says it is positioned to “capture the majority share of that growth.”

As mentioned, while Supermicro shares are up 1,480% in the last two years, the stock has also nosedived more than 70% from its record high in the last eight months. Below is a month-by-month timeline detailing the events that led to that rapid decline in value.