Crypto Analyst Sees Shiba Inu Surging More Than 2,000% In Coming Rally

A market analyst says Shiba Inu SHIB/USD could experience a massive rally, predicting gains exceeding 2,000%.

What Happened: The forecast has sparked excitement among the cryptocurrency’s community as SHIB continues to gain traction as a leading meme coin.

Crypto analyst Austin Hilton, known for his bold predictions, shared his thoughts in a post on YouTube and suggested that favorable market conditions and strategic developments could push SHIB into a significant uptrend.

Hilton highlighted key catalysts, such as increased adoption and potential ecosystem upgrades, as reasons behind the bullish outlook.

Shiba Inu has already seen remarkable growth since its inception, fueled by its vibrant community and utility within the Shiba ecosystem, including decentralized exchanges and NFT marketplaces. The recent prediction has added momentum to the ongoing discussions about SHIB’s long-term potential.

Also Read: Massive Shiba Inu Burn Ignites Hope For Price Recovery Despite Market Downturn

At the time of writing, SHIB was trading at $0.00002478, down by 4% in the last 24 hours.

Despite its current price hovering at fractions of a cent, the analyst believes that strategic milestones could propel SHIB’s value. These include the expansion of ShibaSwap, further token burns to reduce supply, and adoption by mainstream businesses for payments.

However, experts have cautioned that such exponential growth is not guaranteed and remains highly speculative. The cryptocurrency market’s volatility and reliance on broader economic conditions mean that predictions should be approached with caution. Investors are advised to conduct thorough research and assess risks before making decisions.

Read Next

Forget Dogecoin And Shiba Inu — This Meme Coin Skyrockets After Coinbase Hints At Possible Listing

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Home Sellers, 'Start Cutting Prices Or It's Going To Be A Long Winter,' Says Reventure CEO

The housing market continues its downturn as mortgage applications hit their lowest levels in three decades, according to data issued by the Mortgage Bankers Association (MBA).

Nick Gerli, CEO of Reventure Consulting, pointed to the reality on X, formerly Twitter, noting that current mortgage demand has fallen about 50% compared to pre-pandemic levels in 2019. For sellers, the latest figures are a bad sign as they head into winter, with purchase applications down 49.7% from 2019 levels and 55.2% below 2020 numbers.

Don’t Miss:

The downturn continues despite favorable conditions that typically boost market activity. Despite two Federal Reserve rate cuts – one in September and another in early November – and the election’s conclusion, buyers remain hesitant to enter the market.

Behind the reluctance is historically poor homebuyer sentiment. The University of Michigan Sentiment Survey data showed that most Americans “believe that high interest rates are weighing down homebuying conditions.”

According to Gerli, the core issue centers on housing prices. Current home valuations have reached unsustainable levels relative to inflation and income, exceeding the 2006 housing bubble peaks when adjusted for inflation.

The disconnect between perceived value and listing prices drives potential buyers away.

“So buyers look for a home they think should be $350,000. And it costs $500,000,” Gerli said. “And they immediately give up. Because they know the home isn’t worth that amount.”

See Also: Invest in $20+ trillion home equity market today across cities like Austin, Miami, and Los Angeles through a unique 5-year term fund targeting a 14-20% IRR with minimums as low as $2,500

Recent MBA data supports Gerli’s assessment. While overall mortgage application volume showed a minimal 0.5% increase last week – the first rise in seven weeks – the average 30-year fixed-rate mortgage climbed to 6.86%, up from 6.81%. Refinancing applications dropped 2% to their lowest point since May despite being 43% higher than the previous year.

Joel Kan, MBA’s deputy chief economist, notes some bright spots in specific market segments. Applications for FHA and VA loans showed respective increases of 3% and 9%, with FHA rates notably declining against the broader trend.

The regional nature of the housing market means some areas may fare better than others. Gerli noted the variations in price forecasts for 2025, particularly between markets like Florida and New York.

For sellers hoping to move properties this winter, the message appears clear – price adjustments may be necessary to attract buyers in the current market environment.

Market dynamics suggest a shift in buyer behavior outside of typical seasonal slowdowns, pointing to deeper structural challenges in the housing market that might require price corrections to resolve.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Larry Page, Google Co-Founder, Said He'd Leave His Fortune To Elon Musk Over Charity Because Of His Plans 'To Go To Mars To Back Up Humanity'

In 2014, during an interview with Charlie Rose at the TED Conference, Google cofounder Larry Page made headlines with an unusual revelation. Page didn’t point to traditional charitable foundations or heirs when asked about his thoughts on legacy and philanthropy. Instead, he floated the idea of leaving his wealth to Elon Musk, the tech visionary behind Tesla and SpaceX.

Page’s reasoning? Musk’s bold mission to colonize Mars and “back up humanity.” In the interview, Rose referenced past comments Page had made about this idea, asking for clarification.

Don’t Miss:

According to the transcript on the Charlie Rose site, Rose said: “You once said – actually, I think I’ve got this about right – that you might consider, rather than giving your money to a cause, simply giving it to Elon Musk because you had confidence he would change the future.”

Larry Page replied: “He actually wanted to go to Mars – he wants to go to Mars to back up humanity.” He elaborated, “It’s a company and it’s philanthropical. So I think, you know, we aim to do kind of similar things.”

Page then shifted focus to Google’s culture of innovation, adding, “We have a lot of employees at Google who’ve become pretty wealthy … A lot of people in there are pretty wealthy. You’re working because you want to change the world and you want to make it better. So why isn’t the company they work for worthy not just of your time, but your money as well?”

For Page, Musk’s ambitious goals aligned with his belief that companies, when run effectively, could drive revolutionary change. He elaborated, saying, “Lots of companies don’t succeed over time. They usually miss the future … I try to focus on that: What is the future really going to be? And how do we create it?”

See Also: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.26/share

Page and Musk once shared a close friendship. Musk frequently stayed at Page’s house during visits to Silicon Valley and their shared passion for pushing technological boundaries made them natural allies. Their camaraderie landed them on Fortune’s 2016 list of “Business Leaders You Didn’t Know Were BFFs.”

Musk even attempted to sell Tesla to Google for $11 billion, according to Ashlee Vance’s biography, “Elon Musk: Tesla, SpaceX and the Quest for a Fantastic Future.” The two friends actually both agreed to the deal via handshake, but called it off once Tesla “no longer needed a savior.”

However, their relationship reportedly soured around 2013. Musk’s growing concerns about the dangers of artificial intelligence clashed with Page’s more optimistic outlook. At Musk’s birthday party that year, the two had a heated debate about AI. Page allegedly called Musk a “speciesist” for prioritizing human interests over other forms of intelligence.

Trending: This rooftop wind turbine is taking on a market projected to reach over $900 billion by 2032 — With already over 40,000 users signing up to purchase, here’s a chance to be an early investor today!

The tension grew after Musk cofounded OpenAI, a nonprofit ensuring AI safety, which was seen as a direct challenge to Google, which had acquired DeepMind, a leading AI company. Musk even tried to dissuade DeepMind’s CEO from selling to Google, further straining their relationship.

But despite their falling out, Musk has recently desired to mend fences. In a 2023 podcast with Lex Fridman, Musk said, “I would like to be friends again with Larry. I haven’t seen him in ages. We were friends for a very long time.” However, he acknowledged that Page might not feel the same, noting, “He doesn’t want to talk to me anymore.”

Larry Page’s 2014 remarks about leaving his fortune to Elon Musk reflect his belief that revolutionary change outweighs incremental progress. While the future of their friendship remains uncertain, both Page and Musk continue to be key players in shaping the future of technology – and maybe even humanity.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

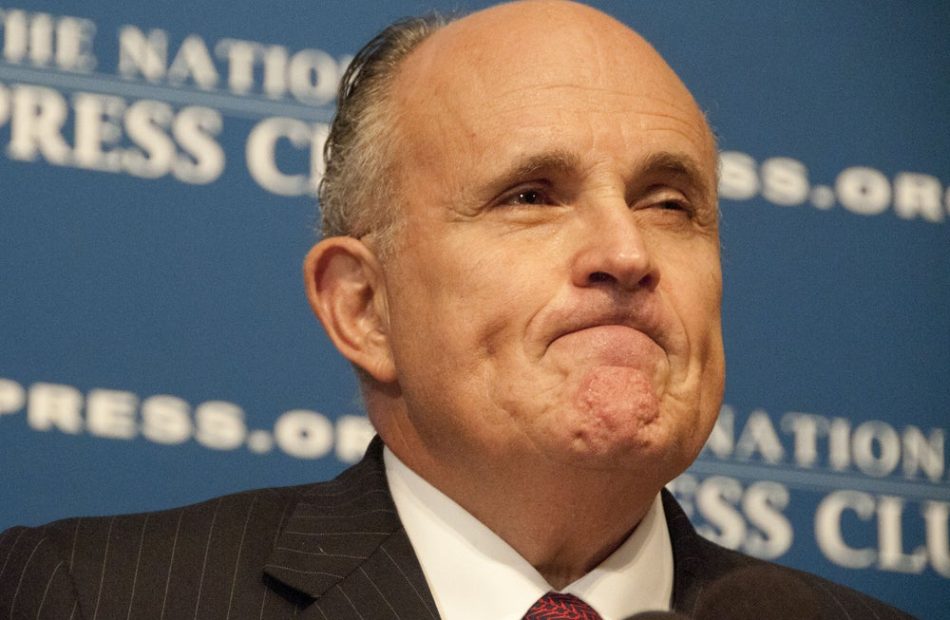

Georgia Election Workers Demand Giuliani Be Held In Civil Contempt

Georgia election workers Ruby Freeman and Wandrea “Shaye” Moss have filed a motion in federal court demanding that Rudy Giuliani be held in civil contempt for continuing to spread false claims about them.

This request, submitted Wednesday, stems from Giuliani’s ongoing defamation despite a prior injunction forbidding him from making such statements, Forbes reports.

A federal judge has ordered Giuliani to respond by December 2, with a hearing set for December 12.

On Thursday, Rudy Giuliani challenged the judge’s ruling from last month, which required him to hand over most of his assets to the two Georgia election workers, per a news report by The Hill.

In May, Giuliani agreed to stop making false allegations related to the 2020 election and its results.

Now, the election workers are seeking sanctions against Giuliani after he failed to honor the terms of this agreement, continuing to falsely accuse Freeman and Moss of wrongdoing, including baselessly claiming that they had “quadruple counted” ballots—a claim for which there is no evidence,

Giuliani allegedly doubled down on his false claims during his online show last week, defiantly shrugging off the threat of another lawsuit. He declared, “What am I going to do but tell the truth?” Forbes writes, quoting Giuliani.

These statements directly violate the court order he had previously agreed to.

As a result of Giuliani’s defamation, he was ordered to pay Freeman and Moss $148 million.

However, after declaring bankruptcy, he has been forced to begin turning over his assets to satisfy the judgment, including his car and New York City apartment.

Freeman and Moss are now asking the court to enforce penalties on Giuliani, potentially including further damages.

Giuliani’s spokesperson, Ted Goodman, has called the motion an attack on Giuliani’s First Amendment rights, insisting that he should be able to defend himself, Forbes adds.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Robert Kiyosaki: 'Trump Will Make America Richer Again By Being The First Bitcoin President'

Investor and author Robert Kiyosaki has criticized the U.S. Federal Reserve and commended Michael Saylor, co-founder and executive chairman of MicroStrategy Inc. for his aggressive Bitcoin acquisition strategy.

What Happened: Kiyosaki, known for his pro-cryptocurrency stance, took to social media X to voice his skepticism about the Fed’s policies and inflation management.

He labeled the central bank’s decisions as detrimental to the economy and suggested that Saylor’s Bitcoin strategy offers a viable hedge against these issues.

“Michael Saylor’s bold Bitcoin purchasing strategy is not just investment; it’s a fight against the Fed’s reckless policies,” Kiyosaki wrote in the post.

The author has long been an advocate for Bitcoin and other alternative assets, frequently advising followers to invest in assets like gold, silver, and cryptocurrencies to protect themselves from what he sees as the erosion of purchasing power.

Saylor’s MicroStrategy is recognized as one of the largest institutional Bitcoin holders, having spent billions acquiring the cryptocurrency. Saylor maintains that Bitcoin is the ultimate store of value in a world grappling with rising inflation and economic uncertainty.

In his post Kiyosaki also praised President-elect Donald Trump and his position on Bitcoin. Kiyosaki highlighted his work with Trump and shared his belief that Trump could become the first “Bitcoin President,” a reflection of Trump’s supportive attitude toward cryptocurrency.

He wrote, “Let’s make America and the world richer again with Bitcoin.”

Kiyosaki continued to criticize fiat currencies, describing them as tools of government control.

Why It Matters: His statements reflect a broader sentiment within the crypto community that views Bitcoin as a decentralized alternative to traditional financial systems.

The debate over Bitcoin as a safeguard against inflation has intensified as governments worldwide grapple with economic challenges. Both Kiyosaki and Saylor remain prominent figures in this discourse, influencing retail and institutional investors alike.

Read Next

Robert Kiyosaki Predicts Stock Market Crash, Says Invest In Gold, Silver, And Bitcoin

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If I Could Tell All Retirees 1 Thing About Social Security in 2025, I'd Say to Do This Before You Claim Benefits

Is retirement on your radar? Maybe you’re even planning to permanently leave the world of work in the coming year. If so, congratulations! You’ve certainly earned the right to focus on yourself rather than your job.

Before calling it quits and initiating your Social Security retirement payments in 2025, however, there’s one thing you’ll want to do — weigh the financial cost of claiming benefits now instead of waiting.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

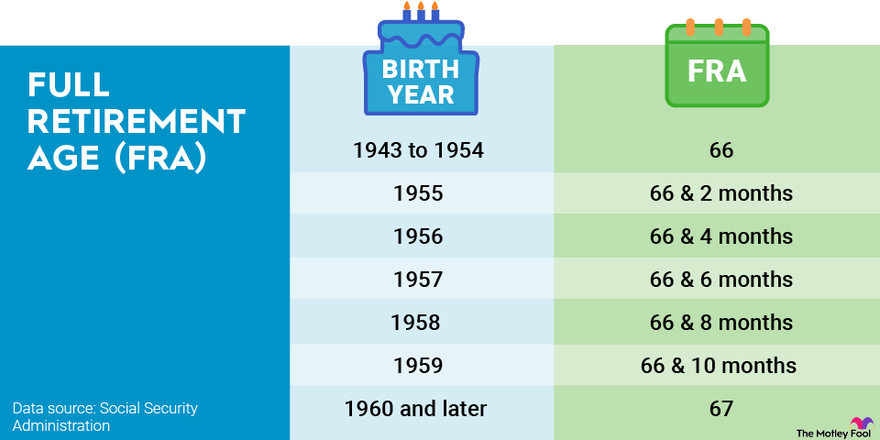

You can begin receiving Social Security benefits as early as 62 years of age. However, you won’t be receiving as much money as you could be. Anyone waiting until their full retirement age (between 66 and 67, depending on birth year) will see bigger monthly checks.

The difference can be significant. Getting this four- or five-year head start on your benefits will permanently reduce your payments by as much as 25% to 30%, depending on your age.

The penalty shrinks the closer you get to your full retirement age (FRA). For example, if you claim 12 months before reaching full retirement age, your monthly benefits are only reduced by 6 2/3% of what your payments would be at FRA.

Given that the average-sized Social Security check currently stands at just over $1,900, though, this potential difference still isn’t small change for most people. It can mean a few hundred dollars per month.

That being said, you should also know that waiting until after you’ve reached your designated FRA makes your eventual payments even bigger. Anyone who waits to claim benefits until they’re 70 years old will see monthly payments between 15% and 25% bigger than they’d receive at their official full retirement age. The table below illustrates the stark financial difference between claiming early or delaying benefits.

|

Birth Year |

Full Retirement Age |

Percentage of Full Benefit by Age at First Claim |

||||||

|---|---|---|---|---|---|---|---|---|

|

1943-54 |

66 |

75 |

80 |

86 2⁄3 |

93 1⁄3 |

100 |

108 |

132 |

|

1955 |

66, 2 mo. |

74 1⁄6 |

79 1⁄6 |

85 5⁄9 |

92 2⁄9 |

98 8⁄9 |

106 2⁄3 |

130 2⁄3 |

|

1956 |

66, 4 mo. |

73 1⁄3 |

78 1⁄3 |

84 4⁄9 |

91 1⁄9 |

97 7⁄9 |

105 1⁄3 |

129 1⁄3 |

|

1957 |

66, 6 mo. |

72 1⁄2 |

77 1⁄2 |

83 1⁄3 |

90 |

96 2⁄3 |

104 |

128 |

|

1958 |

66, 8 mo. |

71 2⁄3 |

76 2⁄3 |

82 2⁄9 |

88 8⁄9 |

95 5⁄9 |

102 2⁄3 |

126 2⁄3 |

|

1959 |

66, 10 mo. |

70 5⁄6 |

75 5⁄6 |

81 1⁄9 |

87 7⁄9 |

94 4⁄9 |

101 1⁄3 |

125 1⁄3 |

|

1960 and later |

67 |

70 |

75 |

80 |

86 2⁄3 |

93 1⁄3 |

100 |

124 |

Data source: Social Security Administration.

Your marching orders, therefore, are to get in touch with the Social Security Administration — online, in person, or by phone — and compare all of your benefit options as they stand right now. You may find there’s good reason to continue working for at least another year. Or, you may earn there’s not enough upside to sticking with your job until you’re 70 years old.

2 No-Brainer High-Yield Dividend Growth Stocks to Buy With $500 Right Now

When investors think about high-yield stocks, the yield is often the only issue considered. That’s a mistake, because sometimes high yields are a sign of a risky dividend. That’s why you should also examine the company backing the yield and, equally important, its commitment to supporting the dividend through good markets and bad ones. Right now, dividend investors should probably be considering reliable income stocks like Enterprise Products Partners (NYSE: EPD) and United Parcel Service (NYSE: UPS). Here’s why.

Enterprise Products Partners is a master limited partnership (MLP) that operates in the midstream segment of the oil and natural gas industry. It owns vital infrastructure assets like pipelines, storage, processing, and transportation facilities. While oil and natural gas companies are often volatile, Enterprise is basically just a toll taker, charging customers fees for the use of its assets. Given the importance of oil and natural gas to the world’s economy, demand for Enterprise’s assets tends to be fairly strong in both good energy markets and bad ones.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Simply put, Enterprise’s cash flows tend to be fairly robust no matter what’s going on with oil prices. That’s how the MLP has managed to increase its distribution every year for 26 consecutive years, despite operating in the often volatile energy sector. Add in an investment grade rated balance sheet and distributable cash flow that covers the distribution by a strong 1.7 times, and you get a very reliable income stock.

That said, it’s important for investors to understand that growth opportunities in the midstream space are fairly limited. Enterprise’s attractive 6.6% yield will likely make up the vast majority of your return. Still, Enterprise is one of the largest midstream players in North America, so a modest capital investment budget will likely be augmented by acquisitions along the way. Distribution growth of around low to mid-single digits is probably a reasonable expectation over time. That’s not a bad combination if you’re a dividend investor looking to maximize the income stream your portfolio generates.

Slow and steady growth with a high yield is what you get from Enterprise. United Parcel Service is a bit different, offering higher dividend growth but a lower yield. To put a number on that, UPS, as the company is more commonly known, increased its dividend at a compound annual rate of nearly 10% over the past decade. That’s two to three times faster than the historical growth rate of inflation, so this package delivery service has materially grown the buying power of its dividend over time.

Money market account rates today, November 24, 2024 (best account provides 5.01% APY)

Between March 2022 and July 2023, the Federal Reserve raised its benchmark rate 11 times. As a result, money market account (MMA) interest rates rose sharply.

However, the Fed slashed the federal funds rate by 50 basis points in September and another 25 basis points in November. So deposit rates — including money market account rates — have started falling. It’s more important than ever to compare MMA rates and ensure you earn as much as possible on your balance.

The national average money market account rate stands at 0.60%, according to the FDIC. This might not seem like much, but consider that just two years ago, it was just 0.23%, reflecting a sharp rise in a short period of time.

This is largely due to monetary policy decisions by the Fed, which began raising its benchmark rate in March 2022 to combat skyrocketing inflation. In fact, the Fed increased rates 11 times. But it finally cut its benchmark rate in September, and again in November, causing deposit account rates to start dropping

Even so, some of the top accounts are currently offering upwards of 5% APY. Since these rates may not be around much longer, consider opening a money market account now to take advantage of today’s high rates.

Here’s a look at some of the top MMA rates available today:

See our picks for the 10 best money market accounts available today>>

Additionally, the table below features some of the best savings and money market account rates available today from our verified partners.

The amount of interest you can earn from a money market account depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (money market account interest typically compounds daily).

Say you put $1,000 in an MMA at the average interest rate of 0.64% with daily compounding. At the end of one year, your balance would grow to $1,006.02 — your initial $1,000 deposit, plus just $6.02 in interest.

Now let’s say you choose a high-yield money market account that offers 5% APY instead. In this case, your balance would grow to $1,051.27 over the same period, which includes $51.27 in interest.

The more you deposit in a money market account, the more you stand to earn. If we took our same example of a money market account at 5% APY, but deposit $10,000, your total balance after one year would be $10,512.67, meaning you’d earn $512.67 in interest.

Nvidia Sees Continued AI Momentum. Is This a Golden Opportunity to Buy the Stock?

Nvidia (NASDAQ: NVDA) once again showed that it is the company most benefiting from the artificial intelligence (AI) infrastructure build-out, as it continued to show astronomical revenue growth in fiscal 2025’s Q3 (ended Oct. 27, 2024). And in a truly incredible feat (despite its huge size), the company generated more in profits this quarter than it generated in revenue in the year-ago quarter. That is just something you do not see often with large companies.

While the stock price did not soar on this latest news, it has still nearly tripled year to date as of this writing. With another great quarter in the books, let’s take a closer look at Nvidia’s most recent results to see if the stock’s momentum can continue.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

While Nvidia’s revenue growth continued to decelerate from the unsustainable levels it saw earlier this year, the chipmaker was still able to see its fiscal 2025 Q3 revenue surge 94% to $35.1 billion. The company saw 262% revenue growth in fiscal Q1 and 122% in fiscal Q2. Adjusted earnings per share (EPS) more than doubled to $0.81. Those results easily topped analyst expectations for adjusted EPS of $0.75 on revenue of $33.2 billion.

Its data center business once again led the way, with revenue soaring 112% year over year to $30.8 billion. The growth was powered by demand for its Hopper graphics processing unit (GPU) computing platform, particularly its H200 Hopper chip. During the quarter, the company also shipped 13,000 samples of chips based on its next-generation Blackwell GPU architecture. The company said it is seeing significant inference revenue growth, and that it has the largest inference platform.

Cloud service providers made up about half of Nvidia’s data center revenue in the quarter. However, it said enterprise AI is becoming the next big wave of AI, and that thousands of companies are using Nvidia NIM, its set of accelerated inference microservices that organizations can use to run large language models (LLMs) on its GPUs. It also said that industrial and robotic AI growth is beginning to accelerate.

Nvidia’s other segments also showed solid growth, although they are now much smaller than its data center business. Gaming revenue jumped 15% to $3.3 billion, while professional visualization rose 17% to $486 million, and automotive and robotics revenue soared 72% to $449 million. The company continues to produce a prodigious amount of cash, with operating cash flow of $17.6 billion and free cash flow of $16.2 billion. Nvidia ended the quarter with net cash and marketable securities of $38.5 billion and $8.5 billion in debt.

Fed's preferred inflation gauge highlights holiday-shortened trading week: What to know this week

Stocks drifted higher leading into the shortened trading week that includes the Thanksgiving holiday.

The Dow Jones Industrial Average (^DJI) gained nearly 2% for the week while the S&P 500 (^GSPC) and tech-heavy Nasdaq Composite (^IXIC) added over 1.5%.

In the week ahead, a fresh reading on the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, will highlight the economic calendar. Updates on third quarter economic growth and housing activity are also on the schedule.

In corporate news, quarterly results from Zoom (ZM), Dell (DELL), Best Buy (BBY), CrowdStrike (CRWD), and Macy’s (M) are likely to catch investor attention.

Markets will be closed on Thursday for Thanksgiving, and Friday’s trading session will end early at 1 p.m. ET.

Recent sticky inflation readings have raised questions about whether the Fed will cut interest rates in December and how much the central bank will lower rates over the next year.

Earlier this month, the “core” Consumer Price Index (CPI), which strips out the more volatile costs of food and gas, showed prices increased 3.3% in October for the third consecutive month. Meanwhile, the “core” Producer Price Index (PPI) revealed prices increased by 3.1% in October, up from 2.8% the month prior and above economist expectations for a 3% increase.

On Wednesday, Federal Reserve governor Michelle Bowman expressed concern that the Fed’s progress toward 2% inflation has “stalled” and the central bank should proceed “cautiously” when lowering interest rates.

“We have seen considerable progress in lowering inflation since early 2023, but progress seems to have stalled in recent months,” Bowman said in a speech at the Forum Club of the Palm Beaches.

Read more: Jobs, inflation, and the Fed: How they’re all related

Economists expect more signs of that stalling in Wednesday’s Personal Consumption Expenditures (PCE) release. Economists expect annual “core” PCE — which excludes the volatile categories of food and energy — to have clocked in at 2.8% in October, up from the 2.7% seen in September. Over the prior month, economists project “core” PCE at 0.3%, unchanged from September.

Bank of America Securities US economist Stephen Juneau wrote in a research note that a print in line with expectations will “certainly lead Fed participants to reassess their inflation and policy outlook.”

“That said,” he added, “we still expect the Fed to cut rates by 25bp in December, but the risk appears to be tilting towards a shallower cutting cycle given resilient activity and stubborn inflation.”