Gold Tumbles as Traders Turn Attention to the Fed’s Next Move

(Bloomberg) — Gold tumbled after surging by the most in 20 months last week, with traders ignoring a softer US dollar and shifting their attention to the Federal Reserve’s upcoming interest-rate decision.

Most Read from Bloomberg

Bullion fell by almost 2% to drop back below $2,700 an ounce, despite a slide in the US currency, which typically aids the commodity. Investors are now focused on the outlook for monetary policy, after a report showed US business activity expanding at the fastest pace since April 2022. Swaps traders see a less-than-even chance the central bank will cuts rates next month. Higher borrowing costs tend to weigh on gold, as it doesn’t pay interest.

The precious metal is still up by more than a quarter this year, supported by central bank purchases and the Fed’s pivot to rate cuts. Haven buying has also been a feature, with prices rallying 6% last week, on an escalation in the Russia-Ukraine war. Most banks remain positive about the outlook, with Goldman Sachs Group Inc. and UBS Group AG seeing further gains in 2025.

“Prices continue to reflect the interplay between geopolitical risks and a less dovish outlook from the Federal Reserve,” said Jun Rong Yeap, a market strategist with IG Asia Pte. “Any upside inflation surprises could further sway bets towards a potential rate hold in December, with any prospects of a slower pace of rate cuts likely to offer some resistance for gold prices.”

A slew of of data this week may yield clues on the Fed’s likely rate path. These include minutes of the central bank’s November meeting, consumer confidence and personal consumption expenditure data — the monetary authority’s preferred gauge of inflation.

The drop in the dollar on Monday — which was accompanied by a decline in US bond yields — came after US President-elect Donald Trump nominated Scott Bessent to oversee the Treasury. Investors expect the hedge fund manager to prioritize economic and market stability over more radical measures.

Spot gold retreated 1.6% to $2,673.94 an ounce as of 12:02 p.m. in Singapore, dropping along with silver, platinum and palladium. The Bloomberg Dollar Spot Index declined 0.5%.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Stocks, Bonds Rise as Traders Embrace Bessent: Markets Wrap

(Bloomberg) — Equities and Treasuries advanced, with traders welcoming Donald Trump’s pick of Scott Bessent for Treasury Secretary as a measured choice that would inject more stability into the US economy and financial markets.

Most Read from Bloomberg

A gauge of Asian stocks rose about 1%, led by gains in Japan, South Korea and Australia. US futures also edged higher. Meanwhile, the yield on 10-year Treasuries dropped five basis points to 4.35%. The dollar declined while Bitcoin rebounded from a weekend drop.

Bessent, who runs macro hedge fund Key Square Group, has indicated he’ll back Trump’s tariff and tax cut plans but investors expect him to prioritize economic and market stability over scoring political points. The nomination has eased concerns over the incoming president’s protectionist policies, which had threatened to stoke inflation, worsen trade tensions and amplify market volatility.

Elements of the so-called Trump Trade that feature a surging dollar and rallying Bitcoin are cooling, as traders trim bets on elevated interest rates that may result from pricier imports and lower taxes.

“Bessent is seen as representing a relatively conventional choice which may deliver more moderate policy changes than some other possible picks,” to which traders have responded by selling the dollar, said Rob Carnell, head of research and chief economist for Asia Pacific at ING Groep NV. After the greenback’s recent strong gains, “the market is paring its positions ahead of important releases” of US inflation data and the Federal Reserve’s next meeting, he added.

The Bloomberg’s dollar index fell by the most in over two weeks, with the yen leading the gains. Traders betting on Trump’s fiscal policies — including sweeping trade tariffs and persistent economic growth — had pushed the dollar up for eight straight weeks through Friday.

Chinese stocks bucked the region’s trend, reflecting investors’ continued disappointment with a lack of stronger fiscal measures to revive the world’s No. 2 economy. Meanwhile, the country’s central bank kept a policy loan rate unchanged after last cutting it in September.

Japan, US Data

Oil dropped after the biggest weekly advance in almost two months as geopolitical risks in Ukraine and the Middle East kept investors on edge. Gold also fell after jumping the most in 20 months last week.

Bluesky Adds Millions Of Users As Elon Musk's X Faces Exodus Post Trump Victory: Here Are A Few Starter Packs To Help You Level Up On The Platform

Following the 2024 U.S. Presidential election, a significant shift is happening in the social media landscape.

Many users, including Taylor Swift’s fanbase, the Swifties, have begun leaving Elon Musk’s X, formerly Twitter, for Bluesky, a rising social media platform.

In just a few days, Bluesky’s user base surged from 14 million to 20 million, growing by a million new users each day.

This sudden influx follows dissatisfaction with Musk’s social media platform, especially after the changes he introduced following the acquisition of Twitter, and now the 2024 election outcome.

Why Bluesky?

Bluesky offers a refreshing alternative to X and Meta Platforms, Inc.’s META Threads.

Unlike Threads, which has minimized political content, Bluesky allows for more personalized, open conversations. Its open-source model, based on the AT Protocol, aims to empower users with greater control over their content and moderation.

With features like user-curated starter packs and decentralized governance, Bluesky has become a top choice for former X users looking for a platform that prioritizes user experience over corporate control.

Getting Started With Bluesky: The Starter Packs

If you’re new to Bluesky, building your feed from scratch can be overwhelming. Thankfully, Bluesky’s starter packs make this process easier.

Starter packs are user-curated lists of accounts, organized by interests, topics, or locations. They allow new users to quickly find and follow accounts that align with their interests without the tedious process of searching individually.

How To Find And Use Starter Packs

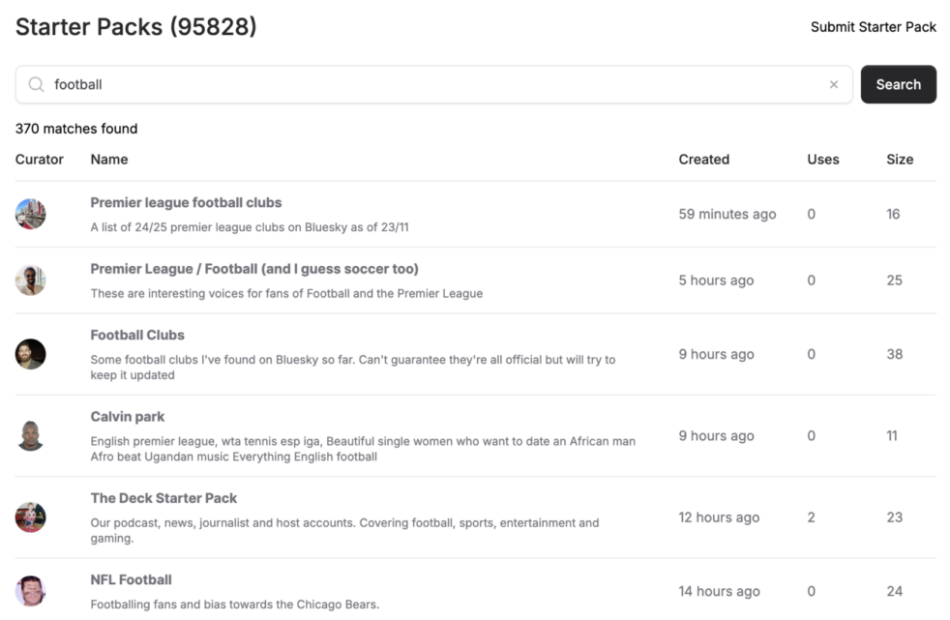

With over 86,000 starter packs available, you can browse them through the directory and search by keywords. Click here to access the directory.

You can either follow individual accounts or use the “follow all” button for faster results.

Here are some examples of user-created starter packs:

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

How To Create Your Own Starter Pack

In case, you want to create your unique starter pack, there are some easy steps you can follow.

Step I: Go to your profile on the mobile or desktop app.

Step II: Tap “Starter Packs” and select “Create.”

Step III: Name your pack, add a description, and choose users to include.

Step IV: Share your new pack with others through a post.

Image via Bluesky

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

As Meta, TikTok, X And Snapchat Stare At Tough Under-16 Ban, Australia's PM Says Destroy Personal Data 'Once Age Is Verified' Or Risk $32M Fine

Australia’s Prime Minister Anthony Albanese announced a plan to ban social media use for children under 16, requiring platforms like Meta Platforms Inc,‘s META Facebook and Instagram, TikTok, X (formerly Twitter), and Snap Inc.‘s SNAP Snapchat to verify users’ ages.

What Happened: The government will trial an age-verification system, possibly including biometrics or government ID. Social media companies must destroy any personal data used for verification, with fines of up to $32 million for non-compliance, reported Reuters.

“There will be very strong and strict privacy requirements to protect people’s personal information, including an obligation to destroy information provided once age has been verified,” Albanese said on Monday.

Critics, including Elon Musk, argue the bill may limit internet access for Australians. The government aims to pass the law by the end of the parliamentary year.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are MicroStrategy's Shares Worth Only $105? Investment Adviser Gary Black Weighs In

Renowned investment adviser Gary Black questioned the valuation of MicroStrategy Incorporated MSTR, suggesting the company’s stock was significantly overpriced.

What Happened: In a recent X post, Black, managing partner at The Future Fund, expressed his confusion over MicroStrategy’s stock price.

He pointed out that the company’s Bitcoin holdings, worth $31.2 billion when he made the observation, and its net debt of $4.2 billion equated to an equity value of $27 billion. However, the company’s stock market value stood at a whopping $106 billion.

Black estimated that MicroStrategy’s shares should be worth about $105/share, a figure 75% lower than its current trading price.

Black added that MicroStrategy’s core software business wasn’t contributing to growth. Indeed, the software segment recorded a 10.3% decline in year-on-year revenues.

“It would be like a company issuing cash or debt and then buying marketable securities. No one will pay for growth from that since anyone can buy Bitcoin,” he argued.

Black also ruled out valuing stocks based on future earnings expectations, instead opting to measure the stock’s fundamental business, in this case, MicroStrategy, in conjunction with the value of Bitcoin.

Why It Matters: Black’s comments come in the wake of recent research by BitMEX, which showed that MicroStrategy is trading at a 256% premium to the net asset value (NAV) of its Bitcoin holdings. The analysis connected the extreme valuation disparity to some financial regulators banning people from buying Bitcoin ETFs, leading them to buy MicroStrategy’s stock instead.

MicroStrategy’s aggressive Bitcoin acquisition strategy has been the subject of intense media coverage in recent weeks. The company’s co-founder, Michael Saylor, recently revealed that MicroStrategy is making $500 million a day as Bitcoin inched closer to $100,000 for the first time in its history.

Since the beginning of November, MicroStrategy’s stock has leaped 83%, while Bitcoin, the asset it holds on its books, has grown by 38%.

Price Action: At the time of writing, Bitcoin was trading at $97,638.71, down 0.85% in the last 24 hours, according to Benzinga Pro data. Shares of MicroStrategy closed 6.19% higher at $421.88 on Friday’s regular session.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Price Target Raised To $75 By Dan Ives Amid 288% YTD Surge: Analyst Calls 2025 A 'Primetime' Year For AI

Wedbush Securities has issued an endorsement of the artificial intelligence software sector, with Managing Director Dan Ives predicting that 2025 will be a pivotal year for AI implementation across the industry. This comes as Palantir Technologies Inc. PLTR continues its remarkable ascent, having surged 288% year-to-date.

What Happened: In a notable sector-wide upgrade, Ives raised Palantir’s price target to $75 while upgrading both Elastic NV ESTC and Snowflake Inc SNOW to Buy ratings. He also increased Salesforce Inc.‘s CRM price target to $375, signaling broader confidence in the software sector’s AI potential.

“The AI Revolution is accelerating and now it’s the software sector that will benefit from the use case phase of AI set to be primetime in 2025,” Ives wrote, adding, “Software AI age here.”

The bullish outlook aligns with Palantir’s recent performance, which has seen its market capitalization soar to approximately $140 billion, surpassing defense contractor Lockheed Martin Corp. LMT. The company’s growth has been particularly notable following recent political developments, with its stock reaching $61 per share.

Why It Matters: Palantir’s momentum is supported by concrete achievements, including a $480 million Pentagon contract for Project Maven and its first profitable year in 2023, reporting $144 million in third-quarter net income.

The company has successfully expanded its commercial sector revenue to 35% of total earnings, securing major contracts with CVS Health Corp. CVS and BP plc BP.

However, some investors express caution regarding valuations. Major hedge funds, including Renaissance Technologies and ARK Investment Management, reduced their Palantir holdings in the third quarter, though maintaining significant positions.

The company’s P/E ratio of 328.85 and heavy retail investor base of approximately 50% have prompted discussions about potential market volatility.

Price Action: Palantir’s stock closed at $64.35 on Friday, gaining 4.87% during the regular trading session. In after-hours trading, the stock dipped slightly by 0.20%. Year-to-date, Palantir has seen a remarkable surge of 288.12%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Has A Laugh As Bitcoin Dips After Jim Cramer's Endorsement

Tech mogul Elon Musk was amused by Bitcoin’s BTC/USD sudden pullback following financial analyst Jim Cramer’s bullish take on the leading cryptocurrency.

What happened: In a recent X post, Musk reacted with a laughing face and 100% emoji in response to a satirical post on the “Inverse Cramer” phenomenon.

The story started Friday when Cramer, host of CNBC’s Mad Money show and a former hedge fund manager, revealed owning Bitcoin and called it a “clear winner.”

Interestingly, Bitcoin, which was on the verge of reaching $100,000, retraced after Cramer’s advocacy and fell below $96,000 early Sunday.

See Also: Crypto Analyst: Bitcoin Poised To Skyrocket To $180K and ‘Eventually’ Top $1M

Why It Matters: For the uninitiated, the “Inverse Cramer” phenomenon hinges on the belief that doing the opposite of what Cramer advises could lead to profits.

In fact, an exchange-traded fund (ETF) was floated in 2022, allowing investors to bet against Cramer’s predictions. The ETF eventually shut down earlier this year.

Even influential cryptocurrency analysts like Ali Martinez wrote, “Another sell signal,” reacting to Cramer’s endorsement.

That said, there has been no definitive proof of counter-trading Cramer’s predictions being a profitable strategy.

Price Action: At the time of writing, Bitcoin was trading at $97,556.56, down 1.03% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Recovers From $95K Dip, Ethereum, Dogecoin Fall Ahead Of Thanksgiving Holiday: BTC Is 'Crossing The Rubicon,' Says Expert

Bitcoin recovered strongly from its morning fall as cryptocurrency investors prepared for Thanksgiving.

| Cryptocurrency | Gains +/- | Price (Recorded at 7:45 p.m. ET) |

| Bitcoin BTC/USD | -0.05% | $97,873.88 |

| Ethereum ETH/USD |

-1.93% | $3,349.58 |

| Dogecoin DOGE/USD | -3.03% | $0.4231 |

What Happened: The leading cryptocurrency fell below $96,000 during the afternoon, only to recover losses as the evening progressed.

On Friday, the asset nearly reached the record $100,000 level before stalling due to a strong pushback from the bears.

Ethereum, the second-largest cryptocurrency by market capitalization, failed to replicate its senior token’s comeback, ending the 24-hour period down by nearly 2%.

The sharp correction caused mayhem in the cryptocurrency derivatives market, with over $511 million getting liquidated in the last 24 hours. About $380 million in leveraged long bets were wiped out.

Bitcoin’s Open Interest (OI) dropped marginally by 0.20%, while the number of short positions for the coin surged dramatically against longs in the last 24 hours.

Market sentiment remained in the “Extreme Greed” zone, as per the Cryptocurrency Fear and Greed Index, signaling a desire to buy more.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 7:45 p.m. ET) |

| The Sandbox (SAND) | +73.46% | $0.7739 |

| Decentraland (MANA) | +31.24% | $0.7014 |

| Tezos (XTZ) | +15.88% | $1.35 |

The global cryptocurrency market capitalization stood at $3.33 trillion, following a marginal contraction of 0.69% in the last 24 hours.

Stock futures inched higher Sunday night. The Dow Jones Industrial Average Futures rose 226 points, or 0.51%, as of 7:45 p.m. EDT. Futures tied to the S&P 500 gained 0.42%, while Nasdaq 100 Futures added 0.49%.

The shortened Thanksgiving trading week would see the release of October’s personal consumption expenditure (PCE) data, the Federal Reserve’s preferred inflation measure.

.See More: Best Cryptocurrency Scanners

Analyst Notes: In a note to Benzinga, Chris Kline, COO and Co-Founder of BitcoinIRA, noted a significant interest in Bitcoin.

“Bitcoin appears to be crossing the Rubicon, garnering enthusiasm among those discussing economic policy at the national level, both in the US and across the globe,” Kline said.

He also highlighted the elevation of Bitcoin proponents to cabinet-level positions in the incoming Donald Trump administration, potentially making “murky regulatory waters” clear.

Widely-followed cryptocurrency analyst Ali Martinez predicted Bitcoin to peak between June and September 2025 in the ongoing bull cycle.

“Long-term Bitcoin holders are showing signs of growing greed! Historically, this behavior suggests it could take 8–11 months for BTC to hit a market top,” Martinez stated.

Photo by Igor Faun on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Economist Slams DOGE: Tells Elon Musk-Led Initiative To 'Do Your Legal Job Well' Amid Super Bowl Ad Spending Clash

Prominent economist Claudia Sahm has criticized the newly formed Department of Government Efficiency (DOGE) and its leadership’s approach to government spending, particularly regarding their stance on the U.S. Census Bureau’s 2010 Super Bowl advertisement.

What Happened: The controversy emerged after DOGE posted examples of government spending on X (formerly Twitter), including “$2.5 million on a Super Bowl Ad for the Census.”

Former presidential candidate Vivek Ramaswamy, recently appointed as co-director of DOGE alongside Tesla Inc. CEO Elon Musk, responded that “the federal government shouldn’t be in the business of buying Super Bowl ads.”

Sahm, creator of the widely-referenced Sahm Rule indicator, countered Ramaswamy’s position, stating, “Rule of thumb: the Census is in the Constitution. Do your legal job well.” She defended the Census Bureau’s decision, noting that the advertisement’s effectiveness could potentially save taxpayers money.

The Census Bureau had previously justified the $2.5 million expenditure, explaining that every 1% increase in mail-in responses would save $85 million in door-to-door collection costs.

Sahm expressed broader concerns about DOGE’s approach, stating, “There is so much good that ‘outside the box thinking’ in the government could do… but it’s being wasted on destructive, simplistic thinking. DOGE is on track to be a wasted opportunity.”

Why It Matters: The economist also criticized DOGE’s focus on reducing resources and employees, arguing that some efficiency improvements would require additional investment. “A MASSIVE overhaul of the IT as one example would be huge,” she noted.

DOGE, announced by President-elect Donald Trump, aims to restructure federal agencies and reduce the government’s $6.5 trillion annual spending.

The department has faced additional criticism from former Labor Secretary Robert Reich, who characterized it as “riddled with conflicts of interest,” particularly regarding Musk’s involvement given his companies’ federal contracts and ongoing investigations.

The department is scheduled to complete its work by Jul 4, 2026, coinciding with America’s 250th independence anniversary.

DOGE’s acronym coincides with the cryptocurrency Dogecoin DOGE/USD, leading to a 30.79% price bump in the coin after the department’s name was announced. Market speculation attributes this rise to Musk’s known association with Dogecoin.

Read Next:

Image via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

McDonald's Spends $100 Million After E. Coli Outbreak As 'Trust And Love' Must Be Rebuilt, Says Chief Impact Officer

McDonald’s is pulling out all the stops to rebuild its reputation and lure customers back after an E. coli outbreak linked to slivered onions in its Quarter Pounder hamburgers. The fast-food giant has reportedly earmarked $100 million for recovery efforts, including marketing and franchisee support to address the fallout.

Don’t Miss:

The outbreak infected more than 100 people across 14 states, hospitalized 34 and tragically claimed one life, according to the Centers for Disease Control and Prevention. The CDC traced the source to a supplier that has since recalled the product, Business Insider reported. Still, McDonald’s is feeling the heat.

The company acknowledged the toll in its third-quarter earnings report, which revealed a decline in-store visits and daily sales as cautious customers stayed away. McDonald’s stock has dropped over 7% in the past month. The crisis has had a broad impact on business.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for with $1,000 for just $0.25/share

To regain customer trust, McDonald’s is spending $35 million on marketing campaigns, including a new TV ad promoting a limited-time offer of 10 Chicken McNuggets for just $1 via the McDonald’s app. The campaign aims to draw customers back with deals that highlight familiar favorites.

An additional $65 million is being directed to support the franchisees hit hardest by the outbreak. These funds will cover operational losses and other costs as local operators work to recover from the health scare’s effects on traffic and sales.

Michael Gonda, McDonald’s Chief Impact Officer for North America and Tariq Hassan, Chief Marketing and Customer Experience Officer, addressed the crisis head-on in a memo seen by CNN. “The relevance, trust and love for the Golden Arches has been hard-earned over nearly 70 years by our unwavering commitment to do the right thing,” they wrote. “The past three weeks have only further exemplified that.”

See Also: This rooftop wind turbine is taking on a market projected to reach over $900 billion by 2032 — With already over 40,000 users signing up to purchase, here’s a chance to be an early investor today!

The fallout has demonstrated the importance of food safety and customer loyalty in maintaining McDonald’s iconic brand. As the company works to restore confidence, the memo clarifies that rebuilding “trust and love” is a top priority.

While the company’s recovery plan is strong, the future remains uncertain. Analysts and investors will watch closely to see whether McDonald’s can successfully rebound from the crisis and reignite customer enthusiasm. The Golden Arches are betting on turning a tough situation into an opportunity to show resilience and commitment to its customers.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.