Veterinary Medicine Market Size to Surpass USD 53.47 Billion by 2033 | Straits Research

New York, United States, Nov. 21, 2024 (GLOBE NEWSWIRE) — Veterinary medicine encompasses preventing, treating, managing, and diagnosing animal diseases, disorders, and injuries. It involves animal husbandry, breeding, nutrition research, and product development. The scope of veterinary medicine is vast, as it incorporates all animal species, both domesticated and companion, and many diseases that can affect different species. Veterinary medicine is widely practiced both with and without professional supervision. A veterinary physician (a veterinarian, veterinary surgeon, or “vet”) typically manages professional care; however, veterinary nurses, technicians, and assistants are frequently involved.

Download Free Sample Report PDF @ https://straitsresearch.com/report/veterinary-medicine-market/request-sample

Market Dynamics

Growing Rates of Pet Ownership Drives the Global Market

The increase in pet ownership drives the demand for improved care for companion animals, increasing the total expenditure on pets. As estimated by the American Pet Products Association, the pet industry in the United States has experienced a significant expenditure increase. In 2019, the total expenditures in the pet industry increased by USD 5.2 billion compared to 2018. Nearly 67% of American households have a companion.

The rising prevalence of pet insurance in developed nations also drives up the pet ownership rate. Countries such as Brazil, China, and Ukraine also invest heavily in animal health. Consequently, the increase in the number of companion animals and expenditures drives the expansion of the veterinary medicine industry.

Increasing Investment in Veterinary Hospitals Creates Tremendous Opportunities

Rising expenditures on veterinary hospitals to ensure quality services present a lucrative market expansion opportunity. The worldwide rise in pet ownership has propelled animal hospitals and clinics. Recently, pet owners’ expenditures on animal well-being have increased significantly due to rising per capita income. In addition, the future of veterinary medicine depends on technological progress and exceptional patient care. Pet owners are looking for the most effective animal treatments and are prepared to spend more. This has led to an increase in veterinary hospital investment.

Regional Analysis

Americas is the most significant global veterinary medicine market shareholder and is anticipated to exhibit a CAGR of 5.44% during the forecast period. The Americas has been bifurcated into North America and Latin America. The market’s growth is anticipated to be supported by the rising number of pets and livestock and the prevalence of veterinary practices. The American Veterinary Medical Association (AVMA) predicted that approximately 110,531 veterinary practices were in operation in 2017, increasing to 113,390 in 2018. Similarly, according to statistics published by the Canadian Veterinary Medical Association in 2018, there were approximately 12,517 veterinarians in Canada.

Furthermore, according to the Canadian Animal Health Institute (CAHI), the dog population increased from 7.6 million in 2016 to 8.2 million in 2018. Moreover, introducing new products also played a crucial role in market expansion. In 2017, Elanco, a U.S.-based global animal health company, introduced Galliprant to treat inflammation and discomfort associated with canine osteoarthritis (OA). Thus, the high number of veterinarians, the increasing prevalence of animal disorders, and the rise in pet ownership are anticipated to contribute to the market’s growth.

Europe is anticipated to exhibit a CAGR of 4.87% over the forecast period. Europe’s market value would trail the Americas over the forecast period. This results from the escalating prevalence of diseases, the certification of new products, and an established veterinary healthcare infrastructure. The prevalence of cancer contributes to the expansion of the market. According to the Animal Tumor Registry of Genoa, the incidence rate of malignant cancers among canines in Italy is estimated to be 185.7 per 100,000 cases. In addition, a high prevalence of animal diseases, such as musculoskeletal disorders, osteoarthritis, and cancer, will spur the expansion of the market over the forecast period. According to a study conducted in the United Kingdom, approximately 2.5% of canines suffer from osteoarthritis yearly.

Ask for Customization @ https://straitsresearch.com/report/veterinary-medicine-market/request-sample

Key Highlights

- The global veterinary medicine market size was valued at USD 33.88 billion in 2024. It is estimated to reach USD 35.64 billion in 2025 to USD 53.47 Billion by 2033, growing at a CAGR of 5.20% during the forecast period (2025–2033).

- Based on animal type, the global veterinary medicine market is segmented into domesticated and companion. The domesticated segment owns the highest market share and is estimated to exhibit a CAGR of 5.99% during the forecast period.

- Based on product, the global veterinary medicine market is bifurcated into drugs and vaccines. The drugs segment dominates the global market share and is projected to exhibit a CAGR of 4.86% over the forecast period.

- Based on the route of administration, the global veterinary medicine market is divided into oral, parental, and other. The oral segment is the most significant contributor to the market and is estimated to exhibit a CAGR of 5.01% over the forecast period.

- Based on distribution channels, the global veterinary medicine market is divided into veterinary hospitals and clinics, retail stores, and online pharmacies. The veterinary hospitals and clinics segment owns the largest market share and is predicted to exhibit a CAGR of 5.60% throughout the forecast period.

- Americas is the most significant global veterinary medicine market shareholder and is anticipated to exhibit a CAGR of 5.44% during the forecast period.

Competitive Analysis

The key global veterinary medicine market players are Ceva, Elanco, Chanelle Pharma Group, Dechra Pharmaceuticals plc, Norbrook Laboratories, Zoetis, Merck Animal Health, Boehringer Ingelheim, Vetoquinol S.A., and others.

Recent Developments

- In January 2023, The U.S. Department of Agriculture (USDA) granted a conditional license for honeybee vaccination against American Foulbrood disease caused by Paenibacillus larvae, it was announced today by Dalan Animal Health, Inc. (“Dalan”), a pioneering biotech company in the field of insect health.

- In June 2023, IDEXX Laboratories, Inc., a global leader in pet healthcare innovation, introduced the first veterinary diagnostic test for detecting kidney damage in cats and dogs.

Segmentation

- By Animal Type

-

- Domesticated

- Companion

- By Product

-

- Drug

- Vaccines

- By Route of Administration

- Oral

- Parental

- Others

- By Distribution Channel

-

- Veterinary Hospitals and Clinics

- Retail Stores

- Online Pharmacies

- By Regions

-

- North-America

- Europe

- Asia-Pacific

- The Middle East and Africa

Get Detailed Market Segmentation @ https://straitsresearch.com/report/veterinary-medicine-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI. Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

For more information on your target market, please contact us below:

Phone: +1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us:LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Habitat for Humanity helped more than 3 million people build or improve a place to call home during past year

Since 1976, the global housing nonprofit has worked alongside more than 62 million people around the world.

ATLANTA, Nov. 20, 2024 /PRNewswire/ — An improved place to call home can lead to better health outcomes and peace of mind for a family. Every culture faces unique barriers to affordable home repair, and in Peru just the first step of finding a trusted contractor to take on a project can often be the most challenging.

Peruvians tend to build homes incrementally and word-of-mouth recommendations are usually trusted more than official certifications. To help meet residents where they are, Habitat for Humanity’s Terwilliger Center of Innovation in Shelter partnered with a local developer to create a coalition of trusted builders, known as Guardian Constructor.

In just two years, the coalition has connected more than 4,000 families with vetted construction professionals—families like Brenda’s. Brenda and her husband built a one-bedroom house with their own hands, but when it came time to expand and plan for the future, she needed a trusted construction company that understood her needs and her budget. Through Guardian Constructor, she selected a local design and construction firm who completed the project in ten weeks. Following her experience, Brenda is planning to add a second floor someday with the help of Guardian Constructor.

This story is highlighted in Habitat for Humanity International’s fiscal year 2024 annual report, released today by the global housing nonprofit.

In 2024, Habitat for Humanity helped 3 million people build or improve a place to call home. An additional 5.3 million people gained the potential to improve their housing conditions through training programs and advocacy work driven by Habitat in local communities.

“This year, thanks to the tireless efforts of homeowners, volunteers, supporters, advocates and staff, Habitat reached families in new ways to help power our vision of a world where everyone has a decent place to live,” said Jonathan Reckford, chief executive officer at Habitat for Humanity International. “Building and improving homes will always remain the core of Habitat’s work, and this year our colleagues across the globe continued to demonstrate the critical importance of advocacy and bridgebuilding to our mission. In the face of a global housing crisis, the Habitat network stepped up time and time again to work alongside more families in more communities around the world.”

Thanks to the generous support of donors and partners, Habitat piloted new programs and improved others to meet the housing need in communities around the world.

Habitat’s Home Equals campaign, a five-year global effort that aims to help 15 million residents of informal settlements access safe, adequate housing, continued in its second year. To date, the campaign has impacted nearly 3 million people and has seen Habitat entities successfully advocate for more than 50 policy or systems changes in 12 countries.

Habitat also wrapped Cost of Home, a five-year U.S. advocacy campaign, in June. Through the campaign, more than 400 state and local Habitat organizations united to advance over 500 policy and system changes at all levels of government, resulting in more than 9.5 million people gaining increased access to home affordability and stability. Thanks to the work of affiliates enrolled in Habitat’s first U.S. advocacy campaign, $23.6 billion in government funding was generated or allocated.

Habitat works to ensure that — even as we build — a growing number of existing homes remain affordable. More than 120 Habitat affiliates are implementing a lasting affordability model, including 26 affiliates that have invested in or created their own community land trusts. Lasting affordability efforts keep housing prices in reach across generations, enable homeowners to gain equity and share in value appreciation over time, help residents with low or modest incomes avoid displacement, and avert gentrification of communities.

And in Central Eastern Europe, Habitat is improving energy efficiency in multifamily apartment buildings through ComActivate, a three-year, US$2.2 million (€2 million) consortium program. The program creates local resource centers to provide guidance, engage advocates, and develop neighborhood-specific road maps to reduce energy poverty, lower residents’ utility costs and decrease the carbon footprint. ComActivate is being implemented with pilot resource centers in four municipalities across Hungary, Bulgaria and Lithuania. These initial efforts focus on 1,179 multifamily buildings and will reach almost 90,000 residents.

“The milestones and accomplishments detailed in our annual report were achieved by bringing people together,” Reckford said. “These are the shared successes of more than 910,000 volunteers who helped build, advocate and raise awareness about the global need for shelter in the past year. To everyone who worked alongside Habitat and its families this year, thank you.”

The FY2024 annual report also provides detailed information about Habitat for Humanity International’s activities and financials for the period between July 1, 2023, and June 30, 2024, along with the network of Habitat affiliates in all 50 states in the U.S. and national organizations and program partnerships in more than 70 countries.

In fiscal year 2024, Habitat reported US$362 million in revenue, along with an estimated US$3.1 billion in total revenue through the organization’s federated network of Habitat organizations in the U.S. and around the world. The audited financial statements are published alongside the annual report at https://www.habitat.org/about/annual-reports-990s.

About Habitat for Humanity

Driven by the vision that everyone needs a decent place to live, Habitat for Humanity found its earliest inspirations as a grassroots movement on an interracial community farm in south Georgia. Since its founding in 1976, the Christian housing organization has since grown to become a leading global nonprofit working in local communities across all 50 states in the U.S., Puerto Rico, and more than 70 countries. Families and individuals in need of a hand up partner with Habitat for Humanity to build or improve a place they can call home. Habitat homeowners help build their own homes alongside volunteers and pay an affordable mortgage. Through financial support, volunteering or adding a voice to support affordable housing, everyone can help families achieve the strength, stability and self-reliance they need to build better lives for themselves. Through shelter, we empower. To learn more, visit habitat.org.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/habitat-for-humanity-helped-more-than-3-million-people-build-or-improve-a-place-to-call-home-during-past-year-302312005.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/habitat-for-humanity-helped-more-than-3-million-people-build-or-improve-a-place-to-call-home-during-past-year-302312005.html

SOURCE Habitat for Humanity International

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Existing-Home Sales Grew 3.4% in October; First Year-Over-Year Gain Since July 2021

Key Highlights

- Existing-home sales climbed 3.4% in October to a seasonally adjusted annual rate of 3.96 million. Sales advanced 2.9% from one year ago, the first year-over-year increase in more than three years (July 2021; +1.8%).

- The median existing-home sales price ascended 4.0% from October 2023 to $407,200, the 16th consecutive month of year-over-year price gains.

- The inventory of unsold existing homes edged higher by 0.7% from the prior month to 1.37 million at the end of October, or the equivalent of 4.2 months’ supply at the current monthly sales pace.

Existing-home sales rose in October, according to the National Association of Realtors®. Sales improved in all four major U.S. regions. Year-over-year, sales elevated in three regions but were unchanged in the Northeast.

Total existing-home sales[1] – completed transactions that include single-family homes, townhomes, condominiums and co-ops – expanded 3.4% from September to a seasonally adjusted annual rate of 3.96 million in October. Year-over-year, sales progressed 2.9% (up from 3.85 million in October 2023).

“The worst of the downturn in home sales could be over, with increasing inventory leading to more transactions,” said NAR Chief Economist Lawrence Yun. “Additional job gains and continued economic growth appear assured, resulting in growing housing demand. However, for most first-time homebuyers, mortgage financing is critically important. While mortgage rates remain elevated, they are expected to stabilize.”

Total housing inventory[2] registered at the end of October was 1.37 million units, up 0.7% from September and 19.1% from one year ago (1.15 million). Unsold inventory sits at a 4.2-month supply at the current sales pace, down from 4.3 months in September but up from 3.6 months in October 2023.

The median existing-home price[3] for all housing types in October was $407,200, up 4.0% from one year ago ($391,600). All four U.S. regions registered price increases.

“The ongoing price gains mean increasing wealth for homeowners nationwide,” Yun added. “Additional inventory and more home building activity will help price increases moderate next year.”

REALTORS® Confidence Index

According to the monthly REALTORS® Confidence Index, properties typically remained on the market for 29 days in October, up from 28 days in September and 23 days in October 2023.

First-time buyers were responsible for 27% of sales in October, up from 26% in September but down from 28% in October 2023. NAR’s 2024 Profile of Home Buyers and Sellers – released earlier this month[4] – found that the annual share of first-time buyers was 24%, the lowest ever recorded.

Cash sales accounted for 27% of transactions in October, down from 30% in September and 29% in October 2023.

Individual investors or second-home buyers, who make up many cash sales, purchased 17% of homes in October, up from 16% in September and 15% in October 2023.

Distressed sales[5] – foreclosures and short sales – represented 2% of sales in October, unchanged from last month and the previous year.

Mortgage Rates

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.78% as of November 14. That’s down from 6.79% one week ago and 7.44% one year ago.

Single-family and Condo/Co-op Sales

Single-family home sales accelerated 3.5% to a seasonally adjusted annual rate of 3.58 million in October, up 4.1% from the prior year. The median existing single-family home price was $412,200 in October, up 4.1% from October 2023.

Existing condominium and co-op sales extended 2.7% in October to a seasonally adjusted annual rate of 380,000 units, down 7.3% from one year ago (410,000). The median existing condo price was $360,300 in October, up 1.6% from the previous year ($354,800).

Regional Breakdown

Existing-home sales in the Northeast in October grew 2.2% from September to an annual rate of 470,000, identical to October 2023. The median price in the Northeast was $472,900, up 7.6% from last year.

In the Midwest, existing-home sales bounced 6.7% in October to an annual rate of 950,000, up 1.1% from the prior year. The median price in the Midwest was $305,300, up 7.2% from October 2023.

Existing-home sales in the South climbed 2.9% from September to an annual rate of 1.77 million in October, up 2.3% from one year before. The median price in the South was $361,200, up 0.9% from one year earlier.

In the West, existing-home sales increased 1.3% in October to an annual rate of 770,000, up 8.5% from a year ago. The median price in the West was $627,700, up 4.4% from October 2023.

About the National Association of Realtors®

The National Association of Realtors® is America’s largest trade association, representing 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics. For free consumer guides about navigating the homebuying and selling transaction processes – from written buyer agreements to negotiating compensation – visit facts.realtor.

# # #

For local information, please contact the local association of Realtors® for data from local multiple listing services (MLS). Local MLS data is the most accurate source of sales and price information in specific areas, although there may be differences in reporting methodology.

NOTE: NAR’s Pending Home Sales Index for October will be released November 27, and Existing-Home Sales for November will be released December 19. Release times are 10 a.m. Eastern. See NAR’s statistical news release schedule.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

[1] Existing-home sales, which include single-family, townhomes, condominiums and co-ops, are based on transaction closings from Multiple Listing Services. Changes in sales trends outside of MLSs are not captured in the monthly series. NAR benchmarks home sales periodically using other sources to assess overall home sales trends, including sales not reported by MLSs.

Existing-home sales, based on closings, differ from the U.S. Census Bureau’s series on new single-family home sales, which are based on contracts or the acceptance of a deposit. Because of these differences, it is not uncommon for each series to move in different directions in the same month. In addition, existing-home sales, which account for more than 90% of total home sales, are based on a much larger data sample – about 40% of multiple listing service data each month – and typically are not subject to large prior-month revisions.

The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. Seasonally adjusted annual rates are used in reporting monthly data to factor out seasonal variations in resale activity. For example, home sales volume is normally higher in the summer than in the winter, primarily because of differences in the weather and family buying patterns. However, seasonal factors cannot compensate for abnormal weather patterns.

Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began. Prior to this period, single-family homes accounted for more than nine out of 10 purchases. Historic comparisons for total home sales prior to 1999 are based on monthly single-family sales, combined with the corresponding quarterly sales rate for condos.

[2] Total inventory and month’s supply data are available back through 1999, while single-family inventory and month’s supply are available back to 1982 (prior to 1999, single-family sales accounted for more than 90% of transactions and condos were measured only on a quarterly basis).

[3] The median price is where half sold for more and half sold for less; medians are more typical of market conditions than average prices, which are skewed higher by a relatively small share of upper-end transactions. The only valid comparisons for median prices are with the same period a year earlier due to seasonality in buying patterns. Month-to-month comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Changes in the composition of sales can distort median price data. Year-ago median and mean prices sometimes are revised in an automated process if additional data is received.

The national median condo/co-op price often is higher than the median single-family home price because condos are concentrated in higher-cost housing markets. However, in a given area, single-family homes typically sell for more than condos as seen in NAR’s quarterly metro area price reports.

[4] Survey results represent owner-occupants and differ from separately reported monthly findings from NAR’s REALTORS® Confidence Index, which include all types of buyers. The annual study only represents primary residence purchases, and does not include investor and vacation home buyers. Results include both new and existing homes.

[5] Distressed sales (foreclosures and short sales), days on market, first-time buyers, all-cash transactions and investors are from a monthly survey for the NAR’s REALTORS® Confidence Index, posted at nar.realtor.

Troy Green National Association of Realtors® tgreen@nar.realtor

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Is Betting Big In SMCI Options

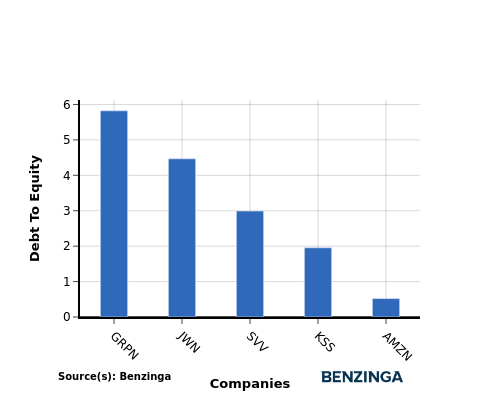

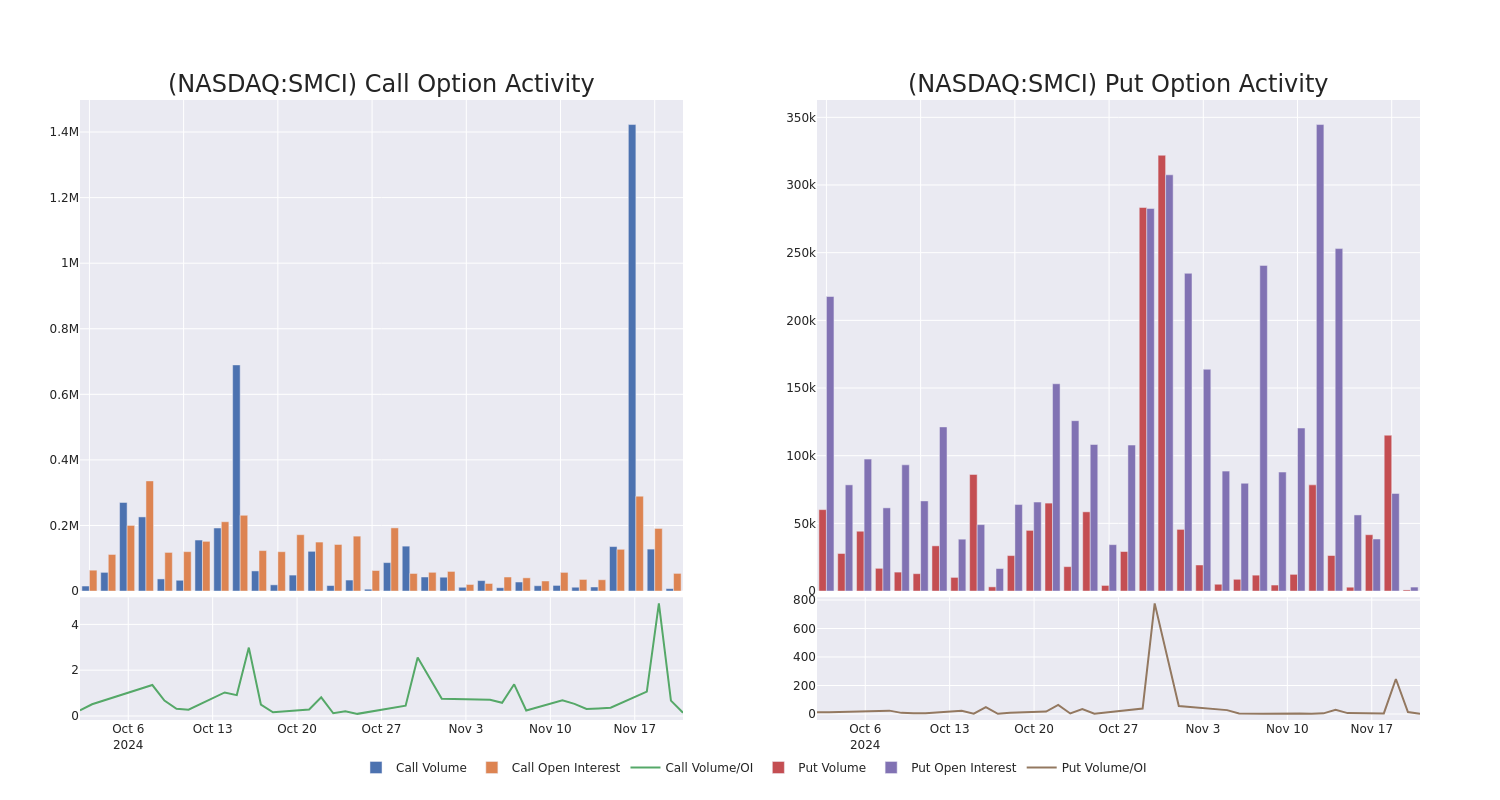

Financial giants have made a conspicuous bullish move on Super Micro Computer. Our analysis of options history for Super Micro Computer SMCI revealed 13 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $2,286,540, and 9 were calls, valued at $866,659.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $24.0 and $75.0 for Super Micro Computer, spanning the last three months.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Super Micro Computer’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Super Micro Computer’s substantial trades, within a strike price spectrum from $24.0 to $75.0 over the preceding 30 days.

Super Micro Computer Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | TRADE | BULLISH | 01/16/26 | $50.3 | $48.1 | $48.8 | $75.00 | $1.4M | 551 | 298 |

| SMCI | PUT | TRADE | NEUTRAL | 01/16/26 | $29.95 | $28.6 | $29.25 | $53.00 | $731.2K | 1.4K | 250 |

| SMCI | CALL | SWEEP | BULLISH | 12/20/24 | $3.45 | $3.3 | $3.45 | $30.00 | $312.3K | 12.8K | 455 |

| SMCI | CALL | SWEEP | BEARISH | 12/20/24 | $6.5 | $6.4 | $6.4 | $24.00 | $205.4K | 2.6K | 335 |

| SMCI | CALL | SWEEP | BULLISH | 03/21/25 | $5.85 | $5.75 | $5.75 | $35.00 | $115.0K | 5.2K | 1.2K |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and “Internet of Things” embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

In light of the recent options history for Super Micro Computer, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Super Micro Computer’s Current Market Status

- With a volume of 21,385,693, the price of SMCI is up 7.98% at $27.86.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 12 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Super Micro Computer options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Deere Q4 Earnings: Beats Expectations, Steep Sales Drop, Margins Squeeze & More

Deere & Co DE reported a fourth-quarter net sales and revenue decline of 28% year-over-year to $11.143 billion, beating the consensus of $9.335 billion.

Deere clocked an EPS of $4.55, down from $8.26 YoY, beating the consensus of $3.90.

Production & Precision Agriculture net sales declined 38% YoY to $4.305 billion, Small Agriculture & Turf net sales fell 25% to $2.306 billion, and Construction & Forestry revenue declined 29% to $2.664 billion due to lower shipment volumes.

Financial services revenues grew 13% year over year to $1.522 billion. Net income declined to $173 million from $190 million a year ago due to higher credit loss provisions, partially offset by portfolio income, lower SA&G expenses, and valuation gains.

Operating profit fell 52.1% YoY to $1.45 billion, and margin contracted by 661 bps to 13%. Segment operating margins: Production & Precision Agriculture 15.3%, down YoY from 26.4%; Small Agriculture & Turf 10.1%, down YoY from 14.4%; Construction & Forestry 12.3%, down YoY from 13.8%.

As of October 27, Deere held $8.5 billion in cash and equivalents. DE’s net cash provided by operating activities for the fiscal was $9.231 billion, compared to $8.589 billion a year ago.

In the third quarter, the company launched employee-separation programs across the U.S., Europe, Asia, and Latin America to align with strategic priorities and reduce redundancies. These largely involuntary programs incurred $157 million pretax ($124 million after-tax) in 2024, with $130 million paid.

“Amid significant market challenges this year, we proactively adjusted our business operations to better align with the current environment. Together with the structural improvements made over the past several years, these adjustments enable us to serve our customers more effectively and achieve strong results across the business cycle,” commented John May, chairman and CEO of Deere.

Guidance: Deere projects fiscal 2025 net income to be between $5.0 billion and $5.5 billion. For fiscal-year 2024, net income attributable to Deere was $7.100 billion.

The company said it remains committed to making investments that enhance customer productivity and profitability.

Price Action: DE shares traded higher by 1.49% at $411.00 premarket at the last check Thursday.

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: JOHN FISHER Sells $323K Worth Of Federated Hermes Shares

JOHN FISHER, Vice President at Federated Hermes FHI, reported an insider sell on November 20, according to a new SEC filing.

What Happened: FISHER opted to sell 7,817 shares of Federated Hermes, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $323,336.

In the Thursday’s morning session, Federated Hermes‘s shares are currently trading at $41.42, experiencing a down of 0.0%.

Discovering Federated Hermes: A Closer Look

Federated Hermes provides asset-management services for institutional and individual investors. The firm had $782.7 billion in managed assets at the end of June 2024, composed of equity (10%), multi-asset (less than 1%), fixed-income (12%), alternative (3%), and money market (75%) funds. The firm’s cash-management operations are expected to generate around 50% of Federated’s revenue this year, compared with 28%, 12%, and 10%, respectively, for the equity, fixed-income, and alternatives/multi-asset operations. The company’s products are distributed via trust banks, wealth managers, and retail broker/dealers (64% of AUM), institutional investors (27%), and international clients (9%).

Federated Hermes’s Financial Performance

Revenue Growth: Federated Hermes’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 1.44%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Key Insights into Profitability Metrics:

-

Gross Margin: With a high gross margin of 66.7%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Federated Hermes’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 1.06.

Debt Management: Federated Hermes’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.41.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 13.11, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 2.08, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 7.75, Federated Hermes could be considered undervalued.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Transaction Codes Worth Your Attention

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Federated Hermes’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inquiry Into Amazon.com's Competitor Dynamics In Broadline Retail Industry

In the ever-evolving and intensely competitive business landscape, conducting a thorough company analysis is of utmost importance for investors and industry followers. In this article, we will carry out an in-depth industry comparison, assessing Amazon.com AMZN alongside its primary competitors in the Broadline Retail industry. By meticulously examining key financial metrics, market positioning, and growth prospects, we aim to offer valuable insights to investors and shed light on company’s performance within the industry.

Amazon.com Background

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services’ cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon’s non-AWS sales, led by Germany, the United Kingdom, and Japan.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Amazon.com Inc | 43.35 | 8.23 | 3.49 | 6.19% | $32.08 | $31.0 | 11.04% |

| Alibaba Group Holding Ltd | 17.85 | 1.57 | 1.62 | 4.64% | $54.02 | $92.47 | 5.21% |

| PDD Holdings Inc | 12.55 | 4.61 | 3.63 | 13.54% | $37.97 | $63.36 | 85.65% |

| MercadoLibre Inc | 68.51 | 24.47 | 5.35 | 10.37% | $0.72 | $2.44 | 35.27% |

| JD.com Inc | 11.31 | 1.61 | 0.35 | 5.22% | $15.92 | $45.04 | 5.12% |

| Coupang Inc | 42.14 | 10.29 | 1.49 | 1.74% | $0.28 | $2.27 | 27.2% |

| eBay Inc | 15.32 | 5.38 | 3.02 | 11.59% | $0.95 | $1.85 | 3.04% |

| Vipshop Holdings Ltd | 6.45 | 1.34 | 0.48 | 2.76% | $1.47 | $4.96 | -9.18% |

| Dillard’s Inc | 10.81 | 3.39 | 1.01 | 6.37% | $0.15 | $0.58 | -4.19% |

| MINISO Group Holding Ltd | 17.80 | 4.13 | 2.90 | 6.26% | $0.79 | $1.77 | 24.08% |

| Ollie’s Bargain Outlet Holdings Inc | 26.70 | 3.38 | 2.44 | 3.14% | $0.08 | $0.22 | 12.41% |

| Macy’s Inc | 22.40 | 0.94 | 0.17 | 3.53% | $0.44 | $2.16 | -3.48% |

| Nordstrom Inc | 12.86 | 3.85 | 0.25 | 13.68% | $0.4 | $1.49 | 3.23% |

| Kohl’s Corp | 6.40 | 0.47 | 0.11 | 1.73% | $0.35 | $1.6 | -4.18% |

| Savers Value Village Inc | 18.67 | 3.17 | 0.94 | 5.09% | $0.07 | $0.22 | 0.53% |

| Groupon Inc | 12.32 | 8.45 | 0.63 | 34.72% | $0.03 | $0.1 | -9.48% |

| Average | 20.14 | 5.14 | 1.63 | 8.29% | $7.58 | $14.7 | 11.42% |

Through a thorough examination of Amazon.com, we can discern the following trends:

-

The current Price to Earnings ratio of 43.35 is 2.15x higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

The elevated Price to Book ratio of 8.23 relative to the industry average by 1.6x suggests company might be overvalued based on its book value.

-

With a relatively high Price to Sales ratio of 3.49, which is 2.14x the industry average, the stock might be considered overvalued based on sales performance.

-

With a Return on Equity (ROE) of 6.19% that is 2.1% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

-

With higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $32.08 Billion, which is 4.23x above the industry average, the company demonstrates stronger profitability and robust cash flow generation.

-

The gross profit of $31.0 Billion is 2.11x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 11.04% is significantly lower compared to the industry average of 11.42%. This indicates a potential fall in the company’s sales performance.

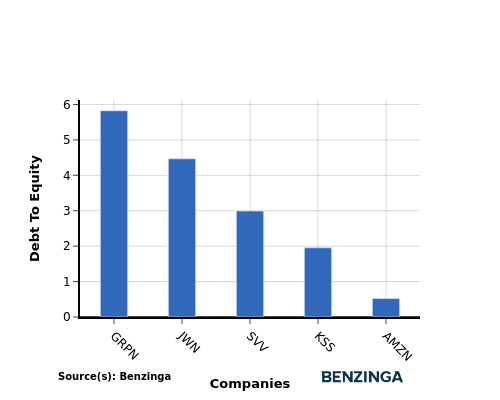

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Amazon.com can be assessed by comparing it to its top 4 peers, resulting in the following observations:

-

Among its top 4 peers, Amazon.com has a stronger financial position with a lower debt-to-equity ratio of 0.52.

-

This indicates that the company relies less on debt financing and maintains a more favorable balance between debt and equity, which can be viewed positively by investors.

Key Takeaways

For Amazon.com, the PE, PB, and PS ratios are all high compared to its peers in the Broadline Retail industry, indicating that the stock may be overvalued. The low ROE suggests that Amazon.com is not generating significant returns on shareholder equity. However, the high EBITDA and gross profit margins show strong operational performance. The low revenue growth rate may be a concern for Amazon.com compared to its industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BJ’s stock rises on first membership-fee increase in 7 years

Last Updated:

First Published:

BJ’s Wholesale Club Holdings Inc. announced an increase in its membership fees Thursday, marking the first hike in seven years. The company’s stock surged in premarket trading and is up 0.4% at 9:36 a.m. Eastern time.

Effective Jan. 1, 2025, BJ’s

BJ Club membership fee will increase by $5, going up to $60 a year, and its Club+ membership fee will increase by $10, to $120 a year, the company said when announcing third-quarter earnings results. Earlier this year, rival Costco Wholesale Corp. COST hiked its membership fees for the first time since 2017.

How To Earn $500 A Month From Intuit Stock Ahead Of Q1 Earnings

Intuit Inc. INTU will release earnings results for the first quarter, after the closing bell, on Thursday, Nov. 21.

Analysts expect the Mountain View, California-based company to report quarterly earnings at $2.36 per share, down from $2.47 per share in the year-ago period. Intuit projects to report quarterly revenue of $3.14 billion, compared to $2.98 billion a year earlier, according to data from Benzinga Pro.

With the recent buzz around Intuit ahead of quarterly earnings, investors may be eyeing potential gains from the company’s dividends. As of now, Intuit offers an annual dividend yield of 0.64%. That’s a quarterly dividend amount of $1.04 per share ($4.16 a year).

To figure out how to earn $500 monthly from Intuit, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Intuit’s $4.16 dividend: $6,000 / $4.16 = 1,442 shares.

So, an investor would need to own approximately $938,165 worth of Intuit, or 1,442 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $4.16 = 288 shares, or $187,373 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis (the dividend payment and the stock price fluctuate over time).

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

INTU Price Action: Shares of Intuit gained by 1% to close at $650.60 on Wednesday.

On Nov. 18, Scotiabank analyst Allan Verkhovski initiated coverage on Intuit with a Sector Perform rating and announced a price target of $700.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Price Hits All-Time High – How You Can Trade The Cryptocurrency's Growth Trajectory

In a relatively short time frame, society’s sentiment towards cryptocurrencies seems to be shifting from skeptical to almost celebratory as the versatility of digital currencies has become more apparent, which is reflected in the fact that the price for Bitcoin hit an all-time high recently after the U.S. elections. Furthermore, the recent securitization of Bitcoin and Ethereum has helped legitimize and expand the value proposition of these currencies, turning them into regulated investable assets that individuals and institutions can trade or allocate to within their portfolios. While this rising popularity has gathered the interest of many individuals, it has also made them aware of the price volatility present within the asset class, leading some to wonder about the underlying dynamics of cryptocurrencies and if it is right for them. But others say there is no need to worry – for example, with Plus500’s Crypto offerings, CFD Crypto assets are available to trade with a leverage of 1:2 while Future Crypto assets are available for U.S. traders.

Factors That Influence Cryptocurrency Prices

Though Bitcoin, Ethereum and other cryptocurrencies are digitally native, supply and demand factors still influence their price. Given that Bitcoin’s underlying protocol/coding limits its supply to 21 million coins, fluctuations in demand can lead to price volatility. Mining new Bitcoin is an energy-intensive process that requires the collaboration of various stakeholders within the blockchain ecosystem. Additionally, investor interest, adoption rates and macroeconomic conditions also affect demand.

A seminal factor influencing Bitcoin’s price is ‘Bitcoin Halving,’ which occurs every four years. The last one occurred on April 14th, 2024. In simple terms, Bitcoin Halving reduces the rate at which new coins are created. Thus, it is self-induced scarcity written into Bitcoin’s code. The rationale for these quadrennial halving events is to reduce the supply of Bitcoin entering circulation, thus allowing existing coins to keep their value (i.e., avoid inflation).

Similarly, supply and demand dynamics also influence Ethereum’s pricing; however, the cryptocurrency’s underlying protocols also influence its value. In 2021, Ethereum developers enacted Ethereum Improvement Proposal 1559 (EIP1559), which overhauled Ethereum’s transaction fee mechanism in a way that impacts users, miners and holders of Ethereum. One of the results stemming from this change relates to how users would transact on Ethereum. More specifically, the change required that users destroy an algorithmically determined amount of the cryptocurrency, thus limiting its oversupply on the network and the possibility of inflation.

Finally, Bitcoin and Ethereum’s mass adoption and securitization are also influential pricing factors. After rejecting Bitcoin for almost a decade, the U.S. Securities and Exchange Commission approved spot Bitcoin ETFs in January this year, which resulted in several ETF makers launching these solutions. The approval of Ethereum ETFs soon followed. Outside the U.S., some markets, such as Hong Kong, are also launching cryptocurrency ETFs, as there is growing investor demand for these asset types. The securitization of these cryptocurrencies and the usage of these instruments by retail and institutional investors is a growing factor influencing their price.

Overall, it’s important for traders to exercise caution and adapt their strategies as new information and market trends emerge, striking a balance between risk and reward. For example, with Plus500 you can learn the basics of risk management with their trading academy tools.

How To Trade Cryptocurrencies

The price volatility present in cryptocurrencies, specifically Bitcoin and Ethereum, is indicative of an active market. As with most asset classes, be it stocks, bonds, commodities or other such instruments, there will be periods of upswings and drawdowns. This cyclicality in price creates opportunities for individuals to enter at a reasonable price point and benefit from potential appreciation. Alternatively, they can take a short position if they believe the current valuation is too high and a correction will occur.

Individuals who want to gain exposure to cryptocurrencies can achieve this in multiple ways. As mentioned previously, Bitcoin and Ethereum ETFs are now available to the broad market. These ETFs allow individuals to have turnkey access to the respective cryptocurrencies in a unitized solution. ETFs are possibly the most accessible avenue for individuals looking to invest or trade cryptocurrencies.

Cryptocurrency futures are contracts between two investors who speculate on a cryptocurrency’s future price, giving them exposure to cryptocurrencies without purchasing them. Crypto futures resemble standard futures contracts because they allow traders to speculate on the price trajectory of an underlying asset. For traders or speculators, using cryptocurrency futures enables them to capitalize on the dynamic shifts that occur with these currencies.

Finally, individuals can buy the specific cryptocurrency they desire through a cryptocurrency trading service or exchange. Doing so would provide them with direct ownership of their chosen cryptocurrency.

Why Consider Cryptocurrencies Now?

Against the backdrop of an uncertain macroeconomic and geopolitical landscape, the decentralized nature of Bitcoin, Ethereum and other cryptocurrencies has risen in appeal as investors seek to diversify their portfolios. Simply put, cryptocurrencies broaden the risk and return spectrum available to investors. In other words, for investors willing to take more risk, the cryptocurrency asset class may have the potential to deliver higher total returns in the form of tradable instruments widely available on exchanges.

How To Trade Cryptocurrencies With Plus500

Plus500 PLSQF is a multi-asset fintech group operating trading platforms globally. Established in 2008, the firm has grown its importance as a player in the financial trading sector, being listed on the London Stock Exchange under the ticker symbol PLUS and included in the FTSE 250 Index.

Given the group’s global operations, it is regulated by several entities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Israel Securities Authority (ISA) and others in Europe and Asia-Pacific jurisdictions.

Regarding service offerings, Plus500 is expanding and currently offers three platforms: Plus500 Contract For Differences (CFD) with more than 2800 CFD instruments, Plus500 Invest with more than 2700 shares (available in certain countries) and Plus500 Futures, which is a futures platform available in the U.S. only.

As a trading platform, Plus500 is designed to be straightforward and accessible for beginners while offering advanced features for experienced traders. Beginner traders should use the demo account and all the resources in the Trading Academy. Traders can start with as little as $100, and Plus500 Futures (U.S.) offers a deposit bonus of up to $200.

For traders interested in cryptocurrency CFDs, Plus500 can provide up to 1:2 leverage on such transactions. Plus 500 also provides educational resources to upskill one’s trading ability and ongoing 24/7 professional support as needed.

Ready to begin your cryptocurrency trading journey? Click here to check out the Plus500 platform! *82% of retail CFD accounts lose money.

Trading in futures and options carries substantial risk of loss is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments.

Featured photo by Traxer on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.