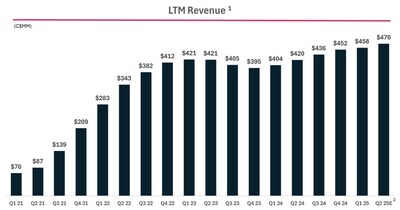

Dye & Durham Forecasts Record Setting Quarter & Announces Upcoming Investor Briefing

- $120-125 million Q2 FY2025 guidance range for revenue versus $110 million in Q2 FY2024

- 6-10% expected Organic Revenue Growth1,3 rate in Q2 FY2025 versus 2.8% in Q2 FY2024

- Results are trending for the Company’s best quarterly revenue1 performance ever – clear proof that management’s value creation plan is working

TORONTO, Nov. 28, 2024 /CNW/ – Dye & Durham Limited (“Dye & Durham” or the “Company“) DND today provided second quarter fiscal 2025 (“Q2 FY2025“) guidance, forecasting its best quarter to date.

Based on the continued success of the Company’s organic growth initiatives, management is pleased to provide Q2 FY2025 revenue guidance of $120-125 million. Management also expects to report an Organic Revenue Growth Rate3 of 6-10% for Q2 FY2025.

“Dye & Durham is delivering on its commitment to investors and generating impressive and record-setting results. The management team’s strategy has worked to transition our revenue model to a more predictable contracted revenue, and to capitalize on organic growth opportunities such as cross-selling,” said Matthew Proud, CEO of Dye & Durham.

|

1) Excludes TM Group |

|

2) Represents mid point of guidance |

“While the events of the past few quarters have imposed an unnecessary distraction on our business, our team has remained focused on executing against our Value Creation Plan, which can be seen in the $50 million annual revenue growth we have delivered on. Our financial profile underscores the strength of our strategy and the quality of our board of directors and management team,” continued Mr. Proud.

Investor Briefing Event

The Company will also host an Investor Briefing event (the “Briefing“) on the afternoon of December 10, 2024, to provide shareholders with an update on the Company’s progress and strategic execution of its recently published ‘Value Creation Plan’. The Briefing will also include a question and answer session. Investors are invited to attend in person or access the Briefing from the Events section on the Investors page of its website.

Details on the Value Creation Plan, which is focused on continuing to drive driving sustainable long-term value for all stakeholders, can be found in the Investors section of the Company’s website and on SEDAR+ under the Company’s profile at www.sedarplus.ca.

|

3) |

Represents a non-IFRS measure. This measure is not a recognized measure under IFRS, does not have a standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. For the relevant definition, see the “Non-IFRS Financial Measures” section of this press release. Management believes non-IFRS measures, including Organic Revenue Growth Rate, provide supplementary information to IFRS measures used in assessing the performance of the business by providing further understanding of the Company’s results of operations from management’s perspective. Please see “Cautionary Note Regarding Non-IFRS Measures”, and “Select Information and Reconciliation of Non-IFRS Measures in the Company’s most recent Management’s Discussion and Analysis, which is available on the Company’s profile on SEDAR+ at www.sedarplus.ca, for further details on certain non-IFRS measures. Please see the “Non-IFRS Financial Measures” section of this press release for a reconciliation of Organic Revenue to Revenue. |

About Dye & Durham Limited

Dye & Durham Limited provides premier practice management solutions empowering legal professionals every day, delivers vital data insights to support critical corporate transactions and enables the essential payments infrastructure trusted by government and financial institutions. The company has operations in Canada, the United Kingdom, Ireland, and Australia.

Additional information can be found at www.dyedurham.com.

Non-IFRS Measures

This press release makes reference to Organic Revenue Growth Rate, which is a non-IFRS measure. This is not a recognized measure under IFRS, does not have a standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies.

Rather, this measure is provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective and to discuss Dye & Durham’s financial outlook. The Company’s definitions of non-IFRS measures may not be the same as the definitions for such measures used by other companies in their reporting. Non-IFRS measures have limitations as analytical tools. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of Dye & Durham’s financial information reported under IFRS. The Company uses non-IFRS measures, including “Organic Revenue Growth Rate” (as defined below), to provide investors with supplemental measures of its operating performance and to eliminate items that have less bearing on operating performance or operating conditions and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. The Company’s management also uses non-IFRS financial measures in order to facilitate operating performance comparisons from period to period. The Company believes that securities analysts, investors, and other interested parties frequently use non-IFRS financial measures in the evaluation of issues.

Please see “Cautionary Note Regarding Non-IFRS Measures” and “Select Information and Reconciliation of Non-IFRS Measures” in the Company’s most recent Management’s Discussion and Analysis, which is available on the Company’s profile on SEDAR+ at www.sedarplus.ca, for further details on certain non-IFRS measures.

Organic Revenue Growth Rate

“Organic Revenue Growth Rate” means total revenue in the current quarter period (excluding the pre-acquisition quarterly revenue of those acquisitions executed in the last twelve month period and discontinued businesses) (“Organic Revenue“) divided by the total revenue in the prior quarter period (excluding TM Group, pre-acquisition quarterly revenue and discontinued businesses). Organic Revenue, which is a non-IFRS measure, is used as a component in Organic Revenue Growth Rate. Below is a reconciliation of the Company’s Q2 FY2025 Organic Growth Rate.

|

$ million |

|

|

Q2 FY2025 Revenue |

120 – 125 |

|

Pre-Acquisition Reporting Results |

3.5 |

|

Organic Revenue |

116.5-121.5 |

|

Q2 FY2024 Revenue |

110 |

|

Organic Revenue Growth Rate (%) |

6% – 10% |

Forward-looking Statements

This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws, which reflects the Company’s current expectations regarding future events, including with respect to the Company’s financial outlook and expected Q2 FY2025 revenue and Organic Revenue Growth Rate. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to guidance, expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management’s current beliefs, expectations, estimates and projections regarding future events and operating performance.

Specifically, statements regarding Dye & Durham’s expectations of future results, including its expected Q2 FY2025 revenue and Organic Revenue Growth Rate, performance, prospects, the markets in which we operate, or about any future intention with regard to its business, acquisition strategies and debt reduction strategy are forward-looking information. The foregoing demonstrates Dye & Durham’s objectives, which are not forecasts or estimates of its financial position, but are based on the implementation of its strategic goals, growth prospectus, and growth initiatives. The forward-looking information is based on management’s opinions, estimates and assumptions, including, but not limited to: (i) the Company’s results of operations will continue as expected, (ii) the Company will continue to effectively execute against its key strategic growth priorities, (iii) the Company will continue to retain and grow its existing customer base and market share, (iv) the Company will be able to take advantage of future prospects and opportunities, and realize on synergies, including with respect of acquisitions, (v) there will be no changes in legislative or regulatory matters that negatively impact the Company’s business, (vi) current tax laws will remain in effect and will not be materially changed, (vii) economic conditions will remain relatively stable throughout the period, (viii) the industries the Company operates in will continue to grow consistent with past experience, (ix) exchange rates being approximately consistent with current levels, * the seasonal trends in real estate transaction volume will continue as expected, (xi) the Company’s expectations for increases to the average rate per user on its platforms, contractual revenues, and incremental earnings from its latest asset-based acquisition will be met, (xii) the Company being able to effectively upsell and cross-sell between practice management and data insights & due diligence customers, (xiii) the Company’s expectations regarding its debt reduction strategy will be met, and (xiv) those assumptions described under the heading “Caution Regarding Forward-Looking Information” in the Company’s most recent Management’s Discussion and Analysis.

While these opinions, estimates and assumptions are considered by Dye & Durham to be appropriate and reasonable in the circumstances as of the date of this press release, they are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, levels of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information. Such risks and uncertainties include, but are not limited to: the Company will be unable to effectively execute against its key strategic growth priorities, including in respect of acquisitions; the Company will be unable to continue to retain and grow its existing customer base and market share; risks related to the Company’s business and financial position; the Company may not be able to accurately predict its rate of growth and profitability; risks related to economic and political uncertainty; income tax related risks; and the factors discussed under “Risk Factors” in the Company’s most recent Annual Information Form and under the heading “Risks and Uncertainties” in the Company’s most recent Management’s Discussion and Analysis, which are available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information. Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to the Company or that the Company presently believes are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information.

Although the Company bases these forward-looking statements on assumptions that it believes are reasonable when made, the Company cautions investors that forward-looking statements are not guarantees of future performance and that its actual results of operations, financial condition and liquidity and the development of the industry in which it operates may differ materially from those made in or suggested by the forward-looking statements contained in this press release. In addition, even if the Company’s results of operations, financial condition and liquidity and the development of the industry in which it operates are consistent with the forward-looking statements contained in this press release, those results of developments may not be indicative of results or developments in subsequent periods.

There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. No forward-looking statement is a guarantee of future results. Accordingly, you should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this press release represents Dye & Durham’s expectations as of the date specified herein, and are subject to change after such date. However, the Company disclaims any intention or obligation or undertaking to update or revise any forward-looking information or to publicly announce the results of any revisions to any of those statements, whether as a result of new information, future events or otherwise, except as required under applicable securities laws. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

All of the forward-looking information contained in this press release is expressly qualified by the foregoing cautionary statements.

SOURCE Dye & Durham Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c0406.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c0406.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

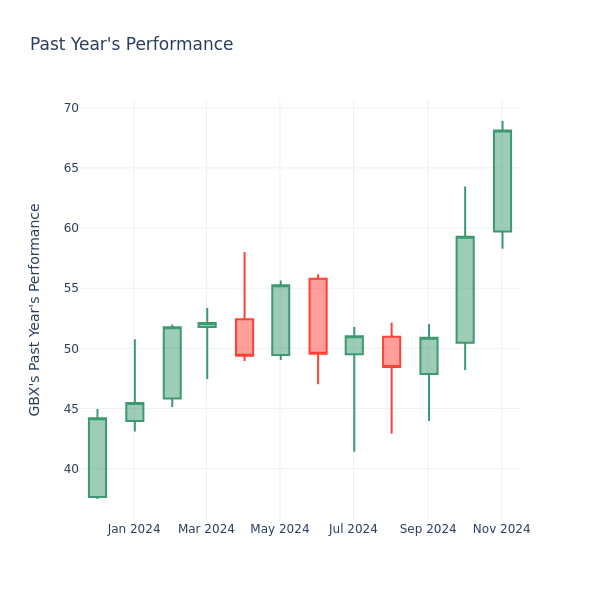

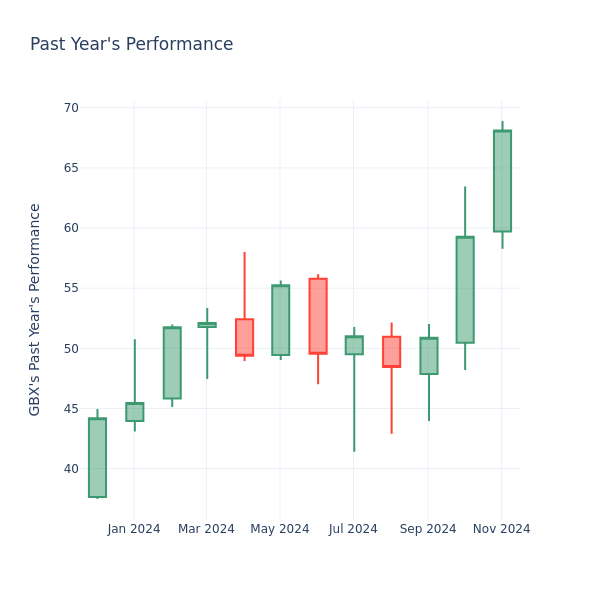

Price Over Earnings Overview: Greenbrier Companies

In the current market session, Greenbrier Companies Inc. GBX stock price is at $68.10, after a 0.09% decrease. However, over the past month, the company’s stock increased by 14.90%, and in the past year, by 74.17%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

Evaluating Greenbrier Companies P/E in Comparison to Its Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Greenbrier Companies has a lower P/E than the aggregate P/E of 15.97 of the Machinery industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

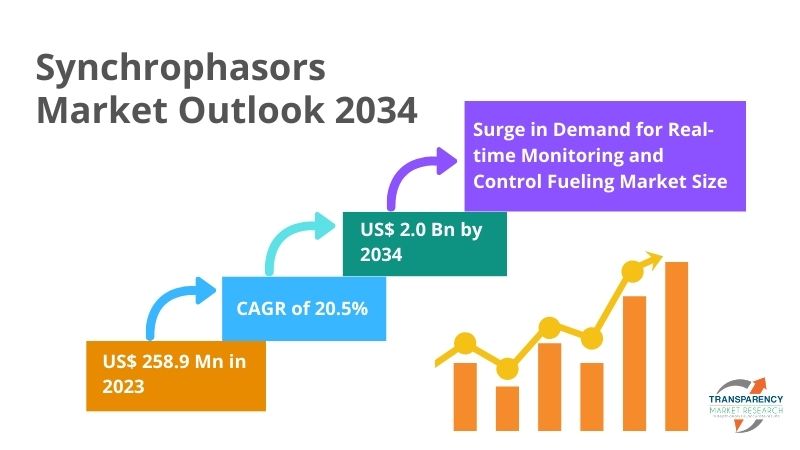

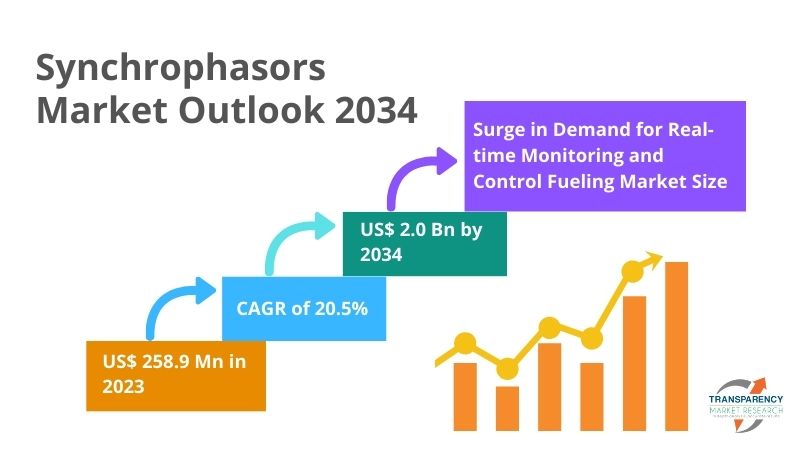

Synchrophasors Market: Driving the Future of Smarter, Resilient Energy Grids, set to Reach USD 2.0 Billion by 2034 | Transparency Market Research

Wilmington, Delaware, Transparency Market Research Inc., Nov. 28, 2024 (GLOBE NEWSWIRE) — The global synchrophasors market (世界のシンクロファーザー市場), valued at US$ 258.9 Mn in 2023, is poised for unprecedented growth. With an anticipated CAGR of 20.5% from 2024 to 2034, the market is expected to surpass US$ 2.0 Bn by the end of 2034.

This remarkable expansion underscores the pivotal role synchrophasors play in modernizing power grids, enhancing grid stability, and integrating renewable energy sources.

Request a Report Sample for More Insights – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2651

Key Drivers Shaping the Synchrophasors Market

The rising demand for reliable and efficient power systems is at the core of the synchrophasors market’s growth. As global energy needs continue to rise, driven by urbanization and industrialization, synchrophasors are becoming integral to the digital transformation of power grids.

- Grid Modernization Initiatives: Governments and utilities worldwide are prioritizing grid upgrades to ensure resilience and minimize blackouts. Synchrophasors, with their ability to monitor grid stability in real-time, are crucial to these initiatives.

- Integration of Renewable Energy: The push for clean energy sources such as wind and solar necessitates advanced tools like synchrophasors to manage the variability and intermittency of renewables.

- Focus on Wide Area Monitoring Systems (WAMS): Synchrophasors enable wide-area situational awareness, allowing utilities to detect, predict, and respond to grid anomalies effectively.

Key Players:

Prominent players in the market include:

- ABB

- Siemens Energy

- General Electric

- Toshiba Corporation

- Schneider Electric

- Schweitzer Engineering Laboratories (SEL)

- Hitachi Energy

- Vizimax

- Wasion Group Holdings Ltd.

Market Segmentation

By Component:

The synchrophasors market is categorized into hardware, software, and services, with hardware dominating due to the increasing deployment of PMUs and real-time dynamic monitoring systems (RTDMS).

- Hardware:

- Real-time Dynamic Monitoring System (RTDMS)

- Phasor Measurement Unit (PMU)

- Phasor Data Concentrators (PDCs)

- Communication Equipment

- Others (Data Units, Clocks, etc.)

- Software: Applications that analyze synchrophasor data to optimize grid operations are gaining traction.

- Services: Maintenance, integration, and consultancy services are emerging as critical segments, supporting hardware and software deployments.

By Application:

The diverse applications of synchrophasors include:

- Fault location and protective relaying

- Stability monitoring

- Power system control

- Wide-area situational awareness

- Islanding detection

- Load characterization

By End-use:

Key end-users include:

- Power transmission systems

- Power distribution systems

- Distributed energy systems

- Power generation facilities

Get a Custom Research Report at https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2651

Regional Insights

North America dominates the synchrophasors market, driven by significant investments in grid modernization and renewable energy integration. The U.S., in particular, has been a frontrunner, supported by government initiatives like the Smart Grid Investment Grant (SGIG) program.

Europe is witnessing steady growth due to the region’s focus on clean energy and stringent regulations for grid reliability. Germany and the U.K. are key contributors to this market.

Asia Pacific is anticipated to emerge as a lucrative market, with countries such as China and India investing heavily in grid infrastructure to meet rising energy demands.

Latin America and the Middle East & Africa are gradually adopting synchrophasors, spurred by the need to enhance grid resilience in remote and underserved areas.

Competitive Landscape

The synchrophasors market is fragmented, with numerous players competing to deliver innovative and efficient solutions. Companies are focusing on:

- Expanding product portfolios

- Strategic collaborations and partnerships

- Research and development (R&D) to launch advanced synchrophasor technologies

Recent Developments:

- ABB introduced a new range of PMUs with enhanced cybersecurity features, addressing growing concerns over grid vulnerabilities.

- Siemens Energy launched advanced synchrophasor solutions aimed at improving grid reliability in renewable energy-dominated systems.

- Schneider Electric partnered with leading utilities to deploy wide-area monitoring systems across Europe.

Trends and Opportunities in the Synchrophasors Market

- Digital Twin Technology:

The integration of synchrophasors with digital twin models is revolutionizing grid management. Utilities can simulate grid conditions, predict failures, and optimize performance using real-time data. - IoT and Big Data Analytics:

The convergence of IoT and advanced analytics with synchrophasor data is enabling smarter decision-making, offering utilities actionable insights to enhance grid stability. - Focus on Cybersecurity:

As synchrophasor systems become increasingly interconnected, addressing cybersecurity risks is critical. Players are investing in robust encryption and monitoring technologies. - Emergence of Microgrids:

The adoption of microgrids is driving demand for synchrophasors to ensure seamless integration with larger grids and maintain reliability in localized systems. - Expansion in Emerging Markets:

Developing countries are recognizing the potential of synchrophasors in improving energy access and reliability, creating significant opportunities for market players.

Aligning with Broader Industry Trends

The synchrophasors market aligns closely with trends in the broader chemicals and materials industry:

- Sustainability Focus: Emphasis on energy efficiency and reduced carbon footprints aligns with global sustainability goals.

- Shift to Decentralized Energy Systems: Decentralized systems and smart grids are reshaping energy infrastructure, boosting the adoption of synchrophasors.

- Technological Synergy: Advanced materials for synchrophasor components are being developed to enhance durability and performance.

The synchrophasors market represents a transformative opportunity in the power sector, playing a vital role in ensuring grid stability, integrating renewable energy, and supporting the transition to smart grids. With a projected value of US$ 2.0 Bn by 2034, this market is poised for robust growth, driven by technological advancements, government initiatives, and a global focus on energy resilience.

Utilities and manufacturers investing in synchrophasor technologies will not only gain a competitive edge but also contribute significantly to the evolution of sustainable and efficient energy systems.

For more insights into market trends, competitive strategies, and emerging opportunities, buy this research report from Transparency Market Research: https://www.transparencymarketresearch.com/checkout.php?rep_id=2651<ype=S

Trending Research Reports in the Research Reports in Electronics and Semiconductors

- Quartz Crystal Market (水晶市場): The continued expansion of 5G networks, IoT applications, smart devices, and automotive electronics has created opportunity for quartz crystal manufacturers to grasp some quartz crystal market share.

- Product Prototyping Market (제품 프로토 타이핑 시장): Estimated to advance at a CAGR of 11.5% from 2024 to 2034 and reach US$ 63.90 Bn by the end of 2034

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Imaflex Reports Q3 2024 Results, Provides Business Update

Delivers sustained top and bottom-line growth

Q3 2024 Highlights

- Revenues of $28.4 million, up 24.3% from $22.9 million in Q3 2023

- Gross profit up 122% to $4.6 million

- Net income up 847.1% to $1.5 million (EPS of $0.03)1

- Solid liquidity with $15.7 million available at quarter end, including a cash balance of $3.7 million ($0.07 per share) and another $12.0 million under Imaflex’s revolving line of credit

- Generated free cash flow2 of $4.2 million

MONTRÉAL, Nov. 28, 2024 /CNW/ – Imaflex Inc. (“Imaflex” or the “Corporation”) IFX reports consolidated financial results for the third quarter (Q3) ended September 30, 2024 and provides a business update. All amounts are in Canadian dollars.

“We continued to deliver solid year-over-year results in the third quarter, reflecting the strength of our dedicated team and expanding capabilities,” said Mr. Yazedjian, Imaflex’s new President and Chief Executive Officer. “As we look ahead, we are confident in our ability to build on this momentum and deliver sustainable growth.” As usual, third quarter performance was impacted by Québec’s annual construction holiday, which results in temporary plant closures across the province, including Imaflex’s Montréal and Victoriaville plants.

Consolidated Financial Highlights (unaudited)

|

Three months ended Sept 30, |

Nine months ended Sept 30, |

|||||

|

CDN $ thousands, except per share amounts |

2024 |

2023 |

% Change |

2024 |

2023 |

% Change |

|

Revenues |

28,418 |

22,858 |

24.3 % |

84,655 |

70,588 |

19.9 % |

|

Gross Profit |

4,617 |

2,080 |

122.0 % |

14,935 |

8,601 |

73.6 % |

|

Selling & admin. expenses |

2,607 |

2,070 |

25.9 % |

7,029 |

6,367 |

10.4 % |

|

Other (gains) losses |

340 |

(360) |

(194.4) % |

(457) |

31 |

(1,574.2) % |

|

Net income |

1,468 |

155 |

847.1 % |

6,750 |

1,516 |

345.3 % |

|

Basic EPS |

0.03 |

0.00 |

n/a |

0.13 |

0.03 |

333.3 % |

|

Diluted EPS |

0.03 |

0.00 |

n/a |

0.13 |

0.03 |

333.3 % |

|

Gross margin |

16.2 % |

9.1 % |

7.1 pp |

17.6 % |

12.2 % |

5.4 pp |

|

Selling & admin. expenses as % of revenues |

9.2 % |

9.1 % |

0.1 pp |

8.3 % |

9.0 % |

(0.7) pp |

|

EBITDA2 (Excluding FX) |

3,339 |

1,126 |

196.5 % |

11,806 |

5,497 |

114.8 % |

|

EBITDA |

2,995 |

1,463 |

104.7 % |

12,247 |

5,358 |

128.6 % |

|

EBITDA margin |

10.5 % |

6.4 % |

4.1 pp |

14.5 % |

7.6 % |

6.9 pp |

|

________________________________ |

|

|

1 |

Earning per share (EPS) based on basic and diluted weighted shares outstanding |

|

2 |

See header titled “Caution Regarding non-IFRS Financial Measures” which follows. |

Financial Review: Quarter Ended September 30

Revenues

Revenues were $28.4 million for the third quarter of 2024, up 24.3% from $22.9 million in 2023. Growth was driven by heightened volumes, stronger sales of higher margin offerings and favourable movements in foreign exchange.

For the first nine months of 2024, revenues increased 19.9% to $84.7 million, driven by the same factors outlined for the quarter.

Gross Profit

Gross profit came in at $4.6 million (16.2% of sales) for the current quarter, up significantly from $2.1 million (9.1% of sales) in 2023. For 2024 year-to-date, the gross profit was $14.9 million (17.6% of sales), versus $8.6 million (12.2% of sales) in 2023.

Despite a competitive pricing environment, the Corporation’s performance in 2024 has been bolstered by higher sales volumes, product mix, operational efficiencies, and ongoing cost controls.

Operating Expenses

Selling and Administrative expenses were $2.6 million (9.2% of sales) in the current quarter, versus $2.1 million (9.1% of sales) in 2023. The year-over-year increase was largely due to increased administrative expenses, including higher provisions for the Corporation’s profit participation plan resulting from the heightened profitability. For 2024 year-to-date, expenses totalled $7.0 million (8.3% of sales), compared to $6.4 million (9.0% of sales) in 2023. The selling expense ratio for both the current quarter and year-to-date benefited from the higher sales base in 2024.

Imaflex recorded other losses of $0.3 million for the current quarter, versus gains of $0.4 million in the same period last year, resulting in a $0.7 million unfavourable year-over-year variance. For 2024 year-to-date, the Company recorded gains of $0.5 million versus losses of $31 thousand in 2023, yielding a $0.5 million favourable variance. Other gains and losses were primarily driven by foreign exchange movements.

A majority of the Corporation’s foreign exchange gains and losses are non-cash impacting and largely relate to intercompany balances for which Imaflex can control the time of settlement.

Net Income and EBITDA

Net income grew to $1.5 million in the current quarter, increasing $1.3 million or 847.1%, over 2023. For the year-to-date, net income grew to $6.8 million, up 345.3% from $1.5 million in 2023. The heightened profitability in 2024 was driven by the higher gross profit.

EBITDA was $3.0 million (10.5% of sales) for the current quarter, up 104.7% from $1.5 million (6.4% of sales) in 2023. On a constant currency basis, EBITDA came in at $3.3 million (11.7% of sales), up 196.5% over the

$1.1 million (4.9% of sales) achieved in the third quarter of 2023.

For 2024 year-to-date, EBITDA stood at $12.2 million (14.5% of sales), up 128.6% from $5.4 million (7.6% of sales) in the corresponding prior-year period. Excluding the impact of foreign exchange, EBITDA grew 114.8% over 2023, coming in at $11.8 million (13.9% of sales), compared to $5.5 million (7.8% of sales) in 2023.

Liquidity and Capital Resources

Net cash flows generated by operating activities, including movements in working capital and taxes, stood at $5.0 million for the current quarter, up from cash inflows of $0.7 million in the same period of 2023. The $4.3 million improvement was driven by the higher profit in 2024, along with movements in trade & other payables, foreign exchange, and income taxes, partially offset by movements in trade & other receivables and inventories.

For the first nine months of 2024, cash flows generated by operating activities, including movements in working capital and income taxes, stood at $9.1 million, up from $2.3 million in the prior year. The $6.8 million increase was primarily driven by the higher profit in 2024, along with movements in income taxes.

As at September 30, 2024 Imaflex continued to maintain a strong financial position with $15.7 million in available liquidity, including $3.7 million of cash (up from $0.7 million at the end of Q2 2024) and a fully undrawn $12.0 million revolving line of credit.

Working capital stood at $21.9 million at quarter end, up from $14.0 million as of December 31, 2023. The improvement was driven by heightened cash levels, higher trade and other receivables, along with a reduction in bank indebtedness and long-term debt, partially offset by higher finance lease obligations.

Equipment Purchase Program – Update

In 2022, Imaflex announced the signing of equipment purchase agreements for three multi-layer extruders and a metallizer. The metallizer and one extruder were fully commissioned in 2023, while the remaining two extruders are now operational and being commissioned. These purchases strengthen Imaflex’s capacity to explore new market opportunities and meet future demand.

ADVASEAL® Update

Imaflex remains focused on securing U.S. Environmental Protection Agency (“EPA”) approval of ADVASEAL®. As is typical with the EPA’s review process, no decision timeline was provided, although it is taking much longer than the Corporation originally expected.

Outlook

“As I step into the President and CEO position, I have made it a priority to meet with employees across the business and engage with some key customers and shareholders,” said Mr. Yazedjian. “These conversations have provided valuable insights, and I am inspired by the strength of our team and the strategic possibilities ahead. The positive momentum we have seen for the first nine months of 2024 is a testament to our capabilities.

While we are mindful of evolving market conditions, we remain confident in our ability to leverage our strong foundation to achieve sustained growth. Moving forward, we will focus on strengthening our core business, while driving innovation and expansion in key areas.”

Caution Regarding Non-IFRS Financial Measures

The Company’s management uses non-IFRS measures in this press release, namely EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), EBITDA excluding foreign exchange and Free Cash Flow.

While EBITDA and Free Cash Flow are not standard International Financial Reporting Standards (IFRS) measures, management, analysts, investors and others use them as an indicator of the Company’s financial and operating management and performance. EBITDA should not be construed as an alternative to net income determined in accordance with IFRS as an indicator of the Company’s performance. The Company’s method of calculating EBITDA and Free Cash Flow may be different from those used by other companies and accordingly they should not be considered in isolation.

About Imaflex Inc.

Founded in 1994, Imaflex is focused on the development and manufacturing of innovative solutions for the flexible packaging space. Concurrently, the Corporation develops and manufactures films for the agriculture industry. The Corporation’s products consist primarily of polyethylene (plastic) film and bags, including metalized plastic film, for the industrial, agricultural and consumer markets. Headquartered in Montreal, Quebec, Imaflex has manufacturing facilities in Canada and the United States. The Corporation’s common stock is listed on the TSX Venture Exchange under the ticker symbol IFX. Additional information is available at www.imaflex.com.

Cautionary Statement on Forward Looking Information

Certain information included in this press release constitutes “forward-looking” statements within the meaning of Canadian securities laws. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the management of the Corporation, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies. The Corporation cautions the reader that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual financial results, performance, or achievements of Imaflex to be materially different from the Corporation’s estimated future results, performance or achievements expressed or implied by those forward-looking statements and that the forward-looking statements are not guarantees of future performance. These statements are also based on certain factors and assumptions. For more details on these estimates, risks, assumptions and factors, see the Corporation’s most recent Management Discussion and Analysis filed on SEDAR+ at www.sedarplus.ca and on the investor section of the Corporation’s website at www.imaflex.com. The Corporation disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Imaflex Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/28/c8684.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/28/c8684.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media (DJT) Shares Fall Over 11% Post-Election, Oscillates Around Key Moving Averages: Technical Indicators Point Toward Period Of Consolidation

Shares of Trump Media & Technology Group Corp DJT have fallen by 11.36% since the U.S. presidential elections. Technical analysis using simple moving averages suggests that the stock price is neither increasing nor decreasing but oscillating within a defined range.

Stock Movement

After the shares zoomed post-election it has now fallen below the pre-election level. The Donald Trump-owned company shares are down 39% in the last six months and 36% in the last month.

However, it has outperformed the Nasdaq Composite and Nasdaq 100 and has risen by 74.44% year-to-date, whereas the two indices rose by 29% and 25% respectively, in the same period.

As of Wednesday’s close, the shares were down 0.23% at $30.44 apiece, which fell further by 0.06% to $30.42 per share during the after-hours. The share price remains 161% below its 52-week high of $79.44 apiece and 35% above its 52-week low of $22.55 per share.

Technical Analysis

From a technical perspective, the analysis of daily moving averages indicates a potential period of consolidation.

According to Benzinga pro data, Wednesday’s after-hour price of $30.42 per share is just below its 200-day simple moving average of $30.45 apiece. On the other hand, the share price is just slightly above its 20-day simple moving average of $30.38 per share. The stock’s eight and 50-day averages are the same at $30.39 apiece, signaling indecisiveness.

The relative strength index at 55.56 level also indicates a neutral stance, representing neither overbought nor oversold conditions.

DJT Options Activity

Benzinga’s analysis of options history for Trump Media revealed 17 unusual trades. Out of all the trades spotted, seven were puts, with a value of $836,390, and 10 were calls, valued at $601,794.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $100.0 for Trump Media & Technology over the recent three months.

Trump holds a 57% stake in Trump Media & Technology Group. Trump Media operates a social media firm Truth Social. The company, via its social media platform, appears to be wading into the crypto payments business as it filed a trademark application with the U.S. Patent and Trademark Office for the name “TRUTHFI.”

Image via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SOURCE ROCK ROYALTIES ANNOUNCES Q3 2024 RESULTS INCLUDING ITS THIRD CONSECUTIVE QUARTER OF RECORD ROYALTY PRODUCTION

/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE U.S./

CALGARY, AB, Nov. 28, 2024 /CNW/ – Source Rock Royalties Ltd. (“Source Rock”) SRR, a pure-play oil and gas royalty company with an established portfolio of oil royalties, announces results for the three and nine month interim periods ended September 30, 2024 (“Q3 2024”).

Q3 2024 Highlights:

- Record quarterly royalty production of 257 boe/d (94% oil and NGLs), an increase of 13% over Q3 2023.

- Quarterly royalty revenue of $1,987,999, a decrease of 2% over Q3 2023.

- Quarterly adjusted EBITDA2 of $1,670,376 ($0.037 per share), a decrease of 4% (5% per share) over Q3 2023.

- Quarterly funds from operations2 of $1,477,458 ($0.032 per share), a decrease of 5% (6% per share) over Q3 2023.

- Declared $0.0195 per share in dividends, resulting in a payout ratio2 of 60%.

- Achieved an operating netback2 of $70.65 per boe and a corporate netback2 of $62.49.

- Ended Q3 2024 with cash and cash equivalents of $3,865,103 ($0.09 per share).

Nine Months Ended September 30, 2024 Highlights:

- Royalty production of 250 boe/d (95% oil and NGLs), an increase of 22% over 2023.

- Royalty revenue of $5,818,341, an increase of 18% over 2023.

- Adjusted EBITDA2 of $5,107,116 ($0.113 per share), an increase of 20% (19% per share) over 2023.

- Funds from operations2 of $4,482,413 ($0.099 per share), an increase of 12% (11% per share) over 2023.

- Declared $0.057 per share in dividends, resulting in a payout ratio2 of 58%.

- Achieved an operating netback2 of $74.26 per boe and a corporate netback2 of $65.18.

President’s Message

Source Rock’s portfolio of oil royalties continued to benefit from drilling by various operators in Q3 2024. During the quarter, 11 new horizontal oil wells began producing on our royalty lands, including 7 Clearwater heavy oil wells in Figure Lake, Alberta and 4 Frobisher light oil wells in S.E. Saskatchewan.

Our working capital is increasing as we continue to pursue additional oil-focused royalty acquisitions to compound growth for existing shareholders. Target acquisitions aim to achieve a balance of increasing our existing royalty production and expanding exposure to identifiable upside drill locations on undeveloped lands. Source Rock’s current working capital is approximately $4.5 million ($0.10 per share).

Financial and Operational Results

|

Three months ended September 30, |

Nine months ended September 30, |

|||||

|

FINANCIAL ($) |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

Royalty revenue |

1,987,999 |

2,018,865 |

-2 % |

5,818,341 |

4,926,062(1) |

18 % |

|

Adjusted EBITDA(2) |

1,670,376 |

1,746,388 |

-4 % |

5,107,116 |

4,267,818 |

20 % |

|

Per share (basic) |

0.037 |

0.039 |

-5 % |

0.113 |

0.095 |

19 % |

|

Funds from operations(2) |

1,477,458 |

1,562,143 |

-5 % |

4,482,413 |

3,990,242 |

12 % |

|

Per share (basic) |

0.032 |

0.035 |

-6 % |

0.099 |

0.089 |

11 % |

|

Total comprehensive income (loss) |

247,925 |

529,845 |

-53 % |

993,404 |

1,183,943 |

-16 % |

|

Per share (basic) |

0.005 |

0.012 |

-58 % |

0.022 |

0.026 |

-15 % |

|

Per share (diluted) |

0.005 |

0.011 |

-55 % |

0.021 |

0.026 |

-19 % |

|

Dividends declared |

888,863 |

741,895 |

20 % |

2,585,076 |

2,156,140 |

20 % |

|

Per share (basic) |

0.0195 |

0.0165 |

18 % |

0.057 |

0.048 |

19 % |

|

Payout ratio(2) (%) |

60 % |

47 % |

28 % |

58 % |

54 % |

7 % |

|

Cash and cash equivalents |

3,865,103 |

8,420,133 |

-54 % |

3,865,103 |

8,420,133 |

-54 % |

|

Per share (basic) |

0.09 |

0.19 |

-53 % |

0.09 |

0.19 |

-53 % |

|

Average shares outstanding (basic) |

45,495,207 |

44,937,406 |

1 % |

45,320,871 |

44,910,381 |

1 % |

|

Shares outstanding (end of period) |

45,582,727 |

44,996,645 |

1 % |

45,582,727 |

44,996,645 |

1 % |

|

OPERATING |

||||||

|

Average daily production (boe/d) |

257 |

228 |

13 % |

250 |

205(3) |

22 % |

|

Percentage oil & NGLs |

94 % |

94 % |

– |

95 % |

93 % |

2 % |

|

Average price realizations ($/boe) |

83.94 |

96.33 |

-13 % |

85.00 |

88.15 |

-4 % |

|

Operating netback(2) ($/boe) |

70.65 |

83.25 |

-15 % |

74.26 |

76.25 |

-3 % |

|

Corporate netback(2) ($/boe) |

62.49 |

74.47 |

-16 % |

65.18 |

71.30 |

-9 % |

|

(1) |

Source Rock also benefited from $171,875 for the nine month period ended September 30, 2023, of sales proceeds from royalty production that occurred after the effective date but prior to the closing dates of acquisitions. These sales proceeds were accounted for as a reduction to the purchase price of the acquisitions. |

|

(2) |

This is a non-GAAP financial measure or non-GAAP ratio. Refer to the disclosure under the heading “Non-GAAP Financial Measures & Ratios” for more information on each non-GAAP financial measure or ratio. |

|

(3) |

Source Rock also benefited from 7 boe/d (100% oil & NGLs) for the nine month period ended September 30, 2023, of royalty production that occurred after the effective date but prior to the closing dates of acquisitions. |

About Source Rock Royalties Ltd.

Source Rock is a pure-play oil and gas royalty company with an existing, oil focused portfolio of royalty interests concentrated in southeast Saskatchewan, central Alberta and west-central Saskatchewan. Source Rock targets a balanced growth and yield business model, using funds from operations to pursue accretive royalty acquisitions and to pay dividends. By leveraging its niche industry relationships, Source Rock identifies and acquires both existing royalty interests and newly created royalties through collaboration with industry partners. Source Rock’s strategy is premised on maintaining a low-cost corporate structure and achieving a sustainable and scalable business, measured by growing funds from operations per share and maintaining a strong netback on its royalty production.

Forward-Looking Statements

This news release includes forward-looking statements and forward-looking information within the meaning of Canadian securities laws. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “is expected”, “expects”, “scheduled”, “intends”, “contemplates”, “anticipates”, “believes”, “proposes” or variations (including negative and grammatical variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements in this news release include statements regarding Source Rock’s dividend strategy and the amount and timing of future dividends (and the sustainability thereof), the potential for future drilling on Source Rock’s royalty lands, expectations regarding commodity prices, Source Rock’s growth strategy and expectations with respect to future royalty acquisition and partnership opportunities, and the ability to complete such acquisitions and establish such partnerships. Such statements and information are based on the current expectations of Source Rock’s management and are based on assumptions and subject to risks and uncertainties. Although Source Rock’s management believes that the assumptions underlying these statements and information are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this news release may not occur by certain dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties affecting Source Rock. Although Source Rock has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements and information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement or information can be guaranteed. Except as required by applicable securities laws, forward-looking statements and information speak only as of the date on which they are made and Source Rock undertakes no obligation to publicly update or revise any forward-looking statement or information, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures & Ratios

This news release uses the terms “funds from operations” and “Adjusted EBITDA” which are non-GAAP financial measures and the terms “payout ratio”, “operating netback” and “corporate netback” which are non-GAAP ratios. These financial measures and ratios do not have a standardized prescribed meaning under GAAP and these measures and ratios may not be comparable with the calculation of similar measures disclosed by other entities.

“Adjusted EBITDA” (earnings before interest, taxes, depreciation and amortization) is used by management to analyze the Corporation’s profitability based on the Corporation’s principal business activities prior to how these activities are financed, how assets are depreciated, amortized and impaired, and how the results are taxed. Additionally, amounts are removed relating to share-based compensation expense, the sale of assets, fair value adjustments on financial assets and liabilities, other non-cash items and certain non-standard expenses, as the Corporation does not deem these to relate to the performance of its principal business. Adjusted EBITDA is not intended to represent net profit (or loss) as calculated in accordance with GAAP.

The most directly comparable GAAP financial measure to funds from operations is cash flow from operating activities. “Funds from operations” is defined as cash flow from operating activities before the change in non-cash working capital. Source Rock believes the timing of collection, payment or incurrence of these non-cash items involves a high degree of discretion and as such may not be useful for evaluating Source Rock’s operating performance. Source Rock considers funds from operations to be a key measure of operating performance as it demonstrates Source Rock’s ability to generate funds to fund operations, acquisition opportunities, dividend payments and debt repayments, if applicable. Funds from operations should not be construed as an alternative to income or cash flow from operating activities determined in accordance with GAAP as an indication of Source Rock’s performance.

“Corporate netback” is calculated as funds from operations divided by cumulative production volumes for the period. Corporate netback is used by Source Rock to better analyze the financial performance of its royalties against prior periods and to assess the cost efficiency of its overall corporate platform as it relates to production volumes. There is no standardized meaning for “corporate netback” and this metric as used by Source Rock may not be comparable with the calculation of similar metrics disclosed by other entities, and therefore should not be used to make comparisons.

“Operating netback” represents the cash margin for products sold. Operating netback is calculated as revenue minus cash administrative expenses divided by cumulative production volumes for the period. Operating netback is used by Source Rock to assess the cash generating and operating performance of its royalties against prior periods and to assess the costs efficiency of its operating platform as it relates to production volumes. There is no standardized meaning for “operating netback” and this metric as used by Source Rock may not be comparable with the calculation of similar metrics disclosed by other entities, and therefore should not be used to make comparisons.

“Payout ratio” is calculated as the aggregate of cash dividends declared in a period divided by funds from operations realized in such period. Source Rock considers payout ratio to be a key measure to assess Source Rock’s ability to fund operations, acquisition opportunities, dividend payments, cash taxes and debt repayments, if applicable.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE Source Rock Royalties Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c2880.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c2880.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is The Stock Market Open On Thanksgiving?

The New York Stock Exchange (NYSE) and the bond market will be closed on Thursday, Nov. 28 for Thanksgiving. Markets will re-open at 9:30 am ET for regular trading on Black Friday, but the stock market will close early at 1 p.m. ET and the bond market will lose at 2 p.m. ET.

What To Know: Historically, markets perform well on Black Friday, with the S&P 500 closing higher 69% of the time since 1960, according to data from Macrotrends. Investors looking to invest in the broader market can look to the SPDR S&P 500 ETF SPY which tracks the S&P 500 index.

The retail sector often outperforms the broader market around Black Friday. Investors can focus on retail sector ETFs like the SPDR S&P Retail ETF XRT or individual retailer’s stocks like Amazon.com, Inc. AMZN or Walmart, Inc. WMT to capture the momentum created by one of the busiest shopping days of the year.

Upcoming Market Holidays:

- Nov. 28, 2024 – Thanksgiving Day, markets closed.

- Nov. 29, 2024 – Black Friday, stock market closes at 1 p.m. ET, bond market closes at 2 p.m. ET.

- Dec. 24, 2024 – Christmas Eve, stock market closes at 1 p.m. ET, bond market closes at 2 p.m. ET.

- Dec. 25, 2024 – Christmas Day, markets closed.

- Dec. 31, 2024 – New Year’s Eve, stock market regular hours, bond market closes at 2 p.m. ET.

- Jan. 1, 2025 – New Year’s Day, markets closed.

Read More: Black Friday, Cyber Monday Shopping Set To Break Sales Records

Image: Reto Keller from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

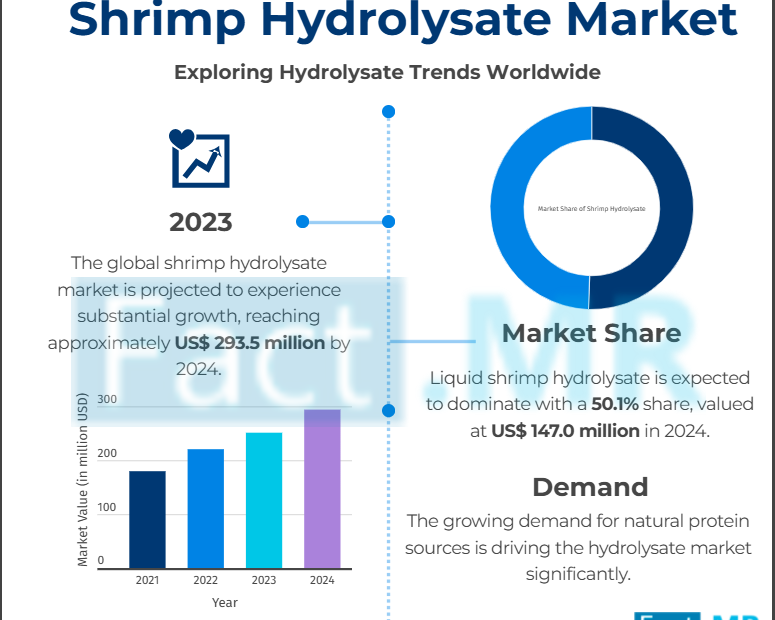

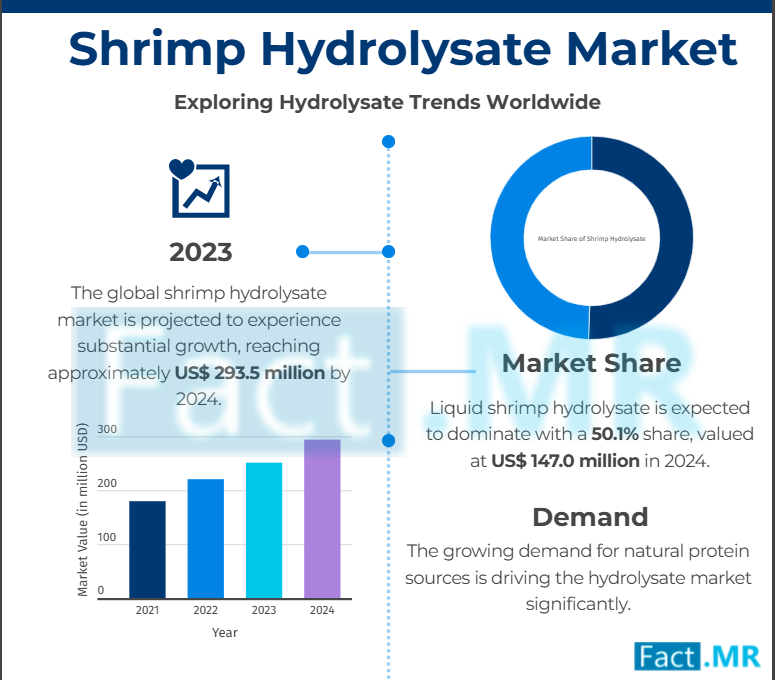

Shrimp Hydrolysate Market Set to Surge to $675.9 Million with an Impressive 8.7% CAGR by 2034

Rockville, MD, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Shrimp Hydrolysate Market is estimated to reach a valuation of US$ 293.5 million in 2024 and is expected to grow at a CAGR of 8.7% during the forecast period of 2024 to 2034.

The global market for shrimp hydrolysate is on an upward trajectory as a result of the growing need for animal feed, aquaculture commodities, and food ingredients which are all sustainable and rich in nutrients. Hydrolysate of shrimp, a protein-dense product obtained from enzymatic digestion of shrimp waste has high value of its digestibility and bioactive materials used for health and growth in different markets namely aquafeed and pet food.

The growing concern over waste minimization and recovery in the seafood sector and the rising tendency towards circular economy principles have equally contributed to market expansion. In addition, it has been looked for incorporation in functional foods and nutraceuticals due to rising health consciousness among consumers and the need for natural raw materials of superior quality. R&D activities looking to improve product formulations and create new applications are on the rise in this market, spurring growth in various industries.

Click to Request a Sample of this Report for Additional Market Insights

https://www.factmr.com/connectus/sample?flag=S&rep_id=10482

Key Takeaways from the Shrimp Hydrolysate Market Study:

- The global shrimp hydrolysate market is projected to grow at 7% CAGR and reach US$ 675.9 million by 2034 The market created an opportunity of US$ 382.4 million between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 3% in 2034. Predominating market players include Hofseth BioCare ASA., Seagarden AS & Diana Aqua Liquid form of Product Form is estimated to grow at a CAGR of 8.8% creating an absolute $ opportunity of US$ 195.0 million between 2024 and 2034

- Pacific White Shrimp of shrimp hydrolysate under Source is expected to reach around US$ 134.7 million by 2024

“An increase in disposable incomes in the developing markets enhances the adoption rates of shrimp hydrolysate consumption,” says Fact.MR analyst.

Leading Players Driving Innovation in the Shrimp Hydrolysate Market:

Leading Players Driving Innovation in the Shrimp Hydrolysate Market:

The Key Players in the Shrimp Hydrolysate industry include Sopropeche; Hofseth BioCare ASA; Seagarden AS; Nikken Foods Co., Ltd.; Diana Aqua; Copalis Sea Solutions; Nueva Pescanova Group; Pacific Bio; Ocean Pride Co., Ltd.; Aroma NZ Ltd.; Bio-Oregon; Agrinos AS; Other Prominent Players.

Shrimp Hydrolysate Industry News & Trends:

Aroma NZ Ltd.: By purchasing Nelson Ranger Fishing mussel farms in December 2023, Aroma NZ Ltd. increased its operations and greatly increased its capability for open ocean activities. Their aquaculture capabilities have grown as a result of this acquisition, which encompasses several farms and expands their operational fleet.

Nikken Foods Co., Ltd.: unveiled a brand-new, cutting-edge spray drier at their Fukuroi facility in Japan, which can produce up to 100 metric tons per month. With the use of cutting-edge production methods, this expansion is anticipated to boost their worldwide commercial growth and increase product quality, In November 2023

Seagarden AS: In order to improve the nutritional value of different aquaculture species, particularly shrimp, Seagarden AS announced in September 2023 the introduction of new marine fish powders designed for larval microencapsulated diets. Their dedication to offering premium ingredients for animal nutrition is in line with this trend.

Get a Custom Analysis for Targeted Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10482

Development by Market Players in the Shrimp Hydrolysate Market:

- Pacific Bio (Vietnam): In Oct 2023, Pacific Bio (Vietnam) announced an increase in its production of bio-based animal feed solutions, focusing on sustainable and natural ingredients. The company’s products are gaining traction in Southeast Asian markets.

- Agrinos AS: In Nov 2023, Agrinos AS expanded its biological solutions portfolio for sustainable agriculture, introducing new fish-based products aimed at improving crop yield while promoting environmental stewardship.

- Aroma NZ Ltd: In February 2024, Aroma NZ Ltd. launched a new line of high-quality marine-derived nutraceuticals, including omega-3 and collagen products, aimed at boosting health and wellness in global markets.

Fact.MR, in its new offering, presents an unbiased analysis of the global shrimp hydrolysate market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on Product Form (Powder, Liquid, Paste), Source (Pacific White Shrimp, Giant Tiger Prawn, Akiami Paste Shrimp, Others), Application (Aquaculture, Agriculture, Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Others) & End-User Industry (Aquaculture, Agriculture, Animal Feed, Food & Beverage, Cosmetics, Pharmaceutical, Others) Distribution Channel(Online Retails[E-commerce platforms, Manufacturer’s online stores, Specialized online retailers], Offline Retails[Specialty Stores, Direct Sales, Distributors/Wholesalers, Agricultural Cooperatives]) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Discover Additional Market Insights from Fact.MR Research:

Global Shrimp Meal Market is expected to be worth US$5,571.7 million by 2024, It is expected to grow at a notable compound annual growth rate (CAGR) of 7.1% to reach US$11,063.3 million by 2034. The Japanese market is expected to reach US$ 341.4 million in 2024 and grow at a compound annual growth rate (CAGR) of 8.2% until 2034.

Global Fish Meal Market is expected to grow at a compound annual growth rate (CAGR) of 7%, from a 2023 valuation of US$5.6 billion to a 2033 valuation of US$11 billion. The nutritional value of fish meal is excellent. Fish meal has balanced EAAs and high amounts of digestible protein.

Global Sales Of Marine Functional Ingredients are projected to reach US$ 7,446.53 million by 2033, up from US$ 4,080.7 million in 2023. From 2018 to 2022, the global sales of marine functional ingredients increased at a compound annual growth rate (CAGR) of 6.1%, per the Fact.MR report.

Global Soy Protein Hydrolysate Market is projected to reach US$ 1.83 billion from its 2023 valuation of US$ 1.11 billion. Protein supplements are becoming more and more popular among athletes, fitness enthusiasts, and others looking to achieve their nutritional needs as a result of increased knowledge of the value of protein in the diet.

Global Demand For Frozen Shrimp is expected to reach US$57.15 billion by 2033, from an anticipated US$25.51 billion in 2023. The fast-paced lifestyles of American consumers are mostly driving up demand for packaged and convenience meals, which is expected to enhance sales of frozen shrimp.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

Contact: US Sales Office: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Building Long-Term Wealth: Why I Chose This Vanguard Growth Fund for My Roth IRA

A Roth IRA offers unique advantages for growth investing. Since withdrawals in retirement are tax-free, housing aggressive growth investments in a Roth can maximize the benefits of long-term capital appreciation. This is why I’ve made the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) the cornerstone of my retirement strategy.

Let me explain why this fund deserves consideration as a Roth IRA anchor holding, and how it compares to Warren Buffett’s preferred S&P 500 index fund.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The Vanguard S&P 500 Growth ETF has delivered compelling returns, gaining 34.54% from Jan. 1 through Nov. 26, 2024, outpacing the broader S&P 500’s 27.66% return, including distributions and assuming reinvestment. The fund achieves this stellar performance by focusing on 234 growth-focused companies from within the S&P 500, selected based on factors like earnings expansion and momentum.

The fund’s technology-heavy portfolio reflects the digital transformation reshaping our economy. Information technology comprises nearly 50% of holdings, led by industry giants like Apple, Nvidia, and Microsoft. These companies’ sustained innovation and market leadership provide a strong foundation for continued growth.

Despite its growth tilt, the fund maintains high standards. The portfolio’s holdings have a 39.7% return on equity and 25.2% earnings growth rate. This combination of profitability and expansion potential helps justify the portfolio’s higher price-to-earnings ratio of 35 compared to the S&P 500’s 26.9 multiple.

Warren Buffett recommends a simpler approach: investing 90% of retirement savings in a low-cost S&P 500 fund like the Vanguard S&P 500 ETF (NYSEMKT: VOO). This strategy offers broader market exposure with an even lower 0.03% expense ratio.

Although the Vanguard S&P 500 ETF provides excellent diversification across 504 stocks, its blend of growth and value companies has historically produced lower returns than the growth-focused fund during strong market cycles. The trade-off comes in reduced volatility and deeper sector diversification.

Investment fees matter because they directly reduce your returns. The Vanguard S&P 500 Growth ETF charges an annual expense ratio of 0.10%, meaning you’ll pay $10 in fees per year on a $10,000 investment. In comparison, the Vanguard S&P 500 ETF charges just 0.03%, or $3 annually on the same investment.

Tribe Property Technologies Announces 74% Increase in Revenue and 93% Improvement in Adjusted EBITDA in Q3-2024

- Tribe achieved record quarterly revenue of $8.33 million in Q3-2024, an increase of 74% from the same period last year, driven by healthy organic growth and the acquisitions of DMS and Meritus Management Group (Meritus).

- Tribe is pleased to report a 93% Year-over-Year improvement in Adjusted EBITDA as a result of increasing revenues in the quarter and the execution of strategic integration and efficiency projects resulting in cost reductions.

- Management provides a strong growth outlook and is on track with its goal of achieving Adjusted EBITDA positive by the end of 2024; and generating positive cash flow from operating activities in 2025.

VANCOUVER, BC, Nov. 28, 2024 /CNW/ – Tribe Property Technologies Inc. TRBE TRPTF (“Tribe” or the “Company“), a leading provider of technology-elevated property management solutions, today announces its financial results for the third quarter ended September 30, 2024. All amounts are stated in Canadian dollars on an as reported basis under IFRS (International Financial Reporting Standards) unless otherwise indicated.

Joseph Nakhla, Chief Executive Officer of Tribe, commented, “We are thrilled with the financial performance of the quarter. The acquisition of DMS and prior to that, Meritus, in combination with our robust organic growth, has propelled Tribe’s annualized revenue run rate to over $32 million and has significantly enhanced the Company’s profitability profile. Furthermore, our cost optimization efforts have delivered material benefits, evidenced by the significant improvement in our Adjusted EBITDA. We remain on track to reach break-even Adjusted EBITDA by year-end and expect to start generating positive cash flow from operating activities in 2025. We are starting to realize the benefits of our national footprint and expanded revenue streams.”

Q3-2024 Financial Highlights:

- Revenue: Tribe achieved record revenue of $8.33 million in Q3-2024, an increase of 74% compared to $4.80 million in Q3-2023. Revenue growth was positively impacted by organic growth and the acquisitions of DMSI and Meritus Group Management Inc.

- Gross profit(2): Gross profit was $3.03 million in Q3-2024, an increase of 99% compared to $1.52 million in Q3-2023. Gross profit was favorably impacted by the increase in revenue and cost optimization efforts as a result of executing on strategic integration and efficiency projects in the quarter.

- Gross margin percentage: Tribe achieved Gross margin percentage of 38.8% in Q3-2024, in line with Gross margin percentage of 38.8% in Q3-2023. Gross margin percentage remained stable, supported by revenue growth and cost optimization initiatives.

- Adjusted EBITDA(1): Tribe had an Adjusted EBITDA loss of $0.11 million in Q3-2024, an improvement of 93% compared to an Adjusted EBITDA loss of $1.44 million in Q3-2023. Adjusted EBITDA improvement was driven by higher gross profit and enhanced operational efficiencies.

- Revenue Segmentation: Recurring revenue, which is composed of Tribe’s management service fees across condo, rental, commercial and not for profit housing, was $7.12 million in Q3-2024, an increase of 67%, compared to $4.26 million in Q3-2023. The increase in recurring revenue was due to the onboarding of new customers, as well as the DMS and Meritus acquisitions. Transactional revenue was $1.21 million as compared to $0.53 million in Q3-2023, representing an increase of 128%. This growth was primarily driven by an increase in financial services revenues through banking partnerships and software licensing fees for upcoming real estate development projects; underscoring the Company’s ongoing commitment to identifying new avenues for creating value for stakeholders.

Q3-2024 Business Highlights:

- On July 17, 2024, Tribe launched its Tribe Home app for Android devices and introduced enhancements to its iOS version, improving customer experience and making it easier than ever to manage and live in multi-family residential homes, such as condos and townhouses.

- On August 22, 2024, Tribe announced that it had rebranded and unified all of DMSI’s various service divisions under the name DMS.

- Tribe also announced it had begun the expansion of DMS’ service offerings to Tribe’s current customer base of Strata and Condo Corporations, Investor-Owners and Property Developers, leveraging expanded service offerings across Canada.

Outlook:

The Company is on track to achieve its key goals for 2024 with accelerating revenue growth, improved profitability and expanding margins. The Company is pleased to report on its key goals for 2024:

- Increase monthly recurring revenue. Organic growth fueled by landing new property management agreements, onboarding more communities onto the Tribe platform, winning new software licensing agreements and increasing digital services revenue.

- Make additional acquisitions. The company expects to continue executing on its aggressive M&A strategy. Tribe closed its transformational acquisition of DMSI in June 2024 and continues to have several additional acquisition targets in its M&A pipeline.

- Improve profitability. The Company expects to continue driving efficiencies in the business resulting in improved gross margins and enhancing Tribe’s EBITDA profile. The completion of key integration milestones for DMS has accelerated the Company’s goal of achieving profitability.

- Continue to innovate. Tribe continued to invest in its proprietary software platform this year, adding functionality to its suite of products in order to maintain its industry leadership position.

The persistent housing shortage across North America remains a key long-term driver of increased construction activity and demand for Tribe’s services. Tribe’s advanced tech-elevated property management solutions continue to be the cornerstone of its success, delivering exceptional value and efficiencies to stakeholders and strengthening the Company’s expansive national footprint.

Third Quarter 2024 Financial Webcast

The Company will hold a conference call and simultaneous webcast to discuss its results on November 28, 2024 at 1:00 pm ET (10:00 am PT). The call will be hosted by Joseph Nakhla, Chief Executive Officer, and Angelo Bartolini, Chief Financial Officer. Please dial-in 10 minutes prior to start of the call.

Webinar Details:

|

Date: |

November 28, 2024 |

|

Time: |

1:00 pm ET (10:00 am PT). |

|

Webinar Registration: |

|

|

Dial-in: |

+1 778 907 2071 (Vancouver local) |

|

+1 647 374 4685 (Toronto local) |

|

|

Meeting ID #: |

870 7609 6115 |

Please connect 5 minutes prior to the conference call to ensure time for any software download that may be required.

Footnotes

|

(1) |

Adjusted EBITDA is a non-IFRS measure that does not have a standardized meaning and may not be comparable to a similar measure disclosed by other issuers. The Company defines Adjusted EBITDA as net income or loss excluding depreciation and amortization, stock-based compensation, interest expense, income tax expense, impairment charges and other expenses. The Company believes Adjusted EBITDA is a useful measure as it provides important and relevant information to management about the operating and financial performance of the Company. Adjusted EBITDA is provided as a proxy for the cash earnings (loss) from the operations of the business as operating income (loss) for the Company includes non-cash amortization and depreciation expense and stock-based compensation. Adjusted EBITDA also enables management to assess its ability to generate operating cash flow to fund future working capital needs, and to support future growth. Excluding these items does not imply that they are non-recurring or not useful to investors. Investors should be cautioned that Adjusted EBITDA attributable to shareholders should not be construed as an alternative to net income (loss) or cash flows as determined under IFRS. |

|

(2) |

Gross Profit and Gross Profit Percentage are non-IFRS measures that do not have a standard meaning and may not be comparable to a similar measure disclosed by other issuers. The Company defines Gross Profit as revenue less cost of software and services and software licensing fees, and Gross Profit Percentage as Pross Profit calculated as a percentage of revenue. Gross Profit and Gross Profit Percentage should not be construed as an alternative for revenue or net loss in accordance with IFRS. The Company believes that gross profit and gross profit percentage are meaningful metrics in assessing the Company’s financial performance and operational efficiency. |

Non-IFRS Measures

The following and preceding discussion of financial results includes reference to Gross Profit, Gross Profit Percentage and Adjusted EBITDA, which are all non-IFRS financial measures.

|

Adjusted EBITDA1 |

Three months ended |

Nine months ended |

||

|

$000s |

2024 |

2023 |

2023 |

2023 |

|

Net loss |

$ (1,341) |

$ (2,071) |

$ (6,241) |

$ (7,199) |

|

Depreciation |

202 |

208 |

620 |

646 |

|

Amortization |

388 |

147 |

913 |

441 |

|

Stock-based compensation |

26 |

47 |

96 |

136 |

|

Interest expense |

437 |

145 |

983 |

436 |

|

Interest income |

– |

(20) |

– |

(72) |

|

Severance costs |

100 |

73 |

140 |

73 |

|

Acquisition costs |

25 |

28 |

649 |

28 |

|

Other |

58 |

4 |

193 |

1 |

|

Adjusted EBITDA 1 |

$ (105) |

$ (1,439) |

$ (2,647) |

$ (5,510) |

|

Gross Profit2 |

Three Months Ended |

Nine Months Ended |

||

|

$000s |

2024 |

2023 |

2024 |

2023 |

|

Revenue, excluding ancillary revenues |

$ 7,823 |

$ 3,921 |

$ 18,146 |

$11,759 |

|

Cost of software & services and software license fees |

4,790 |

2,398 |

10,937 |

7,240 |

|

Gross Profit2 |

$ 3,033 |

$ 1,523 |

$ 7,209 |

$ 4,519 |

|

Gross Profit2 Percentage |

38.8 % |

38.8 % |

39.7 % |

38.4 % |

Financial Statements and Management’s Discussion & Analysis