Is The Stock Market Open On Thanksgiving?

The New York Stock Exchange (NYSE) and the bond market will be closed on Thursday, Nov. 28 for Thanksgiving. Markets will re-open at 9:30 am ET for regular trading on Black Friday, but the stock market will close early at 1 p.m. ET and the bond market will lose at 2 p.m. ET.

What To Know: Historically, markets perform well on Black Friday, with the S&P 500 closing higher 69% of the time since 1960, according to data from Macrotrends. Investors looking to invest in the broader market can look to the SPDR S&P 500 ETF SPY which tracks the S&P 500 index.

The retail sector often outperforms the broader market around Black Friday. Investors can focus on retail sector ETFs like the SPDR S&P Retail ETF XRT or individual retailer’s stocks like Amazon.com, Inc. AMZN or Walmart, Inc. WMT to capture the momentum created by one of the busiest shopping days of the year.

Upcoming Market Holidays:

- Nov. 28, 2024 – Thanksgiving Day, markets closed.

- Nov. 29, 2024 – Black Friday, stock market closes at 1 p.m. ET, bond market closes at 2 p.m. ET.

- Dec. 24, 2024 – Christmas Eve, stock market closes at 1 p.m. ET, bond market closes at 2 p.m. ET.

- Dec. 25, 2024 – Christmas Day, markets closed.

- Dec. 31, 2024 – New Year’s Eve, stock market regular hours, bond market closes at 2 p.m. ET.

- Jan. 1, 2025 – New Year’s Day, markets closed.

Read More: Black Friday, Cyber Monday Shopping Set To Break Sales Records

Image: Reto Keller from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

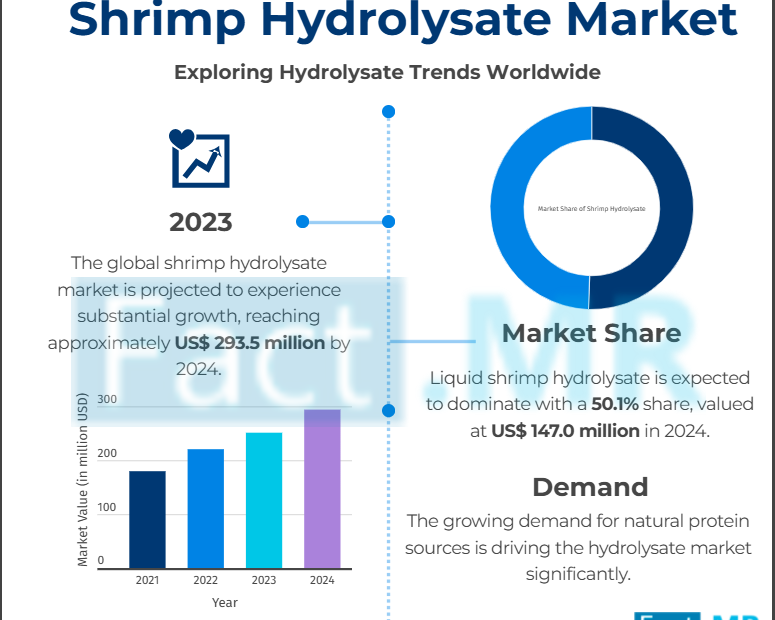

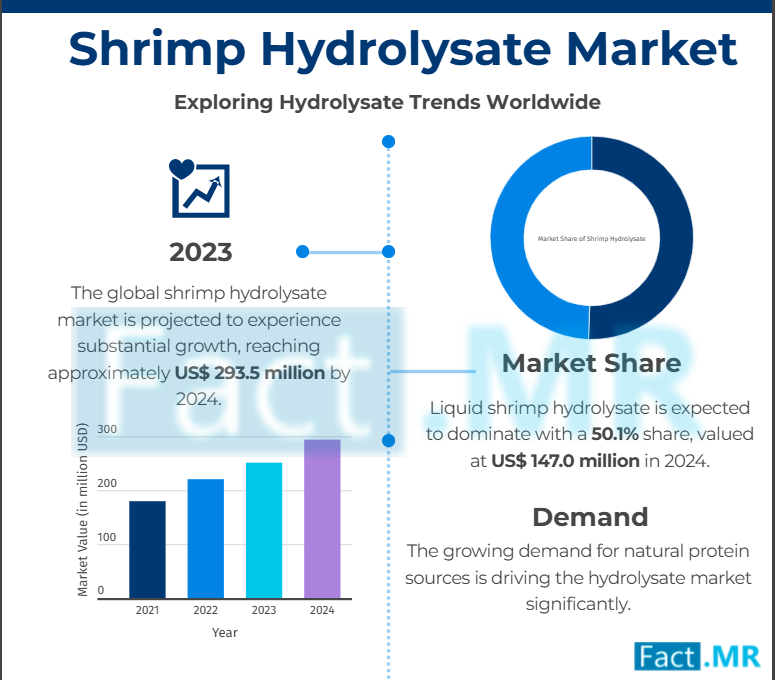

Shrimp Hydrolysate Market Set to Surge to $675.9 Million with an Impressive 8.7% CAGR by 2034

Rockville, MD, Nov. 28, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Shrimp Hydrolysate Market is estimated to reach a valuation of US$ 293.5 million in 2024 and is expected to grow at a CAGR of 8.7% during the forecast period of 2024 to 2034.

The global market for shrimp hydrolysate is on an upward trajectory as a result of the growing need for animal feed, aquaculture commodities, and food ingredients which are all sustainable and rich in nutrients. Hydrolysate of shrimp, a protein-dense product obtained from enzymatic digestion of shrimp waste has high value of its digestibility and bioactive materials used for health and growth in different markets namely aquafeed and pet food.

The growing concern over waste minimization and recovery in the seafood sector and the rising tendency towards circular economy principles have equally contributed to market expansion. In addition, it has been looked for incorporation in functional foods and nutraceuticals due to rising health consciousness among consumers and the need for natural raw materials of superior quality. R&D activities looking to improve product formulations and create new applications are on the rise in this market, spurring growth in various industries.

Click to Request a Sample of this Report for Additional Market Insights

https://www.factmr.com/connectus/sample?flag=S&rep_id=10482

Key Takeaways from the Shrimp Hydrolysate Market Study:

- The global shrimp hydrolysate market is projected to grow at 7% CAGR and reach US$ 675.9 million by 2034 The market created an opportunity of US$ 382.4 million between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 3% in 2034. Predominating market players include Hofseth BioCare ASA., Seagarden AS & Diana Aqua Liquid form of Product Form is estimated to grow at a CAGR of 8.8% creating an absolute $ opportunity of US$ 195.0 million between 2024 and 2034

- Pacific White Shrimp of shrimp hydrolysate under Source is expected to reach around US$ 134.7 million by 2024

“An increase in disposable incomes in the developing markets enhances the adoption rates of shrimp hydrolysate consumption,” says Fact.MR analyst.

Leading Players Driving Innovation in the Shrimp Hydrolysate Market:

Leading Players Driving Innovation in the Shrimp Hydrolysate Market:

The Key Players in the Shrimp Hydrolysate industry include Sopropeche; Hofseth BioCare ASA; Seagarden AS; Nikken Foods Co., Ltd.; Diana Aqua; Copalis Sea Solutions; Nueva Pescanova Group; Pacific Bio; Ocean Pride Co., Ltd.; Aroma NZ Ltd.; Bio-Oregon; Agrinos AS; Other Prominent Players.

Shrimp Hydrolysate Industry News & Trends:

Aroma NZ Ltd.: By purchasing Nelson Ranger Fishing mussel farms in December 2023, Aroma NZ Ltd. increased its operations and greatly increased its capability for open ocean activities. Their aquaculture capabilities have grown as a result of this acquisition, which encompasses several farms and expands their operational fleet.

Nikken Foods Co., Ltd.: unveiled a brand-new, cutting-edge spray drier at their Fukuroi facility in Japan, which can produce up to 100 metric tons per month. With the use of cutting-edge production methods, this expansion is anticipated to boost their worldwide commercial growth and increase product quality, In November 2023

Seagarden AS: In order to improve the nutritional value of different aquaculture species, particularly shrimp, Seagarden AS announced in September 2023 the introduction of new marine fish powders designed for larval microencapsulated diets. Their dedication to offering premium ingredients for animal nutrition is in line with this trend.

Get a Custom Analysis for Targeted Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10482

Development by Market Players in the Shrimp Hydrolysate Market:

- Pacific Bio (Vietnam): In Oct 2023, Pacific Bio (Vietnam) announced an increase in its production of bio-based animal feed solutions, focusing on sustainable and natural ingredients. The company’s products are gaining traction in Southeast Asian markets.

- Agrinos AS: In Nov 2023, Agrinos AS expanded its biological solutions portfolio for sustainable agriculture, introducing new fish-based products aimed at improving crop yield while promoting environmental stewardship.

- Aroma NZ Ltd: In February 2024, Aroma NZ Ltd. launched a new line of high-quality marine-derived nutraceuticals, including omega-3 and collagen products, aimed at boosting health and wellness in global markets.

Fact.MR, in its new offering, presents an unbiased analysis of the global shrimp hydrolysate market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on Product Form (Powder, Liquid, Paste), Source (Pacific White Shrimp, Giant Tiger Prawn, Akiami Paste Shrimp, Others), Application (Aquaculture, Agriculture, Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Others) & End-User Industry (Aquaculture, Agriculture, Animal Feed, Food & Beverage, Cosmetics, Pharmaceutical, Others) Distribution Channel(Online Retails[E-commerce platforms, Manufacturer’s online stores, Specialized online retailers], Offline Retails[Specialty Stores, Direct Sales, Distributors/Wholesalers, Agricultural Cooperatives]) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Discover Additional Market Insights from Fact.MR Research:

Global Shrimp Meal Market is expected to be worth US$5,571.7 million by 2024, It is expected to grow at a notable compound annual growth rate (CAGR) of 7.1% to reach US$11,063.3 million by 2034. The Japanese market is expected to reach US$ 341.4 million in 2024 and grow at a compound annual growth rate (CAGR) of 8.2% until 2034.

Global Fish Meal Market is expected to grow at a compound annual growth rate (CAGR) of 7%, from a 2023 valuation of US$5.6 billion to a 2033 valuation of US$11 billion. The nutritional value of fish meal is excellent. Fish meal has balanced EAAs and high amounts of digestible protein.

Global Sales Of Marine Functional Ingredients are projected to reach US$ 7,446.53 million by 2033, up from US$ 4,080.7 million in 2023. From 2018 to 2022, the global sales of marine functional ingredients increased at a compound annual growth rate (CAGR) of 6.1%, per the Fact.MR report.

Global Soy Protein Hydrolysate Market is projected to reach US$ 1.83 billion from its 2023 valuation of US$ 1.11 billion. Protein supplements are becoming more and more popular among athletes, fitness enthusiasts, and others looking to achieve their nutritional needs as a result of increased knowledge of the value of protein in the diet.

Global Demand For Frozen Shrimp is expected to reach US$57.15 billion by 2033, from an anticipated US$25.51 billion in 2023. The fast-paced lifestyles of American consumers are mostly driving up demand for packaged and convenience meals, which is expected to enhance sales of frozen shrimp.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

Contact: US Sales Office: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Building Long-Term Wealth: Why I Chose This Vanguard Growth Fund for My Roth IRA

A Roth IRA offers unique advantages for growth investing. Since withdrawals in retirement are tax-free, housing aggressive growth investments in a Roth can maximize the benefits of long-term capital appreciation. This is why I’ve made the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) the cornerstone of my retirement strategy.

Let me explain why this fund deserves consideration as a Roth IRA anchor holding, and how it compares to Warren Buffett’s preferred S&P 500 index fund.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The Vanguard S&P 500 Growth ETF has delivered compelling returns, gaining 34.54% from Jan. 1 through Nov. 26, 2024, outpacing the broader S&P 500’s 27.66% return, including distributions and assuming reinvestment. The fund achieves this stellar performance by focusing on 234 growth-focused companies from within the S&P 500, selected based on factors like earnings expansion and momentum.

The fund’s technology-heavy portfolio reflects the digital transformation reshaping our economy. Information technology comprises nearly 50% of holdings, led by industry giants like Apple, Nvidia, and Microsoft. These companies’ sustained innovation and market leadership provide a strong foundation for continued growth.

Despite its growth tilt, the fund maintains high standards. The portfolio’s holdings have a 39.7% return on equity and 25.2% earnings growth rate. This combination of profitability and expansion potential helps justify the portfolio’s higher price-to-earnings ratio of 35 compared to the S&P 500’s 26.9 multiple.

Warren Buffett recommends a simpler approach: investing 90% of retirement savings in a low-cost S&P 500 fund like the Vanguard S&P 500 ETF (NYSEMKT: VOO). This strategy offers broader market exposure with an even lower 0.03% expense ratio.

Although the Vanguard S&P 500 ETF provides excellent diversification across 504 stocks, its blend of growth and value companies has historically produced lower returns than the growth-focused fund during strong market cycles. The trade-off comes in reduced volatility and deeper sector diversification.

Investment fees matter because they directly reduce your returns. The Vanguard S&P 500 Growth ETF charges an annual expense ratio of 0.10%, meaning you’ll pay $10 in fees per year on a $10,000 investment. In comparison, the Vanguard S&P 500 ETF charges just 0.03%, or $3 annually on the same investment.

Tribe Property Technologies Announces 74% Increase in Revenue and 93% Improvement in Adjusted EBITDA in Q3-2024

- Tribe achieved record quarterly revenue of $8.33 million in Q3-2024, an increase of 74% from the same period last year, driven by healthy organic growth and the acquisitions of DMS and Meritus Management Group (Meritus).

- Tribe is pleased to report a 93% Year-over-Year improvement in Adjusted EBITDA as a result of increasing revenues in the quarter and the execution of strategic integration and efficiency projects resulting in cost reductions.

- Management provides a strong growth outlook and is on track with its goal of achieving Adjusted EBITDA positive by the end of 2024; and generating positive cash flow from operating activities in 2025.

VANCOUVER, BC, Nov. 28, 2024 /CNW/ – Tribe Property Technologies Inc. TRBE TRPTF (“Tribe” or the “Company“), a leading provider of technology-elevated property management solutions, today announces its financial results for the third quarter ended September 30, 2024. All amounts are stated in Canadian dollars on an as reported basis under IFRS (International Financial Reporting Standards) unless otherwise indicated.

Joseph Nakhla, Chief Executive Officer of Tribe, commented, “We are thrilled with the financial performance of the quarter. The acquisition of DMS and prior to that, Meritus, in combination with our robust organic growth, has propelled Tribe’s annualized revenue run rate to over $32 million and has significantly enhanced the Company’s profitability profile. Furthermore, our cost optimization efforts have delivered material benefits, evidenced by the significant improvement in our Adjusted EBITDA. We remain on track to reach break-even Adjusted EBITDA by year-end and expect to start generating positive cash flow from operating activities in 2025. We are starting to realize the benefits of our national footprint and expanded revenue streams.”

Q3-2024 Financial Highlights:

- Revenue: Tribe achieved record revenue of $8.33 million in Q3-2024, an increase of 74% compared to $4.80 million in Q3-2023. Revenue growth was positively impacted by organic growth and the acquisitions of DMSI and Meritus Group Management Inc.

- Gross profit(2): Gross profit was $3.03 million in Q3-2024, an increase of 99% compared to $1.52 million in Q3-2023. Gross profit was favorably impacted by the increase in revenue and cost optimization efforts as a result of executing on strategic integration and efficiency projects in the quarter.

- Gross margin percentage: Tribe achieved Gross margin percentage of 38.8% in Q3-2024, in line with Gross margin percentage of 38.8% in Q3-2023. Gross margin percentage remained stable, supported by revenue growth and cost optimization initiatives.

- Adjusted EBITDA(1): Tribe had an Adjusted EBITDA loss of $0.11 million in Q3-2024, an improvement of 93% compared to an Adjusted EBITDA loss of $1.44 million in Q3-2023. Adjusted EBITDA improvement was driven by higher gross profit and enhanced operational efficiencies.

- Revenue Segmentation: Recurring revenue, which is composed of Tribe’s management service fees across condo, rental, commercial and not for profit housing, was $7.12 million in Q3-2024, an increase of 67%, compared to $4.26 million in Q3-2023. The increase in recurring revenue was due to the onboarding of new customers, as well as the DMS and Meritus acquisitions. Transactional revenue was $1.21 million as compared to $0.53 million in Q3-2023, representing an increase of 128%. This growth was primarily driven by an increase in financial services revenues through banking partnerships and software licensing fees for upcoming real estate development projects; underscoring the Company’s ongoing commitment to identifying new avenues for creating value for stakeholders.

Q3-2024 Business Highlights:

- On July 17, 2024, Tribe launched its Tribe Home app for Android devices and introduced enhancements to its iOS version, improving customer experience and making it easier than ever to manage and live in multi-family residential homes, such as condos and townhouses.

- On August 22, 2024, Tribe announced that it had rebranded and unified all of DMSI’s various service divisions under the name DMS.

- Tribe also announced it had begun the expansion of DMS’ service offerings to Tribe’s current customer base of Strata and Condo Corporations, Investor-Owners and Property Developers, leveraging expanded service offerings across Canada.

Outlook:

The Company is on track to achieve its key goals for 2024 with accelerating revenue growth, improved profitability and expanding margins. The Company is pleased to report on its key goals for 2024:

- Increase monthly recurring revenue. Organic growth fueled by landing new property management agreements, onboarding more communities onto the Tribe platform, winning new software licensing agreements and increasing digital services revenue.

- Make additional acquisitions. The company expects to continue executing on its aggressive M&A strategy. Tribe closed its transformational acquisition of DMSI in June 2024 and continues to have several additional acquisition targets in its M&A pipeline.

- Improve profitability. The Company expects to continue driving efficiencies in the business resulting in improved gross margins and enhancing Tribe’s EBITDA profile. The completion of key integration milestones for DMS has accelerated the Company’s goal of achieving profitability.

- Continue to innovate. Tribe continued to invest in its proprietary software platform this year, adding functionality to its suite of products in order to maintain its industry leadership position.

The persistent housing shortage across North America remains a key long-term driver of increased construction activity and demand for Tribe’s services. Tribe’s advanced tech-elevated property management solutions continue to be the cornerstone of its success, delivering exceptional value and efficiencies to stakeholders and strengthening the Company’s expansive national footprint.

Third Quarter 2024 Financial Webcast

The Company will hold a conference call and simultaneous webcast to discuss its results on November 28, 2024 at 1:00 pm ET (10:00 am PT). The call will be hosted by Joseph Nakhla, Chief Executive Officer, and Angelo Bartolini, Chief Financial Officer. Please dial-in 10 minutes prior to start of the call.

Webinar Details:

|

Date: |

November 28, 2024 |

|

Time: |

1:00 pm ET (10:00 am PT). |

|

Webinar Registration: |

|

|

Dial-in: |

+1 778 907 2071 (Vancouver local) |

|

+1 647 374 4685 (Toronto local) |

|

|

Meeting ID #: |

870 7609 6115 |

Please connect 5 minutes prior to the conference call to ensure time for any software download that may be required.

Footnotes

|

(1) |

Adjusted EBITDA is a non-IFRS measure that does not have a standardized meaning and may not be comparable to a similar measure disclosed by other issuers. The Company defines Adjusted EBITDA as net income or loss excluding depreciation and amortization, stock-based compensation, interest expense, income tax expense, impairment charges and other expenses. The Company believes Adjusted EBITDA is a useful measure as it provides important and relevant information to management about the operating and financial performance of the Company. Adjusted EBITDA is provided as a proxy for the cash earnings (loss) from the operations of the business as operating income (loss) for the Company includes non-cash amortization and depreciation expense and stock-based compensation. Adjusted EBITDA also enables management to assess its ability to generate operating cash flow to fund future working capital needs, and to support future growth. Excluding these items does not imply that they are non-recurring or not useful to investors. Investors should be cautioned that Adjusted EBITDA attributable to shareholders should not be construed as an alternative to net income (loss) or cash flows as determined under IFRS. |

|

(2) |

Gross Profit and Gross Profit Percentage are non-IFRS measures that do not have a standard meaning and may not be comparable to a similar measure disclosed by other issuers. The Company defines Gross Profit as revenue less cost of software and services and software licensing fees, and Gross Profit Percentage as Pross Profit calculated as a percentage of revenue. Gross Profit and Gross Profit Percentage should not be construed as an alternative for revenue or net loss in accordance with IFRS. The Company believes that gross profit and gross profit percentage are meaningful metrics in assessing the Company’s financial performance and operational efficiency. |

Non-IFRS Measures

The following and preceding discussion of financial results includes reference to Gross Profit, Gross Profit Percentage and Adjusted EBITDA, which are all non-IFRS financial measures.

|

Adjusted EBITDA1 |

Three months ended |

Nine months ended |

||

|

$000s |

2024 |

2023 |

2023 |

2023 |

|

Net loss |

$ (1,341) |

$ (2,071) |

$ (6,241) |

$ (7,199) |

|

Depreciation |

202 |

208 |

620 |

646 |

|

Amortization |

388 |

147 |

913 |

441 |

|

Stock-based compensation |

26 |

47 |

96 |

136 |

|

Interest expense |

437 |

145 |

983 |

436 |

|

Interest income |

– |

(20) |

– |

(72) |

|

Severance costs |

100 |

73 |

140 |

73 |

|

Acquisition costs |

25 |

28 |

649 |

28 |

|

Other |

58 |

4 |

193 |

1 |

|

Adjusted EBITDA 1 |

$ (105) |

$ (1,439) |

$ (2,647) |

$ (5,510) |

|

Gross Profit2 |

Three Months Ended |

Nine Months Ended |

||

|

$000s |

2024 |

2023 |

2024 |

2023 |

|

Revenue, excluding ancillary revenues |

$ 7,823 |

$ 3,921 |

$ 18,146 |

$11,759 |

|

Cost of software & services and software license fees |

4,790 |

2,398 |

10,937 |

7,240 |

|

Gross Profit2 |

$ 3,033 |

$ 1,523 |

$ 7,209 |

$ 4,519 |

|

Gross Profit2 Percentage |

38.8 % |

38.8 % |

39.7 % |

38.4 % |

Financial Statements and Management’s Discussion & Analysis

Please see the consolidated financial statements and related Management’s Discussion & Analysis (“MD&A”) for more details. The unaudited consolidated financial statements for the third quarter ended September 30, 2024 and related MD&A have been reviewed and approved by Tribe’s Audit Committee and Board of Directors. Tribe recognizes that most of its investors are now accessing corporate and financial information either through pushed news services, directly from www.tribetech.com or SEDAR. Thus, Tribe has prepared this truncated news release to alert investors to its results and that a more detailed explanation and analysis is readily available in the MD&A. These reports have been filed on SEDAR at www.sedar.com and posted at www.tribetech.com.

“Joseph Nakhla”

Chief Executive Officer

1606-1166 Alberni Street

Vancouver, British Columbia V6E 3Z3

Phone: (604) 343-2601

Email: joseph.nakhla@tribetech.com

About Tribe Property Technologies

Tribe is a property technology company that is disrupting the traditional property management industry. As a rapidly growing tech-forward property management company, Tribe’s integrated service-technology delivery model serves the needs of a much wider variety of stakeholders than traditional service providers. Tribe seeks to acquire highly accretive targets in the fragmented North American property management industry and transform these businesses through streamlining and digitization of operations. Tribe’s platform decreases customer acquisition costs, increases retention, and allows for the addition of value-added products and services through the platform. Visit tribetech.com for more information.

Cautionary Statement on Forward-Looking Information

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws regarding the Company and its business. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. Forward-looking statements or information in this news release may relate to statements with respect to the aims and goals of the Company; financial projections; growth plans including future prospective consolidation in the property management sector; future acquisitions by the Company; integration of the acquisition of Meritus Group Management Inc or DMS.; beliefs of the Company with respect to property management and real estate development markets; prospective benefits of the Company’s platform; and other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon several assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, and social risks, contingencies, and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward- looking statements. The Company does not intend, and do not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules, and regulations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Tribe Property Technologies Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c6704.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/28/c6704.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Healthcare IT Market to Hit USD 834.35 Billion by 2029 with 14.7% CAGR | MarketsandMarkets™.

Delray Beach, FL, Nov. 28, 2024 (GLOBE NEWSWIRE) — The global healthcare IT market growth forecasted to transform from USD 420.23 billion in 2024 to USD 834.35 billion by 2029, driven by a CAGR of 14.7% during the forecast period. Increasing demand for interoperability among healthcare systems is the main reason for the growth of this market; as the continuously rising amount of communication and data sharing across EHRs, laboratory systems, and billing software, the need for seamless integration becomes more critical. Moreover, government initiative, such as the 21st Century Cures Act, mandating that healthcare organizations improve their data-sharing capabilities. Further, advancements in technology such as cloud computing and artificial intelligence are enhancing interoperability that is, in turn, fuelling the expansion of the Healthcare IT market. A report from the Office of the National Coordinator for Health Information Technology (ONC) found that while hospitals in the U.S. can access health information from outside their own systems, less than half are integrating that data into individual patient records. This shows there’s a big opportunity for growth in solutions that enable better interoperability.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=252

Browse in-depth TOC on “Healthcare IT Market“

320 – Tables

50 – Figures

420 – Pages

Based on Components, the Healthcare IT market is segmented into services, software, and hardware. The largest share of the healthcare IT market was held by the services segment in 2023. The growth can be attributed to the following factors: healthcare organizations rely heavily on service providers for consulting, storage, implementation, training, maintenance, and regular upgrade of technologies and solutions. Moreover, the introduction of complex software and the requirement for software integration and interoperability, which requires training and regular updates, fuelled the growth of the services segment. And the increasing demand for digital health solutions is driving patients towards distance health care services. especially after the COVID-19 pandemic, which highlighted the need for safe care and efficiency more than ever.

Based on end user, the healthcare provider segment is expected to register the fastest growth in the healthcare IT market. Significant share of this segment is attributed to the patient engagement as patients increasingly seek personalized and accessible care. This growth is fuelled by advancements in technology such as artificial intelligence (AI) and telehealth, which is transforming how patients interact with their care. This increased engagement not only improves patient satisfaction but also enhances the overall efficiency of healthcare services, making it essential for providers to invest in these technologies to stay competitive. Moreover, Medication errors are a serious issue, causing nearly 150,000 deaths each year in the U.S. and costing the industry about USD 20 billion annually. Healthcare IT systems minimizing these errors by improving medication management, ensuring accurate documentation, and enhancing communication among healthcare teams. For instance, EHR systems can alert healthcare providers about potential drug interactions or incorrect dosages, making patient care safer and more efficient.

Based on the region, the Healthcare IT market is segmented into five major regional segments, namely, North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The North American region dominated the Healthcare IT market because of the increasing adoption of health information technology (IT) solutions across healthcare settings, especially the interoperability used in between laboratories, clinics, pharmacies, and hospitals, it can easily share patient information and allows doctors and healthcare providers to quickly access and exchange electronic health records. Moreover, government initiatives led by the Office of the National Coordinator for Health Information Technology (ONC). These initiatives focus on improving health information technology (health IT) systems, enhancing interoperability, and advancing data sharing across healthcare providers. For instance, the Assessing Use of Health IT by U.S. Physicians Providing Outpatient Care initiative received USD 425,000 in its first year to fund a five-year study. The Leading-Edge Acceleration Projects (LEAP) in Health Information Technology, which has various funding announcements each year focusing on innovative solutions in health IT. And the ONC has allocated funding for the Health Information Exchange (HIE) and Immunization Information System (IIS) programs, with a maximum award of USD 10 million aimed at enhancing data-sharing capabilities.

Request Sample Pages : https://www.marketsandmarkets.com/requestsampleNew.asp?id=252

The Healthcare IT market is dominated by key players. The major players operating in this market are, Optum, Inc. (US), Cognizant (US), Koninklijke Philips N.V. (Netherlands), Oracle (US), GE Healthcare (US), Dell Inc. (US), Wipro (India), eClinicalWorks (US), SAS Institute Inc. (US), Inovalon (US), Infor. (US), Conifer Health Solutions, LLC. (US), Nuance Communications, Inc. (US), 3M (US), Merative (US), Epic Systems Corporation. (US), InterSystems Corporation (US), Veradigm (US), Salesforce, Inc. (US), CitiusTech (US), Conduent, Inc. (US), Carestream Health (US), Practice Fusion, Inc. (US), TATA consultancy services limited (India), Elsevier (Netherlands), MedeAnalytics, Inc. (US), Medecision (US), Surgical Information Systems (Georgia), Chartis. (US), and Clearwave Corporation. (Georgia).

Optum, Inc.:

Optum, Inc. (part of the UnitedHealth Group) provides HCIT solutions to healthcare payers, providers, employers, and government & life science companies. The company serves its solutions and services to more than 280 healthcare payers, 5,000 hospitals, and over 100,000 healthcare facilities in the US. The company focuses on forming strategic partnerships and driving innovation in digital health solutions to enhance patient care and reduce costs, especially in areas like value-based care and population health management. A notable example of their strategy is the recent completion of a USD 7.8 billion merger with Change Healthcare, which gives them access to data from millions of healthcare transactions and boosts their IT capabilities for the US population. And, according to an article from Becker’s Health IT, in the last two years, Optum has invested USD 31 billion into acquisitions. These strategic steps have been critical in positioning Optum for rapid growth while also enhancing the capability of the company to offer better patient care and enhance operational efficiency throughout the US healthcare system.

Cognizant:

Cognizant is an IT, consulting, and business process services company. The company provides digital services and solutions, consulting, application development, systems integration, application testing, application maintenance, infrastructure, and business processes. Cognizant operates major metropolitan areas across nearly 50 countries, and its headquarters is in a leased facility situated at Teaneck, New Jersey, US. The company applies a global delivery model, which includes delivery centers around the world, involving both in-country, regional, and global facilities. The space owned and leased for its delivery centers now stands at over 24 million square feet for Cognizant, with its largest presence here being in India at 90% of its total delivery center square footage.

The company focuses on inorganic strategies. For instance, In July 2024 Cognizant partnered with Unity water to sign a five-year deal that envisioned the upgrade of its digital infrastructure and the improvement of its operational efficiency in serving Queensland for more than 800,000 customers. Again, In December 2023, Cognizant acquired Thirdera, which is one of the ServiceNow partners, onboarded more than 940 associates, and thus created one of the biggest ServiceNow teams in the world with 2,400 specialists and 14,000 certifications. This move was to strengthen the efforts of digital transformation and to spur a USD 1 billion AI-driven automation business.

Oracle:

Oracle Corporation, one of the world’s largest technology companies, has revenue of about USD 53 billion for fiscal year 2024. It recently made a comprehensive acquisition of USD 28.4 billion in June 2022 to bolster its footprint in healthcare by acquiring Cerner Corporation. This allows Oracle to use advanced analytics and artificial intelligence in EHR. Oracle Health has extended its EHR contract with the VA until 2024 and announced new partnerships geared to improve patient care and operational efficiency through initiatives in cybersecurity and interoperability. Oracle’s Health Data Warehouse has emerged as the greatest healthcare IT solution; users have attained a strong 417% return on investment (ROI) during five years. This continues to fuel growth for the company in healthcare.

For more information, Inquire Now!

Related Reports:

North American Healthcare IT Market

Get access to the latest updates on Healthcare IT Companies and Healthcare IT Market Size

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMD and Alphabet: Billionaire Steve Cohen Loads Up on 2 Big AI Stocks

AI is booming, providing an important pillar of support for the stock market’s substantial year-to-date gains. Put into numerical terms, the tech-heavy NASDAQ composite index, which features many of the AI sector’s major names, has added nearly 30% for this year to date – on top of the 43% gains it registered last year.

The significance of AI, both as a technological force and an investment opportunity, is underscored by the attention it’s garnering from Wall Street titans – the billionaire investors who’ve made fortunes betting on the right trends.

Steve Cohen, the founder and CEO of Point72, is among them. Drawing parallels between the current AI boom and the tech revolution of the 1990s, Cohen views AI not as a speculative bubble but as a ‘really durable’ phenomenon poised to reshape industries and markets.

More importantly, Cohen is willing to put his money where his mouth is, and is reportedly preparing to set up a new billion-dollar hedge fund to focus on AI stocks. In the meantime, his main firm, Point72, is already betting heavily on AI, and has opened new positions in Advanced Micro Devices (NASDAQ:AMD) and Alphabet (NASDAQ:GOOGL), two of the industry’s leaders.

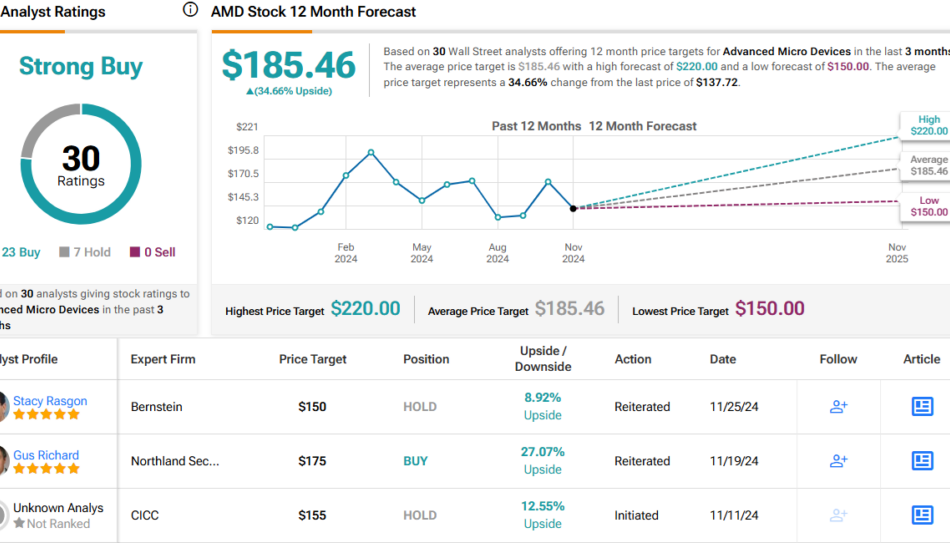

According to the data from TipRanks, both AMD and GOOGL feature Strong Buy consensus ratings and double-digit upside potential for the coming year. Let’s give them a closer look, and find out just why billionaire investor Steve Cohen is loading up on these two big AI stocks.

Advanced Micro Devices

First up is AMD, a leading innovator in the semiconductor chip industry – and a company that is angling to challenge the chip giant Nvidia for a larger slice of the AI pie. While AMD is not in the same trillion-dollar league as the market leader Nvidia – its market cap of ~$229 billion ranks it sixth among its peers – the company has built up a solid business for itself, putting a wide range of top-end PC processor and AI-capable accelerator chips on the market.

Among AMD’s leading products are several newly announced chips and chipsets, including the Ryzen 7 9800X3D desktop processor, optimized for high-end gaming uses; the Versal Premium Series Gen 2, designed to improve data movement efficiency and to unlock more memory storage in data-intensive markets; and the Instinct MI300A APU, the market’s second exascale accelerator, designed to power the fastest-ever supercomputer. Whatever the immediate application, the common denominator in all of these is AI – AMD’s newest chips have the speed and capacity to handle data-heavy workloads.

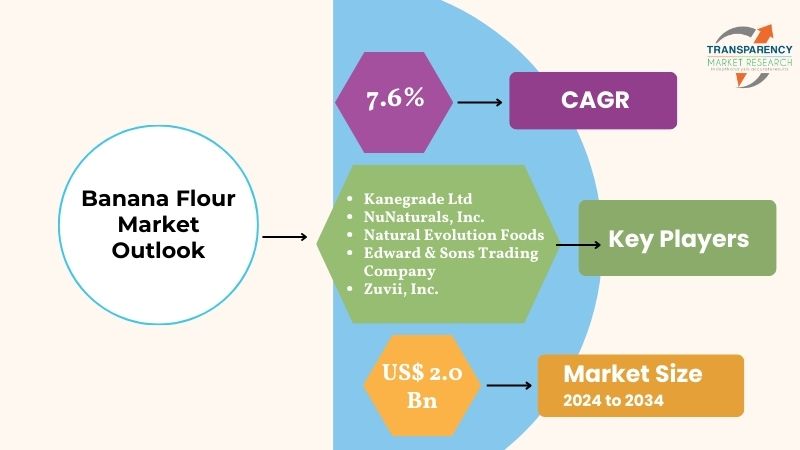

Banana Flour Market Poised for Significant Growth, Expected to Reach US$2.0 Billion by 2034 | Transparency Market Research

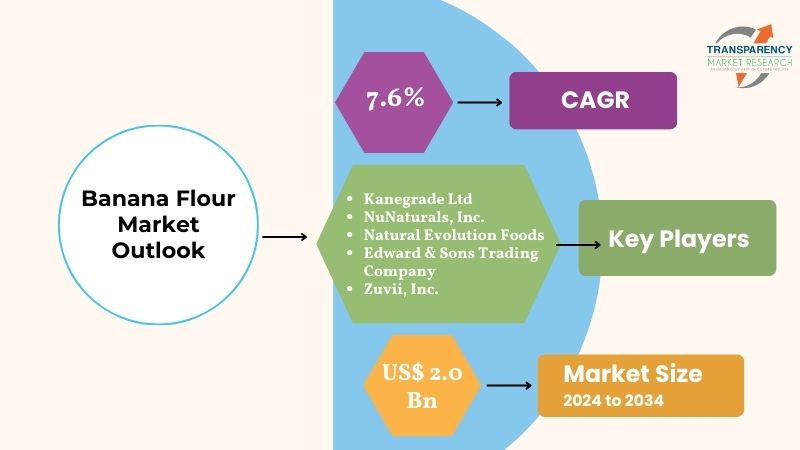

Wilmington, Delaware, Transparency Market Research Inc., Nov. 28, 2024 (GLOBE NEWSWIRE) — The global banana flour market (바나나 가루 시장), valued at US$ 0.9 billion in 2023, is set to experience substantial growth, with an expected CAGR of 7.6% from 2024 to 2034. By the end of 2034, the market is projected to reach US$ 2.0 billion, fueled by growing consumer awareness of gluten-free diets, alternative flours, and the health benefits of banana flour. As more individuals embrace health-conscious eating habits, banana flour, derived from green bananas, is becoming a staple in many households.

Market Drivers: Health-Conscious Eating and Gluten-Free Demand

The increasing popularity of gluten-free diets and the rise in health-conscious eating habits are the primary factors contributing to the growth of the banana flour market. As an alternative to traditional wheat and other gluten-containing flours, banana flour offers a rich source of dietary fiber, is resistant to starch, and aids in digestion. These attributes are fueling its adoption in both everyday cooking and commercial food production.

Request a PDF Sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=34175

The banana flour market is further benefiting from the growing interest in organic products. Banana flour is naturally gluten-free and can be consumed by those with celiac disease or gluten sensitivity. Its nutritional benefits are making it a preferred option for health-conscious individuals and are driving demand in various segments, including the food industry, bakery products, and snacks.

Key Players and Market Developments

The banana flour market is characterized by the presence of several prominent players investing heavily in innovation, research, and development. Some of the leading manufacturers in the market include:

- Natural Evolution Foods: Known for producing a wide range of gluten-free flours, including banana flour, Natural Evolution Foods continues to expand its product portfolio to meet the growing demand for healthy and sustainable alternatives.

- Edward & Sons Trading Company: This company offers banana flour as part of its extensive collection of natural and organic food products, catering to the increasing demand for gluten-free options.

- Kanegrade Ltd: A major supplier of banana flour, Kanegrade Ltd is increasing its market presence by offering high-quality, sustainable banana flour options for food manufacturers.

- NuNaturals, Inc.: As a supplier of natural sweeteners and ingredients, NuNaturals, Inc. is also capitalizing on the demand for banana flour, offering it as a versatile ingredient for both food and beverage applications.

- Zuvii, Inc.: Zuvii is one of the prominent suppliers of banana flour, known for its commitment to sustainability and innovation. The company is leveraging its focus on high-quality, organic banana flour to cater to the growing health-conscious consumer base.

In addition to these players, several other brands and producers are entering the market with a focus on clean-label, organic, and gluten-free products. The market is also witnessing an increase in private-label banana flour offerings as retailers look to cater to the growing demand for health-focused alternatives.

Regional Insights: Expanding Reach Globally

The banana flour market is not only expanding in developed regions such as North America and Europe but is also seeing growth in emerging markets, particularly in Asia Pacific, Latin America, and the Middle East. The market is driven by the increasing popularity of gluten-free foods and growing awareness of the health benefits of banana flour. The use of banana flour in countries such as India, Indonesia, and the Philippines is also gaining momentum due to the region’s agricultural output and the availability of raw bananas.

In North America and Europe, the demand for gluten-free and clean-label products continues to rise, driving the popularity of banana flour. Additionally, consumers are increasingly focused on the nutritional benefits offered by banana flour, including its high fiber content and starch-resistant properties, which help improve digestion.

Request a Custom Research Report – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=34175

Industry Trends: Emphasis on Health and Sustainability

The trend toward healthier and more sustainable food options continues to influence the banana flour market. With consumers increasingly seeking natural, minimally processed ingredients, banana flour fits perfectly into the clean-label and gluten-free trend. It provides a healthy alternative to traditional flour options, making it suitable for a variety of dietary needs, including vegan, paleo, and keto diets.

The rise of e-commerce and online grocery shopping is another trend contributing to the growth of the banana flour market. Consumers now have access to a wide range of gluten-free products, including banana flour, through online platforms. This trend is especially strong in regions like North America and Europe, where consumers are increasingly purchasing health and wellness products through e-retailers.

Market Segmentation:

-

- Organic

- Conventional (kitchen, household, etc.)

-

- Beverages

- Pet Food and Feed Industry

- Household

- Food Industry

- Bakery & Snacks

- Infant Food

- Fillings & Dressings

- Soups and Sauces

- Others

-

- Direct

- Indirect

- Modern Trade

- Convenience Store

- Specialty Store

- E-Retailers

- Other retail format

Regions Covered:

- Global

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Looking Ahead: A Promising Future for Banana Flour

The future of the banana flour market looks promising, with significant growth expected over the next decade. The increasing popularity of gluten-free diets, combined with the rising awareness of the nutritional benefits of banana flour, is driving demand. As consumers continue to embrace healthier and more sustainable eating habits, banana flour is positioned to play a key role in the global food industry.

With its high fiber content, digestive benefits, and suitability for a range of dietary needs, banana flour is expected to become a staple ingredient in many households and food products. The market’s growth will be further fueled by innovations in product development, expanding distribution channels, and a shift toward more sustainable farming practices. As demand increases, the banana flour market is set to become a significant segment within the broader gluten-free and alternative flour markets.

For more insights into market trends, competitive strategies, and emerging opportunities, buy this research report from Transparency Market Research: https://www.transparencymarketresearch.com/checkout.php?rep_id=34175<ype=S

Trending Research Reports in the Research Reports in Food and Beverages

- Mushroom Market (버섯 시장): Rise in awareness about medicinal properties of mushrooms is a primary contributor to the mushroom market growth.

- Dehydrated Vegetables Market (脱水野菜市場): Estimated to grow at a CAGR of 5.0% from 2023 to 2031 and reach US$ 107.8 Bn by the end of 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AT&T price target raised to $26 from $24 at Citi

Citi raised the firm’s price target on AT&T to $26 from $24 and keeps a Buy rating on the shares ahead of the investor day on December 3. The firm expects an update on AT&T’s multi-year strategy, financial prospects, and capital allocation priorities, and continues to view the event as a potentially positive catalyst for the shares. AT&T is likely to focus on its expanding advantage to offer converged facilities-based mobile and fiber services, including possible acceleration of annual new passings with fiber, the analyst tells investors in a research note.

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

See Insiders’ Hot Stocks on TipRanks >>

Read More on T:

ASML LEGAL UPDATE: A Lawsuit has been Filed Against ASML Holding N.V. for Securities Fraud – Contact BFA Law before Court Deadline (NASDAQ:ASML)

NEW YORK, Nov. 28, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against ASML Holding N.V. ASML and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in ASML, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/asml-holding-nv.

Investors have until January 13, 2025, to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in ASML securities. The case is pending in the U.S. District Court for the Southern District of New York and is captioned City of Hollywood Firefighters’ Pension Fund v. ASML Holding N.V., et al., No. 24-cv-8664.

What is the Lawsuit About?

ASML is a leading supplier to the semiconductor industry, providing photolithography machines to chipmakers that are used in the semiconductor fabrication process.

The complaint alleges that ASML repeatedly represented to shareholders that new export controls on semiconductor technology announced by the Dutch government would not have a material effect on ASML’s financial outlook, and that ASML was on a path to recovery in its sales.

On October 15, 2024, ASML announced earnings significantly lower than expectations. The Company attributed this to a market that was “taking longer to recover” and admitted that “[i]t now appears the recovery is more gradual than previously expected.” On this news, the price of the Company’s stock fell 16%, from a closing price of $872.27 per share on October 14, 2024, to $730.43 per share on October 15, 2024.

Then, during the accompanying earnings call with investors on October 16, 2024, the Company attributed the poor earnings results to “a reflection of the slow recovery in the traditional [semiconductor] end markets as customers remain cautious in the current environment.” The Company also disclosed that the decline in ASML’s sales to China would also negatively impact the Company’s gross margins. On this news, the price of the Company’s stock fell 6.4%, from a closing price of $730.43 per share on October 15, 2024, to $683.52 per share on October 16, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/asml-holding-nv.

What Can You Do?

If you invested in ASML you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/asml-holding-nv

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/asml-holding-nv

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bank of America bets on long-term growth in Mexico due to 'nearshoring', despite Trump tariff threat

By Aida Pelaez-Fernandez

MEXICO CITY (Reuters) – Bank of America is bullish on its future in Mexico, according to the head of the bank’s unit in the country, and stands to benefit from the so-called “nearshoring” trend even after threats of tariffs on exports to the U.S. by President-elect Donald Trump.

WHY IT’S IMPORTANT

Trump’s threat earlier this week to slap tariffs on Mexico and Canada has roiled markets and clouded the horizon for investments by multinational firms into the region.

The three countries are part of a regional trade agreement known as the USMCA, which is up for review in 2026. The neighboring nations, particularly the U.S. and Mexico, are heavily reliant on imports and exports from the other country.

KEY QUOTES

“It will be very difficult for uncertainties, either internal or external effects to alter or modify the opportunities that we see in Mexico,” said Bank of America’s Mexico head, Emilio Romano, in a press briefing.

“We believe that the nearshoring or friendshoring phenomenon will not be reversed,” he said, referring to the trend in which large multinationals have moved operations to Latin America’s No. 2 economy.

“Mexico will not deviate from this North American economic integration, there is no turning back.”

BY THE NUMBERS

Bank of America expects to double its revenue and client volume in Mexico within the next five years, Romano said.

The firm’s client base should grow from 400 to 800, according to the executive. In Mexico, BofA offers institutional banking services and does not serve individual clients.

Romano declined to provide more detail about the bank’s revenue outlook.

WHAT’S NEXT

Trump’s tariff threats will continue to generate market volatility, Romano said. However, he cautioned that they were likely a bargaining strategy by Trump to kick off trade negotiates and unlikely to actually be imposed.

(Reporting by Aida Pelaez-Fernandez; Editing by Anthony Esposito, Kylie Madry and Michael Perry)