Trump's media stock falls before insider trading restrictions lift

By Noel Randewich

(Reuters) – Shares of Donald Trump’s media company fell for a second session on Tuesday ahead of the end of restrictions on share sales by the former U.S. president and other insiders.

Trump Media & Technology Group, which is 57% owned by the Republican presidential candidate, fell 3.6%, bringing its loss this week to 7%.

Trump Media’s stock jumped 12% on Friday after Trump told reporters he does not plan to sell his now $1.9 billion stake in the company, reversing weeks of steady losses partly due to worries about the end of insider trading restrictions related to its stock market debut in March.

Newly listed companies often see pressure on their stocks ahead of the end of so-called lock-up restrictions due to expectations that insiders may sell their shares and flood the market.

Trump Media, which operates the Truth Social app, saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by retail traders and Trump supporters who see it as a speculative bet on his chances of securing a second four-year term as president.

Other Trump Media insiders who will be allowed to begin selling shares when the lock-up ends include United Atlantic Ventures and Patrick Orlando, whose fund, ARC Global Investments II, sponsored the blank-check company that merged with Trump Media. They own a combined 11% of Trump Media, according to a company filing.

Trump Media’s market capitalization on Tuesday stood at $3.3 billion, with shares at $16.68, down about 75% from their March closing peak of over $66. The slide has accelerated in recent weeks after President Joe Biden gave up his reelection bid and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election.

The company’s revenue is equivalent to two Starbucks coffee shops and it is burning cash.

If Trump Media’s stock price remains at or above $12 through Thursday, then Trump and other insiders will be free to sell shares beginning on Friday. Otherwise, they are eligible to sell shares beginning on Sept. 26.

(Reporting by Noel Randewich; Editing by David Gregorio)

New Soil Survey Expands Copper and Gold Prospects in Chile

Source: Streetwise Reports 09/13/2024

Fitzroy Minerals Inc. FTZFF announced a major expansion of copper-in-soil anomalies at its Polimet Gold-Copper-Silver Project in Chile. The new soil geochemistry results highlight two continuous mineralized trends of 2.0 km and 1.9 km in length, alongside five additional anomalies ranging from 400 m to 1,000 m. These anomalies total 6.9 km and show significant expansion potential, particularly in a 450 m-wide zone at the southern end of one grid where no previous surface mineralization was indicated. This expansion follows the company’s earlier soil survey results reported on May 14, 2024.

Merlin Marr-Johnson, President and CEO of Fitzroy Minerals, spoke about these findings in the company news release, stating that they “highlight the mineral potential of Polimet” underscoring the project’s status as a high-priority drilling target.

Fitzroy’s soil sampling campaign included 800 samples, with 24% showing copper concentrations over 150 ppm, and 11% exceeding 200 ppm. The highest copper (Cu) concentration was measured at 993 ppm (0.1% Cu). The survey also correlated well with field and aerial observations, showing promising trends in both soil color and ASTER imagery data.

Digging Into Copper, Silver, and Gold Mining

Stockhead reported on September 13 that gold reached an all-time high of US$2,568/oz, driven by U.S. economic data and the anticipation of a potential interest rate cut by the Federal Reserve. ANZ commented that weak labor market data in the U.S., along with an uptick in initial jobless claims, raised the likelihood of an interest rate cut, further buoying the precious metals market. The rally in gold prices was also supported by investors buying back once-bearish bets, as money managers’ net short positions in Comex gold futures reached their highest level in four weeks by September 3.

This bullish trend in the gold sector is particularly relevant for companies such as Fitzroy Minerals, which continues to explore and develop projects like the Polimet Gold-Copper-Silver Project in Chile. Fitzroy Minerals’ CEO, Merlin Marr-Johnson, highlighted the recent soil geochemistry survey, noting that the Polimet project continues to deliver promising results. The discovery of multiple copper-in-soil anomalies, including two continuous trends measuring 2.0 km and 1.9 km, positions Polimet as a priority drilling target.

In terms of copper, Katusa Research pointed out on September 3 that its role in the global green energy transition is equally crucial. Copper is essential in electric vehicles, solar panels, and wind turbines, and the ongoing electrification of the world is set to increase its demand. Katusa emphasized that the mismatch between supply and demand is creating a “perfect storm” in the copper market, with inventories falling and prices expected to rise as industries scramble to secure this critical metal.

This growing deficit, combined with tightening market conditions, suggests a bullish future for copper prices, further supporting companies like Fitzroy Minerals, which are active in copper exploration.

Company Catalysts Section

The latest soil geochemistry results, as specified by the company, are expected to guide Fitzroy Minerals’ future exploration efforts at the Polimet project. The discovery of large-scale copper-in-soil anomalies across multiple kilometers enhances the company’s drilling strategy, with the anomalies acting as direct indicators for potential gold drilling targets within the gold-copper-silver system.

The Polimet project benefits from its proximity to the El Bronce Epithermal District, known for its significant gold and copper deposits. Fitzroy Minerals will build upon the current soil survey by conducting geophysical surveys and structural mapping to fine-tune their drilling targets.

Marr-Johnson noted, “Given these results and the significant infrastructure advantages of the area, Polimet is shaping up to be a priority drill target.” With further soil surveys and geophysical analysis planned, Fitzroy Minerals aims to capitalize on the promising indications of a robust mineral system, targeting high-grade pay shoots expected to be concentrated between 1,000 and 1,600 meters above sea level. The project’s strategic location and evolving data make it a key focus for the company’s upcoming exploration initiatives.

Expert Opinions Section

Michael Ballanger of GGM Advisory Inc., in his September 12 newsletter and covered on Streetwise Reports, provided a positive outlook on Fitzroy Minerals Inc., particularly regarding its Polimet Gold-Copper-Silver Project in Chile. He noted that Polimet is “a highly prospective copper-gold anomaly now believed to be far more extensive than originally thought.”

Ballanger expressed strong confidence in the company’s overall potential, stating that Fitzroy’s portfolio is “worth a great deal more than the current market cap of CA$21 million” implying significant undervaluation and investment potential.

In addition to his praise for the Polimet project, Ballanger highlighted that Fitzroy’s broader project portfolio, which includes two Chilean copper-gold projects and the Argentinian gold prospect Taquetren, positions the company well for future growth. He projected that with the upcoming drilling at Buen Retiro, Fitzroy’s market could move quickly into the CA$0.20 range. He also emphasized the substantial value of Buen Retiro, calling it “a company-maker” and one of the few projects in his 45-year career that has the potential to enrich shareholders in a meaningful way.

Ballanger’s analysis underscored his long-term belief in the gold and copper sectors, noting that while copper has faced headwinds due to concerns over China’s slowing economy, “gold has taken up the slack and risen to its rightful seat on the throne of all commodities.” His Buy recommendation on Fitzroy reflects his confidence in its dual focus on copper and gold, two metals he deems most promising for 2024 and beyond.

Ownership and Share Structure

According to Refinitiv, 6.67% of Fitzroy Minerals is owned by management and insiders. Of those, Executive Chairman Campbell Smyth owns the most, with 5.51%

5.18% of ownership is institutions, with CloudBreak Discovery Group holding the most at 5.18%. The rest is retail.

Fitzroy Mineral’s market capitalization is 10.08 million with 80.38 free float shares. The 52-week range for FTZ.V is US$0.02 – 0.18.

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

84% of Retirees Are Getting This RMD Rule Wrong, Study Finds

Though retirees are only required to take a certain portion of their retirement savings out as distributions each year, a study from JPMorgan Chase shows that there is likely good reason to take out more. A withdrawal approach based solely on required minimum distributions (RMDs) not only fails to meet retirees’ annual income needs but can also leave money on the table at the end of their lives, the financial services firm found.

A financial advisor can help you right-size your retirement income. Find an advisor today.

Using internal data and an Employee Benefit Research Institute database, JPMorgan Chase studied 31,000 people as they approached and entered retirement between 2013 and 2018. The vast majority (84%) of the retirees who had already reached RMD age were only withdrawing the minimum. Meanwhile, 80% of retirees still had not reached RMD age were yet to take distributions from their accounts, the study found, suggesting a desire to preserve capital for later in retirement.

Retirees’ prudence surrounding withdrawals may be misguided, though.

“The RMD approach has some clear shortcomings,” JPMorgan Chase’s Katherine Roy and Kelly Hahn wrote. “It does not generate income that supports retirees’ declining spending in today’s dollars, a behavior that we see occurs with age. In fact, the RMD approach tends to generate more income later in retirement and can even leave a sizable account balance at age 100.”

What Are RMDs?

An RMD is the minimum amount the government requires most retirees withdraw from their tax-advantaged retirement accounts at a certain age. In 2020, the RMD age was raised from 70.5 to 72. The JPMorgan Chase study examined data that predated this change.

While most employer-sponsored retirement plans and individual retirement accounts (IRAs) are subject to RMDs, owners of Roth IRAs are exempt from taking minimum annual distributions.

The following retirement accounts all come with required minimum distributions:

An RMD is calculated by dividing a person’s account balance (as of Dec. 31 of the previous year) by his current life expectancy factor, a figure set by the IRS. For example, a 75-year-old has a life expectancy factor of 22.9. If a 75-year-old retiree has $250,000 in a retirement account, he would be required to withdraw at least $10,917 from his account that year.

A financial advisor can help you navigate the rules of RMDs.

RMD Approach vs. Declining Consumption Strategy

Using an RMD approach, a retiree simply sticks to the minimum required distributions each year. This strategy does have several notable advantages over a more static technique, like the 4% rule. For one, using actuarial statistics, the RMD approach factors in a person’s expectancy based on his current age; the 4% method does not. Also, by only withdrawing the minimum each year, the account owner will lessen his tax bill for the year and maintain maximum tax-deferred growth.

However, Roy and Hahn of JPMorgan Chase note that a more flexible withdrawal strategy tied to actual spending behaviors of retirees is more effective for meeting income needs and lowering the possibility of dying with a considerable account balance left over.

Assuming people spend more earlier in retirement than during their latter years, a withdrawal strategy should match this declining consumption, even if it means taking more than the required minimum distribution, Roy and Hahn wrote.

“On the consumption front, we believe the most effective way to withdraw wealth is to support actual spending behaviors, as spending tends to decline in today’s dollars with age,” they wrote. “Unlike the RMD approach, reflecting actual spending allows retirees to support higher spending early in retirement and achieve greater utility of their savings.”

In comparing the RMD approach to the declining consumption strategy, JPMorgan Chase found that a 72-year-old with $100,000 in retirement savings could spend more money each year using the declining consumption strategy approach until age 87 when the RMD strategy would support higher spending.

Meanwhile, the same retiree would still have more than $20,000 in his account by the time he turns 100 if he limited his distributions to the minimum amount. A 72-year-old using the declining consumption approach would only have a couple thousand left over by age 100.

Though RMD approach may increase a retiree’s odds of being able to leave money to loved ones, a retiree who’s more concerned with meeting his own needs would likely benefit from an option tied to his declining consumption later in life. Consider matching with a financial advisor if you need help with an RMD strategy.

Bottom Line

A whopping 84% of retirees who reached RMD age were limiting their retirement account withdrawals to the minimums that are required, a JPMorgan Chase study found. This method may leave a retiree with not enough annual income than what is needed. A withdrawal approach more closely aligned with a retiree’s spending needs will provide more retirement income and lessen the chances that retirement funds will outlast the retiree.

Tips for Retirement Saving

-

Do you have a financial plan for retirement? It’s never too late to begin planning and a financial advisor can help you do just that. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

If you’re still years or decades away from retiring, knowing where you stand on the path to retirement is still important. SmartAsset’s free 401(k) calculator can help you determine how much you can expect your savings to grow over time and how much you may have when the time comes to retire.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/katleho Seisa, ©iStock.com/Wand_Prapan, ©iStock.com/eggeeggjiew

The post 84% of Retirees Are Making This RMD Mistake appeared first on SmartAsset Blog.

Crown LNG Announces Receipt of Nasdaq Notification Regarding Nasdaq Listing Rule 5550

LONDON, Sept. 17, 2024 (GLOBE NEWSWIRE) — Crown LNG Holdings Limited (“Crown” or “Crown LNG”), a leading provider of LNG liquefaction and regasification terminal technologies for harsh weather locations, today announced that on September 3, 2024, the Company received a notification letter (the “Notification Letter”) from the Listings Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) regarding a failure to meet Nasdaq’s minimum bid price requirements. The Notification Letter advised that for the last 30 consecutive business the minimum closing bid price per share for the Company’s common stock was below the $1.00 per share requirement for continued listing under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). This press release is issued pursuant to Nasdaq Listing Rule 5810(b), which requires prompt disclosure of receipt of a deficiency notification.

The Notification Letter has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Capital Market.

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company has a compliance period of 180 calendar days, or until March 3, 2025 (the “Compliance Period”), to regain compliance with the Bid Price Rule. If at any time during the Compliance Period, the closing bid price per share of the Company’s common stock is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company a written confirmation of compliance and the matter will be closed, unless the Staff exercises its discretion to extend this 10 day period pursuant to Nasdaq Listing Rule 5810(c)(3)(H).

In the event the Company does not regain compliance by March 3, 2025, the Company may be eligible for an additional 180 calendar day period to regain compliance. To qualify, the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period, including by effecting a reverse stock split, if necessary. If the Company chooses to implement a reverse stock split, it must complete the split no later than ten business days prior to the expiration of the second compliance period.

The Company intends to monitor the closing bid price of its common stock and may, if appropriate, consider available options to regain compliance with the Bid Price Rule, which could include effecting a reverse stock split. However, there can be no assurance that the Company will be able to regain compliance with the Bid Price Rule.

About Crown LNG Holdings Limited

Crown LNG is a leading provider of offshore LNG liquefaction and regasification terminal infrastructure solutions for harsh weather locations, which represent a significant addressable market for bottom-fixed, gravity based (“GBS”) liquefaction and floating storage regasification units, as well as associated green and blue hydrogen, ammonia and power projects. Through this approach, Crown aims to provide lower carbon sources of energy securely to under-served markets across the globe. Visit www.crownlng.com/investors for more information.

Contacts For Crown LNG Investors Caldwell Bailey ICR, Inc. CrownLNGIR@icrinc.com Media Zach Gorin ICR, Inc. CrownLNGPR@icrinc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Small Caps, Bitcoin Rally As Traders Await Fed Rate Cut; Treasury Yields, US Dollar Tick Up On Strong Retail Sales: What's Driving Markets Tuesday?

Wall Street experienced a slightly positive session Tuesday, supported by investor optimism as the Federal Open Market Committee (FOMC) kicked off its two-day meeting, expected to deliver the first interest rate cut in over four years on Wednesday.

The session’s notable performers were small caps, with the Russell 2000 index surging about 1.3%, targeting its highest close since early August and outperforming larger-cap indices.

Among industries, solar, clean energy and regional banks led gains as traders eyed pockets of the markets that would benefit from lower interest rates.

On the macro front, August retail sales provided an upside surprise, growing by 0.1% month-over-month compared to the expected 0.2% decline. This stronger-than-anticipated data slightly reduced the likelihood of a more aggressive 50-basis-point rate cut, with market-implied probabilities for such a move slipping from 67% to 63%, according to the CME FedWatch Tool.

Short-dated Treasury yields rose as expectations for a substantial rate cut moderated. Meanwhile, the dollar strengthened, gaining 0.2%.

In the commodities market, gold retreated 0.7% from Monday’s record-high close. Oil prices increased by 1.3% following escalating geopolitical tensions in the Middle East.

Reports indicate a coordinated attack in Lebanon led to thousands of pagers linked to Hezbollah militants being detonated, resulting in numerous casualties within the Iran-backed organization.

Additionally, Iran’s ambassador to Lebanon is reportedly injured, though the official responsibility for the attack remains unclaimed.

Bitcoin BTC/USD jumped over 4%, buoyed by positive ETF inflows, signaling renewed investor interest in the digital asset space as interest rates shift.

| Major Indices | Price | 1-day %chg |

| Russell 2000 | 2,220.44 | 1.3% |

| S&P 500 | 5,642.79 | 0.2% |

| Nasdaq 100 | 19,441.83 | 0.1% |

| Dow Jones | 41,636.05 | 0.0% |

According to Benzinga Pro platform:

- The SPDR S&P 500 ETF Trust SPY was 0.1% higher to $563.44.

- The SPDR Dow Jones Industrial Average DIA inched 0.1% up to $417.61.

- The tech-heavy Invesco QQQ Trust Series QQQ also rose 0.1% to $473.60.

- The iShares Russell 2000 ETF IWM rose 1.2% to $220.28.

- The Energy Select Sector SPDR Fund XLE outperformed, up 1.2%. The Health Care Select Sector SPDR Fund XLV lagged, down 0.9%.

- Moderna Inc. MRNA surged over 6% after receiving approval from Health Canada for its updated SPIKEVAX COVID-19 vaccine, designed to target the KP.2 sub-lineage of SARS-CoV-2 in individuals aged six months and older.

- GE Vernova Inc. GEV climbed 3.5% following an upgrade from Bank of America, which raised its rating on the stock from Neutral to Buy and increased the price target from $200 to $300.

- Hewlett Packard Enterprise Co HPE advanced nearly 5% after Bank of America also upgraded its rating from Neutral to Buy and boosted the price target from $21 to $24.

Read Now:

The image was created using artificial intelligence MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Abercrombie & Fitch Co.

Analyst Profile

Kristina Ruggeri

Analyst: Generalist

Kristina began working with Argus Research in 2019. She is responsible for covering selected Consumer Discretionary and Consumer Staples Stocks and has nearly 20 years of experience in the financial services industry. Kristina began her career at Price Waterhouse where she audited asset managers, broker dealers, and banks. Later she joined J.P. Morgan as a financial analyst. In 1994, Kristina joined Bankers Trust Company where she managed the daily operations of several equity derivative funds and later implemented tools to mitigate risk and improve workflow processes. Prior to working with Argus, Kristina was a Senior Director at S&P Global where she led key competitive intelligence and market research initiatives and executed programs to better understand client needs. Kristina earned a BS in Accounting and a minor in Spanish from Bucknell University. She holds an MBA in Finance from New York University’s Stern School of Business and is a Certified Public Accountant. Kristina is also a certified teacher in the State of New Jersey and devotes time to working with elementary and middle school-aged students.

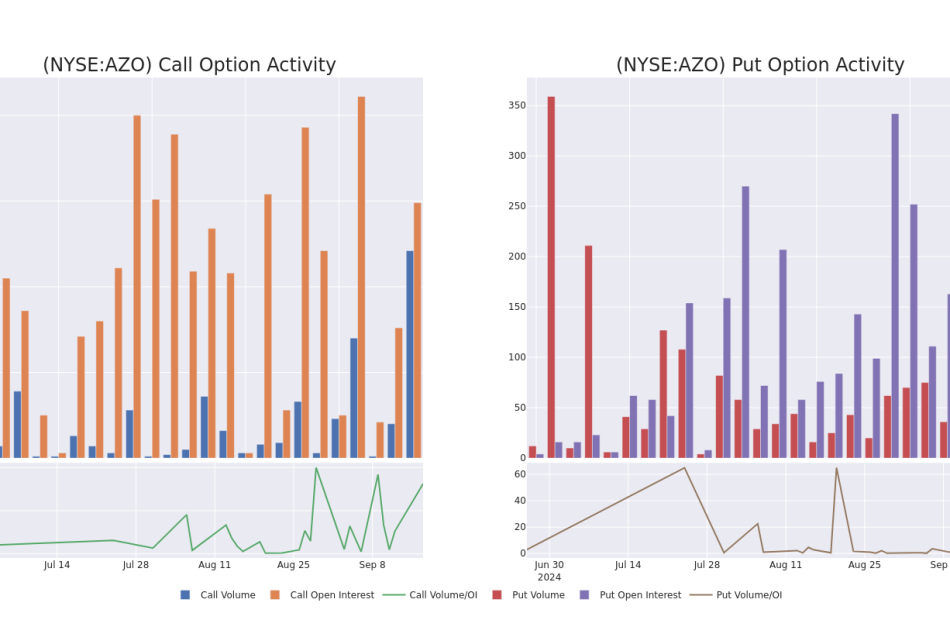

Unpacking the Latest Options Trading Trends in AutoZone

Investors with a lot of money to spend have taken a bearish stance on AutoZone AZO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AZO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for AutoZone.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 41%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $148,330, and 9 are calls, for a total amount of $868,830.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2400.0 to $3400.0 for AutoZone over the recent three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AutoZone’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AutoZone’s whale trades within a strike price range from $2400.0 to $3400.0 in the last 30 days.

AutoZone 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AZO | CALL | TRADE | BEARISH | 01/17/25 | $94.4 | $89.3 | $89.7 | $3400.00 | $179.4K | 90 | 38 |

| AZO | CALL | TRADE | BEARISH | 01/17/25 | $95.2 | $89.3 | $91.1 | $3400.00 | $163.9K | 90 | 18 |

| AZO | CALL | SWEEP | BEARISH | 01/17/25 | $95.6 | $89.6 | $89.6 | $3400.00 | $161.2K | 90 | 56 |

| AZO | CALL | TRADE | BULLISH | 12/19/25 | $312.0 | $294.0 | $312.0 | $3350.00 | $93.6K | 4 | 3 |

| AZO | CALL | TRADE | BULLISH | 03/21/25 | $786.0 | $774.8 | $786.0 | $2400.00 | $78.6K | 0 | 1 |

About AutoZone

AutoZone operates as a leading retailer of aftermarket automotive parts in the United States. The firm operates over 6,300 stores domestically, serving both the do-it-yourself and commercial (do-it-for-me) end markets. Through its vast store footprint and distribution network, AutoZone manages a wide array of stock-keeping units applicable to numerous vehicle makes and models, providing its consumers with ample product availability. The firm drives traffic by providing superior and convenient customer service as AutoZone’s team of knowledgeable staff assists consumers with diagnosing a vehicle’s problem, selecting the necessary part for replacement, and in some instances, installation. The company also operates internationally, with over 750 stores in Mexico and more than 100 in Brazil.

After a thorough review of the options trading surrounding AutoZone, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is AutoZone Standing Right Now?

- Currently trading with a volume of 60,141, the AZO’s price is down by -0.58%, now at $3083.16.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 7 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AutoZone with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk And Oracle's Larry Ellison 'Begged' Jensen Huang For Nvidia GPUs At A Dinner: 'Please Take Our Money'

Larry Ellison and Elon Musk recently implored Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang for additional GPUs during a dinner at Nobu Palo Alto.

What Happened: During a meeting with analysts last week, Ellison, co-founder and CTO of Oracle Corp. (NYSE:ORCL), revealed that he and Tesla Inc. (NASDAQ:TSLA) CEO Musk “begged” Huang for more GPUs.

Don’t Miss:

Ellison humorously recounted, “Please take our money. By the way, I got dinner. No, no, take more of it. We need you to take more of our money please.”

The dinner’s outcome was positive, according to Ellison, who said, “It went ok. I mean, it worked.” Ellison, whose fortune is estimated at $206 billion, according to Forbes, has a history of anticipating technological shifts and positioning Oracle to benefit from them.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

Oracle has maintained a strong relationship with Nvidia, which dominates the artificial intelligence chip market. The company is heavily investing in GPU technology for AI applications, with revenues up 7% to $13.3 billion in the first quarter of fiscal 2025.

Similarly, Tesla relies on Nvidia GPUs to train its neural networks for self-driving technology. Ellison emphasized the importance of being the first to build the most capable neural network, stating, “It’s a big deal.”

Trending: Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million.

Why It Matters: The global supply of high-performance memory chips is expected to remain constrained throughout 2024, driven by the soaring demand for artificial intelligence technology. Leading memory chip suppliers like SK Hynix and Micron Technology Inc. are already facing shortages, with stock for 2025 nearly depleted.

See Also: The startup behind White Castle’s favorite Robot Fry Cook announces a next-generation fast food robot – Here’s how to get a share for under $5 today.

In May, Musk acknowledged and praised Nvidia’s impressive market cap, which had reached $2.55 trillion, making it the third most-valued global corporation.

In June, Musk justified his decision to divert Nvidia chips meant for Tesla to his other ventures, X and xAI, explaining that the existing factory space was already allocated to vehicle, battery, and cell production.

The demand for Nvidia’s RTX 4090 graphics cards has also surged, leading to a supply crisis exacerbated by U.S. sanctions on advanced chips to China.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Elon Musk And Oracle’s Larry Ellison ‘Begged’ Jensen Huang For Nvidia GPUs At A Dinner: ‘Please Take Our Money’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why big banks are obsessed with 1995

Does this sound familiar?

The rate of inflation was slowing along with spending by US consumers. So, the Fed cut interest rates by a quarter in July. It did it again in December — and again in January.

That was 1995 — and those interest rate cuts sparked the beginning of one of the best multiyear periods for banks in US history. An index broadly tracking the sector would finish the year up over 40%, outperforming the S&P 500 (GSCP). And that outperformance would hold for two more years.

Can 1995 happen again for the big banks? As it stands now, it might be a moonshot scenario for 2025 as the Fed contemplates rate cuts. But that hasn’t stopped Wall Street from thinking about that glorious year — and what it would take to see such a winning streak again.

So far, the industry is off to a decent start when it comes to chasing that dream.

This year, the same banking industry index (^BKX) is up more than 14%, while a regional bank-focused index is up 8%. True, both trail some major indexes. But an even wider financial sector index, the Financial Select Sector SPDR Fund (XLF), which has roughly a little less than a quarter of exposure to the country’s biggest banks, is up 19%.

“History isn’t likely to repeat, but it may rhyme,” Mike Mayo, a Wells Fargo analyst who covers the country’s largest banks, said of the 1995 comparison. Though Mayo isn’t counting on next year being as good as that mystical year, he does see similarities.

On the three occasions (1995, 1998, and 2019) where the Fed cut interest rates and a recession didn’t follow, bank stocks on average sold off initially after the first cut, then rallied several weeks after —outperforming the S&P 500, according to analysis from Wells Fargo Securities.

But a wider review of the past six rate-cutting cycles (including three that were followed by recessions) shows the industry’s outperformance doesn’t usually last long. Only in 1995 did banks rally more than the broader stock market for longer than three months after the first rate cut.

Back then, it wasn’t just monetary policy that lined up right for banks.

Rough start

The industry started the year off in rough shape. Major institutions failed: That included the municipality of Orange County, Calif., declaring bankruptcy in December of ’94 and British merchant bank Barings, which collapsed in February of 1995. Banks with big trading desks had taken serious losses from a bond market wipeout the year before — and commercial real estate lenders were still seeing loan losses from a crisis that began in the late ’80s.

Meanwhile, real US GDP even slipped below 1% over the first half of the year. And yields on the longer-term 10-year Treasury plunged by 250 basis points.

Yet, crucially, those longer-term yields remained higher than short-term notes. That allowed banks, which borrow at short-term rates and lend at long-term rates, to profit by a wider margin from the difference.

And it wasn’t just interest rates that sparked higher bank profits in 1995.

US bank regulation was also entering a period of loosening, starting with a federal law signed by then-President Bill Clinton the year before. That law eliminated restrictions that stopped banks from opening branches across state lines, setting the stage for a period of deregulation that would eventually give rise to the country’s mega-banks like Wells Fargo (WFC) and Bank of America (BAC).

Regulating like it’s 1995 again?

Without going too far, Wells Fargo’s Mayo said, “It looks like the regulatory pendulum may be swinging back that way.”

While bank regulation has tightened since the Trump administration, big banks have more recently grown bolder in confronting regulators over disagreements. The Supreme Court also struck down the so-called Chevron doctrine, which gave regulators deference in more legally ambiguous court disputes.

Last week, regulators also unveiled new bank capital rules that signaled a backpedal from what was initially a more stringent set of increases.

What is so different this time compared to ’95 is that the current shift in monetary policy follows one of the longest periods of low interest rates in US history. Along with the rush of deposits flooding into banks during the pandemic, that unusually long, and easy, period left many lenders poorly positioned when adjusting to significant rate increases, said Allen Puwalski, chief investment officer and co-portfolio manager at Cybiont Capital.

“There’s no argument that the falling rates are good for banks. I’m just not sure that it’s for the same reasons that it was in ’95,” Puwalski added.

For next year to be anywhere near as good as it was for banks 29 years ago, the Fed will first need to pull off the so-called soft landing scenario, managing to bring down inflation without causing an economic downturn. And even if it’s not going to look as good for banks as 1995, that is exactly what happened back then.

“There are plenty of things that could go wrong,” former Federal Reserve Bank of Boston president Eric Rosengren told Yahoo Finance. “But I think it’s a high enough probability that it’s still reasonable to talk about a soft landing.”

Dream — or fever dream?

For now, 2025 looks like a mixed bag when it comes to bank earnings. Lenders that benefited from high rates are likely to see less profits, while those that lagged are expecting a boost.

Even without a US recession, a repeat of 1995 would still require loan growth and the continued revival of investment banking.

At a Barclays conference last week, some bank executives, including Bank of America CEO Brian Moynihan and PNC (PNC) CEO Bill Demchak, reiterated their expectations for better earnings in 2025.

Others didn’t.

JPMorgan Chase (JPM) COO Daniel Pinto told investors that analysts are “a bit too optimistic” about how much the bank will earn in 2025.

“Over the course of the quarter, our credit challenges have intensified,” Russell Hutchinson, CFO of Ally Financial (ALLY), said of the bank’s retail auto business the same day.

Gerard Cassidy, a RBC Capital Markets analyst, expects banks to see higher revenues next year but also more credit problems.

“We do expect to see incrementally higher loan loss provisions in the next 12 months, in our view,” Cassidy added.

This much is clear: Though betting on banks having another 1995 next year may ultimately prove risky or foolish, the industry is shifting once again. For now, the arrows seem pointed in the right direction.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

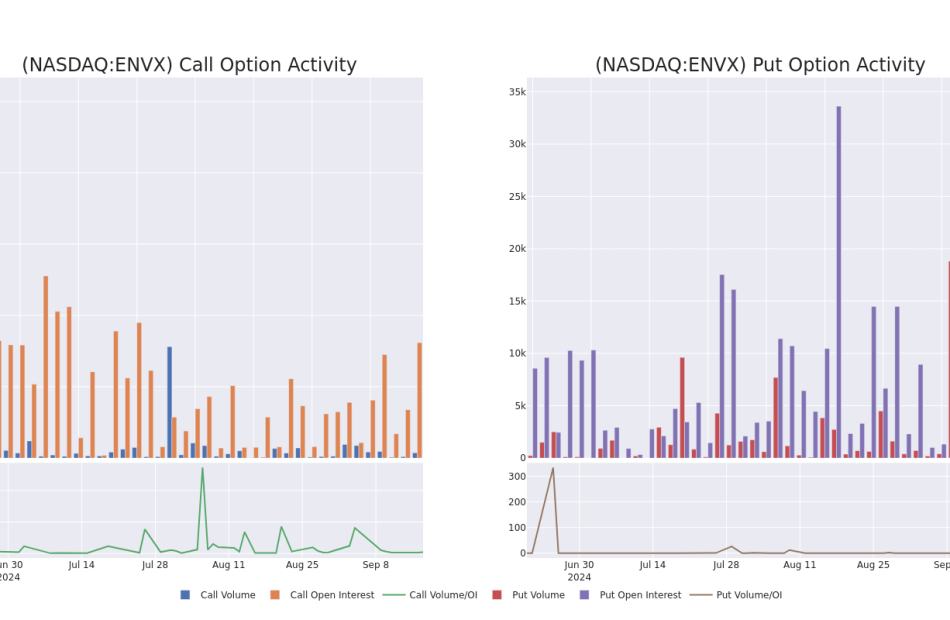

Smart Money Is Betting Big In ENVX Options

Deep-pocketed investors have adopted a bullish approach towards Enovix ENVX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ENVX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Enovix. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 37% bearish. Among these notable options, 2 are puts, totaling $59,914, and 6 are calls, amounting to $322,750.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $2.5 and $15.0 for Enovix, spanning the last three months.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Enovix’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Enovix’s substantial trades, within a strike price spectrum from $2.5 to $15.0 over the preceding 30 days.

Enovix Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | CALL | TRADE | BULLISH | 01/16/26 | $3.75 | $3.65 | $3.75 | $10.00 | $75.0K | 11.2K | 231 |

| ENVX | CALL | TRADE | BULLISH | 01/17/25 | $7.0 | $6.9 | $7.0 | $2.50 | $71.4K | 381 | 102 |

| ENVX | CALL | SWEEP | BEARISH | 01/16/26 | $3.5 | $3.25 | $3.25 | $12.00 | $65.0K | 5.6K | 200 |

| ENVX | CALL | TRADE | BULLISH | 01/16/26 | $2.7 | $2.63 | $2.7 | $15.00 | $54.0K | 13.1K | 500 |

| ENVX | PUT | TRADE | BEARISH | 10/18/24 | $1.39 | $1.36 | $1.38 | $10.00 | $34.9K | 16.8K | 230 |

About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Having examined the options trading patterns of Enovix, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Enovix Standing Right Now?

- With a volume of 3,709,975, the price of ENVX is down -3.02% at $9.47.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 49 days.

Professional Analyst Ratings for Enovix

1 market experts have recently issued ratings for this stock, with a consensus target price of $36.0.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Enovix, which currently sits at a price target of $36.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enovix, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.