ACRES Commercial Realty Corp. Declares Quarterly Cash Dividends for its Preferred Stock

UNIONDALE, N.Y., Sept. 17, 2024 /PRNewswire/ — ACRES Commercial Realty Corp. ACR (the “Company”) announced today that its Board of Directors declared cash dividends on its Preferred Stock.

The Company will pay a cash dividend on its 8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock (“Series C Preferred Stock”) in the amount of $0.6988981 per share, which reflects a rate of 11.18237%, equal to three-month Term SOFR on the dividend determination date plus a spread of 5.927% per annum. The floating rate period for dividends on the Series C Preferred Stock began on July 30, 2024. The dividend will be payable on October 30, 2024, to holders of record on October 1, 2024.

The Company will also pay a cash dividend on its 7.875% Series D Cumulative Redeemable Preferred Stock in the amount of $0.4921875 per share. The dividend will be payable on October 30, 2024, to holders of record on October 1, 2024.

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate (“CRE”) mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market CRE lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “trend,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-declares-quarterly-cash-dividends-for-its-preferred-stock-302250766.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-declares-quarterly-cash-dividends-for-its-preferred-stock-302250766.html

SOURCE ACRES Commercial Realty Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Eugene A Hall Offloads $17.21M Worth Of Gartner Stock

Eugene A Hall, Chairman and CEO at Gartner IT, executed a substantial insider sell on September 16, according to an SEC filing.

What Happened: Hall’s recent move involves selling 34,060 shares of Gartner. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $17,213,808.

Tracking the Tuesday’s morning session, Gartner shares are trading at $511.7, showing a up of 0.32%.

All You Need to Know About Gartner

Based in Stamford, Conn., Gartner provides independent research and analysis on information technology and other related technology industries. Its research is delivered to clients’ desktops in the form of reports, briefings, and updates. Typical clients are chief information officers and other business executives who help plan companies’ IT budgets. Gartner also provides consulting services. The Company operates through three business segments, namely Research, Conferences and Consulting. The company generates majority of the revenue from Research segment.

Unraveling the Financial Story of Gartner

Revenue Growth: Gartner’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 6.11%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Holistic Profitability Examination:

-

Gross Margin: The company excels with a remarkable gross margin of 67.82%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Gartner’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 2.95.

Debt Management: Gartner’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 4.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Gartner’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 48.53.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 6.65 is above industry norms, reflecting an elevated valuation for Gartner’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 29.75 reflects market recognition of Gartner’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Gartner’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Core Molding Technologies Recent Insider Activity

DAVID DUVALL, Chief Executive Officer at Core Molding Technologies CMT, reported an insider sell on September 16, according to a new SEC filing.

What Happened: DUVALL’s decision to sell 50,846 shares of Core Molding Technologies was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $911,591.

At Tuesday morning, Core Molding Technologies shares are up by 0.16%, trading at $18.4.

Get to Know Core Molding Technologies Better

Core Molding Technologies Inc operates in the engineered materials market as one operating segment as a molder of thermoplastic and thermoset structural products. It produces and sells molded products for varied markets, including medium and heavy-duty trucks, automobiles, power sports, construction and agriculture, building products, and other industrial markets. The processes include compression molding of sheet molding compound (SMC), resin transfer molding (RTM), liquid molding of dicyclopentadiene (DCPD), spray-up and hand-lay-up, direct long-fiber thermoplastics (D-LFT) and structural foam, and structural web injection molding (SIM). It operates operates in Columbus, Ohio; Gaffney, South Carolina; Winona, Minnesota; Matamoros and Escobedo, Mexico; and Cobourg, Ontario, Canada.

Core Molding Technologies’s Financial Performance

Revenue Challenges: Core Molding Technologies’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -9.19%. This indicates a decrease in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 19.97%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Core Molding Technologies’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.74.

Debt Management: Core Molding Technologies’s debt-to-equity ratio is below the industry average. With a ratio of 0.15, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 9.82 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.5, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 4.24, Core Molding Technologies presents an attractive value opportunity.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Core Molding Technologies’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Edges Lower; US Homebuilder Sentiment Rises For September

U.S. stocks traded mostly higher toward the end of trading, with the Nasdaq Composite gaining around 0.2% on Tuesday.

The Dow traded up 0.01% to 41,628.39 while the NASDAQ rose 0.19% to 17,624.93. The S&P 500 also rose, gaining, 0.03% to 5,634.76.

Check This Out: How To Earn $500 A Month From FedEx Stock Ahead Of Q1 Earnings

Leading and Lagging Sectors

Energy shares jumped by 1.3% on Tuesday.

In trading on Tuesday, health care shares fell by 1.1%.

Top Headline

The NAHB/Wells Fargo Housing Market Index climbed to 41 in September versus 39 in the prior month.

Equities Trading UP

- BurgerFi International, Inc. BFI shares shot up 88% to $0.23 after the company received interim approval for $3.5 million in financing to support 144 locations during its restructuring.

- Shares of Galmed Pharmaceuticals Ltd. GLMD got a boost, surging 422% to $20.19. Galmed Pharmaceuticals regained Nasdaq compliance.

- Compass Minerals International, Inc. CMP shares were also up, gaining 24% to $11.40 after the company announced preliminary third-quarter revenue above estimates.

Equities Trading DOWN

- Tupperware Brands Corporation TUP shares dropped 58% to $0.5099 following a report suggesting the company is planning bankruptcy.

- Shares of Netcapital Inc. NCPL were down 29% to $2.0450 following first-quarter earnings.

- Korro Bio, Inc. KRRO was down, falling 8% to $37.42. HC Wainwright & Co. analyst Mitchell Kapoor reiterated Korro Bio with a Buy rating and maintained a $100 price target. The company, on Monday, announced a collaboration with Novo Nordisk to advance the discovery and development of new genetic medicines, with the initial target to treat cardiometabolic diseases.

Commodities

In commodity news, oil traded up 1.6% to $71.21 while gold traded down 0.4% at $2,597.30.

Silver traded down 0.3% to $31.05 on Tuesday, while copper rose 0.1% to $4.2760.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 rose 0.40%, Germany’s DAX rose 0.50% and France’s CAC 40 gained 0.51%. Spain’s IBEX 35 Index rose 1.06%, while London’s FTSE 100 rose 0.38%.

The ZEW Indicator of Economic Sentiment for the Eurozone fell 8.6 points to an eleven-month low level of 9.3. The ZEW Indicator of Economic Sentiment for Germany fell to 3.6 in September from 19.2 in August.

Asia Pacific Markets

Asian markets closed mostly higher on Tuesday, with Japan’s Nikkei 225 falling 1.03%, Hong Kong’s Hang Seng Index gaining 1.37% and India’s BSE Sensex gaining 0.11%.

The merchandise trade deficit in India increased to $29.7 billion in August, recording the highest level in ten months. India’s wholesale prices rose by 1.31% year-over-year in August compared to a 2.04% rise in the prior month.

Economics

- U.S. retail sales rose 0.1% month-over-month in August compared to revised 1.1% gain in July, and topping market estimates of a 0.2% decline.

- The NAHB/Wells Fargo Housing Market Index climbed to 41 in September versus 39 in the prior month.

- Total business inventories rose by 0.4% month-over-month in July compared to a 0.3% gain in June and topping market expectations of a 0.3% increase.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Noteworthy Insider Activity: Linda Harty Invests $240K In Chart Industries Stock

Linda Harty, Director at Chart Industries GTLS, disclosed an insider purchase on September 16, based on a new SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Harty purchased 5,000 shares of Chart Industries. The total transaction amounted to $240,229.

Chart Industries‘s shares are actively trading at $120.83, experiencing a up of 3.02% during Tuesday’s morning session.

Discovering Chart Industries: A Closer Look

Chart Industries provides a variety of cryogenic equipment for storage, distribution, and other processes within the industrial gas and liquefied natural gas industries. It also provides natural gas processing solutions for the natural gas industry and specialty products that serve a variety of spaces, including hydrogen, biofuels, cannabis, and water treatment. The firm acquired Howden in a significant deal in early 2023, roughly doubling the size of the company.

Understanding the Numbers: Chart Industries’s Finances

Revenue Growth: Over the 3 months period, Chart Industries showcased positive performance, achieving a revenue growth rate of 14.56% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company faces challenges with a low gross margin of 33.8%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Chart Industries’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.23.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.48, caution is advised due to increased financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 52.36 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.48 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 11.48, Chart Industries’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Chart Industries’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

REGAL REXNORD CORPORATION HOSTS 2024 INVESTOR CONFERENCE, INTRODUCES NEW THREE YEAR FINANCIAL TARGETS

MILWAUKEE, Sept. 17, 2024 /PRNewswire/ — Regal Rexnord Corporation RRX is hosting its 2024 Investor Day today at The Mandarin Oriental Hotel in New York City beginning at 8:30 AM ET. A live webcast of the event will be accessible on the Company’s investor relations website at investors.regalrexnord.com.

CEO Louis Pinkham, CFO Rob Rehard, and other members of the executive leadership team will discuss the Company’s strategic growth objectives, including plans to accelerate profitable organic sales growth, continue to expand adjusted gross margins and adjusted EBITDA margins, grow free cash flow, and drive significant potential value creation through various capital deployment initiatives.

In conjunction with today’s event, the Company is maintaining its previously announced annual 2024 guidance, including sales of $6.2 billion, GAAP diluted earnings per share in a range of $3.70 to $4.10, and adjusted diluted earnings per share* in a range of $9.40 to $9.80. However, based on recent performance, the Company now believes that the lower half of the outlook range is more likely.

The Company is also introducing the following financial targets for the 2024 to 2027 period:

- Organic net sales growth at a CAGR of 2% to 5%

- Adjusted gross margins** rising to ~40% exiting 2025 and remaining steady thereafter

- Adjusted EBITDA margins** rising to ~25% exiting 2025 and remaining steady thereafter

- Adjusted diluted earnings per share** growth at a low double digit CAGR

- Adjusted free cash flow margins** in the low- to mid-teens by 2027

- Net leverage** declining to ~2.5x in 2025 and to 1.5–2.0x by 2027

Commenting on the Company’s three-year outlook, CEO Louis Pinkham said: “We see many opportunities to create significant value for shareholders by capitalizing on the strengths of our enterprise, which over the last five years we have dramatically transformed, through organic and inorganic actions, to be increasingly durable, high-margin, and cash generative. As we will discuss in some detail at our investor meeting today, our teams are working on a wide range of compelling initiatives to accelerate organic growth. We also see a clear path to top quartile gross, EBITDA and cash flow margins, ROIC expansion, and meaningful opportunities to create value through de-levering and, over time, inorganic growth. In short, we believe Regal Rexnord presents a highly compelling value creation opportunity, underpinned by lots of controllable execution.”

Supplemental Materials

Supplemental materials and additional information will be accessible on Regal Rexnord’s Investor website: https://investors.regalrexnord.com. The Company intends to disseminate important information about the Company to its investors on the Investors section of its website: https://investors.regalrexnord.com. Investors are advised to look at Regal Rexnord’s website for future important information about the Company.

About Regal Rexnord

Regal Rexnord’s 30,000 associates around the world help create a better tomorrow by providing sustainable solutions that power, transmit and control motion. The Company’s electric motors and air moving subsystems provide the power to create motion. A portfolio of highly engineered power transmission components and subsystems efficiently transmits motion to power industrial applications. The Company’s automation offering, comprised of controls, actuators, drives, and precision motors, controls motion in applications ranging from factory automation to precision control in surgical tools.

The Company’s end markets benefit from meaningful secular demand tailwinds, and include factory automation, food & beverage, aerospace, medical, data center, warehouse, alternative energy, residential and commercial buildings, general industrial, construction, metals and mining, and agriculture.

Regal Rexnord is comprised of three operating segments: Industrial Powertrain Solutions, Power Efficiency Solutions, and Automation & Motion Control. Regal Rexnord is headquartered in Milwaukee, Wisconsin and has manufacturing, sales and service facilities worldwide. For more information, including a copy of our Sustainability Report, visit RegalRexnord.com.

* Non-GAAP Financial Measure, See Appendix for Reconciliation to the most directly comparable GAAP financial measure.

** Regal Rexnord does not provide a reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures on a forward-looking basis because it is unable to predict certain adjustment items without unreasonable effort.

Forward Looking Statements

All statements in this communication, other than those relating to historical facts, are “forward-looking statements.” Forward-looking statements can generally be identified by their use of terms such as “anticipate,” “believe,” “confident,” “estimate,” “expect,” “intend,” “plan,” “may,” “will,” “project,” “forecast,” “target, ” “would,” “could,” “should,” and similar expressions, including references to assumptions. Forward-looking statements are not guarantees of future performance and are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. Forward-looking statements include, but are not limited to, statements about expected market or macroeconomic trends, future strategic plans and future financial and operating results. Important factors that could cause actual results to differ materially from those presented or implied in the forward-looking statements in this communication include, without limitation: the possibility that the Company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the sale of the Industrial Motors and Generators businesses, the acquisition of Altra Industrial Motion Corp. (“Altra Transaction”), and the merger with the Rexnord Process & Motion Control business (the “Rexnord PMC business”) within the expected time-frames or at all and to successfully integrate Altra Industrial Motion Corp. (“Altra”) and the Rexnord PMC business; the Company’s substantial indebtedness as a result of the Altra Transaction and the effects of such indebtedness on the Company’s financial flexibility; the Company’s ability to achieve its objectives on reducing its indebtedness on the desired timeline; dependence on key suppliers and the potential effects of supply disruptions; fluctuations in commodity prices and raw material costs; any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; unanticipated operating costs, customer loss or business disruption; the Company’s ability to retain key executives and employees; uncertainties regarding our ability to execute restructuring plans within expected costs and timing; challenges to the tax treatment that was elected with respect to the merger with the Rexnord PMC business and related transactions; actions taken by competitors and our ability to effectively compete in the increasingly competitive global electric motor, drives and controls, power generation and power transmission industries; our ability to develop new products based on technological innovation, such as the Internet of Things and artificial intelligence, and marketplace acceptance of new and existing products; dependence on significant customers and distributors; risks associated with climate change and uncertainty regarding our ability to deliver on our sustainability commitments and/or to meet related investor, customer and other third party expectations relating to our sustainability efforts; risks associated with global manufacturing, including risks associated with public health crises and political, societal or economic instability, including instability caused by ongoing geopolitical conflicts; issues and costs arising from the integration of acquired companies and businesses; prolonged declines in one or more markets; risks associated with excess or obsolete inventory charges, including related write-offs or write-downs; economic changes in global markets, such as reduced demand for products, currency exchange rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration, customs, border actions and the like, and other external factors that the Company cannot control; product liability, asbestos and other litigation, or claims by end users, government agencies or others that products or customers’ applications failed to perform as anticipated; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; the Company’s ability to identify and execute on future M&A opportunities, including significant M&A transactions; the impact of any such M&A transactions on the Company’s results, operations and financial condition, including the impact from costs to execute and finance any such transactions; unanticipated costs or expenses that may be incurred related to product warranty issues; infringement of intellectual property by third parties, challenges to intellectual property, and claims of infringement on third party technologies; effects on earnings of any significant impairment of goodwill; losses from failures, breaches, attacks or disclosures involving information technology infrastructure and data; costs and unanticipated liabilities arising from rapidly evolving laws and regulations; and other factors that can be found in our filings with the SEC, including our most recent periodic reports filed on Form 10-K and Form 10-Q, which are available on our Investor Relations website. Forward-looking statements are given only as of the date of this communication and we disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Measures

(Unaudited)

(Dollars in Millions, Except per Share Data)

We prepare our financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We also periodically disclose certain financial measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events that may be considered “non-GAAP” financial measures. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP.

In this release, we disclose certain non-GAAP forward-looking information, including adjusted targets such as gross margin, EBITDA margin, diluted earnings per share, free cash flow margin and net leverage. We believe that these forward-looking non-GAAP financial measures are useful measures for providing investors with additional information regarding our financial targets. The Company believes that a quantitative reconciliation of this forward-looking information to the most comparable financial measure calculated and presented in accordance with GAAP cannot be made available without unreasonable efforts. A reconciliation of this non-GAAP financial measure would require the Company to predict the timing and likelihood of future restructurings and other charges. Neither these forward-looking measures, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of the most directly comparable forward-looking GAAP measure is not provided.

In addition to these non-GAAP measures, we use the term “organic sales growth” to refer to the increase in our sales between periods that is attributable to organic sales. “Organic sales” refers to GAAP sales from existing operations, excluding any sales from acquired businesses recorded prior to the first anniversary of the acquisition and excluding any sales from divested businesses recorded prior to the first anniversary of the exit, and excluding the impact of foreign currency translation. The impact of foreign currency translation is determined by translating the respective period’s organic sales using the currency exchange rates that were in effect during the prior year periods.

|

Appendix

|

||||

|

2024 ADJUSTED ANNUAL GUIDANCE |

||||

|

Unaudited |

||||

|

Minimum |

Maximum |

|||

|

2024 GAAP Diluted EPS Annual Guidance |

$ 3.70 |

$ 4.10 |

||

|

Intangible Amortization |

3.92 |

3.92 |

||

|

Restructuring and Related Costs (a) |

0.68 |

0.68 |

||

|

Share-Based Compensation Expense |

0.51 |

0.51 |

||

|

Operating Lease Asset Step Up |

0.01 |

0.01 |

||

|

Impairments and Exit Related Costs |

0.02 |

0.02 |

||

|

Loss on Sale of Businesses |

0.06 |

0.06 |

||

|

Gain on Sale of Assets |

(0.01) |

(0.01) |

||

|

Transaction and Integration Related Costs (b) |

0.26 |

0.26 |

||

|

Discrete Tax Items |

0.25 |

0.25 |

||

|

2024 Adjusted Diluted EPS Annual Guidance |

$ 9.40 |

$ 9.80 |

||

|

(a) Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges.

(b) Primarily relates to (1) legal, professional service, and rebranding costs associated with the sale of the industrial motors and generators businesses and (2) legal, professional service and integration costs associated with the Altra Transaction. |

||||

![]() View original content:https://www.prnewswire.com/news-releases/regal-rexnord-corporation-hosts-2024-investor-conference-introduces-new-three-year-financial-targets-302249433.html

View original content:https://www.prnewswire.com/news-releases/regal-rexnord-corporation-hosts-2024-investor-conference-introduces-new-three-year-financial-targets-302249433.html

SOURCE Regal Rexnord Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insecticides Market Size is Expected to Reach USD 32.8 billion, Advancing at a CAGR of 5.5% by 2034: Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 17, 2024 (GLOBE NEWSWIRE) — The global insecticides market (세계 살충제 시장) is estimated to flourish at a CAGR of 5.5% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for insecticides is estimated to reach US$ 32.8 billion by the end of 2034.

With changing climate patterns, there’s a growing need for insecticides resilient to environmental fluctuations. Companies are investing in research to develop insecticides capable of withstanding extreme weather conditions, ensuring consistent pest control and crop protection.

Escalating pest resistance to conventional insecticides necessitates the development of novel solutions. Innovations in mode of action and formulation techniques are vital to overcome resistance challenges and maintain effective pest control strategies.

The integration of digital technologies such as precision agriculture and remote sensing revolutionizes pest monitoring and management. Advanced analytics and data-driven insights enable farmers to optimize insecticide application, reducing wastage and enhancing efficacy.

Increasing consumer awareness about environmental and health impacts drives demand for eco-friendly insecticides. Manufacturers are responding by investing in research and development of bio-based and organic insecticide alternatives, catering to the growing preference for sustainable agricultural practices.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/insecticides-market.html

Collaboration between academia, industry, and government institutions fosters innovation in insecticide development. Joint research initiatives and knowledge-sharing platforms accelerate the discovery and commercialization of novel insecticide solutions, driving market growth and competitiveness.

Insecticides Market: Competitive Landscape

In the fiercely competitive insecticides market, industry giants such as Bayer AG, Syngenta, and BASF SE dominate, leveraging extensive R&D and global distribution networks. These key players offer a diverse portfolio of insect control solutions, including chemical and biological formulations, to combat pests effectively. Emerging contenders like FMC Corporation and Corteva Agriscience intensify competition by focusing on innovation and sustainability.

Market consolidation through mergers and acquisitions further shapes the competitive landscape, driving companies to differentiate through product efficacy, safety profiles, and environmental sustainability. With rising demand for crop protection and increasing pest resistance, the Insecticides Market continues to evolve with dynamic strategies and technological advancements. Some prominent players are as follows:

- Bayer AG

- BASF SE

- Dow

- Syngenta

- FMC Corporation

- Nufarm Limited

- PI Industries

- Sumitomo Chemical Co. Ltd.

- UPL

- ADAMA

Product Portfolio

- Syngenta offers a comprehensive portfolio of crop protection products and seeds, engineered to enhance agricultural productivity and sustainability. With a focus on innovation and research, Syngenta provides farmers worldwide with cutting-edge solutions to address evolving challenges in crop management and food security.

- Nufarm Limited specializes in developing and manufacturing crop protection products and seed technologies tailored to meet the needs of farmers globally. Through continuous innovation and strategic partnerships, Nufarm strives to provide effective and sustainable solutions that support agricultural productivity, profitability, and environmental stewardship.

Key Findings of the Market Report

- Pyrethrin & pyrethroid products dominate the insecticides market due to their effectiveness, low toxicity to humans, and broad-spectrum pest control capabilities.

- Cereals & grains lead the insecticides market, with significant demand for pest control to protect staple crops and ensure food security.

- North America leads the insecticides market, driven by advanced agricultural practices, extensive use of genetically modified crops, and stringent regulatory standards.

Insecticides Market Growth Drivers & Trends

- Increasing global population and urbanization spur demand for insecticides to safeguard food production.

- Adoption of integrated pest management practices promotes sustainable insecticide usage and reduces environmental impact.

- Technological advancements drive innovation in safer and more effective insecticide formulations.

- Regulatory pressure encourages the development of bio-based and organic insecticides.

- Expansion of agriculture in emerging economies amplifies market opportunities for insecticide manufacturers.

Global Insecticides Market: Regional Profile

- In North America, particularly the United States, a sophisticated agricultural sector and extensive adoption of genetically modified crops drive significant demand for insecticides.

- Key players like Bayer AG and Corteva Agriscience dominate the market, offering advanced formulations to combat a wide range of pests. Stringent regulatory standards ensure product safety and environmental sustainability, shaping market trends towards integrated pest management practices.

- In Europe, countries like Germany, France, and Spain adhere to stringent regulatory frameworks, fostering a shift towards safer and more sustainable insecticide solutions.

- This trend is fueled by growing environmental concerns and increasing consumer demand for organic produce. Companies such as BASF SE and Syngenta lead innovation in biological and bio-based insecticides, aligning with European Union regulations on pesticide use and residues.

- In the Asia Pacific region, rapid urbanization, expanding population, and rising disposable incomes drive demand for insecticides to protect crops and ensure food security.

- Countries like China and India witness robust market growth, supported by government initiatives to modernize agriculture and enhance productivity. Local players and multinational corporations like Sumitomo Chemical and UPL Limited cater to diverse agricultural landscapes, offering tailored solutions to address regional pest challenges and crop protection needs.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/insecticides-market.html

Insecticides Market: Key Segments

By Product

- Organochlorine

- Organophosphate

- Carbamate

- Pyrethrin & Pyrethroid

- Others

By Crop

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Others

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

Chloromethane Market (クロロメタン市場) Set to Surge at 4.4% CAGR, to Reach USD 5.4 billion by 2031 | Transparency Market Research, Inc.

Calcium Chloride Market (سوق كلوريد الكالسيوم) Expected to Achieve USD 2.3 billion by 2031 with a 5.3% CAGR from 2023 | Insights from TMR Research

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jefferies Says These 2 Utility Stocks Could Benefit From the Rising Demand for Data Centers

Utility companies have been under pressure from high inflation in recent years, facing both customer pushback over rising prices and the burden of higher interest rates, which have driven up credit costs, further adding to the providers’ debt burden.

Utility investors can take heart, however, as long-term trends are bullish for utility stocks. Demand for electricity is growing, powered in part by the AI boom, and its dependence on power-hungry data centers, and in part by the advent of electric vehicles, with their own demands on the power grid.

Watching the electric utility sector from Jefferies, analyst Julien Dumoulin-Smith sees utility stocks as a good choice for investors.

“It is impossible to understate the transformation underway with the proliferation of data centers,” Dumoulin-Smith said. “The unregulated merchants can capture outsized profits and cash flows. There are a wide range of demand growth projections from various parties with the consensus being roughly 2-4% annual demand growth through 2030 driven predominately by data centers. Data center demand is forecasted by BCG and others to represent 6-8% of total US demand vs 2-3% currently.”

The analyst has taken this general stance and used it to back up two specific recommendations on utility stocks, based on the rising demand for data centers. Opening up the TipRanks database, we’ve found that his picks hold Strong Buy consensus ratings from the Street. Let’s give them a closer look.

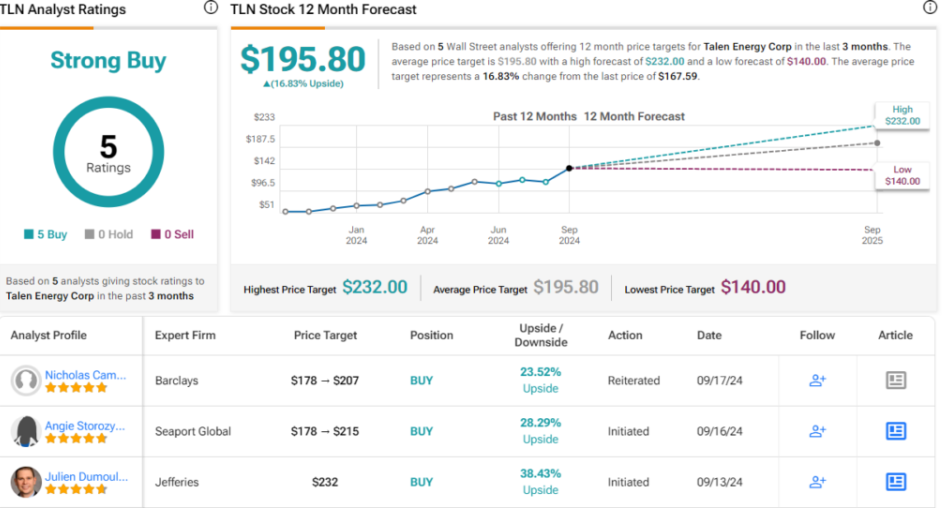

Talen Energy (TLN)

First up is Talen Energy, an independent power and infrastructure company – and one of the largest such companies in North America. Talen focuses on delivering safe and reliable power generation, with the most value per megawatt of energy produced. The company’s power generation portfolio includes a full range of assets: nuclear, natural gas, oil, and coal. These power generation operations are anchored by the company’s Susquehanna nuclear power plant, the sixth-largest such plant operating in the US. In addition to Susquehanna, Talen operates power generation and other facilities across five states – Massachusetts, New Jersey, Pennsylvania, Maryland, and Montana – and produces up to 10.7 gigawatts of power.

Talen’s Susquehanna plant, capable of delivering clean and reliable power 24 hours per day, seven days per week, has led the way for the company to become a leader in providing energy for data centers. Talen describes this niche as a ‘unique opportunity for growth,’ as data centers are notoriously power-hungry. The company has a track record of delivering clean power on demand, and of expanding its generating capabilities to meet expanding demand, the two prerequisites for meeting the power needs of data centers and their AI applications.

In the company’s last reported quarter, 2Q24, Talen posted a top line of $489 million. This revenue total was up an impressive 62.5% year-over-year, and supported an EPS of $7.60. Also of note, Talen reported an adjusted free cash flow for 1H24 of $165 million. We should note here that the company’s stock has been a huge winner in 2024, having gained 160% for the year-to-date.

This power company’s success in finding and filling a niche have caught the attention of analyst Dumoulin-Smith. In his coverage of the company for Jefferies, he writes, “TLN’s PJM-based, generation-only portfolio is well positioned to benefit from a variety of Power trends, including the rising electricity demand notably from data centers and the growing value of firm capacity. These trends translate into multiple sources of potential upside that could drive both increased profitability and multiple expansion. While TLN is not the only IPP destined to profit from these market phenomenons, some of the company’s characteristics make it susceptible to maximize relative upside. Beyond that, TLN has high visibility on substantial earnings growth in the next few years, driven by the dramatic increase in capacity prices.”

Talen has earned a Buy rating from Dumoulin-Smith, whose $232 price target on the stock implies additional gains of 38.5% are in the cards for the next 12 months. (To watch Dumoulin-Smith’s track record, click here)

The Street view is also upbeat here, with a Strong Buy consensus rating based on 5 unanimously positive recent analyst reviews. The stock’s $167.59 trading price and $195.8 average target price together point toward a one-year upside potential of 17%. (See Talen stock forecast)

Vistra Energy (VST)

Next up is Vistra Energy, a Texas-based power company that generates electricity at utility scales. Vistra is the largest competitive power generation company working in the US, and can produce approximately 41,000 megawatts of electricity – enough to power 20 million homes. The company operates in all of the nation’s major competitive wholesale markets, and has a reputation for focusing on reliability, affordability, and sustainability. Vistra’s power generation portfolio features natural gas, coal, nuclear, and solar facilities, and even includes battery facilities for energy storage. The company is expanding its zero-carbon generation footprint, and operates the nation’s second-largest fleet of competitive nuclear power plants. Vistra employs over 6,800 people nationwide, and provides energy to more than 5 million customers.

On the retail side, Vistra’s environmentally conscious customers can choose from more than 50 renewable energy and conservation-focused plans. These are available across 16 states plus DC, and are provided through Vistra’s network of 6 retail power supply brands. The company is best known as an electric utility, but it can also provide customers with natural gas services.

Vistra’s core business, power generation and supply, brought the company $3.85 billion in revenues during its last reported quarter, 2Q24. This was up from $3.19 billion in 2Q23, a year-over-year gain of more than 20%, although the 2Q24 number missed the forecast by $110 million. At the bottom line, the company realized a net income of $467 million, down from $476 million one year prior. Cash flow from operations in the quarter came to just under $1.2 billion. The company finished Q2 with $3.85 billion in available liquidity, a total that included cash and cash equivalents of $1.62 billion.

From the standpoint of Dumoulin-Smith, there is plenty to recommend Vistra to investors. He writes of the company, “As one of the largest and most diversified IPPs, VST is well geared to the upside on multiple fronts, including the general increase in power and capacity prices, higher plant utilization, as well as potential above-market contracts with data centers. As we project outsized growth over the forecast period, we still see value in the stock, which continues to trade at a discount to peers, at 15%+ FY27 FCF yield.”

Getting into specifics, the top analyst goes onto explain the quality of Vestra’s power generation assets, adding, “From a data center-related growth perspective, VST owns a large fleet of CCGTs across Texas and PJM, as well as four nuclear plants also in the same two regions. The breadth of the fleet means a greater ability to cater to specific customer needs, which should translate into higher contract signing success and overall more favorable terms.”

All things considered, the Jefferies analyst puts a Buy rating here, complemented by a $99 price target that shows his confidence in an 11% gain on the one-year horizon.

The Street generally has given this stock a unanimous Strong Buy consensus rating, based on 6 positive analyst reviews set in recent weeks. The shares are trading for $89.4 and the $108.17 average price target points toward a 12-month gain of 21%, even more bullish than the Jefferies view. (See Vistra stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Vibratory Hammer Market to Surpass US$ 1.12 Billion, Expanding at 5.6% CAGR by 2034 | Fact.MR Analysis

Rockville, MD , Sept. 17, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, through its newly published market analysis, reveals that revenue from the global Vibratory Hammer Market is approximated to reach US$ 649.4 million in 2024 and subsequently advance at a CAGR of 5.6% through 2034.

The expansion of infrastructure and the number of urban construction projects are driving up demand for vibratory hammers. They are used in marine construction, building foundation construction, and environmental remediation. The global market is expanding steadily due to the increasing need for roads, buildings, railroads, and other infrastructure with population growth.

These infrastructure developments and urbanization are the factors driving the vibratory hammer market. In addition, these hammers are adaptable for installation and dismantling as they are used to extract piles. Lower levels of vibration and noise make the workplace safer by reducing the risks of workers’ exposure to loud noises.

The expansion of the equipment rental industry has made vibratory hammers more accessible to contractors without any need for higher capital investments. Since operator training is easily accessible and consumers are becoming more aware of the benefits of vibratory hammers, the market is growing even more. In addition, more foreign direct investment (FDI) in the building sector is fueling demand for state-of-the-art machinery.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10351

Key Takeaways from the Market Study:

- The global market for vibratory hammers is analyzed to reach a value of US$ 1.12 billion by the end of 2034.

- India is evaluated to reach a market valuation of US$ 75.3 million in 2024.

- China is projected to contribute a market share of 61.2% in East Asia in 2024.

- Demand for vibratory hammers in Japan is estimated to reach US$ 44.6 million in 2024.

- The market in the South Asia & Pacific region is projected to advance at 5.9% CAGR through 2034.

- Sales from cranes-mounted vibratory hammers are forecasted to reach US$ 515.2 million by 2034.

“The vibratory hammer market is driven by the growing demand for buildings, railroads, roads, and other infrastructure projects worldwide,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Vibratory Hammer Market:

Key players in the vibratory hammer market are ABI Equipment Limited, Hydraulic Power Systems, Inc., American Piledriving Equipment, ThyssenKrupp, Xuzhou Hercules Machine Manufacture Co., Ltd., PTC (Fayat Group), Shinsegae Power Equip Industrial Co., Ltd, OMS Pile Driving Equipment GmbH, Liebherr Group, MOVAX Oy, Dieseko Group B.V., Yongan Machinery Co., Ltd, Les Produits Gilbert Inc., Hercules Machinery Corporation, Guangdong Liyuan Hydraulic Machinery Company Ltd.

High-Frequency Vibrations Produced by Hammers Hasten Pile Driving and Shorten Project Duration:

Construction projects involving harbors, airports, railroads, bridges, and canals are using crane hammers. They are also utilized in infrastructure projects pertaining to the building of pipelines, the stabilization of soil, the reinforcement of urban areas, and the treatment of wastewater. These hammers generate high-frequency vibrations that speed up pile driving and reduce project time. These hammers are suitable for a wide range of projects and are used on a variety of pile types (such as steel, concrete, and others) in a range of soil conditions.

Vibratory Hammer Industry News:

- In order to create models that are stronger, lighter, and more effective, major players in the vibratory hammer industry are funding research and development. More advanced features like automatic controls and remote monitoring are starting to become commonplace. They are also concentrating on ecologically friendly designs and techniques, such lowering noise and vibration levels, in order to comply with regulations and appeal to environmentally conscious customers.

- In this new market analysis, Fact.MR offers comprehensive details on the pricing points of top vibratory hammer manufacturers located worldwide, as well as sales growth, production capacity, and technological breakthroughs.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10351

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the vibratory hammer market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the vibratory hammer market based on mounting (crane mounted, excavator mounted), centrifugal force (0 to 1000kn, 1001 to 2000kn, 2001 to 3000kn, 3001 to 4000kn, 4001kn & above), by end-use industry (construction, residential, non-residential, infrastructural, offshore, oil & gas, wind), and across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA)

Segmentation of Vibratory Hammer Market Research:

By Mounting :

- Crane Mounted

- Excavator Mounted

By Centrifugal Force :

- 0 to 1000KN

- 1001 to 2000KN

- 2001 to 3000KN

- 3001 to 4000KN

- 4001 KN & Above

By End-Use Industry :

- Construction

- Residential

- Non-Residential

- Infrastructural

- Offshore

- Oil & Gas

- Wind

Check out More Related Studies Published by Fact.MR:

Soil Compaction Machines Market: Sales are estimated at US$ 5.4 billion and are forecasted to climb to US$ 10.6 billion by 2033-end. The global soil compaction machines market is projected to expand at a robust 6.8% CAGR over the next ten years.

Power Hammer Market: Size was valued at US$ 843.4 million in 2023 and has been forecasted to expand at a CAGR of 5.4% to climb to US$ 1.5 billion by the end of 2034.

Piling Machine Market: Size is estimated at US$ 5.42 billion in 2024 and is predicted to reach a size of US$ 8.34 billion by 2034-end, expanding at a CAGR of 4.4% between 2024 and 2034.

Hydraulic Breakers Rental Market: Demand is expanding and is poised to grow at a rate of 6.0% during the forecast period and reach a valuation of US$ 698.2 million in 2033 from US$ 389.9 million in 2023.

Cordless Power Tools Market: Sales reached a global total of US$15.3 billion. The market is anticipated to expand at a rate of 9.1% a year between 2023 and 2033, when it is expected to have reached a valuation of US$ 39.2 billion.

Fastening Power Tool Market: Size is expected to be worth US$ 3.5 billion globally. By2034, the market is projected to have grown at a 6.4% CAGR and reach US$ 6.5 billion.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: American Electric Power Co Inc

Summary

American Electric Power is a major U.S. investor-owned electric utility with generation, transmission, and distribution operations and eight utility subsidiaries. The company’s vertically integrated utilities and distribution utilities deliver electricity to more than 5.6 million customers in 11 states in the Midwest and Southeast. AEP ranks among the nation’s largest generators of electricity, with about 23,000 megawatts of generating capacity and 225,000 distribution lines. AEP also owns the nation’s largest electricity transmission system, with 40,000 system miles.

In 2023, vertical utilities accounted for about 60% of total annual revenue, while transmission and distribution utilities accounted for about 30%.

With the 2H23 sale of its competitive generating plant, Cardinal 1, in Ohio, the company has exited the wholesale generation business and left the Ohio competitive electricity market. AEP’s 2023 owned generation mix is approximately 4

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level