Steel Dynamics Expects Lower Q3 Earnings Amid Pricing Pressures

Steel Dynamics, Inc. STLD has issued earnings guidance for the third quarter of 2024 in the $1.94-$1.98 per share range. This represents a decline from the company’s second-quarter 2024 earnings of $2.72 per share and its third-quarter 2023 earnings of $3.47.

STLD’s steel operations profitability is expected to be significantly lower than the second quarter due to reduced average realized pricing in the flat rolled operations. Approximately 80% of this business is contract-based, linked to lagging pricing indices. However, flat rolled steel prices have stabilized and are showing improvement, with underlying demand remaining consistent.

The metals recycling division’s earnings for the third quarter of 2024 are anticipated to be in line with second-quarter results, as steady volumes offset the impact of slightly lower realized pricing.

Demonstrating continued confidence in the company’s earnings outlook and cash flow, Steel Dynamics repurchased $307 million worth of its common stock through Sept. 11, 2024.

Shares of Steel Dynamics have gained 13.1% in the past year against a 14.3% decline in its industry.

Image Source: Zacks Investment Research

STLD’s Zacks Rank & Key Picks

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and Eldorado Gold Corporation EGO, each sporting a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14 per share, indicating a rise of 15.3% from the year-ago level. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days.The stock has rallied around 95% in the past year.

The Zacks Consensus Estimate for Carpenter Technology’s current-year earnings is pegged at $6.06 per share, indicating a rise of 27.9% from the year-ago level. CRS’ earnings beat the consensus estimate in each of the trailing four quarters, with the average surprise being 15.9%. The stock has surged nearly 108.8% in the past year.

The Zacks Consensus Estimate for Eldorado Gold’s current-year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO beat the consensus estimate in each of the trailing four quarters, with the average earnings surprise being 430.3%. The company’s shares have surged nearly 75.3% in the past year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

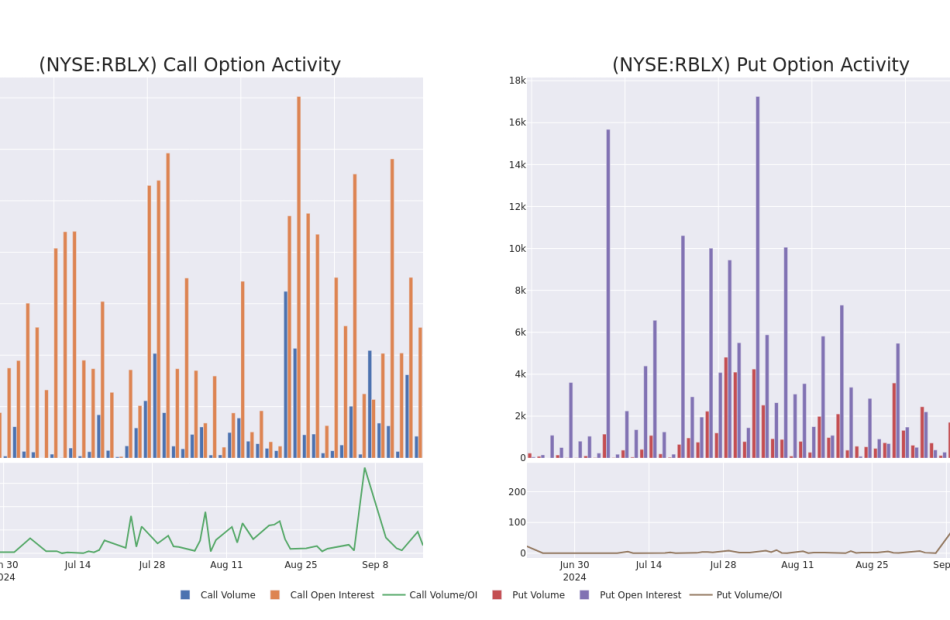

Roblox Unusual Options Activity For September 17

Deep-pocketed investors have adopted a bullish approach towards Roblox RBLX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RBLX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 21 extraordinary options activities for Roblox. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 61% leaning bullish and 38% bearish. Among these notable options, 8 are puts, totaling $401,501, and 13 are calls, amounting to $581,946.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $60.0 for Roblox over the last 3 months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Roblox’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Roblox’s substantial trades, within a strike price spectrum from $25.0 to $60.0 over the preceding 30 days.

Roblox Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | SWEEP | BEARISH | 11/15/24 | $3.15 | $3.05 | $3.15 | $45.00 | $94.5K | 1.4K | 1.4K |

| RBLX | CALL | SWEEP | BEARISH | 01/17/25 | $21.75 | $21.7 | $21.75 | $25.00 | $82.7K | 1.8K | 40 |

| RBLX | CALL | TRADE | BULLISH | 06/20/25 | $3.7 | $3.45 | $3.6 | $60.00 | $72.0K | 515 | 200 |

| RBLX | PUT | SWEEP | BULLISH | 11/01/24 | $3.1 | $3.0 | $3.0 | $47.00 | $67.2K | 49 | 5.1K |

| RBLX | PUT | SWEEP | BULLISH | 10/18/24 | $1.63 | $1.53 | $1.53 | $45.00 | $61.2K | 3.0K | 74 |

About Roblox

Roblox operates an online video game platform that lets young gamers create, develop, and monetize games (or “experiences”) for other players. The firm effectively offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning revenue in multiple places while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers then creating new games or franchises.

Current Position of Roblox

- Currently trading with a volume of 3,246,470, the RBLX’s price is down by -0.35%, now at $46.08.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 50 days.

What The Experts Say On Roblox

1 market experts have recently issued ratings for this stock, with a consensus target price of $51.0.

- Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Roblox, targeting a price of $51.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Roblox, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

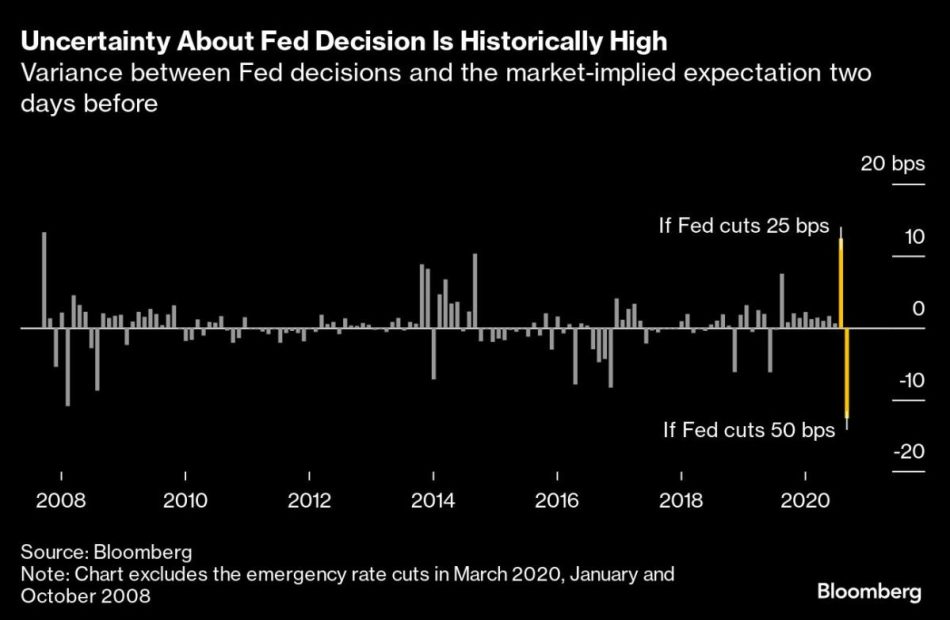

'What The Fed Wants And What The Market Wants Are Two Different Things,' Expert Says As Investors Brace For 50 Basis Points Rate Cut

In a recent discussion, Morgane Delledonne, head of investment strategy at Global X ETFs, shed light on the Federal Reserve’s interest rate policy and its effect on the markets.

What Happened: Delledonne, in an interview with CNBC on Monday, highlighted the gap between the Federal Reserve’s goals and the expectations of the market.

“What the Fed wants and what the market wants are two different things,” she explained.

She pointed out that the Federal Reserve heavily depends on economic data, which currently suggests a robust economy despite some weakening in the job market. However, Delledonne emphasized that core inflation continues to remain high.

Delledonne opined that the Fed is unlikely to risk the downward inflation trend by being overly aggressive.

“I don’t see the balance of risks pointing to a 50 basis points cut,” she said. She also suggested that such a move by the Fed could signal to the market that a recession risk is imminent.

Why It Matters: The Federal Reserve’s interest rate policy significantly influences the financial markets. The Federal Reserve was set to cut the federal funds rate for the first time in over four years. The market participants were leaning towards a larger 50-basis-point cut, with a 65% probability.

Furthermore, the performance of the S&P 500 following the Federal Reserve’s rate cuts largely depends on whether the economy is in a recession or not. The stock markets typically experienced significant declines after the Fed’s initial rate cut during recessionary periods.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Illustration created using artificial intelligence via MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Churn as Traders Split on Size of Fed Cut: Markets Wrap

(Bloomberg) — Stocks drifted near all-time highs ahead of the Federal Reserve decision, with traders split on the size of an interest-rate cut.

Most Read from Bloomberg

The S&P 500 closed little changed after briefly crossing the threshold of a record amid an increase in US retail sales. Economically sensitive industries once again outperformed tech. Treasury yields edged up, with shorter maturities leading the move. The market-implied odds the Fed announces a 50-basis-point reduction on Wednesday were around 55%.

A survey conducted by 22V Research showed investors who expect a 25 basis-point reduction are split on whether that cut would deliver a “risk-on” or “risk-off” reaction. Meantime, those betting on 50 basis points think a smaller Fed move would be “risk-off.”

“If the Fed doesn’t initiate its easing cycle with 50 basis points, surely a 25 basis-point move will be enveloped by a dovish tone,” according to Quincy Krosby at LPL Financial. Ryan Detrick at Carson Group said “a larger cut out of the gate makes a lot of sense” given that now the big concern is the potential for a quickly slowing labor market.

Steve Sosnick at Interactive Brokers still believes the Fed should lean to 25 basis points, but notes that years of trading experience have taught him to respect the message of the market. And that message has been saying 50, he said.

Sosnick noted there will likely be widespread disappointment if the Fed opts for 25 basis points. He says equity markets always crave more liquidity, and at the same time, bond markets have all but priced in an aggressive rate cutting path for future meetings. So the smaller cut would bias against both.

The Nasdaq 100 and Dow Jones Industrial Average also closed little changed. The Russell 2000 of smaller firms gained 0.7%. Treasury 10-year yields advanced two basis points to 3.64%. The dollar rose.

The Fed will either cut 50 basis points or opt for a 25 basis-point reduction, but signal that they will be more aggressive going forward, according to Matt Maley at Miller Tabak.

Still, he says, that does not guarantee that the stock market and/or bond market will rally in a meaningful way. Maley says the Fed will likely try to convey that a more dovish stance is not seen as something that means they’re suddenly worried about an imminent recession.

“Therefore, given that the stock market is approaching overbought territory, we could still get a ‘sell the news’ reaction to the Fed this week,” he added.

Kristina Hooper at Invesco expects the Fed to cut by 25 basis points as a bigger reduction would raise alarm bells about the state of the US economy.

“Recall that the Fed started a brief easing cycle with a 50 basis point cut in March 2020 with the global pandemic upon us; it would be very hard to argue that the situation is so dire now,” she noted.

What Fed Chair Jerome Powell says in his press conference about the state of the US economy could help build confidence for those worried about a recession in the near term, Hooper added.

“In addition, it will be valuable to hear Powell’s thoughts on the expected path of rate cuts — in particular, what conditions could trigger a change of course, either a moderation or acceleration in easing,” she noted. “These are just things you can’t glean from the dot plot, so the press conference is ‘must see TV’ in my view.”

Corporate Highlights:

-

Microsoft Corp. raised its quarterly dividend 10% and unveiled a new $60 billion stock-buyback program, matching the size of a repurchase plan three years ago.

-

Intel Corp. made a raft of announcements, spurring optimism that the chipmaker’s turnaround plan is starting to bear fruit.

-

Salesforce Inc. is unveiling a pivot in its artificial intelligence strategy this week at its annual Dreamforce conference, now saying that its AI tools can handle tasks without human supervision and changing the way it charges for software.

-

Newmont Corp., the world’s biggest gold miner, said it’s on track to raise $2 billion — if not more — from selling smaller mines and development projects.

-

JPMorgan Chase & Co. is in discussions with Apple Inc. about taking over a credit card portfolio that rival Goldman Sachs Group Inc. has been trying to ditch.

-

Snap Inc. Chief Executive Officer Evan Spiegel unveiled a new version of the company’s Spectacles smart glasses, revitalizing an effort to build an advanced augmented reality product that may one day replace or rival the smartphone.

-

Ozempic, the blockbuster diabetes shot made by Novo Nordisk A/S, is “very likely” to be one of the next drugs targeted for a price cut in bargaining with the US government’s Medicare program, a company executive said.

Key events this week:

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Eurozone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 was little changed as of 4 p.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average was little changed

-

The MSCI World Index was little changed

-

S&P 500 Equal Weighted Index rose 0.2%

-

Bloomberg Magnificent 7 Total Return Index rose 0.4%

-

The Russell 2000 Index rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.1% to $1.1117

-

The British pound fell 0.4% to $1.3163

-

The Japanese yen fell 1.1% to 142.22 per dollar

Cryptocurrencies

-

Bitcoin rose 4% to $59,953.71

-

Ether rose 3.4% to $2,352.4

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.64%

-

Germany’s 10-year yield advanced two basis points to 2.14%

-

Britain’s 10-year yield advanced one basis point to 3.77%

Commodities

-

West Texas Intermediate crude rose 1.8% to $71.34 a barrel

-

Spot gold fell 0.5% to $2,568.94 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Singapore's DBS Bank Launches Bitcoin And Ethereum Options Trading For Institutional Clients

Singapore’s largest bank DBS on Tuesday announced its launch of over-the-counter (OTC) cryptocurrency options trading and structured notes, becoming the first Asian-headquartered bank to offer financial products tied to Bitcoin BTC/USD and Ethereum ETH/USD prices.

What Happened: These products, available from Q4 2024, are tailored for institutional investors and accredited wealth clients looking to expand their exposure to the digital asset class while managing risk.

DBS’ move comes at a time when interest in digital assets has surged.

In a release, Jacky Tai, Group Head of Trading and Structuring at DBS said professional investors are increasingly allocating to digital assets in their portfolios and that these financial products provide trusted, institutional-grade access to the digital asset ecosystem, allowing clients to better manage their portfolios.

Also Read: Contrarian Trader Bets $200K To Win $6.5M On This Unlikely Fed Rate Cut Scenario

By offering options trading, clients holding Bitcoin or Ethereum with DBS can hedge against volatility and potentially earn yield through advanced options structures, such as put options.

The timing of this launch coincides with significant growth in the cryptocurrency market in 2024.

DBS Digital Exchange (DDEx) reported a near tripling in the value of digital assets traded in Singapore dollar terms in the first five months of the year, with a 36% increase in active trading clients and a 50% surge in cryptocurrency market capitalization.

What’s Next: These developments will likely be discussed further at Benzinga’s Future of Digital Assets event on Nov. 19, where industry leaders will explore how innovations like DBS’ new offerings are helping institutional clients tap into the growing digital asset space.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bausch + Lomb Surges 14.5%: Is This an Indication of Further Gains?

Bausch + Lomb BLCO shares ended the last trading session 14.5% higher at $17.80. The jump came on an impressive volume with a higher-than-average number of shares changing hands in the session. This compares to the stock’s 2.8% loss over the past four weeks.

Bausch + Lomb scored a strong price increase on investors’ optimism surrounding a Financial Times report stating that the company is contemplating a sale to address challenges related to its spin-off from the parent company Bausch Health. Private equity firms are likely to be among those interested in the deal, according to the report.

This company is expected to post quarterly earnings of $0.16 per share in its upcoming report, which represents a year-over-year change of -27.3%. Revenues are expected to be $1.17 billion, up 15.8% from the year-ago quarter.

Earnings and revenue growth expectations certainly give a good sense of the potential strength in a stock, but empirical research shows that trends in earnings estimate revisions are strongly correlated with near-term stock price movements.

For Bausch + Lomb, the consensus EPS estimate for the quarter has remained unchanged over the last 30 days. And a stock’s price usually doesn’t keep moving higher in the absence of any trend in earnings estimate revisions. So, make sure to keep an eye on BLCO going forward to see if this recent jump can turn into more strength down the road.

The stock currently carries a Zacks Rank #3 (Hold).

Bausch + Lomb is a member of the Zacks Medical Services industry. One other stock in the same industry, Alignment Healthcare ALHC, finished the last trading session 3.2% lower at $11.51. ALHC has returned 36.7% over the past month.

Alignment Healthcare’s consensus EPS estimate for the upcoming report has changed -7.8% over the past month to -$0.14. Compared to the company’s year-ago EPS, this represents a change of +26.3%. Alignment Healthcare currently boasts a Zacks Rank of #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

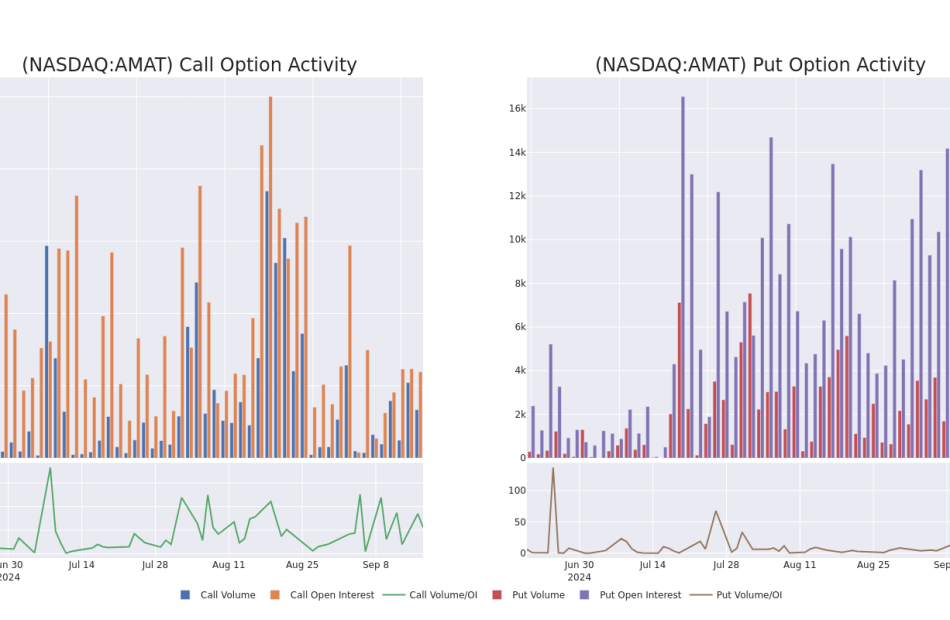

Applied Mat Unusual Options Activity

Financial giants have made a conspicuous bearish move on Applied Mat. Our analysis of options history for Applied Mat AMAT revealed 23 unusual trades.

Delving into the details, we found 34% of traders were bullish, while 65% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $231,435, and 20 were calls, valued at $2,281,061.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $260.0 for Applied Mat over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Applied Mat’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat’s whale trades within a strike price range from $150.0 to $260.0 in the last 30 days.

Applied Mat Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | TRADE | BULLISH | 10/18/24 | $8.2 | $7.95 | $8.19 | $190.00 | $818.9K | 1.2K | 130 |

| AMAT | CALL | TRADE | BULLISH | 06/20/25 | $52.6 | $52.35 | $52.6 | $150.00 | $263.0K | 228 | 50 |

| AMAT | CALL | SWEEP | BULLISH | 09/27/24 | $4.35 | $4.3 | $4.35 | $190.00 | $217.5K | 232 | 1.1K |

| AMAT | CALL | SWEEP | BEARISH | 11/15/24 | $9.3 | $9.1 | $9.1 | $200.00 | $182.0K | 1.0K | 201 |

| AMAT | PUT | SWEEP | BEARISH | 09/20/24 | $1.54 | $1.31 | $1.54 | $185.00 | $107.6K | 1.5K | 1.4K |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

Where Is Applied Mat Standing Right Now?

- Currently trading with a volume of 2,810,644, the AMAT’s price is up by 0.04%, now at $187.65.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 58 days.

Professional Analyst Ratings for Applied Mat

3 market experts have recently issued ratings for this stock, with a consensus target price of $204.0.

- Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Applied Mat with a target price of $210.

- An analyst from Citigroup persists with their Buy rating on Applied Mat, maintaining a target price of $217.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Applied Mat, targeting a price of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Applied Mat, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Underfloor Heating Market to Reach $8.1 Billion, Globally, by 2030 at 6.7% CAGR: Allied Market Research

Wilmington, Delaware , Sept. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Underfloor Heating Market by Product Type (Hydronic and Electric), System (Heating and Control), Installation (New Installations and Retrofit Installation), and End Use (Residential, Commercial and Industrial): Global Opportunity Analysis and Industry Forecast, 2024-2030″. According to the report, the underfloor heating market was valued at $5.2 billion in 2023, and is estimated to reach $8.1 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A06488

Prime determinants of underfloor heating market growth

The global underfloor heating market is experiencing growth due to several factors such as an increase in urban migration, rapid expansion of multi-story residential buildings, and stringent government regulations towards the ban of gas boilers. However, upfront cost hinders market growth. Moreover, the rapid development of the construction sector in developed and developing countries will provide opportunities for underfloor heating market growth.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2030 |

| Base Year | 2023 |

| Market Size in 2023 | $5.2 billion |

| Market Size in 2033 | $8.1 billion |

| CAGR | 6.7% |

| No. of Pages in Report | 340 |

| Segments Covered | Product Type, System, Installation, Application, and Region |

| Drivers | Stringent government regulations towards the ban of gas boilers |

| The increasing urban migration and rapid expansion of multi-story buildings |

The hydronics segment is expected to grow faster throughout the forecast period.

Based on product type, hydronics dominate the market in 2023. A hydronic underfloor heating system consists of a network of pipes running under the floor. Hot water heated by a boiler flows through the network of pipes to heat the substrate and therefore heat the room. It uses water or a mix of water and an anti-freeze substance such as propylene glycol. It can use a single source or a combination of energy sources to help manage energy costs such as combined heat and power plants heated by natural gas, fossil fuels, electricity, solar thermal, and biofuels. It is much more efficient and with much lower running costs than electric underfloor heating systems, while the initial purchase cost of the system will be significantly higher than an electric system and also require regular maintenance. The shifting trends towards the demand for improved living standards and rising awareness among people to reduce bills. Efforts of government and corporate industries towards improving air quality along with increasing demand for high level of comfort will further augment the development of the market.

Procure Complete Report (340 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/underfloor-heating-market

The heating segment is expected to grow faster throughout the forecast period.

The heating segment dominates the global underfloor heating market in 2023. Heating systems of underfloor heating consist of actuators and thermostats to provide comfort to individuals. Actuators play a major role as a gate for opening and closing to allow water to flow through each circuit. The thermostat plays a huge role in the demand for actuators while regulating the heat in the entire system. The increasing harsh climatic conditions across the globe and the need for comfort among individuals have led to the application of heating systems in residential and commercial buildings.

The new installation segment is expected to grow faster throughout the forecast period.

The new installation segment dominates the global underfloor heating market. New installation means the installation of fresh underfloor heating systems with related equipment, insulation, and other materials in the ongoing construction projects. The government initiatives to invest in the development of smart cities with green buildings in major developing and developed countries have increased the demand for new installations of underfloor heating. The development of new technologies in the heating system and control systems with an increase in the demand from customer’s living standards has increased the demand for underfloor heating. The increase in urban migration due to the rapid industrialization near the coastal areas has led to a surge in the development of the construction sector. The presence of spending power of individuals to improve living standards has a positive impact on the underfloor heating market.

The residential segment is expected to grow faster throughout the forecast period.

The residential segment dominates the global underfloor heating market. Residential is also one of the end-users, where underfloor heating equipment has surged in the market, which can be attributed to the growing awareness among individuals about the benefits brought by it. Underfloor heating can be considered to be an ideal need for new buildings and also becoming more popular for renovations because of new product innovations in this area. The rise in population and increase in the construction of residential buildings with the favorable support of government policies have a positive impact on the development of the underfloor heating market.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A06488

The Europe segment dominated the market in 2023

Europe occupies the largest part of the underfloor heating market and consists of countries such as Germany, France, the UK, Italy, Spain, and the rest of Europe. Intense R&D activities and awareness of people regarding the prospects of heating systems in the construction sector, especially in cold regions, have shown a positive impact on the growth of the underfloor heating market. The ongoing large-scale renovations and government policies regarding the ban on gas boiler installation in new homes by 2025 have stimulated the electric underfloor heating market growth. The presence of cold countries in this region, and the people’s demand for comfort in their dwelling places has increased the demand for underfloor heating systems in the forecast period. The increase in awareness among the people regarding the advantages of the radiant heat produced from underfloor heating to provide a comfortable life at a low cost is a major factor driving the growth of the market.

Leading Market Players: –

- Danfoss

- Daikin

- Emerson Electric Co.

- Honeywell

- Mitsubishi Electric Corporation

- Pentair Plc

- Robert Bosch

- Siemens

- Schneider Electric

- Thermosoft International

The report provides a detailed analysis of these key players in the underfloor heating market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Industry:

Electric Water Heater Market Size, Share, Competitive Landscape and Industry Forecast, 2021-2030

Combined Heat Power Market: Global Analysis and Industry Forecast, 2021–2030

Heat Exchanger Market Size, Share, Competitive Landscape and Trend Analysis, 2020-2030

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Web: https://www.alliedmarketresearch.com/reports-store/food-and-beverages

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Adhesion Barrier Market to Reach $1.5 Billion, Globally, by 2033 at 7.8% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Adhesion Barrier Market by Type (Synthetic Adhesion Barrier and Natural Adhesion Barrier), Application (General/Abdominal Surgeries, Gynecological Surgeries, Cardiovascular Surgeries, Orthopedic Surgeries, Neurological Surgeries and Other Applications), and End User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the adhesion barrier market was valued at $0.7 billion in 2023, and is estimated to reach $1.5 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

Request Sample of the Report on Adhesion Barrier Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A09554

Prime determinants of growth

Alarming increase in the prevalence of chronic diseases has emerged as a primary driving force behind the expansion of the adhesion barrier market. Notable increase has been witnessed in the incidence of chronic health conditions such as cardiovascular diseases, diabetes, cancer, and gastrointestinal disorders. These conditions often necessitate surgical interventions for treatment, whether for disease management, symptom alleviation, or curative purposes. Moreover, the growing number of surgical procedures performed to address chronic diseases has led to a higher incidence of post-operative complications, including the formation of adhesions. Adhesions, abnormal tissue connections that can develop between internal organs or tissues following surgery, pose significant risks to patient health and can lead to complications such as bowel obstructions, infertility, and chronic pain.

In response to the heightened awareness of these complications, there has been an increased demand for adhesion prevention products among healthcare providers and surgeons. Adhesion barriers play a crucial role in reducing the likelihood of adhesion formation post surgery, thereby minimizing patient morbidity, improving surgical outcomes, and enhancing the quality of life for individuals with chronic diseases.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2035 |

| Base Year | 2023 |

| Market Size in 2023 | $0.7 billion |

| Market Size in 2035 | $1.5 billion |

| CAGR | 7.8% |

| No. of Pages in Report | 280 |

| Segments Covered | Product Type, Application, End User, and Region |

| Drivers |

|

| Opportunities |

|

| Restraint |

Want to Explore More, Connect to our Analyst –

https://www.alliedmarketresearch.com/connect-to-analyst/A09554

Segment Highlights

The adhesion barrier market is segmented into product type, application, end user, and region. By product type, the market is divided into synthetic adhesion barrier and natural adhesion barrier. Depending on application, it is segregated into general/abdominal surgeries, gynecological surgeries, cardiovascular surgeries, orthopedic surgeries, neurological surgeries, and other applications. On the basis of end user, it is fragmented into hospitals, specialty clinics, and ambulatory surgical centers.

By product type, the synthetic adhesion barrier segment is expected to dominate market share in 2023, due to the fact that synthetic barriers are engineered to provide a controlled barrier between tissues, effectively preventing adhesion formation without interfering with the body’s natural healing processes. Their standardized composition and manufacturing processes ensure reproducible results, instilling confidence among surgeons and healthcare providers in their efficacy. Depending on application, the general/abdominal surgeries segment was the major shareholder in 2023, due to the fact that general/abdominal surgeries are associated with a higher risk of post-operative adhesion formation compared to surgeries in other body parts. On the basis of end user, the hospital segment acquired the maximum share in 2023. This is attributed to the fact that within hospital settings, a diverse array of surgical procedures is performed across various medical specialties, ranging from routine appendectomies to complex cardiac surgeries. This broad spectrum of surgeries translates to a consistent and substantial demand for adhesion prevention products to mitigate the risk of post-operative complications, including adhesions. Furthermore, hospitals possess the necessary infrastructure, resources, and skilled surgical teams to support the utilization of adhesion barriers effectively. Surgeons, nurses, and operating room staff are trained in the proper application of these products, ensuring their appropriate use during surgical procedures.

Regional Outlook

North America holds a significant share of the market, driven by advanced healthcare systems, high adoption rates of innovative medical technologies, and increasing surgical volumes. The presence of key market players and ongoing R&D activities contribute to the region’s dominance. In Europe, stringent regulatory frameworks and emphasis on patient safety propel the adoption of adhesion prevention products, particularly in countries with robust healthcare systems and high healthcare expenditure.

Asia-Pacific is witnessing rapid growth attributed to expanding healthcare infrastructure, rising prevalence of chronic diseases, and increasing demand for surgical interventions. Latin America and the Middle East & Africa are also experiencing growth driven by rising healthcare expenditure, increasing awareness about adhesion-related complications, and efforts to enhance surgical outcomes. However, the market growth in these regions may be constrained by economic challenges, healthcare disparities, and regulatory hurdles.

Key Market Players

- Integra LifeSciences Holdings Corporation

- Atrium Medical Corporation

The report provides a detailed analysis of these key players in the global adhesion barrier market. These players have adopted different strategies such as product launch, acquisition, and partnership to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A09554

Recent Developments in Adhesion Barrier Market Worldwide

- In June 2022, CGBIO launched Mediclore, an anti-adhesion agent in Indonesia. Mediclore inhibits adhesion by changing from sol to gel form by body temperature when applied to the body.

- In January 2021, Integra LifeSciences Holdings Corporation announced the acquisition of the Acell Inc.

- In October 2021, Toray Industry Inc. entered into a partnership with ASKA Pharmaceuticals Co., Ltd. to develop and commercialize adhesion barrier. Under the agreement, Toray and ASKA will jointly develop the product to obtain a marketing approval of the product in Japan. Upon the approval, Toray will manufacture the product, as ASKA will exclusively market it in Japan.

Trending Reports in Healthcare Industry:

Drug Screening Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Digital Pathology Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Antinuclear Antibody Test Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Consumer Healthcare Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meta Is Leaving Its Austin Office, Guess What Big Tech Company Is Moving In

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The office real estate picture in Austin, TX is constantly changing but one company’s loss may be another company’s gain. Meta (NASDAQ:META) is leaving behind its lease in The Domain, a mixed-use neighborhood that includes several office towers.

Meta leased Domain 12, a 15-story glass tower, but as of Jan. 1, 2026, IBM will be taking over 320,000 square feet of office space. The property includes a cafe, outdoor terraces, a fitness center and bike storage. The new lease will extend the lease maturity from 2031 to 2040.

Check It Out:

IBM has a long history with the area now called the Domain. The original 235-acre IBM research campus was sold in 1999 for $60 million and IBM leased back part of the property. IBM announced that it would be relocating to a new campus by 2027. The company was planning to lease space in OneTerra, a 507,200-square-foot office project being developed by Hines Real Estate. In a statement, IBM said, “IBM remains committed to investing in new experiences for our clients and employees in this market.”

The move is a win for Cousins Properties (NYSE:CUZ), an office REIT that owns the building. Cousins’ Domain portfolio comprises 2.5 million square feet and is currently over 99% leased. “The Domain provides a highly amenitized experience that leading companies recognize as a critical tool to drive employee recruitment, retention and culture. We are thrilled to see growing customer demand for lifestyle office properties in Austin,” said Colin Connolly, President and Chief Executive Officer of Cousins Properties.

Keep Reading:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

Meta has been changing its relationship with office properties in Austin and elsewhere. Over the past several years, it has tried to leave around one million square feet of office space in Austin. In 2022, it announced it would not be moving into the 586,000-square-foot space it leased at the recently completed Sixth & Guadalupe Tower, currently the tallest in Austin at 865 feet. Last year, the company also put 120,000 square feet at 300 West Sixth Street into the sublease pool. It still has 320,000 square feet of space at the Third + Shoal building.

Meta’s office footprint is also shrinking in Bellevue, WA, where it has leased several properties, some of which are now up for sublease. Last year, it subleased its space in Fremont, CA, to a pharmaceutical company. It listed its 435,000-square-foot space at 181 Fremont in San Francisco for sublease in 2023 and potential interested tenants have included TikTok and Zendesk.

The Austin office market has been experiencing a lot of supply coming online at the same time that many companies are reconsidering their relationship with office space. Many tech companies have at least some footprint in the booming state capital but some have been reducing or scaling back their efforts. In recent months, as much as 20% of Austin’s office space has been vacant. Deals are still getting done but are often smaller leases under 100,000 square feet as companies reconsider their relationship with large headquarters.

Invest In Texas

Ready to be part of the Texas market without having to buy or manage property? Cityfunds by Nada are city-specific portfolios of home equity investments. The portfolios contain fractional shares of unique homes in growth areas, diversified for stability. The home equity investments are obtained at below current market rates and are resilient to market interest rate fluctuations, making them a stable and attractive choice for investors, regardless of market conditions. Each city is structured as a REIT for home equity investments, allowing investors to gain exposure to the home equity market. Nada offers funds in Austin, Dallas, and Houston, making it an easy way to invest in Texas’s boom markets. Get started today.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Meta Is Leaving Its Austin Office, Guess What Big Tech Company Is Moving In originally appeared on Benzinga.com