Why AT&T Stock Was a Market-Beater Today

The broader stock market might not have had a thrilling Monday, but there was plenty of action and interest in AT&T (NYSE: T) shares. The telecom company was the subject of hot speculation in the satellite broadcasting world, and investors bid up its share price by nearly 3% on the scuttlebutt. This was more than sufficient to crush the S&P 500 index’s performance, as the indicator closed only marginally higher.

An old merger idea revived?

After market hours Friday, Bloomberg reported that AT&T and its business partner TPG are holding discussions on a merger of their DirecTV satellite unit with Dish, currently owned by EchoStar. Citing unnamed “people familiar with the matter,” the financial news agency added that the talks are currently in an early stage.

Bloomberg said that unnamed spokespeople from both DirecTV and Bloomberg declined comment. TPG and EchoStar representatives also turned down similar requests.

DirecTV and Dish are the two largest satellite TV providers in this country. A merger would create a business with roughly 20 million customers, according to Bloomberg.

This is not the first time a tie-up of the two satellite entities has been floated. In 2002, the pair attempted a merger, but the U.S. Justice Department quashed it on antitrust grounds.

It’s a streaming world these days

These are not salad days for the satellite TV industry, as it’s largely been overshadowed by streaming video. Subscription plans in the highly competitive streaming space can be very inexpensive compared to traditional pay TV offerings like satellite; presumably, a marriage of DirecTV and Dish would result in synergies that could bring down costs (and reduce those subscription rates).

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why AT&T Stock Was a Market-Beater Today was originally published by The Motley Fool

Gronk Spike? Did Rob Gronkowski Save The Stock Market? New Chart Shows Potential, But Jensen Huang Would Like A Word

Rob Gronkowski is best known for his time in the National Football League, but his recent call of timing the bottom in the stock market might be a welcome sign during the often losing month of September.

What Happened: Gronkowski offered a sense of urgency to get stock market prices back up last week after the S&P 500, which is tracked by the SPDR S&P 500 ETF Trust SPY, started the week down.

The former NFL star, who won four Super Bowls during his 11-year NFL career with the New England Patriots and Tampa Bay Buccaneers, was featured in a live television interview sharing his financial takes.

“I want to bring the stock market back. I heard it’s down right now with the election thing and everything that’s going on. So I’m here at Cantor Fitzgerald to do some trades. I want to do the biggest trades of the day and bring that stock market so it’s just moving back, you know, back up to the sky,” Gronkowski said.

Tker founder Sam Ro shared the chart below on Gronkowski’s comments and the S&P 500 move shortly after.

What followed in the days after Gronkowski spoke was the S&P 500 trading higher. The index was up Wednesday, Thursday and Friday. On Monday, the S&P 500 also traded up.

So was Gronkowski the good luck charm the stock market needed as September came in with a whimper?

Not exactly.

Wednesday saw the release of CPI data and the stock market reacted negatively with the S&P 500 going down 1.6% before finishing the day 1.1% higher, as shared by Freedom Capital Markets Chief Global Strategist Jay Woods in his weekly newsletter.

Woods said Wednesday marked the largest intraday comeback since November 2022, which he said is coincidentally “about the same time this current bull market began.”

The market strategist, like many financial experts and analysts, attributed the rally on Wednesday to positive comments from NVIDIA Corp NVDA CEO Jensen Huang while speaking at the day’s Goldman Sachs Communacopia and Technology Conference.

“That led to an 8% rally in one of the most influential stocks in the market and continued to rally the rest of the week. In fact, the semiconductor and technology sectors had their best week of the year,” Woods said.

Woods said Gronkowski timed the market “just right.”

“I’ll let the readers decide if it was more of a Jensen Huang-led rally or Gronk. Either way, the markets held the lows set a week ago Friday and finished last week at its highs.”

Did You Know?

Why It’s Important: While the chart above points to Gronkowskis’ timing, the likely reason for the stock market optimism last week was Nvidia and Huang.

Huang spoke of strong AI demand, no Blackwell (AI chip) delays and the potential return on investment for companies buying products from Nvidia.

The comments sparked optimism for Nvidia and the overall stock market.

The SPDR S&P 500 ETF is now up 4.2% from its low of $539.96 on Sept. 11. With a closing price of $562.84 on Monday (Sept. 16), the stock market index ETF is now almost even with the August closing price of $563.68.

The weak open to September could soon be a thing of the past thanks to Huang and Gronkowski.

Read Next:

Photo: Ron Gronkowski, Public Domain, Chairman of the Joint Chiefs of Staff from Washington D.C, U.S. via Wikimedia Commons; Jensen Huang via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Artificial Intelligence (AI) Colossus Nvidia Plummet 98%?

For the better part of two years, no trend has excited investors more on Wall Street than the rise of artificial intelligence (AI).

The lure of AI is twofold. First, there’s the ability for AI-driven software and systems to learn over time without human intervention. The capacity for software and systems to become more proficient at their tasks, or perhaps even learn new jobs/skill sets, gives this technology utility in almost every sector and industry around the globe.

The other reason investors can’t seem to get enough of AI stocks is the eye-popping addressable market attached to this game-changing technology. According to the researchers at PwC, AI is forecast to add $15.7 trillion to the global economy by 2030, with these gains coming from a combination of consumption-side benefits and productivity improvements.

With a seemingly limitless ceiling for AI and an addressable market that dwarfs pretty much every other next-big-thing innovation for three decades, it’s not a surprise to see investors flock to AI colossus Nvidia (NASDAQ: NVDA). Just be mindful that not everyone on Wall Street expects Nvidia to maintain its lofty valuation.

Nvidia’s ascent has been virtually textbook

When 2022 came to a close, Nvidia had a $360 billion market cap and was an important, but not critical, company in the tech sector. Less than 18 months later, it briefly became the largest publicly traded company in the world, with a peak market cap of $3.46 trillion.

Nvidia’s historic gains are a reflection of the otherworldly demand for its H100 graphics processing unit (GPU) used in high-compute data centers. Based on estimates from the analysts at TechInsights, Nvidia has accounted for a roughly 98% share of the GPUs shipped to data centers in 2022 and 2023. In other words, its hardware is being relied on as the undisputed preferred choice for training large language models (LLMs) and running generative AI solutions.

In addition to its hardware being in high demand, Nvidia’s CUDA software platform is doing its part to keep enterprises loyal to its ecosystem of products and services. CUDA is the toolkit developers use to build LLMs and maximize the computing capacity of their Nvidia GPUs.

There’s also plenty of excitement surrounding future innovation. Nvidia’s next-generation Blackwell chip, which will be far more energy-efficient than its predecessor, is set for its debut in the coming months. CEO Jensen Huang also teased the release of his company’s Rubin GPU architecture in 2026, which will run on a new processor, known as Vera. Investing in innovation makes it likely that Nvidia will maintain its No. 1 spot in terms of AI-GPU computing capacity.

Despite this array of positives, big-time Nvidia bears do exist.

Could Nvidia plunge 98%?

Perhaps no Nvidia skeptic has been more vocal on Wall Street than financial writer and economist Harry Dent.

In an interview with Fox News Digital in June, Dent highlighted that the mammoth increase in money supply has set the U.S. economy and stock market up for disaster. He referred to the current market as the “bubble of all bubbles,” with Nvidia expected to be a victim of an upcoming crash. Dent pegged Nvidia’s potential decline at 98%. Dent further opined,

This bubble has been going for 14 years. Instead of most bubbles [going] five to six, it’s been stretched higher, longer. So you’d have to expect a bigger crash than we got in 2008 to ’09.

As an Nvidia bear myself, I don’t expect it to come anywhere close to a 98% downdraft.

Although we have witnessed a couple of next-big-thing market leaders eventually plummet by 98%, including Canopy Growth following the hype in cannabis stocks, and 3D Systems, which has lost just shy of 98% of its value after 3D-printing buzz failed to materialize, a 98% peak-to-trough loss for a market leader is rare.

Furthermore, Nvidia had other established sales channels in place prior to its AI revenue windfall. It’s a leading provider of GPUs used in gaming and cryptocurrency mining, and should enjoy steady gains from its virtualization software segment. While these now-ancillary operations won’t offset substantial weakness if the AI bubble were to burst, they’d almost certainly keep Nvidia from losing 98% of its value.

But even though a 98% decline isn’t in the cards, a sizable drop that could extend beyond 75% is quite possible.

Dent is right about one thing: History

Although Harry Dent’s call for a 98% plunge in Nvidia may be out in left field, he did hit the nail right on the head when discussing history. While history doesn’t repeat to a “t” on Wall Street, it does have a tendency to rhyme.

Since the advent of the internet roughly three decades ago, every highly touted innovation, technology, and trend has worked its way through an early stage bubble-bursting event. Though the timing of when the music stops will differ in every instance, the end result is always the same — market leaders getting pummeled.

Without fail, investors overestimate the utility and uptake of game-changing innovations and technologies. While artificial intelligence appears to have a bright long-term future, the fact that most businesses lack a well-defined game plan to profit in the near-term from their AI investments is a pretty clear indication that investor expectations are vastly outpacing real-world utility. In other words, it points to the formation of an AI bubble.

The vast majority of market-leading businesses for game-changing innovations over the last 30 years have shed 75% or more of their value on a peak-to-trough basis.

There are other potential concerns, too. For instance, insiders have been selling stock for 45 months without a single insider purchase. Though there are benign reasons for selling stock, such as for tax purposes, there’s only one reason to purchase shares on the open market — you think they’ll increase in value. No insider has bought shares of Nvidia on the open market since Chief Financial Office Colette Kress in December 2020.

It’s also logical to expect Nvidia’s monopoly like AI-GPU market share to come under pressure in the quarters that lie ahead. The interesting thing is that internal competition might be even more worrisome than the AI-GPUs its rivals are bringing to market.

Nvidia’s four largest customers by net sales are all internally developing AI-GPUs for use in their data centers. Even with Nvidia’s chips having superior computing capacity, these four customers will likely be incented to utilize their own hardware over Nvidia’s. This is a recipe for fewer orders in the future.

Although a 98% decline is highly unlikely for Nvidia, a steep drop still appears very likely.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends 3d Systems. The Motley Fool has a disclosure policy.

Will Artificial Intelligence (AI) Colossus Nvidia Plummet 98%? was originally published by The Motley Fool

Recent Price Trend in Recruit Holdings Co. is Your Friend, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Recruit Holdings Co., Ltd.

RCRRF is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. RCRRF is quite a good fit in this regard, gaining 24.3% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 15.2% over the past four weeks ensures that the trend is still in place for the stock of this company.

Moreover, RCRRF is currently trading at 97% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in RCRRF may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

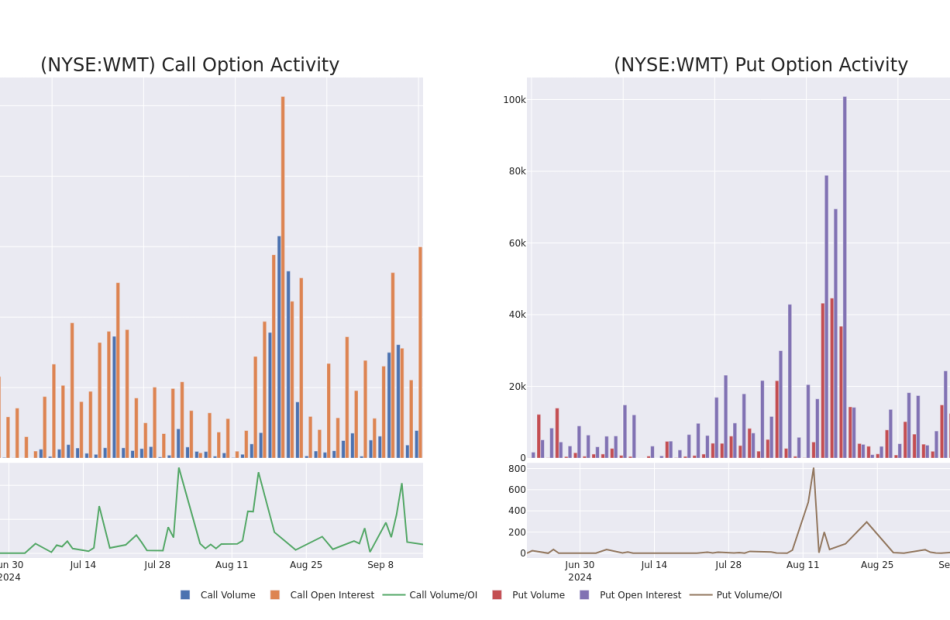

Walmart Unusual Options Activity For September 16

Deep-pocketed investors have adopted a bearish approach towards Walmart WMT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WMT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 52 extraordinary options activities for Walmart. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 28% leaning bullish and 55% bearish. Among these notable options, 11 are puts, totaling $538,393, and 41 are calls, amounting to $2,894,884.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $46.67 to $115.0 for Walmart over the recent three months.

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walmart’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walmart’s whale trades within a strike price range from $46.67 to $115.0 in the last 30 days.

Walmart Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | TRADE | BEARISH | 03/21/25 | $22.15 | $21.95 | $22.02 | $60.00 | $220.2K | 481 | 330 |

| WMT | CALL | SWEEP | BULLISH | 03/21/25 | $22.5 | $21.95 | $21.95 | $60.00 | $219.5K | 481 | 130 |

| WMT | CALL | TRADE | BULLISH | 01/17/25 | $21.6 | $21.6 | $21.6 | $60.00 | $216.0K | 6.2K | 251 |

| WMT | CALL | SWEEP | BULLISH | 01/17/25 | $21.65 | $21.35 | $21.53 | $60.00 | $215.3K | 6.2K | 151 |

| WMT | CALL | TRADE | BULLISH | 01/17/25 | $21.5 | $21.5 | $21.5 | $60.00 | $215.0K | 6.2K | 451 |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Having examined the options trading patterns of Walmart, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Walmart

- Trading volume stands at 15,333,543, with WMT’s price down by -0.05%, positioned at $80.56.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 59 days.

Expert Opinions on Walmart

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $85.0.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Walmart with a target price of $80.

- An analyst from Jefferies has decided to maintain their Buy rating on Walmart, which currently sits at a price target of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walmart options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

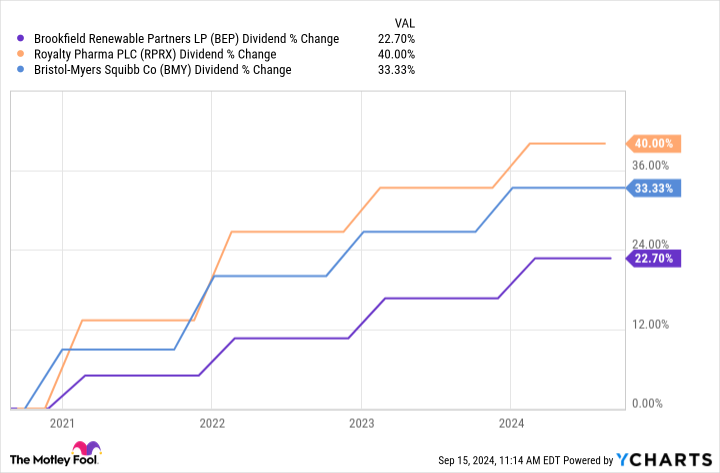

3 High-Yield Dividend Stocks Down by More Than 39% to Buy Now and Hold at Least a Decade

With the major stock market indices up near all-time highs, finding stocks that pay satisfying dividend yields isn’t nearly as easy as it used to be. Before you give up, though, consider Brookfield Renewable Partners (NYSE: BEP), Royalty Pharma (NASDAQ: RPRX), and Bristol Myers Squibb (NYSE: BMY).

Since 2020, these three dividend payers have increased their quarterly payouts between 22.7% and 40% higher. Despite the increased payments, their stock prices are way down from the all-time highs they reached in 2021.

Rising dividend payments coupled with sinking share prices is a recipe for high yields. At recent prices, these stocks offer dividend yields that are way above average. Here’s why investors can look forward to steadily climbing payouts from these three exceptional stocks for at least another 10 years.

Brookfield Renewable Partners

If you’re looking for businesses that can steadily raise their payouts, the utilities sector is right up your alley. Instead of focusing on fossil fuels, though, consider Brookfield Renewable Partners. At recent prices, it offers a 5.4% dividend yield. That’s more than four times the average yield of dividend payers in the benchmark S&P 500 index.

The stock is down about 37% from an all-time high it reached a few years ago, but its dividend payout is up by about 22.7% since 2020. At recent prices, it offers a juicy 5.4% yield.

As its name implies, Brookfield Renewable invests in sources of hydroelectric, wind, solar, and nuclear power. Investors seeking a steadily growing source of income love this stock because its customers tend to sign contracts that last decades and include inflation-adjusted rate increases.

In addition to steadily climbing demand for electricity from consumers, Brookfield Renewable investors can look forward to steady gains driven by a long development pipeline for corporate customers. In the second quarter alone, it inked agreements to deliver an additional 2,700 gigawatt hours per year of generation, around 90% of which was contracted to corporate customers.

Royalty Pharma

Sales for individual products can be highly unpredictable, but overall spending on prescription drugs is rising steadily. Americans spent $405 billion on prescription drugs in 2022, which was 8.4% more than they spent a year earlier.

With a financial stake in more than 35 commercial-stage products, Royalty Pharma is arguably the safest way to bet on steadily rising demand for new drugs.

Shares of Royalty Pharma are down about 38% from the all-time high they reached in 2021 even though its dividend payout has risen by 40% since 2020. At recent prices, the stock offers a 3% dividend yield.

This specialty financier’s recent results are a lot more encouraging than you’d expect after looking at its stock chart. Second-quarter royalty receipts jumped 11% higher year over year. The company expects royalty receipts to reach at least $2.7 billion this year, or 9% more than it reported last year.

Royalty Pharma isn’t resting on the 35 commercial-stage products that are already generating revenue. In the first half of 2024, the company announced about $2 billion worth of new transactions. They can’t all be zingers, but there are probably enough blockbusters in its rapidly growing portfolio to keep pushing its needle forward in the decade ahead.

Bristol Myers Squibb

Shares of Bristol Myers Squibb, a pharma giant more than a century old, have fallen about 39.4% from their peak a few years ago. The stock is down even though the company has raised its dividend every year since 2009.

A rapidly growing portfolio will allow Bristol Myers Squibb to raise its dividend in the years ahead, too. In the first half of 2023, five drugs in Bristol Myers Squibb’s portfolio rose more than 10% year over year. The company is also recording sales for three new cancer therapies that earned approval from the FDA in 2024. Breyanzi is a cellular therapy for advanced lymphoma, Krazati is a targeted colon cancer treatment, and Augtyro is approved to treat just about anyone with solid tumors driven by an NTRK gene mutation.

Any day now, Bristol Myers Squibb could also receive a green light for a highly anticipated anti-psychotic treatment called KarXT. If approved, it will be the first anti-psychotic drug that doesn’t act on dopamine receptors. With far fewer side effects that make adherence to recommended dosage schedules a challenge, KarXT sales are expected to top $10 billion annually at their peak.

Bristol Myers Squibb’s dividend raises in recent years haven’t been small ones. The drugmaker’s quarterly payout is up by 46% since 2019. At recent prices, the stock offers a big 4.9% dividend yield. With a large slate of recently launched drugs, and potential blockbusters in late-stage development, this company could keep raising its payout for another 15 years.

Should you invest $1,000 in Brookfield Renewable Partners right now?

Before you buy stock in Brookfield Renewable Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks Down by More Than 39% to Buy Now and Hold at Least a Decade was originally published by The Motley Fool

Tecnoglass Is a Great Choice for 'Trend' Investors, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Tecnoglass

TGLS is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. TGLS is quite a good fit in this regard, gaining 56.6% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 13.4% over the past four weeks ensures that the trend is still in place for the stock of this architectural glass maker.

Moreover, TGLS is currently trading at 97.1% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in TGLS may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood's Monday Maneuvers: Ark Invest Continues To Offload Robinhood And Palantir Shares

On Monday, Cathie Wood-led Ark Invest made significant trades, with Robinhood Markets Inc HOOD and Palantir Technologies Inc PLTR being the most prominent.

The HOOD Trade: Ark Invest’s Ark Fintech Innovation ETF ARKF fund sold 18,961 shares of Robinhood in a trend that continues from the previous week. This move follows Robinhood’s recent agreement to a $3.9 million settlement with California’s Department of Justice over its past ban on Bitcoin BTC/USD cryptocurrency withdrawals.

Despite this, Robinhood has been transitioning from a meme stock trading platform to a more mature and competitive player against traditional brokerages. Based on Robinhood’s closing price of $22.21 on the same day, the value of the trade is approximately $421,123.

The PLTR Trade: Ark Invest’s ARK Innovation ETF ARKK fund sold 4,407 shares of Palantir. The firm had been offloading Palantir shares last week as well.

This sale after Palantir’s stock soared by 14.08% following the announcement that the company will join the S&P 500 index. Based on Palantir’s closing price of $36.31 on the same day, the value of the trade is approximately $160,018.

Other Key Trades:

- Ark Invest’s ARKG fund bought shares of Guardant Health Inc (GH).

- Ark Invest’s ARKG fund sold shares of Veracyte Inc (VCYT). Ark Invest’s ARKK fund bought shares of Shopify Inc (SHOP).

- Ark Invest’s ARKK fund sold shares of Roku Inc (ROKU). Ark Invest’s ARKQ fund sold shares of Materialise NV (MTLS).

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morgan Stanley lays out the stock market's best-case scenario for this week's Fed decision — and 2 areas to buy after the cut

-

Ideally the Fed will cut rates by a half-point without triggering growth worries, Morgan Stanley says.

-

CIO Mike Wilson noted that the bond market is acting like the Fed is behind the curve.

-

He said defensive and quality stocks are worth owning after the rate cut on Wednesday.

Wall Street is bracing for a pivotal interest-rate-cut announcement on Wednesday, and there’s still uncertainty around how far the Federal Reserve will go.

As of Monday morning, the CME FedWatch tool showed the market is pricing in a 59% chance of a 50-basis-point cut. According to new research from Morgan Stanley, that would be the best possible outcome for stocks. But there’s a caveat: it has to cut a half-point and keep the market from worrying about economic growth.

“In the very short-term, we think the best case scenario for equities this week is that the Fed can deliver a 50bp rate cut without triggering either growth concerns or any remnants of the yen carry trade unwind—i.e., purely an “insurance cut” ahead of macro data that is assumed to stabilize,” chief investment officer Mike Wilson wrote in a Monday note.

In the months leading to the Federal Reserve’s policy meeting this week, deteriorating labor data has persuaded investors that the central bank needs to start reducing borrowing costs to avert an economic cooldown.

In Morgan Stanley’s view, the Fed might want to cut by 50 basis points, as the bond market indicates that monetary policy is behind the curve: if interest rates stay for higher for longer, they risk rupturing something in the economy.

At the same time, some analysts have noted that an aggressive cut could be the Fed’s way of acknowledging trouble in the economy.

Ahead of the rate cut, Morgan Stanley suggested that investors increase exposure to two stock cohorts that have historically outperformed in similar environments: defensive and high-quality.

Part of the reason is due to rising growth concerns. Although the S&P 500 index is signaling high conviction that the Fed will deliver a soft landing and 15% earnings-per-share growth into 2025, market internals show a different story: investors are piling into defensive stocks in fear of a deceleration.

In this context, the performance defensive over cyclicals has been the strongest since the last recession, Wilson noted. Defensive stocks include sectors such as utilities and consumer staples — groups that are less reliant on macroeconomic conditions to perform well.

“Defensives tend to outperform cyclicals fairly persistently both before and after the cut. Large caps also tend to outperform small caps both before and after the Fed’s first rate cut. These last 2 factor dynamics are supportive of our defensive and large cap bias as Fed cuts often come in a later cycle environment,” Morgan Stanley said.

Read the original article on Business Insider

GTLB Class Action Alert – Shareholder Rights Law Firm Robbins LLP Reminds Stockholders of the Lead Plaintiff Deadline in the GitLab Inc. Class Action Lawsuit

SAN DIEGO, Sept. 16, 2024 (GLOBE NEWSWIRE) —

Robbins LLP reminds investors that a shareholder filed a class action on behalf of all investors who purchased or otherwise acquired GitLab Inc. GTLB securities between June 6, 2023 and March 4, 2024. GitLab is a global software company that designs and develops software solutions.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that GitLab Inc. (GTLB) Misled Investors Regarding Demand for its Product

According to the complaint, during the class period, defendants created the false impression that they possessed reliable information pertaining to the Company’s ability to develop and incorporate AI throughout the software development cycle to optimize code generation thereby increasing market demand and making all levels of software development more affordable and properly monetizing its AI features. In truth, there was weak market demand for Gitlab’s touted AI features and the Company was incurring an increasing amount of expenses involving JiHu, its joint venture in China, as well as the annual company-wide summit. Defendants misled investors by continually highlighting its AI-driven innovations to develop software more efficiently and drive market share demands.

Plaintiff alleges that on March 4, 2024, GitLab issued a press release reporting strong Q1 2024 results and then immediately followed this with a disclosure announcing lower than expected full-year guidance for 2025. GitLab attributed it to time needed to “build pipeline and close deals on new products.” On this news, the price of GitLab’s common stock declined from $74.47 per share on March 4, 2024, to $58.84 per share on March 5, 2024, a decline of about 21%.

What Now: You may be eligible to participate in the class action against GitLab Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by November 4, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against GitLab Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0b88c72f-afbc-4f12-932d-44bb72bd4f8d

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.