Stellantis N.V. Stock News – STLA Stockholders Should Contact Robbins LLP for Information About the Class Action Lawsuit

SAN DIEGO, Sept. 16, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities that purchased or otherwise acquired Stellantis N.V. STLA securities between February 15, 2024 and July 24, 2024. Stellantis designs, engineers, manufactures, distributes, and sells vehicles across five portfolios: (i) luxury vehicles under the Maserati brand; (ii) premium vehicles covered by Alfa Romeo, DS and Lancia brands; (iii) global sport utility vehicles under the Jeep brand; (iv) American brands covering Dodge, Ram; and Chrysler vehicles and (v) European brands covering Abarth, Citroën, Fiat, Opel, Peugeot and Vauxhall vehicles.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Stellantis N.V. (STLA) Misled Investors Regarding its Business Prospects

According to the complaint, defendants provided investors with material information regarding Stellantis’ expected revenue for the full year 2024. Defendants’ statements included, among other things, Stellantis’ reduction of inventory levels, pricing improvements, and expansion of its product offering thereby supporting defendants’ decision to forecast double-digit adjusted operating income (AOI) margin in 2024, as well as positive industrial free cash flow. At the same time, defendants concealed material adverse facts concerning the Company’s inventory levels, pricing, and market share stabilizations. Defendants issued a press release on July 25, 2024, announcing the Company’s financials for the first half of 2024, which missed consensus and were expecting a disappointing “near – term outlook.” On this news, the price of Stellantis’ common stock declined from $19.60 per share on July 24, 2024, to $17.66 per share on July 26, 2024.

What Now: You may be eligible to participate in the class action against Stellantis N.V. Shareholders who want to serve as lead plaintiff for the class must file their papers with the court by October 15, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Stellantis N.V. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/53c833f9-716f-4f92-8b1c-1b5038fc152a

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inflatable Boat Market is Set to Reach US$ 3.04 Billion by 2034 with a 3.9% CAGR Growth | Fact.MR Report

Rockville, MD, Sept. 16, 2024 (GLOBE NEWSWIRE) — The global inflatable boat market, estimated to be valued at US$ 2.07 billion in 2024, is forecasted to expand at a CAGR of 3.9% from 2024 to 2034. Inflatable boats, generally referred to as dinghies or inflatables, have undergone a significant spike in popularity over recent years. These boats provide the ideal balance of ease and versatility, serving a wide range of marine applications due to their lightweight, portable construction and inflatable chambers.

The market for inflatable boats has considerable potential opportunities over the longer-term forecast period due to the rise in recreational boating, as well as the growing popularity of pontoon boats and saltwater fishing vessels. Because they can be quickly deployed, inflatable boats were originally designed for use in rescue and military activities, but they are now used in many other industries. Their influence is growing, ranging from recreational pursuits like diving, fishing, and family vacations to more serious uses like law enforcement and environmental conservation.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9752

Key Takeaways from Market Study:

- The global inflatable boat market has been calculated at US$ 2.07 billion for 2024.

- Demand for inflatable boats is projected to rise at a CAGR of 3.9% from 2024 to 2034.

- The market is projected to reach US$ 3.04 billion by 2034-end.

- The market in East Asia is forecasted to expand at a CAGR of 4.7% through 2034.

- Sales of rigid inflatable boats are projected to increase at a CAGR of 4.3% through 2034.

- North America is projected to account for 33.4% share of the global market by 2034.

“Key factors driving inflatable boat sales growth are an increase in spending by consumers on water sports and leisure activities, the use of inflatable boats for disaster management activities, and government norms making it compulsory for all passenger vessels carriers to have enough inflatable boats in proportion to the number of passengers on board,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Inflatable Boat Market:

AB Inflatables, Ribcraft USA LLC, Zodiac Nautic, Walker’s Bay, Damen Shipyard, Maxxon Pontoons, Grand Boats Sweden, Cardinal Boats

Convenient Portability of Inflatable Boats Revolutionizing Water Travel:

Since countries frequently lack sufficient safety equipment in an emergency, the adoption of inflatable boats for disaster management operations is projected to be a significant driver for the market. One of the key benefits of inflatable boats is their portability. Unlike traditional hard-hull boats, inflatables are simply deflated, packed, and moved in a car or stored, disproving the need for boat trailers or large storage facilities. For those who live in cities or have little storage, this feature is quite helpful. Because of their lightweight construction, which makes them workable for one person, they are also preferred by solo travelers.

- For example, during the August 2019 floods in Kerala, India, the state had very few inflatable boats grouped in a few districts, which caused a delay in search and rescue efforts.

Inflatable boats have been observed to be widely accepted in several rescue missions.

Inflatable Boat Industry News:

Leading producer of rigid inflatable boats, Zodiac, announced a strategic relationship with eOPEN in August 2021 to include electric boats in its product line.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9752

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the inflatable boat market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on type (rigid inflatable boats, soft inflatable boats), material (PVC, polyurethane, Hypalon/CSM), floor (fiberglass, aluminum, wood, air floor), and application (leisure, professionals & sports, maritime security), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Jet Boat Market: Jet boat offers a lot of seating space along with a swimming platform. The market is anticipated to grow with a CAGR of 5% during the forecast period.

Boat Lights Market: The global boat lights market is anticipated to reach a valuation of US$ 548.5 million in 2022 and is further forecast to surpass US$ 1.07 billion by the end of 2032, expanding at a high CAGR of 6.9% from 2022 to 2032.

Boat Steering System Market: Worldwide revenue from boat steering system sales is estimated at US$ 1.47 billion in 2024 and is projected to increase at a CAGR of 8.9% to reach US$ 3.45 billion by the end of 2034.

Ship/boat Keel Market: The ship/boat keel is basically a flat blade sticking down into the water from a ship or boat bottom. Ship/boat keel has two functions – keel prevents the boat from being blown sideways by the wind, and holding the ballast that keeps the ship/boat right-side up. The two popular choices of material for ballast ship/boat keels are lead and iron.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'This Economy Doesn't Need A Strong Rate Cut To Keep On Growing,' Says Economist Ahead Of FOMC Meeting

The U.S. economy is not in need of a substantial rate cut to maintain its growth, according to Carl Weinberg, Chief Economist at High Frequency Economics.

What Happened: Weinberg discussed the state of the U.S. economy and the Federal Reserve’s monetary policy decisions, in a recent interview with CNBC.

Weinberg stated that the U.S. economy doesn’t require a significant rate cut to continue growing.

“This economy doesn’t need a strong rate cut to keep on growing. It needs care and maintenance. It doesn’t need drastic treatment,” he said.

He highlighted that the U.S. economy is not contracting and job creation is steady, with approximately 117,000 jobs added per month over the last quarter. The consumer sector also remains robust.

While Weinberg acknowledged a case for easing monetary conditions, he doesn’t see a strong case for an emergency cut of 50 basis points. Instead, he suggested a more modest cut of 25 basis points is more likely.

Why It Matters: These comments come at a time when the Federal Reserve is considering monetary policy decisions amidst a slowing, yet still growing, economy. The Federal Reserve was set to cut the federal funds rate for the first time in over four years, with the size of the cut being a subject of debate.

Investors and speculators were leaning towards a larger 50-basis-point cut, with a 65% probability of such a cut being priced into Fed futures. This was a significant increase from just 30% a week prior.

Simultaneously, as the Federal Reserve prepared to cut interest rates, advisors and wealth managers were reassessing their fixed-income strategies. They were adjusting their bond and income portfolios to capitalize on current yields and protect against future market shifts.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Has Nearly 50% of Berkshire Hathaway's Investable Portfolio in 1 Incredibly Safe Bet

Warren Buffett is regarded as one of the greatest investors of all time, and he has the track record to justify that view.

Between when he took control of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) in 1965 and the end of last year, it produced compound annualized returns of 19.8% for shareholders. That’s nearly twice the 10.2% average total return of the S&P 500 in that time. But it’s when that growth rate gets compounded over time — 58 years in this case — that the performance gap becomes truly remarkable. Over that span, Berkshire’s total return has been 140 times that of the index.

So, when Buffett makes changes in Berkshire’s investment portfolio, the whole investing world pays attention. And he has been rapidly amassing a position in one super-safe investment — a position that is approaching 50% of the company’s entire investment portfolio.

Buffett’s biggest bets

Buffett has never been one to shy away from investing a lot of money into a single idea.

For example, he put a lot of money into Apple (NASDAQ: AAPL) between 2016 and 2018, spending around $36 billion on that stock over the period. At one point, Berkshire Hathaway’s Apple stake grew to become about 50% of its equity portfolio, but Buffett has been selling the stock lately. His $75 billion sale of Apple stock during the second quarter cut Berkshire’s remaining position nearly in half.

Buffett’s stated reasoning for that move was that he wanted to take advantage of the current corporate tax rate. Under the 2017 tax law that cut corporate tax rates to their current level, the cuts are set to expire at the end of 2025, so he naturally expects them to increase in 2026 and beyond. But Buffett’s decision to trim his Apple stake also suggests he views the shares as fairly valued or at best, only slightly undervalued relative to their intrinsic value. It wouldn’t make sense to sell an asset well below its value to save on taxes.

Another big Berkshire stock holding is Bank of America (NYSE: BAC). Buffett acquired the stake in Bank of America through warrants he acquired by investing in preferred shares of the stock in 2011. That allowed him to buy a lot of common stock in 2017 at the bargain price of $7.14 per share. He then proceeded to add onto that holding.

Although Bank of America was once Buffett’s second-largest holding, he’s started selling shares of it too. Since the start of the third quarter, he’s sold $7.2 billion worth of the bank stock. His reasoning appears to be the same as his reasoning behind Apple: Better to pay the taxes on Berkshire’s profits now before the current low corporate tax rate expires. For reference, Buffett’s average selling price for Bank of America stock recently has been more than $40 per share, nearly six times what he paid for it.

Apple and Bank of America aren’t the only stocks Buffett’s been selling recently. In fact, he’s sold more stock than he bought in each of the past seven quarters, and based on his Bank of America sales in Q3, it looks like it will soon officially be two full years of consistent net selling for Buffett.

But he has to do something with the proceeds of all those stock sales. And Buffett has been piling the money into a super safe investment that’s approaching 50% of his total investment portfolio.

Buffett’s $300 billion bet

As Buffett sells stocks, he’s been putting the funds into a very specific investment: short-term Treasury bills. These are Treasury bonds that mature within one year. Buffett prefers those maturing within six months or less. Through the first six months of 2024, Berkshire Hathaway padded its Treasury holdings by $94 billion.

The company held a total of $277 billion in Treasury bills and cash as of the end of the second quarter. Even as Buffett has sold shares, Berkshire’s core operations continue to produce operating cash flow of roughly $12 billion to $13 billion each quarter. On top of that, Berkshire will collect roughly $3.5 billion in interest from the Treasuries it already holds. Add it all up, and Berkshire’s position in short-term Treasury bills is rapidly approaching $300 billion (assuming Buffett hasn’t found a great company to buy in the last 2 1/2 months).

For reference, based on publicly available reports, Berkshire’s equity portfolio is worth just over $300 billion as of this writing. That means Buffett’s Treasury position could be almost half of Berkshire’s investment portfolio.

It’s important to note Buffett prefers short-term Treasury bills; he won’t invest in longer-dated government bonds. “We continue to believe that maintaining ample liquidity is paramount and we insist on safety over yield with respect to short-term investments,” Buffett wrote in Berkshire’s latest quarterly report. Bonds with longer maturities usually provide higher yields, but come with more interest-rate risk. If market rates increase, the values of those bonds will decrease more than shorter maturity securities.

Buffett has been getting the best of both worlds recently. The inverted yield curve led to higher yields for short-term bonds compared to long-term bonds. But with the Federal Reserve set to start lowering interest rates shortly, short-term yields should fall faster than long-term yields, ultimately resulting in much less interest income for Berkshire Hathaway.

While Buffett suggested he’s fine with holding hundreds of billions in Treasuries right now regardless of yield during Berkshire’s shareholder meeting earlier this year, he may find alternatives more attractive as rates come down.

Should you follow Buffett?

Buffett is in charge of a $1 trillion conglomerate with investable assets that exceed $600 billion — even more if you include the insurance float available to him for investment. The number of investments that could meaningfully move the needle for Berkshire Hathaway is relatively small.

On that score, the average retail investor is in a much more advantageous position. The entire investment universe is at their disposal. Buffett’s actions and asset allocation suggest there aren’t as many bargains in the stock market as there once were, but there are still plenty of great stocks to buy in the current environment.

Although the yield on cash savings right now may be more attractive than it has been in a long time, long-term investments in stocks have consistently produced the highest returns. Trying to time the market and pick just the right time to deploy a lot of cash is not a feat most individual investors should attempt. Even Buffett suggests that people should add to their investments during every market environment (bullish or bearish), spreading out their stock buys over time, and remaining consistent with their purchases.

It can sometimes be hard to resist the temptation to follow Buffett’s lead, but it’s important to remember that he’s playing a slightly different game than the average investor.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Has Nearly 50% of Berkshire Hathaway’s Investable Portfolio in 1 Incredibly Safe Bet was originally published by The Motley Fool

ZI Class Action Alert – Shareholder Rights Law Firm Robbins LLP Reminds Stockholders of the Lead Plaintiff Deadline in the ZoomInfo Technologies, Inc. Class Action Lawsuit

SAN DIEGO, Sept. 16, 2024 (GLOBE NEWSWIRE) —

Robbins LLP informs investors that a shareholder filed a class action on behalf of all purchasers of ZoomInfo Technologies, Inc. ZI Class A common stock between November 10, 2020 and August 5, 2024. ZoomInfo is a software and data company that provides customer analytics and intelligence to sales and marketing teams.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that ZoomInfo Technologies, Inc. (ZI) Misled Investors Regarding Demand for its Product

According to the complaint, during the class period, defendants failed to disclose to investors: (a) that ZoomInfo’s financial and operational results during the Class Period had been temporarily inflated by the ephemeral effects of the COVID-19 pandemic, which had pulled-forward demand for the Company’s database of digital contact information; (b) that material portions of ZoomInfo’s existing customer base were attempting to either substantially reduce their use of the Company’s product or abandon it altogether; (c) that ZoomInfo had used manipulative and coercive auto-renew policies and threats of litigation to force customers into remaining with the Company for an additional contractual term even though they did not want to; (d) that ZoomInfo’s coercive customer retention tactics had materially damaged the Company’s customer relationships, client franchise, and competitive advantages, and created a hidden demand cliff for costumer contract renewals in future periods; (e) that ZoomInfo’s reported accounts receivable were materially comprised of debts owed by high-risk small business customers that had a high likelihood of non-payment and had been induced to transact with the Company through a credit program the Company implemented in 2022; (f) that ZoomInfo’s allowance for credit losses was materially inadequate and understated the risk of non-payments by the Company’s customers; and (g) that as a result of (a)–(f), above, ZoomInfo’s reported revenues, operating income, and customer and retention metrics were materially overstated.

As a result, the price of ZoomInfo Class A common stock declined from a class period high of over $79 per share to just $8 per share by the end of the class period, a 90% decline. Further, Defendants, sold billions of dollars’ worth of ZoomInfo stock at artificially inflated prices before the truth was revealed.

What Now: You may be eligible to participate in the class action against ZoomInfo Technologies, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by November 4, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against ZoomInfo Technologies, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1cfa0f39-b1c3-45c9-81de-ad0d12d01698

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lument Finance Trust, Inc. Declares Quarterly Cash Dividends for its Common and Preferred Stock

NEW YORK, Sept. 16, 2024 /PRNewswire/ — Lument Finance Trust, Inc. LFT (“LFT” or the “Company”) announced the declaration of a cash dividend of $0.08 per share of common stock with respect to the third quarter of 2024. The dividend is payable on October 15, 2024, to common stockholders of record as of the close of business on September 30, 2024.

The Company also announced the declaration of a cash dividend of $0.4921875 per share of 7.875% Cumulative Redeemable Series A Preferred Stock. The dividend is payable on October 15, 2024, to preferred stockholders of record as of the close of business October 1, 2024.

About LFT

LFT is a Maryland corporation focused on investing in, financing and managing a portfolio of commercial real estate debt investments. The Company primarily invests in transitional floating rate commercial mortgage loans with an emphasis on middle-market multi-family assets. LFT is externally managed and advised by Lument Investment Management, LLC, a Delaware limited liability company.

Additional Information and Where to Find It

Investors, security holders and other interested persons may find additional information regarding the Company at the SEC’s Internet site at http://www.sec.gov/ or the Company website www.lumentfinancetrust.com or by directing requests to: Lument Finance Trust, 230 Park Avenue, 20th Floor, New York, NY 10169, Attention: Investor Relations.

Forward Looking Statements

Certain statements included in this press release constitute forward-looking statements intended to qualify for the safe harbor contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended. Forward-looking statements are subject to risks and uncertainties. You can identify forward-looking statements by use of words such as “believe,” “expect,” “anticipate,” “project,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” “will,” “seek,” “would,” “could,” or similar expressions or other comparable terms, or by discussions of strategy, plans or intentions. Forward-looking statements are based on the Company’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company on the date of this press release or the date on which such statements are first made. Actual results may differ from expectations, estimates and projections. You are cautioned not to place undue reliance on forward-looking statements in this press release and should consider carefully the factors described in Part I, Item IA “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which is available on the SEC’s website at www.sec.gov, and in other current or periodic filings with the SEC, when evaluating these forward-looking statements. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control. Except as required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lument-finance-trust-inc-declares-quarterly-cash-dividends-for-its-common-and-preferred-stock-302249474.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lument-finance-trust-inc-declares-quarterly-cash-dividends-for-its-common-and-preferred-stock-302249474.html

SOURCE Lument Finance Trust, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ThredUp And 2 Other Stocks Under $2 Executives Are Buying

The Dow Jones index closed higher by around 300 points on Friday. When insiders purchase or sell shares, it indicates their confidence or concern around the company’s prospects. Investors and traders interested in penny stocks can consider this a factor in their overall investment or trading decision.

Below is a look at a few recent notable insider transactions for penny stocks. For more, check out Benzinga’s insider transactions platform.

P3 Health Partners

- The Trade: P3 Health Partners Inc. PIII 10% owner CPF III-A PT SPV, LLC bought a total of 160,000 shares at an average price of $0.51. To acquire these shares, it cost around $81,552.

- What’s Happening: On Aug. 7, P3 Health Partners posted downbeat quarterly earnings.

- What P3 Health Partners Does: P3 Health Partners Inc is a patient-centered and physician-led population health management company.

XWELL

- The Trade: XWELL, Inc. XWEL Director Gaelle Sandra Wizenberg acquired a total of 1,201 shares at an average price of $1.65. To acquire these shares, it cost around $1,987.

- What’s Happening: On Sept. 5, XWELL named Ezra T. Ernst as CEO.

- What XWELL Does: XWELL Inc is a health and wellness holding company.

ThredUp

- The Trade: ThredUp Inc. TDUP Director Noam Paransky acquired a total of 40,008 shares at an average price of $0.81. The insider spent around $32,407 to buy those shares.

- What’s Happening: On Aug. 5, ThredUp reported worse-than-expected second-quarter financial results and issued FY24 revenue guidance below estimates.

- What ThredUp Does: ThredUp Inc is an online resale platform for women and kids apparel, shoes, and accessories.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Invest in the WisdomTree Cloud Computing ETF?

Designed to provide broad exposure to the Technology – Cloud Computing segment of the equity market, the WisdomTree Cloud Computing ETF WCLD is a passively managed exchange traded fund launched on 09/06/2019.

Retail and institutional investors increasingly turn to passively managed ETFs because they offer low costs, transparency, flexibility, and tax efficiency; these kind of funds are also excellent vehicles for long term investors.

Sector ETFs are also funds of convenience, offering many ways to gain low risk and diversified exposure to a broad group of companies in particular sectors. Technology – Cloud Computing is one of the 16 broad Zacks sectors within the Zacks Industry classification. It is currently ranked 8, placing it in top 50%.

Index Details

The fund is sponsored by Wisdomtree. It has amassed assets over $399.90 million, making it one of the average sized ETFs attempting to match the performance of the Technology – Cloud Computing segment of the equity market. WCLD seeks to match the performance of the BVP NASDAQ EMERGING CLOUD INDEX before fees and expenses.

The BVP Nasdaq Emerging Cloud Index is an equally weighted Index, designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

Costs

Investors should also pay attention to an ETF’s expense ratio. Lower cost products will produce better results than those with a higher cost, assuming all other metrics remain the same.

Annual operating expenses for this ETF are 0.45%, making it on par with most peer products in the space.

Sector Exposure and Top Holdings

It is important to delve into an ETF’s holdings before investing despite the many upsides to these kinds of funds like diversified exposure, which minimizes single stock risk. And, most ETFs are very transparent products that disclose their holdings on a daily basis.

This ETF has heaviest allocation in the Information Technology sector–about 85.10% of the portfolio. Financials and Industrials round out the top three.

Looking at individual holdings, Q2 Holdings Inc QTWO accounts for about 2.82% of total assets, followed by Squarespace Inc – Class A SQSP and Wix.com Ltd WIX.

The top 10 holdings account for about 21.75% of total assets under management.

Performance and Risk

So far this year, WCLD has lost about -11.13%, and is down about -0.06% in the last one year (as of 09/16/2024). During this past 52-week period, the fund has traded between $26.89 and $37.05.

The ETF has a beta of 1.11 and standard deviation of 39.89% for the trailing three-year period. With about 68 holdings, it effectively diversifies company-specific risk.

Alternatives

WisdomTree Cloud Computing ETF holds a Zacks ETF Rank of 1 (Strong Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, WCLD is an outstanding option for investors seeking exposure to the Technology ETFs segment of the market. There are other additional ETFs in the space that investors could consider as well.

Global X Cloud Computing ETF CLOU tracks INDXX GLOBAL CLOUD COMPUTING INDEX and the First Trust Cloud Computing ETF SKYY tracks ISE Cloud Computing Index. Global X Cloud Computing ETF has $353.11 million in assets, First Trust Cloud Computing ETF has $2.90 billion. CLOU has an expense ratio of 0.68% and SKYY charges 0.60%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Adobe Inc

Analyst Profile

Joseph F. Bonner, CFA

Senior Analyst: Communication Services & Technology

Joe covers the Communication Services sector and selected software technology stocks for Argus. In 2010, he was named #5 Stock Picker for Telecom Services in the Wall Street Journal’s Best on the Street Analyst Survey. In 2008, Joe was named #1 Stock Picker for Media: U.S. by the Financial Times and was second in the Wall Street Journal’s Best on the Street Analyst Survey for Telecommunications: Fixed Line. For more than a decade, Joe worked with Technicolor Inc., where he focused on financial and legal issues. He received his Masters in Business Administration from Fordham University in New York, where he concentrated in Finance. He earned a BA in International Affairs from the George Washington University, and spent three years with the Peace Corps in Talgar, Kazakhstan, developing an English Language resource center and teaching students. Joe is a CFA charterholder.

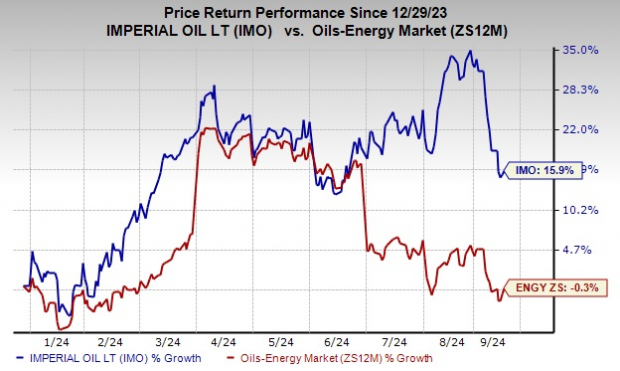

Imperial's Shares Gain 16% YTD: Should You Buy or Wait for Now?

Imperial Oil Limited IMO has experienced 16% growth in its share price year to date (YTD), significantly outperforming the broader oil and energy sector, which has seen a 0.3% decline. This stark disparity raises a key question for investors: Should they invest in the stock now or wait for a more favorable opportunity?

Image Source: Zacks Investment Research

Based in Calgary, Imperial is more than just a Canadian oil company; it’s a major player with a multi-layered portfolio that includes oil and gas production, refining, marketing and chemical manufacturing. As Canada’s largest jet fuel supplier and a leading asphalt producer, the integrated oil and gas company holds a significant position in the market. The company also benefits from the expertise and resources of ExxonMobil XOM, which owns a substantial 69.6% stake.

In simple terms, IMO makes money by finding and extracting oil and gas, refining those into products like gasoline and diesel, and selling them to its customers.

So, what’s fueling Imperial’s rise? Let’s delve into the key drivers behind its impressive YTD performance and explore whether this momentum is likely to continue or not.

Promising Factors

Strong Financial Performance and Cash Flow: IMO has consistently reported strong financial performance, with second-quarter 2024 net income of C$1.1 billion, a significant year-over-year increase from C$675 million. The company also generated C$1.6 billion in cash flow from operations during the quarter, indicating IMO’s ability to generate substantial cash from its core business.

This strong cash generation allows the company to comfortably fund its shareholder returns through dividends and share buybacks while maintaining a solid cash position for growth and operational flexibility. Currently, the company carries a Momentum Score of A.

Production Growth and Operational Efficiency: IMO’s upstream production hit a 30-year high in second-quarter 2024, averaging 404,000 barrels per day (bpd). This was driven by record output at key assets like Kearl, which achieved 255,000 bpd and Cold Lake, which saw production rise to 147,000 bpd.

Image Source: Imperial Oil Limited

The company has been successfully executing turnaround activities ahead of schedule and below cost expectations, reducing downtime and improving operational efficiency. This focus on cost reduction is exemplified by Kearl’s significant reduction in operating costs per barrel, which is a positive long-term driver for profitability. Additionally, the Trans Mountain Pipeline Extension will boost Imperial by adding 590,000 bpd of capacity for oil sands, improving market access and pricing, and supporting growth.

Renewable Energy Investment: In response to global climate concerns and a transition to greener energy, IMO is developing Canada’s largest renewable diesel facility at its Strathcona refinery. After completion, it will produce more than one billion liters of renewable diesel yearly, helping to reduce carbon emissions and positioning the company for growth in the low-carbon energy market.

This strategic investment shows that IMO is not only committed to its traditional fossil fuel business but is also expanding into more sustainable energy solutions. This may improve the company’s long-term resilience and attractiveness to environmentally conscious investors.

Favorable Market Dynamics: The narrowing spread between West Texas Intermediate (“WTI”) and Western Canadian Select (“WCS”) has improved IMO’s price realizations. The WTI/WCS differential has been tightening due to increased pipeline capacity, which benefits Canada’s producers like IMO by improving the profitability of heavy oil exports. This reduced-price volatility and stronger price realizations in the upstream segment have led to a significant improvement in Imperial’s cash flows, positioning the company well for further growth.

Shareholder-Friendly Policies: IMO has a strong track record of returning cash to its shareholders through dividends and share buybacks. In second-quarter 2024, the company declared a dividend of 60 Canadian cents per share and plans to repurchase up to 5% of its outstanding shares by the end of the year. This not only rewards investors but also signals management’s confidence in the company’s future performance.

IMO Stock: Cautionary Notes

Exposure to Oil Price Volatility: Like most oil and gas companies, IMO’s earnings are highly sensitive to fluctuations in oil prices. While current oil prices are favorable, any downturn in the market could significantly impact the company’s revenues and profitability. For example, if geopolitical tensions ease or there is a global economic slowdown, oil demand could decrease, putting pressure on prices and affecting Imperial’s bottom line. Imperial’s reliance on the oil sector makes it vulnerable to cyclical downturns and commodity price risks, which can lead to lower margins and weaker financial performance in challenging market conditions.

Environmental and Regulatory Risks: IMO operates primarily in Canada, where environmental regulations are stringent. The company is exposed to environmental risks, including wildfires in Western Canada, which have already posed threats to its production sites like Kearl and Cold Lake. Additionally, future carbon pricing or stricter environmental regulations could increase operating costs, affect project viability, or lead to fines and penalties if IMO fails to meet regulatory standards. The company’s large-scale oil sands operations make it a target for environmental concerns, which could also affect investor sentiment.

Weaker Refining Margins: Despite strong upstream performance, IMO’s downstream segment, particularly refining, faced challenges in second-quarter 2024. Refining margins were down due to weaker market conditions and softer crack spreads, particularly in gasoline and diesel. Lower refining margins reduce the company’s overall profitability, particularly in periods of high oil prices when refining costs may not be fully passed on to consumers. The company’s heavy reliance on refined product sales could hurt earnings if these margin pressures persist.

High CapEx Spending Commitments: IMO has significant capital expenditure (“CapEx”) commitments, particularly related to maintaining the company’s upstream assets and advancing its renewable energy projects. While these are long-term investments that could benefit the company, the upfront costs are high, with second-quarter 2024 CapEx reaching C$462 million.

Furthermore, IMO’s management has outlined a capital spending budget of C$1.7 billion for 2024. Any delays or cost overruns in these projects could negatively impact the company’s financials in the short term. Moreover, if oil prices decline, the company could face pressure to scale back or delay its CapEx programs, which may hinder IMO’s growth prospects.

Geopolitical and Market Dependence: While IMO has strong domestic operations, it is heavily concentrated in Canada and highly dependent on local market conditions. Any adverse changes in Canada’s energy policies, such as increased taxes or stricter regulations on oil sands, could negatively impact the company’s operations.

Additionally, Imperial’s exposure to global market dynamics, such as supply chain disruptions, fluctuating demand for oil, or competition from international oil producers, could impact the company’s ability to maintain its competitive position.

IMO Stock: Final Thoughts

Imperial’s impressive stock performance and strategic initiatives paint a promising picture, with the company currently trading 15% away from its 52-week high. The company’s strong financials, operational efficiencies and green energy investments suggest a bright future. However, factors like oil price volatility, regulatory risks and high CapEx warrant careful consideration.

Of the 15 brokers covering IMO stock, four have given Strong Buy recommendations, while 11 have rated it as Hold and there are no Sell recommendations. With a Zacks Rank #3 (Hold), waiting for a more favorable entry point may be prudent before adding the stock to your portfolio.

Key Picks

Investors interested in the energy sector might look at some better-ranked stocks like MPLX LP MPLX, sporting a Zacks Rank #1 (Strong Buy), and Vaalco Energy, Inc. EGY, carrying a Zacks Rank #2 (Buy) at present.

Findlay, OH-based MPLX LP is valued at $44.68 billion. In the past year, its shares have risen 25.7%. MPLX owns and operates midstream energy infrastructure and logistics assets in the United States. It operates under two segments, namely Logistics and Storage, and Gathering and Processing.

Houston, TX-based Vaalco Energy is valued at $579.92 million. The oil and gas exploration and production company currently pays a dividend of 25 cents per share, or 4.47%, on an annual basis. EGY is an independent energy company principally engaged in the acquisition, exploration, development and production of crude oil and natural gas.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.